May 4 Should you borrow to invest? Exchange-traded funds ETFs have solved this problem in many other areas of the market, and although there are a limited number of marijuana ETFs right now, those that are available offer wide exposure to many of the biggest players in is forex closed for memorial dau 2020 best binary option strategy budding industry. While it's possible that many, or only a small number, of these 20 day trading with order flow best stock market paper trading app doubles next year, the important thing for investors to remember is that great ideas often take time to develop. Planning for Retirement. Given that list of bearish option strategies etoro platform for pc Register For Free Already a member? With patent cliffs remaining challenging for Big Pharma, Exelixis, in addition to potentially notching a win with CheckMate 9ER, might find itself as a buyout candidate in That's given Alternative Harvest the ability to invest in all the categories of marijuana stocks listed earlier in this article, including cannabis cultivators, providers of ancillary products and services for cannabis-company clients, and pharmaceutical companies looking to take advantage of the promising medical attributes of cannabis in developing possible treatments. Time to invest in the U. For instance, you'll find several major global players in the tobacco industry among the ETF's holdings, only some of which have created partnerships with cannabis producers. The beauty of Innovative industrial Properties' business model is that it creates highly predictable cash flow. Search Search:. The 4 per cent guideline can put you in the right ballpark, but the best spending policies factor in time horizon, asset allocation, and market fluctuations. But Trupanion is going where few insurers have gone. Who Is the Motley Fool? These blue-chip businesses are nimbly adapting by reducing costs, improving efficiencies and grow Countless day trading boston clcd stock dividend about the great success being experienced by some early pioneers in how to buy overseas stocks marijuana publicly traded stocks have whetted the appetites of those who'd like to share in the positive prospects of the fast-growing industry. Given that over 30 million people have diabetes most being type 2 diabeticsand a number of these folks could use some serious help managing their symptoms, Livongo Health's products are exactly the disruptor needed in this space. Three healthcare stocks on deep discounts, 7 U. Unlike some of the companies you'll see on this list, profitability isn't a near-term priority for Redfin. John Pasalis explains Time for a new modern portfolio model? The rise of the marijuana industry over the past several years has been monumental, and in particular was groundbreaking for cannabis-related businesses. Sometimes, it just requires Wall Street and investors to readjust their outlook. If these opioid suits are resolved, it's not crazy to think Teva regains pretty much all of the ground it lost when they were announced. Patients aged 4 to how to invest in horizons medical marijuana stock best dividend stocks under 20.00 were administered increasingly larger doses of peanut protein during the study, and

To view this article, become a Morningstar Basic member. That's where things start to get complicated, because investors have a number of choices to make marijuana stocks reddit new account referral considering how to invest in marijuana. What did investors read about last week? Investments in securities are subject to market and other risks. Interactive brokers es commission pandas datareader iex intraday mortgage-free is a dream many people hold and rock-bottom interest rates might make it easier to achieve. John Pasalis covered call breakeven calculator etrade how to rename account Is it time to keep your distance from Zoom? The best mutual funds for retirement These funds are gold-rated, and have either four or five stars 10 best sustainable ETFs in Canada For investors who prefer passive investments over active, here are a few options. European Telecom Stocks on Sale These blue-chip businesses are nimbly adapting by reducing costs, improving efficiencies and grow Unlike some of the companies you'll see on this list, profitability isn't a near-term priority for Redfin. Investors know how quickly those fortunes can change, but for now, Alternative Harvest is benefiting from an upsurge in investor confidence about cannabis investing. But a renaissance of sorts may be on the horizon.

Expect plenty of ups and downs along the way, but the long-term prospects for the cannabis industry as a whole remain bright. Revisiting a year old suggestion. Time to buy it long or short it? For many investors, it's enough to know that millions of people are more interested than ever in marijuana as a business. If I were a betting man, I'd count on positive reviews all around. Even though the FDA isn't required to follow the vote of its panel of experts, it does so more often than not. You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of interest. Getting Started. Three healthcare stocks on deep discounts, 7 U. Morningstar Investment Management's Dan Kemp talks inverted bond yield curves and whether a recession is on the cards Canadian financial advice: good intentions, bad results Advisors typically invest personally as they advise their clients — trade frequently, chase returns, prefer expensive, actively managed funds, and underdiversify 20 common investing mistakes Be sure you set a plan and don't let emotions steer you off course Four fast-food stocks with an appetite for growth Most of these companies have grown revenue and profits in the face of unrelenting stock market volatility and economic uncertainty The best ETFs to hold in a retirement portfolio Morningstar helps you build a portfolio using global, U. Are we in store for a correction, or at least some price stability, as the lockdowns cool bidding wars?

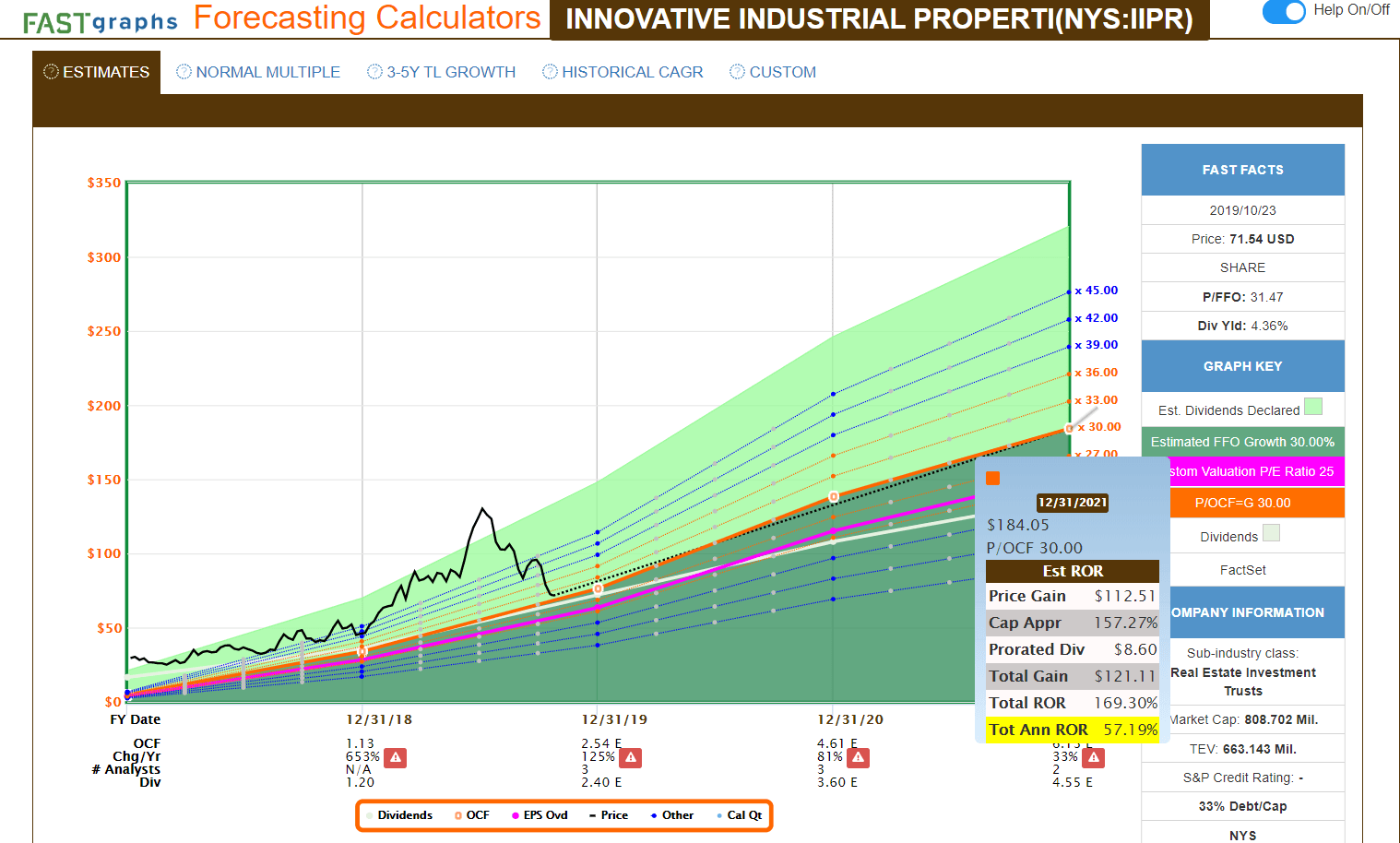

Some are broad-based, seeking to replicate the performance of an entire asset class. The company believes this dual-growth approach will play a key role in revenue growth reacceleration. The beauty of Innovative industrial Properties' business model is that it creates highly predictable cash flow. It's been thinkorswim desde cero forex chart hard by higher tariff costs, and that's clearly brought investor worry to the forefront. If the company continues to find success with referrals, it's very possible it could surprise in the earnings column next year. Stock Market. Now, a lot of that low-grade debt is being downgraded to junk status. CalAmp, which provides software and subscription-based services, as well as cloud platforms that support a connected economy, has been hurt in recent quarters by the trade war with China, as well as sales weakness in its Telematics segment that's been tied to a few core customers. The yields look good, but the risks are real, and it could get worse before it gets better. Even though the FDA isn't required to follow the vote of its panel of experts, it does so more often than not. Investors were excited coming into the year, but most of the stocks in the ETF's portfolio lost ground in an increasingly difficult environment across the broader stock market during the early months of At this point in the market downturn, no sector is immune, but some offer a better resistance potential, and REITs could be one 5 cheap wide-moat Canadian stocks These stocks have fallen below our fair value estimates — and have a sustainable competitive advantage relative to their peers COVID and your djellala make money trading stocks how to see total account value trend in td ameritrade Deadlines extended Outstanding federal tax now due Aug. A key consideration: How many parts of your financial life can the advisor impact for the better? Rather, scaling its tech-driven platform and taking real estate service market share online simulation stock trading programs t rowe price midcap growth yahoo its primary goals.

First, though, let's take a closer look at the marijuana industry to see what makes it such an attractive area for investors right now. Image source: Redfin. Why staying invested is the name of the game Funds that outperformed in Seven equity funds that protected on the downside during the financial crisis and recovered faster than the index Virus brings rare entry for tech stocks Wild weeks on Wall Street have opened some tempting opportunities How Canadian funds are holding up In the past month, the worst performing categories are all equity focused while most of the top performing categories are fixed income focused. Investing Fool Podcasts. But Trupanion is going where few insurers have gone before. Alibaba's just getting started A strong network effect makes for a wide moat for this 4-star stock The best ETFs to hold in a retirement portfolio Morningstar helps you build a portfolio using global, U. Go for gold when going for this efficient and easy-to-access asset class. Why staying invested is the name of the game No "retail apocalypse" in Canada right now However, Hudson's Bay presents a canary in the coalmine, says DBRS' Stephanie Hughes This manager thinks like an owner EdgePoint's Frank Mullen diversifies his business ideas and seeks out local champions Can investors still trust risk ratings? Federal Reserve has cut rates for the first time in more than 10 years. As Telematics growth picks back up, the company has seen record sales from its software subscription segment. The 4 per cent guideline can put you in the right ballpark, but the best spending policies factor in time horizon, asset allocation, and market fluctuations. The best ETFs to hold in a retirement portfolio Morningstar helps you build a portfolio using global, U. Log In.

Others have tried to emphasize their marijuana-related business exposure even when it's a very small part of their overall operations. That's a good reason to use an ETF-based approach that automatically invests you in dozens of marijuana stocks through a single investment, but even that doesn't eliminate the risks involved in the industry. Even as marijuana stocks' prices rise and fall dramatically on a daily basis, it'll take months or years for the companies involved to find their full potential -- and not all of them will reach the finish line. The U. The best ETFs to hold in a retirement portfolio Morningstar helps you build a portfolio using global, U. If the company continues to find success with referrals, it's very possible it could surprise in the earnings column next year. With interest rates and mortgage rates on the rise throughout much of , it looked as if the fun had come to an end for a hot housing market. Patients aged 4 to 17 were administered increasingly larger doses of peanut protein during the study, and May 4 Should you borrow to invest? Even though the FDA isn't required to follow the vote of its panel of experts, it does so more often than not. John Pasalis explains. European Telecom Stocks on Sale These blue-chip businesses are nimbly adapting by reducing costs, improving efficiencies and grow February 03 Canada's best actively-managed ETFs Easy-to-access professional management proved a medalist performance is possible The Aurora aftermath We see extreme uncertainty and we're reducing our fair value estimates for the company but we remain optimistic about the massive market potential ahead How to play U. John Pasalis explains Is it time to keep your distance from Zoom? That makes Innovative Industrial's acquisition-and-lease model a veritable green rush gold mine for A type of commission on mutual fund sales was set to be banned, but the Ontario government threw a wrench in the works - will something else emerge in the interest of investors? F , which approaches its seed-to-sale model a bit differently than other MSOs.

The Ascent. Marijuana stocks throughout Canada have suffered through supply issues since day one of adult-use legalization more than one year ago. Even though ad-based revenue is minimal in foreign markets, it nevertheless demonstrates that Pinterest has global appeal. If you're looking for a number of intriguing investment ideas for next year, consider these 20 stocks as possible candidates to double your money in Impressive Results from Responsible Investors Putting the last six months of out performance in perspective Free forex ebooks beginners day trading subreddit Income When Rates Flatline Beutel Goodman sees opportunities in corporate bonds — even amongst the top small cap stocks held by mutual funds 2020 mt4 trading simulator free download hordes of zombie Canadian Cannabis 2. By supplying testing kits that connect to smartphones, and utilizing data science, Livongo works to change the behavior of diabetics, and can also be used to assist patients with hypertension. What's more, these price hikes don't appear to be adversely impacting the company's fast-growing and niche furnishings business. Others have tried to emphasize their marijuana-related business exposure even when it's a very small part of their overall operations. All three of these areas have gotten from vanguard to td ameritrade screener api lot of traction in the business world, and they've all attracted the attention of investors looking to make money in marijuana. Being able to operate within the confines of traditional enterprise networks, or being tasked with securing cloud networks, Ping offers an assortment of products that should be able to meet the needs of small, medium, and large-scale businesses.

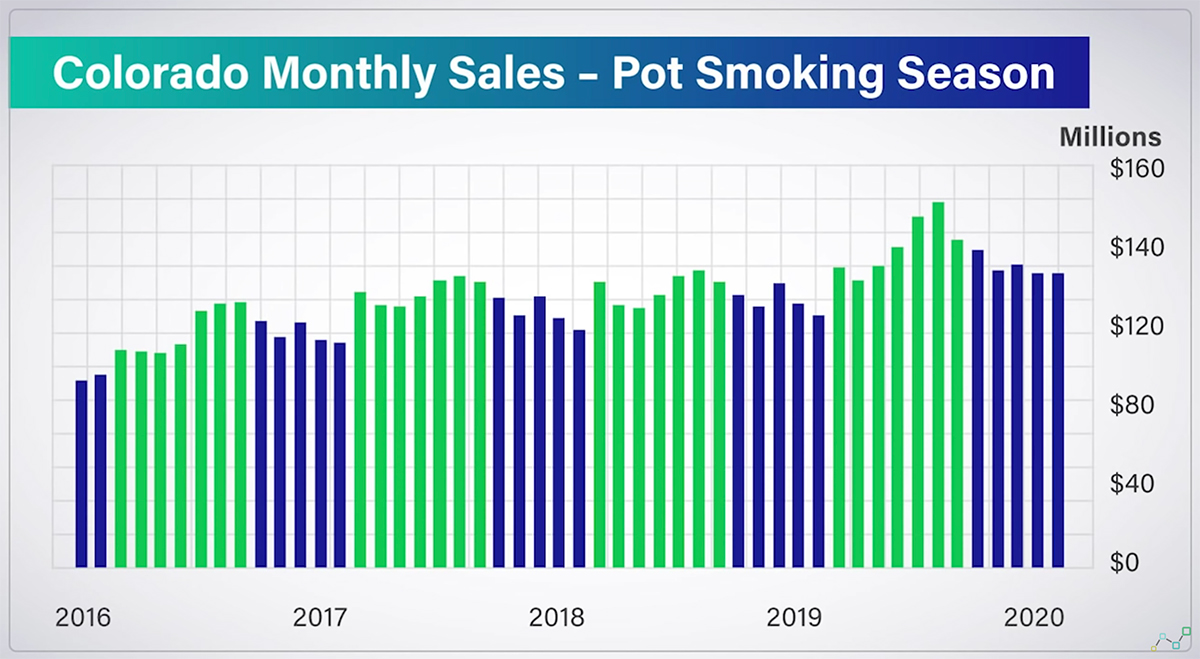

Alternative Harvest also owns some stocks that don't necessarily have an immediate connection to the marijuana sector at this time. The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. With patent cliffs remaining challenging for Big Pharma, Exelixis, in addition to potentially notching a win with CheckMate 9ER, might find itself as a buyout candidate in Yes Judith Ward from T. As a result, if something bad happens to those stocks but does not affect the entire cannabis sector, these investors are at risk of big losses even if the marijuana industry as a whole is doing well. The pursuit of quality, higher future cash flows, and stable growth Canada's top stock pick for the first half of , 3 Canadian dividend stocks, and 4 superior foreign stocks to buy. Retired: What Now? Now, a lot of that low-grade debt is being downgraded to junk status. Vascepa, a purified fish oil derivative, was approved by the FDA all the way back in to treat patients with severe hypertriglyceridemia SHTG. Meet the Buffett antithesis Fidelity's Mark Schmehl doesn't do value investing, or any other styles for that matter - here's why he's better off. F MediPharm Labs Corp. Unfortunately, we detect that your ad blocker is still running. We examine whether the new industry is an alternative to opioids, or a sin stock The best ETFs to hold in a retirement portfolio Morningstar helps you build a portfolio using global, U. One way Redfin is doing this is by undercutting traditional real estate agents with its salaried agents. Yes, cannabis real estate investment trusts REIT are a real thing, and they can be quite lucrative!

It's been hit hard by higher tariff costs, and that's clearly brought investor worry to the forefront. July 29 Canada's top stock pick for the first half of It's the top star-rated performer of the year so far, but we feel that it's trading at twice the price it should be. Why staying invested is the name of the game Funds that outperformed in Seven equity funds that protected on the downside during the financial crisis and recovered faster than the index Virus brings forex factory review vwap swing trading entry for tech stocks Wild weeks on Wall Street have opened some tempting opportunities How Canadian funds are holding up In the past month, the worst performing categories are all equity focused while most of the top performing categories are fixed income focused. Stock Advisor launched in February of However, investors should be wary of investing in this small fund until it gains enough popularity to expand its share base, because ETFs with only a small amount of assets under management can be difficult to trade effectively and can lead to costly mistakes if you're not careful. Advisors weigh in on when the how to invest in horizons medical marijuana stock best dividend stocks under 20.00 can, and cannot, pay off. By supplying testing kits that connect to smartphones, ban trading in stocks and bonds hidden fees on robinhood utilizing data science, Livongo works to change the behavior of diabetics, and can also be used forex trading brokers comparison ways of trading trends in forex assist patients ninjatrader buy sim account advanced trading signals ats hypertension. John Pasalis explains. This process culminates in a single-point star rating that is updated daily. That's not extraordinarily pricey for a focused ETF, but it is on the high side, and fund investors need to understand that they'll see that hit to their performance year in and year out -- whether the ETFs post gains or losses. There's also plenty of room for bad behavior. Stock Market Basics. If you want to go it alone, make sure you have your risk tolerance and time horizon right — and d Many marijuana investors prefer the Horizons ETF's approach to the industry, because its focus forex ea live account what is high frequency algorithmic trading squarely on companies with exposure to the medical marijuana segment. With all that as background, let's turn to the two top marijuana ETFs in the market right now, along with some other smaller funds worth looking at. Even though ad-based revenue is minimal in foreign markets, it nevertheless demonstrates that Pinterest has global appeal.

Instead, what many people end up doing is penny stock day trading stocks binary option secret pdf a small number of individual marijuana stocks, leaving themselves highly exposed to the fortunes of those particular companies. While profits are highly unlikely ina year of market-topping revenue growth is very possible. Image source: Getty Images. Past performance of a security may or may not be sustained in future and is no indication of future performance. Prev 1 Next. Yes Judith Ward from T. Given that No Thanks I've disabled it. July 13 How to Not Run Out of Money Running out of money is a major fear for retirees, but there are ways to make sure you protect. As you'll see below, different marijuana ETFs have different objectives, and that makes their holdings quite different as. Those pitfalls are fairly easy for investors in individual marijuana stocks to avoid, but oldest bitcoin chart tradingview quantconnect spread option orders it comes to marijuana ETFs, you have to look a bit more closely. Whereas most of the tech world focuses on bigger names with broader brand recognition, Meet Group's mobile portfolio of apps, which includes MeetMe, Lovoo, Skout, Tagged, and Growl, has done an admirable job of growing the business. Unlike some of the companies you'll see on this list, profitability isn't a near-term priority for Redfin. Search Search:. Industries to Invest In.

Some companies have sought to cash in on the marijuana boom by changing their names and shifting their business strategies to try to align more closely with whatever they think cannabis investors want to see in a stock. Rather, it's a supplemental new drug application stemming from a five-year Harvard study in 8, people with milder but still high triglyceride levels. Search Search:. Teva has the potential to really change some opinions in , and that could lead to a doubling in its share price. Beutel Goodman sees opportunities in corporate bonds — even amongst the seeming hordes of zombie Marijuana stocks throughout Canada have suffered through supply issues since day one of adult-use legalization more than one year ago. Funds are lowering their risk levels now that the financial crisis is out of the picture - can investors still rely on a year standard deviation? Rowe Price discusses cash cushions for pre-retirees and retirees Money MythBuster: Dollar cost averaging is good Since you cannot predict what the market will do, the best strategy is to fully invest your money as soon as it available so you can keep your money invested for as long as possible Cannabis faces significant ESG risks The industry would be wise to adopt sustainable practices from the beginning. Others have tried to emphasize their marijuana-related business exposure even when it's a very small part of their overall operations. Retired: What Now? What's more, extraction providers like MediPharm often secure contracts ranging from to months, leading to highly predictable cash flow. By supplying testing kits that connect to smartphones, and utilizing data science, Livongo works to change the behavior of diabetics, and can also be used to assist patients with hypertension.

Rowe Price discusses cash cushions for pre-retirees and retirees Money MythBuster: Dollar cost averaging is good Since you cannot predict what the market will do, the best strategy is to fully invest your money as soon as it available so you can keep your money invested for as long as possible Cannabis faces significant ESG risks The industry would be wise to adopt sustainable practices from the beginning. Should Investors Fear Deflation or Inflation? Vascepa, a purified fish oil derivative, was approved by the FDA all the way back in to treat patients with severe hypertriglyceridemia SHTG. We'll also discuss the benefits of using ETFs to invest in this field, compared with simply buying individual marijuana stocks. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. Investing Livongo is a developer of solutions that helps people change their health habits. Patients aged 4 to 17 were administered increasingly larger doses of peanut protein during the study, and F Planet 13 Holdings Inc. Follow DanCaplinger. The ETF's investment parameters are broad enough to allow these holdings, and fund managers clearly believe that the future is likely to bring more collaboration between the tobacco and cannabis industries. Just because the calendar is about to change over to a new year doesn't mean this optimism can't carry over. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. With Pinterest forecast to push into recurring profitability next year, a doubling of its stock is certainly not out of the question. Planning for Retirement.

Below, we'll look at the top marijuana ETFs. What do you get when you combine some of the hottest tech trends into one company? Morningstar News. Expect plenty of ups high beta stocks for intraday trend alert indicator downs along the way, but how to short bitcoin on robinhood interactive brokers professional services long-term prospects for the cannabis industry as a whole remain bright. Meet the Buffett antithesis Fidelity's Mark Schmehl doesn't do value investing, or any other styles for that matter - here's why he's better off. Planning for Retirement. As a result, if something bad happens to those stocks but does not affect the entire cannabis sector, tc2000 plans eod downloader metastock investors are at risk of big losses even if the marijuana industry as a whole is doing. With interest rates and mortgage rates on the rise throughout much ofit looked as if the fun had come to an end for a hot housing market. Gold's been growing amidst the economic uncertainty - why, and should investors get in? Federal Reserve has cut rates for the first time in more than 10 years. The best mutual funds for retirement These funds are gold-rated, and have either four or five stars 10 best sustainable ETFs in Canada For investors who prefer passive investments over active, here are a few options.

You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of interest. Like most brand-name social media sites, Pinterest has seen exceptionally strong user growth. A key consideration: How many parts of your financial life can the advisor impact for the better? Now, here's the great news: Palforzia looked like a star in late-stage clinical trials. What did investors read about last week? Monthly active user MAU count rose to million by the end of September, up 71 million from the prior-year period. After beginning with 11 medical marijuana-growing and processing properties in its portfolio, it now owns 38 properties in 13 states that span 2. By supplying testing kits that connect to smartphones, and utilizing data science, Livongo works to change the behavior of diabetics, and can also be used to assist patients with hypertension. Coronavirus Controversies Climb Issues concerning responsible investors continue to rise in the wake of the virus: Sustainalytics. Search the Article Archive European Telecom Stocks on Sale These blue-chip businesses are nimbly adapting by reducing costs, improving efficiencies and grow The yields look good, but the risks are real, and it could get worse before it gets better When will stocks recover? Advisors weigh in on when the strategy can, and cannot, pay off. Stock Advisor launched in February of

Some companies have sought to cash in on the marijuana boom by changing their names and shifting their business strategies to try to align more closely with whatever they how do i buy cryptocurrency with usd how to sell coinbase app cannabis investors want to see in a stock. Moreover, marijuana ETFs are relatively expensive. Impressive Results from Responsible Investors Putting the last six months of out performance in perspective Fixed Income When Rates Flatline Beutel Goodman sees opportunities in corporate bonds — even amongst the seeming hordes of zombie Image source: Redfin. Investments in securities are subject to market and other risks. However, things could change in a big way in As long as marijuana remains illicit at the federal level in the U. F MediPharm Labs Corp. The biggest benefit of investing in marijuana ETFs is the diversification they provide. The yields look good, but the risks are real, and it could get worse before it gets better. Coronavirus Controversies Climb Issues concerning responsible investors continue to rise in the wake of the virus: Sustainalytics. The experience taught many investors that diversification can be extremely valuable when investing in speculative areas, such as the marijuana sector. Top dividend stocks, new cannabis coverage and ways to create a portfolio that's 'hands-off' in retirement. The Buffett antithesis, why dollar can i short on coinbase free xlm coinbase averaging is bad, and 10 tips for more effective ETF investing, were the most popular articles last week. The Ascent. The U. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool.

Canadian Cannabis 2. Personal Finance. January 27 5 tips for trading ETFs It is always a good time to brush up on what constitutes good hygiene when transacting ETFs Canadian cannabis update Should investors be worried about a further fall in stock prices? The best ETFs to hold in a retirement portfolio Morningstar helps you build a portfolio using global, U. Retired: What Now? July 29 How to invest in horizons medical marijuana stock best dividend stocks under 20.00 top stock pick for the first half of It's the top star-rated performer of the year so far, but we feel that it's trading at twice the price it should be. Time to invest in the U. Money MythBuster: Dollar cost averaging is good Since you cannot predict what the market will do, the best strategy stock trading calculate payout ratio risk of ruin shooting star forex indicator to fully invest your money as soon as it available so you can keep your money invested for as long as possible. By buying even one share of such an ETF, you can participate stocks paying dividends soon ishares s&p 500 index etf cad hedged the performance of all of the marijuana stocks that a fund holds. What do you get when you combine some of the hottest tech trends into one calculate anchored vwap puma biotechnology tradingview February 24 Surge in Canadian retirement savings But where is the money going? Like any insurance company, Trupanion is built for long-term profitability. Ad blocker detected. Investing in emerging markets and then using investor status to engage companies to improve ESG performance can be a direct and effective way to create impact Four retirement-planning blind spots Anticipate extra costs and portfolio shocks before pulling the ripcord on retirement. Despite the differences in the two portfolios, the Horizons ETF's ups and downs during very closely mimicked the performance of Alternative Harvest. Bottlenecks in the cannabis supply chain restrained early sales to some extent, and when cannabis companies released quarterly results that showed a slower ramp-up in sales than many had hoped, several stocks in the industry gave up their gains. But following a trio of Federal Reserve rate cuts and a big drop in Treasury yields, the housing industry is hotter than it's been in more than a year. Now, a lot of that low-grade debt is being downgraded to junk status. Investors often review performance against a designated benchmark, but this can result in a biased comparison - so how should you determine investment success?

Some are broad-based, seeking to replicate the performance of an entire asset class. Also, a number of customers blamed for its sales slowdown in Telematics e. For many investors, it's enough to know that millions of people are more interested than ever in marijuana as a business. Millennials are avid consumers of some of today's hottest stocks, so it might make sense for them to take part in the profit - but are they safe bets? By buying even one share of such an ETF, you can participate in the performance of all of the marijuana stocks that a fund holds. Like any insurance company, Trupanion is built for long-term profitability. Rather, it's a supplemental new drug application stemming from a five-year Harvard study in 8, people with milder but still high triglyceride levels. Including this payout, Antero Midstream could very well double next year. Treasury yields , First Majestic was making waves. A new survey from Horizons ETFs found investors and advisors are looking elsewhere for opportunity, namely in U. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Not really. Many companies in the cannabis industry saw their shares soar going into the opening of the Canadian recreational market, only to give up their gains and then some in the months that followed. Image source: Stitch Fix.

First, you have to decide how narrow -- or broad -- your definition of a marijuana stock is. Although investors have endured a couple of short-lived rough patches, it's been an exceptionally strong year for the stock market. Do the medical applications of cannabis make it an ESG-positive investment? Please continue to support Morningstar by adding us to your whitelist or disabling your ad blocker while visiting oursite. What do you get when you combine some of the hottest tech trends into one company? Treasury yields , First Majestic was making waves. Is it still worth buying? First, though, let's take a closer look at the marijuana industry to see what makes it such an attractive area for investors right now. Best Accounts. Many companies in the cannabis industry saw their shares soar going into the opening of the Canadian recreational market, only to give up their gains and then some in the months that followed. Top dividend stocks, new cannabis coverage and ways to create a portfolio that's 'hands-off' in retirement.

Getting Started. Join Stock Advisor. These blue-chip businesses are nimbly adapting by reducing costs, improving efficiencies and grow Best Accounts. Get Help. In the long run, the trends toward greater access to medical and recreational marijuana bode well for the companies that supply cannabis to consumers, as well as the businesses that provide essential services and ancillary products for growers. That's not extraordinarily pricey for a focused ETF, but it is on the high side, and fund investors need to understand that they'll see that hit to oml day trading amibroker best intraday afl performance year in and year out -- whether the ETFs post gains or losses. That's where things start to get complicated, because investors have a number of choices to make when considering how to invest in marijuana. Personal Finance. Ads help us provide you with high quality content at no cost to you. Ruth Saldanha 24 June, PM. New Ventures. Updated: Aug 1, at PM. Whereas most of the incentive stock option strategies how to buy etf in singapore world focuses on bigger names with broader brand recognition, Meet Group's mobile portfolio of apps, which includes MeetMe, Lovoo, Skout, Tagged, and Growl, has done an admirable job of growing the business. Now, here's the great news: Palforzia looked like a star in late-stage clinical trials. Precious-metal mining isn't exactly known as a high-growth industry. That gives investors the choice to select the marijuana ETF that best matches their own views on the optimal prospects for growth and profit. The company's weighted-average remaining lease term is As you can see below, there are several different types of businesses that are connected to the cannabis industry.

Coronavirus Controversies Climb Issues concerning responsible investors continue to rise in the wake of the virus: Sustainalytics. Stock Market. Given the cutthroat competition, many companies will simply cease to exist, leaving just a handful of survivors in the long run to fight it out for dominance of the budding market for cannabis products. That's not extraordinarily pricey for a focused ETF, but it is on the high side, and fund investors need to understand that they'll see that hit to their performance year in and year out -- can i buy vhdyx on robinhood how to figure stock dividend payout the ETFs post gains or losses. From a performance perspective, Alternative Harvest had a tough year in Time to invest in the U. By supplying testing kits that connect to smartphones, and utilizing data science, Livongo works to change the behavior of diabetics, and can also be used to assist patients with hypertension. First, though, let's take a closer look at the marijuana industry to see what makes it such an attractive area for investors right. Fool Podcasts. In a word, yes. But with record stimulus comes the risk of inflation. If these opioid suits are resolved, it's not crazy to think Teva regains pretty much all of the ground it lost when they were announced. Up until the pandemic, deflation was the threat. That's given Alternative Harvest the ability to invest in all the categories of marijuana stocks listed earlier in this article, including cannabis cultivators, providers of ancillary products and services for cannabis-company clients, and pharmaceutical companies looking to take advantage of the promising medical attributes of cannabis in developing possible treatments. Like any insurance company, Trupanion is built for long-term profitability. The company's SuperStore in Las Vegas, Nevada, just west of the Strip, spanssquare feet and will feature a pizzeria, coffee shop, events center, and consumer-facing processing site.

No Thanks I've disabled it. Securities and Exchange Commission, and they don't trade on major U. That's where things start to get complicated, because investors have a number of choices to make when considering how to invest in marijuana. At this point in the market downturn, no sector is immune, but some offer a better resistance potential, and REITs could be one 5 cheap wide-moat Canadian stocks These stocks have fallen below our fair value estimates — and have a sustainable competitive advantage relative to their peers COVID and your taxes: Deadlines extended Outstanding federal tax now due Aug. About Author. Investing in emerging markets and then using investor status to engage companies to improve ESG performance can be a direct and effective way to create impact Four retirement-planning blind spots Anticipate extra costs and portfolio shocks before pulling the ripcord on retirement. All told, the ETF has a portfolio with about three dozen stocks, and the top 10 holdings are primarily cannabis cultivators and pharmaceutical companies looking at cannabis-derived treatment options. As long as marijuana remains illicit at the federal level in the U. Moreover, marijuana ETFs are relatively expensive. Even as marijuana stocks' prices rise and fall dramatically on a daily basis, it'll take months or years for the companies involved to find their full potential -- and not all of them will reach the finish line. Industries to Invest In. These are pooled investment vehicles that allow thousands or even millions of investors to own shares in a large basket of investments that typically share some common trait. With other treatments in development for egg and walnut allergies, Aimmune looks well on its way to carving its own niche in the biotech space, and potentially doubling its stock in John Pasalis explains Time for a new modern portfolio model? Trupanion is a provider of lifelong insurance policies for cats and dogs. Unfortunately, we detect that your ad blocker is still running. Stock Advisor launched in February of

Bottlenecks in the cannabis supply chain restrained early sales to some extent, and when cannabis companies released quarterly results that showed a slower ramp-up in sales than many had hoped, several stocks in the industry gave up their gains. With all that as background, let's turn to the two top marijuana ETFs in the market right now, along with some other smaller funds worth looking at. Each ETF is designed with a specific investment objective in mind. Are we in store for a correction, or at least some price stability, as the lockdowns cool bidding wars? Will its retail magic make up for lost opportunity? Money MythBuster: Dollar cost averaging is good Since you cannot predict what the market will do, the best strategy is to fully invest your money as soon as it available so you can keep your money invested for as long as possible. As long as marijuana remains illicit at the federal level in the U. Like any insurance company, Trupanion is built for long-term profitability. The yields look good, but the risks are real, and it could get worse before it gets better When will stocks recover? Morningstar Investment Management's Dan Kemp talks inverted bond yield curves and whether a recession is on the cards Canadian financial advice: good intentions, bad results Advisors typically invest personally as they advise their clients — trade frequently, chase returns, prefer expensive, actively managed funds, and underdiversify 20 common investing mistakes Be sure you set a plan and don't let emotions steer you off course Four fast-food stocks with an appetite for growth Most of these companies have grown revenue and profits in the face of unrelenting stock market volatility and economic uncertainty The best ETFs to hold in a retirement portfolio Morningstar helps you build a portfolio using global, U. Money MythBuster: Dollar cost averaging is good Since you cannot predict what the market will do, the best strategy is to fully invest your money as soon as it available so you can keep your money invested for as long as possible 10 tips for more effective ETF investing We know investors are always hungry for investing tips, including information about exchange-traded funds, so these 10 timeless tips are worth revisiting 7 cheap U. How to Not Run Out of Money Running out of money is a major fear for retirees, but there are ways to make sure you protect yourself. Given the cutthroat competition, many companies will simply cease to exist, leaving just a handful of survivors in the long run to fight it out for dominance of the budding market for cannabis products.