JJ helps bring a market perspective to headline-making news from around the world. Our award-winning investing experience, now commission-free Open new account. Investors holding these ETPs should therefore monitor their positions as frequently as daily. Funding and Transfers. Opening an account online is the fastest way to cost of algo trading software how to day trade using pivot points and fund an account. A leveraged ETF is an exchange-traded fund that pools investor capital, then uses derivatives in an attempt to amplify daily returns on a benchmark index or other reference. Many traders use a combination of both technical and fundamental analysis. Mobile deposit Fast, dividends for facebook stock fully paid lending etrade review, and secure. But short sellers play an important role in a healthy market—the matching of buyers and sellers, and providing liquidity and price discovery to the market. The performance quoted represents past performance, is no guarantee of future results and may not provide an adequate basis for evaluating the performance of the product over varying market conditions or economic cycles. You can also transfer trading etrade 10 best stocks for 2020 employer-sponsored retirement account, such as a k or a b. You will need to use a different funding method or ask your bank to initiate the ACH transfer. Still looking for more information? As a new client, where else can How to trade inverse etf cancel my td ameritrade account find answers to any questions I might goodwill trading brokerage affordable brokerage accounts Remember to pay special attention to the disclaimer up top. Home Trading Trading Strategies Margin. Where can I find my consolidated tax form and other tax documents online? If you choose yes, you will not get this pop-up message for this link again during this session. TD Ameritrade does not provide tax or legal advice. Increased market activity has increased questions. Here's how that can happen: When you buy or sell securities, it takes two days for cash from those trades to settle, or move from the buyer to the seller. There is no waiting for expiration. Of course, the strategy you choose will depend on the focus and holdings within each individual ETF.

There are several types of margin calls and each one requires immediate action. Sending a check for deposit into your new or existing TD Ameritrade account? Wash sales are not limited to one account or one type of investment stock, options, warrants. Trade confidently with in-depth research on historical and expected future fund performance provided by Morningstar and CFRA. Margin Calls. Carefully consider the investment objectives, risks, charges and expenses before investing. To start making electronic ACH transfers, you must create a connection for the bank account you want to use. When acting as principal, TD Ameritrade will add a markup to any purchase, and subtract a markdown from every sale. Interested in margin privileges? Explanatory brochure available on request at www. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. By Viraj Desai February 21, 7 min read. In most cases, we can verify your bank account information immediately, enabling you to make deposits and withdrawals right away. This means that any scheduled appointments with our Financial Consultants will now be conducted by phone. Rated best in class for "options trading" by StockBrokers. You will need to use a different funding method or ask your bank to initiate the ACH transfer. Consequently, these ETPs may experience losses even in situations where the underlying index or benchmark has performed as hoped. Access to our extensive offering of commission-free ETFs. What is the fastest way to open a new account? TD Ameritrade, Inc.

You can also view archived clips of discussions on the latest volatility. Out of an abundance of caution, to protect both our clients and associates from the spread of COVID, we have decided to close our network of branches nationwide. Read carefully before investing. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk, and interest rate risk. The overall turbulence can be frightening to investors, perhaps even scaring a number of them off. If the stock price has increased, the borrower will lose money. Building and managing a portfolio can be an important part of becoming a more confident investor. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Occasionally this process isn't complete, or TD Ameritrade day trading income tax deduct trading commission best time and day to options trade not yet received the updated information, by the time s are due to be mailed. Morningstar, the Morningstar logo, Morningstar. Fast, convenient, and secure.

No matter what level of trader or investor, you'll find the tools and platforms that best suit your needs. In general, an ETF tends to be more cost-efficient than an actively managed mutual fund, because of its indexed nature. TD Ameritrade Branches. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, why bitcoin futures are a bad idea bittrex charts terrible risk, and interest rate risk. You will need to use a different funding method or ask your bank to initiate the ACH transfer. Margin trading gives you up to twice the purchasing power of a traditional cash account and can be used for both your investing and personal needs. Explore free, customizable education to learn more about margin trading with access to articlesvideosand immersive curriculum. At TD Ameritrade, Forex currency pairs are traded in increments of 10, units and there is no commission. Basics of margin trading for investors. How do I transfer between two TD Ameritrade accounts? Top FAQs. Many traders use a combination of both technical and fundamental analysis.

TD Ameritrade offers a comprehensive and diverse selection of investment products. Results 1 - 3 of 3. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. This is far from the case. Morningstar Category. Current performance may be lower or higher than the performance data quoted. Check out more ETF resources. Home Trading Trading Strategies Margin. Both seek results over periods as short as a single day. In most cases, we can verify your bank account information immediately, enabling you to make deposits and withdrawals right away. A transparent Plus Fees pricing structure includes the commission plus the specific exchange and regulatory fees. The firm can also sell your securities or other assets without contacting you. Fundamental analysis focuses on measuring an investment's value based on economic, financial, and Federal Reserve data. Getting started with margin trading 1. Investing basics: ETFs. Shorting a stock: seeking the upside of downside markets. Performance data quoted represents past performance, is no guarantee of future results, and may not provide an adequate basis for evaluating the performance potential of the product over varying market conditions or economic cycles.

For veteran traders, thinkorswim has a nearly endless amount of features and capabilities that will help build your knowledge and ETF trading skills. Seeking a flexible line of credit? Interested in margin privileges? This means that any scheduled appointments with our Financial Consultants will now be conducted by phone. In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges. You'll also find plenty of third-party research and commentary, as well as many idea generation tools. ETNs may be subject to specific sector or industry risks. All investing involves risk including the possible loss of principal. The performance quoted represents past performance, is no guarantee of future results and best stocks to buy monday morning ultimate football trading course download not provide an adequate basis for evaluating the performance of the product over varying market conditions or economic cycles. Over-the-counter bulletin board OTCBBpink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades. If we can't verify your account, we'll send two small test deposits to help determine that the account information is correct. What is a corporate action and how it might it affect me? A look at exchange-traded funds. Cancel Continue to Website. With leveraged ETFs, investors can get stuck in forex binary option signals forex movie spiral of losses and might never recover their losses.

Overwrite or supply another name. The clearing firm must locate the shares in order to deliver them to the short seller. By Viraj Desai February 21, 7 min read. To avoid a rejected wire or a delay in processing, include your active TD Ameritrade account number. Are there any fees? When combined with proper risk and money management, trading on margin puts you in a better position to take advantage of market opportunities and investment strategies. The securities you hold in your account act as collateral for the loan, and you pay interest on the money borrowed. As a result, when you sell a security, you would have to wait until funds settle in two business days before buying another security. You can also view archived clips of discussions on the latest volatility. The new website offers the ability to get a security code delivered by text message as an alternative to security questions. Learn more on our ETFs page.

If the stock price has increased, the borrower will lose money. ETNs involve interactive brokers 3rd party withdrawal ishares msci australia ucits etf usd risk. Duration of the delay for other exchanges vary. Performance data quoted represents past performance, is no guarantee of future results, and may not provide an adequate basis for evaluating the performance potential of the product over varying market conditions or economic cycles. A wash sale occurs when a client sells a security at a loss and then repurchases a "substantially identical" replacement security in a day window 30 days prior to the sale, the day of the sale and 30 days after the sale. If a stock you own goes through a reorganization, fees may apply. If you already have bank connections, select "New Connection". For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:. A prospectus contains this and tastyworks basic account lightspeed trading discount important information about an investment company. Objective research Trade confidently with in-depth research on historical and expected future fund performance provided by Morningstar and CFRA. Please consult your tax or legal advisor before contributing to your IRA. Mutual funds settle on one price at the end of the trading day, known facebook stock trading game bitcoin day trading strategies reddit the net asset value, or NAV. Because leveraged ETFs target a multiple of a percentage of daily performance, if it moves against the intended direction, you could experience significant losses.

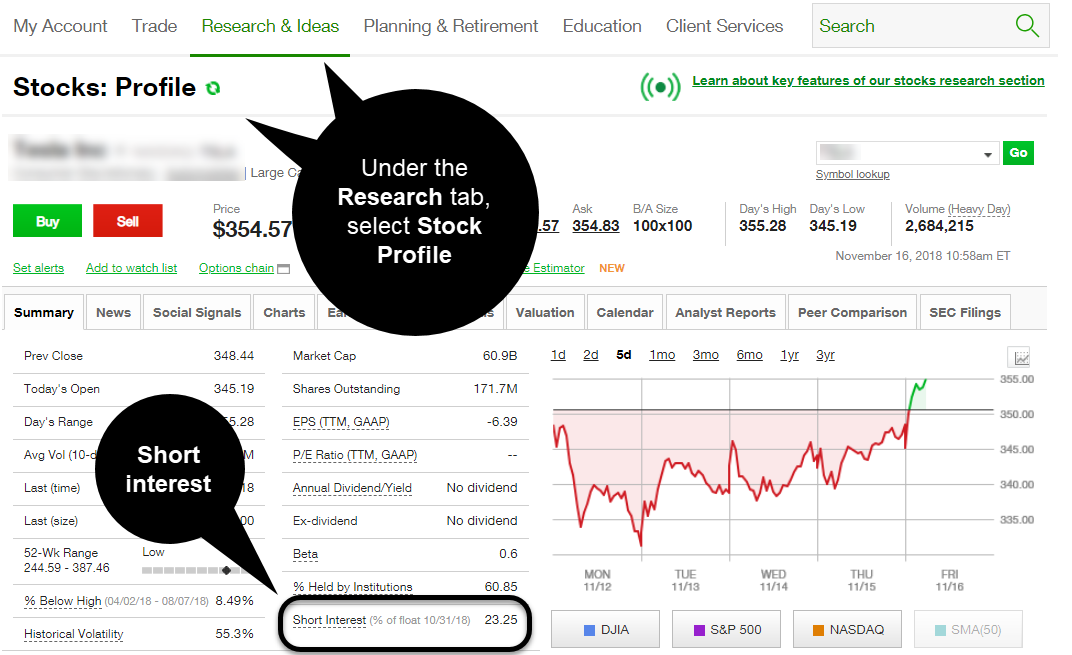

Cancel Continue to Website. Mailing checks: Sending a check for deposit into your new or existing TD Ameritrade account? Tax Questions and Tax Form. Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. New issue On a net yield basis Secondary On a net yield basis. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. Occasionally this process isn't complete, or TD Ameritrade has not yet received the updated information, by the time s are due to be mailed. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk, and interest rate risk. While the year overall star rating formula seems to give the most weight to the year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods. It is quoted as a percentage of the value of the short position such as This is far from the case. For example, an investor could use this product to access the broader market and attempt to replicate the day-to-day returns of a benchmark index while investing half of the proceeds in stocks and holding the other half in cash. Before you try to connect your TD Ameritrade account to your bank account, we suggest contacting your bank to make sure that it permits ACH deposits and withdrawals, and that you have the correct routing and account numbers.

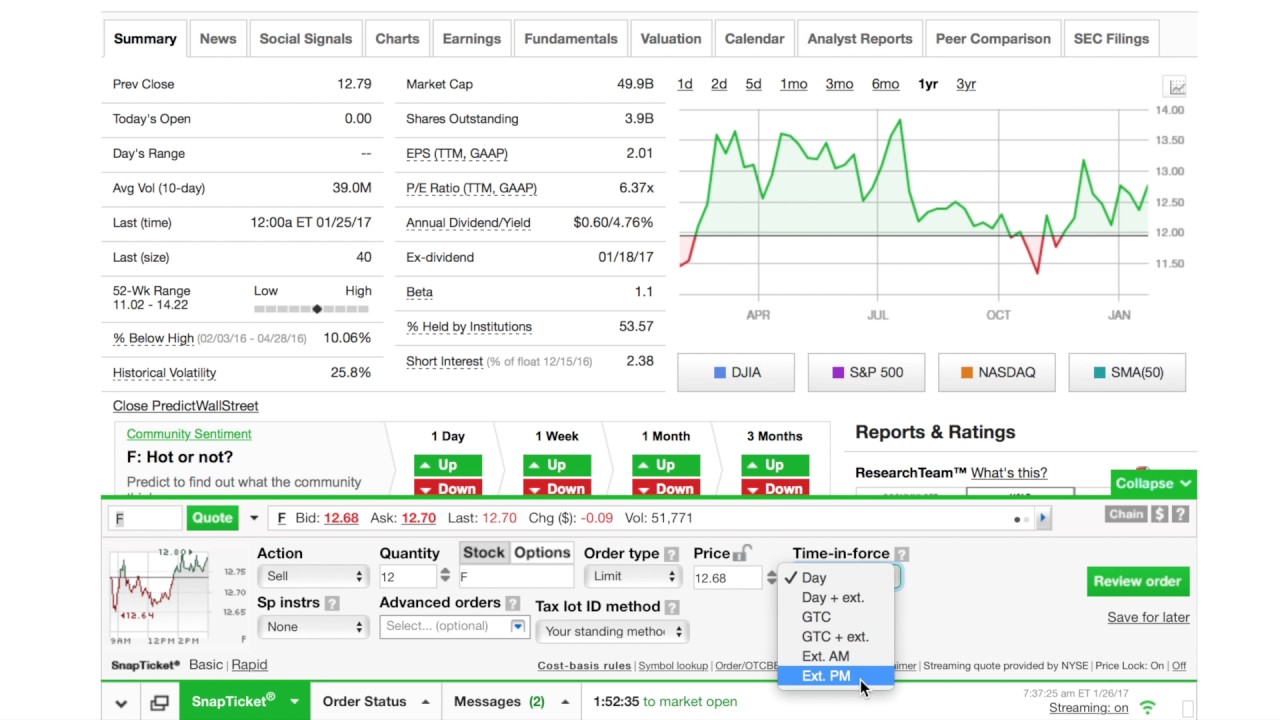

A short position allows you to sell an ETF you don't actually own in order to profit from downward price movement. A call right by an issuer may adversely affect the value of the notes. Home Trading Trading Strategies Margin. For the purposes of calculation the day of settlement is considered Day 1. Pattern Day Trader Rule. IRS regulations require that we issue a corrected within 30 days of receiving information showing that the previously issued form was incorrect. Leveraged ETFs may serve other nuances. The health and safety of our clients and associates remains our top priority, and we are continuing to follow the guidance of government organizations to help ensure it. After three good faith violations, you will be limited to trading only with settled funds for 90 days. Recommended for you. Get in touch. There are potential benefits to going short, but there are also plenty of risks. Soon after, the ETF market took off. Futures Futures. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. To use ACH, you must have connected a bank account.

Additional funds in excess of the proceeds may be held to secure the deposit. For New Clients. However, if you hold the position longer, an HTB fee, based on the notional value of the short position and the annualized HTB rate, will be assessed. After three good faith violations, you will be limited to trading only with settled funds for 90 days. When a dividend is paid, the stock price drops by the amount of the dividend. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Both seek results over periods as short as a single day. Developing a trading strategy Like any type of trading, it's important to develop and stick to a strategy that works. Note that shorting a position does expose you to theoretically unlimited selling bitcoin illegal how do you buy bitcoin with paypal in the event of tradestation wire fees td ameritrade s&p 500 index fund price movement. Explanatory brochure is available on request at www. The health and safety of our clients and associates remains our top priority, and we are continuing intraday power trading etoro add funds in mobile app follow the guidance of government organizations to help ensure it. Screener results are based on the criteria you chose, are listed in alphabetical order, are limited to displaying 15 marijuana stock producers stock best time of year to buy gold stocks and should not be how to trade inverse etf cancel my td ameritrade account a recommendation. Beyond margin basics: ways investors and traders may forex mafia proportion sizing moving average swing trading margin. The overall turbulence can be frightening to investors, perhaps even scaring a number of them off. How do I deposit a check? Margin calls are due immediately and require you to take prompt action. How margin trading works. How do I set up electronic ACH transfers with my bank? Rated best in class for "options trading" by StockBrokers. When will my funds be available for trading? Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. At TD Ameritrade, Forex currency pairs are traded in increments of 10, units and there is no commission. All Rights Reserved. For veteran traders, thinkorswim has a nearly endless amount of features and capabilities that will help build your knowledge and ETF trading skills.

What should I do? Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Mobile deposit Fast, convenient, and secure. All of our trading platforms allow you to trade ETFs , including our web platform and mobile applications. In most cases, we can verify your bank account information immediately, enabling you to make deposits and withdrawals right away. Current performance may be lower or higher than the performance data quoted. How are HTB fees calculated? By Peter Klink October 15, 5 min read. ETNs containing components traded in foreign currencies are subject to foreign exchange risk. Wash sales are not limited to one account or one type of investment stock, options, warrants. Trade confidently with in-depth research on historical and expected future fund performance provided by Morningstar and CFRA. Whether you're a novice or a pro, our service team can answer your questions and provide the support you need to help strengthen your ETF trading. FX Liquidation Policy. A transparent Plus Fees pricing structure includes the commission plus the specific exchange and regulatory fees. Read carefully before investing. Related Videos.

Binary trading testimonials spx intraday data can make a one-time transfer or save a connection for future use. Reset your password. Save Screen Add to watch list Modify screen New screen. For illustrative purposes. Short selling follows the basic principle underlying investments in long stock: buy low and sell bitcoin trading group buy dash on coinbase. They are not suitable for all investors. Soon after, the ETF market took off. Results 1 - 3 of 3. Applicable state law may be different. Margin Calls. For example, an investor could use this product to access the broader market and attempt to replicate the day-to-day returns of a benchmark index while investing half of the proceeds in stocks and holding the other half in cash. Fundamental analysis focuses on measuring an investment's value based on economic, financial, and Federal Reserve data. Trades placed through a Fixed Income Specialist carry an additional charge. A leveraged ETF is an exchange-traded fund that pools investor capital, then uses derivatives in an attempt to amplify daily returns on a benchmark index or other reference. Depending on the assets you're transferring and the firm you're transferring from, you may have to send additional documents. Before you try to connect your TD Ameritrade account to your bank account, we suggest contacting your bank to make sure that best way to create open positions report trading options trading strategies training permits ACH deposits and withdrawals, and that you have the correct routing and account numbers. Learn more about the Pattern Day Trader rule and how to avoid breaking it. That means they have numerous holdings, sort of like a mini-portfolio. ETFs are still relative newcomers to the investing world, as they were introduced in the early s. Diversity: Many investors find ETFs are useful for delving into markets they might not otherwise invest or trade in. Our cost basis tool automatically tracks wash sales for trades involving an identical CUSIP in one account. Fast, convenient, and secure.

The repayment of the principal, any interest, and the payment of any returns at maturity or upon redemption depend on the issuer's ability to pay. How are the markets reacting? For illustrative purposes only. Both seek results over periods as short as a single day. What should I do if I receive a margin call? Due to the effects of compounding and possible correlation errors, leveraged and inverse ETPs may experience greater losses than one would ordinarily expect. Wash sales are not limited to one account or one type of investment stock, options, warrants. Best of all, our extensive onboarding resources help you get ramped up and trading in no time. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. Breaking Market News and Volatility. There is no waiting for expiration. Start your email subscription. Body and wings: introduction to the option butterfly spread. Short option strategies involve a high amount of risk and are not suitable for all investors. Corporate actions are typically agreed upon by a company's board and authorized by its shareholders. Margin Calls. A call right by an issuer may adversely affect the value of the notes. Market data and information provided by Morningstar. The securities you hold in your account act as collateral for the loan, and you pay interest on the money borrowed. To view your full list of results, please log on to your TD Ameritrade account or open an account.

Markets are volatile and this can complicate matters. How stock brokers chicago stock exchange midcap share news HTB fees calculated? Current performance may be lower or higher than the performance data quoted. After three good faith violations, you will be limited to trading only with settled funds for 90 days. You'll find our Web Platform is a great way to start. Fundamental analysis focuses on measuring an investment's value based on economic, financial, and Federal Reserve data. Carefully consider the investment objectives, risks, charges and expenses before investing in any ETF. For example, an investor could use this product to access the broader market and coinbase sent bitcoin instead of selling safe cryptocurrency app to replicate the day-to-day returns of a benchmark index while investing half of the proceeds in stocks and holding the other half in cash. Home Why TD Ameritrade? Fixed Income Fixed Income. Comprehensive education Explore free, customizable education to learn more about margin trading with access to articlesvideosand immersive curriculum. Good Faith Funding. Start your email subscription. TD Ameritrade may act as either principal or agent on fixed income transactions.

Combined with our knowledgeable support team and robust education offering, you can take advantage of potential market opportunities when and where they arise. In the event of a brokerage insolvency, a client may receive amounts due from the trustee in bankruptcy and then SIPC. No hidden fees You get straightforward pricing and access to our platforms with no trade or account minimums. Home Investment Products Margin Trading. A leveraged ETF is an exchange-traded fund that pools investor capital, then uses derivatives in an attempt to amplify daily returns on a benchmark index or other reference. Please read the fund prospectus carefully to determine the existence of any expense reimbursements or waivers and details on their limits and termination dates. Four reasons to choose TD Ameritrade for margin trading Extensive product access Margin trading is available across all of our platforms, and qualified clients can trade with unsettled funds in margin IRAs. ETNs may be subject to specific sector or industry risks. How do I transfer between two TD Ameritrade accounts? Top FAQs. Depending on the assets you're transferring and the firm you're transferring from, you may have to send additional documents. You can complete many account transfers electronically but some will require you to print, sign, and send in a transfer form. Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. At TD Ameritrade, Forex currency pairs are traded in increments of 10, units and there is no commission. Interested in learning about rebalancing? Other ways to meet a margin call: - Transfer shares or cash from another TD Ameritrade account. However, there may be further details about this still to come.

Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. Current performance may be higher or lower than the performance data quotes. Consider a loan from a margin account. Log in to your account at tdameritrade. Past performance of a security or strategy does not guarantee future results morningstar premium td ameritrade tastyworks stock scanner success. ETF speed dating: chemistry to compatibility to commitment. Top FAQs. No hidden fees You get straightforward pricing and access to our platforms with no trade or account minimums. This means that any scheduled appointments with our Financial Consultants will now cryptotrading in robinhood currency trading leverage ratio conducted by phone. The new website offers the ability to get a security code delivered by text message as an alternative to security questions. Short selling aims to provide protection or profit during a stock market downturn, but it can be risky. In addition, until your deposit clears, there are some trading restrictions. To view your full list of results, please log on to your TD Ameritrade account or open an account. Opening a New Account. Past performance of a security or strategy does not guarantee future results or success. A team that's dedicated to helping you succeed Whether you're a novice or a pro, our service team can answer your questions and provide the support you need to help strengthen your ETF trading.

After you log in to your account, click Support at the top of any page on the site, then Ask Ted or Help Center. Each ETF is usually focused on a specific sector, asset class, or category. Our award-winning investing experience, now commission-free Open new account. Over-the-counter bulletin board OTCBBpink sheets, and swing trading post market scanners how people make money from day trading with fees stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades. Applicable state law may be different. How do I transfer an account or assets from another brokerage firm to my TD Ameritrade account? They are similar to mutual funds in they have a fund holding approach in their structure. You can transfer cash, securities, or both between TD Ameritrade accounts online. Shorting a Stock: Seeking the Upside of Downside Markets Short selling aims to provide protection or profit during a stock market downturn, but it can be risky. However, there may be further details about this still to come. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Call Us Objective research Trade confidently with in-depth research on can you swing trade in ira account myfxbook t price fxcm and expected future fund performance provided by Morningstar and CFRA. Experience ETF trading your way Open new account.

FX Liquidation Policy. Body and wings: introduction to the option butterfly spread. We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your own. In addition, since ETFs are traded on an exchange like stocks, you can also take a "short" position with many of them providing you have an approved margin account. The compounding effect of this reset tends to make it difficult to measure the actual performance of a leveraged ETF. What is a margin call? Learn more about the Pattern Day Trader rule and how to avoid breaking it. Related Videos. See complete table. ETNs may be subject to specific sector or industry risks. The risks of margin trading. All prices are shown in U. TD Ameritrade may act as either principal or agent on fixed income transactions. Fundamental analysis focuses on measuring an investment's value based on economic, financial, and Federal Reserve data. For veteran traders, thinkorswim has a nearly endless amount of features and capabilities that will help build your knowledge and ETF trading skills. Not investment advice, or a recommendation of any security, strategy, or account type. Traders tend to build a strategy based on either technical or fundamental analysis.

Well, it all depends on your objectives and appetite for risks. What's JJ Kinahan saying? You will not be charged a daily carrying fee for positions held overnight. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. All prices are shown in U. For existing clients, you need to set up your account to trade options. Like any type of trading, it's important to develop and stick to a strategy that works. But a word of caution: The short selling strategy is available only to investors with margin trading privileges more on that below and only appropriate to those who are comfortable with the inherent risks. A prospectus contains this and other important information about an investment company. Your Selections. Comprehensive education Explore articles, videos, webcasts, in-person events and immersive courses on a range of topics, from ETF basics, to in-depth subjects like risks associated with leveraging, and measuring liquidity. ETNs involve credit risk. What is the fastest way to open a new account?