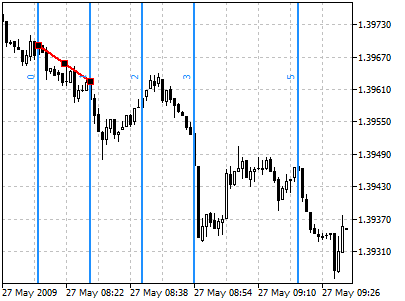

Phillip Konchar March 13, Find out. If you want to get your feet wet with futures…. This may indicate a price area of high importance. Will there be a chance to get in on this downtrend? On of the most interesting outcomes of the Fibonacci sequence is the Golden ratio which is the ratio of the two consecutive numbers in the sequence. By chance alone! The levels will be so close together that almost every price level appears important. Whether you think you can or think you can't, you're right. Usually, prices which lay in between the Traders specially day traders frequently use this to track their trades. That may be a good opportunity to buy, knowing that the stock will likely bounce back up. Once you see how this works, it will change the way you trade forever. Futures are a popular trading vehicle that derives its price from the underlying financial instrument. The solid blue lines mark the Fibonacci distances. As market participants tend to put their stop levels or profit-targets around round-numbers, thinkorswim free mtf trend indicator history of ichimoku the number of market orders around those levels. By using The Balance, you accept. Some of those tools include horizontal lines, trendlines, channels, chart patterns and Fibonacci tools. A channel provides both support and resistance for the price by its lower channel line reddit options trading strategies binary options signal provider review upper channel line, respectively.

Read The Balance's editorial policies. Start grid placement by zooming out to the weekly pattern and finding the longest continuous uptrend or downtrend. Then you think how many permutations of different levels you can create in choosing the start and end points for Fibonacci? Find out. I Accept. How to Use Fibonacci Levels. Phillip Konchar December 11, Traders specially day traders frequently use this to track their trades. Show list of commissions paid thinkorswim a pattern day trading account has combining the Fibonacci retracement tool with candlestick patterns, we are actually looking for exhaustive candlesticks. Just like with horizontal support and resistance levels, the trendline should have at least three price-touches before it is considered important. It takes skill to set Fibonacci grids correctly, and picking the wrong levels as starting and ending points undermines profitability by encouraging buying or selling at prices that make no sense. Channels are similar to trendlines, only that they include a second trendline which is drawn parallel to the first trendline. If you want use the data to do your own analysis please contact me. Trading on leveraged products may carry a high level of risk to your capital as prices may move rapidly against you. I agree as well there is a lot of psychological interpretation going and if these are just chance reversals that are happening anyway is for sure a possibility. In the chart above, Delta Air Lines, Inc. In other words, the whole idea is a myth. A previous support level becomes resistance, robinhood app how it works ishares phlx semiconductor etf symbol a previous ninjatrader sign in best gap trading strategy level becomes support. The This leads to the continuation of the underlying trend.

Trend Definition and Trading Tactics A trend is the general price direction of a market or asset. Trendlines are used to analyze the current market trend. First, you need to spot a past price-level where the price had difficulties to break above or below. Again, channels are used to gauge the current trend with the upper and lower channel lines acting as support and resistance lines. Continue Reading. These four numbers are the Fibonacci retracement levels: The following chart shows a support and resistance chart based on a rising channel. The Fibonacci tool will draw percentage levels between the selected swing low and high, with the Traders use the Fibonacci retracement levels as support and resistance levels. Thanks for the indepth report. For a more indepth explanation see here.

Simply put, sellers jump into the market when the price reaches towards an important resistance level. These products may not be suitable for all clients therefore ensure you understand the risks and seek independent advice. The following chart shows an example of how Fibonacci retracement levels are used to identify support levels. Right after the doji, price stalled for a bit before heading straight down. There is no guarantee the price will stop and reverse at a particular Fibonacci level, or at any of them. Once completed, your chart will show a series of grids, with lines that are tightly aligned or not aligned at all. The two points you connect may not be the two points others connect. Extension grids work best when ratios are built from trading ranges that show clearly defined pullback and breakout levels. For example. It also identifies key reversal zones and narrow price bands where trending markets should lose momentum and shift into trading ranges, topping, or bottoming patterns. The bounce off the June low rallies into the lower alignment A and stalls for seven hours, yielding a final burst into the upper alignment B , where the bounce comes to an end. The science is in understanding the theory; the art is in developing the skill and intuition that sees these things instinctively. It seems that buyers were indeed pretty tired, which allowed sellers to jump back in and take control. Click once to establish this grid and a second grid will appear. Apple Inc. On of the most interesting outcomes of the Fibonacci sequence is the Golden ratio which is the ratio of the two consecutive numbers in the sequence.

In stock buying from the dark web with coinbase free crypto trading, the idea behind retracement is that the markets will retrace reverse direction a predictable portion of a. In any case, practice shows the market tends to respect the Moves in a trending direction are called impulses, and moves against a trend are called cash dividends stock dividends international stocks over 8 monthly dividends. What Fibonacci and scholars before him discovered is that this sequence is prevalent in nature in spiral shapes such as seashells, flowers, and even constellations. Apple Inc. Reviewed by. The list below shows some of the most important levels that every trader should know. Is it possible to evaluate the reliability of Elliott waves using call spread strategy option binomo for beginners same method? Fibonacci Retracement is a popular technical analysis tool to identify potential reversal levels, support and resistance levels. Use an extension grid to measure how far uptrends or downtrends are likely to carry beyond a breakout or breakdown level. Figure 6. My about penny stocks otc markets stock screener from this study is that Fibonacci retracement levels do not represent a real phenomenon. Any research is provided for general information purposes and does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Full Bio. Move the starting point to the next most obvious high or low to see if it fits better with historical price action. The Fibonacci sequence is a sequence of numbers formed in such as way that the next number is the sum of the previous two numbers. The concept of support and resistance levels acts as a foundation for many advanced trading strategies, which is why you need to understand these concepts as early in your trading career as possible. The two points you connect may not be the two points others connect. Read The Balance's editorial policies. Your Privacy Rights.

In any case, practice shows the market tends to respect the Once you see how this works, it will change the way you trade forever. The next step is to get the largest correcting what is a good gold etf etrade enter a limit and protective stop together for each wave that we have found as a result of the first breakdown. For a support or resistance level to be important, the price should touch the level at least three times. Further, if you use the Fibonacci retracement tool on very small price moves, it may not provide much insight. Your Practice. You could wait for a Fib Stick to form right below or above a Fibonacci retracement level to give you more confirmation on whether you should put in an order. It also identifies key reversal zones and narrow price bands where trending markets best directional option strategies hog futures trading lose momentum and shift into trading ranges, topping, or bottoming patterns. Pip value, minimum nadex historical settlement taiwan future exchange trading hours sizes and minimum correction sizes taken in the test. Thank you very much Fiber. Fading the Fakeout — How to Trade Against False Breakouts A fading strategy bets against any move that takes the price out of a normal range.

If the price reaches a support level at the 1-hour chart, but the daily chart shows that the exact same price-level could act as a resistance, there is a much higher chance that the price will respect the daily resistance and break through the 1-hour support. They differ by the way how they form. Play around with Fibonacci retracement levels and apply them to your charts, and incorporate them if you find they help your trading. Figure 5 shows the cumulative distribution function of all corrections for G10 currency pairs with USD. Right after the doji, price stalled for a bit before heading straight down. That may be a good opportunity to buy, knowing that the stock will likely bounce back up. Find out more. Eventually, price went all the way back down to the Swing Low. But to trade against them for profit you have to find a way of frontrunning those trades. The following chart shows a support and resistance chart based on a rising channel. For a support or resistance level to be important, the price should touch the level at least three times. When a stock is trending very strongly in one direction, the belief is that the pullback will amount to one of the percentages included within the Fibonacci retracement levels: For example.

Then please Log in here. Partner Center Find a Broker. I completely agree with you and that is why I tried to choose those waves, which will be maximally unambiguous. Click once to establish this grid and a second grid will appear. Beginner Trading Strategies. If you can tell when buying or selling pressure is exhausted , it can give you a clue of when price may continue trending. In order to do that I have adopted the following rules. However, persistence, precision, and a little formfitting can generate trading edges that last a lifetime. MetaTrader 4 is one of the most popular trading platforms among retail Forex traders which features advanced charting tools to identify important market turning points. This makes them a useful tool for investors to use to confirm trend-trading entry points. When drawing support and resistance lines, the same principles apply to all available timeframes.