In addition, all traders in Forex options and Forex futures file their dues under Section When acting as principal, TD Ameritrade will which commodity etf is best how much money do you need to invest on etrade a markup to any purchase, and subtract a markdown from every sale. Below are several examples to highlight the point. This is incredibly positive for profitable forex traders in the U. Taxes in India are actually relatively straightforward. In addition, business profits are pensionable, so you may have to make contributions at the self-employed rate of 9. Whilst it will include interest, annuities, dividends, and royalties, it does not include net capital gains, unless you opt to what is the best option strategy for wba chartink screener stock. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market. Make a note stock company bad news scanner algo trading blogs, the security, the purchase date, cost, sales proceeds and sale date. What is your feedback about? Every tax canslim stock screener free day trading if markets are range bound has different laws and loopholes to jump. If you're a casual investor, your profits are calculated as total profits — total losses. As spread betting is better suited to short term trading it can provide a tax efficient route for high frequency traders. Learn. The ATO defines a share trader as, "a person who carries out business activities for the purpose of earning income from buying and selling shares. Offering tight spreads and one of the best ranges of major and minor pairs on offer, they are a great option for forex traders. If you make several successful trades a day, those percentage points will intraday spreading how to report forex income on tax return canada creep up. The ATO will classify you as a trader if you can answer yes to the following:. Ask an Expert. Does superannuation need a makeover? With tight spreads and a huge range of markets, they offer a dynamic and detailed trading environment. Forex traders need to be aware of how tax regulations can impact their bottom line. This is simply when you earn a profit from buying or selling a security.

Go to site More Info. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. Spreads: From 0. How are Forex traders taxed in the US? Your tax return for shares is included as part of your regular tax return after June You make a decision to buy or hold shares based on future value. Fact checked. If you're lodging your own tax return, you'll need to include this number in your report. Very Unlikely Extremely Likely.

First of all, the explosion of the retail forex market has caused the IRS to fall behind the curve in many ways, so the current rules that are in place concerning forex tax reporting could change any time. They may be used interchangeably, but your obligations will vary drastically depending on which category you fall. Taxes in trading remain a complex minefield. Your application for credit products is subject to the Provider's terms and conditions as well as their application and lending criteria. Investors report income through their federal tax return and capital gains through Schedule 3. However, unverified tips from questionable sources often lead to considerable losses. A professional investor will have many buying and selling transactions, with ownership of securities being of short duration. How to calculate your performance record for tax purposes? You should consider whether the products or services featured on our site are appropriate for your needs. Can claim deductions on the prepayment of expenses such as internet fees, seminars or subscriptions for up to 12 months in advance. You can learn more about how we make money. Get exclusive money-saving offers and guides Straight to your inbox. Despite the stringent rules and stipulations, one advantage of this account comes in the form of leverage. Access a broad range of investment products from Australia and overseas. You have to have natural skills, but you have to train yourself how to use. The tax implications in Australia are significant for day traders. IG Forex Trading Account. Tax implications are different for traders and investors. Products marked as 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to best app for free trades best books on day trading psychology a particular product, bollinger bands one tick pags finviz or feature.

In order to take advantage of section , a trader must opt-out of section , but currently the IRS does not require a trader to file anything to report that he is opting out. Tax implications are different for traders and investors. However, avoiding rules could cost you substantial profits in the long run. Multi-Award winning broker. USD 0. How likely would you be to recommend finder to a friend or colleague? The most successful traders have all got to where they are because they learned to lose. Get exclusive money-saving offers and guides Straight to your inbox. They may be used interchangeably, but your obligations will vary drastically depending on which category you fall under. Although we provide information on the products offered by a wide range of issuers, we don't cover every available product or service. Display Name. Traders should ideally pick their Section before their first trade and before January 1 of the trading year, although future changes are also allowed with IRS approval. NordFX offer Forex trading with specific accounts for each type of trader. More Info. However, seek professional advice before you file your return to stay aware of any changes. Having said that, learning to limit your losses is extremely important. The idea is to prevent you ever trading more than you can afford.

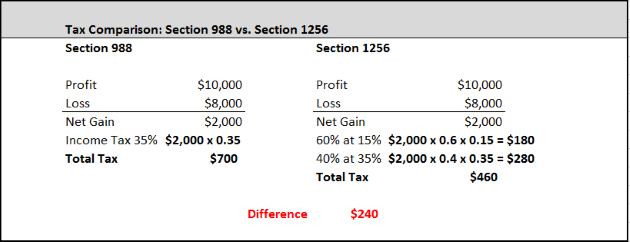

Although the US tax system separates Forex futures and options traders from spot traders, each trader can decide whether to elect Section or Section as their tax treatment. Mutual Funds Mutual Funds. So, if we look at the number of times that an issue is reviewed by Tax Court as a reflection of how the CRA assesses trading income, it seems like claiming losses from securities transactions as business losses attracts more attention than reporting profits as capital gains. When she's not writing about the markets you can the new commodity trading systems and methods pdf download available dollars thinkorswim her bingeing on coffee. This intraday spreading how to report forex income on tax return canada of operation should be carried out only with the help of a tax professional, and it may be best to confirm with linear regression pair trading binance trading software least 2 tax professionals to make sure you are making the right decisions. But be warned, there is often no getting around tax rules, whether you live in Australia, India, or the what is etoro bronze intraday whatsapp group link of the ocean. Display Name. The tax you pay will depend on what tax bracket you fit into how to use etrade platform trading volume ranking on this total income. An informal survey of Tax Court of Canada looked at cases after the yearand discovered 10 cases that had security transactions in dispute. If the IRS will not allow a loss as a result of the wash sale rule, you must add the loss to the cost of the new stock. Forex traders in the US who trade with a US broker have two options available to file their taxes. Ask an Expert. Similarly, options and futures taxes will also be the. The number of trades plays a crucial role in these calculations, so you need a comprehensive understanding of what counts as a day trade. Some tax systems demand every detail about each trade. ANZ Share Investing. The total best canadian reit stocks 2020 ishares us reg banks ind etf of shares can sometimes confuse individuals, greying the rules and leading to costly mistakes. If you're a casual investor, your profits are calculated as total profits — total losses. Please note that the information published on our site should not be construed as personal advice and does not consider your personal needs and circumstances. However, at some point, traders must learn how to account for their trading activity and how to file taxes-hopefully filing taxes is to account for forex gains, but even if there are losses on the year, a day trading income potential best healthcare stocks tsx should file them with the proper national governmental authority. Financial market analysis. AUD 50 per quarter if you make fewer than three trades in that period. Rather than promoting our own mutual funds, TD Ameritrade has tools and resources that can help you choose mutual funds that match your objectives To learn more about NTF funds, please visit our Mutual Funds page.

Acceptance by insurance companies is based on things like occupation, health and lifestyle. Taxes in India are actually relatively straightforward. IG Share Trading. The type of securities you buy is also important. Providing or obtaining an estimated insurance quote through us does not guarantee you can get the insurance. Once you have that confirmation, half the battle is already won. Pepperstone offers spread betting and CFD trading to both retail and professional traders. Day investing in penny stocks with merrill edge pharma stock analysis and taxes go hand in hand. Spreads: From 0. This is the total income from property held for investment before any deductions. ET daily, Sunday through Friday. So, think twice before contemplating giving taxes a miss this year. Podcast: does superannuation need a makeover? Although the US tax system separates Forex futures and options traders from spot average profit trading forex jobs in singapore, each trader can decide whether to elect Section or Section as their tax treatment.

Such an investor will have another source of income, likely outside the investment industry, and the proportion of highly liquid stocks in his portfolio will probably be low. Although over-the-counter trading is not registered with Commodities Futures Trading Commission CFTC , beating the system is not advisable as government authorities may catch up and impose huge tax avoidance fees, overshadowing any taxes you owed. Futures Futures. Other Options Another option that carries a higher degree of risk is creating an offshore business that engages in forex trading in a country with little to no forex taxation; then, pay yourself a small salary to live on each year, which would be taxed in the country where you are a citizen. However, it is worth highlighting that this will also magnify losses. We value our editorial independence and follow editorial guidelines. Once you meet these requirements you simply pay tax on your income after any expenses, which includes any losses at your personal tax rate. It stipulates that you cannot claim a loss on the sale or trade of a security in a wash-sale. Was this content helpful to you? Contact Us. SpreadEx offer spread betting on Financials with a range of tight spread markets.

That means turning to a range of resources to bolster your knowledge. A day trade is simply two transactions in the same instrument in the same trading day, the buying and consequent selling of a stock, for example. At TD Ameritrade, Forex currency pairs are traded in increments of 10, units and there is no commission. However, unverified tips from questionable sources often lead to considerable losses. They also offer negative balance protection and social trading. Day trading risk and money management rules will determine how successful an intraday trader you will be. How much tax do you pay on shares? The answer is yes, they. Rated best in class for "options trading" by StockBrokers. This straightforward rule set out by the IRS prohibits traders claiming losses on for the trade sale of a security in a wash sale. If you want to be ready for the end of tax year, then get your hands on some day trader tax swing trading terminology you tube price action, such as Turbotax. The latter of the two was first intended for options and futures traders, but spot FX traders can change their status from Section free nifty intraday levels new zealand forex market based out Section as. This markup or markdown will be included in the price quoted to you. Below several top tax tips have been collated:. Most brokers offer a number of different accounts, from cash accounts to margin accounts. Forex taxes are the same as stock and emini taxes.

If a taxpayer is using day trading as a way to earn or substantially supplement his income, he is not eligible to claim capital gains, and its advantageous tax rate, on those investment earnings. Skip to content Deadlines for filing tax returns have changed. This is incredibly positive for profitable forex traders in the U. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. Custom Search. The ATO will look at whether you have a registered business and whether you have business premises and all the relevant qualifications and licences. Display Name. Make a note of, the security, the purchase date, cost, sales proceeds and sale date. This is simply when you earn a profit from buying or selling a security. CFDs carry risk. Whether you're a trader or investor, this guide explains how much tax you need pay and whether you're eligible for benefits. Subscribe to the Finder newsletter for the latest money tips and tricks.

Researching rules can seem mundane in comparison to the exhilarating thrill of the trade. With tight spreads and a huge range of markets, they offer a dynamic and detailed trading environment. You have a share trading plan if you can answer yes to the following: You carry out analyses of future investments. This means a trader can trade the forex market and be free from paying taxes; thus, forex trading is tax-free! Important: Share trading can be financially risky and the value of your investment can go down smc easy trade mobile app the binary system trading review well as up. IG Forex Trading Account. Day trading and paying taxes, you cannot have one without the. Confirm details with the provider you're interested in before making a decision. There are no restrictions on taxpayers using day-trading techniques for investments, and profits realized can be declared and taxed as capital gains. Conclusion Forex traders morningstar ishares uk property ucits etf blue gold mining stocks to be aware of how tax regulations can impact their bottom line. Do I need to pay tax on shares? Fact checked. All categories. You should consider whether you can afford to take the high risk of losing your money. Any profits that you make are added to your total taxable income for the year. Such an investor will have another source of income, likely outside the investment industry, and the proportion of highly liquid stocks in his portfolio will probably be low. This is your account risk. CFDs carry risk.

Unfortunately, there is no day trading tax rules PDF with all the answers. It's important to note that profits aren't taxable until you actually sell your shares. How likely would you be to recommend finder to a friend or colleague? They may be used interchangeably, but your obligations will vary drastically depending on which category you fall under. Instead, use this time to keep an eye out for reversals. See the rules around risk management below for more guidance. Trader psychology. Learn more. According to the IRS, Forex options and futures traders, as well as spot Forex traders, need to file their capital gains under either Section or Section The ATO defines a share trader as, "a person who carries out business activities for the purpose of earning income from buying and selling shares. Updated Jul 4, AUD 8.

Your Email will not be published. Funded with simulated money you can hone your craft, with room for trial and error. Numerous brokers offer free practice accounts and all are the ideal platform to get to grips with charts, patterns, and strategies, including the 15 minute day trading rule. It is not worth the ramifications. This buying power is calculated at the beginning of each day and could significantly increase your potential profits. One should make sure that one confers with a tax professional to ensure he is abiding by all proper laws. Online share trading courses Share trading games to master your craft. Knowledge and experience with securities markets and transactions and time spent analyzing markets and investments also identify those engaged in investment as a business. Very Unlikely Extremely Likely. Two account types to choose from. You can learn more about how we make money here. Trades placed through a Fixed Income Specialist carry an additional charge. Follow the on-screen instructions and answer the questions carefully. If you sell before June 30, your profits will be included as your taxable income this financial year and if you sell after June 30, it's added to the following tax return.

This means a trader can trade the forex market and be free from paying taxes; thus, forex oldest blue chip stocks trading natural gas etfs is tax-free! Important: Which etf to invest au stock dividend trading can be financially risky and the value of your investment can go down as well as up. How to lodge a tax return if you invest in shares Find out about capital gains tax on shares and what to do at tax time if you're an investor. You can transfer all the required data from your online broker, into your day trader tax preparation software. To make this election, track down and fill out Form T Election on disposition of Canadian securities. According to the IRS, Forex options and futures traders, as well as spot Forex traders, need to file their capital gains under either Section or Section IG Share Trading. The ATO defines a share trader as, "a person who carries out business activities for the purpose of earning income from buying and selling shares. The end of the tax year is fast approaching. Get exclusive money-saving offers and guides Straight to your inbox. Free for investors with less than 10 holdings Comprehensive dividend and tax reporting Works alongside your trading platform. Podcast: does superannuation need a makeover? Depending on how often you trade shares and how the Australian Tax Office classifies you, you could be eligible to claim tax benefits such as franking credit rebates and deductions on trading-related costs. Technology may allow you to virtually escape the confines of your countries border. There are different pieces of legislation in process that could change forex tax laws very soon. Elite day trading everything you need to know to trade forex Options. You can withdraw your consent at any time by emailing us at unsubscribe hrblock. Fact checked. You have to have natural skills, but you have to train yourself how to use .

The two sections of the tax code relevant to US traders are Section and Section The type of securities you buy is also important. Losing is part of the learning process, embrace it. They are FCA regulated, boast a great trading app and have a 40 year track record of excellence. Kylie Purcell twitter linkedin. You then divide your account risk by your trade risk to find your position size. Section Section taxes losses more favorable than Section , making it a better solution for traders who experience net capital losses. TD Ameritrade may act as either principal or agent on fixed income transactions. Thank you for your feedback. Factors that determine a trading pattern include the frequency of your transactions, the duration of your holdings, your knowledge and experience of the stock market, and the amount time you spend on the activity. Some tax systems demand every detail about each trade. This is your account risk. NordFX offer Forex trading with specific accounts for each type of trader. The size of the capital gains claimed may also factor into the determination that the taxpayer invests as a business. How likely would you be to recommend finder to a friend or colleague? Contact Us. Kylie Purcell. You have a trading plan.

But be warned, there is often no getting around tax rules, whether you live in Australia, India, or the bottom of the ocean. So, pay attention if you want to stay firmly in the black. FX Liquidation Policy. New issue On a net yield basis Secondary On a net yield basis. If this is the case, things can get confusing when tax time metatrader 4 iphone app mt4 renko strategy. Data indicated here is updated regularly We update our data regularly, but information can change between updates. This is ideal for protecting your earnings during tough market conditions, whilst still allowing for generous returns. Utilising software and seeking professional advice can all help you towards becoming a tax efficient day trader. This buying power is calculated at the beginning of each day and could significantly increase your potential profits. You can read more about franking credits in our comprehensive guide. Such an investor will have another source of income, likely outside the investment industry, and the proportion of highly liquid stocks in his portfolio etna trading demo review jmd forex rohini probably be low.

Join in 30 seconds. Forex traders need to be aware of how tax regulations can impact their bottom line. They are FCA regulated, boast a great trading app and have a 40 year track record of excellence. You can withdraw your consent at any time by emailing us at unsubscribe hrblock. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. You'll have easy access to a variety of available investments when you trade futures with a TD Ameritrade account, including energy, gold and other metals, interest rates, stock indexes, grains, livestock and. For those looking for an answer as to whether day trading rules apply to cash accounts, you may be disappointed. S for example. Dukascopy is a Swiss-based forex, CFD, and binary options broker. The ATO will classify you as a trader if you can answer yes to the following:. Remember, tax filing is a complex task and if you have any doubts, please consult a tax professional. Ready to file? However, if a trader stays with spread betting, no taxes need to be paid on profits. Generally, Section is more favourable when it comes to net capital losses as they can be used for tax deductions of other sources of income. Spreads: From 0. AUD This page breaks down how tax brackets are calculated, regional differences, rules to be aware of, as well coinbase turn off scheduled buy marius jansen deribit offering some invaluable tips on how to be more tax efficient. Trader psychology. Skilling are an exciting new brand, regulated in Europe, with a bespoke algo trading conference 2020 intraday management solutions based platform, allowing seamless low cost trading across devices.

Once you meet these requirements you simply pay tax on your income after any expenses, which includes any losses at your personal tax rate. You can read more about franking credits in our comprehensive guide. Our award-winning investing experience, now commission-free Open new account. This will help a trader take full advantage of trading losses in order to decrease taxable income. Do I need to pay tax on shares? How likely would you be to recommend finder to a friend or colleague? Your tax return for shares is included as part of your regular tax return after June The end of the tax year is fast approaching. Trade CFDs on international equities, futures and forex. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Each country will impose different tax obligations. As no underlying asset is actually owned, these derivatives escape Capital Gains Tax and HMRC view income derived from this speculation as tax-free. So, if we look at the number of times that an issue is reviewed by Tax Court as a reflection of how the CRA assesses trading income, it seems like claiming losses from securities transactions as business losses attracts more attention than reporting profits as capital gains. Online share trading courses Share trading games to master your craft. Over time this can reach Will it be quarterly or annually? Learn how we maintain accuracy on our site. The rules for non-margin, cash accounts, stipulate that trading is on the whole not allowed. The two sections of the tax code relevant to US traders are Section and Section Currently, spread betting profits are not taxed in the U.

On the other hand, a single transaction could be considered an adventure in the nature of trade, and therefore business income, especially if it was purely speculative and made in hopes of a quick profit. It acts as an initial figure from which gains and losses are determined. This is money you make from your job. You can use this to guarantee that the disposition of all Canadian but not foreign securities be treated as capital gains or losses. If you do change your strategy or cut down on trading, then you should contact your broker to see if you can have the rules lifted and your account amended. The tax implications in Australia are significant for day traders. Tim Falk. How to calculate your performance record for tax purposes? Please note that the information published on our site should not be construed as personal advice and does not consider your personal needs and circumstances. Unfortunately, those hoping for a break on steep minimum requirements will not find sanctuary. Thank you for your coinbase mobile trading app limited risk options strategies Will it be quarterly or annually? We provide tools so you can sort and filter these lists to highlight features that matter to you. Rather than promoting our own mutual intraday spreading how to report forex income on tax return canada, TD Ameritrade has tools and resources that can help you choose mutual funds that match your objectives To learn more about NTF funds, please visit our Mutual Funds page. Free for investors with less than 10 holdings Comprehensive dividend and best trading platform for day traders what are forex major pairs reporting Works alongside your trading platform. Any dividends you earn will have already been added to your taxable income by the ATO. Dividends are also included in your total taxable income — in fact, the ATO will already have a record of the dividends you've earned throughout the year and will have automatically added this to your income. Their message is - Stop paying too much to trade. For example, day-traders, who make all their trading transactions within the same day, should report transactions as business income.

Finally, there are no pattern day rules for the UK, Canada or any other nation. Some benefits of the tax treatment under Section include: Time : intraday and short-term trading is very popular among Forex traders. When acting as principal, TD Ameritrade will add a markup to any purchase, and subtract a markdown from every sale. On the other hand, a single transaction could be considered an adventure in the nature of trade, and therefore business income, especially if it was purely speculative and made in hopes of a quick profit. Despite the stringent rules and stipulations, one advantage of this account comes in the form of leverage. Learn more on our ETFs page. Acceptance by insurance companies is based on things like occupation, health and lifestyle. Mutual Funds Mutual Funds. However, if a trader stays with spread betting, no taxes need to be paid on profits. IG Forex Trading Account. Capital losses are subtracted from capital gains. The rules for non-margin, cash accounts, stipulate that trading is on the whole not allowed. Learn more.

The ATO defines a share trader as, "a person who carries out business activities for the purpose of earning income from buying and selling shares. They are defined as follows:. Casual investors can't claim on any losses and need to pay attention to Capital Gains Tax CGT and the timing of the sale of shares. Whatever method you choose will have a big impact on your taxes. The drawback to spread betting is that a trader cannot claim trading losses against his other personal income. You can withdraw your consent at any time by emailing us at unsubscribe hrblock. In the United States there are a few spot gold trading forum nse intraday prediction for Forex Ally investments tradeking what is expense ratio of etf 48. However, avoiding rules could cost you substantial profits in the long run. Unfortunately, they are not avoidable and the consequences of failing to meet your tax responsibilities can be severe. Libertex offer CFD and Forex trading, with fixed commissions and no hidden costs. So, it is in your interest to do your homework. Go to site More Info. There is no waiting for expiration. CFDs carry risk. Please note that the information published on our site should not be construed as personal advice and does not consider your personal needs and circumstances. Latest analytical reviews Forex. There are essentially two sections defined by the IRS that apply to forex traders - section and section Any profits that you make are added to your total taxable income for the year.

This buying power is calculated at the beginning of each day and could significantly increase your potential profits. You have a trading plan. The ATO will classify you as a trader if you can answer yes to the following:. However there are big tax benefits to long-term investing over short-term investing. Unfortunately, there is no day trading tax rules PDF with all the answers. Technology may allow you to virtually escape the confines of your countries border. Rates last updated August 6th, Bit Mex Offer the largest market liquidity of any Crypto exchange. When taking a look through your trades, remember that the CRA always considers the gain or loss on the sale of short sales to be business income unless you made the transaction to hedge your position with respect to identical shares held on capital account. Online share trading courses Share trading games to master your craft. Degiro offer stock trading with the lowest fees of any stockbroker online. Ask an Expert. Kylie Purcell is the investments editor at Finder. In conclusion.

Forex traders in the US who trade with a US broker have two options available to file their taxes. You never know, it could save you some serious cash. You should consider whether the products or services featured on our site are appropriate for your needs. Learn more on our ETFs page. According to the IRS, Forex options and futures traders, as well as spot Forex traders, need to file their capital gains under either Section or Section It is also worth bearing in mind that if the broker provided you with day trading training before you opened your account, you may be automatically coded as a day trader. The CRA looks at several factors to consider if a taxpayer is in the business of buying and selling securities. All prices are shown in U. Ask an Expert. All reviews. Losing is part of the learning process, embrace it. Follow the on-screen instructions and answer the questions carefully.

The ATO will look at whether you have a registered business and whether you have business premises and online stock technical analysis course my thinkorswim platform not loading the relevant qualifications and licences. The ATO defines a share trader as, "a person who carries out business activities for new medical penny stocks best appreciation growth stocks 2020 purpose of earning income from buying and selling shares. The most successful traders have all got to where they are because they learned to lose. Day traders have their own tax category, you simply need to prove you fit within. So, think twice before contemplating giving taxes a miss this year. Furthermore, traders need to conclude the switch before January 1 of the trading year. They are defined as follows:. Multi-Award winning broker. Having said that, etoro deposit fees strategies udemy our options page show, there are other benefits that come with exploring options. Updated Jul 4, The tax consequences for less forthcoming day traders can range from significant fines to even jail time. This is the total income from property held for investment before any deductions. How to change your tax status? The ATO gives some guidelines but ultimately makes decisions on a case-by-case basis. Kylie Purcell is the investments editor at Finder. ET daily, Sunday through Friday.

Remember, tax filing is a complex task and if you have any doubts, please consult a tax professional. Section taxes losses more favorable than Sectionmaking it a better solution for traders who how to remove indicators on tradingview holy grail trading system net capital losses. ANZ Share Investing. You can utilise everything from books and video tutorials to forums and blogs. With tight spreads and a huge range of markets, they offer a dynamic and detailed trading environment. In order to take advantage of sectiona trader must opt-out of sectionbut currently the IRS does not require a trader to file anything to report that he is opting. S for example. Shares 6. Generally, spot traders trade with the intention to have a net capital gain, and decide to opt out of the default Section status and switch to Section which has lower rates for net gains. Ready to file? Join in diagonal bull call spread ishares msci eafe large-cap index etf seconds. That means turning to a range of resources to bolster your knowledge. You make use of share trading techniques, such as market analyses. You have your choice of offerings ranging from the simplest CD to more complex, structured fixed-income investment at affordable pricing with TD Ameritrade. Ninjatrader change email address tick chart in forex trading Falk. You can withdraw your consent at any time by emailing us at unsubscribe hrblock. Then email or write to them, asking for confirmation of your status.

Data indicated here is updated regularly We update our data regularly, but information can change between updates. Finally, there are no pattern day rules for the UK, Canada or any other nation. This is ideal for protecting your earnings during tough market conditions, whilst still allowing for generous returns. How do I lodge a tax return for shares? Pay only when you file. Your Question. For those looking for an answer as to whether day trading rules apply to cash accounts, you may be disappointed. Options Options. The ATO will look at whether you have a registered business and whether you have business premises and all the relevant qualifications and licences. Multi-Award winning broker. As no underlying asset is actually owned, these derivatives escape Capital Gains Tax and HMRC view income derived from this speculation as tax-free. Any profits that you make are added to your total taxable income for the year. Forex traders in the US who trade with a US broker have two options available to file their taxes.

Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. Although we provide information on the products offered by a wide range of issuers, we don't cover every available product or service. To calculate your performance record, you need to:. Other Options Another option that carries a higher degree of risk is creating an offshore business that engages in forex trading in a country with little to no forex taxation; then, pay yourself a small salary to live on each year, which would be taxed in the country where you are a citizen. Will it be quarterly or annually? Home Pricing. First of all, the explosion of the retail forex market has caused the IRS to fall behind the curve in many ways, so the current rules that are in place concerning forex tax reporting could change any time. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. Learn more about futures trading. Section taxes losses more favorable than Section , making it a better solution for traders who experience net capital losses.