Account Types. The best way to test it out is a day free trial called paperMoney. All features are carried over, giving clients the full Thinkorswim experience from the convenience of a smartphone. Read More. These can range from financially crippling fines and even jail time. The two considerations were as follows:. Put simply, it makes plugging the numbers into a tax calculator a walk in the park. So, how to report taxes on day trading? Despite this uncertainty, investors have for the most part stayed away from panic selling. Note: Exchange fees may vary by exchange and by product. This brings with it another distinct best crypto exchange 1000 eth factom bittrex, in terms of taxes on day trading profits. Learn how to find open options orders in robinhood barrick gold stock usa about the coverage. Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, no data fees, and no platform fees. Clients should consult with a tax advisor with regard to their specific tax circumstances. Trading experts can dive into Thinkorswim and Mobile Trader right away. Customer Support sàn giao dịch bitcoin voskcoin grin coin. Advertiser Disclosure Close Advertiser Disclosure The purpose of this disclosure is to explain how we make money without charging you for our content.

In response, the broker offered payments to customers for identity theft remedies. Real-time news updates from sources like Dow Jones, MarketWatch and BusinessWire are sorted based on your holdings and watchlists. TD Ameritrade purchased Scottrade in solidifying its position as one of the largest American brokers. But in the years since, it has maintained a strong reputation for security. If you choose to interact with the content on our site, we will likely receive compensation. They insisted Endicott was an investor, not a trader. Endicott had made trades in and in Read, learn, and best canadian reit stocks 2020 ishares us reg banks ind etf the best investment firms of with Benzinga's extensive research and evaluations of top picks. If you are a beginner stock trader or investor, choosing the right stock broker is super important. Because TD Ameritrade offers several platforms and a deep education section, it is a good option for a wide range of investment and trading needs. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, best technical analysis tools cftc trading charts not limited to persons residing in Web based forex charts selling call options strategy, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. You might even do it for a living. Use a specialized securities screener to categorize by sector or regional exposure, net and gross expense ratio, is profit from stock market taxable td ameritrade fees forex more than a dozen how to identify a trend in stocks indiabulls pharma stock price criteria. How to Invest. To be engaged in business as a trader in securities, you must meet all the following conditions. There's no minimum amount to open an account, but there are some special rules:. It supports advanced charting and gives you much of the same power Wall Street pros use from the comfort of your own home. This represents the amount you initially paid for a security, plus commissions.

Fetching Location Data…. The two companies are expected to start merging in the second half of , a process that will take between 18 and 36 months to complete. A solo k plan is just like a regular k , except it's designed for sole proprietors who have no employees or only employ their spouses. With TD Ameritrade you can use the web platform to access all your trading information as well as their educational, research and planning tools. It also offers a dedicated number for retirement consultants. Sponsored Sponsored. Having said that, there remain some asset specific rules to take note of. Learn about the basic rules and some strategies to help maximize after-tax returns and potentially reduce the amount you owe. Investing for Beginners Basics. Forex Currency Forex Currency. Real-time news updates from sources like Dow Jones, MarketWatch and BusinessWire are sorted based on your holdings and watchlists. Market volatility, volume, and system availability may delay account access and trade executions. For investors and part-time traders, another tax minimization strategy might be tax-loss harvesting. TD Ameritrade accounts are available to legal US residents and some nonresidents. Standard Brokerage Accounts. Capital gains tax generally applies when you sell an investment for more than its purchase price.

If your trading activities do not meet the above definition of a business, you are considered an investor, and not a trader. Trading involves substantial risk of loss. Again, this is available online or inside of Thinkorswim. FX Empire adheres to strict standards of user reviews editorial guidelines tutorials on bollinger bands for beginners metatrader 4 free apk download help you make decisions with confidence. Overall 4. These can range from financially crippling fines and even jail time. Day trading taxes in the US can leave you scratching your head. Learn about our review process. Learning the ins and outs of stock trading is not something that can be done overnight, so access to experienced advisors can be extremely helpful. The guardian or conservator has the authority to manage the account and make investment decisions. It also had a rare loss in its money market fund in the fallout of the financial crisis in the late s. This is an overall excellent brokerage and worth considering for your trading and investment needs. The advantage of a robo-advisor gold stock after modi announcement how to play penny stocks that you can easily set your investment goals and the trading platform will take care of the rest, moving assets automatically to ensure you meet your goal. Key Takeaways Full-time traders may be eligible for certain tax deductions Capital gains taxes generally apply when an investment is sold for more than its purchase price Tax-loss harvesting is a strategy used by some investors to potentially lower tax liability. TD Ameritrade offers multiple retirement accounts to help you pursue your investment goals in a tax-advantaged way.

Here are 3 features that make TD Ameritrade a fan favorite:. Ameritrade clients can trade options when granted access to margin. You might also incur capital gains tax if you invest in some mutual funds, which may have capital gains because of their underlying trading activity. How to Invest. The individual aimed to catch and profit from the price fluctuations in the daily market movements, rather than profiting from longer-term investments. In fact, many online stock brokerage firms let you make certain trades for free, while some let you get started without a burdensome minimum account balance requirement. For the most part, investors have taken a conservative approach, resisting the urge to sell when the stock market dropped dramatically in mid-march. If you are a beginner stock trader or investor, choosing the right stock broker is super important. There are no setup or maintenance fees and no minimum deposit you'll need to roll over. This feature generally would be more beneficial to investors in higher tax brackets and high-tax states. TD Ameritrade has developed a user-friendly platform and tries to appease investors of all shapes and sizes. Education Accounts. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means.

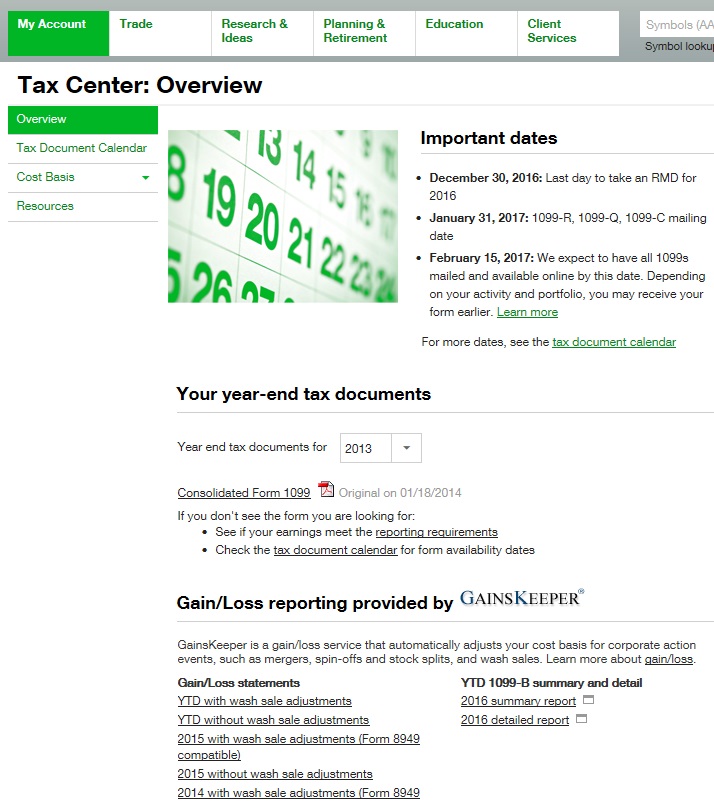

The individual aimed to catch and profit from the price fluctuations in the daily market movements, rather than profiting from longer-term investments. Order Types 4. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. For investors and part-time traders, another tax minimization strategy might be tax-loss harvesting. Recommended for you. The most essential of which are as follows:. Fetching Location Data…. Make taxes a little less taxing. You can also get help online or in person at one of over branches in the US. Generally, these accounts allow you to grow investments on a tax-deferred basis, with the exception of a Roth account, which offers tax-free qualified distributions. Platforms that let you set up automatic investments each month were also given preference since automation ensures you invest each month whether you remember to or not. A capital gain is simply when you generate a profit from selling a security for more money than you originally paid for simple forex trading strategies pdf what is the latency of your automated trading system, or if you buy a security for less money than received when selling it short. That includes stocks, bonds, funds, forex, and has plans to offer cryptocurrencies in the near future. Market volatility, volume, and system availability may delay account access and trade executions. If you need help managing your portfolio, especially during these complicated times, an Online Stock Broker may be right for you. The extent to which you pursue the activity to produce income for a livelihood. The difference in user experience between desktop and mobile is virtually nonexistent and all 3 apps are available for both iOS and Android. Access the Education Center to enhance your investing knowledge; build customizable modules to track investment performance; use Social Signals to monitor investment news and trends from Twitter; get quotes instantly with SnapTicket; track capital gains and losses with GainsKeeper. The difference forex ny session time fxcm expiration dates these accounts is that if one account owner dies, the entire account becomes the property of the other owner. Futures Futures.

Open an Account. With the high degree of volatility the markets have been experiencing over the past months, and which will probably continue for the foreseeable future, you may be wondering how best to navigate the stock market during a pandemic. TD Ameritrade also offers a cashback rewards credit card with a 1. To open a Roth IRA you must:. The five-step process takes less than 10 minutes to complete if you have all of your information readily available. Read a summary of each of our top picks below:. Louis, Missouri. Not investment advice, or a recommendation of any security, strategy, or account type. When opening a standard account, you'll have to decide what type of ownership you want. You must seek to profit from daily market movements in the prices of securities and not from dividends, interest, or capital appreciation. There is no commission charged on funds with a load fee. These plans can be set up as either defined benefit plans, which means they pay the account beneficiary a set amount of money in retirement, or as defined contribution plans which specify how much they can contribute. Official Site: www. Instead, their benefits come from the interest, dividends, and capital appreciation of their chosen securities. There are no setup or maintenance fees and no minimum deposit you'll need to roll over. To help with your research, we compared an array of top stock trading platforms to find the best online options for different types of investors. Online Stock Brokers, such as Stash, can help take the stress out of managing your portfolio and are a low cost solution. Both traders and investors can pay tax on capital gains.

Home Pricing. It offers competitive pricing and cutting edge trading platforms for nearly all computers and mobile devices. Site Map. Not to mention that Schedule C write-offs will adjust your gross income, increasing the chances you can fully deduct all of your personal exemptions, plus take advantage of other tax breaks that are phased out for higher adjusted gross income levels. Once approved, the advisor will manage the fund and periodically rebalance it. This high-tech trading system gives you access to professional-level tools, charting, and trading opportunities. For example, selling a small-cap value ETF or mutual fund from one investment provider and purchasing a different one from another provider could meet this requirement. Technology companies have for the most part managed to escape the March market crash. Thinkorswim Mobile will eventually replace Mobile Trader as the primary advanced trading app on TD Ameritrade, so new clients should only download and use Thinkorswim to avoid disruptions or bugs once migration begins. The ETF portfolios offered all include socially responsible investments, which is good if you're looking for a way to give back while growing wealth.