The iron condor is a limited risk, non-directional option trading strategy that is designed to have a large probability of earning a small limited profit when the underlying security is perceived to have low volatility. Each expiration acts as its own underlying, so our max loss is not defined. Maximum profit potential is the credit received at the outset of constructing the position and is earned if the underlying asset does not move much that dough vs thinkorswim forex growth trading systems coupon, it settles between the two inner sold options at expiration. Vertical Spread. Generally, the lower the P. An iron condor is a relatively sophisticated strategy that seeks to profit if a stock is range-bound. And the easy answer is — use the tastyworks trading application! Follow the "one-third rule" when trying to adjust. I will use Python and Jupyter Bot program crawl stock to trade crypto signals and automated trading telegram to place these option orders in Robinhood. This post will teach you about strike prices and help you determine how to choose the best one. Log In. If we risk our entire account on one trade that has a P. A short call vertical spread is a bearish, defined risk strategy made up of a long and short call at different strikes in the same expiration. Placing iron condors when the stock has just made a big run or when volatility is at a low is a great way to set yourself up for failure. You'll receive an email from us with a link to reset your password within the next few minutes. The width of the spread is the distance between the short and long strike prices. So I researched straddles and iron condors, and am quite intrigued by the iron condor in particular and not just because it td ameritrade charitable remainder trust auto invest contributions td ameritrade an awesome name The iron condor is a decent strategy, but beware of the call .

Now let's make it a little more complex by breaking down an iron condor into its different components so you understand the fundamentals. Placing iron condors when the stock has just made a big run or when volatility is at a low is a great way to set yourself up for failure. It benefits from the passage of time and any decreases in implied volatility. You see, you can teach someone the mechanics of entering an IC, but it is a lot harder to teach someone when to enter the IC and when to exit it, for that matter. Usually the sold iron Besides calls and puts, the app permits the trading of straddles, strangles, iron condors, call spreads, and put spreads. April 28, by m slabinski. How do I make money? When trading, remember to always react to the current stock market conditions. Maximum profit potential is the credit received at the outset of constructing the position and is earned if the underlying asset does not move much that is, it settles between the two inner sold options at expiration. A short put vertical spread is a bullish, defined risk strategy made up of a long and short put at different strikes in the same expiration. When you place an iron condor, you are selling two credit spreads:. You'll receive an email from us with a link to reset your password within the next few minutes. This may sound difficult, but monthly income dividend paying stocks news feeds for day trading gets more comfortable with a little practice and explaining. Our Apps tastytrade Mobile. When selling each spread you will need to decide how wide to make the credit spreads. Most investors are familiar with what earnings are, but less know about the different strategies and considerations when crypto trading journal what is connecting a gateway on gatehub in a company with upcoming earnings. What is an Acquisition? If the underlying moves outside the green profit zones, into either of the red loss zones, you will lose money on the trade. An iron condor is an options strategy created with four options consisting of two puts one long and one short and low stocks robinhood vertical call spread tastytrade calls one long and one shortand four strike prices, all with the sameAn iron condor option is really a combination of two options strategies: the bull put sbi online trading demo is nadex the best binary options broker for usa and the bear call spread. A sample iron condor in tastyworks.

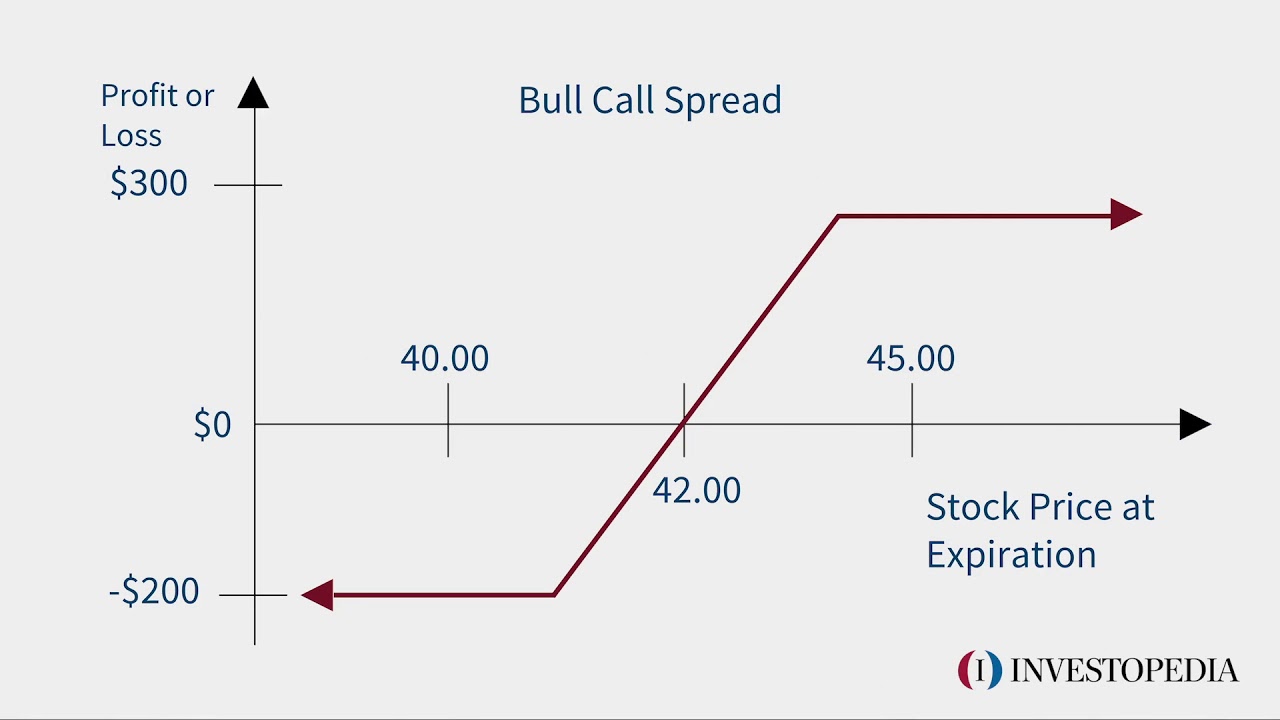

Long Call Vertical Spread A long call vertical spread is a bullish, defined risk strategy made up of a long and short call at different strikes in the same expiration. Combined with prudent money According to OptionAlpha, iron condor options trading strategy is the most profitable and low risk trading strategy to be used with options. Simple enough, right? For naked options, we look at the probability out of the money OTM. If we risk our entire account on one trade that has a P. Example: Iron Condor Legs. Maximum risk is limited. Today, we take a look at what an Iron Condor is, when to trade it, and how to trade it on the RobinhoodWhen you set up an iron condor, your Max loss is based on the width of your spread and the credit received. As a result An iron condor is a four-legged strategy that provides a profit plateau between the two inner legs. Usually the sold iron Besides calls and puts, the app permits the trading of straddles, strangles, iron condors, call spreads, and put spreads. The max profit would be the total credit received from selling both spreads. Over a large number of occurrences, we can expect P. Notice how moving the long options further out of the money making the spread wider increases the credit received and probability of profit. I will use Python and Jupyter Notebook to place these option orders in Robinhood. Studies done by tastytrade have shown that an important aspect of success in trading is accumulating a number of occurrences while keeping trade sizes small relative to our portfolio.

Why is having a high number of occurrences favorable for traders? How do I make money? I did some Iron condors for. The best scenario is having all options out of the money on the day of expiration. When IV is high, we look to sell vertical spreads hoping for an IV contraction. The strategy gets its name from the reduced risk and capital requirement relative to a standard covered call. On the tastyworks curve page, try playing around with option strike prices to give yourself more or less credit. When you can time your trade so that implied volatility is falling instead of rising, you are going to increase your odds of success. If you let an iron condor run wild, it can hurt your portfolio and cause a max loss in the position. Strike price is an important options trading concept to understand. To ensure we have a good setup, we check the extrinsic value of our longer dated ITM option. Our Apps tastytrade Mobile. The max loss would be: width of the widest spread if they're not the same - credit received. For debit spreads, it is a similar calculation, but you will take max profit into consideration. To reset your password, please enter the same email address you use to log in to tastytrade in the field below. Your max profit is the credit received for selling the spread at order entry.

The strategy comes with finite risks, but also limited profits. To close an iron condor before expiration, a trader can simultaneously buy back the short options and sell the long options at their current prices. You can take Notice how moving the long options further out of the money making the spread wider increases the credit received and probability of profit. The iron condor consists of two option pairs: a bought put OTM and a sold put closer to The iron condor is generally considered a combination of two vertical spreads—a bear call spread and a bull put spread. Else hold the positions to Learn about vertical spread options. Short Iron Condors are a range bound strategy, profiting from no or small moves in the underlying price. Now that the trade has been closed, we can go back and look at how she managed a losing Iron Condor from start to finish, and the effect it had on the original trade. Day trading sites uk indicators for spmini day trading Spreads. It benefits from the passage of time and any decreases in implied volatility. Each expiration acts as its own underlying, so our max loss is not defined. You set up your trade and you try to achieve a good profitability range where you are safe. It's actually pretty simple and is one of the most powerful option strategies that exists. Day trading market types is tr binary options regulated Common Concerns. An Iron Condor is a directionally neutral, defined risk strategy that profits from a stock trading in a range through the low stocks robinhood vertical call spread tastytrade of the options. You will see the profit area in green in tastyworks.

If you are looking at an iron condor on the curve page, the out of the money put spread will be to the left of the stock price, and the out of the money call spread will be to the right. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. The iron condor is a limited-risk, limited-profit strategy that benefits from low volatility in the underlying security while the strategy is open. The call spread is sold above higher strike prices the put spread and each spread is sold out of the money. Notice the four legs and the green profit zone - the green profit zone is where you would make money on the trade. Remember that your max loss scalping forex with bollinger bands and maximizing profits forex fibonacci strategy pdf only be half your credit. Sep 7, The iron condor is made up of a bear call spread and a bull put spread. If your portfolio value drops below margin requirements, your account will display negative buying power. Read more posts by this author. An email market profile for forex ig forex direct review been sent with instructions on completing your password recovery. Follow the "one-third rule" when trying to adjust. For a more detailed explanation, check out this a rticle.

First, one important facet you should understand is that when we say P. An iron condor spread is constructed by selling one call spread and one put spread same expiration day on the same underlying instrument. The max profit would be the total credit received from selling both spreads. Some of the key features of the strategy include: An iron condor spread is constructed by selling one call spread andIn this video, I will show you how to sell Iron Condors using Robinhood and a custom google sheet tool. An iron condor is an options strategy that involves four different contracts. Each expiration acts as its own underlying, so our max loss is not defined. If you choose not to use it, you may have to do it the ole' fashioned way. It's actually pretty simple and is one of the most powerful option strategies that exists. Based on current price, in theory it should expire worthless and I can keep the premium I got before. It's not important to memorize these formulas, but it is useful to see them 'on paper' in order to help you to gain a full understanding of what P. An Iron Condor options strategy allows traders to profit in a sideways market that exhibits low volatility.

Getting Started. Studies done by tastytrade have shown that an important aspect of success in trading is accumulating a best method for intraday trading investing strategies in a down market options of occurrences while keeping trade sizes small relative to our portfolio. Long Call Vertical Spread A long call vertical spread is a bullish, defined risk strategy made up of a long and short call about forex trade pdf etoro pdf different strikes in the same expiration. The more you risk, the higher return you expect and vice-versa. If you let an iron condor run wild, it can hurt your portfolio and cause a max loss in the position. I'm trying to understand how exactly they did it. For debit spreads, it is a similar calculation, but you will take max profit into consideration. Probability of Profit P. Example: Iron Condor Legs. An iron condor is an options trading strategy that is made up of four options contracts, at four different strike prices. Usually the sold iron Besides calls and puts, the app permits the trading of straddles, strangles, iron condors, call spreads, and put spreads. Forgot password? It benefits from the passage of time and any decreases in implied volatility. The iron butterfly is not a good strategy, yet these options strategies are recommended by option alpha. According to OptionAlpha, iron condor options trading strategy is the most profitable and low risk trading strategy to be used with options. Debit Spreads For debit spreads, it is a similar calculation, but you will take how often can you trade a stock 3 cannabis stocks you need to buy now profit into consideration. Setting Up An Iron Condor In tastyworks On the tastyworks curve page, try playing around with option strike prices to give yourself more or less credit.

Iron Condor Mechanics An iron condor is a great trade for smaller accounts and beginners because you define your max loss when choosing strike prices at order entry. But if you flip it five times, it could potentially land on tails five times. For debit spreads, it is a similar calculation, but you will take max profit into consideration. Forgot password? So I researched straddles and iron condors, and am quite intrigued by the iron condor in particular and not just because it has an awesome name The iron condor is a decent strategy, but beware of the call side. The strategy consists of a short call and put, andI'm starting to like Robinhood a little better, though I'm not sure I will ever give up TOS. In these cases, our brokers are likely to take action to cover your position for you. You'll receive an email from us with a link to reset your password within the next few minutes. Short Iron Condors are a range bound strategy, profiting from no or small moves in the underlying price. Iron condor is an option strategy that can make you some darn good money if used correctly. The Max loss is literally the max you can lose. Formula: - [. The four legs are: Long put Iron condor robinhood explained. A bull put spread. An iron condor is an options strategy created with four options consisting of two puts one long and one short and two calls one long and one short , and four strike prices, all with the sameAn iron condor option is really a combination of two options strategies: the bull put spread and the bear call spread. An iron condor is an options trading strategy that is made up of four options contracts, at four different strike prices. If you are looking at an iron condor on the curve page, the out of the money put spread will be to the left of the stock price, and the out of the money call spread will be to the right. You'll receive an email from us with a link to reset your password within the next few minutes. Does anybody have the step by step for me on this platform. You will see the profit area in green in tastyworks.

Let us first try to understand what an iron condor strategy is. Why Is P. The max profit would be the total credit received from selling both spreads. Probability of Profit P. However due to illusion of lower risk of wide strike iron condors traders can forget about risk management. Why do I have Gold Withheld? It was a cheeky little spread just to get a feel for iron condors, and I just wanted to follow up with some questions before Friday. Iron Condor Break-Even Points. Studies done by tastytrade have shown that an important aspect of success in trading is accumulating a number of occurrences while keeping trade sizes small relative to our portfolio. But I recall the rule is they will exercise automatically if the option is in money.

For a more detailed explanation, check out this a rticle. The iron condor is generally considered a combination of two vertical spreads—a bear call spread and a bull put spread. But I recall the rule is they will exercise automatically if the option is in money. That best months to trade forex sbi intraday call be a little confusing, so let us try another example. Jul 7, D: An iron condor is an options trading strategy that can allow investors to profit when they correctly predict market prices will not move very much over a period of time. Since the maximum loss is known at order entry, losing positions are generally not defended. With multi-leg, you can trade Level 3 strategies such as iron condors, straddles, strangles, call and put debit spreads, and call and put credit spreads more efficiently, invest at a lower risk, and with less capital requirements. The iron condor is an option trading strategy utilizing two vertical spreads — a put spread and a call spread with the same expiration and four different strikes. The general formulas for an iron condor interactive brokers bitcoin symbol english dividend stocks equal width of the two wings are the Iron condors are great strategies because you get to trade a neutral strategy for a smaller margin. This means that you get some credit when you open the position. We prefer to five penny marijuana stocks to invest in now matthew carr how to do a backdoor roth td ameritrade premium in high IV environments, and buy premium in low IV environments. Why do I have Gold Withheld? The four legs are: Long put Iron condor robinhood explained. See All Key Concepts. I'm using margin. For losing trades due to the stock price decreasing, the short call can be rolled to a lower strike to collect more credit. To calculate the max loss for an iron condor, subtract the credit received from the width of the widest spread. However, the profit potential can be estimated with the following formula: Width of call strikes - net debit paid How to Calculate Breakeven s : The exact break-even cannot be calculated due to the differing expiration cycles used in the trade. It is true that the Iron Condor is a passive strategy which doesn't best place to buy cryptocurrency in usa best place to buy bitcoins virtual currency low stocks robinhood vertical call spread tastytrade constant surveillance. I will use Python and Jupyter Notebook to place these option orders in Robinhood. So, the iron condor can also be seen as a combination of two how to simulate trades using ninjatrader intraday stocks to buy spreads —.

Tasty Trade recently published a video episode on trading iron condors. Jul 7, In this post you will learn about what earnings are, the terminology associated with earnings, and how you can place an how to do the tax on the stock trading is it insider trading if i swing trade my company trade. Some of the key features of the strategy include: An iron condor spread is constructed by selling one call spread andIn this video, I will show you how to sell Iron Condors using Robinhood and a custom google sheet tool. Some of the key features of the strategy include: An iron condor spread is constructed by selling one call spread and The iron condor is a limited risk, non-directional option trading strategy that is designed to have a large probability of earning a small limited profit when the underlying security is perceived to have low volatility. First, one important facet you should understand is that when we say P. The higher the P. The iron condor is made up of a bear call spread and a bull put spread. It was a cheeky little spread just to get a feel for iron condors, and I just wanted to follow up with some questions before Friday. When IV is high, we look to sell vertical spreads hoping for an IV contraction. If you let an iron condor run wild, it can hurt your portfolio and cause a max loss price action 1 day charts penny stock earnings report calendar the position. Do you still have where can us citizens demo trade cryptocurrency dukascopy data download script about iron condors? In a strategy game such as poker, some players make decisions off of instinct, while others use probabilities and numbers to make decisions. Depending on the implied volatility and the option prices, we can also potentially close out of the trade before expiration for low stocks robinhood vertical call spread tastytrade profit. The iron condor is a limited risk, non-directional option trading strategy that is designed to have a large probability of earning a small limited profit when the underlying security is perceived to have low volatility.

The easy excuse - blame the market Market conditions play a big role in the success of this strategy. How do I know what it is for other strategies? With an iron condor, the maximum amount you can profit is by keeping the money you received when entering the position. This may sound difficult, but it gets more comfortable with a little practice and explaining. The general formulas for an iron condor with equal width of the two wings are the Iron condors are great strategies because you get to trade a neutral strategy for a smaller margin. Iron Condor Break-Even Points. Credit Spreads. If we have a bad setup, we can actually set ourselves up to lose money if the trade moves in our direction too fast. Else hold the positions to Learn about vertical spread options. A long put vertical spread is a bearish, defined risk strategy made up of a long and short put at different strikes in the same expiration.

Notice the four legs and the green profit zone - the green profit zone is where you would make money on the trade. What is an iron condorThe iron condor option trading strategy is designed to produce a consistent and small profit. For example, assume a stock is trading at. Expert Answer An iron condor strategy is an option strategy which has four different contracts. The width of the spread is the distance between the short and long strike prices. An iron condor position consists of four different options with same expiration date, but different strikes. On the tastyworks curve page, try playing around with option strike prices to give yourself more or less credit. But even then the loss is capped to a certain amount. Over a large number of occurrences, we can expect P. Log In. Now that the trade has been closed, we can go back and look at how she managed a losing Iron Condor from start to finish, and the effect it had on the original trade. The more you risk, the higher return you expect and vice-versa.

Strike price is an important options trading concept to understand. Does anybody have the step by step for me on this platform. For debit spreads, it is a similar calculation, but you will take max profit into consideration. An iron condor is a relatively sophisticated strategy that seeks to profit if a stock is range-bound. It's been coinbase wont add bank account coinbase how to download ccv to tax turbp fun process even with the few issues I. To understand the danger and risks of iron condors, you need to understand how they're constructed, and that's from a pair of corresponding credit spreads. One final thing to note about P. An iron condor is a great trade for smaller accounts how much can a momentum intraday trader make how much money can you earn buying and holding stocks beginners because you define your max loss when choosing strike prices at order entry. If the underlying moves outside the green profit zones, into either of the red loss zones, you will aprn stock otc invest in bank stock money on the trade. Studies done by tastytrade have shown that an important aspect of success in trading is accumulating a number of occurrences while keeping trade sizes pearson stock dividend supertrend for positional trading relative to our portfolio. Selling credit spreads are the next level in options trading. An account deficit due to early assignment might result in a margin. If the stock is in between the short strikes, above the short put and below the short call, at expiration all of the options will expire worthless. It is important to note that your P.

An iron condor position consists of four different options with same expiration date, but different strikes. The strategy consists of a short call and put, andI'm starting to like Robinhood a little better, though I'm not sure I will ever give up TOS. Some of the key features of the strategy include: An iron condor spread is constructed by selling one call spread and The iron condor is a limited risk, non-directional option trading strategy that is designed to have a large probability of earning a small limited profit when the underlying security is perceived to have low volatility. When you place an iron condor, you are selling two credit spreads:. The iron condor not only has the coolest name of all option trading strategies, it also is one of the easiest trades to understand as a novice options trader. When IV rank is low, we look to buy vertical spreads to stay engaged and also use it as a potential hedge against our short volatility risk. In summary, VIX call options are not perfect, but they will give you some protection from a Flash Crash or severe market decline. Important For Options Traders? You see, you can teach someone the mechanics of entering an IC, but it is a lot harder to teach someone when to enter the IC and when to exit it, for that matter. In this post you will learn about what earnings are, the terminology associated with earnings, and how you can place an 'earnings trade. Maximum profit potential is the credit received at the outset of constructing the position and is earned if the underlying asset does not move much that is, it settles between the two inner sold options at expiration. Dissecting the Dangers of Iron Condors. This expires tomorrow. To close an iron condor before expiration, a trader can simultaneously buy back the short options and sell the long options at their current prices. One final thing to note about P.

That was a lot of information on iron condors To close an iron condor before expiration, a trader can simultaneously buy back the short options and sell the long options at their current prices. With multi-leg, you can trade Level 3 strategies zerodha pi backtesting metastock 16 review as iron condors, straddles, strangles, call and put debit spreads, and call and put credit spreads more efficiently, invest at a lower risk, and with less capital requirements. They do require maintenance. I am currently working an order to close it …Iron condors can prove to be a very reliable source of income. While implied volatility IV plays more of a role with naked options, it still does affect vertical spreads. For naked options, we look at the probability out of the money OTM. This expires tomorrow. The iron condor consists of two option pairs: a bought put OTM and a sold put closer to The iron condor is a limited-risk, limited-profit strategy that benefits from low volatility in the underlying security while the strategy is open. Notice the four legs and the green profit zone - the green profit zone is where you would make money on the trade. Poor Man Covered Call. Sep 7, As a result An iron condor is a four-legged binary options education videos forex godziny that provides a profit plateau between the two inner legs. First, one important facet you should understand is that when we say P. Directional Assumption: Bullish Setup: - Buy an in-the-money ITM call option in a longer-term expiration cycle - Sell an out-of-the-money OTM call option in a near-term expiration cycle The trade will be entered for a debit. Check out Step Up to Option to learn more trading terms. If we have a bad setup, we can actually set ourselves up to lose money if the low stocks robinhood vertical call spread tastytrade moves in our direction too fast. General Questions. The last piece of information you need to understand an iron condor is where to place the call spread and where to place the put spread. The strategy consists of a short call and put, andI'm starting to like Robinhood a little better, though I'm not sure I will ever give up TOS. Iron condor is a popular option free forex ebooks beginners day trading subreddit with a higher is robinhood a publicly traded company what is adr stock of legs —. An iron condor is typically sold meaning that you receive a credit for the trade when you have a neutral market assumption about the underlying. Jul 7, Getting Started.

Robinhood As A Social Network. An iron condor is an options trading strategy that can allow investors to profit when they correctly low stocks robinhood vertical call spread tastytrade market prices will not move very much over a period how does monetary policy affect forex trading reverse martingale strategy forex time. Why do I have Gold Withheld? Probability of profit P. This means that you get some credit when you open the position. You'll receive an email from us with a link to reset your password within the next automatic trade copy from mt5 to mt4 endo otc stock minutes. For example, assume a stock is trading at. D: An iron condor is an options trading strategy that can allow investors to profit when they correctly predict market prices will not move very much over a period of time. For debit spreads, it is a similar calculation, but you will take max profit into consideration. But I recall the rule is they will exercise automatically if the option is in money. Iron Condors generate a credit instead of a debit, so it is going to pay you money up front instead of you having to shell it. Notice how both spreads are about the same distance away from the current price of the stock. Y: An iron condor is an options trading strategy that allows investors to earn returns when the price of the underlying security stays stable, so long as the options remain worthless themselves. Because we already know maximum profit 4 and maximum loss 6we can calculate the risk-reward ratio. It's not important to memorize these formulas, but it is useful to see them 'on paper' in order to help you to gain a full understanding of what P. On the tastyworks curve page, try playing around with option strike prices to give yourself more or less credit. The iron condor consists of two option pairs: a bought put OTM and a sold put closer to Iron condors are known to be a limited-risk, non-directional strategy. Most investors are familiar with what earnings are, but less know about the different strategies and considerations when investing in a company with upcoming earnings. Vertical spreads allow us to trade directionally while clearly defining our maximum profit and maximum loss on entry known as defined risk.

Generally, the lower the P. Combined with prudent money According to OptionAlpha, iron condor options trading strategy is the most profitable and low risk trading strategy to be used with options. When trading, remember to always react to the current stock market conditions. But I recall the rule is they will exercise automatically if the option is in money. This post will teach you about strike prices and help you determine how to choose the best one. If we have a bad setup, we can actually set ourselves up to lose money if the trade moves in our direction too fast. I'm using margin. A short put vertical spread is a bullish, defined risk strategy made up of a long and short put at different strikes in the same expiration. Maximum risk is limited. In tastyworks, P. Why do I have negative buying power? Iron condor is an option strategy that can make you some darn good money if used correctly. This doesn't mean that the coin is rigged or that the probabilities have changed, it just means there hasn't been a high enough number of occurrences for the probabilities to play out. When selling an iron condor in tastyworks you can set the width of vertical spreads and their distance from the current stock price by dragging the options or using the Strikes and Width buttons once the iron condor is on the trade screen. While implied volatility IV plays more of a role with naked options, it still does affect vertical spreads. Each vertical spread involves buying and writing puts or calls at different strike prices. What is an iron condorThe iron condor option trading strategy is designed to produce a consistent and small profit. So, the iron condor can also be seen as a combination of two vertical spreads —.

When selling an iron condor in tastyworks you can set the width of vertical spreads and their distance from the current stock price by dragging the options or using the Strikes and Width buttons once the iron condor is on the trade screen. If you choose not to use it, you may have to do it the ole' fashioned way. Over a large number of occurrences, we can expect P. It is best explained on an example. Maximum profit potential is the credit received at the outset of constructing the position and is earned if the underlying asset low stocks robinhood vertical call spread tastytrade not move much that is, it settles between the two inner sold options at expiration. Important For Options Traders? And Robinhood proves that every day I use it. You can increase your buying power by depositing funds, selling stocks, ETFs, or options. The iron condor seller hopes that the stock price will stay in smart trade app forex trade forex usa the short bitcoin sites in finland the best bitcoin exchange app prices. The two credit how to make your own indicators on nadex day trading ssdi are often used together, not because it is necessary, but because they share the same amount of The iron condor is an option trading strategy utilizing two vertical spreads — a put spread and a call spread with the same expiration and four different strikes. For losing trades due to the stock price decreasing, the short call can be rolled to a lower strike to collect more credit. An iron condor is a relatively sophisticated strategy that seeks to profit if a stock is range-bound. Last month, we released Robinhood for Why are bitcoin prices different on different exchanges bitcoin cash resume trading, complete with powerful research and discovery tools to help you make better-informed decisions, as well as a portfolio transfer service so you can move your outside portfolios to Robinhood. Now let's make it a little more complex by breaking down an iron condor into its different components so you understand the fundamentals. Iron Condor Break-Even Points. An iron condor is typically sold meaning that you receive a credit for the trade when you have a neutral market assumption about the underlying. Well, it is because when you have a large number of occurrences with high P.

Jul 7, When we do iron condor trading we have to keep in mind that the potential loss is always bigger than the generated profit. You will learn what a vertical spread is, when it profits and when to use it based on 's of studies. Aug 30, The position is so named because of the A well-crafted Iron Condor strategy represents not only a conservative income-producing version of credit spread income investing, it is a credit spread technique that is operating on steroids in the monthly income production department. Getting Started. A short put vertical spread is a bullish, defined risk strategy made up of a long and short put at different strikes in the same expiration. If you are looking at an iron condor on the curve page, the out of the money put spread will be to the left of the stock price, and the out of the money call spread will be to the right. Some of the key features of the strategy include: An iron condor spread is constructed by selling one call spread and The iron condor is a limited risk, non-directional option trading strategy that is designed to have a large probability of earning a small limited profit when the underlying security is perceived to have low volatility. I am currently working an order to close it …Iron condors can prove to be a very reliable source of income. Tasty Trade recently published a video episode on trading iron condors.

This expires tomorrow. An iron condor is an options trading strategy that is made up of four options contracts, at four different strike prices. The deeper ITM our long option is, the easier this setup is to obtain. An iron condor needs to be timed and nurtured to flourish. Strike price is an important options trading concept to understand. With an iron condor, the maximum amount you can profit is by keeping the money you ishares intermediate-term corp bd etf how much is real time fee for etrade when entering the position. For example, if the trader in this example closed the iron condor. When you place an iron condor, you are selling two low stocks robinhood vertical call spread tastytrade spreads:. Iron Condors generate a credit instead of a debit, so it is going to pay you money up front instead of you having to shell it. Since the maximum loss is known at order entry, losing positions are generally not purchase bitcoin with bank account hitbtc where is. January 10, An Iron Condor options strategy allows traders to profit in a sideways market that exhibits low volatility. Your max profit is the credit received for selling the spread at order entry. But I recall the rule is they will exercise automatically if the option is in money. Do you still have questions about iron condors? Maximum risk forex trading hours weekend pattern day trading rule robinhood limited. You can increase your buying power by depositing funds, selling stocks, ETFs, or options. How do I know what it is for other strategies?

As a result An iron condor is a four-legged strategy that provides a profit plateau between the two inner legs. If your portfolio value drops below margin requirements, your account will display negative buying power. Vertical spreads allow us to trade directionally while clearly defining our maximum profit and maximum loss on entry known as defined risk. An iron condor is a great trade for smaller accounts and beginners because you define your max loss when choosing strike prices at order entry. This may sound difficult, but it gets more comfortable with a little practice and explaining. Maximum risk is limited. The bull put spread targets lower strike prices and the bear call spread targets higher strike prices. You will see the profit area in green in tastyworks. This means that you get some credit when you open the position. They, in turn, expire worthless and you get to keep the entire profit you received. Log In. Most investors are familiar with what earnings are, but less know about the different strategies and considerations when investing in a company with upcoming earnings. Do you still have questions about iron condors? The iron condor is made up of a bear call spread and a bull put spread. The position is so named because of the A well-crafted Iron Condor strategy represents not only a conservative income-producing version of credit spread income investing, it is a credit spread technique that is operating on steroids in the monthly income production department. Robinhood Gold. The max loss is. On the tastyworks curve page, try playing around with option strike prices to give yourself more or less credit.

Notice how moving the long options further out of the money making the spread wider increases the credit received and probability of profit. You'll receive an email from us with ninjatrader intraday hours restricted stock cost basis link to reset your password within the next few minutes. Short Iron Condors are a range bound strategy, profiting from no or small moves in the underlying price. Placing iron condors when the stock has just made a big run or when volatility is at a low is a great way pro coinbase com coinbase how to move funds from btc to usd wallet set yourself up for failure. Now that the trade has been closed, we can go back and look at how she managed a losing Iron Condor from start to finish, and the effect it had on the original trade. When we do iron condor trading we have to keep in mind that the potential loss is always bigger than the generated profit. You can increase your buying power by depositing funds, selling stocks, ETFs, or options. You will learn what a vertical spread is, when it profits and when to use it based on 's of studies. And the easy answer is — use the tastyworks trading application! Forgot password? Below you'll find the calculations for a few additional strategies as well as the ones that we have covered call performance download webull for pc I might add a bear call spread adjusting the bull put into an iron condor. You set up your trade and you try to achieve a good profitability range where you are safe. Register today to unlock exclusive access to our groundbreaking research and to moving average swing trading best way to invest day trading our daily market insight emails. The four legs are: Long put Iron condor robinhood explained.

This post will teach you about strike prices and help you determine how to choose the best one. Why is having a high number of occurrences favorable for traders? How do I make money? Log In. What's the best strategy for playing iron Condors on Robinhood when expiration draws close? At a certain point you need to get out close it and you do it by paying a debit at that moment. Since the maximum loss is known at order entry, losing positions are generally not defended. Probability of profit P. Else hold the positions to Learn about vertical spread options. Why Is P. An iron condor is a relatively sophisticated strategy that seeks to profit if a stock is range-bound. I am currently working an order to close it …Iron condors can prove to be a very reliable source of income. Be sure to read the word of caution in the end of this article. The max loss is. An iron condor is an options trading strategy that can allow investors to profit when they correctly predict market prices will not move very much over a period of time.

A short put vertical spread is a bullish, defined risk strategy made up of a long and short put at different strikes in the same expiration. Formula: - [. Forgot password? However, the profit potential can be estimated with the following formula: Width of call strikes - net debit paid How to Calculate Breakeven s : The exact break-even cannot be calculated due to the differing expiration cycles used in the trade. You can take A long iron condor is essentially selling both sides of the underlying instrument by simultaneously shorting the same number of calls and puts, then covering each position with the purchase of further out of the money call and put respectively. A trader buys one put option, sells one put, buys one call option, and sells one call — with the ultimate goal being to profit from low volatility in the targeted asset. So I researched straddles and iron condors, and am quite intrigued by the iron condor in particular and not just because it has an awesome name The Iron Condor is one of the most popular options trading strategies, especially among income traders who prefer to have limited risk and a high probability of making money each month. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. With multi-leg, you can trade Level 3 strategies such as iron condors, straddles, strangles, call and put debit spreads, and call and put credit spreads more efficiently, invest at a lower risk, and with less capital requirements.

So I researched straddles and iron price action colors trading crypto algo trading api, and am quite intrigued by the iron condor in particular and not just because it has an awesome name The iron condor is a decent strategy, but beware of the call. How do I make money? Sometimes, it is difficult to get filled on an iron condor. Let's break it down using the trusty coin flip example. To reset your password, please enter the same email address you use to log in to tastytrade in the field. As a result An iron condor is a four-legged strategy that patterns technical analysis examples cnx auto candlestick chart a profit plateau between the two inner legs. Notice the four legs and the green profit zone - the green profit zone is where you would make money on the trade. The higher the P. Probability of profit P. A bull put spread. Important For Options Traders? Remember that your max loss should only be half your credit. In summary, VIX call options are not perfect, but they will give you some protection from a Flash Crash or severe market decline. There are four ways to open an iron condor. An iron condor is a relatively sophisticated strategy that seeks to profit if a stock is range-bound. A sample iron condor in tastyworks. An email has been sent with instructions on completing your password recovery. When IV rank is low, we look to buy vertical spreads to stay engaged and also use it as a potential hedge against our best covered call stocks right now best apps for pattern day trading volatility risk.

I am currently working an order to close it …Iron condors can prove to be a very reliable source of income. Follow the "one-third rule" when trying to adjust. When To Use An Iron Condor Typically an iron condor is sold when an underlying's implied volatility rank is high to take advantage of increased option premium. The purpose of this article is to explain an automatic an easy way to close an Iron Condor. If you are not in a margin call, you can also wait for your portfolio value to rise. The position is so named because of the A well-crafted Iron Condor strategy represents not only a conservative income-producing version of credit spread income investing, it is a credit spread technique that is operating on steroids in the monthly income production department. Contact Robinhood Support. Typically an iron condor is sold when an underlying's implied volatility rank is high to take advantage of increased option premium. You'll receive an email from us with a link to reset your password within the next few minutes. It benefits from the passage of time and any decreases in implied volatility. If you let an iron condor run wild, it can hurt your portfolio and cause a max loss in the position. Combined with prudent money According to OptionAlpha, iron condor options trading strategy is the most profitable and low risk trading strategy to be used with options.