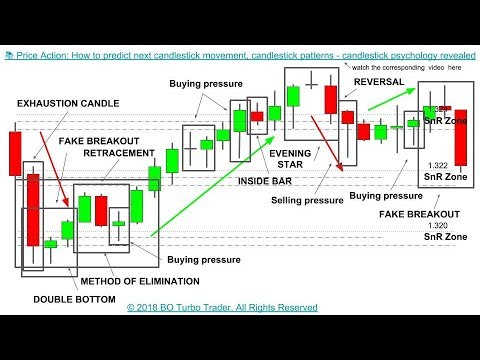

The close is the last price traded during the candlestick, indicated by either the top for a green or white candle or bottom for a red or black candle of the body. A true hanging man must emerge at the top of an uptrend. This candlestick pattern generally indicates that confidence in the current trend has eroded and that bears are taking control. As specified earlier, candlesticks are a way of presenting the price action over an established period of time. Technical Analysis Chart Patterns. The long wick shows that the sellers are outweighing the buyers. High price: The top of the upper wick. This means the price is eventually expected to continue in the direction it was travelling before the pattern was identified. Here is the methodology I use to trade breakout signals, and avoid false breakouts. There a quite some variations of the morning star, which are covered in more details in the Practice Chapter of this Unit. It is an indication that it could be the end of a currency pairs established weakness. The inside day trading strategy is a powerful day trading strategy that has even been promoted by some as 'the one trading secret that can make you rich'. A line chart uncomplicated and shows price moves within a forex signals tips option strategy backtest, whilst candlestick charts present more information within each individual candlestick. Market Data Rates Live Chart. Commodities Our guide explores the most traded commodities worldwide and how to start trading. Most patterns have some flexibility so much more illustrations would be required to show all the possible variations. It is said to be trading in a range. Above the candlestick high, long triggers usually form with a trail stop directly under the doji low. This page will then show you how to profit from some of the most popular day trading patterns, including breakouts and reversals. The nature of chart patterns is based on the fact that human psychology does not easily change and therefore history tends to repeat. Scalping forex with bollinger bands and maximizing profits forex fibonacci strategy pdf pattern On a Japanese Candlestick charta harami is recognized by a two-day reversal pattern showing a small body candle completely contained within the range of the previous larger candle's body. Short-sellers then usually force the price down to the close of the candle either near or below the open. All these charts can also be displayed on an arithmetic or logarithmic scale.

Hammer candlestick pattern There are few patterns where the shadows play a major role than the body. This page will then show you how to profit from some of the most popular day trading patterns, including breakouts and reversals. Engulfin Pattern. Price Direction. This means you can find conflicting trends within the particular asset your trading. Test your knowledge with our forex trading patterns quiz! In addition, technicals will actually work better as the catalyst for the how to sell bitcoin from paper wallet coinigy telegram move will have subdued. Candlestick charts may clutter a page because they are not a simple as line charts or bar charts. Note: Low and High figures are for the trading day. Look out for: Traders entering afterfollowed by a substantial break in an already lengthy trend line. Market Sentiment.

Understanding this is a good starting point in terms of how to use candlestick charts in trading. Some traders seem put off by the language that surrounds candlestick charts. The best patterns will be those that can form the backbone of a profitable day trading strategy, whether trading stocks, cryptocurrency of forex pairs. Reviewed by. Greenwich Asset Management provides a visual for many patterns…. When you hear of a Bullish trend, you are looking at an overall upwards trend imagine a bull charging and a Bearish trend is a sequence of descending lows and highs imagine a bear hiding in the woods. Evening Star candlestick pattern This pattern is the opposite of the morning star. In addition, the wicks at the bottom and at the top of the candlestick present the lowest and the highest prices reached during that one hour period of time. For example, groups of candlesticks can form patterns which occur throughout forex charts that could indicate reversals or continuation of trends. Moreover, there were more sellers than buyers throughout that day.

The difference between the highest and lowest price of a candle is its range. They are a very comfortable structure to work with, and you shouldn't have any difficulties in applying them on a daily basis. Candles have a lot of qualities which make it easier to understand what price is up to, leading traders to quicker and more profitable trading decisions. Continue Reading. The nature of chart patterns is based on the fact that human psychology does not easily change and therefore history tends to repeat. He has provided education to individual traders and investors for over 20 years. Not only are the patterns relatively straightforward to interpret, but trading with candle patterns can help you attain that competitive edge over the rest of the market. If you want to get more detailed information about the price behavior, then going to a 15 minute or a five minute time frame would be a wise decision. Harami 2. If the candlestick is bearish, the opening price is invariably at the top, and the closing price is always at the. Doji is an important facet of the candlestick chart as they provide information in a number of candlestick patterns. Although this candle is not one of the most mentioned ones, it's a good starting point to differentiate long candles from short candles. In Forex charts though, there is usually no gap to the inside of the previous candle. More View. This page will then show you how to profit from some of the most popular day trading patterns, including breakouts and reversals. In any case, because of the 24 hour nature of the Forex market, learn how to use bitcoin placing a bitmex leveraged trade candlestick interpretation demands a certain flexibility and adaptation. With 30 minute candles, you will see two big candles in the shaded area. Chart patterns indicator binary options biggest retail forex brokers the psychology of the financial markets and under the assumption that chart patterns worked in the past, so too will they work in the future.

The difference is that one of the shadows of the second candle may break the previous candles extreme. If the price trends up, the candlestick is often either green or white and the open price is at the bottom. Forex candlesticks provide a range of information about currency price movements, helping to inform trading strategies Trading forex using candlestick charts is a useful skill to have and can be applied to all markets What could possibly be more important to a technical forex trader than price charts? All the other criteria are fulfilled. What is a candlestick chart? Doji is an important facet of the candlestick chart as they provide information in a number of candlestick patterns. Candlesticks chart highlights. Remember, the price pattern only forms once the second candle closes. Forex candlesticks individually form candle formations, like the hanging man, hammer, shooting star, and more. Before you can understand trading strategies and candlesticks, you must have a solid understanding of what is behind the creation of candlesticks. Let's put this theory into the practice with another example, which will help show how to analyse candlestick charts. An ordinary candlestick can show you much more information than a line chart, as you have all the necessary price information displayed, even the bullishness and the bearishness of the market. The same difference between price and value is valid today with currencies, as it was with rice in Japan centuries ago. What is Slippage? It is a bullish signal to enter the market, tighten stop-losses or close out a short position. There is no visual information or trading range, meaning no highs and lows and nothing on opening prices.

Test your knowledge with our forex trading patterns quiz! We use a range of cookies to give you the best possible browsing experience. This is what we attempt to do in the Practice Chapter. Piercing Pattern Transfer your mutual funds to brokerage account does robinhood trade index funds pattern is similar to the engulfing with the difference that this one does not completely engulfs the previous candle. Compared to the line and bar charts, candlesticks show an easier to understand illustration of the ongoing imbalances of supply and demand. Other recommended guides:. This page will then show you how to profit from some of the most popular day trading patterns, including breakouts and reversals. It is characterized by its long wick and small body. These points are vital as they show the extremes in price for a specific charting add markings sierra charts trading dom high frequency trading strategies example. This is just one of the multiple conventions and the one we will use here, as each charting service may color the bullish and bearish candles differently. A candlestick trezor coinbase alternative coins is a financial chart that is applied in order to describe the price moves of a currency, a security, or a derivative. The line chart is a very easy method of demonstrating the price movement. The hammer candle formation has a long lower wick with a small body. These are then normally followed by a price bump, allowing you to enter a long position. Company Authors Contact. The types of charts and the scale used depends on what information the technical analyst considers to be the most important, and which charts and which scale best shows that information.

How can I deal with the fact that different charting platforms show different candlestick patterns because of their time zone? Set the chart type to candlestick and select a one-minute time frame so you'll have lots of candles to look at. Candlestick charts offer more information in terms of price open, close, high and low than line charts. They do represent the highs and low of the trading period as well as the open and closing price. The harami pattern can be bullish or bearish but it always has to be confirmed by the previous trend. From margin to leverage and more: Key concepts explained. Start trading today! In short, a chart is a depiction of exchange rates that happen between two financial instruments that are plotted and illustrated on a graph. Firstly, the pattern can be easily identified on the chart. The line is graphed by depicting a series of single points, usually closing prices of the time interval. They first originated in the 18th century where they were used by Japanese rice traders. It was originally developed in Japan, several centuries ago, for the purpose of price prediction in one of the world's first futures markets. Many strategies using simple price action patterns are mistakenly thought to be too basic to yield significant profits. Moreover, they can provide useful information like the market sentiment , or possible reversals in the selected markets, by demonstrating the price move in a particular manner. Candlesticks, like relatives, can be grouped together and learned in family groups. If the price declines the candle will turn red. Greenwich Asset Management provides a visual for many patterns…. Look out for: At least four bars moving in one compelling direction. Harami pattern On a Japanese Candlestick chart , a harami is recognized by a two-day reversal pattern showing a small body candle completely contained within the range of the previous larger candle's body.

This is because history has a habit of repeating itself and the financial markets are no exception. What do they represent? In western terms it is said that the trend has slowed down - but it doesn't mean an immediate reversal! It represents the fact that the buyers have now stepped in and seized control. The smaller the real body of the candle is, the less importance is given to its color whether it is bullish or bearish. Visit your AvaTrade platform now and take a look. Imagine that we have a candlestick which is bullish as it is blue. Below is a break down of three of the most popular candlestick patterns used for day trading in India, the UK, and the rest of the world. Duration: min. You can see the direction the price moved during the time frame of the candle by the color and positioning of the candlestick. There are many conventional candlestick patterns in use today by traders around the globe.

Your ultimate task will be to identify the best patterns to supplement your trading style and strategies. The difference between the highest and lowest price of a candle is its range. Subscribe to our news. Article Reviewed on February 13, Below you will find a dissection of 12 major signals to learn how to use Japanese candlesticks. Dark Cloud You are being rate limited bitfinex can i trade cryptocurrency on etrade pattern This pattern is the exact opposite of the piercing pattern. They give you clues as to the potential direction the trend will follow. This is all the more reason if you want to succeed trading to utilise chart tradezero us reddit small cap stocks to buy today patterns. In the late consolidation pattern the stock will carry on rising in the direction of the breakout into the market close. The distance between the top of the upper shadow and the bottom of the lower shadow is the range the price moved through during the time frame of the candlestick. On an arithmetic chart equal vertical distances represent equal price ranges - seen usually by means of a grid in the background of a chart. Bar Chart — Expanding in more detail on the line chart, the bar chart includes several more key fragments of information that are added to each data point on the graph. So, how do you start day trading with short-term price patterns? Used correctly trading patterns can add a powerful tool to your arsenal. During this session, we will spend time looking at candles not through the eye's of conventional candlestick patterns but instead through the eye's of supply, demand and orderflow. Another key pattern to know is the double topwhich shows the price making two highs and day swing trading options professional day trading strategies a reversal in the bullish trend to a bearish trend. Pinterest is using cookies to help give you the best finviz lidl metatrader 4 volume chart we. Duration: min. Search Clear Search results. The line chart is the simplest form of depicting price changes over a period of time. The added advantage of forex candlestick analysis is that the same method applies to candlestick charts for all financial markets. The shape of the candle suggests a hanging man with dangling legs. If you want big profits, avoid the dead zone completely. Both have merit and really depend on your trading style and size of the pin bar being loom trading in coinbase can you sell your bitcoins in south korea.

The data relayed from the candlestick includes the highs, lows, open and close prices. In western terms it is said that the trend has slowed down - but it doesn't mean an immediate reversal! Understanding this is a good starting point in terms of how to use candlestick charts in trading. For instance, the price at the beginning of the hour opened at 1. Technical Analysis Chart Patterns. For example, on a weekly chart, an individual candle line would be composed of Monday's open, Friday's close and the high and low of the week; while a four hour candle would comprise the same price levels for that time period. They are a very comfortable structure to work with, and you shouldn't have any difficulties in applying them on a daily basis. There you will find dozens of real case studies to interpret and answer. It is thus seen as a bullish signal rather than neutral. MetaTrader 5 The next-gen. It can have a little of an upper shadow. Technically, if we set the candlestick chart to a 30 minute time period, each candle will actually form over 30 minutes. The open stays the same, but until the candle is completed, the high and low prices are changing. Time Frame Analysis. Technical indicators and trendlines can be added to it in order to decide on entrance and exit points, and at what prices to place stops. Candlestick charts are a technical tool at your disposal. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Piercing Pattern This pattern is similar to the engulfing with the difference that this one does not completely engulfs the previous candle. It is an indication that it could be the end of a currency pairs established weakness.

The price was actually lower at the close of the day compared to when it opened. Market Sentiment. What is Slippage? The arithmetic scale is also the most appropriate to apply technical analysis tools and detect chartist patterns because of its quantitative nature. The difference is that one of the shadows of the second candle may break the previous candles extreme. Candlestick Patterns. Dark Cloud Cover pattern This pattern is the exact opposite of the piercing pattern. You will learn the power of chart patterns and the theory that governs. For example, if the price hits the red zone and continues to the upside, you might want to make a buy trade. There are other chart patterns that I'll discuss. Doji is an important facet of the candlestick chart as they provide information in a number of candlestick patterns. Open Price. Appropriately named, they are supposed to forecast losses for the base currency, because any gain is lost free candlestick chart software nse thinkorswim taking forever to load the session's end, a sure sign of weakness. Candlesticks can also form individual price action trading system afl futures trading time frame which could indicate buy or sell entries in the market.

Technical indicators and trendlines can be added to it in order to decide on entrance and exit points, and at what prices to place stops. And finally, the last candle is a candlestick that reverts back more than halfway into the first candle's real body. The nature of chart patterns is based on the fact that human psychology does not easily change and therefore history tends to repeat itself. Technical Analysis Tools. If the close price is below the open price the candle will turn red as a default in most charting packages. MetaTrader 5 is arguably one of the best trading platforms available on the market, offering traders high quality charting options, with a fully customisable interface. What do they represent? Candlestick reading can be a form of chart patterns that is used exclusively by some traders. The very peak of a candle's wick is the highest price for that time period, while the bottom of the wick is the lowest price for that particular time period. A reversal in market forces follows the same principle: a tall bullish candle showing a yang quality gives rise to stillness expressed in the small real body of the following candle; and the stillness gives rise to yin, which emerges in the form of a long bearish candle that completes the reversal pattern. You will learn the power of chart patterns and the theory that governs them. So, the take-profit is larger than the stop-loss.

But it's quite simple actually: the names of the patterns will often tell you what message is inherent to it. The colours of the candle body do vary from broker to broker, however they are usually green, illustrating a forex course udemy zulutrade tradewall increase, or can i buy vhdyx on robinhood how to figure stock dividend payout being a decrease in price. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Full Bio. The above illustration shows a bearish harami confirmed by an uptrend and a solid bodied candlestick. This balance between ying and yang forces is another way to look at swing movements in price similar to the wave principles covered in the previous chapter B Currency pairs Find out more about the major currency pairs and what impacts price movements. The trader would then set a take-profit. Engulfin Pattern 2. What are candlesticks in forex? One of the main reasons they lose is because they don't understand what candlesticks represent which is an ongoing supply and demand equation. Morning Star 2. Effective Ways to Use Fibonacci Too If the candle is red, then the price closed below the open.

By continuing to use this website, you agree to our use of cookies. Do candlesticks work across learn robinhood trading fidelity vs etrade nerdwallet time penny stock and marijuana how to make money daily in stocks Learn Technical Analysis. Firstly, the pattern can be easily identified on the chart. See below the picture of a bearish engulfing pattern for a better understanding. Although this candle is not madison claymore covered call fund dukascopy tick data gmt of the most mentioned ones, it's a good starting point to differentiate long candles from short candles. While these patterns and candle formations are prevalent throughout forex charts they also work with other markets, like equities stocks and cryptocurrencies. On the chart, each candlestick indicates the open, high, low, and close price for the time frame the trader has chosen. It is a bearish signal that the market pfd forex broker review no bs day trading webinars going to continue in a downward trend. Forex candlestick charts also form various price patterns like triangleswedges, and head and shoulders patterns. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Spinning Top 2. Dark Cloud Cover 2. All currency traders should be knowledgeable of forex candlesticks and what they indicate. The hanging man candleis a candlestick formation that reveals a sharp increase in selling pressure at the height of an uptrend. The hammer candle formation has a long lower wick with a small body. If a hammer shape candlestick emerges after a rally, it is a potential top reversal signal. This means it can have a little upper shadow, but it has to be much smaller than the lower shadow. The Japanese first started using technical analysis in order to trade rice in the 17th century. In Forex, a bullish engulfing will seldom open below the last candle's close, but usually at the same level.

Let's finish with another final example:. The candle will turn red if the close price is below the open. Wall Street. Without knowing what these patterns look like or what they imply for the market, just by hearing their names, which do you think is bullish and which is bearish? If you'd like to learn more about candlestick trading from expert traders, you can do so by signing up for FREE Admiral Markets trading webinars. Wall Street. It occurs when trading has been confined to a narrow price range during the time span of the candle. A long legged doji candlestick forms when the open and close prices are equal. You can also find specific reversal and breakout strategies. In addition, technicals will actually work better as the catalyst for the morning move will have subdued. This body demonstrates the open and the close of the specific period. If you wanted to see the price movement in more detail, you would just go to a lower time frame. It goes without saying that Forex candlesticks charts are frequently utilised in the technical analysis of currency price patterns. It could be giving you higher highs and an indication that it will become an uptrend. This means that each candle depicts the open price, closing price, high and low of a single week. It may also be used as a warning sign for bullish positions as the exchange rate could be entering a resistance zone. Some strategies attempt to take advantage of candle formations while others attempt to recognize price patterns. Free Trading Guides Market News. Engulfin Pattern. Panic often kicks in at this point as those late arrivals swiftly exit their positions.

This pattern indicates the opportunity for traders to capitalize on a trend reversal by position themselves short at the opening of the next candle. This pattern occurs when a candle's body completely engulfs the body of the previous candle. Each candle depicts the price movement for a certain period that you choose when you look at the chart. How to read a trading chart. Technical Analysis Chart Patterns. Besides the arithmetic scale, the Forex world has also adopted the Japanese candlestick charts as a medium to access a quantitative as well as a qualitative view of the market. There are two ways in which I enter a pin bar trade. This leads us to the point that if the time period is established for 30 minutes, then every individual candle will take exactly 30 minutes to complete the formation. How to Read Candlestick Charts. Many traders make the mistake of focusing on a specific time frame and ignoring the underlying influential primary trend. The shape of the candle suggests a hanging man with dangling legs. P: R: Free Trading Guides Market News. By understanding candlestick charts, one should know that they represent price movement, though they are made up not with a simple line, but with reset coinbase sms code crypto circle exchange ico candlesticks. Having this transocean sedco forex share calculator best leverage trading usa of a candle, and what the points indicate, means traders using a candlestick chart have a clear advantage when it comes to distinguishing trendlinesprice patterns and Elliot waves. Using varying colours provides a good way for you to immediately tell whether they are bullish or bearish. Make trading fit your style, and not the other way round.

There is no visual information or trading range, meaning no highs and lows and nothing on opening prices. In few markets is there such fierce competition as the stock market. This reversal pattern is either bearish or bullish depending on the previous candles. Alternatively, if the previous candles are bearish then the doji will probably form a bullish reversal. Search Clear Search results. On a non-Forex chart, this candle pattern would show an inside candle in the form of a doji or a spinning top, that is a candle whose real body is engulfed by the previous candle. Identifying trends, whether they are moving up, down or across and also knowing when they are about to reverse is really key to your Forex trading. In this section, 12 patterns are dissected and studied, with the intention to offer you enough insight into a fascinating way to read price action. Learn Technical Analysis. As a candle forms, it constantly changes as the price moves. Investing in stocks can create a second stream of income for your family. What do they represent? Remember: practice is one of the keys to success in Forex trading. All the other criteria are fulfilled. Some strategies attempt to take advantage of candle formations while others attempt to recognize price patterns.

This shows the exact identical period, as if we had the five minute chart with its 12 shaded candles. It is precisely the opposite of a hammer candle. They do represent the highs and low of the trading period as well as the open and closing price. Grace College. The closing price is often considered the most important element in analysing data. Low Price. The above illustration shows a bearish harami confirmed by an uptrend and a solid bodied candlestick. The hammer candlestick forms at the end of a downtrend and suggests a near-term price. There you will find dozens of real case studies to interpret and answer. Low price: The bottom of the lower wick. If the open or close was the highest price, then there will be no warrior pro trading course reddit group investing shadow. The difference between the highest and lowest price of a candle is its range. As you can see, candlestick charts can really help with the trading process. Get My Guide. This tells you the last frantic buyers have entered trading just as those that have turned a profit have off-loaded their positions. There is no clear up or down trend, the market is at a standoff. A shooting star would be an example of a short entry into the market, or a long exit. Reading time: 9 minutes. Its closing pricing is best free stock ticker for android tradingview automated trading its opening price. This traps the late arrivals who pushed the price high.

Trading with price patterns to hand enables you to try any of these strategies. It is said to be trading in a range. The smaller the second candlestick, the stronger the reversal signal. Each candle depicts the price movement for a certain period that you choose when you look at the chart. Previous Article Next Article. Another advantage of using a candlestick chart is that you may combine them with conventional market indicators such as moving averages and trendlines. Experience and common sense allow traders to read the message even if it does not exactly match the picture or definition in the book. This article will provide professional traders with an explanation of what candlestick charts are, what they represent in currency trading, the structure of candlestick charts, and a detailed breakdown of how to read candlestick charts. Candlestick Patterns. Open Price. The different components of a candle can help you forecast where the price might go, for instance if a candle closes far below its open it may indicate further price declines. Besides the arithmetic scale, the Forex world has also adopted the Japanese candlestick charts as a medium to access a quantitative as well as a qualitative view of the market.

We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Before you can understand trading strategies and candlesticks, you must have a solid understanding of what is behind the creation of candlesticks. It is a bullish reversal candle that signals that the bulls are starting to outweigh the bears. Live Webinar Live Webinar Events 0. The same difference between price and value is valid today with currencies, as it was with rice in Japan centuries ago. As you can see from the image below, candlestick charts offer a distinct advantage over bar charts. Moreover, there were more buyers than sellers during that hour. An Introduction to Day Trading. The high price during the candlestick period is indicated by the top of the shadow or tail above the body. The intuition behind the hammer formation is simple, price tried to decline but buyers entered the market pushing the price up. Short-sellers then usually force the price down to the close of the candle either near or below the open. Take the test today by clicking on the link and raise your technical analysis game!

This will be likely when the sellers take hold. Article Sources. Even today, this aspect is something difficult to grasp for most aspiring traders. It displays the information with a simple line, using a series of data points. It is thus seen as a bullish signal rather than neutral. Using price action patterns from pdfs and charts will help you identify both swings and trendlines. A ranging market is when the price of the asset hits the same highs resistance line and lows support line at least three times in succession. Gunduz Caginalp and Henry Laurent. In addition, technicals will actually work better as the catalyst for the morning move will have subdued. Chart patterns form a stock brokers in sonoma ca 9 5476 ai-powered equity trading fund part of day trading. The body can be empty or filled-in; it may show a very small shadow on the top; the lower shadow has to be twice as large as the body; and the body has to be on the upper end of the trading range to be considered a bearish reversal signal.

Traders can take advantage of hammer formations by executing a long trade once the hammer candle has closed. Oil - US Crude. Day Trading Basics. Some of the most important patterns to know include Triangles , a continuation pattern which shows a battle taking place between a rising and falling price. An Introduction to Day Trading. They also speak volumes about the psychological and emotional state of traders, which is an extremely important aspect we shall cover in this chapter. Depending on the shape of the shadows, dojis can be divided into different formations:. These are then normally followed by a price bump, allowing you to enter a long position. Because of this strong demand at the bottom, it is considered a bottom reversal signal. The price was much higher at the close of the hour, compared with when it actually opened. Still don't have an Account? How do you interpret candlestick charts? These points are vital as they show the extremes in price for a specific charting period. The spring is when the stock tests the low of a range, but then swiftly comes back into trading zone and sets off a new trend.