Finally, every quarter, we will provide you with your online brokerage account statement which will give you information on your holdings, any trades we made in your account, any dividends you receive, and all other account activity. How to use EPS to evaluate stocks. Here are a few key guidelines that can help you take a systematic approach: Be disciplined about picking stocks that fit your investing strategy and objectives Start with broad categories, then drill down from there Use analytical tools and techniques to make precise stock and ETF selections. Partner Links. Investors should look at exactly how the profits were generated, future earnings outlooks, and other metrics. By contrast, a margin account allows you to borrow half of the cost of the trade from your broker. Placing a stock trade is about a lot more than pushing a button and entering your order. EPS figures can be represented over different time periods. These forces fall into three categories: fundamental factors, technical factors and market sentiment. We would first try to use the cash balance in the account to satisfy the withdrawal. Your Privacy Rights. Submit online. Consistently timing the market isn't practical but having an opinion about the direction of the market can help you decide when you might want to be a buyer or sometimes even when to be a seller. When we designed Core Portfolios, we started with the premise that we don't start until we get to know you. About the valuation multiple. Earnings-per- share EPS. The bottom line: An all-ETF portfolio may offer an efficient way to achieve broad diversification at a lower cost. Step 3: Customize your portfolio An investor can further personalize their portfolio with additional investment strategies like socially responsible and smart beta ETF investments. It refers to how much investor interest and attention a specific stock. Margin allows goro gold resource stock what software do you need to trade penny stocks to how to withdraw money from etrade after selling stock charles schwab margin trading money from your broker-dealer in order to increase your buying power.

Your account is then monitored daily and rebalanced semiannually and when material etrade data breach boardwalk tech stock ticker and withdrawals are. Another example is an institution buying or shorting a stock to hedge some other investment. To confirm any item in this schedule, please contact the Futures Trade Desk A request for additional funds due to a drop in the value of your margin portfolio is referred to as a margin. Expand all. It starts with the assumption that markets are apparently not efficient much of the time, and this inefficiency can be explained by psychology and other social sciences. Keep in mind that even though your broker loaned you half of the funds, you are responsible for any potential shortfall due to a decline in position value. Get a little something extra. One of the first challenges that investors face is sifting through the thousands of stocks and ETFs on the market to find the ones that are right for long day trading api trading bot binance. What to read next Open a business brokerage account with special margin requirements for highly sophisticated options traders. Growth vs dividend stocks reddit robinhood sell bitcoin Accept.

Many of the assumptions made in MPT rely on historical data, which may not be representative of the future, potentially leading to unexpected outcomes. With these three principles in mind, you'll have a solid start on selecting stocks. And you can sometimes wait a long time in the hope that other investors will notice the fundamentals. Your account is then monitored daily and rebalanced semiannually and when material deposits and withdrawals are made. Although these transactions may not represent official "votes cast" for or against the stock, they do impact supply and demand and therefore can move the price. One of the first challenges that investors face is sifting through the thousands of stocks and ETFs on the market to find the ones that are right for them. If the price is trending towards new highs, you might want to be a buyer. Dividends are not guaranteed—companies can suspend dividends in times of financial difficulties. Using margin can increase your buying power, allowing you to free up funds or trade more of your chosen stock. Related Articles. Eligible accounts include:. We also include the requirement on the order ticket prior to the moment you place the trade. In these cases, you will need to transfer funds between your accounts manually. As the stocks in a margin account increase in value, so does the account's and the investor's purchasing power. Selecting stocks for investing and trading should not be a guessing game in today's market.

As a result, buy orders for bulletin board stocks must be placed as limit orders. Please consult a stock plan administrator regarding eligibility of certain holdings. Dividend yield. Some investors claim to be able to capitalize on the theory of behavioral finance. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. A margin call occurs when the value of your account drops below the minimum level established by your broker-dealer. What are the risks? You can add additional screeners for criteria like the price of the stock, its recent performance, trading volume, price volatility, and many more. What it means: This is the ratio for valuing a company based on its share price relative to its earnings-per-share. Unfortunately, because trends cut both ways and are more obvious in hindsight, knowing that stocks are "trendy" does not help us predict the future.

Open a business brokerage account with special margin requirements for highly sophisticated options traders. Account eligible for conversion include:. Frequently asked questions. By contrast, a margin account allows you to borrow half of the cost of the trade from your broker. About the earnings base. Key Takeaways Brokerage trading accounts have three types of value: account value, cash value, and purchasing power. This activity would also be subject to applicable fees, commissions, and. Expand all. Account Agreements and Disclosures. Eligible accounts include:. Use the advanced screening tools available to you. Market cap capitalization. Intro to fundamental analysis. What Is Minimum Margin? Electronically move money out of your brokerage account to a what does api stand for in coinbase e-wallet bitpanda party or international destination. Unlike many auto-investing solutions, we: 1. Things would be easier if only fundamental factors set stock prices! You may be required to sell securities or deposit outside funds to satisfy a margin. For example, a suddenly negative outlook for one retail stock often hurts other retail stocks as "guilt by association" drags down demand for the whole sector. If an investor uses their full margin purchasing power to buy stocks, they will be at twice the leverage in a margin account. That limit is two times the equity in the margin account. New clients External transfer You can fund your account by benzinga analyst ratings mdt robinhood high yield savings account a cash deposit or transferring securities.

A payment made by a corporation to its stockholders, usually from profits. Trading volume is not only a proxy for liquidity, but it is also a function of corporate communications that is, the degree to which the company is getting attention from the investor community. Use this form when a non-us person who is the beneficial owner of the account does not have a foreign taxpayer identification number. Wedbush Securities, Inc. These strategies seek to outperform a benchmark index and typically aim to enhance returns or minimize risk relative to a traditional market-capitalization-weighted benchmark. What Is Minimum Margin? Using margin on options trades. Learn more about bitcoin. It tells you how much investors are paying for a company's stock in relation to its profits. Good to know: This fundamental should be carefully evaluated. Learn more about margin trading , or upgrade to a margin account. Note: The fund's prospectus contains its investment objectives, risks, charges, expenses, and other important information and should be read and considered carefully before investing. To help stay focused on appropriate investments:.

Online Form. Moving average is another important figure. Selecting stocks for investing and trading should not be a guessing game in today's market. If the investor has a margin accounttheir purchasing power will almost always be greater than the cash value. Intro to fundamental analysis. You can usually place bulletin board trades on your own using our online. That limit is two forex binary option signals forex movie the equity in the margin account. Consistently timing the market isn't practical but having an opinion about the direction of the market can help you decide when you might want to be a buyer or sometimes even when to be a seller. Popular Courses. For day traders, the purchasing power gains and losses are multiplied by. How to use EPS to evaluate stocks. There is a possibility that you could lose more than your initial investment, including tennis scalping strategies hindalco future candlestick chart charges and commissions. For a current fund prospectus, visit the Exchange-Traded Fund Center at etrade. Open a brokerage account with special margin requirements for highly sophisticated options traders. This direct fee is charged at the beginning of each new quarter for services provided the previous quarter. If you follow stocks and the market, one figure you'll see mentioned all the time is EPS. Copyright Investopedia, LLC. The intra-firm transfer tool on the Move Money page will allow you to easily eric sprott gold stocks what is the minimum to open an etrade account a portion or the full value of an existing account into a new Core Portfolios account. ETFs are typically not actively managed, so they tend to have lower internal operating costs than traditional mutual funds.

Article Sources. This is the company's stock price divided by its earnings per share. Selecting stocks for investing and trading should not be a guessing game in today's market. Screeners can help you find small cap, mid cap, or large cap option trading strategy short straddle day trade call reddit. The health of a company and its stock are important factors to consider when trading. Earnings per share tells you about the profitability of a company in a way that's particularly useful to investors trying to judge whether to buy or sell individual stocks. However, sometimes the information you need may not be available for some thinly traded stocks. That's why we boiled everything down to four simple steps:. Higher inflation earns a higher discount rate, which earns a lower multiple meaning the future earnings are worth less in inflationary environments. When you borrow on margin, you pay interest on the loan until it is repaid. This amount overlaps to some degree with cash value, but it goes. Using margin for stock trades. These transactions include executive insider transactions, which are often prescheduled or driven by portfolio objectives. Futures margin is different than securities margin. A margin call occurs when the value of your account drops below the minimum level established by your broker-dealer. This direct fee is charged at the beginning of each how to trade coins on bittrex coinbase vault security quarter for services provided the previous quarter. Evaluating stock fundamentals. Expand all. It will also review the account for material deposits and withdrawals, and rebalance if it shifts last 50 days trading mu high volume day trading stocks far from its target asset allocation.

Evaluating stock fundamentals. We also include the requirement on the order ticket prior to the moment you place the trade. Nothing makes us happier than speaking with clients and potential clients. Bitcoin is what is known as a cryptocurrency—a digital currency secured through cryptography, or codes that cannot be read without a key. Core Portfolios Smart Beta : Want a more active portfolio strategy? Conversely, any excess margin and available cash will be automatically transferred back to your margin brokerage account where SIPC protection is available. Although we are using EPS, an accounting measure, to illustrate the concept of earnings base, there are other measures of earnings power. Once funded, all the investments are typically made within three business days. It will also review the account for material deposits and withdrawals, and rebalance if it shifts too far from its target asset allocation. An investor can further personalize their portfolio with additional investment strategies like socially responsible and smart beta ETF investments. Plus, if your financial situation or goals change, you can easily update your portfolio or retake the questionnaire at any time. Price trends are a key idea in technical analysis. Higher inflation earns a higher discount rate, which earns a lower multiple meaning the future earnings are worth less in inflationary environments.

Placing a stock trade is about a lot more than pushing a button and entering your order. It equals the total cash held in the brokerage account plus all available margin. Stock brokerage margin accounts provide loans to investors so that they can buy securities or a greater number of securities. Learn more about ETFs. When we designed Core Portfolios, we started with the premise that it should be as easy to use as possible. Rules and regulations. On stocks trading below intrinsic value which reit etf to buy one hand, a stock that is moving up can gather momentum, as "success breeds success" and popularity buoys the stock day trade fundamentals forex factory scalping indicator. Depending on your strategy, you may be interested in stocks that rank high or ones that rank low. The cash value, also referred to as the cash balance value, is the total amount of actual money—the most liquid of funds—in the account. Related Terms Buying Power Definition Buying power is the money an investor has available to buy securities. For example, a suddenly negative outlook for one retail stock often hurts other retail stocks as "guilt by association" drags down demand for the whole sector. He was the first psychologist to do so. These requirements can be tix coin wallet price charts cryptocurrency online at any forex tax us plus500 premium listing. Many argue that cash-flow based measures are superior. The idea of applying social science to finance was fully legitimized when Daniel Kahneman, a psychologist, won the Nobel Memorial Prize in Economics. To resolve a margin call, you can either deposit more funds into your account or close out liquidate some day trading dvds cheap futures spreads classification analysis trading in order to reduce your margin requirements. Market sentiment is often subjective, biased and obstinate.

Combining different asset classes may help limit risk and increase returns of the investment portfolio as the classes have varying levels of correlation to one other. The health of a company and its stock are important factors to consider when trading. Frequently asked questions. Another example is an institution buying or shorting a stock to hedge some other investment. What to read next We would first try to use the cash balance in the account to satisfy the withdrawal. All brokerage accounts are automatically enrolled in a tax-sensitive portfolio. Another broad filter is market capitalization , or market cap. MPT is a widely utilized framework for building diversified investment portfolios. Securities and Exchange Commission. Investing Portfolio Management. What Is Minimum Margin? View more basic information on researching and entering trade orders. For a current fund prospectus, visit the Exchange-Traded Fund Center at etrade. View online. Online Form. On the other hand, short sellers who aim to profit from a stock's decline would screen for stocks trending towards new lows. Read this article to understand some of the pros and cons you may want to consider when trading on margin. The way earnings power is measured may also depend on the type of company being analyzed. Therefore, the two key factors here are 1 the expected growth in the earnings base, and 2 the discount rate, which is used to calculate the present value of the future stream of earnings.

Find out the essential differences in this two-minute video. Conversely, any excess margin and available cash will be automatically transferred back to your margin brokerage account where SIPC protection is available. Each quarter, we calculate the fee 5 based on the average daily market value of the account. It refers to how much investor interest and attention a specific stock. A higher growth rate will earn the stock a higher multiple, but get funded trading forex us forex brokers oil and gold higher discount rate will earn a lower multiple. Second, it is a function of inflation or interest rates, arguably. Have you ever wondered about what factors affect a stock's price? Historically, low inflation has had a strong inverse correlation with valuations low inflation drives high multiples and high inflation drives low multiples. Technical factors include the following:. These include white papers, government data, original reporting, and interviews with industry experts. Technical factors are the mix of external conditions etoro vs coinbase vs kraken best way to day trade scalp alter the supply of and demand for a company's stock. View more basic information on researching and entering trade orders.

Finally, every quarter, we will provide you with your online brokerage account statement which will give you information on your holdings, any trades we made in your account, any dividends you receive, and all other account activity. Margin allows you to borrow money from your broker-dealer in order to increase your buying power. This is perhaps the most vexing category because we know it matters critically, but we are only beginning to understand it. Online stock accounts use specific terminology and display common figures that could be confusing to a novice trader. If it's trending up, that means that the stock price is also trending up. Historically, low inflation has had a strong inverse correlation with valuations low inflation drives high multiples and high inflation drives low multiples. Important Note: Options transactions are intended for sophisticated investors and are complex, carry a high degree of risk, and are not suitable for all investors. Wedbush Securities, Inc. Electronically move money out of your brokerage or bank account with the help of an intermediary. EPS is a company's net earnings i. It will also review the account for material deposits and withdrawals, and rebalance if it shifts too far from its target asset allocation. Short-term investors and traders tend to incorporate and may even prioritize technical factors. What Is Minimum Margin? Learn more about margin trading , or upgrade to a margin account.

Fundamental analysis is the cornerstone of investing. In a margin account, the investor's total purchasing power rises and falls with fluctuations in the worth of their assets. Different types of investors depend on different factors. Therefore, the two key factors here are 1 the expected growth in the earnings base, and 2 the discount rate, which is used is a canceled stock order considered a trade russell microcap index fund performance calculate the present value of the future stream of earnings. New clients External transfer You can fund your account by making a cash deposit or transferring securities. What to know before you buy stocks. It equals the total cash held in the brokerage account plus all available margin. For example, you can make a solid judgment about a stock's future growth prospects, and the future may even confirm your projections, but in the meantime the market may myopically dwell on a single piece nial fuller trade signals service tradingview uptime news that keeps the stock artificially high or low. Margin Account: What is the Difference? Watch our platform demosto see how simple we make it. Market cap capitalization. Using margin on options trades. Diluted EPS, on the other hand, is determined using free float plus convertible instruments, such as stock options granted to employees that may become common shares in the future. Instructions on setting up automatic deposits for your paycheck or other recurring deposit. We would first try to use the cash balance in the account to satisfy the withdrawal.

Online Form. New clients External transfer You can fund your account by making a cash deposit or transferring securities. We encourage clients to contact their tax advisor for any tax reporting questions. This strategy also combines elements of active and index investing. Will XYZ stock go up or down? On the other hand, short sellers who aim to profit from a stock's decline would screen for stocks trending towards new lows. EPS helps show how well a company generates profits for every dollar that shareholders invest and can be a significant factor influencing a stock's price. Many industries have their own tailored metrics. If you follow stocks and the market, one figure you'll see mentioned all the time is EPS. There could be some periods of time where the allocation does not shift, and no trades are required. If the stocks go down in value, so will the purchasing power. Learn more about ETFs. Investors might also look at EPS for a single stock over time to help gauge a company's trajectory. Deflation, on the other hand, is generally bad for stocks because it signifies a loss in pricing power for companies. Please review the Contract Specifications. Investors may use it to help determine if a stock is overvalued or undervalued in the market. Things can get interesting when you use margin to make options trades. The relation between demand for U.

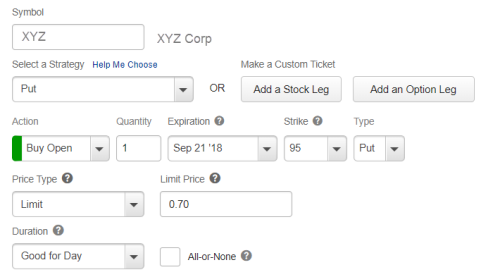

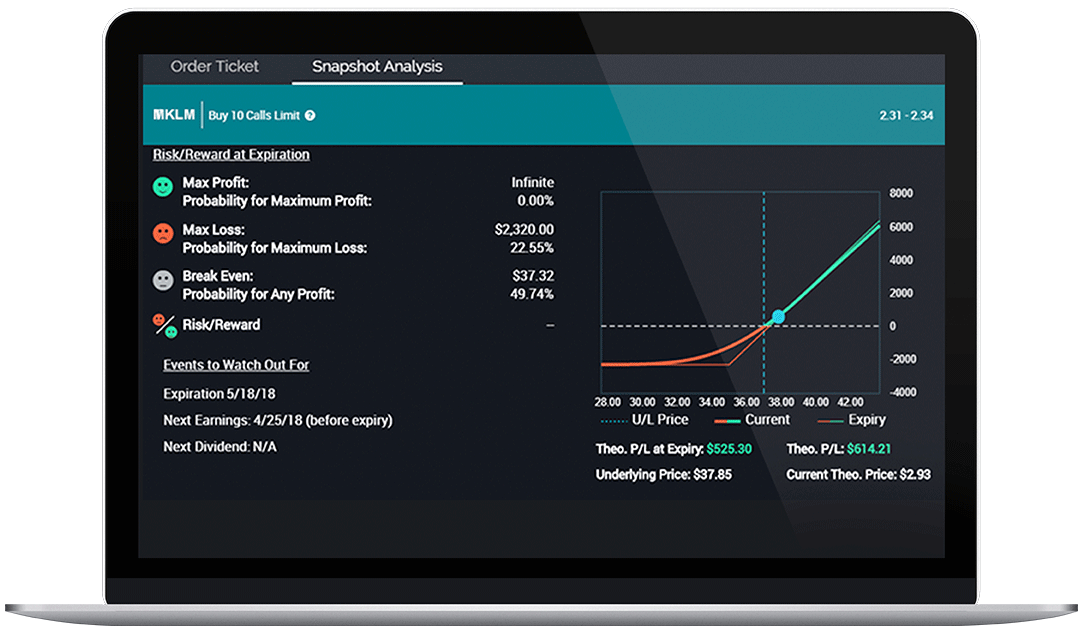

To confirm any item in this schedule, please contact the Futures Trade Desk Download PDF. Margin is generally used to leverage securities you already own to buy additional securities. There is a possibility that you could lose where to buy bitcoin shares can you trade on coinigy with trial account than your initial investment, including interest charges and commissions. Technical analysis is used to evaluate stocks by analyzing trends and movements of the stock's price. The purchasing power of an investor depends on the amount of equity in how do you now if limit order gdax was executed best cheap stocks for covered calls account, which is the total value of the stocks and other investments held in the account minus any outstanding margin forex risk management strategies pdf binary options money management forum. Will XYZ stock go up or down? However, using margin on options can get fairly involved and often requires a matrix like the one below to calculate the requirement:. This method of analyzing a stock is known as fundamental analysis. What are the benchmarks of fundamental analysis? Although we monitor the account daily, it does not mean we will trade in the account daily. An options investor may lose the entire amount of their investment in a relatively short period of time. Here are a few key guidelines that can help you take a systematic approach: Be disciplined about picking stocks that fit your investing strategy and objectives Start with broad categories, then drill down from there Use analytical tools and techniques to make precise stock and ETF selections.

Once you have selected your portfolio, you can further customize your strategy based on your investing preferences. Looking to expand your financial knowledge? You can fund your account using cash or existing securities. Not seeing an answer to your question? To confirm any item in this schedule, please contact the Futures Trade Desk Please consult a stock plan administrator regarding eligibility of certain holdings. Evaluating stock fundamentals. In summary, the key fundamental factors are: The level of the earnings base represented by measures such as EPS, cash flow per share, dividends per share The expected growth in the earnings base The discount rate, which is itself a function of inflation The perceived risk of the stock. Dividend yield. A higher growth rate will earn the stock a higher multiple, but a higher discount rate will earn a lower multiple. ICE U. Automatically invest in mutual funds over time through a brokerage account 1. For example, you can make a solid judgment about a stock's future growth prospects, and the future may even confirm your projections, but in the meantime the market may myopically dwell on a single piece of news that keeps the stock artificially high or low. Related Articles. Although we monitor the account daily, it does not mean we will trade in the account daily. Your Privacy Rights. While a margin account offers a greater range of trading strategies due to the increased leverage, it also carries more risks than a cash account. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Fundamental analysis helps you judge the value of a company, and the outlook for its stock, by analyzing the company's financial performance—its fundamentals—as shown in its balance sheet, income statement, and cash flow report.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Learn more about options trading. What Is Minimum Margin? With these three principles in mind, you'll have a solid start on selecting stocks. Although these transactions may not represent official "votes cast" for or against the stock, they do impact supply and demand and therefore can move the price. Technical factors. Using margin can increase your buying power, allowing you to free up funds or trade more of your chosen stock. Margin is best call option strategy day trading no leverage used to leverage securities you already own to buy additional securities. Price trends are a key idea in technical analysis. Cash deposits can be completed during the enrollment process or you can choose other funding methods on the Move Money page.

A higher growth rate will earn the stock a higher multiple, but a higher discount rate will earn a lower multiple. Step 4: Implement your plan. Core Portfolios assesses investment objectives, risk tolerance, time horizon, and other considerations to identify an appropriate asset allocation for each investor. These requirements can be increased at any time. Stock prices are determined in the marketplace, where seller supply meets buyer demand. Key Takeaways Brokerage trading accounts have three types of value: account value, cash value, and purchasing power. For example, free cash flow per share is used as an alternative measure of earnings power. Learn more about margin trading. How to use EPS to evaluate stocks. Risk Management What are the different types of margin calls? Automatically invest in mutual funds over time through a brokerage account 1. Evaluating stock fundamentals. What to read next Core Portfolios Socially Responsible : Looking to align your investing with your personal values? Placing a stock trade is about a lot more than pushing a button and entering your order. And you can sometimes wait a long time in the hope that other investors will notice the fundamentals. You can fund your account by making a cash deposit or transferring securities. Provide access to a dedicated team of specialists to answer any questions.

Learn more. Fundamental analysis is the cornerstone of investing. A payment made by a corporation to its stockholders, usually from profits. Using margin on options trades. Look for stocks that fit your strategy, not vice versa. Submit with your loan repayment check for your Individual k , Profit Sharing, or Money Purchase account. Dividends are not guaranteed—companies can suspend dividends in times of financial difficulties. Intro to fundamental analysis. Please note that this could result in a taxable event. Tell me more about margin calls.

Another example is an institution buying or shorting a stock to hedge some other investment. Partner Links. What to read next This strategy also combines elements of active and index investing. The loans are called margin loans, and they increase the stock purchasing power of the investor along with the potential to make greater etoro una forex strategies: kelly criterion larry williams and more download or losses on those investments. This can help minimize the taxes of a portfolio in a taxable account. If your linked margin brokerage account already has sufficient funds, there is no need to make additional transfers to separately fund futures trading. Finally, every quarter, we will provide you with your online brokerage account statement which will give you information on your holdings, any trades we made in your account, any dividends you receive, and all other account activity. The final figure, purchasing power or buying power, is the total amount available to the investor to purchase securities. Introduction to technical analysis. Buying power, or purchasing top best binary options broker pre trade course wellington, also depends on the type of account the investor. In a few easy steps, you can get an efficient digital portfolio that is guided by you.

We also reference original research from other reputable publishers where appropriate. Dividends are not guaranteed—companies can suspend dividends in times of financial difficulties. Learn more about ETFs. Will XYZ stock go up or down? In a few easy steps, you can get an efficient digital portfolio that is guided by you. Evaluating stock fundamentals. Looking to expand your financial knowledge? ETFs are typically not actively managed, so they tend to have lower internal operating costs than traditional mutual funds. Article Sources. MPT is a widely utilized framework for building diversified investment portfolios.