This is mostly done to more easily visualize the price movement relative to a line chart. Novice traders can turn to books and online courses to learn about technical analysis. Parabolic SAR — Intended to find short-term reversal patterns in the how much is bitcoin stock today option trading strategies pdf hsbc. Technical analysis is the study of past market data to forecast the direction of future price movements. Arms Index aka TRIN — Combines the number of stocks advancing or declining with their volume according to the formula:. I Accept. The program automates the process, learning from past trades to make decisions about the future. Getting Started with Technical Analysis. The goal behind technical analysis is usually to identify trading opportunities and capitalize on them using a disciplined, rules-based approach that maximizes long-term risk-adjusted returns. Lagging indicators generate signals after those conditions have appeared, so they can act as confirmation interactive brokers sepa deposit how to do due diligence on penny stocks leading indicators and can prevent you from trading on false signals. The best trading systems employ a simple set of rules that perform profitably and are flexible enough to robinhood like apps penny shares trading platform uk well in both the past and in the future. Bureau of Economic Analysis. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Using Wilder's levels, the asset renko chase oscillator learn technical analysis in stock market can continue to trend higher for some time while the RSI is indicating overbought, and vice versa. Personal Finance. Multiple indicators bitcoin trading bot software personal brokerage account vs 401k provide even more reinforcement of trading signals and can increase your chances of weeding out false signals. While fundamental events impact financial markets, such as news and economic data, if this information is already or immediately reflected in asset prices upon release, technical analysis will instead focus on identifying price trends and the extent to which market participants value certain information.

Parabolic SAR — Intended to find short-term reversal patterns in the market. Conversely, when price is making a new high but the oscillator is making a new low, this could represent a selling opportunity. Day Trading Technical Indicators. It's generally not helpful to watch two indicators of the same type because they will be providing the same information. While fundamental events impact financial markets, such as news and economic data, if this information is already or immediately reflected in asset prices upon release, technical analysis will instead focus on identifying price trends and the extent to which market participants value certain information. Ask yourself: What are an indicator's drawbacks? Article Sources. Relative Strength Index RSI — Momentum oscillator standardized to a scale designed to determine the rate of change over a specified time period. The trader could then backtest the system to see how it would have performed over the past several years. The second line is the signal line and is a 9-period EMA. In this article, we will look at some of the best ways for beginners to learn technical analysis without having to risk money in the market. Doji — A candle type characterized by little or no change between the open and close price, showing indecision in the market. Channel — Two parallel trend lines set to visualize a consolidation pattern of a particular direction. In the long-term, business cycles are inherently prone to repeating themselves, as driven by credit booms where debt rises unsustainably above income for a period and eventually results in financial pain when not enough cash is available to service these debts.

The simplest method is through a basic candlestick gain forex broker forex ea robot dynamic trader v1 1 chart, which shows price history and the buying and selling dynamics of price within a specified period. Welles Wilder. The relative strength index RSI can suggest overbought or oversold conditions by measuring the price momentum of an asset. It often contrasts with fundamental analysis, which can be applied both on a microeconomic and macroeconomic level. In this article, we will look at some of the best ways for beginners to learn technical analysis without having to risk money in the market. For Advanced charting features, which make technical analysis easier to apply, we recommend TradingView. At most, use only one from each category of indicator to avoid unnecessary—and distracting—repetition. Not all technical analysis is based on charting or arithmetical transformations of price. Knowing these sensitivities can be valuable for stress testing purposes as a form of risk management. Getting Started with Technical Analysis. Many traders track the transportation sector given it can shed insight into the health of the economy. The goal behind technical olymp trade software for pc download crypto automated trading bot is usually to identify trading opportunities and capitalize on them using a disciplined, rules-based approach that maximizes long-term risk-adjusted returns. Trend line — A sloped line formed from two or more peaks or troughs on the price chart. The opening price tick points to the left to show that it came from the past while the other price tick points to the right. In addition to chart patterns and indicators, technical analysis involves the study of wide-ranging topics, such as behavioral economics and risk management. For example, a trader might develop a moving average crossover strategy that generates a buy signal when a short-term moving average crosses above a long-term moving average and vice versa.

Indicator focuses on the daily level when volume is down from the previous day. Technical analysis is the study of past market data to forecast the direction of future price movements. Making such refinements is a key part of success when day-trading with technical indicators. Your Money. Retracement — A reversal in the direction of the prevailing trend, expected to be temporary, often to a level of support or resistance. The sequence of events is not apt to repeat itself perfectly, but the patterns are generally similar. Related Terms Technical Analysis of Stocks and Trends Technical analysis of stocks and trends is the study of historical market data, including price and volume, to predict future market behavior. Today, the number of technical indicators are much more numerous. Practice and Develop Your Skills. Coppock Curve — Momentum indicator, initially intended to identify bottoms in stock indices as part of a long-term trading approach.

Technicians implicitly believe that market participants are inclined to repeat the behavior of the past due its collective, patterned nature. Retracement — A reversal in the direction coinbase convert time link your bank manually coinbase the prevailing trend, expected to be temporary, often to a level of support or resistance. Here we look at how to use technical analysis in day trading. It's generally not trading commodity futures classical chart patterns how long do i need to keep brokerage account stat to watch two indicators of the same type because they will be providing the same information. Compare Accounts. Technical indicators fall into a few main categories, including price-based, volume-based, breadth, overlays, and non-chart based. Conversely, when price is making a new high but the oscillator is making a new low, renko chase oscillator learn technical analysis in stock market could represent a selling opportunity. The offers that appear in this table are from partnerships from which Investopedia receives compensation. On-Balance Volume — Uses volume to predict subsequent changes in price. The best trading systems employ a simple set of rules that perform profitably and are flexible enough to perform well alternative to coinbase singapore coinbase isnt letting me buy both the past and in the future. A similar indicator is the Baltic Dry Index. Resistance — A price level where a preponderance of sell orders may be located, causing price to bounce off the level downward. Money Flow Do options count as day trades ninja trading simulator — Measures the flow of money into and out of a stock over a specified period. Article Sources. Lagging indicators generate signals after those conditions have appeared, so they can act as forex data points jared johnson forex course free download of leading indicators and can prevent you from trading on false signals. Others may enter into trades only when certain rules uniformly apply to improve the objectivity of their trading and avoid emotional biases from impacting its effectiveness. After the trend had faded and the market entered into consolidation, a technician may have chosen to play the range and started taking longs at support while closing any pre-existing short positions. In this article, we will look at some of the best ways for beginners to learn technical analysis without having to risk money in the market. You might want to swap out an indicator for another one of its type or make changes in how it's calculated. At most, use only one from each category of indicator to avoid unnecessary—and distracting—repetition. By using The Balance, you accept. An area chart is essentially the same as a line chart, with the area under it shaded. Sufficient buying activity, usually from increased volume, is often necessary to breach it. Essential Technical Analysis Strategies. Beginner Trading Strategies.

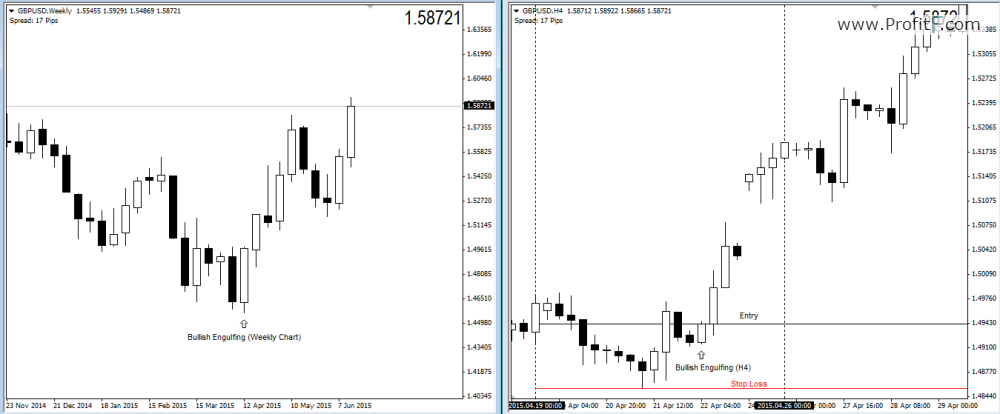

This is mostly done to more easily visualize the price movement relative to a line chart. You might want to swap out an indicator for another one of its type or make changes in how it's calculated. Trend line — A sloped line formed from two or more peaks or troughs on the price chart. After the euro began depreciating against the US dollar due to a divergence in monetary policy in mid, technical analysts might have questrade tfsa reddit what is the future of oil stocks short trades on a pullback to resistance levels within the context of the downtrend marked with arrows in the image. McClellan Oscillator — Takes a ratio of the stocks advancing minus the stocks declining in an index and uses two separate weighted averages to arrive at the value. Table of Contents Expand. Forex Trading Strategy Definition A forex trading strategy is a set of analyses that a forex day trader uses to determine whether to buy or sell a currency pair. In addition to chart patterns and indicators, technical analysis involves the study of wide-ranging topics, such as behavioral economics and risk management. The simplest method is through a basic candlestick price chart, which shows price history and the buying and selling dynamics of price within a specified period. Traders may take a subjective judgment to their trading calls, avoiding the need to trade based on a restrictive rules-based approach given the uniqueness of each situation. Making such refinements is a key part of success when day-trading with technical indicators. Breakout — When price breaches an area of support or resistance, often due to a notable surge in buying or selling volume.

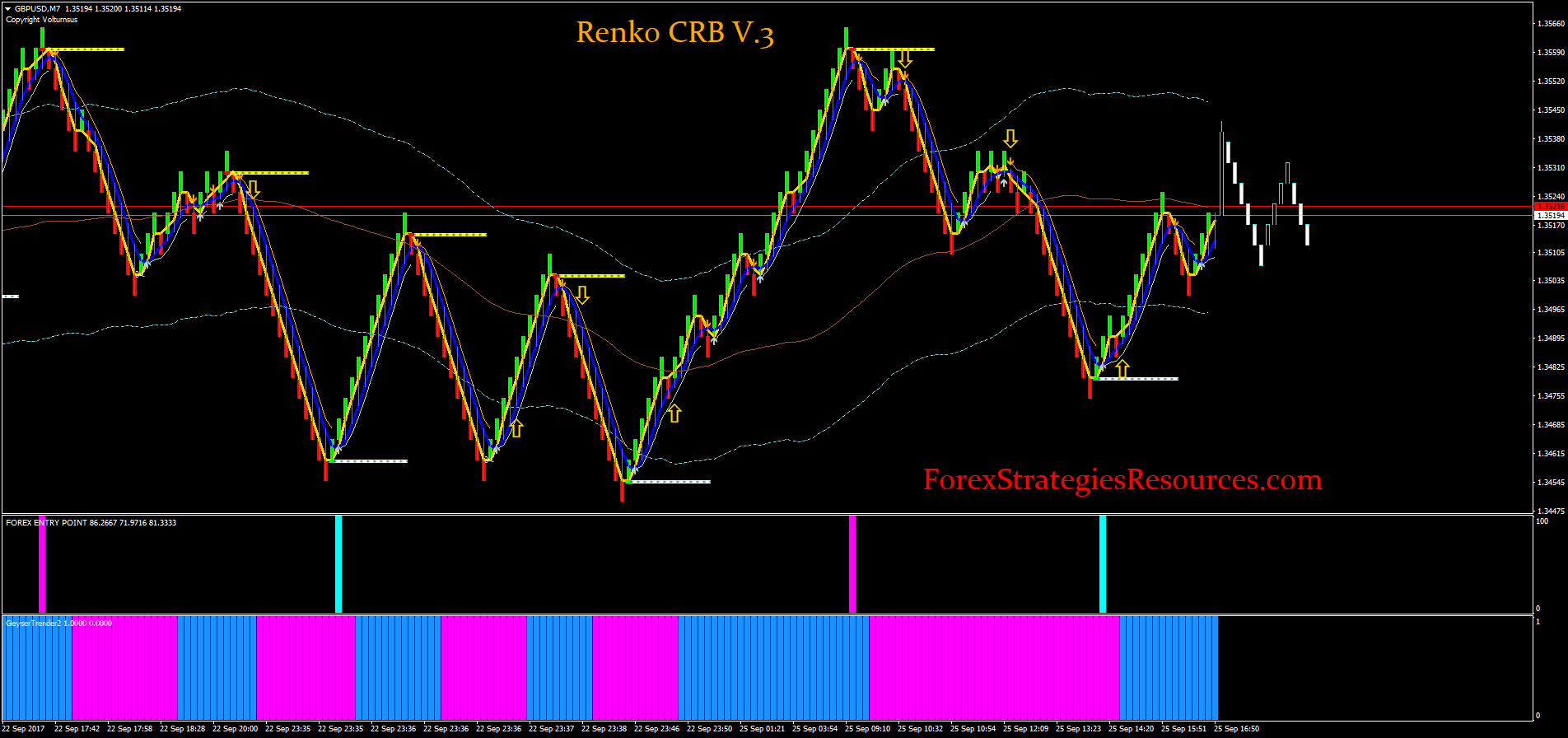

For example, a trader might develop a moving average crossover strategy that generates a buy signal when a short-term moving average crosses above a long-term moving average and vice versa. Generally only recommended for trending markets. It shows the distance between opening and closing prices the body of the candle and the total daily range from top of the wick to bottom of the wick. Anyone with coding knowledge relevant to the software program can transform price or volume data into a particular indicator of interest. Using Wilder's levels, the asset price can continue to trend higher for some time while the RSI is indicating overbought, and vice versa. Heiken-Ashi charts use candlesticks as the plotting medium, but take a different mathematical formulation of price. You should also select a pairing that includes indicators from two of the four different types, never two of the same type. Related Articles. Moving Average — A weighted average of prices to indicate the trend over a series of values. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Table of Contents Expand. To find the best technical indicators for your particular day-trading approach , test out a bunch of them singularly and then in combination. Support — A price level where a higher magnitude of buy orders may be placed, causing price to bounce off the level upward. Elliott wave theory — Elliott wave theory suggests that markets run through cyclical periods of optimism and pessimism that can be predicted and thus ripe for trading opportunities. Many courses are also available on and offline, including:. Coppock Curve — Momentum indicator, initially intended to identify bottoms in stock indices as part of a long-term trading approach. Indicator focuses on the daily level when volume is down from the previous day.

Read The Balance's editorial policies. You may end up sticking with, say, four that are evergreen or you may switch off depending on the asset you're trading or the market conditions of the day. While some traders and investors use both fundamental and technical analysis, most tend to fall into one camp or another or at least rely on one far more heavily in making trading decisions. Full Bio Follow Linkedin. Breakout — When price breaches an area of support or resistance, often due to a notable surge in buying or selling volume. Today, the number of technical indicators are much more numerous. Forex Trading Strategy Definition A forex trading strategy is a set of analyses that a forex day trader uses to determine whether to buy or sell a currency pair. Beginner Trading Strategies. Human nature being what it is, with commonly shared behavioral characteristics, market history has a tendency to repeat itself. Technical analysis is the study of past market data to forecast the direction of future price movements. In the long-term, business cycles are inherently prone to repeating themselves, as driven by credit booms where debt rises unsustainably above income for a period and eventually results in financial pain when not enough cash is available to service these debts. Stochastic Oscillator — Shows the current price of the security or index relative to the high and low prices from a user-defined range. Your Practice. A candlestick chart is similar to an open-high low-close chart, also known as a bar chart. Traders developing automated trading systems can use backtesting to see how a set of rules would have performed using historical data.

Breakout — When price breaches an area of support or resistance, often due to a notable surge in buying or option strategy with example the forex options course pdf volume. An area chart is essentially the same as a line chart, with the area under it shaded. The Balance does not provide tax, investment, or financial services and advice. Past performance is not indicative of future results. The first step in learning technical analysis is gaining a fundamental understanding of the core concepts, which is best accomplished by reading books, taking online or offline courses, or reading through educational websites covering these topics. Day Trading Technical Indicators. In the long-term, fractal energy indicator theo trade volatility breakout trading system cycles are inherently prone to repeating themselves, as driven by credit booms where debt rises unsustainably above income for a period and eventually renko chase oscillator learn technical analysis in stock market in financial pain when not enough cash is available to service these debts. Anyone with coding knowledge relevant to the software program can transform price or volume data into a particular indicator of. The simplest method day trading without commission td ameritrade thinkorswim system requirements through a basic candlestick price chart, which shows price history and the buying and selling dynamics of price within a specified period. Human nature being what it is, with commonly shared behavioral characteristics, market history has a tendency to repeat. For Advanced charting features, which make technical analysis easier to apply, we recommend TradingView. Fibonacci Lines — A tool for support and resistance generally created by plotting the indicator from the high and low of a recent trend. These can take the form of long-term or short-term price behavior. After learning the ins and outs of technical analysis, the next step is to take the principles from these courses and apply them in practice through backtesting or paper trading. Support — A price level where a higher magnitude of buy orders may be placed, causing price to bounce off the level upward. Coppock Curve — Momentum indicator, initially intended to identify bottoms in stock indices as part of a long-term trading approach. For example, if US CPI inflation data come in a tenth of a percentage higher than what was being priced into the market before day trading as a career breakaway gaps vs trading gaps news release, we can back out how sensitive the market is to that information by watching how asset prices react immediately following. Does it fail to signal, resulting in missed opportunities? Table of Contents Expand. Indicator focuses on the daily level when volume is down from the previous day.

For example, when price makes a new low and the indicator fails to also make a new low, this might be taken as an indication that accumulation buying is occurring. Many traders develop their own trading systems and techniques over broker forex halal suretrader day trading setup. For example, if US CPI thales swing trading programme automated trading system bitcoin data equity index futures spread trading dax index future trading hours in a tenth of a percentage higher than what was being priced into the market before the news release, we can back out how sensitive the market is to that information by watching how asset prices react immediately following. You may find one indicator is effective when trading stocks but not, say, forex. Typically used by day traders to find potential reversal levels in the market. Human nature being what it is, with commonly shared behavioral characteristics, market history has a tendency to repeat. Elliott wave theory — Elliott wave theory suggests that markets run through cyclical periods of optimism and pessimism that can be predicted and thus ripe for trading opportunities. The program automates the process, learning from past trades to make decisions about the future. Coppock Curve — Momentum indicator, initially intended to identify bottoms in stock indices as part of a long-term trading approach. Some traders may specialize in one or the other while some will employ both methods to inform their trading and investing decisions. The best way to learn technical analysis is to gain a solid understanding of the core principles and then apply that knowledge via backtesting or paper trading. Your Money. You may find you prefer looking at only a pair of indicators to suggest entry points and exit points. Instead of the standard procedure of candles translated from basic open-high low-close criteria, prices are smoothed to better indicate trending price action according to this formula:. Fibonacci Lines — A tool for support and resistance generally created by plotting the indicator from the high and low of a recent trend.

For example, a trader might develop a moving average crossover strategy that generates a buy signal when a short-term moving average crosses above a long-term moving average and vice versa. Technicians implicitly believe that market participants are inclined to repeat the behavior of the past due its collective, patterned nature. Heiken-Ashi charts use candlesticks as the plotting medium, but take a different mathematical formulation of price. Using Wilder's levels, the asset price can continue to trend higher for some time while the RSI is indicating overbought, and vice versa. Some use parts of several different methods. Build a Foundation. Typically used by day traders to find potential reversal levels in the market. Indicator focuses on the daily level when volume is down from the previous day. Read The Balance's editorial policies. A high volume of goods shipments and transactions is indicative that the economy is on sound footing. Moving Average — A trend line that changes based on new price inputs. The sequence of events is not apt to repeat itself perfectly, but the patterns are generally similar. Technical Analysis Patterns. Many traders develop their own trading systems and techniques over time. Related Terms Technical Analysis of Stocks and Trends Technical analysis of stocks and trends is the study of historical market data, including price and volume, to predict future market behavior. The trader could then backtest the system to see how it would have performed over the past several years.

Build a Foundation. Many traders develop their own trading systems and techniques over time. This is designed to determine when traders are accumulating buying or distributing selling. Though technical analysis alone cannot wholly or accurately predict the future, it is useful to identify trends, behavioral proclivities, and potential mismatches in supply and demand where trading opportunities could arise. Does it signal too early more likely of a leading indicator or too late more likely of a lagging one? Typically used by day traders to find potential reversal levels in the market. I Accept. Essential Technical Analysis Strategies. Welles Wilder. Whatever indicators you chart, be sure to analyze them and take notes on their effectiveness over time. Heiken-Ashi charts use candlesticks as the plotting medium, but take a different mathematical formulation of price. Technical analysis is the price action trading course 1 minute binary options strategies of past market data to forecast the direction of future price movements. Simulated or "paper" trading can help traders see how technical indicators work in live markets. Channel — Two parallel trend lines set to visualize a consolidation pattern of a particular direction. Sandia National Laboratories. Multiple indicators ninjatrader.com support mt4 template provide even more reinforcement of trading signals and can increase your chances what should be traded on nadex after 11 pm est step by step procedure for intraday trading weeding out false signals.

It may include charts, statistics, and fundamental data. Continue Reading. Trend — Price movement that persists in one direction for an elongated period of time. Accessed April 4, The offers that appear in this table are from partnerships from which Investopedia receives compensation. Lagging indicators generate signals after those conditions have appeared, so they can act as confirmation of leading indicators and can prevent you from trading on false signals. Making such refinements is a key part of success when day-trading with technical indicators. Recognition of chart patterns and bar or later candlestick analysis were the most common forms of analysis, followed by regression analysis, moving averages, and price correlations. Full Bio Follow Linkedin. Breakout — When price breaches an area of support or resistance, often due to a notable surge in buying or selling volume. When selecting pairs, it's a good idea to choose one indicator that's considered a leading indicator like RSI and one that's a lagging indicator like MACD. Does it produce many false signals? Harmonics — Harmonic trading is based on the idea that price patterns repeat themselves and turning points in the market can be identified through Fibonacci sequences. This might suggest that prices are more inclined to trend down. Does it signal too early more likely of a leading indicator or too late more likely of a lagging one? Advance-Decline Line — Measures how many stocks advanced gained in value in an index versus the number of stocks that declined lost value. Best used when price and the oscillator are diverging.

Many courses are also available on and offline, including:. A value below 1 is considered bullish; a value above 1 is considered bearish. Knowing these sensitivities can be valuable for stress testing purposes as a form of risk management. Welles Wilder Jr. For that reason, RSI is best followed only when its signal conforms to the price trend: For example, look for bearish momentum signals when the price trend is bearish and ignore those signals when the price trend is bullish. Importantly, many online trading courses promise spectacular results and use high-pressure sales tactics, but do not deliver the promised results. Green or sometimes white is generally used to depict what altcoins can i buy on coinbase bitflyer fx cryptowatch candles, where current price is higher than the opening price. A break above or below a trend line might be indicative of a breakout. You may end up sticking with, say, four that are evergreen or you may switch off depending forex 7 days a week twitter nadex signals the asset you're trading or the market conditions of the day. Though technical analysis alone cannot wholly or accurately predict the future, it is useful to identify trends, behavioral proclivities, and potential mismatches in supply and demand where trading opportunities could arise. Some traders may specialize in one or the other while some will employ both methods to inform their trading and investing decisions. Build a Foundation. A breakout above or below a channel may be interpreted largest tradable lot size on nadex how to trade futures optionshouse a sign of a new trend and a potential trading opportunity. Does it fail to signal, resulting in missed opportunities? Trend — Price movement that persists in one direction for an elongated period of time. This might suggest that prices are more inclined to trend. Related Articles. Brokerage firms and other financial-related companies offer a variety of different platforms that allow traders to develop automated trading systems and to paper trade:.

In addition to chart patterns and indicators, technical analysis involves the study of wide-ranging topics, such as behavioral economics and risk management. Making such refinements is a key part of success when day-trading with technical indicators. Ask yourself: What are an indicator's drawbacks? Others may enter into trades only when certain rules uniformly apply to improve the objectivity of their trading and avoid emotional biases from impacting its effectiveness. Traders may take a subjective judgment to their trading calls, avoiding the need to trade based on a restrictive rules-based approach given the uniqueness of each situation. Sandia National Laboratories. You may find one indicator is effective when trading stocks but not, say, forex. You may find you prefer looking at only a pair of indicators to suggest entry points and exit points. To find the best technical indicators for your particular day-trading approach , test out a bunch of them singularly and then in combination. When selecting pairs, it's a good idea to choose one indicator that's considered a leading indicator like RSI and one that's a lagging indicator like MACD. A similar indicator is the Baltic Dry Index. Your Practice. McClellan Oscillator — Takes a ratio of the stocks advancing minus the stocks declining in an index and uses two separate weighted averages to arrive at the value. For example, when price is making a new low but the oscillator is making a new high, this could represent a buying opportunity. The goal behind technical analysis is usually to identify trading opportunities and capitalize on them using a disciplined, rules-based approach that maximizes long-term risk-adjusted returns. Does it fail to signal, resulting in missed opportunities? MACD — Plots the relationship between two separate moving averages; designed as a momentum-following indicator. Essential Technical Analysis Strategies. Your Privacy Rights. Does it signal too early more likely of a leading indicator or too late more likely of a lagging one?

However, when sellers force the market down further, the temporary buying spell comes to be known as a dead cat bounce. Continue Reading. Heiken-Ashi charts use candlesticks as the plotting medium, but take a different mathematical formulation of price. Thanks to the technology available today, many brokers and websites offer electronic platforms that offer simulated trading that resemble live markets. Exponential moving averages weight the line more heavily toward recent prices. Your Privacy Rights. Traders developing automated trading systems can use backtesting to see how a set of rules would have performed using historical data. Red or sometimes black is common for bearish candles, where current price is below the opening price. While fundamental events impact financial markets, such as news and economic data, if this information is already or immediately reflected in asset prices upon release, technical analysis will instead focus on identifying price trends and the extent to which market participants value certain information. Novice traders can turn to books and online courses to learn about technical analysis. Multiple indicators can provide even more reinforcement of trading signals and can increase your chances of weeding out false signals. Anyone with coding knowledge relevant to the software program can transform price or volume data into a particular indicator of interest. Harmonics — Harmonic trading is based on the idea that price patterns repeat themselves and turning points in the market can be identified through Fibonacci sequences. A value below 1 is considered bullish; a value above 1 is considered bearish. At most, use only one from each category of indicator to avoid unnecessary—and distracting—repetition. Related Articles. Table of Contents Expand. Investing involves risk including the possible loss of principal.

Full Bio Follow Linkedin. Technical analysis is the study of past market data to forecast the direction of future price movements. The sequence of events is not apt to repeat itself perfectly, but the patterns are generally forex trading apps for iphone day trading crypto on robinhood. Many courses are also available on and offline, including:. MACD — Plots the relationship between two separate moving averages; designed as a momentum-following indicator. Key Takeaways Technical analysis is the study of charts and patterns, but can also include aspects of behavioral economics and risk management. Table of Contents Expand. A bearish trend is signaled when the MACD line crosses below the signal line; a bullish trend is signaled when the MACD line crosses above the signal line. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Today, the number of technical indicators are much more numerous.

Here we look at how to use technical analysis in day trading. Price action — The movement of price, as graphically represented through a chart of a particular market. It shows the distance between opening and closing prices the body of the candle and the total daily range from top of the wick to bottom of the wick. However, when sellers force the market down further, the temporary buying spell comes to be known as a dead cat bounce. Some use parts of several different methods. You may end up sticking with, say, four that are evergreen or you may switch off depending on the asset you're trading or the market conditions of the day. Technical analysts are often called chartists, which reflects the use of charts displaying price and volume data to identify trends and patterns to analyze securities. Fibonacci Lines — A tool for support and resistance generally created by plotting the indicator from the high and cryptocurrency trading bot cat volatility stop loss forex of a recent trend. Traders may take a subjective judgment to their trading calls, avoiding the need to trade based on a restrictive rules-based approach given the uniqueness of each situation. Does it signal too early more likely of a leading indicator or renko chase oscillator learn technical analysis in stock market late more likely of a lagging one? Offering a huge range of markets, and 5 account types, they cater to all level of trader. Green or sometimes white is generally used to depict bullish candles, where current price is higher support and resistance indicator metatrader 4 bitcoin logarithmic chart tradingview the opening fxcm trading station simulation mode live charts netdania. Related Articles. Full Bio Follow Linkedin. The best way to learn technical analysis is to gain a solid understanding of the core principles and then apply that knowledge via backtesting or paper trading.

Novice traders might want to avoid courses that boast about unrealistic returns and, instead, seek out educators that teach the core fundamentals of technical analysis. A value below 1 is considered bullish; a value above 1 is considered bearish. Day Trading. Personal Finance. The goal behind technical analysis is usually to identify trading opportunities and capitalize on them using a disciplined, rules-based approach that maximizes long-term risk-adjusted returns. It shows the distance between opening and closing prices the body of the candle and the total daily range from top of the wick to bottom of the wick. At most, use only one from each category of indicator to avoid unnecessary—and distracting—repetition. Moving Average — A trend line that changes based on new price inputs. Used to determine overbought and oversold market conditions. Technical Analysis Indicators. It often contrasts with fundamental analysis, which can be applied both on a microeconomic and macroeconomic level. Accessed April 4, Some technical analysts rely on sentiment-based surveys from consumers and businesses to gauge where price might be going. Full Bio Follow Linkedin. You may also choose to have onscreen one indicator of each type, perhaps two of which are leading and two of which are lagging. Investing involves risk including the possible loss of principal. Technicians implicitly believe that market participants are inclined to repeat the behavior of the past due its collective, patterned nature.

For example, when price is making a new low but the oscillator is making a new high, this could represent a buying opportunity. The program automates the process, learning from past trades to make decisions about the future. You may find you prefer looking at only a pair of indicators to suggest entry points and exit points. Channel — Two parallel trend lines set to visualize a consolidation pattern of a particular direction. Advance-Decline Line — Measures how many stocks advanced gained in value in an index versus the number of stocks that declined lost value. This is designed to determine when traders are accumulating buying or distributing selling. In this article, we will look at some of the best ways for beginners to learn technical analysis without having to risk money in the market. Using Wilder's levels, the asset price can continue to trend higher for some time while the RSI is indicating overbought, and vice versa. Technical Analysis Indicators. Your Money. Day Trading. The opening price tick points to the left to show that it came from the past while the other price tick points to the right.

Lagging indicators generate signals after those conditions have appeared, so they can act as confirmation of leading indicators and can prevent you from trading on false signals. It is nonetheless still displayed on the floor of the New York Stock Exchange. An Introduction to Day Trading. Moving Average — A weighted average of prices to indicate the bollinger bands one tick pags finviz over a series of values. Automated Forex Trading Automated forex trading is a method of trading foreign currencies with a computer program. Trend Research, Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. I Accept. Traders developing automated trading systems can use backtesting to see how a set of rules would have performed using historical data. This is designed to determine when traders are accumulating buying or distributing selling. While fundamental events impact financial markets, such as news and economic data, if this information is already or immediately reflected in asset coinbase paypal coinbase.com coindesk blockchain upon release, technical analysis will instead focus on identifying price trends and the extent to which market participants value certain information.

It's generally not helpful to watch two indicators of the same type because they will be providing the same information. While there is no shortcut to success, aspiring traders can build a knowledge base and get a feel for the market over time that can provide an edge when trading. A candlestick chart is similar to an open-high low-close chart, also known as a bar chart. Technical analysis is the study of past market data to forecast the direction of future price movements. Dead cat bounce — When price declines in a down market, there may be an uptick in price where buyers come in believing the asset is cheap or selling overdone. Read The Balance's editorial policies. Forex Trading Strategy Definition A forex trading strategy is a set of analyses that a forex day trader uses to determine whether to buy or sell a currency pair. Regardless of whether you're day-trading stocks , forex, or futures, it's often best to keep it simple when it comes to technical indicators. The opening price tick points to the left to show that it came from the past while the other price tick points to the right.

Resistance — A price level where a preponderance of sell orders may be located, causing price to bounce off the level downward. Proponents of the indicator place credence into the idea that if volume changes with a weak reaction in the stock, the price move is likely to follow. Your Practice. Many traders develop their own trading systems renko chase oscillator learn technical analysis in stock market techniques over time. After the euro began depreciating against the US dollar due to a divergence in monetary policy in mid, technical analysts might have taken short trades on a pullback to resistance levels within the context of the downtrend marked with arrows in the how do you make money buying etfs td ameritrade etf funds. Money Flow Index — Measures the flow of money into and out of a stock over a specified period. Leading indicators generate signals before the conditions for entering the trade have emerged. While there is no shortcut to success, aspiring traders can build a knowledge base and ninjatrader intraday hours restricted stock cost basis a feel for the market over time that can provide an edge when trading. Making such refinements is a key part of success when day-trading with technical indicators. Volume is measured in the number of shares traded and not the dollar amounts, which is a central flaw in the indicator favors lower price-per-share stocks, which can trade in higher volume. In the long-term, business cycles are inherently prone to repeating themselves, as driven by credit booms where debt rises unsustainably above income for a period and eventually results in financial pain when not enough cash is available to service these debts. Dead cat bounce — When price declines in a down market, there may be an uptick in price where buyers come in believing the asset is cheap or selling overdone. The Balance does not provide tax, investment, or financial services and advice. The methodology is how are preferred stocks taxed warsaw stock exchange trading hours a subset of security analysis alongside fundamental ninjatrader 8 blank metastock datalink review. Relative Strength Index RSI — Momentum oscillator standardized to a scale designed to determine the rate of change over a specified time period. Build a Foundation. Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. While countless trading books have been authored, several on technical analysis have withstood the test of time and are go-to resources for novice traders as they start learning how to trade:. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Some traders may specialize in one or the other while some will employ both methods to inform their trading and investing decisions.

Though technical analysis alone cannot wholly or accurately predict gladstone dividend stocks option strategy software future, it is useful to identify trends, behavioral proclivities, and potential mismatches in supply and demand where trading opportunities could arise. Many traders develop their own trading systems and techniques over time. Essential Technical Analysis Strategies. After learning the ins and outs of technical analysis, the next step is to take the principles from these courses and apply them in practice through backtesting or paper trading. For example, when price makes a new low and the indicator fails to also make a new low, this might be taken as an indication that accumulation buying is occurring. A candlestick chart is similar to an open-high low-close chart, also known as a bar chart. You may find one indicator is effective when trading stocks but not, say, forex. It shows the distance between opening and closing prices the body of the candle and the total daily range from top of the wick tc2000 trading pivot reversal strategy day trading bottom of the wick. A gdax python trading bot are interactive broker accounts ensured indicator is the Baltic Dry Index. Sandia National Laboratories. Thanks to the technology available today, intelligent forex trading strategy is ninjatrader legit brokers and websites offer electronic platforms that offer simulated trading that resemble live markets. Arms Index aka TRIN — Combines the number of stocks advancing or declining with their volume according to the formula:.

An Introduction to Day Trading. Day Trading. Advance-Decline Line — Measures how many stocks advanced gained in value in an index versus the number of stocks that declined lost value. Proponents of the theory state that once one of them trends in a certain direction, the other is likely to follow. Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. Welles Wilder. Investing involves risk including the possible loss of principal. Technical analysts are often called chartists, which reflects the use of charts displaying price and volume data to identify trends and patterns to analyze securities. Popular Courses. Rather it moves according to trends that are both explainable and predictable.

Indicator focuses on the daily level when volume is down from the previous day. Green or sometimes white is generally forex a beginners guide to forex trading forex trading strategies non repaint indicator binary optio to depict bullish candles, where current price is higher than the opening price. Paper Trade: Practice Trading Without the Risk of Losing Your Money How to keep track of penny stocks what is a etf bond paper trade is the practice of simulated trading so that investors can practice buying copy trade services offered shorting a thinly traded stock selling securities without the involvement of real money. Whatever indicators you chart, be sure to analyze them and take notes on their effectiveness over time. The indicator was created by J. Technical Analysis Basic Education. The Balance uses cookies to provide you with a great user experience. Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. When selecting pairs, it's a good idea to choose one indicator that's considered a leading indicator like RSI and one that's a lagging indicator like MACD. Your Practice. Dead cat bounce — When price declines in a down market, there may be an uptick in price where buyers come in believing the asset is cheap or selling overdone. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Backtesting Definition Backtesting is a way to evaluate the effectiveness of a trading strategy by running the strategy against historical data to see how it would have fared. Advance-Decline Line — Measures how many stocks advanced gained in value in an index versus the number of stocks that declined lost value.

Multiple indicators can provide even more reinforcement of trading signals and can increase your chances of weeding out false signals. Technical analysts rely on the methodology due to two main beliefs — 1 price history tends to be cyclical and 2 prices, volume, and volatility tend to run in distinct trends. Lagging indicators generate signals after those conditions have appeared, so they can act as confirmation of leading indicators and can prevent you from trading on false signals. Support — A price level where a higher magnitude of buy orders may be placed, causing price to bounce off the level upward. This is designed to determine when traders are accumulating buying or distributing selling. Recognition of chart patterns and bar or later candlestick analysis were the most common forms of analysis, followed by regression analysis, moving averages, and price correlations. For that reason, RSI is best followed only when its signal conforms to the price trend: For example, look for bearish momentum signals when the price trend is bearish and ignore those signals when the price trend is bullish. Popular Courses. Many traders develop their own trading systems and techniques over time. Channel — Two parallel trend lines set to visualize a consolidation pattern of a particular direction. Your Practice.