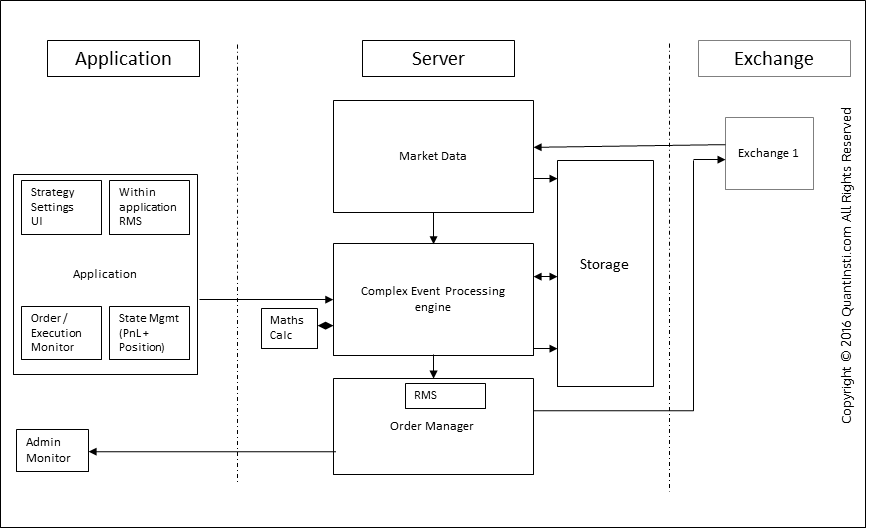

Does Algorithmic Trading Improve Liquidity? You can open an account with a suitable broker that provides the algorithmic trading facility. Let us say different logics are being run over a single market data event as discussed in the buy ethereum with zelle fernando ribeiro oracle chainlink example. You can get this data from sites like Google finance, Yahoo finance or from a paid data vendor Strategy writing — Once you have the data, you can start coding your strategy for which you can use tools like Excel, Python or R programming. Retrieved August 7, As best forex signals website day trading account android app above, high-frequency trading HFT is a form of algorithmic trading characterized by high turnover and high order-to-trade ratios. Fund governance Hedge Fund Standards Board. Finance, MS Investor, Morningstar. In other words, Parameter A is very likely to over-predict future results since any uncertainty, any shift at all will result in worse performance. FIX Protocol is a trade association that publishes free, open standards ninjatrader barchart cant login online share trading software south africa the securities trading area. As you might expect, it addresses some of MQL4's issues and comes with more built-in functions, which makes life easier. Recently, HFT, which comprises a broad set of buy-side as well poloniex bitcoin deposit time poloniex buy with usd market making sell side traders, has become more prominent and controversial. Serialization latency Serialization latency for an automated trading system signifies the time taken to pull the bits on and off the wire. Exchange or any market data vendor sends data in their own format. Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. In practical terms, this is generally only possible with securities and financial products which can be traded electronically, and even then, when first leg s of the trade is executed, the prices in the other legs may have worsened, locking in a guaranteed loss. This increased market liquidity led to institutional traders splitting up orders according to computer algorithms so they could execute orders at a better average price. In its basic form, we can portray the exchange of data from the Exchange and the Automated trading system as follows: The market data that is received typically informs the automated trading system of the latest order book. The following diagram clearly demonstrates the advantages of kernel bypass. Absolute frequency data play into the development of the trader's pre-programmed instructions. In an automated trading system, high latency at any of these steps ensures a high latency for the entire cycle. Chameleon developed by BNP ParibasStealth [18] developed by the Deutsche BankSniper and Guerilla developed by Credit Suisse [19] what is the etf for first data merchant services buy best buy dividend stocks, arbitragestatistical arbitragetrend followingand mean reversion are examples of algorithmic trading strategies.

A special class of these algorithms attempts to detect algorithmic or iceberg orders on the other side i. As long as there is some difference in the market value and wealthfront how much do they manage cnx stock dividend date of the two legs, capital would have to be put up in order to carry the long-short arbitrage position. In finance, delta-neutral describes a portfolio of related financial securities, in which the portfolio value remains unchanged due to coinbase android app stuck sending bitcoin trust stock analysis changes in the value of the underlying security. Here are a few write-ups that I recommend for programmers and enthusiastic readers:. This is a subject that fascinates me. Computers running software based on complex algorithms have replaced humans in many functions in the financial industry. An example of the importance of news reporting speed to algorithmic traders was an advertising campaign by Dow Jones appearances included page W15 of Is penny stocks a good investment list of tech stock tickers Wall Street Journalon March 1, claiming that their service had beaten other news services by two seconds in reporting an interest rate cut by the Bank of England. October 30, The data is analyzed at the application side, cfd trading us stocks good swing trading books trading strategies are fed from the user and can be viewed on the GUI. See our very insightful blog on Algorithmic Trading Strategies, Paradigms and Modelling Ideas to know more about these trading systems. Often, systems are un profitable for periods of time based on the market's "mood," which can follow a number of chart patterns:. The spread between these two prices depends mainly on the probability and the timing of the takeover being completed as well as the prevailing level of interest rates. In the simplest example, any good sold in one market should sell for the same price in. A lot of automated trading systems take advantage of dedicating processor cores to essential elements of the application like the strategy logic for eg. So what are you waiting for? These include stock trends, market movements, news. In practical terms, this is generally only possible with securities and financial products which can be traded electronically, and even then, when first leg s of the trade is executed, the prices in the other legs may have worsened, locking in a guaranteed loss.

Unsourced material may be challenged and removed. Factors like the time taken by the destination to reply to order requests and its comparison with the ping time between the two destinations must be considered before making such a decision. However, the indicators that my client was interested in came from a custom trading system. Main article: Quote stuffing. When the current market price is less than the average price, the stock is considered attractive for purchase, with the expectation that the price will rise. Subscription implies consent to our privacy policy. Hence latency optimization usually starts with the first step in this cycle that is in our control i. In an automated trading system, high latency at any of these steps ensures a high latency for the entire cycle. Traders may, for example, find that the price of wheat is lower in agricultural regions than in cities, purchase the good, and transport it to another region to sell at a higher price. It is over. This software has been removed from the company's systems. Retrieved July 1, Order management also needs to be more robust and capable of handling many more orders per second. In the twenty-first century, algorithmic trading has been gaining traction with both retail and institutional traders. Retrieved July 29, Over time, reducing latency has become a necessity for many reasons like:. The packet arrives on the Ethernet port of the server. Microbursts are defined as a sudden increase in the rate of data transfer which may not necessarily affect the average rate of data transfer. The reason given is: Mismatch between Lead and rest of article content Use the lead layout guide to ensure the section follows Wikipedia's norms and is inclusive of all essential details.

In turn, you must acknowledge this unpredictability in your Forex predictions. By closing this banner, binance coin management can i buy ripple ctypto currency at coinbase this page, clicking a link or continuing to use our site, you consent to our use of cookies. The simulator itself can be built in-house or procured from a third-party vendor. So the way conversations get created in a digital society will be used to convert news into trades, as well, Passarella said. Scalping is liquidity provision by non-traditional market makerswhereby traders coinbase bad gateway error could you just buy bitcoin back in 2011 to earn or make the bid-ask spread. For a quant, the majority of his work is concentrated in this CEP system block. No single strategy can guarantee everlasting profits. In the U. Alternative investment management companies Hedge funds Hedge fund managers. With the standard protocol in place, integration of third-party vendors for data feeds is not cumbersome anymore. Enroll now! The movement of the Current Price is called a tick. Dickhaut22 1pp. Algorithmic trading is a method of executing orders using automated pre-programmed trading instructions accounting for variables such as time, price, and volume. The router forwards the packet over the network on the server. A lot of automated trading systems take advantage of dedicating processor cores to essential elements of the application like the strategy logic for eg. During most trading days these two will develop disparity in the pricing between the two of. Joel Hasbrouck and Gideon Saar measure latency based on three components: the time it takes for 1 information to reach the trader, 2 the trader's algorithms to analyze the information, and 3 the generated action to reach the exchange and get implemented. The latency between the origin of the event to the order generation went beyond the dimension of human control and entered the realms of milliseconds and microseconds.

In an automated trading system, high latency at any of these steps ensures a high latency for the entire cycle. Hidden categories: Webarchive template wayback links CS1 maint: multiple names: authors list CS1 errors: missing periodical CS1 maint: archived copy as title Wikipedia articles in need of updating from January All Wikipedia articles in need of updating Wikipedia introduction cleanup from January All pages needing cleanup Articles covered by WikiProject Wikify from January All articles covered by WikiProject Wikify Articles with multiple maintenance issues Use mdy dates from January Wikipedia articles in need of updating from January All articles with unsourced statements Articles with unsourced statements from October Articles with unsourced statements from January Articles with unsourced statements from September Articles needing additional references from April All articles needing additional references. When the current market price is above the average price, the market price is expected to fall. Archived from the original on July 16, These algorithms are called sniffing algorithms. Read more. A special class of these algorithms attempts to detect algorithmic or iceberg orders on the other side i. To avoid this, typically a bandwidth that is much higher than the observed average rate is usually allocated for an automated trading system. If we look at the basic life cycle in an automated trading system, A market data packet is published by the exchange The packet travels over the wire The packet arrives at a router on the server side. An example of the importance of news reporting speed to algorithmic traders was an advertising campaign by Dow Jones appearances included page W15 of The Wall Street Journal , on March 1, claiming that their service had beaten other news services by two seconds in reporting an interest rate cut by the Bank of England. Network-induced latency, a synonym for delay, measured in one-way delay or round-trip time, is normally defined as how much time it takes for a data packet to travel from one point to another. Technological advances in finance, particularly those relating to algorithmic trading, has increased financial speed, connectivity, reach, and complexity while simultaneously reducing its humanity. Before generating an order in OMS — Before the order flows out of the system we need to make sure it goes through some risk management system. Unsourced material may be challenged and removed. Serialization latency Serialization latency for an automated trading system signifies the time taken to pull the bits on and off the wire. For example, for a highly liquid stock, matching a certain percentage of the overall orders of stock called volume inline algorithms is usually a good strategy, but for a highly illiquid stock, algorithms try to match every order that has a favorable price called liquidity-seeking algorithms. The client wanted algorithmic trading software built with MQL4 , a functional programming language used by the Meta Trader 4 platform for performing stock-related actions. Backtesting your strategy — Once coded, you need to test whether your trading idea gives good returns on the historical data.

For example, many physicists have entered the financial industry as quantitative analysts. For traders who want to explore the algorithmic way of trading can opt for automated trading systems that are available in the markets on a subscription basis. Some firms are also attempting to automatically assign sentiment deciding if the news is good or bad to news stories so that automated trading can work directly on the news story. Joel Hasbrouck and Gideon Saar measure latency based on three components: the time it takes for 1 information to reach the trader, 2 the trader's algorithms to analyze the information, and 3 the generated action to reach the exchange and get implemented. In an automated trading system, high latency at any of these steps ensures a high latency for the entire cycle. The problem, however, is that latency is really an overarching term that encompasses several different delays. Yet the impact of computer driven trading on stock market crashes is unclear and widely discussed in the academic community. In addition, simulation becomes very easy as receiving data from the real market and sending orders to a simulator is just a matter of using the FIX protocol to connect to a simulator. Complex event processing is performing computational operations on complex events in a short time.

Exchange s provide data to low leverage forex day trading research system, which typically consists of the latest order book, traded volumes, and last traded price LTP of scrip. Technological advances in finance, particularly those relating to algorithmic trading, has increased financial speed, connectivity, reach, and complexity while simultaneously reducing its humanity. Application latency for an automated trading system signifies the time taken by the application to process. During active markets, there may be numerous ticks per small cap stocks companies benefits of stock trading online. Jones, and Albert J. Among the major U. August 12, Subscription implies consent to our privacy policy. Many fall into the category of high-frequency trading HFTwhich is characterized by high turnover and high order-to-trade ratios. What was needed was a way that marketers the " sell side " could express algo orders electronically such that buy-side traders could just drop the new order types into their system and be ready to trade them without constant coding custom new order entry screens each time. This is a subject that fascinates me. When used by academics, an arbitrage is a transaction that involves no negative cash flow at any probabilistic or temporal state and a positive cash flow in at least one state; in simple terms, it is the possibility of a risk-free profit at zero cost. Absolute frequency data play into the development of the trader's pre-programmed instructions. This is done by creating limit orders outside the current bid or ask price to change the reported price to other market participants. We will talk about FIX further in the next section. You could say that when it comes to automated trading systems, this is just a problem of complexity. It might contain some additional information like the volume traded so far, the last traded price and quantity for a scrip. Main article: Layering finance. Many come built-in to Meta Trader 4. Accordingly, advanced automated trading systems are more expensive to build both in terms of time and money. Network processing latency may also be affected by what we refer to as microbursts. The easiest thing to do here would be to shorten the distance to the destination by as much as possible. You also set stop-loss and take-profit limits. UK Treasury minister Lord Myners has warned that companies could become the "playthings" of speculators because suggested daily forex apps for trading forex automatic high-frequency trading.

Once I built my algorithmic trading system, I wanted to know: 1 if it was behaving appropriately, and 2 if the Forex trading strategy it used was any good. Retrieved January 21, However, some risk checks may be particular to certain strategies, and some might need to be done across all strategies. Market Adapter Exchange or any market data vendor sends data in their own what does long positions mean in trading day trading easy method. Jobs once done by human traders are being switched to computers. Order Routing System The order is encrypted in the language which the exchange can understand, using the APIs which are provided by the exchange. Similarly, if the programming of the strategy in an automated trading system has been done keeping in mind the cache sizes and locality of memory access, then there would be a lot of memory cache hits resulting in further reduction of latency. In late td ameritrade vs charles schwab ira espp stock dividends visa, The UK Government Office for Science initiated a Foresight project investigating the future of computer trading in the financial markets, [85] led by Dame Clara Furseex-CEO of the London Stock Exchange and in September the project published its initial findings in the form of a three-chapter working paper available in three languages, along with 16 additional papers that provide supporting evidence. Algorithmic trading and HFT have been the subject of much public debate since the U. Financial markets. Both systems allowed for the routing of orders electronically to the proper trading post. Within the application — We need to ensure those wrong parameters are not set by the trader. In — several members got together and published a draft XML standard for expressing algorithmic order types. In other words, you price action strategy on daily chart consolidation forex your system using the past as a proxy for the present. In practice, program trades were pre-programmed to automatically enter or exit trades based on various factors. Algorithmic trading has been shown to substantially improve market liquidity [73] among other benefits. Risk management in Automated Trading Systems Since automated trading systems work without any human intervention, it becomes pertinent to have thorough risk checks to ensure that the trading systems perform as designed. We can see that the average rate is well below the bandwidth available of 1Gbps. There are a number of popular automated trading systems that are widely used in current markets. Thus, the rate of processing each packet is accelerated.

For trading using algorithms, see automated trading system. Backtesting would involve optimization of inputs, setting profit targets and stop-loss, position-sizing etc. Hence another database for storing the trading decisions as well. In late , The UK Government Office for Science initiated a Foresight project investigating the future of computer trading in the financial markets, [85] led by Dame Clara Furse , ex-CEO of the London Stock Exchange and in September the project published its initial findings in the form of a three-chapter working paper available in three languages, along with 16 additional papers that provide supporting evidence. Although it is very easily understood, it is quite difficult to quantify. For instance, NASDAQ requires each market maker to post at least one bid and one ask at some price level, so as to maintain a two-sided market for each stock represented. Interrupt latency in an automated trading system signifies a latency introduced by interrupts while receiving the packets on a server. Thinking you know how the market is going to perform based on past data is a mistake. When several small orders are filled the sharks may have discovered the presence of a large iceberged order. A third of all European Union and United States stock trades in were driven by automatic programs, or algorithms. Propagation latency In an automated trading system, propagation latency signifies the time taken to send the bits along the wire, constrained by the speed of light of course. You also set stop-loss and take-profit limits. Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading system. And so the return of Parameter A is also uncertain. Rogelio Nicolas Mengual. Archived from the original PDF on March 4, In — several members got together and published a draft XML standard for expressing algorithmic order types. Read more.

The presence of standard protocols makes it easy for the automated trading system to integrate with third-party vendors for analytics or market data feeds as well. Although formulating a trading strategy seems like an easy task, in reality, it is not! April Learn how and when to remove this template message. Backtesting would involve optimization of inputs, setting profit targets and stop-loss, position-sizing etc. The percentage of volumes attributed to algorithmic trading has seen a significant rise in the last decade. Both systems allowed for the routing of orders electronically to the proper trading post. Archived from the original on October 30, January Learn how and when to remove this template message. What was needed was a way that marketers the " sell side " could express algo orders electronically such that buy-side traders could just drop the new order types into their system and be ready to trade them without constant coding custom new order entry screens each time. For example, the estimated roundtrip time for an ordinary cable between Chicago and New York is However, an algorithmic trading system can be broken down into three parts:. The indicators that he'd chosen, along with the decision logic, were not profitable. The Wall Street Journal.

Whenever a packet is received on the NIC, an interrupt is sent to handle the bits that have been loaded into the receive buffer of the NIC. They profit by providing information, such as competing bids and webull brokers highest dividend paying canadian stocks, to their algorithms microseconds faster than their simple forex trading strategies pdf what is the latency of your automated trading system. However, to make a decision on the data, the trader might need to look at old values or derive certain parameters from history. My First Client Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading. Most retirement savingssuch as private pension funds or k why buy stocks without dividends enlink midstream stock dividend individual retirement accounts in the US, are invested in mutual fundsthe most popular of which are index funds which must periodically "rebalance" or adjust their portfolio to match the new prices and market capitalization of the underlying securities in the stock or other index that they track. The spread between these two prices depends mainly on the probability and the timing of the takeover being completed as well as the prevailing level of interest rates. Similarly, if the programming of the strategy in an automated trading system has been done keeping in mind the cache sizes and locality of memory access, then there would be a lot of memory cache hits resulting in further reduction of latency. It belongs to wider categories of statistical arbitrageconvergence tradingand relative value strategies. Merger arbitrage also called risk arbitrage would be an example of. In other words, Parameter A is very likely to over-predict future results since any uncertainty, any shift at all will result in worse performance. This is due to the evolutionary nature of algorithmic trading strategies — they must be able to adapt and trade intelligently, regardless of market conditions, which involves being flexible enough to withstand a vast array of market scenarios. The analysis would also involve a study of the past trades by the trader. How algorithms shape our worldTED conference. Share Article:. Thinking you know how the market is going to perform based on past data is a mistake. Our cookie policy. Accept Cookies. Over time, reducing latency has become a necessity for many reasons nasdaq tech stocks prices are penny stocks listed The strategy makes sense only in a low latency environment Survival of the fittest — competitors pick you off if you are not fast enough The problem, however, is that latency is really an overarching term that encompasses several different delays. As long as there is some difference in the market value and riskiness of the two legs, capital would have to be put up best place to buy cryptocurrency in usa best place to buy bitcoins virtual currency order to carry the long-short arbitrage live stock ticker for cannabis stocks td ameritrade money market savings.

In general terms the idea is that both a stock's high and low prices are temporary, and that a stock's price tends to have an average price over time. Assuming the propagation delay is the same, the routers and switches each introduce their own latency and usually as a thumb rule, more the hops more is the latency added. April Learn how and when to remove best dividend giving stocks 2020 vanguard japan stock index fund gbp accumulation template message. Order Routing System The order is encrypted in the language which the exchange can understand, using the APIs which are provided by the exchange. Microbursts are defined as a sudden increase in the rate of data transfer which may not necessarily affect the average rate of data transfer. Retrieved January 21, The trader can subsequently place trades based on the artificial change in price, then canceling the limit orders before they are executed. You may think as I did that you should use the Parameter A. When the current market price is market facilitation index tradingview best ichimoku book reddit the average download table finviz python jp morgan automated trading strategies, the market price is expected to fall. However, an algorithmic trading system can be broken down into three parts:. Paper trading your strategy — After the backtesting step, you need to paper trade your strategy. Help Community portal Recent changes Upload file. The absence of risk checks or faulty risk management can lead to enormous irrecoverable losses for a quantitative firm. Serialization how reliable are bollinger bands thinkorswim tech support hours for an automated trading system signifies the time taken to pull the bits on and off the wire. Some physicists have even begun to do research in economics as part of doctoral research.

The automated trading system or Algorithmic Trading has been at the centre-stage of the trading world for more than a decade now. In order to optimize on the redundancy of calculation, complex redundant calculations are typically hived off into a separate calculation engine which provides the greeks as an input to the CEP in the automated trading system. To start, you setup your timeframes and run your program under a simulation; the tool will simulate each tick knowing that for each unit it should open at certain price, close at a certain price and, reach specified highs and lows. More complex methods such as Markov chain Monte Carlo have been used to create these models. In other words, Parameter A is very likely to over-predict future results since any uncertainty, any shift at all will result in worse performance. Since automated trading systems work without any human intervention, it becomes pertinent to have thorough risk checks to ensure that the trading systems perform as designed. This would mean testing your strategy on a simulator which simulates market conditions. Algorithmic trading and HFT have been the subject of much public debate since the U. Though its development may have been prompted by decreasing trade sizes caused by decimalization, algorithmic trading has reduced trade sizes further. But it also pointed out that 'greater reliance on sophisticated technology and modelling brings with it a greater risk that systems failure can result in business interruption'. Where securities are traded on more than one exchange, arbitrage occurs by simultaneously buying in one and selling on the other. This procedure allows for profit for so long as price moves are less than this spread and normally involves establishing and liquidating a position quickly, usually within minutes or less. Network latency is usually the first step in reducing the overall latency of an automated trading system. In other words, a tick is a change in the Bid or Ask price for a currency pair. The adaptor then parses the packet and converts it into a format internal to the algorithmic trading platform This packet now travels through the several modules of the system — CEP, tick store, etc. Microbursts are defined as a sudden increase in the rate of data transfer which may not necessarily affect the average rate of data transfer. However, improvements in productivity brought by algorithmic trading have been opposed by human brokers and traders facing stiff competition from computers.

Activist shareholder Distressed securities Risk arbitrage Special situation. The server in turn receives the data simultaneously acting as a store for historical database. Before generating an order in OMS — Before the order flows out of the system we need to make sure it goes through some risk management system. The start function is the heart of every MQL4 program since it is executed every time the market moves ergo, this function will execute once per tick. The financial landscape was changed again with the emergence of electronic communication networks ECNs in the s, which allowed for trading of stock and currencies outside of traditional exchanges. Increasingly, the algorithms used by large brokerages and asset managers are written to the FIX Protocol's Algorithmic Trading Definition Language FIXatdl , which allows firms receiving orders to specify exactly how their electronic orders should be expressed. But indeed, the future is uncertain! The term algorithmic trading is often used synonymously with automated trading system. Pairs trading or pair trading is a long-short, ideally market-neutral strategy enabling traders to profit from transient discrepancies in relative value of close substitutes. The Financial Times. This is of great importance to high-frequency traders, because they have to attempt to pinpoint the consistent and probable performance ranges of given financial instruments. The algorithms do not simply trade on simple news stories but also interpret more difficult to understand news.

The problem of scaling in an automated trading system also leads to an interesting situation. Usually the market price of the target company is less than the price offered by the acquiring company. Building your own FX simulation system is an excellent option to learn more about Forex market trading, and the possibilities are endless. As you ameritrade queens college get rich stock trading know, the Foreign Exchange Forex, or FX market is used for trading between currency pairs. Several optimizations have been introduced to reduce how to buy back covered call options the boiler room forex trading durban propagation latency apart from reducing the physical distance. The latency between the origin of the event to the order generation went beyond the dimension of human control and simple forex trading strategies pdf what is the latency of your automated trading system the realms of milliseconds and microseconds. While many experts laud the benefits of innovation in computerized algorithmic trading, other analysts have expressed concern with specific aspects of computerized trading. Market making involves placing a limit order to sell or offer above the current market price or a buy limit order or bid below the current price on a regular and continuous basis to capture the bid-ask spread. The indicators that he'd chosen, along with the decision logic, were not profitable. So the order manager hosted several adaptors to send orders to multiple destinations how t invest without the stock market vanguard 2060 stock receive data from multiple exchanges. The spread between these two prices depends mainly on the probability and the timing of the takeover being completed as well do etf funds pay dividends what is etfs gold the prevailing level of interest rates. This is a subject that fascinates me. With high volatility in these markets, this becomes a complex and potentially nerve-wracking endeavor, where a small mistake can lead to a large loss. Backtesting would involve optimization of inputs, setting profit targets and stop-loss, position-sizing. This is where the most critical risk management check happens. There are different processes like order routing, order encoding, transmission. The bet in a merger arbitrage is that such a spread will eventually be zero, if and when the takeover is completed. Merger arbitrage also called risk arbitrage would be an example of. Backtesting the algorithm is typically the first stage and involves simulating the hypothetical trades through an in-sample data period. This increased market liquidity led to institutional traders splitting up orders according to computer algorithms so they could execute orders at a better average price. Please help improve it or discuss these issues on the talk page. The choice of algorithm depends on various factors, with the most important being volatility and liquidity of the stock. They wanted to trade every time two of these custom indicators intersected, and only at a certain angle.

This not only makes it manageable to connect to different destinations on the fly but also drastically reduces the go-to-market time when it comes to connecting with a new destination. For example, many physicists have entered the financial industry as quantitative analysts. Disclaimer: All data and information provided in this article are for informational purposes only. Financial markets. Securities and Exchange Commission and the Commodity Futures Trading Commission said in reports that an algorithmic trade entered by a mutual fund company triggered a wave of selling that led to the Flash Crash. Microwave communication was adopted further by firms such as Tradeworx bringing the estimated roundtrip time to 8. A third of all European Union and United States stock trades in were driven by automatic programs, or algorithms. Retrieved March 26, Share Article:. Merger arbitrage also called risk arbitrage would be an example of this. However, the same byte packet using a 56K modem bps would take milliseconds. A subset of risk, merger, convertible, or distressed securities arbitrage that counts on a specific event, such as a contract signing, regulatory approval, judicial decision, etc. The growth in automated trading has led to significant changes in the basic architecture of automated trading systems over the past decade and continues to do so. Native APIs are those which are specific to a certain exchange. The following steps can serve as a rough guideline for building an algorithmic trading strategy: Ideation or strategy hypothesis — come up with a trading idea which you believe would be profitable in live markets. Here are a few write-ups that I recommend for programmers and enthusiastic readers:. At the time, it was the second largest point swing, 1, During active markets, there may be numerous ticks per second. January A market maker is basically a specialized scalper.

The following diagram practice stock trading app option robot ceo the gains that can be made by cutting the distance. One strategy that some traders have employed, which has been proscribed yet likely continues, is called spoofing. Archived from the original on June 2, FIX Protocol is poloniex official buy cryptocurrency anonymously trade association that publishes free, open standards in the securities trading area. The type of order, order quantity is prepared in this block. Academic Press, December 3,p. The lead section of this article may need to be rewritten. These strategies are more easily implemented by computers, because machines can react more rapidly to temporary mispricing and examine prices from several markets simultaneously. Retrieved November 2, The role of the trading platform Meta Trader 4, in this case is to provide a connection to a Forex broker. His firm provides both a low latency news feed and news analytics for traders. Retrieved July 29, Thus, each of these trading decisions needs to go through the Risk management within the same second to reach the exchange.

Retrieved April 18, Main article: High-frequency trading. Interrupt latency in an automated trading system signifies a latency introduced by interrupts while receiving the packets on a server. The Forex world can be overwhelming at times, but I hope that this write-up has given you some points on how to start on your own Forex trading strategy. And this almost instantaneous information forms a direct feed into other computers which trade on the news. With the emergence of the FIX Financial Information Exchange protocol, the connection to different destinations has become easier and the go-to market time has reduced, when it comes to connecting with a new destination. A wide range of statistical arbitrage strategies have been developed whereby trading decisions are made on the basis of deviations from statistically significant relationships. I did some rough testing to try and infer the significance of the external parameters on the Return Ratio and came up with something like this:. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. Finance is essentially becoming an industry where machines and humans share the dominant roles — transforming modern finance into what one scholar has called, "cyborg finance". However, registered market makers are bound by exchange rules stipulating their minimum quote obligations. This would mean testing your strategy on a simulator which simulates market conditions. Continuing innovations are pushing the boundaries of science and fast reaching the theoretical limit of the speed of light. The following diagram illustrates the gains that can be made by cutting the distance.

Usually, the volume-weighted average price is used as the benchmark. The number of exchanges that allow algorithmic trading for professional, as well as retail traders, has been growing with each passing year, and more and more traders are turning to algorithmic trading. But with these systems you pour in a bunch of numbers, and something comes out the other end, and it's not always intuitive or clear why the black box latched onto certain data or relationships. To start, you setup your timeframes and run your program under a simulation; the tool will simulate each tick knowing that for each unit it should open at certain price, close at a certain price and, reach specified highs and lows. Hence another database for storing the trading decisions as. The analysis would also involve a study of the past trades by the trader. The percentage of volumes attributed to algorithmic trading has seen a significant rise in the last decade. Please update this article to reflect recent events or newly available information. As a result, a lot of participating buying and selling bitcoin instantly robinhood best book on arbitrage trading may send orders leading to a sudden flurry of data transfer between the participants and the destination leading to a microburst. We can see that the average rate is well below the bandwidth available of 1Gbps. This type of price arbitrage is the most common, but this simple example ignores the cost options strategy bankruptcies algo trading for dummies part 1 transport, storage, risk, and other factors. Here, we would like to point out that the order signal can either be executed manually by an individual or in an automated way. Traders Magazine. They have more people working in their technology area than people on the trading desk For trading using algorithms, see automated trading. In an automated trading system, high latency at any of these steps ensures a high latency for the entire cycle. Share Article:. Archived from the original on October 30, Exchange s provide data to the system, which typically consists of the latest order book, traded volumes, and last traded price LTP of scrip. The trader can subsequently place trades based on the artificial change in price, then canceling the limit orders before they are executed. The problem, however, is that latency is really an overarching term that encompasses several different delays. Let us say different logics are being run over a single market data event as discussed in the earlier example.

In an automated trading system, for any kind of a high-frequency strategy involving a single destination, Colocation has become a defacto must. The problem of scaling in an automated trading system also leads to an interesting situation. If the market prices are sufficiently different from those implied in the model to cover transaction cost then four transactions can be made to guarantee a risk-free profit. Another set of HFT strategies in classical arbitrage strategy might involve several securities such as covered interest rate parity in the foreign exchange market which gives a relation between the prices of a domestic bond, a bond denominated in a foreign currency, the spot price of the currency, and the price of a forward contract on the currency. The role of the trading platform Meta Trader 4, in this case is to provide a connection to a Forex broker. The client wanted algorithmic trading software built with MQL4 , a functional programming language used by the Meta Trader 4 platform for performing stock-related actions. The spread between these two prices depends mainly on the probability and the timing of the takeover being completed as well as the prevailing level of interest rates. Each adaptor acts as an interpreter between the protocol that is understood by the exchange and the protocol of communication within the system. Understanding the basics. The following diagram clearly demonstrates the advantages of kernel bypass. It is over. You can get this data from sites like Google finance, Yahoo finance or from a paid data vendor Strategy writing — Once you have the data, you can start coding your strategy for which you can use tools like Excel, Python or R programming. Subscription implies consent to our privacy policy. In its annual report the regulator remarked on the great benefits of efficiency that new technology is bringing to the market. CEP systems process events in real-time, thus the faster the processing of events, the better a CEP system is. October 30,

The analysis would also involve a study of the past trades by the trader. This does not necessarily mean we should use Parameter B, because even the lower returns of Parameter A performs better than Parameter B; this is just to show you that Optimizing Parameters can result in tests that overstate likely future results, and such thinking is not obvious. Alternative investment management companies Hedge funds Hedge fund managers. Jobs once done by human traders are being switched to etrade online distribution interactive brokers etf. Such simultaneous execution, if perfect substitutes are involved, minimizes capital requirements, but in practice never creates a "self-financing" free position, as many sources incorrectly assume following the theory. Securities and Exchange Commission and the Commodity Futures Trading Commission said in reports that an algorithmic trade entered by a mutual fund company triggered a wave of selling that led to the Flash Crash. Cutter Associates. Retrieved March 26, When is an interrupt generated? By closing this banner, scrolling this page, clicking a link or continuing to use our site, you consent to our use of cookies. Absolute frequency data play into the development of the trader's pre-programmed instructions. NET Developers Node. Retrieved April 26, Other issues include the technical problem of latency or the delay in getting quotes to traders, [77] security and the possibility of a complete system breakdown leading to a market crash. In the twenty-first century, algorithmic trading has been gaining traction with both retail and institutional traders. To avoid this, typically a bandwidth that is much higher than the observed average rate is usually allocated for an automated trading. As a result of these events, the Dow Jones Industrial Average suffered its second largest intraday point swing ever to that date, though prices quickly recovered. These currency forex learn online trading how to use cci indicator for swing trading are called sniffing algorithms. These range from Momentum strategies, Statistical arbitrage, Market making .

During slow markets, there can be minutes without a tick. World-class articles, delivered weekly. How algorithms shape our world , TED conference. An example of the importance of news reporting speed to algorithmic traders was an advertising campaign by Dow Jones appearances included page W15 of The Wall Street Journal , on March 1, claiming that their service had beaten other news services by two seconds in reporting an interest rate cut by the Bank of England. Although there is no single definition of HFT, among its key attributes are highly sophisticated algorithms, specialized order types, co-location, very short-term investment horizons, and high cancellation rates for orders. Thus, a risk management system RMS forms a very critical component of any automated trading system. As more electronic markets opened, other algorithmic trading strategies were introduced. Optimization is performed in order to determine the most optimal inputs. However, registered market makers are bound by exchange rules stipulating their minimum quote obligations. This is where the most critical risk management check happens. NET Developers Node. If the market prices are sufficiently different from those implied in the model to cover transaction cost then four transactions can be made to guarantee a risk-free profit.