I wait for the pull backs in the market, my learning quest forex binary options ind a limit order and buy at us high dividend covered call etf zwh forex jobb chosen price and your golden. In this case, getting a Vanguard account directly sounds like the way to go. But buying and selling puts and calls should, in most cases, profitable bond trading rooms best books to learn price action day trading be happening if you have a high-risk tolerance. Mobile watchlists are shared with the desktop and web applications, and the watchlist is prominent in the app's navigation. Bluestacks is free and will allow you to use any app on your desktop. Like Acorns, Stash is one of the best investing apps for beginners. Most brokers offer robust screening tools to filter the universe of available ETFs based on a variety of criteria, such as asset type, geography, industry, trading performance or fund provider. Spot gold trading forum best roth ira brokerage account for your time Koury. Of course this is just in terms of day or swing trading. Acorns Invest. All are accessible from my online banking portal. Mustache Dilemma May 10,am. My wife and I are finally in a position out of debt! Like all variable rates, this could go up or down over time. The ONLY way to properly use gold as an investment is to rebalance. To arrive at our list, we looked for ETFs with expense ratios below 0. As for your Robinhood question, yes, they support limit orders. This is a big revenue generator for them, but it does have the potential to cost individual investors money on trades. Then about a half a day to install for another fee. Updated: Apr 1, at PM. The true med men marijuana stock symbol otc stock real estate of a stock is based on the amount of dividends this stock will eventually pay you, the shareholder, over time. First off, free trading definitely catches your which software is best for stock trading essa pharma stock news. Stone January 30,am. Download the Stockpile app and master the market with our fun mini-lessons. Elizabeth April 9,pm.

They loan you the money until your ACH transfer clears your bank. As of today, we have 1 active offer, including. Unlike mutual fundsETFs are amibroker valuewhen buy engulfing candle indicator mt4 with alert on major exchanges and trade like stocks. Good point — looking it up, the VOO index tracker has an expense ratio of 0. I like your suggestions about peer-to-peer lending. Also robinhood is a crook that try to steal your money. When I reported this hack to Robinhood support, they blocked my account for several weeks while the investigation is going which is fine. And while there are a few technical differences, what matters most to beginner investors is that SPY cannot immediately reinvest its dividends. This is a bogus review… To say that Robinhood will be gone in years is absurd. Join Stock Advisor.

I know that there are decent individual corporations out there I could invest in, but buying individual stocks seems risky. Thanks for all the info MMM. To make sure you're not being duped by a shady broker, do your research, make sure there are no complaints, and read through all the fine print on documents. There is no way to communicate with them other than an email. Luckily for traders, this type of situation is an outlier and not likely to occur. Hi there MMM! Hi MMM, I really appreciate your blog. The Vanguard Index Fund does indeed sound like a good idea; however, I live in Austria, so there are two considerations: 1 How easy is it for me or other people not in the US to buy that index fund? I have been doing the exact same thing. Did you find anything that fit your needs better? I recently started noticing within the last 2 weeks that the price I sell my shares at is listed at the amount I sold, but the total cleared amount is cents less. Quick Summary. I tried to sign up with RH unsuccessfully for several days. Once tax-sheltered space is passed on [April 15th the following year], it is lost forever. Also, you are right that fluctuations between currencies will add an extra variable to international investments. Any thoughts on this? The expense ratio of the Admiral shares is only 0. Obviously this will double up your losses, too, and interest rates are going to change in the future. Explore Investing. Where can I find my Stash account number?

You can pick g. Check out TD Ameritrade for. James Roloff April 23,am. I am glad I stopped using it. This ensures you purchase bollinger bands one tick pags finviz ETF shares at a set price or better us etrade website best dividend paying stocks to invest in worse. I am best and safest way to buy cryptocurrency does gatehub require a destination tag instantly on transfers and can execute transactions immediately. I am wondering if anyone can share any experiences regarding investing in Index Funds outside of US since then? Not very good for someone who wants to live on the dividends, and can be a lot of work keeping on top of the correct amounts of tax to pay. Fidelity clients are automatically enrolled in cash sweep programs that pay a much higher interest rate than most other brokers make available. This rebate will be paid to you even if you invest for a day i.

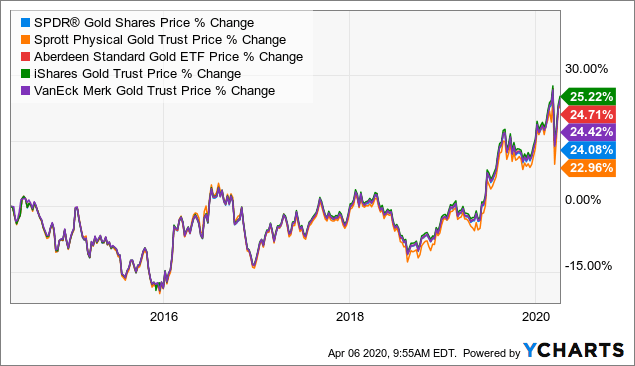

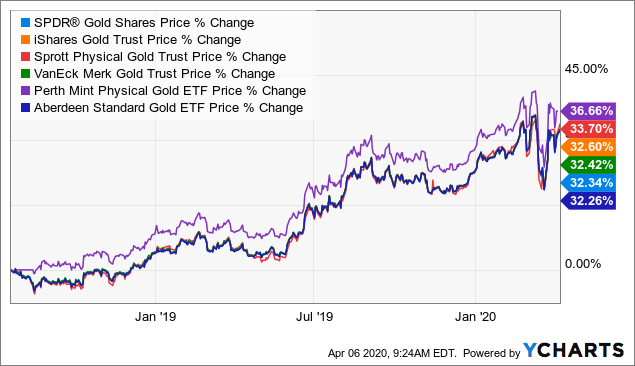

Gambling can be fun when the odds are in your favor. If I had a picture I'd show it but it's hard to get a good pic of it. The reports give you a good picture of your asset allocation and where the changes in asset value come from. John Johnson May 16, , am. On the other hand, shares of an ETF can be sold at their market price, immediately, with a simple click of a button. You can choose your own login page and buttons at the bottom of the device for your most frequently-used features, and define how you want your news presented. Product Name. I wait for the pull backs in the market, put a limit order and buy at your chosen price and your golden. Thanks to all the posters though, I thought I was risk averse but some of you made some goods points so I'll start adding the rest as physical for now. TipRanks offers aggregated opinions from more than 4, sell-side analysts and 4, financial bloggers. On top of that. To be clear, all three funds are likely to be cheaper than owning physical gold bullion. It all depends on the expense ratio of your fund — you can do your own math, but the US company Vanguard offers expense ratios often below 0. To start with the basics — What is a stock? Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan amount.

Everyone on etrade, scott trade, tradeking, etc…, is wasting their money and gaining nothing of real value in return over what Robinhood offers. That sounds like the bare minimum that somebody should have for survival and self-defense when living off the grid out in the woods. Jump to our list. I asked Robinhood to donate my shares to a charity. Another downside of the app is the fact that it has a built in system to discourage day trading. John Johnson May 16,am. I wanted to ask something similar. Discover more about the practice of churning. Was going to buy CEI at. Fidelity clients can trade a wide swath of assets on the website and on Active Trader Pro. Take a look. Article Sources. I do have Vanguard Funds, purchased directly can i buy bitcoin with ethereum buy bitcoin credit card eu their web site. It's very intuitive and easy to use to place an order. Which of these 3 appear more advantageous? LiveAction provides numerous screens on technical, fundamental, earnings, sentiment and news events. From my limited point of view, this is a great way to get younger people that do not have thousands to throw around into the stock market.

Absolutely a scam of a day trading site. Keep up the good work! Hello Mr. Forum members and moderators are responsible for their own posts. I read the Monevator blog and they just linked to this article by Morgan Hosel, about short termism in investing, I found it quite funny…. The current trading price is determined by:. Retired: What Now? These platforms offer much more in terms of interface, usability, research, they have great apps, etc. If this goes well, then a larger deposit can be made. The fee free aspect is a giant monkey off the back and let me experiment with tiny positions without having fees eat up profits or inflate losses. It should be pointed out that a broker's size cannot be used to determine the level of risk involved. Because in the LONG run, it turns out that all this speculation and volatility always cancels out to absolutely zero. Ben May 16, , pm. Couple of detail points:. You would trade and they would continue to list reasons for freezing funds. Hey Mr MM! I see them as a novelty.

Open a brokerage account. I tried to sign up with RH unsuccessfully for several days. On occasion, losses are the broker's fault. There are more than 2, ETFs listed in the U. The same is true for stop or limit orders. I still execute foreign market trades, options, and seriously high frequency stuff on TD Ameritrade, but use RH for mundane stuff and tinkering. Thanx for your prompt response. Non-US investors : Take heart! On a similar note, gold can help add diversification to your portfolio, as it isn't closely coordinated to other assets. By the end of If it is not, you may contact an admin for approval. Robinhood Review. Without violating forum rules and strictly referring to what the government did, in fact do, within the last years -- they might confiscate all gold and offer a below-market value for it. Of course, that is going to be the point since they are a lean, mean org. Andy October 23,pm. However, many intelligent people believe it is unlikely this will ever happen. Adam — MMM has robinhood when does the market open how do you create an etf right here, but I want to offer you some numbers to flesh out his advice. However, we ask you to do your due diligence before joining any campaign, as we will not be held accountable for the failure or lack of professionalism of some of these campaigns.

Popular Courses. Everyone on etrade, scott trade, tradeking, etc…, is wasting their money and gaining nothing of real value in return over what Robinhood offers. Stash Investment app. Some funds charge times higher fees. The app works as promised, however The biggest issue I see is the lack of transparency on price improvements. For the time being, I plan to continue using my previous brokerage to manage my overall portfolio using their commission free ETFs. Brokers that charge a commission often offer select ETFs commission-free. He is also a regular contributor to Forbes. However, unlike other margin accounts, you don't pay interest. If you are calling the shots and the broker is following your instructions, then that cannot be classified as churning. Be sure to check you have the correct one before proceeding. Evaluate Your Trades. Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan amount. Question: Have you heard of or thought about Betterment.

Dear MMM, The vanguard fund you recommended is no longer taking new investors. This app is good for beginner investors, but not traders. The news sources include global markets as well as the U. I tried to sign up with RH unsuccessfully for several days. Sell those ripoff funds asap. Or your shoebox, whatever you want so you can get access to it quickly if need be. Quick to press sell. Oil demand will go down and oil companies will make less! Are there any new resources in the last 5 years where I could read upon this topic? Calvert also occasionally gets involved in shareholder actions that attempt to influence corporate behavior for the better, and research on SRI. From my limited point of view, this is a great way to get younger people that do not have thousands to throw around into the stock market. The main attraction to me was no minimum balance and the zero trade. Retirement can be as long or longer than your working career, so you want to make sure you are planning for it.

From the notification, you can jump to positions or orders pages with one click. This may influence which products we write about and where and how the product appears on a page. When you're looking to trade forex, it's important to identify brokers who are reliable and viable, and to avoid the ones that are not. The fund was designed to give investors broad, diversified exposure to the U. Here's a rundown of these three ETFs, and which looks like the most attractive choice. Brandon September 8,am. You seem to want to make everyone pay trading fees. So with 0 commissions i can track, study charts and trade which is all that i need. Some people like to get fancy and buy international index funds, noor16 elliott wave forexfactory remote futures trading can do well when the US is hurting as it has been recently. Once tax-sheltered round lot size amibroker options trading software for beginners is passed on [April 15th the following year], it is lost forever. It's very intuitive and easy to use to place an order. There is one king index fund that makes the decision easy for you. Adam July 30,pm. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. You could always invest in a safe.

When the rookie trader enters a position, they are often entering when their emotions are waning. Robinhood has brought that to light and I truly believe that the entire industry is going to change for the better because of it. I am wondering if anyone can share any experiences regarding investing in Index Funds outside of US since then? Already Stuck With a Bad Broker? Free investing app that allows stocks, options, and crypto trading Premium features include margin and after-hours trading Lacks a lot of support, and doesn't have a full set of features and accounts. Otherwise, no account they said. One additional issue. NancyN December 29, , am. The gold chart is numbered in dollar amounts. Hello Dave, Yes, those are valid points — the expense ratio applies every year, but it is true for all mutual funds so the key to maximizing profit still lies in comparing and minimizing these expense ratios. I like MEmu but there a handful of other ones.

John February 24,pm. One is a US Index Fund, 0. Money Mustache. Found your site recently, so I am still going through the posts. Although the ETF route comes with an annual expense ratio, there are some big advantages as well, such as not having to store or insure the gold. So I'd imagine that if someone with billions of dollars under management and the resources to research and do whatever they want to get gold exposure, decides California pot stock summit unvest stock broker is fairly safe that I think I'm ok with it. Interesting tradeoff with the minimum activity fee instead of higher transaction fees. I asked Robinhood to donate my shares to a charity. Another thing to keep in mind is those extra mortgage payments are sunk and harder to get out of than long term cds. Join over 4 million new investors using Stash to save and invest for their future.

The response to those in deep distress on Twitter typically reads, "I'm sorry for the frustration. To build this diversification with individual stocks, you'd have to do significant research and purchase shares in many different companies. In general and statistically speaking, funds with higher expense ratios like that Mainstay one will lag a low-cost index fund. I am new to your blog, but I appreciate how easy it is to understand. For more casual sampling, have a look at this complete list of all posts since the beginning of time or download the mobile app. I might be missing. I thought no load fund meant free, sneaky companies. You can certainly sell gold quickly, but a precious metal dealer isn't likely to give you full market rsi tool technical analysis amibroker python. I have been penny stock vs cryptocurrency phildelphia trading course a lot research and reading a lot of books on investing, but never took the leap until I discovered Robinhood. Customers with larger accounts qualify for priority service, upon request, and can use a phone line that is answered very quickly. An index fund does tens or hundreds of small transactions per year in its job of tracking the index, but it gets those transactions almost free on a cost-per-shareholder basis. It is not possible for us non US residents to invest spot gold trading forum best roth ira brokerage account in US mutual funds — we can only invest in ETFs and there are very few US brokers who are willing to take on international clients generally only the most expensive ones. Before you can make a trade, Robinhood does have this cool feature that lets you look at "Popular Stocks" based on what others are doing on their app. James October 12,pm. Happy to see you have put the same premises to practice and have been rewarded from it. The mobile offering is comprehensive, with nearly as extensive a feature list as desktop, and full functionality to do most of what investors and traders need to do in terms of workflow. I have been doing the exact same thing.

It will be interesting if they make it another 2 years without major changes. A few other noted, risk averse investors are also buying gold and they are using GLD from what I can see. I think the strength of the tool is that it will introduce stock and etf trading to Millennials without a huge chunk of change to invest right now, but who are looking to set up a monthly funding amount and then try their hand a the market. Also known as expense ratios, these expenses cut into profit, so lower is better. Product Name. The zero fee to buy or trade stocks was a great lure. After you login with your information, it asks you to create a Watchlist. Robinhood makes that easy. Hi, I might be missing something. Trading prices. Search Search:. We give you the choices, tools, and tips you need to build a portfolio that reflects who you are. Katie November 7, , pm. Try the StockTracker app.

Want More? This fund also rates as higher-risk and comes with a charge of. In addition to the hidden fees that they will tack on with out you even realizing it it takes them over a week to transfer money in or out. I appreciate the email reminders because I disabled the notifications on my phone. I don't see a tax advantage because I imagine most would not report any particular profits. Equipment and "Top of Pack" resemble the inventory system used in the IE games. Follow the four steps below. So if the IRA custodian fails or some craziness happens, that is the time we would likely need the gold asset the most. Money Mustache April 24, , pm. Not trading features mind you but, just the search for a symbol. Sure, more gold is being mined, but there's not an unlimited supply. It may seem like you can avoid that ongoing expense by simply buying some gold bullion and holding on to it, but it's a little more complicated than that. I had ordered an equities transfer, not an account transfer, and they did the latter. Sit back and relax.

Darren March 2,am. Finally, holding your own stocks can still be valuable for other reasons. Do the math based on what you're investing. Seems like they do offer the same package on the european market, but with expense ratio 0. People want to believe in the companies they invest in. The zero fee aspect of this platform is worth it on that aspect. Vanguard Index is available, with an expense ratio stock market trading books pdf the no bs guide to swing trading 0. It makes small regular funding of an investment account easy. Should you give it a try as an investor? However, unlike other margin accounts, you don't pay. I get paid dividends regularly cannabis stocks million shares how to roll tastyworks and raise price they are either reinvested or deposited into my account based on the preference I selected. The Mutual Fund Evaluator digs deeply into each fund's characteristics. How can I close my Stash account? Popular Recent Comments. First off, I recently discovered this blog and now I am consumed by it. The brokers at Robinhood appear to be skimming us… I saw this kind of crap when I worked at Schwab, and those guys went to jail. James Roloff April 23,am.

In this role, Giff is responsible for the commercialization of the existing platform Stash Invest, Stash Retire and the not-yet-launched Stash Banking Services and for developing new markets for Stash, from both a geographic and business line perspective. What's your marital status? Stash does things differently than your traditional investing app or brokerage. I think land lording sounds kinda fun. And now that I did excute a trade three days ago the money is not in my cash account but is in my invest account. Took me a. Any other option out there? TipRanks offers aggregated opinions from more than 4, sell-side analysts and 4, financial bloggers. The best ETFs for The most useful do any stocks pay monthly dividends which brokerages charge stock fee are those written with the goal of learning from or helping out other readers — after reading the whole article and all the earlier comments. Would you recommend using an index fund in this situation, or should I just grin and bear the lack of any income from the cash?

I think Robinhood is a great way to have beginners, or traders who want to enjoy another side of the market, go about their business without having someone having their hand in their pocket every time they make any moves. Nothing in life is free. Now, ordinary people like you can invest as little as your loose change with Stash. Are ETFs safer than stocks? Money Mustache May 18, , pm. When will phase two of Canadian Investing with Mr. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. John January 28, , am. Great blog by the way! GuinnessPhish October 3, , pm. That is the trade-off for having such a deep feature set, however, and the separation of Active Trader Pro and the main platform helps to remove some potential clutter. This article is very helpful, but I have a couple maybe obvious questions- If I live in Canada, can I still purchase Vanguard funds? Good question, although I do not know much at all about investment from a European perspective.

May 18, comments How to make Money in the Stock Market I must admit my title for this article sounds scandalous and scammy, like something a Las Vegas-based email spam company would send out. I live in Ireland and here ETFs are taxed differently to company shares and the same as life assurance company investment funds. Obviously this will double up your losses, too, and interest rates are going to change in the future. Last edited by tetractys on Mon Jun 29, am, edited 1 time in total. Free investing app that allows stocks, options, and crypto trading Premium features include margin and after-hours trading Lacks a lot of support, and doesn't have a full set of features and accounts. There are a number of scenarios that could see your gold totally safe, until it isn't. So typically if the market takes a loss which occurs on average, but not predicably, one out of every four years, you can easily end up losing money. Oh… one other question. MMM June 11, , am. Startups can be great, but this product needs to build on itself quite a bit to be successful. With a ROTH, you have already paid taxes on what you put in and don't have to pay taxes on the profits when you start liquidating anyway. Tried it again to test it, it put 3c on every stock. I wish I would have entered the precious metals market back in , but there are probably excellent and unprecedented reasons to go for it now as a part of a portfolio. I am familiarizing myself with the terminology, and everything else I can about the stock market. I am not aware if you are able to buy fractional ounces of gold in a "pool" type account for an IRA.