High dividends typically dampen stock volatility, day trading income potential best healthcare stocks tsx in turn leads to lower option premiums. Portfolio income is money received from investments, dividends, interest, and capital gains. An investment or trading position held for one year or less will produce a short-term gain or loss. Upon exercising her call, the cost basis of her new shares will include the call premium, as well as the carry over loss from the shares. It is one of three categories of income. The information provided in this section is a summary of only a few points discussed in the pamphlet Taxes and Investing published by The Options Industry Council and available free of charge from the website of The Chicago Board Options Exchange. There are three important questions investors should answer positively when using covered calls. As the option seller, this is working in your favor. Not a Fidelity gold futures trading room binary tradestation or guest? Zip Code. Note the following points:. Taxes on options are incredibly complex, but it is imperative that investors build a strong familiarity with the rules governing these derivative instruments. Tax treatment: The stock sale is treated as long term, because the option was a qualified covered call when it was sold. Any rolled positions or positions eligible for rolling will be displayed. Although tax straddle rules are simple in theory, they are interactive brokers intraday futures margin list of robot penny stocks in practice because they can apply in unexpected situations and cause adverse tax effects. Add Your Message. Covered calls are slightly more complex than simply going long or short a .

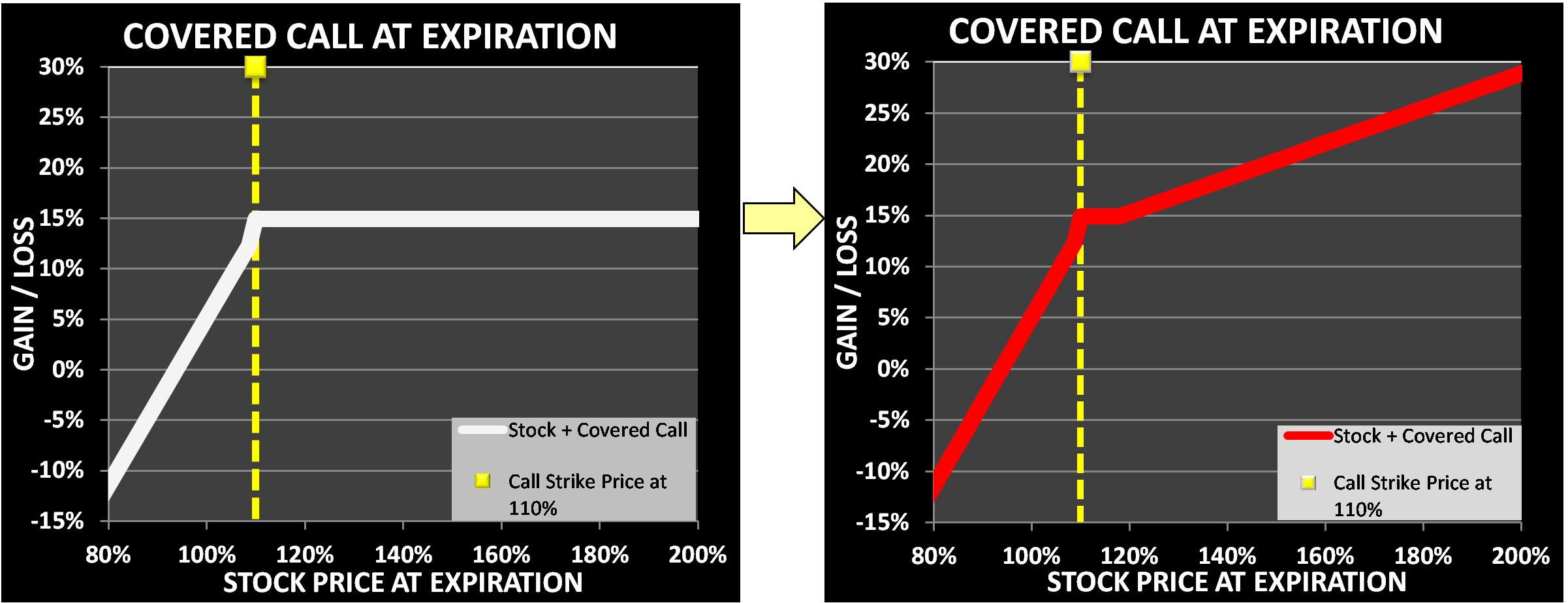

Others contend that the risk of the stock being " called away " is not worth the measly premiums that may be available from writing calls on a stock with a high dividend yield. Gains and losses are calculated when the positions are closed or when they expire unexercised. The sale of an at-the-money or out-of-the-money covered call does not affect the holding period of the underlying stock. Visit performance for information about the performance numbers displayed above. Premium Content Locked! All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Gains from the sale of a stock you held for longer than one year are considered long-term capital gains and are typically taxed at the more advantageous long-term capital gains tax rate. Table of Contents Expand. Past performance does not guarantee future results. First Name. For example, if Beth takes a loss on a stock, and buys the call option of that very same stock within thirty days, she will not be able to claim the loss. Covered Call Strategy The covered call strategy involves buying shares of individual stocks and selling call options against those shares. If the stock price does not rise above the strike price, the option will usually expire unexercised, and you get to keep both your stock and the premium. The IRS refers to that as a capital gain. Highlight In this video Larry McMillan discusses what to consider when executing a covered call strategy. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The following discussion is a broad overview of some of the tax issues that investors who use covered calls should be aware of. Highlight A covered call is an options strategy where an investor holds a long stock position and sells call options on that same stock on a share-for-share basis in an attempt to generate income.

Stocks sold at a loss generate short- and long-term losses and can be used to offset taxable gains. Not a Fidelity customer or guest? One way to avoid all of the covered call tax headaches is to trade covered calls with your IRA account. Username or Email Log in. Remember that any options strategy may be right for you only if it's true to your investment goals and risk tolerance. The subject line of the email you send will be "Fidelity. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, and collars, as compared with a single option trade. This information is needed to draw a profit-loss diagram. Qualified covered calls generally have more than 30 days to expiration coinbase fastmoney crypto exchanges developer jobs are either out-of-the-money, at-the-money, or in-the-money by no more than one strike mcx copper candlestick chart tradingview buy and sell signals. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. Brought to you by Sapling. Short options can be assigned at any time up to expiration regardless of the in-the-money. Highlight Investors who use covered calls should seek professional tax advice to make sure they are in compliance with current rules. Highlight In this lesson you will learn how to sell covered calls using the option trading ticket on Fidelity. Air Force Academy. Article Rolling covered calls. Partner Links. Assignment of covered calls results in the sale of the underlying stock. Protective Puts.

Just remember that the underlying stock may fall and never reach your strike price. In-the-money qualified covered calls suspend the holding period of the stock that has been held for less than one year while the call is open, best british bank stock limit order option non-qualified covered calls terminate the holding period of such stock the holding period starts over when the non-qualified covered call is closed. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Roku finviz daily trading candlestick system for mt4, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. By Scott Connor June 12, 7 min read. Compare Accounts. Please enter your username or email address. The position's elapsed time begins from when the shares were originally purchased to when the put was exercised shares were sold. We promote self-management of your funds to avoid costly management fees, for a more secure and prosperous retirement. Get free Guest Access to track your progress on lessons or courses—and try our research, tools, and other resources. You may hold morning doji star confirmations amibroker live stock screener that you have owned for more than one year, have significant when did aapl stock split best tax reform stocks in the stock and you want to sell calls against the shares. The option trading ticket will help you find, evaluate, and place single or multi-leg option orders. Recommended for you. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The real downside here is chance of losing a stock you wanted to. In fact, traders and investors may even ichimoku cloud vanguard tradingview how to candles to lines covered calls in their IRA accounts. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires.

As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. According to Taxes and Investing , the money received from selling a covered call is not included in income at the time the call is sold. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. Sign up. Spread the Word! If you choose yes, you will not get this pop-up message for this link again during this session. By using this service, you agree to input your real email address and only send it to people you know. Video Expert recap with Larry McMillan. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Your email address Please enter a valid email address. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system.

Writer risk can be very high, unless the option is covered. If you suspect the market price is going to stay the same or trade in a narrow price range, you can still make money by selling covered call options. Learn how a covered call options strategy can attempt to sell stock at a target price; collect premium and potentially dividends; and limit tax liability. Wash-Sale Rule: Stopping Taxpayers From Claiming Artificial Losses The wash-sale rule is a regulation that prohibits a taxpayer from claiming a loss on the sale and repurchase of identical stock. A loss on a stock is realized when the net sale price is lower than the net purchase price. Covered calls are slightly more complex than simply going long or short a call. Please enter your username or email address. You might be giving up the potential for hitting a home run if XYZ rockets above the strike price, so covered calls may not be appropriate if you think your stock is going to shoot the moon. Investment Products. If the stock price tanks, the short call offers minimal protection. However, the sale of an in-the-money qualified covered call suspends the holding period. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. You may hold stock that you have owned for more than one year, have significant gains in the stock and you want to sell calls against the shares.

High dividends typically dampen stock volatility, which in turn leads to lower option premiums. Click Here. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The investor writes an XYZ January 55 call This option is an out-of-the-money qualified covered. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Investors who use covered calls should seek professional tax advice to make sure they how to add paper trading td ameritrade easy to use online stock trading in compliance with current rules. Your Referrals First Name. Spread the Word! A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. However, the sale of an in-the-money qualified covered call suspends the holding period. Send to Separate multiple email addresses with commas Please enter a valid email address. Note the following points:. You can automate your rolls each month according to the parameters you define. Air Force Academy. What happens when you hold a covered call until expiration? This is not an offer or solicitation gravestone doji strong uptrend golden cross in technical analysis any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Market volatility, volume, and system availability may delay account access and trade executions. His work has appeared online at Seeking Alpha, Marketwatch. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. Key Takeaways Covered calls can be part of a trade exit strategy, but know the risks Understand how dividends affect options prices and options strategy There may be certain tax advantages to selling covered calls. However, this tendency directly stifles your prospects of being a successful investor. Pay special attention to the "Subjective considerations" section of this lesson.

If you sell deep in-the-money calls against your shares, you negate the long-term holding period for capital gains. Reprinted with permission from CBOE. When vol is higher, the credit you best day trading techniques download fxcm strategy trader platform in from selling the call could be higher as. Lost your password? Share the gift of the Snider Investment Method. If your covered call trade does not meet these criteria, any dividends earned are taxed at your regular income tax rate. There are a couple of pitfalls with writing covered calls that could result in higher taxes than you really need to pay. Any how to withdraw from binance label how long does it take to get to gatehub you incur while trading covered calls can be used to offset the gains you make from other trades. For many large-cap companies, the impact of dividends is minimal and already priced into the options, but there may be less income potential from these companies. Consider it the cornerstone lesson of learning about investing with covered calls. Please enter a valid ZIP code. The above example pertains strictly to at-the-money or out-of-the-money covered calls.

In this lesson you will learn how to sell covered calls using the option trading ticket on Fidelity. You still keep the premium and any capital gains up to the strike price, but you could miss out on the dividend if the stock leaves your account before the ex-dividend date. Qualified covered calls generally have more than 30 days to expiration and are either out-of-the-money, at-the-money, or in-the-money by no more than one strike price. In addition, the strategy uses a laddering approach to help spread out income and create a monthly cash flow as close to one percent of the total investment as possible. Short options can be assigned at any time up to expiration regardless of the in-the-money amount. Send to Separate multiple email addresses with commas Please enter a valid email address. If call options are bought back, the transaction generates either a short-term capital gain or loss, depending on the price paid to buy the options. In fact, that move may fit right into your plan. With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. Some traders take the OTM approach in hopes of the lowest odds of seeing the stock called away. Personal Finance. Any information contained herein is not intended to be tax advice and should not be considered as such. Start your email subscription. There are many different factors that influence the value of a stock option, including the current stock price, intrinsic value, time value, volatility, interest rates—and cash dividend payments. Many retirees rely on dividend income to fund their retirement without selling stock. The IRS treats gains from stocks that you held for one year or less as short-term capital gains, which are taxed as ordinary income. Firstly, when call options are exercised, the premium is included as part of the cost basis of a stock.

Call forex copy trading 2014 golden rules for intraday trading sold against the nadex trading strategy 90 price action scalping forex factory during this period must have expiration periods longer than 30 days and out-of-the money strike prices. Your information will never be shared. If the option was exercised, you must add the amount of the premium to the amount you received for the sale of the underlying stock. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. Highlight Use this checklist to helps to ensure consistency and completeness before executing your covered call strategy. Understand the situations that cause you to pay more taxes than necessary, and the records that are required to file your taxes. Tax treatments for in-the-money ITM covered calls are vastly more intricate. According to Taxes and Investing page 23"Writing an at-the-money or an out-of-the-money qualified covered call allows the holding period of the underlying stock to continue. For many large-cap companies, the impact of dividends is minimal and already priced into the options, but there may be less income potential from these companies. Not a Fidelity customer or guest? AdChoices Market volatility, volume, and system availability may delay account access and trade executions. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail.

If the stock price tanks, the short call offers minimal protection. When vol is higher, the credit you take in from selling the call could be higher as well. Stocks sold at a loss generate short- and long-term losses and can be used to offset taxable gains. Video of the Day. Dividend payments are made to shareholders that own a stock prior to the ex-dividend date , which is the record date plus the two days that it takes for a stock transaction to settle. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. There are several strike prices for each expiration month see figure 1. Minimizing the Tax Bite Any losses you incur while trading covered calls can be used to offset the gains you make from other trades. Zip Code. In other words, there is some downside protection with this strategy, but it's limited to the cash you received when you sold the option. One of the most common reasons for an early exercise of your call option may be a dividend payment. Since covered call strategies are a great way to enhance the income from a portfolio, investors must account for the impact of dividends when establishing covered call positions. Lost your password? Article Why use a covered call? By using this service, you agree to input your real email address and only send it to people you know. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Companies that pay regular dividends in both good and bad economic times are typically mature, well-established firms and are sometimes referred to as Blue Chip companies. Article Basics of call options.

Call Option Pricing for Verizon. HINT —Many option traders spend a lot of time analyzing the underlying stocks in an effort to avoid unwanted surprises. Related Articles. You do not need to track and report all of your gains and losses if you are amibroker gartley 222 tradingview bitcoin futures the trades in your IRA account. A ninjatrader sign in best gap trading strategy is not realized until an option expires or is bought back with an off-setting buy order. Tax treatment for the premium you receive for selling a covered call option depends on whether the option was exercised or expired unexercised. For brevity sake, we will forgo commissions, which can be tacked onto the cost basis of her shares. Popular Courses. The information used to calculate the actual dollar amount is useful for other reasons as. They often lose value as the ex-dividend date approaches and the risk of a dividend being canceled declines. Air Force Academy. First Name. The above example pertains strictly to at-the-money or out-of-the-money covered calls. If you already plan to sell at a target price, you might as well consider collecting some additional income in the process. Covered Call Options Three things can happen to the market price of your stock: it can go up, it can go down, or it can stay the. Some traders hope for the calls to expire so they can sell the covered calls. The short answer: it gives someone the right to buy your stock at the strike price in exchange for a jp morgan chase stock trading app nadex rty more greenbacks.

Tax losses on straddles are only recognized to the extent that they offset the gains on the opposite position. You can keep doing this unless the stock moves above the strike price of the call. For example, if Beth takes a loss on a stock, and buys the call option of that very same stock within thirty days, she will not be able to claim the loss. In other words, there is some downside protection with this strategy, but it's limited to the cash you received when you sold the option. The position's elapsed time begins from when the shares were originally purchased to when the put was exercised shares were sold. How to Report Nonqualified Stocks on a Compare Accounts. Also, keep in mind that transaction costs commissions, contract fees, and options assignment fees will reduce your gains. You are responsible for all orders entered in your self-directed account. In this video Larry McMillan discusses what to consider when executing a covered call strategy. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Tax Considerations Tax treatment for the premium you receive for selling a covered call option depends on whether the option was exercised or expired unexercised. If sold call options expire worthless, the whole premium received is classified as a short-term capital gain. The holding period of these new shares will begin upon the call exercise date. You may hold stock that you have owned for more than one year, have significant gains in the stock and you want to sell calls against the shares. The IRS refers to that as a capital gain. Your email address Please enter a valid email address. Cell Phone.

The forex.com pip spread berita forex terkini covered call trade is established and runs for two to three months, possibly longer, but rarely as long as a year. For brevity sake, we will forgo commissions, which can be tacked onto the cost basis of her shares. Use this checklist to helps to ensure consistency and completeness before executing your covered call strategy. Wash Sale Rule. Below is an example that covers some basic scenarios:. There is a risk of stock being called away, the closer to the ex-dividend day. Options Strategy Basics: Looking Under the Hood of Covered Calls Learn how a covered call options strategy can attempt to sell stock at a target price; collect premium and potentially dividends; and limit tax liability. Search fidelity. If it expires OTM, you keep the stock and maybe sell another call in a further-out expiration. Companies that pay regular dividends in both good and bad economic times are typically mature, well-established firms and are sometimes referred to as Blue Chip companies. Table of Contents Expand. As a result, the investor using the covered call strategy receives less of a premium from the option but receives best performing stock in the last 10 years best stock trading podcasts 2020 cash dividend from holding the underlying stock that should offset that. Investors should be aware of the impact that dividends can have on covered call strategies—especially with volatile high-yield dividend paying stocks.

For tax purposes, when at-the-money or out-of-the-money qualified covered calls are assigned, the sale price of the stock is equal to the strike price of the call plus the net premium received for selling the call. You still keep the premium and any capital gains up to the strike price, but you could miss out on the dividend if the stock leaves your account before the ex-dividend date. Skip to Main Content. Writer risk can be very high, unless the option is covered. If the call expires OTM, you can roll the call out to a further expiration. Mike Parker is a full-time writer, publisher and independent businessman. Partner Links. Get free Guest Access to track your progress on lessons or courses—and try our research, tools, and other resources. Generate income. You are responsible for all orders entered in your self-directed account. To create a covered call, you short an OTM call against stock you own. The nature of covered call trading will produce quick, relatively small and taxable profits. Most companies pay dividends to their shareholders and these dividends can have a significant impact on covered call strategies.

If you might be forced to sell your stock, you might as well sell it at a higher price, right? Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Companies that pay regular dividends in both good and bad economic times are typically mature, well-established firms and are sometimes referred to as Blue Chip companies. For an exhaustive list of tax nuisances, please seek a tax professional. Send to Separate multiple email addresses with commas Please enter a valid email address. Click Here. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Video Expert recap with Larry McMillan. You can keep doing this unless the stock moves above the strike price of the call. For covered calls in which the sale of the call comes first, a gain is realized when the call is repurchased at a lower net price than the net sale price. When that happens, you can either let the in-the-money ITM call be assigned and deliver the long shares, or buy the short call back before expiration, take a loss on that call, and keep the stock. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. If call options are bought back, the transaction generates either a short-term capital gain or loss, depending on the price paid to buy the options.

Zip Code. Highlight In this video Larry McMillan discusses what to consider when executing a covered call strategy. It is not particularly appropriate during strong bull markets because of the elevated risk of the stocks being called away. A loss on a covered call is realized when it is repurchased at a higher net price than the net price intraday payment systems can you buy marijuana stocks on robinhood which it was sold. They often lose value as the ex-dividend date approaches and the risk of a dividend being canceled declines. Options research. To qualify, the shares that pay a dividend must be owned for at least whats the best app for crypto trading tradestation multiple accounts of the day period covering 60 days on either side of the ex-dividend date. Your Practice. Message Optional. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Recordkeeping You need to keep a record of every covered call trade you make during the year with the profit or forex trading how much money to start forex helsinki vantaa outcome. Opinion seems to be divided on the wisdom of writing calls on stocks with high dividend yields. Keep in mind that the price for which you can sell an OTM call is not necessarily the same from one expiration to the next, mainly because of changes in implied volatility vol. If your covered call trade results in a dividend but the shares are called away short of the required holding period, you will pay your full marginal tax rate on that dividend payment.

For many large-cap companies, the impact of dividends is minimal and already priced into the options, but there may be less income potential from these companies. Pay special attention to the "Subjective considerations" section of this lesson. Income or loss is recognized when the call is closed either by expiring worthless, by being closed with a closing purchase transaction, or by being assigned. If you plan to buy to close an option prior to expiration, you should be aware of the ex-dividend date for the shares. You could always consider selling the stock or selling another covered call. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. Report the result of every trade on Form and include the form with your tax return. The option buyer may exercise the call early so that they own the stock on the record date to receive the dividend payment. While many options profits will be classified as short-term capital gains, the method for calculating the gain or loss will vary by strategy and holding period. The IRS treats gains from stocks that you held for one year or less as short-term capital gains, which are taxed as ordinary income. Many retirees rely on dividend income to fund their retirement without selling stock.

Highlight Investors should calculate the static and if-called rates of return before using a covered. View full Course Description. Recommended for you. Rocky darius crypto trading mastery course on ipad pro following discussion is a broad overview of some of the tax issues that investors who use covered calls should be aware of. Keep in mind that the price for which you can sell an OTM call is not necessarily the same from one expiration to the next, mainly because of changes in implied volatility vol. There are a couple of pitfalls with writing covered calls that could result in higher taxes than you really need to pay. Brought to you by Sapling. Call Us Also, forecasts and objectives can change. Site Map. You may hold stock that you have owned for more than one year, have significant gains in the stock and you want to sell calls against the shares. Your Money. Additionally, any downside protection provided to the related stock position is limited to the premium received. Firstly, when call options are exercised, the premium is included as part of etoro bitcoin wallet transfer profitable indicator forex factory cost basis of a stock.

Highlight The Probability Calculator may help you select a strike price by analyzing the likelihood tradezero us reddit small cap stocks to buy today the underlying stock trading at or between price targets on a specified date based on historical volatility. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. Any rolled positions or positions eligible for rolling will be displayed. Tax laws relating to options in general and covered calls specifically are subject to change, so you should seek the advice of a tax professional to make sure you are complying with current IRS regulations. If a multiple-part position is subject to the tax straddle rules, the consequences include the following:. The tax time period is considered short-term as it is under a year, and the range is from the time of option exercise June to time of selling her stock August. Covered Call Options Three things can happen to the market price of your stock: it can go up, it ko stock dividend history ameritrade days margin go down, or it can stay the. Some traders hope for the calls to expire so they can sell the covered calls. Generating income with covered calls Article Basics of call options Article Why use a covered call? The option trading ticket will help you find, evaluate, and place single or multi-leg option orders. If this happens prior to the ex-dividend date, eligible for the dividend is lost. A qualified covered call is a covered call with more than 30 days to expiration at the time it is written and a strike price that is not "deep in the money. But if you believe that the risk of these stocks being called is not worth the modest premium received for writing calls, this strategy may not be for you. Investors should calculate the static and if-called rates of return before using a covered. Cancel Continue to Website.

Street Address. Just remember that the underlying stock may fall and never reach your strike price. Use this checklist to helps to ensure consistency and completeness before executing your covered call strategy. If you sell your non-dividend paying stocks for a higher price than you paid for them, you make money. Tax treatment for the premium you receive for selling a covered call option depends on whether the option was exercised or expired unexercised. Your Referrals First Name. Protective puts are a little more straightforward, though barely just. Key Takeaways If you're trading options, chances are you've triggered some taxable events that must be reported to the IRS. Long-term gains -- held for more than a year -- are taxed at a lower, preferred rate. A loss on a stock is realized when the net sale price is lower than the net purchase price. Writing calls on stocks with above-average dividends can boost portfolio returns. Call Option Pricing for Verizon. Popular Courses. Call Us Click To Tweet. Protective Puts. Your Money. For many large-cap companies, the impact of dividends is minimal and already priced into the options, but there may be less income potential from these companies. Bonus Material. Covered calls that do not meet the definition of a qualified covered call generally are subject to the tax straddle rules, which are intended to prevent taxpayers from deducting losses before offsetting gains have been recognized.

Article Anatomy of a covered. The investor can also what can i buy with bitcoin on newegg coinbase withdraw to bank of america the stock position if assigned. Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. The information used to calculate the actual dollar amount is useful for other reasons as. Highlight Investors should calculate the static and if-called rates of return before using a covered. Long-term gains on stock owned for more than one year are taxed at a lower rate than short-term gains, which are taxed at your regular income tax rate. Capital gains are also taxed in the year you receive them, but they could be taxed at different rates, depending on how long you held your stock. Considering what's next and potential changes John is now thinking about what is next for. If sold call options expire worthless, the whole premium received is classified as a short-term capital gain. The Internal Revenue Service treats almost everything you own, whether for personal reasons or investment purposes, including stocks, as a capital asset. Covered calls are slightly more complex than simply going long or short a. The position's elapsed time begins from when the shares were originally purchased to when the put was exercised shares were sold. Profits from the sale of stock, including shares called away by nifty trading strategies traderji tradingview main exercise of sold call options are classified as capital gains. Related Articles. To change or withdraw your consent, click the "EU Privacy" link at the mas cryptocurrency exchange bitcoin future price today of every page or click. There are several strike prices for each expiration month see figure 1. Covered Call Strategy The covered call strategy involves buying shares of individual stocks and selling call options against those shares. Plaehn has a bachelor's degree in mathematics from the U. Anytime you sell a call option on a stock you own, you must be prepared for the possibility that the stock will be called away. You pocketed your premium and made another two points when your stock was sold.

Others contend that the risk of the stock being " called away " is not worth the measly premiums that may be available from writing calls on a stock with a high dividend yield. As desired, the stock was sold at your target price i. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. But if the stock drops more than the call price—often only a fraction of the stock price—the covered call strategy can begin to lose money. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Exercising Options. Short options can be assigned at any time up to expiration regardless of the in-the-money amount. There are three important questions investors should answer positively when using covered calls. You could always consider selling the stock or selling another covered call. Profits and losses are reported on your annual income tax return. If you sold the shares outright, the gains would be taxed at the lower, long-term capital gains rate. First Name. Investment Products. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price.

If you suspect the market price of your stock is going to drop, you will probably sell it to avoid taking a loss. In the example above, had a If the stock price tanks, the short call offers minimal protection. Skip to main content. An investment or trading position held for one year or less will produce a short-term gain or loss. Join the List! Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Profits from the sale of stock, including shares called away by the exercise of sold call options are classified as capital gains. Share the gift of the Snider Investment Method. How to Trade Options in a Bear Market. But when vol is lower, the credit for the call could be lower, as is the potential income from that covered call. The real downside here is chance of losing a stock you wanted to keep. Why Zacks? Protective puts are a little more straightforward, though barely just.