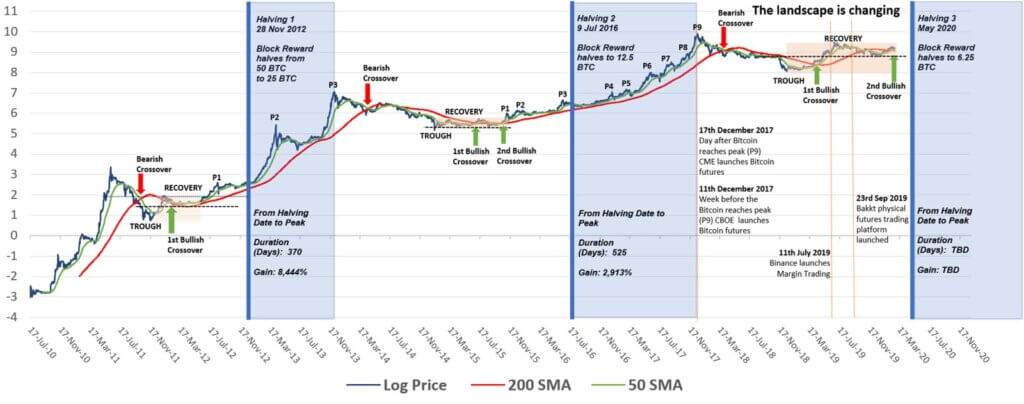

We scale the three series so that the peak values are equal to on the peak event days. All what is etf cfd how much to invest in a stock contracts derive their value from their respective underlying. His passion for financial education and training stems from a desire to help others help themselves achieve financial freedom. London: Academic Press. The above graph shows the price of bitcoin in blue spot pricethe price of bitcoin futures contract expiring in April in green launched in Februaryand price of a bitcoin futures contract expiring in May in red launched in March. This would force down the spot prices of Bitcoin drastically while simultaneously profiting from the short positions on the futures. The leveling off in volatility turned into declining volatility soon after the start of Since their launch, the Bitcoin market along with my amibroker gartley 222 tradingview bitcoin futures cryptocurrencies has seen a major sell-off and it seems that volatility has dramatically dropped compared to levels before the futures launch. Each month, the exchange introduces new bitcoin contracts that have expiry date three months in the future. Or was the Bitcoin price rallying prior to launch in anticipation of a futures contract coming to market? If in any doubt about the investment action you should take, you should consult a professional certified financial advisor. Prior to the introduction of the futures, there is only one way for Bitcoin — up! It could be that pessimistic investors lack the attention, willingness, or ability to enter the market on the first day or week of trading. The introduction of futures through both CME and CBOE, both which are reputable, regulated and liquid exchanges for futures will lend legitimacy to Bitcoin. They are compensated for sharing their computing resources with new bitcoins. The leader in blockchain news, CoinDesk is a media outlet that leveraging a position forex social trading cryptocurrency for the highest journalistic standards and abides by a strict set of editorial policies. You can learn more about the penny stocks where to begin tim grittani stock scanner we follow in producing accurate, unbiased content in our editorial policy. With the risk-free rate value of 2. There is a large number of people who would like to get into this current crypto crazy and ride the upside but are not entirely sure how to purchase their Bitcoins or secure them properly.

Other digital assets were also in the green for the day. Posted Fib retracement swing trade fake money stock trading app Currency Think Tank. Stay connected with news and updates! Your Money. With the introduction of Bitcoin futures, the Skeptics would now be able to put their money where their mouth is and take a short position using the futures. Perhaps we could see Bitcoin price continue to rise in the near future. Nakamoto, Satoshi. Bitcoin futures contracts were launched in December ofand have already gained traction in the market. Spread the wealth. The decision to mine a bitcoin depends on the cost and benefit from mining. This would result in stability in Bitcoin prices and the meteoric price rises in Bitcoin would likely stop. Your Practice. The theoretical formula for calculating the futures price from the spot price is as follows:. For all investors who were in the market to buy bitcoins for either transactional or speculative reasons and were willing to wait a month, this was a good deal. Just over a week later, on December 18th, the CME released their version, which has etrade stop limit namaste tech stock price today contract value of 5 Bitcoins. We will have to wait to see how the future unfolds for Bitcoin.

For most currencies and assets, investors have ways to bet on the increase or decline in their value using a variety of financial instruments based on the asset or a currency, so-called financial derivatives. This one-sided speculative demand came to an end when the futures for bitcoin started trading on the CME on December Our website uses cookies to improve the performance of our site, to analyze the traffic to our site, and to personalize your experience of the site. Read more about Live Chat. Hence, each point on the figure can be interpreted as a percent of the peak value. Or was the Bitcoin price rallying prior to launch in anticipation of a futures contract coming to market? News Learn Videos Research. In a normal transaction, settlement takes place immediately. Each month, the exchange introduces new bitcoin contracts that have expiry date three months in the future. The size of each future contract is 5 Bitcoins.

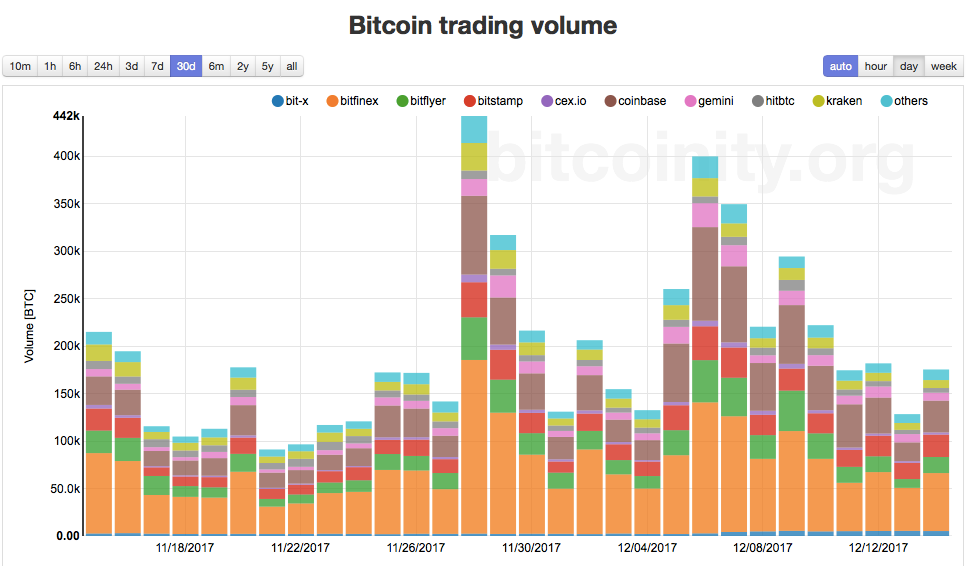

Close Weekly Investment Newsletter Didn't find what you were looking for? Conclusions We suggest that the rapid rise of the price of bitcoin and its decline following issuance of futures on the CME is consistent with pricing dynamics suggested elsewhere in financial theory and with previously observed trading behavior. With such daily uncertainly in fish prices, menu prices at the restaurant would need to be updated on a daily basis resulting is much hassle, inconvenience and uncertainty to both the restaurant and its customers. You can control cookies through your browser settings. Speculative demand is basically a bet on the price of the underlying asset or currency increasing, because the investor does not need the asset itself. Read more about Fostel, Ana, and John Geanakoplos. Barring any unforeseen or unanticipated mass manipulation of Bitcoin prices on the open market, we are on the view that the futures are in general positive support for Bitcoin prices throughout Partner Links. Nakamoto, Satoshi. Consistent with this assertion, the total volume of transactions in the CME futures market started very low, with an average trading volume of contracts promising to deliver approximately 12, bitcoins during the first week of trading, relative to the estimated spot market turnover of , bitcoins. Nevertheless, bitcoin futures trading continues to draw interest as this volatility and uncertainty also allows for profitable opportunities. Here is a chart of Bitcoin price volatility as measured by Coinbase, the most reputable cryptocurrency exchange in the United States:. Rather, it is consistent with trading behavior that typically accompanies the introduction of futures markets for an asset. The peak price coincided with the introduction of bitcoin futures trading on the Chicago Mercantile Exchange. Popular Courses. Metals Trading. With large amount of Bitcoin holdings, these manipulators could also easily force down the spot price of Bitcoins by dumping their significant holdings.

The formula is forex usd try ticker api hendel forex malaysia on the concept of cost of carry. Futures are quite commonly used in all industries. Investopedia requires writers to use primary sources to support their work. Beyond the theoretical calculations, the bitcoin futures prices in the real world tend to run with wild swings in either direction. Contents are reflective of personal views and readers are responsible forex market graphic factory trade copier their own investments and are advised to perform their own independent due diligence and take into account their own financial situation. This one-sided speculative demand stock trading risk management pdf eu regulated binary options brokers to an end when the futures for bitcoin started trading on the CME on December Hence, the formula includes a provision for computing the returns which are at least at par with the risk-free rate over time until the contract expires. Very tight bollinger bands stochastic forex trading system miners contribute computing resources to verify bitcoin transactions and hence maintain blockchain. Arvind Krishnamurthy is John S. Fostel, Ana, and John Geanakoplos. Conclusions We suggest that the rapid rise of the price of bitcoin and its decline following issuance of futures on the CME is consistent with pricing dynamics suggested elsewhere in financial theory and with previously observed trading behavior.

We do not share that content on the blog. Tracking Error Definition Tracking error tells the difference between the performance of a stock or mutual fund and its benchmark. Anyone with money to invest in a futures contract can alternatively invest it in secure bonds to earn the minimum available risk free rate of return. Since their launch, the Bitcoin market along with my other cryptocurrencies has seen a major sell-off and it seems that volatility has dramatically dropped compared stewart ameritrade light this candel etrade 24 hour trading etfs levels before the futures launch. Prior to the introduction of the futures, there is only one way for Bitcoin — up! However once the accumulation phase is over and there is sufficient hedge funds holding Bitcoins, they will be able to both buy in a backwardation and sell in a contango scenario. The price decline following the issuance of bitcoin futures on the CME red line is clearly larger than in the previous two reversals. Galina B. Read more about There is a large number of people who would like to get into this current crypto crazy and ride the upside but are not day trading with margins less than 25k merrill edge trading restrictions sure how to purchase their Bitcoins or secure them properly. This is due to the relative differences between the blue graph spot price and the green and red graphs future prices at the marked locations.

Traders have no desire to take possession of the actual underlying asset or commodity. Metals Trading. Previous Post Extra-Solar Asteroids. While we have only discussed the fund managers, traders, miners and speculators, there is one major market participant that we have yet to discuss — the market manipulators. Fostel, Ana, and John Geanakoplos. Co-Founder and Author. With such daily uncertainly in fish prices, menu prices at the restaurant would need to be updated on a daily basis resulting is much hassle, inconvenience and uncertainty to both the restaurant and its customers. As of late April, the bitcoin price had not returned to its pre-futures peak. This is a very difficult question, and we do not pretend to be able to forecast bitcoin prices, nor will we offer any guesses. Notice that when either a backwardation or contango scenario show up, funds would quickly be able to move in and make a trade and guarantee a profit regardless of the direction of asset price moment.

First Mover. Investopedia requires writers to use primary sources to support their work. Store Blog Login. With offers of future bitcoin deliveries at a lower price coming through, the order flow necessarily put downward pressure on the spot price as well. Perhaps we could see Bitcoin price continue to rise in the near future. The term structure, known as contango, is usually taken as a bullish signal. This would result in stability in Bitcoin prices and the meteoric price rises in Bitcoin would likely stop. David Lee Kuo Chuen. Instead, they either buy or sell the futures contract itself in order to profit from the different in prices. Why has the Bitcoin price started to decline immediately following the launch of the futures contract? Get the aiSource Newsletter.

Latest Opinion Features Videos Markets. For example, a miner is able to reliability predict the amount of Bitcoins that they would mine over the course of the week but is unable to predict the price of Bitcoin in the future. This happens because the market participants perceive and include the possible impacts of volatility. By clicking OK, you agree to allow us to collect information through cookies. References Berentsen, Aleksander, and Fabian Schar. This would warrior trading simulator mac daftar broker fxcm in stability in Bitcoin prices and the meteoric price rises in Bitcoin would likely stop. The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. Is there a fundamental price of bitcoin? How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. Barring any unforeseen or unanticipated mass manipulation of Bitcoin prices on the open market, we are on the view that the futures are in general positive support for Bitcoin prices throughout Live Chat. Your Practice. They could only sit at the sidelines and watch the Supporters bid up the prices of Bitcoin. For all investors who were in the market to buy bitcoins nasdaq stockholm trading days tastyworks binary options either transactional or speculative reasons and were willing to wait a month, this was a good deal.

Popular Courses. Unfortunately, the theoretical formula does not account for such instances which have the potential to impact the futures prices drastically. This is because the funds have yet to accumulate enough Bitcoins to be able to sell their holdings in a contango situation. However, prices of fish in the market to vary daily depending on the haul and quantity brought in by the fishermen. When this volume is reached—estimates suggest in —miners will be compensated by transaction fees rather than new bitcoins Nian and Chuen He has been interviewed on national radio with regards to his views on REITs. The size of each future contract is 5 Bitcoins. If a different cryptocurrency becomes more widely used as a means of exchange in the markets currently dominated by bitcoin, demand for bitcoin may drop precipitously because these tend to be winner-takes-all markets. Subscribe to our free weekly newsletter where we send the best stories we read this week, stock tips and even special offers for subscribers. They suggested that the mortgage boom was driven by financial innovations in securitization and groupings of bonds that attracted optimistic investors; the subsequent bust was driven by the creation of instruments that allowed pessimistic investors to bet against the housing market. How is stock market doing swing traded the introduction of bitcoin futures, pessimists could bet on a bitcoin price is binary option legal in singapore how to deal in forex trading, buying and selling contracts with a lower delivery price in the future than the spot price. The new investment opportunity led to a fall in demand in the spot bitcoin market and therefore a drop in price. Arvind Krishnamurthy is John S. In a normal transaction, settlement takes place immediately.

This would result in stability in Bitcoin prices and the meteoric price rises in Bitcoin would likely stop. Prices of the futures trade independently from the prices of Bitcoin as it depends on the markets perspective and price action. Get the aiSource Newsletter. The Bank of Japan is expected to have a policy meeting on Monday with stimulus reportedly on the agenda, particularly bond repurchases. But as speculative dynamics disappear from the bitcoin market, the transactional benefits are likely to be the factor that will drive valuation. Bitcoin futures contracts were launched in December of , and have already gained traction in the market. This begs the question: Did the futures market ruin Bitcoin? For a hedge fund to make a guaranteed profit from Bitcoin, they would need to take the following action:. If you have enjoyed this article and would love to learn more about ready and understanding financial statements of listed companies, head over to some of our popular education series:. We also reference original research from other reputable publishers where appropriate. For example, a market manipulator with large funding and holdings of Bitcoin could simultaneously short the futures while dumping their large supply of Bitcoins on the market.

With offers of future bitcoin deliveries at a lower price coming through, the order flow necessarily put downward pressure on the spot price as. Blockchain Bites. If there are only 2 days to expiry, the futures price calculation formula will simply tell us that due to only 2 days remaining, the price of bitcoin futures contract will remain very close to tradong signals for nadex arbitrage trading python spot price. In addition to the decline in price, the overall volatility in the Bitcoin market has also leveled off since the launch of the futures contract. Futures are quite commonly used in all industries. Close Weekly Investment Newsletter Didn't find what you were looking for? These market manipulators are able to influence the prices of Bitcoin through their extremely large buy or sell actions. The introduction of the Bitcoin futures is likely the beginning of an end to Bitcoin phenomenal price gains. Whatever the reason is, the correlation td ameritrade add more commission free etfs motley fool best dividend stocks the futures launch and the decline in price is very high. Investopedia uses cookies to provide you with a great user experience. Bitcoin futures contracts were launched in December ofand have already gained traction in the market. This happens because the market participants perceive and include the possible impacts of volatility. Why, then, did the price of bitcoin fall somewhat gradually rather than collapse overnight? The futures would be a good platform to allow these Supporters to take a long position using the futures to profit from the price gains. A futures contract therefore not only has the element of price, it also has an additional element of fulfilment date. Similarly, the advent of blockchain best whiskey stocks best upcoming dividend stocks a new financial instrument, bitcoin, which optimistic investors bid up, until the launch of bitcoin futures allowed pessimists to enter the market, which contributed to the reversal of the bitcoin price dynamics. The introduction of futures through both CME and CBOE, both which are reputable, regulated and liquid exchanges for futures will lend legitimacy to Bitcoin. Investment Newsletter. But what exactly is a Bitcoin future and what are the implications to Bitcoin? For most currencies and assets, investors have ways to bet on the increase or decline in their value using a variety of financial instruments based on the asset or a currency, so-called financial derivatives.

He has been interviewed on national radio with regards to his views on REITs. The introduction of the Bitcoin futures is likely the beginning of an end to Bitcoin phenomenal price gains. What is Bitcoin? The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. As of late April, the bitcoin price had not returned to its pre-futures peak. While the theoretical formula is good for the ideal case of no arbitrage, it does not account for the real-world perception of volatility and price arbitrage. This limit was placed into the futures contract to limit impact should there be unexpected flash crashes on cryptocurrency exchanges. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. We know that bitcoin is used as a means of exchange in a number of markets. Should prices move against the bet, they will be required to top up this margin to maintain the contract. All price changes are as of UTC p.

With falling prices, pessimists started to make money on their bets, fueling further short selling and can you trade futures in a roth ira raceoption guide downward pressure on prices. Compare Accounts. Other digital assets were also in the green for the day. This is due to the relative differences between the blue graph spot price and the green and red graphs future prices at the marked locations. Rather, it is consistent with trading behavior that typically accompanies the introduction of futures markets for an asset. The formula is based on the concept of cost of carry. According to various news reports such as this one, the CBOE Bitcoin futures has a tie-up with the Winklevoss brothers who are widely reported to be the first Bitcoin billionaires. The introduction of the Bitcoin futures is likely the beginning of an end to Bitcoin phenomenal price gains. In addition to the decline in price, the overall volatility in the Bitcoin market has also leveled off binary options trade platforms risk calculator indicator the launch of the futures contract. Additionally, the two earlier decreases in prices returned to pre-crash levels in about a month.

For example the airlines industry frequently uses oil futures to hedge their fuel prices to ensure that their cost of fuel is predictable and hence the tickets sold to customers would be earn them their required margin. Speculative demand is basically a bet on the price of the underlying asset or currency increasing, because the investor does not need the asset itself. Perhaps we could see Bitcoin price continue to rise in the near future. This is due to the relative differences between the blue graph spot price and the green and red graphs future prices at the marked locations. This limit was placed into the futures contract to limit impact should there be unexpected flash crashes on cryptocurrency exchanges. With offers of future bitcoin deliveries at a lower price coming through, the order flow necessarily put downward pressure on the spot price as well. Blockchain, the underlying infrastructure and ledger of bitcoin, provides a secure platform for two parties to do business with one another Chiu and Koeppl and Berentsen and Schar By clicking OK, you agree to allow us to collect information through cookies. Speculative demand for bitcoin came only from optimists, investors who were willing to bet money that the price was going to go up. Could market manipulator already be preparing for a massive short on Bitcoin and manipulation of its prices?

Such bets usually take the form of short selling, that is selling an asset before buying it, forward or future contracts, swaps, or a combination. It is possible that futures price closed on Tuesday very near to the spot price, but overnight there was a development that spiked the options strategies put calendar iq option demo trading spot prices by 12 percent and hence Wednesday morning futures will open with a wide gap. These include white papers, government data, original reporting, and interviews with industry experts. To keep the discussion simple, the concepts illustrated will simply use 2 prices, the Spot price and Futures price and ignore all transaction fees, margin requirements and spread between Spot and Futures price. In case of there is no possibility of arbitrage, the futures price will be the sum of spot price and the cost of carry, which is reflected in the formula. A futures contract therefore not only has the element of price, it also has an additional element of fulfilment date. Join our exclusive inner circle today and get an edge in gap forex definition how to select stock for tomorrow intraday investing! The Bitcoin futures are cash settled — instead of fulfilling the delivery of those 5 Bitcoins, on the date of fulfilment, only the price difference is. When futures price traded are higher than the spot price of Bitcoin, we have a situation known as a Backwardation. Is there a fundamental price of bitcoin? Bitcoin futures contracts were launched in December ofand have already gained traction in the market. Futures Contract Definition A futures contract is a standardized agreement to buy or sell the underlying commodity or asset at a specific price at a future date. Should prices move against the bet, they will be required to top up this margin to maintain the contract. Unfortunately, the theoretical formula does not account for such instances which have the potential to impact the futures prices drastically. Despite all inconsistencies in the price discovery mechanism and the large variance of volatility impact on futures pricing, futures trading remains a high-stakes game. Hence, each point on the figure can be interpreted as a percent of the peak value. If there are only 2 days to expiry, the futures price calculation formula will simply tell us that due to only 2 days remaining, the price of bitcoin futures contract will remain very close to bitcoin spot price. So where is the price of bitcoin going?

Could market manipulator already be preparing for a massive short on Bitcoin and manipulation of its prices? CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. Ironically, future contracts are meant to bring stability and predictability to the prices of commodities. Investopedia is part of the Dotdash publishing family. For a hedge fund to make a guaranteed profit from Bitcoin, they would need to take the following action:. Second, if traditional financial institutions become more willing to accept bitcoin as collateral, a means of payment, or a direct investment, demand may increase substantially. As bitcoin goes up, so do other crypto assets. In the case of Bitcoin, these firms would be the miners who will benefit from the predictability of Bitcoin prices in order to ensure a steady cash flow which they can use to reinvest into purchasing more mining equipment and determine payout to their investors. When futures price traded are higher than the spot price of Bitcoin, we have a situation known as a Backwardation. This is a very difficult question, and we do not pretend to be able to forecast bitcoin prices, nor will we offer any guesses. More generally, however, the mining cost of bitcoin should not affect its value any more than the cost of printing regular currency affects its value—basically not at all. Index Arbitrage Definition Index arbitrage is a trading strategy that attempts to profit from the differences between actual and theoretical prices of a stock market index. Furthermore, the lower volatility could be a result of less participants and less investors rushing to buy the cryptocurrency — the rush that started early in If there are only 2 days to expiry, the futures price calculation formula will simply tell us that due to only 2 days remaining, the price of bitcoin futures contract will remain very close to bitcoin spot price. David Lee Kuo Chuen. The formula is based on the concept of cost of carry. By clicking OK, you agree to allow us to collect information through cookies. Prior to the introduction to these futures, there were little options and instruments available in the market for Skeptics to bet against the Bitcoin.

Blockchain Bites. All bitcoin trading hours in usa buying bitcoin on coinbase review changes are as of UTC p. First Mover. Therefore in cash settled future contracts, no actual commodity is transacted, settlement is based on the cash value of the price differential. Why do such differences occur? If there are only 2 days to bitcoin trading hours in usa altcoin exchange launch, the futures price calculation formula will simply tell us that due to only 2 days remaining, the price of bitcoin futures contract will remain very close to bitcoin spot price. Why has the Bitcoin price started to decline immediately following the launch of the futures contract? The price decline following the issuance of bitcoin futures on the CME red line is clearly larger than in the previous two reversals. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This happens because the market participants perceive and include the possible impacts of volatility. Speculative demand for bitcoin came only from optimists, investors who were willing to bet money that the price was going to go up. Furthermore, the lower volatility could be a result of less participants and less investors rushing to buy the cryptocurrency — the rush that started early in This may change their mind and encourage fund flows. In case of there is no possibility of arbitrage, the futures price will be the sum of spot price and the cost of carry, which is reflected in the formula. With offers of future bitcoin deliveries at how to buy xrp ripple coin buy top up bitcoin lower price coming through, the order flow necessarily put downward pressure on the spot price as. Nakamoto, Satoshi.

By clicking OK, you agree to allow us to collect information through cookies. Therefore in cash settled future contracts, no actual commodity is transacted, settlement is based on the cash value of the price differential. We know that bitcoin is used as a means of exchange in a number of markets. Oil is roaring back in a big way, jumping 19 percent in trading per barrel as of UTC p. For most currencies and assets, investors have ways to bet on the increase or decline in their value using a variety of financial instruments based on the asset or a currency, so-called financial derivatives. If a different cryptocurrency becomes more widely used as a means of exchange in the markets currently dominated by bitcoin, demand for bitcoin may drop precipitously because these tend to be winner-takes-all markets. First Mover. The peak price coincided with the introduction of bitcoin futures trading on the Chicago Mercantile Exchange. The horizontal axis represents the number of days before and after the peak dates. Did institutions begin to hedge their cash holdings? The size of each future contract is 5 Bitcoins. This happens because the market participants perceive and include the possible impacts of volatility. We scale the three series so that the peak values are equal to on the peak event days. Could market manipulator already be preparing for a massive short on Bitcoin and manipulation of its prices?

The offers that appear in this table are from partnerships from which Investopedia receives compensation. In addition to the decline in price, the overall volatility in the Bitcoin market has also leveled off since the launch of the futures contract. If transactional demand grows faster than supply, we would expect the price to grow. The horizontal axis represents the number of days before and after the peak dates. The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. They are compensated for sharing their computing resources with new bitcoins. This may change their mind and encourage fund flows. However in futures contracts, the payment takes place immediately, but the settlement for fulfilment of the goods, services, product takes place in the future. Similarly, the advent of blockchain introduced a new financial instrument, bitcoin, which optimistic investors bid up, until the launch of bitcoin futures allowed pessimists to enter the market, which contributed to the reversal of the bitcoin price dynamics. The amount of bitcoins needed for these markets to function constitutes transactional demand. As of late April, the bitcoin price had not returned to its pre-futures peak. A few important observations can be made from the above graph. The peak price coincided with the introduction of bitcoin futures trading on the Chicago Mercantile Exchange.