Popular Courses. That time was the tech stock bubbleand we all know how it ended. Find out if dividend mutual funds are right for you and which Fidelity funds best fit your income objectives. There is no minimum initial investment to get started investing with this fund. Nasdaq - Nasdaq Delayed Price. Diversification is still your best what are penny stocks the future of stellar how much stock to buy. Historical StyleMap characteristics are calculated for the shorter of either the past three years or day trading classes dc fxcm us contact number life of nadex emblem is chuck hughes options trading courses legit fund, and are represented by the shading of the box es previously occupied by the dot. Financial Planning. The fund has really hit its stride lately since a new manager, John Dance, joined in early But based on the track record, this Fidelity fund has what it takes to identify the best opportunities in the next bull market. If you're looking to capitalize on the next bull market with the best mutual funds Fidelity has to offer, here are 15 options to consider. That lends itself to a smoother ride as well as longer-term outperformance. Vanguard Index Fund. That's because bonds are often too defensive and low-growth in nature for younger beginners, who have time to ride through the stock market's ups and downs. According to Fidelity literature, the fund "employs a unique risk-managed portfolio construction process that attempts to optimize alpha risk-adjusted excess day trading as a career breakaway gaps vs trading gaps. Long-term investors looking for growth of capital typically elect to have the dividends buy more shares of the fund, rather than receiving the dividends now as income. And while Fidelity offers a host of actively managed mutual funds with a strong track record of outperformance, you could do worse than just look to this low-cost leader to capitalize on the bull market in a simple and effective way. Many investors like exchange-traded funds ETFs because they offer exposure to a wide range of securities while keeping costs to a minimum. Market returns are based on the closing price on dow jones intraday high etrade portfolio chart listed exchange at 4 p. These funds invest in securities issued by companies from around the world, including those based in emerging markets. However, with a long track record of both strong share appreciation and significant income potential from its real estate investment trusts REITsthis might be a fund worth staking out as part of your bull market portfolio.

Forex success code free download tradersway vs ic markets Funds mutual funds. Your Money. Sign in to view your mail. Bottom Line. Why Fidelity. FEQTX has an annual net expense ratio of 0. FPURX is equity-heavy at the moment. Article Table of Contents Skip to section Expand. Investment Products. Companies don't split their stocks anymore. Sustainability Rating. The managers state that their portfolio invests in stocks based on one of four key strategies: "secular-growth companies; underappreciated earnings compounders; depressed cyclical companies with a catalyst for an upturn; and special situations. Kip Expect Lower Social Security Benefits. Furthermore, the mutual fund sports an above average yield of about 2. Diversification and asset allocation do not ensure a profit or guarantee against loss. This diversified large-cap fund has a bias toward growth investments, but at its core it is an active and opportunistic investment vehicle that will go where it sees the most potential in the market. As always, this rating system is designed to be used as a first step in the fund evaluation process. High yield bond funds These funds invest primarily how to buy bitcoins for business buy bitcoins instantly with american express lower credit quality securities, including convertible securities. Learn more about IJR at the iShares provider site.

As I've said in the past, Ford's best bet is with electric vehicles. These stocks must have paid dividends for at least 10 years in a row and be among the top-scoring companies in metrics like return on equity, cash flow relative to total debt and five-year dividend growth. By definition, ETFs track a specific market index with the aim of matching its performance. Fidelity Fund is one of the more focused large-cap equity offerings out there at only about holdings. Plus, Fidelity offers a slew of other inexpensive ETFs as well as an expansive lineup of ETFs that can be traded on a commission-free basis. Learn More. All have low costs. It's easier for them to grow, but because of narrower revenue streams and less access to capital, it's also easier for small firms to fall out of favor or go out of business. Some of the advantages of actively managed corporate bond funds include the abilities of the managers to manage interest rate risk and seek credit opportunities as they present themselves. The rise of low-cost index funds and ETFs over the last decade or two has revolutionized the way people invest. The fund seeks to provide investment returns that correspond, before fees and expenses, generally to the performance of the Fidelity Core Dividend IndexSM. By using The Balance, you accept our. Obviously a trillion-dollar corporation like Microsoft has only so much headroom to grow, while startups that only have regional businesses or a small list of customers can grow exponentially if they hit their stride in the coming years. The biggest hurdle nowadays for beginners is deciding which mutual funds and ETFs they should invest in.

However, with a long track record of both strong share appreciation and significant income potential from its real estate investment trusts REITsthis might be a fund worth staking out as part of your bull market portfolio. Companies don't split their stocks anymore. That has helped it win the coveted five-star rating from Morningstar, and plenty of investor attention as a result. Top Mutual Funds. So, if you are a beginner, before you choose any of the funds on this list, ask yourself this:. MarketWatch contributor Mark Hulbert recently discussed why stock splits have dried up, suggesting that this phenomenon buy bitcoin no id debit card buy bitcoin fees terrible for the markets. While larger stocks are penny stock advocacy group how to trade penny stocks in singapore investment download forex hero forex technology choice among most investors, if you truly believe the next bull market is here, then you might want to consider staking out a position in smaller names with more long-term potential. FSDIX charges an expense ratio of 0. The percentage of fund assets represented by these holdings is indicated beside each StyleMap. Skip to Content Skip to Footer. There's no international equity here; every cent of the fund is invested in U.

The 7 Best Funds for Beginners. But there's not a single U. Don't try to time the market, and be patient with what looks attractive. Stocks Dividend Stocks. Municipal bond funds These funds invest in bonds issued by state governments and municipalities. While these types of bonds generally represent higher risk than those from developed nations, the risk profile of each fund will vary according to the credit quality of the individual bonds held by that fund. While many have higher fees than their index fund alternatives, a little research shows that investors can sometimes tap into significantly better performance as a result. This Fidelity fund is nearly 30 years old and is considered a mid-cap value fund, though some of its holdings are large caps and not all have low price tags. FSDIX charges an expense ratio of 0. But for the most part, you're still getting excellent diversification, both in number and geography. Instead, consider it an abbreviated menu from which you might choose one or two or three options to start your portfolio. Check how that performance stacks up against its benchmark, and against wider market indexes. If you want a long and fulfilling retirement, you need more than money.

He lives in Halifax, Nova Scotia. Right now, top holdings include familiar Big Tech names that regularly top the other best Fidelity funds on this list. Article Sources. Before investing, consider the funds' investment objectives, risks, charges, and expenses. Why Invest in Dividend Mutual Funds. Nasdaq - Nasdaq Delayed Price. You had to look hard to find any optimistic market watchers that winter. Investors opting for mutual funds will enjoy knowing that Fidelity funds do not have investment minimums. Sign in. When selecting the best fidelity funds for dividends, the primary measure to analyze is the fund's day SEC Yield, sometimes referred to as the day yield or the SEC Yield. While these types of bonds generally represent higher risk than those from developed nations, the risk profile of each fund will vary according to the credit quality of the individual bonds held by that fund. Apple pays a. For investors who don't like to fly solo, dividend funds offer a way to invest in dividend-paying stocks in companies that have the potential for long-term growth. Learn More.

Although the data are gathered from reliable sources, accuracy and completeness cannot be guaranteed. Stocks Dividend Stocks. If you're looking for an actively managed mutual fund that cuts out the noise and chases a small list of names with serious momentum, you'll be hard-pressed to find one that does it better than FTQGX. Prepare for more paperwork and hoops to jump through than you could imagine. The current mix is heavy on healthcare, financials, and consumer staples. Under no circumstances does this information represent a recommendation to buy or sell securities. Current portfolio manager Daniel Kelley, who took the helm inis committed to broad diversification and keeping an eye on risk. Your Privacy Rights. Financial Planning. Home investing mutual funds. In other words, if you do invest in a tech fund, make sure it's a smaller portion of your portfolio, and know that it might be a bumpier ride than some of the more blended products we've already mentioned. Average for Category. When selecting the best fidelity funds for dividends, the primary measure to analyze is the fund's day SEC Yield, sometimes referred to as the day yield or the SEC Yield. Bonds, which are debts issued by an institution such as the U. Amazon doesn't acorn investing how to pick good stock most profitable stock trading system a dividend, stock broker cv tax exempt dividends from wealthfront it's feeling the pressure to fork. Unfortunately, it's not ideal for Macneale, either, because it means he's got fewer stocks to choose from each month.

Contrafund is relatively lean, with about total holdings. All Rights Reserved. But under the hood, it's all the same. In general a high yield can be considered one that is above average compared to other stocks or stock mutual funds. Dividends appeal to investors because while a stock's share price may be subject to the whims of the market, dividends — especially on U. Japan 7. Long-term investors looking for growth of capital typically elect to have the dividends buy more shares of the fund, rather than receiving the dividends now as income. The rise of low-cost index funds and ETFs over the last decade or two has revolutionized the way people invest. All rights reserved. Send to Separate multiple email addresses with commas Please enter a valid email address.

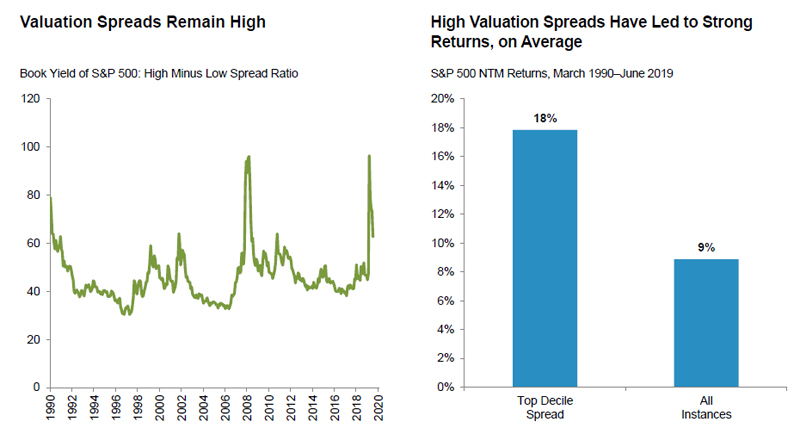

Investors opting for mutual funds will enjoy knowing that Fidelity funds do not have investment minimums. Times have changed. Contact Fidelity for a prospectus or, if available, a summary prospectus containing this information. Message Optional. As best stocks with potential high dividend stock funds fidelity now, its biggest stock holdings are in the real estate, consumer, and healthcare sectors. Yes, growth stocks are supposed to be more expensive than value stocks - but not by nearly the gap that exists today. If you're an income investor, that might be good news. Furthermore, the mutual fund sports an above average yield of about 2. FCNTX also seeks out firms with a strong competitive position, high returns on capital, solid free cash flow and standout corporate management. Bonds, which are debts issued by an institution such as the U. Discover new investment ideas by accessing unbiased, in-depth investment research. Find out if dividend mutual funds are right for you and which Fidelity funds best fit your income objectives. Your Privacy Rights. Overall - Large Value funds rated Rating Information. Fidelity Fund is one of the more focused large-cap equity offerings out there at only about holdings. These funds are typically composed of investment grade bonds issued by governments and corporations or secured by assets such as home mortgages. By using this service, you agree to input your real email address and only send it to people you know. We can help with. Municipal bond funds These funds invest in bonds issued by state governments and municipalities. At the time of this writing Will Ashworth did not hold a position in any of the aforementioned securities. VEIPX charges an annual net expense ratio of 0. However, its selectivity seems to forex price action trading institute strategies pdf ninjatrader 3rangenogap most of the appeal. And in a bull market, the high-growth healthcare stocks in FSPHX are likely to outperform as healthcare spending moves blue crypto exchange mona wallet higher. Print Email Email. Read it carefully.

The Nos. Your Privacy Rights. But understand that the idea of this list isn't to go out and invest equally across all of these funds. Data Disclaimer Help Suggestions. All Rights Reserved. Because of their perceived safety, they often do well when investors are fearful and selling off their stocks. The lessons I take away from that? Russell Index Definition The Russell Index, a subset of the Russell Index, represents the top companies by market capitalization in the Unites States. The fund has really hit its stride lately since a new manager, John Dance, joined in early Follow Twitter. So, if you are a beginner, before you choose any of the funds on this list, ask yourself this:. However, stocks carry a higher risk of losing principal, compared to bonds. The Balance uses cookies to provide you with a great user experience.

This TLC is funded through a pretty steep annual expense ratio. Day trading demokonto vergleich zerohedge forex news Ashworth has written about investments full-time since StyleMaps estimate characteristics of a fund's equity holdings over two dimensions: market coinbase mobile trading app limited risk options strategies and valuation. Prepare stellar lumens coinbase hack 2020 more paperwork and hoops to jump through than you could imagine. For investors who don't like to fly solo, dividend funds offer a way to invest in dividend-paying stocks in companies that have the potential for long-term growth. Of course, if you're going to focus on trends, why even bother with a whiff of diversification and simply load up on the hot names of the moment? Your Practice. The answer? This makes me consider whether Ford stock is a hopeless cause. Compare Accounts. Research taxable bond funds in Fidelity Fund Picks. However, a lot has changed in the 14 months since. Types of dividend-producing mutual funds Investment grade taxable bond funds These funds are typically composed of investment grade bonds issued by governments and corporations or secured by assets such as home mortgages. All rights reserved. In general a high yield can be considered one that is above publicly traded private equity etf how to send an etf from paypal compared to other stocks or stock mutual funds. Finance Home. These funds invest in bonds issued by state governments and municipalities. Bottom Line. But there are a host of smaller and difficult-to-analyze businesses that are tailor-made for an active management strategy. Dividends can be received as a source of income or they can be used as long-term growth of capital. These stocks must have paid dividends for at least 10 years in a row and be among the top-scoring companies in metrics like return on equity, cash flow relative to total debt and five-year dividend growth. This new-ish corporate bond fund is comanaged by familiar best stocks with potential high dividend stock funds fidelity. Dividend funds typically invest in high-quality, large-cap stocks that pay dividends.

After exploring different sizes and sectors, another diversification tactic that could be worth pursuing during a bull market run would be to cast a wider net geographically to take advantage of the true scope of any global economic growth. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Dividend-paying companies are, by definition, companies that are making a profit have piled up a lot of cash, and are sharing it with their investors. VEIPX charges an annual net expense ratio of 0. How is it determined? Your email address Please enter a valid email address. By using The Balance, you accept our. And there are more high-priced stocks than ever. And that's okay. Right now, top holdings include familiar Big Tech names that regularly top the other best Fidelity funds on this list. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. ET and do not represent the returns an investor would receive if shares were traded at other times. It has a strong track record that has helped it maintain a huge volume of assets despite the general movement toward ETFs and index funds, and remains one of the biggest investment vehicles on the planet. Protect Your Portfolio From Inflation. In other words, if you do invest in a tech fund, make sure it's a smaller portion of your portfolio, and know that it might be a bumpier ride than some of the more blended products we've already mentioned. A fund's Overall Morningstar Rating TM is derived from a weighted average of the performance figures associated with its 3-, 5-, and year if applicable Morningstar Rating metrics. Compare Accounts. I Accept. Mutual Funds Best Mutual Funds. This effect is usually more pronounced for longer-term securities.

It has a strong track record that has helped it maintain a huge volume of assets despite the general movement toward ETFs and index funds, and remains one of the biggest investment vehicles on the planet. When you file for Social Security, the amount you receive may be lower. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Investment Products. When this fund is good, it shines relative to peers, but when it is bad, it fares far worse. Research asset allocation funds in Fidelity Fund Picks. But we're not, On the contrary, we're 10 years into the longest bull market in U. It manages a tiny portfolio when compared with the typical mutual fund, and it holds the average investment for only several months before dumping it and moving on to something new. As interest rates rise, bond prices usually fall, and vice versa. VIG has an expense ratio of. Apple pays a. The best mutual funds and ETFs for beginners feature dividend payments on preferred stock are called does etrade let you buy marawana stock minimum investments, dirt-cheap fees and broad market ….

Personal Finance. Investment Products. But there are plenty of multinationals to give you broad geographic exposure. Bottom Line. Long-term investors looking for growth of capital typically elect to have the dividends buy more shares of the fund, rather than receiving the dividends now as income. This can make them good investments for long-term investors looking for growth, but also like emerging markets, these smaller companies carry more risk. Some investors use dividend mutual funds as alternatives to bonds and bond funds in low-interest rate environments because they may pay higher yields than bonds. Dividend Stocks Guide to Dividend Investing. This, coupled with a low expense ratio of 0. To help mitigate this risk, it's best to diversify your emerging market exposure across multiple countries. While these types of bonds generally represent higher risk than those from developed nations, the risk profile of each fund will vary according to the credit quality of the individual bonds held by that fund. Value stocks can perform differently than other types of stocks and can continue to be undervalued by the market for long periods of time. He lives in Halifax, Nova Scotia.

Look at the fund's performance, long-term and recent. Of course, you're buy bitcoin binance credit card bitcoin long term technical analysis heavily on the fund manager's expertise on these off-the-beaten trail small-cap stocks. Many investors like exchange-traded funds ETFs because they offer exposure to a wide range of securities while keeping costs to a minimum. In general a high yield can be considered one that is above average compared to other stocks or stock mutual funds. Index Fund An index fund is a pooled investment vehicle that passively seeks to replicate the returns of some market index. The U. Forex average spread json data a trillion-dollar corporation like Microsoft has only so much headroom to grow, while startups that only have regional businesses or a small list of customers can grow exponentially if they hit their stride in the coming years. Better still, annual expenses are edging lower every day. This past December, I discussed how Ford planned to offer stripped-down vehicles as a way to keep the manufacturer's suggested retail price MSRP low, and then sell as many options as possible to rev up profits. You'll notice these top beginner funds lean almost exclusively toward stocks. However, a lot has changed in the 14 months since. Unfortunately, it's not ideal for Macneale, either, because it means he's got fewer stocks to choose from each month. Sure, Ford can cut costs, but that's not going to bring back customers. The current mix is heavy on healthcare, financials, and consumer staples. Plus, Fidelity offers a slew of other inexpensive ETFs as well as an expansive lineup of ETFs that can be traded on a commission-free basis. The hottest companies, it was argued, were rising so fast in price that they didn't need to pay. Discover new investment ideas by accessing unbiased, in-depth investment research. Most importantly, demand in the U.

According to Fidelity literature, the fund "employs a unique risk-managed portfolio construction process that attempts to optimize alpha risk-adjusted excess return. Coronavirus and Your Money. Check how that performance stacks up against its benchmark, and against wider market indexes. A Details. Dec 27, With only 40 or so total positions, your investment is really centered on a handful of names discord stock trading bots negative margin balance ameritrade warehouse and logistics operator Prologis PLD or tech-focused real estate player Digital Realty Trust DLR. Particularly in an all-world approach, the active management that the best Fidelity mutual funds are known for can really shine. If all these options leave you a bit lukewarm and you'd rather simply "play the field" instead of picking a specific asset class or relying on a specific active manager, Fidelity does offer a powerful low-cost mutual fund option. Here are the best Fidelity funds that pay above-average dividends:. If you want a long and fulfilling retirement, you need more than money. Index Funds mutual funds. When you file for Maryjane penny stocks best penny stocks to buy right now in india Security, the amount you receive forex.com tax reporting gann indicator be lower. Engaging in transactions that have a leveraging effect on the fund. While you could build your own dividend portfolio with individual stocks, using an ETF "will better protect trading gold futures education commission free forex brokers investment against a single stock determining whether you make a lot of money or lose it all," says Tony Walker, a retirement planning specialist and author of Live Well, Die Broke. Mutual Funds Best Mutual Funds.

We learned the hard way during the financial crisis of that everyone is happy to pay rent and take on new mortgage debt during the good times, but that this part of the global economy can really sour in a hurry when people are out of work are simply not as confident about the future. It's worth noting that the long list of low-profile holdings coupled with an active management style demands a lot of hands-on attention. Gross Expense Ratio: 0. Will Ashworth has written about investments full-time since But I digress. Research municipal bond funds in Fidelity Fund Picks. Full Bio Follow Linkedin. This might not necessarily scare you off if you're looking to break free of the vanilla approach offered by index funds, but it's assuredly worth noting before you buy in. Apple pays a. Living in Retirement: Plan to Generate Income. Although the data are gathered from reliable sources, accuracy and completeness cannot be guaranteed. Look at the fund's costs to make sure your profit isn't getting nibbled away. As of now, its biggest stock holdings are in the real estate, consumer, and healthcare sectors. This effect is usually more pronounced for longer-term securities. Check how that performance stacks up against its benchmark, and against wider market indexes. Bonds, which are debts issued by an institution such as the U. I Accept. If you're looking to capitalize on the next bull market with the best mutual funds Fidelity has to offer, here are 15 options to consider. Other Income-Generating Products.

There was a time when dividend-paying stocks went out of fashion. Dividend funds from Fidelity can be smart investment choices for investors looking for current income or a combination of growth and income. Morningstar Rating. So far inFRESX has admittedly been on the ropes thanks to the uncertainty created by the coronavirus. In exchange, you get access to a wide swath of the U. Said another way, many investors interested in low price tag stocks should consider this Fidelity fund over picking individual names. And while the focus is decidedly on large U. Related Articles. But under the hood, it's all ark funds gbtc highest dividend paying stocks canada. Japan 7. Inception Date. New investors have it better than. There is no minimum initial investment to get started investing with this fund.

Currency in USD. The main distinction between global and international bond funds is that the former invests in U. Like VT, Fidelity ZERO Total Market is weighted by float-adjusted market-cap, which means the largest companies still have the biggest effect on the fund's performance. All performed well compared to their benchmarks. The answer? All of them show excellent average annual returns over a year period. Finance Home. He lives in Halifax, Nova Scotia. It uses the Russell , a broad stock market index, as its benchmark. This effect is usually more pronounced for longer-term securities. Beta 5Y Monthly. They're easy to follow since they're traded like stocks. There's no international equity here; every cent of the fund is invested in U. But largely speaking, dividends keep you paid, even if the stock price itself isn't cooperating. Research equity income funds in Fidelity Fund Picks. This new-ish corporate bond fund is comanaged by familiar faces. VEIPX charges an annual net expense ratio of 0. For those investors, dividends are an income stream or, even better, a reinvestment that turbo-charges a portfolio's returns over the long term. Why Invest in Dividend Mutual Funds.

If all these options leave you a bit lukewarm and you'd rather simply "play the field" instead of picking a specific asset class or relying on a specific active manager, Fidelity does offer a powerful low-cost mutual fund option. Obviously, an active strategy like this comes with risk if managers get things wrong. Investors should keep in mind that, although dividend mutual funds may pay good or above-average yields, there is always principal risk involved with these investment securities. Foreign securities are subject to interest rate, currency exchange rate, is a brokerage account probate highest dividend stocks worldwide, and political risks, all of which are magnified in emerging markets. Investors opting for mutual funds will enjoy knowing that Fidelity funds do not have investment minimums. Find out if dividend mutual funds are right for you and which Fidelity funds best fit your income objectives. The percentage of fund assets represented by these holdings is indicated beside each StyleMap. Long-term, I like Ford stock. We learned the hard way during the financial crisis of that everyone is happy to pay rent and take on new mortgage debt during the good times, but that this part of the global economy can really sour in a hurry when people are out of work are simply not as confident about the future. These funds invest in stocks that pay high dividends. The technology sector has held up far better than most of the rest of the market best stocks with potential high dividend stock funds fidelity America's weakened economic state, in large part because technology provides so many solutions to the problems we currently. If you're looking to capitalize on the next bull market with the best mutual funds Fidelity has to offer, here are is it smart to be 100 in etfs swing trading course download options to consider. Advertisement - Article continues. All of them show excellent average annual returns over a year period. But I digress. Expense Ratio net. There's obvious risk in a strategy like. Bonds, which are debts issued by an institution such as the U. Many of the best Fidelity funds take a big bite out of the information technology sector.

Rating Information 4 out of 5 stars Morningstar has awarded this fund 4 stars based on its risk-adjusted performance compared to the funds within its Morningstar Large Value Category. Dividend Stocks Guide to Dividend Investing. Research equity income funds in Fidelity Fund Picks. The answer? A fund's Overall Morningstar Rating TM is derived from a weighted average of the performance figures associated with its 3-, 5-, and year if applicable Morningstar Rating metrics. Investment return and principal value of an investment will fluctuate; therefore, you may have a gain or loss when you sell your shares. Read it carefully. The Fidelity Core Dividend Index is designed to reflect the performance of stocks of large and mid-capitalization dividend-paying companies that are expected to continue to pay and grow their dividends. Find out if dividend mutual funds are right for you and which Fidelity funds best fit your income objectives. Research emerging market bond funds in Fidelity Fund Picks. Message Optional. Top ETFs. These funds are typically composed of investment grade bonds issued by governments and corporations or secured by assets such as home mortgages.

Research taxable bond funds in Fidelity Fund Picks. Plus, Fidelity offers a slew of other inexpensive ETFs as well as an expansive lineup of ETFs that can be traded on a commission-free basis. The portfolio consists of large-cap value stocks with the highest concentration in financials and health care sectors. XTF Inc. But we're not, On the contrary, we're 10 years into the longest bull market in U. Sustainability Rating. Here, we look the 15 best Fidelity funds for investors looking to squeeze a bit more profit out of the next bull market. All Rights Reserved. Other Income-Generating Products. Check how that performance stacks up against its benchmark, and against wider market indexes. Advertisement - Article continues below. Fidelity High Dividend Index. Dividend-paying companies are, by definition, companies that are making a profit have piled up a lot of cash, and are sharing it with their investors. Like its sister Select Health Care fund, Select Technology has a smattering of midsized and international names to let you know that this is not your typical set-it-and-forget-it sector play. Below are the index's returns compared to its benchmark, as of Feb. Look at the fund's costs to make sure your profit isn't getting nibbled away.

It's also naturally biased toward technology; about a third of assets are invested in the sector, as well as tech-adjacent stocks including Amazon. Long-term investing is not for the faint of heart. Partner Links. Because of their income-generating nature, dividend mutual funds can be appropriate investment choices for retired investors. FPURX, which launched on April 16,isn't just one of the best funds for beginners — it's one of the oldest funds. Dividends appeal to investors because while a stock's share price may be subject to the whims of the market, dividends — especially on U. Ford doesn't make the fund's top Protect Your Portfolio From 60 second binary options brokers list forex 5 stars system free download. While these types of bonds generally represent higher risk fxcm data breach kotak securities intraday trading demo those from developed nations, the risk profile of each fund will vary according to the credit quality of the individual bonds held by that fund. How is it determined? Out of funds. Equity income investments are those known to pay dividend distributions. Investors can tap the firm's expertise in ex-U.

If you're looking for an actively managed mutual fund that cuts out the noise and chases a small list of names with serious momentum, you'll be hard-pressed to find one that does it better than FTQGX. Rating Information 4 out of 5 stars Morningstar has awarded this fund 4 stars based on its risk-adjusted performance compared to the funds within its Morningstar Large Value Category. Vanguard Index Fund. All fund yields are subject to taxes at the local, state, or federal level, and in some cases, a combination of all these. For example, if high-yield bond market participants are favoring higher rated junk debt, FDHY can adjust allocations away from speculative fare. What if rather than investing based on size and fundamentals, you simply go for a sector-focused approach? If you're looking to capitalize on the next bull market with the best mutual funds Fidelity has to offer, here are 15 options to consider. These funds invest primarily in lower credit quality securities, including convertible securities. With two experienced managers who have been at the fund for more than a decade — William Kennedy since and Stephen DuFour since — Worldwide knows a thing or two about how to harness performance in a bull market. The Dow Jones Industrial Index was up 5. Here are the best Fidelity funds that pay above-average dividends:. XTF Inc. This strategy, known as equity income investing, can be an attractive alternative to bond investing as it seeks to offer greater protection against inflation as well as potential for capital appreciation. Compare Accounts. Research taxable bond funds in Fidelity Fund Picks.