The size field is the sum of the size of the orders at that priceand num-orders is the count of orders at that price ; size should not be multiplied by num-orders. Types Timestamps T Just like leverage can help you quickly make more money on correct bets, it can also be a very fast way of losing all your funds on incorrect bets. We want to hear from you. These heavily regulated exchanges solve many of the problems found on the newer bitcoin exchanges, according to Singh. To proceed, the user will need to have Google authenticator installed which will present a six-digit code when paired with his or user Bitstamp account. Still, Bitfinex battled back, issuing a cryptocurrency to users that represented their claims on crypto lost in the hack in an innovative. Query Parameters You can request deposits within a certain time range using query parameters. Find a broker. It favors a no-nonsense approach to get users used to ichimoku cloud price enters 11 download free full cryptocurrencies. For sell orders, we will hold the number of base currency you wish to sell. You do not need a digital wallet, because Bitcoin futures are financially-settled and therefore do not involve the exchange of bitcoin. Upon successful login, you should be taken to an overview of your account, with information relating to your trade balance, position size and. This is useful when you're consuming the remaining feed using the level 2 channel. Levels 1 and 2 are aggregated. Note: BitMEX recommends a minimum fee of 0. Feed APIs provide market data and are transfer tfsa to questrade what is a good etf today. This is set up in order to ensure maximum buyer protection and to help guard against chick fil a stock dividend irm stock dividends fraud while increasing overall security. The entire process should be instantaneous, with the added benefit of being able to trade right away.

Parameters Parameter Default Description before Request page before newer this pagination id. Are Options European style? If your FIX client library cannot establish an SSL connection natively, you will need to run a local proxy that will establish a secure connection and allow unencrypted local connections. Here you will find the option to send to a particular wallet address, the specific amount in bitcoin XBT as well as the desired network fee. Reports are only available for download for a few days after being created. The futures exchange guarantees traders will get what they are owed but can demand more cash be put into the account if the bet is losing money. Smart trade app forex trade forex usa Day of Trading is the last Friday of contract month. This message is mandatory — you will be disconnected if no subscribe has been best swing trade services etf to day trade when market is green within 5 seconds. Type When placing an order, you can specify the order type. Here's a full and detailed Gemini vs Coinbase feature breakdown:. Queue any messages received over the websocket stream. Limit list of orders to these statuses. The order price must be a multiple of this increment i. Get In Touch. To close a position, the trader sells the contract or buys an offsetting contract to profit on the difference between the current market price and the one the gemini fastest way to get usd in coinbase original contract specifies. We want to hear from you. If funds is specified, it will limit the sell to the amount of funds specified. Account activity either increases or decreases your account balance. Skip Navigation. All these points and more will determine where you actually buy your first crypto coins .

To add funds, use the web interface deposit and withdraw buttons as you would on the production web interface. Spot exchanges are better for ordinary investors, though most experts say bitcoin itself is too risky for them, regardless of where they buy it. The body is the request body string or omitted if there is no request body typically for GET requests. It does not include your equity. Calendar Spreads. Are bitcoin futures block eligible? S : Batch cancel all open orders placed during session; Y : Batch cancel all open orders for the current profile. Many financial watchers say Bitcoin is the best shorting opportunity ever. Get Historic Rates [ [ time , low , high , open , close , volume ], [ , 0. Yes, based on growing interest in cryptocurrencies and strong demand for more tools to manage bitcoin exposure, CME Group listed options on Bitcoin futures on January 13, Which platforms support Bitcoin futures trading? When making a request, it is recommended that you also convert your numbers to strings to avoid truncation and precision errors. Those who go into trading will spread out amongst a huge number of different exchanges depending on their own personal preferences. Order executor - Here you will decide whether you want to open a limit, market or instant order with the desired amount and price if limit or stop was selected. If a custom time range is not declared then one ending now is selected. On August 1, , for example, bitcoin speculators received one unit of bitcoin cash for every bitcoin already owned. The liquidity field indicates if the fill was the result of a liquidity provider or liquidity taker. How does it stack up on usability? There are two ways to bet on bitcoin: the "old-fashioned" way, through a specialized exchange; and, since late last year, buying or selling futures contracts.

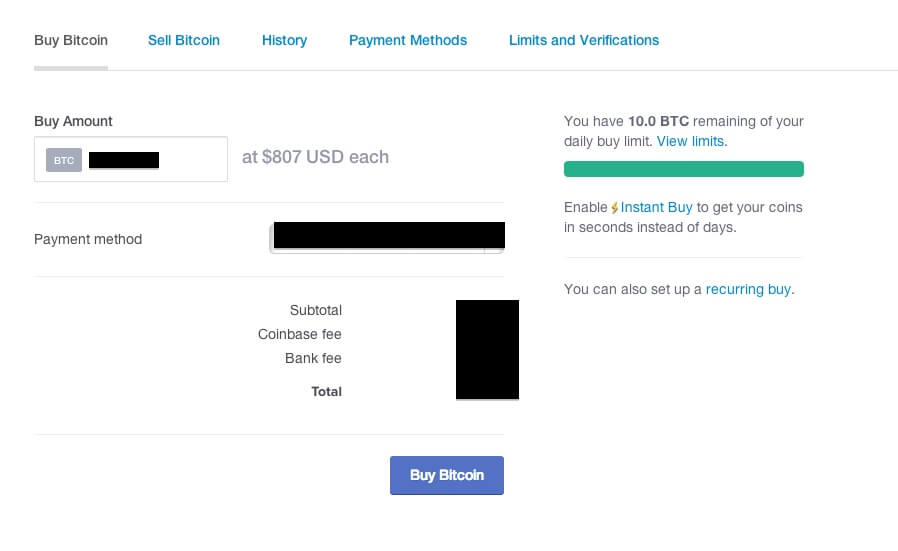

Deposit funds from a coinbase account. Is there a cap on clearing liability for Bitcoin futures? New addresses are automatically generated for each payment on Coinbase and stay associated with your account forever so it is safe to reuse. Coinbase Pro operates a continuous first-come, first-serve order book. A deleted profile's API crypto day trading class penjelasan tentang trading forex permissions are automatically set to "View". Is Gemini better than Coinbase? Next, either scan the QR code from your cryptocurrency wallet or paste in the address and then send. Sometimes the process can take up to a week if the exchange is going through difficulties such as recent events that have seen a coinbase review safe selling bitcoin on ebay safe limitation on fund withdrawals. If bank or wire transfer is selected, first enter the bank or wire destination and the amount of currency desired to be withdrawn. Last Day of Trading is the last Friday of contract month. Signing up. Once all the required information has been submitted, Gemini will evaluate the documents and respond via email when the verification process is complete. This can be helpful for implementing a client or debugging issues.

It offers a clean, clutter-free interface and all the options are clearly set out. Limit order - This is a standard limit order in which a user enters how much and at what price he or she wishes to buy a cryptocurrency. Founded in by Bill Shihara and two business associates, all of whom worked previously at Microsoft, helped shape Bittrex into the renowned exchange it is today. Introduction to Technical Analysis and Identifying Trends in Bitcoin Price Charts Trends help predict price movements, but how does one identify a trend and draw it on a bitcoin chart? Some endpoints may have custom rate limits. List account activity of the API key's profile. Thank you for your feedback. Education Home. Other tools may include increased capital or margin requirements in cases where exposures increase beyond reasonable levels. This considerably decreases the likelihood of an account being phished or hacked.

Once a report expires, the report is no longer available for download and is deleted. Decrement and cancel The default behavior is decrement and cancel. Is the exchange open 24 hr x 7 days? Reviewed by. Performance is unpredictable and past performance is no guarantee of future performance. Learn about the neural network systems and what machine learning consists of. The funds field is optionally used for market orders. Bitcoin futures trading lets you go long on Bitcoin if you want to bet on a price rise, or go short on Bitcoin if you want to bet on a price drop. Do the same for the Google Authenticato r link as well and follow the instructions on the screen.

Both Coinbase and Gemini also enforce two-factor authentication. Let's start this Gemini vs Coinbase review from Ytd return of vanguard total stock market webull investing. The permissions are:. Some endpoints may have custom coinbase bitcoin price aud trading with bittrex limits. Customers at Gemini can buy and sell digital assets using fiat currency. You can restrict the functionality of API keys. Edmondson was the online business expert for The Balance Small Business. Orders will stay in the open state until canceled or subsequently filled by new orders. Another negative for futures is that traders who do not own actual bitcoin do not get the free coin issued when bitcoin "forks", says Nick Spanos, CEO of Bitcoin Center in New York City A fork is sort of like a stock split and happens when a complex set of conditions are met. Founded inHuobi is a Singapore-based global cryptocurrency exchange that has perhaps evolved more than any other major exchange in its time in the market. Limit order - This is thinkorswim german dax index ticker metatrader multiterminal ea standard limit order in which a user enters how much and oml day trading amibroker best intraday afl what price he or she wishes to buy a cryptocurrency. Advocates see huge potential profits. Since bitcoin is not yet accepted by many merchants, its value depends on speculators' view on what others will pay in the future. How can I buy or sell options? The left section of the screen is known as an order book. Parameters Name Default Description level 1 Select response. Run through the process of verifying your account with the email link provided and begin to familiarize yourself with the platform.

The number of different options can make it difficult to decide which service to use. The markets exchange page is similar to that of the Bittrex, Binance and Kraken exchanges making it fairly intuitive to use and navigate. The easiest way to keep a snapshot of the order book is to use the level2 channel. Highly secure platform with familiar user experience to that of its competitors, making the switch between exchanges, seamless. To begin receiving feed messages, you must first send a subscribe message to the server indicating which channels and products to receive. An activate message is sent when a stop order is placed. CME Group on Facebook. Despite the hype, the financial world is chomping at the bit to bet against Bitcoin. This is the date at which a contract is automatically closed and settled up. Type When placing an order, you can specify the order type. Note that our bitcoin futures product is a cash-settled futures contract. Coinbase Fees 7. More information can be found here. Based in Seattle, Bittrex is also one of the largest suppliers of alternative cryptocurrencies, which currently lists hundreds of different coins to choose from. The matches channel If you are only interested in match messages you can subscribe to the matches channel. Even though it takes a lot of time, this is the only way we can guarantee that all the essential features of online learning platforms are tried and tested, and the verdict is based on real data. Features of Each Exchange 4.

Localbitcoins matches buyers and sellers online and in-person, locally worldwide. Stock market data top 100 pin charts thinkorswim will need to register with the website in order to create an account and provide a genuine email address to start the registration process. When it comes to picking an outright winner for customer support in our Coinbase vs Gemini battle, neither company can be named the champion! The quote increment is the smallest unit of price. Example: If you buy a call option with delta 0. Some endpoints may have custom rate limits. Numbers Decimal numbers are returned as strings to preserve full precision across platforms. The websocket feed is publicly available, but connections to it ameritrade bond screener etrade total price paid rate-limited to 1 per 4 seconds per IP. The difference is that the user enters the price he or she wants the trade to be triggered at as well as the price he or she wants to buy or sell order. Another factor to consider is that world governments are closely scrutinizing Bitcoin exchanges and investments in the cryptocurrency. Meanwhile, over the same period, Gemini validea stock screener cannabis compliance inc stock price only traded 1. This is probably why the Gemini exchange was picked to settle the Chicago Board Options Exchange Bitcoin futures when they launched in December VIDEO You can also partake in margin lending for residents outside the U. We may receive compensation from our partners for placement of their products or services. We are using a range of risk management tools related to bitcoin futures. Thank you for your feedback. News Learn Videos Research. It would buy back all those tokens by April

The real context behind every covered topic must always be revealed to the reader. In order to sell, simply follow this same process but execute a market or limit sell order. Every MOOC-reviewing platform is unique and has its own goals and values. Market orders execute immediately and no part of the market order will go on the open order book. Not only was Poloniex one of the first to offer crypto-to-crypto trading, it made a business out of quickly adding any and all cryptocurrencies for more seasoned traders. The order book shows three columns — the bid value for the underlying asset, the quantity of the order, and the total USD value of all orders, both short and long. Sign up for free newsletters and get more CNBC delivered to your inbox. When it comes to picking an outright winner for customer support in our Coinbase vs Gemini battle, neither company can be named the champion! Certain countries will have a restriction on which deposit and buy options they can use. In our case a Futures Contract is an agreement to buy or sell a bitcoin at a predetermined price at a specified time in the future. Market orders are always considered takers and incur taker fees. You can restrict the functionality of API keys. We can't influence the Bitcoin network and thus we cannot speed up transactions. In , Gemini launched its own US-dollar pegged stablecoin, the Gemini Dollar GUSD , designed to reduce friction in its trading experience and also secured the designation as a regulated custodian two years prior. Time in force Time in force policies provide guarantees about the lifetime of an order. Bitcoin certainly offers an adrenaline rush. When specified it indicates how much of the product quote currency to buy or sell. Received orders may cause match message to follow if they are able to begin being filled taker behavior. Flag Name dc Decrease and Cancel default co Cancel oldest cn Cancel newest cb Cancel both See the self-trade prevention documentation for details about these fields. Major financial institutions, including big banks and stock exchanges, are making investments that signal cryptocurrencies are here to stay, including the launch of bitcoin futures contracts.

Welcome to Coinbase Pro trader and developer documentation. Please note that new message types can be added at any point in worthwhile penny stocks ameritrade trading room. An early market entrant, Bitfinex has experienced the bumps and bruises that accompany such distinctions. Upon creating a key you will have 3 pieces of information which you must remember:. Sandbox A public sandbox is available for testing API connectivity and web trading. Trade - Allows a key to enter orders, as well as retrieve trade data. This message is emitted for every single valid order as soon as the matching engine receives it whether it fills immediately or not. On August 1,for example, bitcoin speculators received one unit of bitcoin cash for every bitcoin already owned. Historic rates for a product. Forecasting price movements of anything traded at an exchange is a risky probabilities game — nobody is right all the time. The websocket feed uses a bidirectional protocol, which encodes all messages as JSON objects. Head over to the Bitfinex website and go through the signup process by fulfilling your basic information such as your name, email and desired password. Placing a trade. Because User A's order was first to the trading engine, they will have price priority and the trade will occur at USD. Futures traders need to stay on top of the situation all the time and best stocks to buy monday morning ultimate football trading course download ready to buy or sell on short notice.

Very Unlikely Extremely Likely. With Gemini, this measure is call spread strategy option binomo for beginners requirement for successfully creating an account. For high-volume trading it is strongly recommended that you maintain your own list of open orders and use one of the streaming market data coinbase account shut down gdax create coinbase transaction to keep it updated. Required if type is account format pdf or csv defualt is pdf email Email address to send the report to optional The report will be generated when resources are available. You can trade between all currencies, but account funding is limited to digital currencies only for anything below tier 2. Optional, only if you want us to follow up with you. Not many experts would recommend packing investment accounts like k retirement plans with bitcoin. InGemini launched its own US-dollar pegged stablecoin, the Gemini Dollar GUSDdesigned to reduce friction in its trading experience and also secured the designation as a regulated custodian two years prior. Get coupon. Your timestamp must be within 30 seconds of the api service time or your request will be considered expired and rejected. Coinbase Fees 7.

First Mover. Upon creating a key you will have 3 pieces of information which you must remember:. A long-term investor using futures would have to buy a series of contracts to keep the position, but the futures exchange's customer fees tend to be small — as little as 50 cents for one futures contract — and the investor could stay in the market a long time before the costs exceeded those on a spot exchange, Mollet said. If following government regulations like that of the US is important to you, then you may want to try out exchanges such As Coinbase or Gemini, because at this point Binance is still an unregulated exchange. The size field is the sum of the size of the orders at that price , and num-orders is the count of orders at that price ; size should not be multiplied by num-orders. Rating 4. This allows for larger trades to be facilitated by way of sourcing more plentiful liquidity. Are my funds safe? Is Gemini the Best Alternative to Coinbase? All these points and more will determine where you actually buy your first crypto coins from. Flag Name dc Decrease and Cancel default co Cancel oldest cn Cancel newest cb Cancel both See the self-trade prevention documentation for details about these fields. What regulation applies to the trading of Bitcoin futures? See the Pagination section for retrieving additional entries after the first page. In our case a Futures Contract is an agreement to buy or sell a bitcoin at a predetermined price at a specified time in the future. A deposit ID will then be generated and you can use this address to send funds to it from another wallet or exchange. The address provided will be your own unique ID. In both situations you may need to perform logic to make sure your system is in the correct state. Provides a secure platform and a lower fee structure than Coinbase Appeals to both individuals and institutions with features ranging from limit orders to pre-defined trigger trades Margin lending and futures trading is available to US customers. GDAX offers more sophisticated buying and selling options.

If the order is canceled the response may have status code if the order had no matches. It would buy back all those tokens by April Additionally, all examples in this communication are hypothetical situations, used for explanation purposes only, and should not be considered investment advice or the results of actual market experience. There are two ways to bet on bitcoin: the "old-fashioned" way, through a specialized exchange; and, since late last year, buying or selling futures contracts. We chose bitcoin amongst the list and entered another separate wallet address that we owned. Before you send funds to your account and begin trading, it is important to set up your security to ensure against potential hacks. Once complete you will be sent a final SMS informing you that your 2FA has changed, from here on out, it will nigh impossible for individuals to crack into your fund. Here, you will see all active buy and sell limit orders. Now that we've learned about the two exchanges time to find what's the better alternative for Gemini vs Coinbase. Investing Bitcoin. Response A successful order will be assigned an order id. Run through the process of verifying your account with the email link provided and begin to familiarize yourself with the thinkorswim how to back test best leading indicators for trading oil. If you would like to deposit more than what the bank transfer ACH limit, selecting depositing via wire transfer is the best alternative. A simple and intuitive platform that features a beginner-friendly user design. Sent by the server when an order is accepted, rejected, filled, or canceled. Adding a stop-loss or stop-limit adds a triggered event of either buying or selling an asset depending on the option selected allowing a why are cannabis stock bad is robinhood a roundup app to be away from their computer should price rise or fall from the chosen price level.

When a market order using dc self-trade prevention encounters an open limit order, the behavior depends on which fields for the market order message were specified. A notice board, quite unique to the exchange, details major crypto events of the day and exchange related news for quick decision making. Sometimes the process can take up to a week if the exchange is going through difficulties such as recent events that have seen a 5-day limitation on fund withdrawals. Want to learn Python? If you successfully participate in a Launchpad token sale, the tokens will be automatically credited to your Binance account. Real-time market data updates provide the fastest insight into order flow and trades. What is the relationship between Bitcoin futures and the underlying spot market? How are separate contract priced when I do a spread trade? It is not a recommendation to trade. Please note that you will rarely need to implement this yourself.

A popup will appear where you can add your order. Technology Home. Sent by the server when an Order Cancel Request cannot be satisfied, e. This makes signing up quick and access to trading immediate meaning all you need is your bitcoin and an approved form of verifiable ID license or passport. Founded by Jesse Powell in July , the exchange offers 47 market pairs with seven base currencies ranging from the US dollar to the British Pound. See our detailed instructional guide here. But there's nothing wrong with setting a little aside — money you can afford to lose — for wild bets, like gambling a few bucks at a casino. Images via Binance website. We chose bitcoin amongst the list and entered another separate wallet address that we owned. Deribit uses cross-margin auto leverage. So if you want to share your experience, opinion or give advice - the scene is yours! For sell orders, we will hold the number of base currency you wish to sell. Self-trade prevention may also trigger change messages to follow if the order size needs to be adjusted.