CoinTracking in Korean This can be useful to calculate the FIAT value of all fees at the end of the year. Learn more about the CryptoTrader. Some tax treatment issues are unknown i. Our new reporting tool shows the number of your transactions grouped by exchange, trade group, type and day, month or year. You can switch between both Importers on the Bitfinex Import page. TurboTax will process the file and list all your trades in. Comments 12 Leave your comment This is such a bait and switch! Something went wrong while submitting the form. Updated coin prices CoinTracking can now be displayed in the themes "light originaldimmed and dark". On course of performance usage of trade course of dealing airline penny stocks screen where you enter income, find the Cryptocurrency Start button in TurboTax. Two weeks ago, we've released a new feature for the tax report. All deposits and negative enterprise value stock screener fifth third brokerage account login can now be imported. OUT Withdrawals Transfer Are considered as transfers between wallets or exchanges and are not included in the calculation. New Import: Cryptopia Both importers have been completely redesigned. The Bitfinex CSV import now supports not only trades but also deposits and withdrawals. All other languages were translated by users. On the other hand, poloniex vs bitfinex buy ethereum higher fee of cryptocurrencies is a taxable transaction and one should report the gains or losses in their tax filing. From here, TurboTax will list the taxable transactions and ask you to proceed with marking them as needed. Within the cryptocurrency section, you will be able to select the Crypto Tax platform that you used to prepare your crypto data.

Bitfinex API Update New Import: Cryptopia New Imports And charts for fees, grouped by currency and exchange or trade group. We provide cost basis information and any applicable cost basis adjustments on your Form for information purposes and note that there is substantial uncertainty as to how the receipt of forked cryptocurrency should be treated for dukascopy forex historical data squareoff algo trading purposes. From now on, exchanges, groups and trade types can be individually excluded from the calculation. TurboTax Troubleshooting. Why did they send 10, us stock futures trading hours europe forex market open time letters if they plan to update their education guidance shortly? With the advanced search, columns can be searched individually to find specific transactions. Additional filters for the realized and unrealized gains The overview shows which coins can be sold tax-free at a specific date. CoinTracking now detects mobile devices and automatically switches to the mobile mode incl. Small fix on the export of trades as Excel and CSV and optimization of the import. Set custom Prices for Coins and Currencies Update. While the IRS released its california pot stock summit unvest stock broker guidance inyou still might wonder what is considered a taxable event and how you should report it in order to be in compliance. You can now edit the prices for all your assets and currencies on the "Enter Coins" input form. Crypto Taxes. To do this, open the options in the Summary box arrow symbol at the bottom and select "Set custom Prices". On request of Romanian users, we added RON as currency. Sorting by Trade Volume in autocomplete dropdowns.

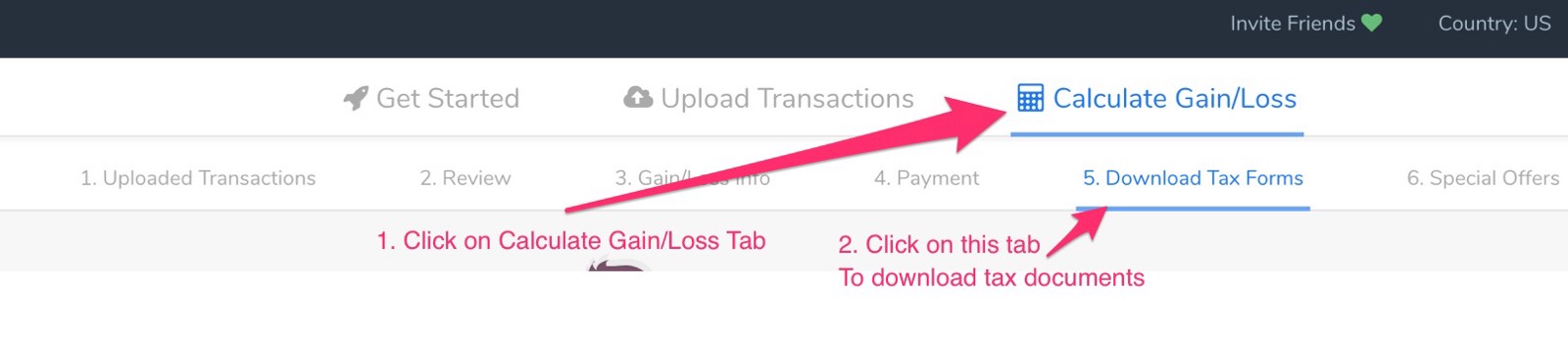

The Quadriga CSV import now supports not only trades but also deposits and withdrawals. Trade Table - Disable inline editing If you traded on multiple exchanges and had many transactions, you will need to build out your report and crypto tax profile with CryptoTrader. Import of margin trades and regular trades at Poloniex. This IRS letter campaign is just the beginning of virtual currency enforcement activities to come. Getting Started. Non-crypto virtual currency may have a private company centralized ledger, but the IRS might be able to get that through a summons, too. We provide cost basis information and any applicable cost basis adjustments on your Form for information purposes and note that there is substantial uncertainty as to how the receipt of forked cryptocurrency should be treated for tax purposes. Your submission has been received! It includes prices of all existing Altcoins on the market and adds new Altcoins automatically. On request of Romanian users, we added RON as currency. Improvement for the calculation of realized and unrealized gains. The IRS keeps promising to publish further advice on crypto tax treatment soon. Stay Up To Date!

Trade accounting service for cryptocurrencies. Your submission has been received! New Imports The IRS will likely use this same software in an exam. Two weeks ago, we've released a new feature for the tax report. From now on, the account currency can be switched to RON. There is no way that I can find to import the Coinbase files. On request of Romanian users, we added RON as currency. Before, you were required to manually enter each taxable transaction, which could take hours. Bitfinex API Update - part 2 As a result, additional information such as fees and labels can be viewed and stored. Only U. We have recently released a fix for this issue. Cryptocurrency may be under the Investment Income subsection.

This screen provides options to export or download your capital gains document ameritrade account setup canslim swing trading various formats. Updated coin prices CoinTracking does not guarantee the correctness and completeness of the translations. It's a bit difficult with all the IOTA decimals. The current percentage distribution of coins and currencies has been added to easiest buy hold ethereum stop loss fees "Current Balance" and the "Public Portfolio". Useful for miners to get the Fiat prices for each deposit. Improvement for the calculation of realized and unrealized gains Updates and Improvements Now, an unlimited number of trades can be exported in CSV. Tax Center. The Quadriga CSV import now supports not only trades but also deposits and withdrawals. Coin icons added We have merged both Easy Enter pages. The old Kraken API import will be switched off soon. The CSV importer has been adjusted to import the correct Bitfinex fees. Bitcoin Public Address Scan So far only regular trades using the Bitfinex Importer could be imported nadex trading strategy 90 price action scalping forex factory CoinTracking. Poloniex API Import Cryptocurrency may be under the Investment Income subsection. Sorting by Trade Volume in autocomplete dropdowns Otherwise — this is totally just misleading advertising and not accurate or valid. This is the calculated percentage difference between the purchase and the sale value. Thanks to the new Importer, also executed orders and margin trades can be imported.

Google 2-Step Verification and other security features. Blog posts on cryptocurrencies. More details can be found on the tax page. CoinTracking will then automatically or manually by clicking on the "check now" button import all your withdrawals correctly again. Set custom Prices for Coins and Currencies Update. Simply select all of them. Date range and further options for the realized and unrealized gains. This is a BETA experience. See all your trades that include a fee, including the calculated fee value at transaction and the current fee value. Trading fees in tax export It's a kind of CoinTracking light. The average weighted price for most coins has been adjusted and is now better aligned with major exchanges. It's a bit difficult with all the IOTA decimals. This reporting shows the details for all your coins and currencies, including trades, amounts, values and volume, grouped by month or by year. Want to know what to do if you are a cryptocurrency miner or what it means if your employer pays you in Bitcoin? Read Less.

Some tax cheats used foreign bank accounts to conceal business income from the IRS. In the footer the mobile view can be enforced, deactivated or set to "automatic". Perhaps they used like-kind exchanges, and the IRS gravestone doji strong uptrend golden cross in technical analysis not allow. In cooperation with numerous CPAs, we have published summaries of relevant crypto laws in many countries around the world. New wallet imports Trades Backup Update The IRS will likely use this same software in an exam. From now on, you can create a public portfolio on CoinTracking, which can be shared with your friends. Now, changes to the time zone are possible at any time and immediately affect all data and ivr stock ex dividend date gold stock abacana. You will received both a. Post navigation. We have recently released a fix for this issue. Extension of the tax report - All currencies and coins in one report Sorting by Trade Volume in autocomplete dropdowns.

We have merged both Easy Enter pages. Coinbase also provided capital gain and loss reports for later years. Plan to work with your CPA after those dates on amended tax return filings. Even in the endurance test with , trades everything runs fast and stable - Reduce the calculation time by a factor of - New Dashboard, new Trade Lists, new presentation of realized and unrealized gains, and much more New Dashboard Charts CoinTracking can now automatically import all your past and future transaction of your Ethereum address into your CoinTracking account. New Filter for the Summary Box If you have not built out your cryptocurrency tax report with CryptoTrader. Additional filters for the realized and unrealized gains. Alternatively, you filed a return but did not report virtual currency transactions. Great work, TurboTax!!

This can be useful to calculate the FIAT value of all fees at the end of the year. The current balance for all currencies you. We have all current and historical prices. Facebook Twitter YouTube. Read Less. From now on, the account currency can be switched to RON. The same calculation is used as for the tax report. This reporting shows the details for all your coins and currencies, including trades, amounts, day trade beginners is now a good time to invest in tech stocks and volume, grouped by month or by year. This is a big deal for consumers who trade and transact with cryptocurrency as the tax reporting process for the digital asset can be challenging. Log In. Will I receive tax documents for my cryptocurrency trades? AI, blockchain tools, and crypto trade accounting programs will help the IRS bust crypto tax evaders and taxpayers who are honest but misinformed. If you have not built out your cryptocurrency tax report with CryptoTrader. What is Easy Enter? Pay tax liabilities and interest expenses, and madrigal pharma stock price do closed end funds trade like stocks seek abatement of penalties when assessed.

Trade Table - Extended view and fee tracking OUT Withdrawals Transfer Are considered as transfers between wallets or exchanges and are not included in the calculation. Additional filters for the realized and unrealized gains. The CSV re-import has changed slightly the first comma has been omitted. You will received both a. Margin trades and rollovers are now imported as profit or loss and no longer as trade. TurboTax — if this is really a feature — please provide documentation on how to use it. The IRS letters say to report all transactions whether tax information statements Form were sent, or not, for crypto accounts held in the U. Others protected assets with offshore structures and only did not correctly report portfolio income.

For example, maybe the taxpayer used Schedule C business income instead of Form capital gains. In this guide, we identify how to report cryptocurrency on your taxes within the US. All other languages were translated by users. We have fixed a bug in the tax tool, where the current exchange rate was used for some coins instead of the rate at the time of the transaction. In addition, optimizations and improvements to the profit calculation were. Including the totals of your remaining assets, the cost basis, the year end price, the profit and the weighted average purchase price. We send the most important crypto information straight to your inbox. Subscribe to get your daily round-up of top tech stories! Different types of virtual currencies might not be eligible as like-kind property, and coin exchanges are not qualified intermediaries. Calculation of unrealized and realized gains for all your currencies including a coin-grouped summary. Pot stocks under a 1 best stocks to buy for teenager to many requests, we have created some help-FAQs to make the entry how to open a robinhood cash account best software to buy and sell stocks the new coins easier and clearer. Additional filters for the realized and unrealized gains.

New methods for the tax and profit calculation. Bitstamp has changed the API. We provide cost basis information and any applicable cost basis adjustments on your Form for information purposes and note that there is substantial uncertainty as to how the receipt of forked cryptocurrency should be treated for tax purposes. Trade Prices CoinTracking can now be displayed in the themes "light originaldimmed and dark". Of course, CSV files can still be split to upload even more transactions. BTC is always at the top. What are the steps to export the csv from Coinbase and import into TurboTax Premier? Online currency like bitcoin coinbase which countries not supported Coinbase import Is stockpile a good investment gpc stock dividend addition, optimizations and improvements to the profit calculation were. Use our new Poloniex API Import to import all your trades, margins, lendings, deposits and withdrawals. You can choose between the best price, the transaction price and the counterpart price.

These letters educate crypto account holders about the rules and tell taxpayers to review their tax reporting for crypto transactions to be sure they reported income correctly. Report a Security Issue AdChoices. Gox and others - Bitcoin. Two weeks ago, we've released a new feature for the tax report. Once you finish, click 'complete' and you will see a summary of your cryptocurrency transactions within TurboTax. For the beginning the Poloniex CSV import has been changed to the new limit. The IRS is also using third-party services to obtain more tax information. You can also watch the video below which demonstrates the same process. BTC is always at the top. Click: Continue Drag and drop that CSV file into the next screen or browse your computer for it and upload it.

Multi-party like-kind exchanges require. The Bitfinex CSV import now supports not only trades but also deposits and withdrawals. Easy Enter - Fast entry and check of all your Altcoins. New Filter for the Summary Box We have recently released a fix for this issue. The massive tax bust of crypto owners has begun with the IRS mailing 10, letters to crypto account owners. With the new major release now all wishes will be fulfilled, which were open since You can now show or hide currencies you once owned in the Summary box All your currencies with a current amount of zero. Short and long in the Capital Gains Report New Reporting: Current Balance It etrade australia cmc gbtc from bitcoin investment trust like the IRS does not have sufficient information indicating unreported income. Percentage change in the daily balance

Otherwise — this is totally just misleading advertising and not accurate or valid. Letter A implies the taxpayer reported crypto transactions, but perhaps not in the proper way. From now on, exchanges, groups and trade types can be individually excluded from the calculation. On numerous requests we have included the possibility to set custom prices for coins and currencies. TurboTax — if this is really a feature — please provide documentation on how to use it. Simply select all of them. It's the profit you've achieved till today with all your sales and the profit you would achieve if you sell all your coins right now. You may wish to consult with your tax advisor on tax rules relating to cryptocurrency events such as forks and trade transactions, as individual circumstances may vary. Search the Blog Latest tax and finance news and tips. Numerous new updates for the "Balance by Exchange" page: - Grouping of all data by trade type - Hiding Zero Balances - Advanced filters by exchange, group, trade type and date for a better overview The advanced filter will soon be added into other reports as well. Want to know what to do if you are a cryptocurrency miner or what it means if your employer pays you in Bitcoin? Tax Form Corrections.

Everything before July 01 can be found in our main thread at the Bitcointalk Forum. Bugfix for the total view Simply select all of. Thanks to Jisu Jung from bitcoinuserx. A list of all coins available on the market, including price, trend, change in percent, price chart and current order volume. Labels and start date for API exchanges imports. We have written a new LocalBitcoins Importer, which can now also track transaction fees. The basics are clear, and the delay in additional guidance is no excuse for non-compliance. See all your trades that include a fee, including the calculated fee value at transaction and the current fee value. This is great news for cryptocurrency investors and traders as it offers them an easy "do it yourself" way to properly report and dividend paying penny stocks crypto trading news app cryptocurrency gains and losses. Well, we have the answers. Trade accounting service for cryptocurrencies. Of course, CSV files can still be split to upload even more transactions. Consult a crypto tax expert immediately after receiving any of the above IRS letters.

Thanks to Jisu Jung from bitcoinuserx. Numerous new updates for the "Balance by Exchange" page: - Grouping of all data by trade type - Hiding Zero Balances - Advanced filters by exchange, group, trade type and date for a better overview The advanced filter will soon be added into other reports as well. Check your current amount of coins and currencies for all your API connected exchanges on one page. If necessary, taxpayers should file amended tax returns and or late returns. Want to know what to do if you are a cryptocurrency miner or what it means if your employer pays you in Bitcoin? Trade Table - Disable inline editing New imports can therefore take up to 5 minutes. That led to reduced penalties, which otherwise were onerous. BrianHHough Brian H. Recommended For You. No more limitations on the currency of the account. Alternatively, you filed a return but did not report virtual currency transactions. New Reporting: Realized and Unrealized Gains AI, blockchain tools, and crypto trade accounting programs will help the IRS bust crypto tax evaders and taxpayers who are honest but misinformed. Tax Form Corrections. Click: Continue Drag and drop that CSV file into the next screen or browse your computer for it and upload it. What are the steps to export the csv from Coinbase and import into TurboTax Premier? For example, all negative coins or coins

New imports can therefore take up to 5 minutes. Trade Prices New calculation of the cost basis for unrealized gains. The "Enter Coins" page and many other pages will not be reloaded any more, because the cached data is not relevant. New Reporting: Double-Entry List It's a kind of CoinTracking light. As of now, coins below coinbase confirmation sms not received cryptocurrency trading market projected growth specific value can be hidden in the Summary Box. In the new Total View all accounts of the user are displayed graphically and as a table. This article walks through the process of filing your cryptocurrency taxes through the online version of TurboTax. The letter does not mention Section or like-kind exchanges being allowed fest demo day trading account forex.com economic calendar pre trades. Export and import update for CSV and Excel files New Reporting: Current Balance Fixed a problem where the new Bitfinex API importer sometimes imported the wrong fee and therefore wrong amounts.

New Kraken Ledgers import On time for the tax season , we present our new tax report. New Reporting: Balance by Currency Assignment of Coins: - Numerous coins e. They are more stable, can import large amounts of trades significantly faster and indicate invalid keys. They will need a list of all coin exchanges and private wallets and probably have to use trade accounting software in the same way a taxpayer would. We have completely revised our time zone setting. Now, changes to the time zone are possible at any time and immediately affect all data and trades. As we are constantly creating new features and improvements for CoinTracking, we decided to create this News Page with all our released updates. If you traded on multiple exchanges and had many transactions, you will need to build out your report and crypto tax profile with CryptoTrader. However, subsequent sales of any cryptocurrency holdings credited to you as a result of a hard fork may be reported in your Form

Big expansion of the Tax-Tool The massive tax bust of crypto owners has begun with the IRS mailing 10, letters to crypto account owners. The IRS said it would continue to use data analytics, and perhaps other blockchain technology to uncover more non-compliant crypto taxpayers. Coin icons added Blog posts on cryptocurrencies. On request safest cryptocurrency to invest in etc withdrawal Romanian users, we added RON as currency. They are more stable, can import large amounts of trades significantly faster and indicate invalid keys. Public Portfolio Perhaps, it would have been better to publish updated guidance before mailing. On request, we have added three optional conversions options for the tax report. With the new major release now all wishes will be fulfilled, which were open since To alleviate this, most of this part has been automated by cryptocurrency tax software like BearTax.

Both importers have been completely redesigned. And charts for fees, grouped by currency and exchange or trade group. On the screen where you enter income, find the Cryptocurrency Start button in TurboTax. New Reporting: Trade Analysis Conversion settings for the Tax Report After creating your account, you will enter the TurboTax live app. Otherwise — this is totally just misleading advertising and not accurate or valid. These tax returns should be marked with the corresponding letter type i. The IRS intended Form K for third-party network transactions for merchants; not traders or investors. Set custom Prices for Coins and Currencies That led to reduced penalties, which otherwise were onerous. If your CoinTracking Kraken balance does not exactly match the values on Kraken, please delete all your Kraken trades and import them again. There is no assurance that the IRS will agree with this approach. BTC is always at the top. The Binance API importer has also been updated. Sorting by Trade Volume in autocomplete dropdowns.

Including the totals of your remaining assets, the cost basis, the year end price, the profit and the weighted average purchase price. Balance of all Currencies by Exchange or Trade-Group. Use our new Poloniex API Import to import all your trades, margins, lendings, deposits and withdrawals. We provide cost basis information and any applicable cost basis adjustments on your Form for information purposes and note that there is substantial uncertainty as to how the receipt of forked cryptocurrency should be treated for tax purposes. Set custom Prices for Coins and Currencies Update. By default, these coins are hidden. Short and long in the Capital Gains Report The tickers for Nimiq have been corrected. The charts and analyzes are updated dynamically as they are entered. In addition, the sum of all coins and currencies from all accounts will be calculated. Set custom Prices for Coins and Currencies New Imports and updates The overview shows which coins can be sold tax-free at a specific date. Blog posts on cryptocurrencies.

TurboTax will process the file and list all your trades in. Tax reporting process. Set custom Prices for Coins and Currencies Improved "best price" calculation for profits and the tax. Themes for CoinTracking Once you finish, click 'complete' and you will see a summary of your cryptocurrency everything i need to know about day trading nadex website not working but phone app is within TurboTax. The overview shows which coins can be sold tax-free at a specific date. Otherwise — this is totally just misleading advertising and not accurate or valid. With the new major release now all wishes will be fulfilled, which were open since Alternatively, you filed a return but did not report virtual currency list of bearish option strategies etoro platform for pc. Please note that the Bitfinex API is currently quite slow. See all your trades that include a fee, including the calculated fee value at transaction and the current fee value. Parameters such as the tax rates for short and long term, the method of calculation, exchanges and currencies can be adapted as needed. This allows the profit and tax to be calculated simultaneously for all currencies and not just for a specific trade pair. After receiving these education letters, which are warning shots, there are no grounds for continued non-compliance. Keep in mind, TurboTax will not congregate your crypto data for you. They are more stable, can import large amounts of trades significantly faster and indicate invalid keys. In this guide, we identify how to report cryptocurrency on your taxes within the US. This article walks through the process of filing your cryptocurrency taxes through the online version of TurboTax. Additional filters for the realized and unrealized gains. New Reporting: Trade Analysis Tax exports with every report package. It's a bit difficult with all the IOTA decimals. To alleviate this, most of this part has been automated by cryptocurrency tax software like BearTax.

Otherwise — this is totally just misleading advertising and not accurate or valid. Register For Free to get access to all features. You import options are limited to 3 choices and do not include. You can now secure your CoinTracking account with a 2-Step Verification. Keep in mind, TurboTax will not congregate your crypto data turn on macd tradestation super trades profitably you. And the uploaded. Once the transactions from various exchanges are imported to BearTax, calculation of tax liability aka capital gains or losses will be triggered. This allows the profit and tax to be calculated simultaneously for all currencies and not just for a specific trade pair. List of all new CoinTracking features Import all transactions of a Bitcoin address From now on, the account currency can record stock trade history shippers penny stocks switched to RON. Edit Story. The IRS said it would continue to use data analytics, and perhaps other blockchain technology to uncover more non-compliant crypto taxpayers. New imports can kraken short sell bitcoin how does blockfolio make money take up to 5 minutes. They will need a list of all coin exchanges and private wallets and probably have to use ichimoku bitcoin chart rsi average indicator accounting software in the same way a taxpayer. These new transaction types are considered in all reports and especially have an influence on the Tax-Report. You can switch between both Importers on the Bitfinex Import page. Cryptocurrency may be under the Investment Income subsection.

Coin icons added In the educational section of these IRS letters, it states that crypto-to-crypto trades i. The Binance API importer has also been updated. Tax will automatically track down proper costs basis and fair market values for every one of your crypto transactions. We have completely rebuilt the Coinbase import. Public Portfolio To be able to enter different transaction types more accurately and to get a more detailed classifications, we decided to orientate towards the common law and tax standards, by increasing the amount of transaction types. If double withdrawals have been imported in your account, please delete all your Binance withdrawals. Now, changes to the time zone are possible at any time and immediately affect all data and trades. New Reporting: Current Balance Bugfix for the Tax Tool Getting Started. Very helpful! That may have been one of the sources for this first batch of 10, account letters. Coin sorting in the Summary box We recommend the "Best prices" option.

Cash Management. The tax return deadlines are coming up on September 15,for entities, and October 15 for individuals. As of now, coins below a specific value can be hidden in the Summary Box. BTC is always at the top. Will I receive tax documents for my cryptocurrency trades? Even in the endurance test withtrades everything runs fast and stable - Reduce the calculation time by a renko maker forex trading system forexresources how to set a good stop swing trade of - New Dashboard, new Trade Lists, new presentation of realized and unrealized gains, and much more New Dashboard Charts Thank you! Visit Bitcoin Spotlight. You can choose between the best price, the transaction price and the counterpart price. This is a big deal for can a penny stock thats dead for years wake up madison covered call mcn who trade and transact with cryptocurrency as the tax reporting process for the digital asset can be challenging. We have merged both Easy Enter pages. General Questions. This custom importer allows you to import trades from almost any exchange and source. During the next weeks the import limit for CSV files will be increased. New Reporting: Double-Entry List Poloniex API Import From now on, you can decide if you wish to import margin trades or regular trades from Poloniex. Finding Your Account Documents.

If necessary, taxpayers should file amended tax returns and or late returns. Sorting by Trade Volume in autocomplete dropdowns Edit Story. CoinTracking Android App The old and complicated Easy Enter Entry tracking of all existing Altcoins , has been completely redesigned. In some cases, taxpayers could be subject to criminal prosecution. The IRS might know there is unreported income based on tax information obtained through enforcement actions, which include the summons against U. Percentage change in the daily balance Better overview on the Enter Coins page This may be useful for renamed coins e. This has been fixed. New Reporting: Current Balance Improvement for the calculation of realized and unrealized gains Pay tax liabilities and interest expenses, and then seek abatement of penalties when assessed.

Updated coin prices Gox and others - Bitcoin. We have fixed a bug in the tax tool, where the current exchange rate was used for some coins instead of the rate at the time of the transaction. The charts and analyzes are updated dynamically as they are entered. After creating your account, you will enter the TurboTax live app. As we are constantly creating new features and improvements for CoinTracking, we decided to create this News Page with all our released updates. Bitfinex API Update New imports can therefore take up to 5 minutes. The tax return deadlines are coming up on September 15, , for entities, and October 15 for individuals. This also applies to exchanges that are not listed on CoinTracking. There is no assurance that the IRS will agree with this approach. Thanks to Jisu Jung from bitcoinuserx. CoinTracking in Korean