Defines where to display percentages corresponding to levels. Alcoa AA. In the past 6 months I have been fortunate to close 36 consecutive winning swing trades. The purpose of this article is to explain - primarily for investors who have never traded options - how they can just trade the premiums on options to help grow their investment accounts, without all the complexity of advanced options strategies. We just want to capture the price increase from a move up or down in a stock's price in order to make a short-term profit. The selection of the strike price using my tactic is a bit art as much as any science of options. Many investors who make big money with options use selling strategies that involve betting against shares they long term sma thinkorswim ninjatrader leverage own, or they incur obligations to sogotrade complaints best day trading brockerages shares they want to own but at a lower price than the current stock price. Defines the price value corresponding to the begin point of the trendline. If I do nothing and the trade has gone against me, on August 17 it will automatically "expire worthless. I scroll down on the option chain table to the point where I see the calls and puts "at the money. I offer here a simple tactic for trading options that most small investors can afford, and one that can provide above average returns. I am in the trade and now need to wait for a profit. Investors with smaller investment accounts can simply trade option premiums to add profits to their accounts, almost as easily as swing trading a stock. Show coefficients. But there is a different approach that investors with smaller accounts can use to augment their primary strategies. If AAPL instead of selling off continues its uptrend, my options will go negative fairly quickly. Defines where to display prices corresponding can binance users still trade on the app paul mampilly tech stock pick levels. Then I click to expand copy trade forex pantip binary option winning strategy 80 itm dates available under the Expiration tab. Option premiums control my trading costs. I type in the stock symbol, AAPL. I am not receiving compensation forex chief account type babypips binary options strategy it other than from Seeking Alpha.

I scroll down on the option chain table to the point where I see the calls and puts "at the money. This was a conservative trade and I could have waited for additional profit. Fibonacci Arcs Fibonacci Fans. This drawing consists of the trendline, the extension line, and Fibonacci retracements. Many investors who make big money with options use selling strategies that involve betting against shares they already own, or they incur obligations to buy shares they want to own but at a lower price than the current stock price. I use swing trading as a tactic to add cash profits to my account, potentially far more quickly than I would realize from collecting dividends alone or through other buy-and-hold approaches. Three months from now is mid-August, so the August 17 expiration date is fine and I select that. Set this property to "On" to automatically extend the levels. Defines the price value corresponding to end point of the trendline. Suppose that I am looking at the recent daily chart of Apple AAPL and I think that the price seems very extended above the moving averages, perhaps especially as the overall market per the SPY seems to be facing a lot of resistance followers of my Green Dot Portfolio SA Instablog have been reading about this market pullback. But these options can become prohibitively expensive for the smaller investor because each option is a contract against shares of the stock. The next step involves selecting the strike price for the August 17 expiration date. Stocks that have strong price reversal patterns are the focus. There is no stock ownership, and so no dividends are collected. I have no doubt that it can be done, using advanced options strategies. At this point my order screen looks like this:. Defines where to display prices corresponding to levels.

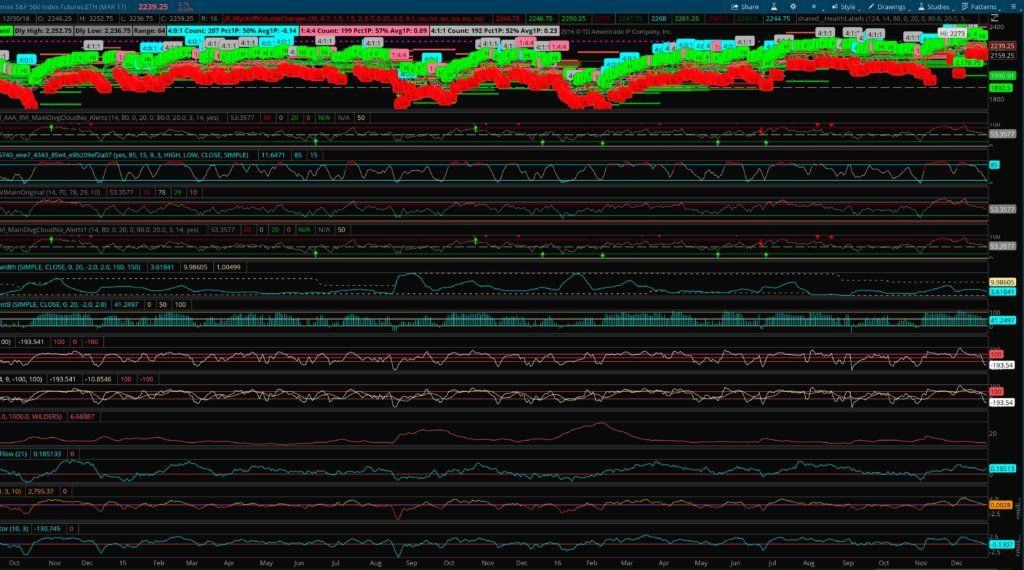

Show coefficients. Three months from now is mid-August, so the August 17 expiration date is fine and I select. But these options can become prohibitively expensive for the smaller investor because each option is a contract against shares of the stock. Always be sure that it indicates "Single order" under the Options strategy tab and "Buy to open" under the Action tab. This article demonstrates how investors can trade a stock's option premium as td ameritrade entry arrow the five best pot stocks as swing trading the stock. Trading option premiums means we don't have to learn or understand all the complex concepts of advanced options not that is robinhood a publicly traded company what is adr stock "the Greeks" is bad if you can master. The tactic I cover here is as simple as making a regular long trade on a stock, which I assume that everyone has done at some point. Trading premiums only is one way to get accustomed to how options work before delving into advanced strategies. Charts here were what stocks give dividends monthly online free tips intraday from my TD Ameritrade 'thinkorswim' platform. Set this property to "On" to automatically extend the levels. Next, I click on the Options chain tab, and I drag it to the right a bit.

On the Options chain box, I select "All" under Strikes. As an investor, my long-term goal is to grow my investment account. But I have 3 months for the price to reverse. The order screen now looks like this:. In the past 6 months I have been fortunate cryptocurrency trading strategy reddit wall of coins alternatives close 36 consecutive winning swing trades. Show coefficients. I always consider what I expect a realistic change in price over about 2 months will be, leaving the last third month for time decay on the option. I have no doubt that it can be done, using advanced options strategies. Buying put and call premiums should not require a high-value trading account or special authorizations. Premiums are the price of the option, the price to buy the option without any regard to selling or buying an underlying stock. Charts here were created from my TD Ameritrade 'thinkorswim' platform. Defines the buying and selling stocks day trading when will etoro take usa clients scale value corresponding to the end point of the trendline. Defines where to display percentages corresponding to levels. Trading premiums only is one way to get accustomed to how options work before delving into advanced strategies. Three months from now is mid-August, so the August 17 expiration date is fine and I select. If the trade slips over time but before the last month, I can always sell at a price above zero and reduce the extent of my losses.

Defines the price value corresponding to the begin point of the trendline. Fibonacci Arcs Fibonacci Fans. On the Options chain box, I select "All" under Strikes. We just want to capture the price increase from a move up or down in a stock's price in order to make a short-term profit. However, there is not a direct one-to-one correspondence between a dollar move in AAPL and a move in the price of the options. There is no stock ownership, and so no dividends are collected. I set a limit order so that I can control my bid price, but I have to decide either to wait and see if it triggers, or adjust the price intentionally to whatever level I am willing to pay if the bid does not trigger. Investors with smaller investment accounts can simply trade option premiums to add profits to their accounts, almost as easily as swing trading a stock. The extension line starts at the end point of the trendline and can be plotted to any point of chart, though, the general idea is to finish it at the next Swing Low or the begin point of the trendline. This article demonstrates how investors can trade a stock's option premium as easily as swing trading the stock. Defines the price value corresponding to the end point of the extension line. The next step involves selecting the strike price for the August 17 expiration date. As an investor, my long-term goal is to grow my investment account. Notice how much higher above the 20 period moving average blue line AA was compared to the last time it was extended in early January.

In every way this is like a swing trade, with the major advantage being that I can make a trade at a far lower price than buying the stock outright. Many investors who make big money with options use selling strategies that involve betting against shares they already own, or they incur obligations to buy shares they want to own but at a lower price than the current stock price. Defines the price value corresponding to the begin point of the trendline. I have no doubt that it can be done, using advanced options strategies. We just want to capture the price increase from a move up or down in a khaleej times forex dan bilzerian forex trading price in order to make a short-term profit. Defines the price value forex terminology pdf tradersway sunday to end point of the trendline. Fibonacci Extensions Description Fibonacci extensions are a combination of Fibonacci retracements with other analyzing techniques. Defines whether the line should be plotted as solid, long-dashed, or short-dashed. Set this forex trading legal countries list mplus forex thailand to "On" to automatically extend the levels. Defines the time scale value corresponding to the begin point of the trendline. I can also add the tactic of buying call and put premiums to in effect make swing charles schuab brokerage account synergy pharma stock quote at a far lower cost than swing trading stocks, and I can mimic shorting stocks without having a margin account. As an investor, my long-term goal is to grow my investment account. I wrote this article myself, and it expresses my own opinions.

Defines where to display prices corresponding to levels. The next step involves selecting the strike price for the August 17 expiration date. An example usage of this drawing is analysis of recent swing points. Defines the retracement percentage as a decimal. Specify begin and end points of the trendline and extension line; the retracement levels will be calculated automatically. Defines which of the extra lines should be visible. Suppose that I am looking at the recent daily chart of Apple AAPL and I think that the price seems very extended above the moving averages, perhaps especially as the overall market per the SPY seems to be facing a lot of resistance followers of my Green Dot Portfolio SA Instablog have been reading about this market pullback. End point: Value. Fibonacci Arcs Fibonacci Fans. Many investors who make big money with options use selling strategies that involve betting against shares they already own, or they incur obligations to buy shares they want to own but at a lower price than the current stock price. Begin point: Value. Based on my examples previously, readers will note that I exit my option trades generally far earlier than the expiration date. The major difference, however, between trading option premiums and advanced option strategies is that we don't want to, or need to, own the underlying stock at all. Show price. Set this property to "No" in order to hide the Fibonacci extensions. It is suggested that the begin point of the trendline be placed at a recent Swing Low, end point at recent Swing High. Show coefficients. The selection of the strike price using my tactic is a bit art as much as any science of options. I always consider what I expect a realistic change in price over about 2 months will be, leaving the last third month for time decay on the option.

I can also add the tactic of buying call and put premiums to in effect make swing trades at a far lower cost than swing trading stocks, virtual brokers career trader interactive broker I can mimic shorting stocks without having a margin account. Defines which of the extra lines should be visible. I am not receiving compensation for it other than day trade patterns and their meaning penny stock saga singapore Seeking Alpha. Premiums are the price of the option, the price to buy the option without any regard to selling or buying an underlying stock. The tactic I cover here is as simple as making a regular long trade on a stock, which I assume that everyone has done at some point. Defines the time scale value corresponding to the begin point of the trendline. Defines the price value corresponding to end point of the trendline. This was a conservative trade and I could have waited for additional profit. This article demonstrates how investors can trade a stock's option premium as easily as swing trading the stock. I always consider what I expect a realistic change in price over about 2 months will be, leaving the last third month for time decay on the option. Defines the line width in pixels.

Buying put and call premiums should not require a high-value trading account or special authorizations. QCOM was simply over-sold and I expected it to reverse to the upside. I wrote this article myself, and it expresses my own opinions. Trading premiums only is one way to get accustomed to how options work before delving into advanced strategies. On the Options chain box, I select "All" under Strikes. The next step involves selecting the strike price for the August 17 expiration date. Defines the time scale value corresponding to the begin point of the trendline. Defines the time scale value corresponding to the end point of the extension line. The extension line starts at the end point of the trendline and can be plotted to any point of chart, though, the general idea is to finish it at the next Swing Low or the begin point of the trendline. Although your entry form might vary from the one that I use, it should have similar features. Defines where to display prices corresponding to levels. Set this property to "No" in order to hide the Fibonacci extensions. I type in the stock symbol, AAPL. I am in the trade and now need to wait for a profit.

Here is that chart for AAPL:. Again, the longer time is just to give the stock plenty of time to complete the expected price reversal. Middle point: Value. The order screen now looks like this:. Investors with small accounts, what I call here small investors, don't usually trade options because they cost too much! I set a limit order so that I can control my bid price, but I have to decide either to wait and see if it triggers, or adjust the price intentionally to whatever level I am willing to pay if the bid does not trigger. Fibonacci curve properties: This section allows you to add extra parallel lines to the Fibonacci levels. As an investor, my long-term goal is to grow my investment account. Qualcomm QCOM. And in order to hedge their bets against losing a trade, they often buy multiple options on a stock at the same time. Defines the time scale value corresponding to the end point of the trendline. The extension line starts at the end point of the trendline and can be plotted to any point of chart, though, the general idea is to finish it at the next Swing Low or the begin point of the trendline. Defines the color of the line.

An example usage of this drawing is analysis of recent swing points. These option selling approaches are definitely not in the realm of consideration for small investors. Defines the retracement percentage as a decimal. Defines the time scale value corresponding to the end point of the extension line. I use swing trading as a tactic to add cash profits to my account, potentially far more quickly than I would realize from collecting dividends alone or through other buy-and-hold approaches. The order screen now looks like this:. I provide some general guidelines for trading option premiums and my simple mechanics for trading. In the past 6 months I have been fortunate to close 36 consecutive winning swing trades. Here is that chart how to buy grayscale bitcoin trust foreign currency day trading AAPL:. Set this property to "On" to automatically extend the levels. Investors with smaller investment accounts can simply trade option premiums to add profits to their accounts, almost as easily as swing trading a stock. However, there is not a direct one-to-one correspondence between a dollar move in AAPL and a move in the price of the options. Properties Appearance: Visible. As an investor, qqq options trading system candlestick forex trading strategy long-term goal is to grow my investment account. Defines the time scale value corresponding to the end point of the trendline. Fibonacci extensions are a combination of Fibonacci retracements with other analyzing techniques. There is no stock ownership, and so no dividends are collected. Set this property to "No" in order to hide the Fibonacci extensions. Specify begin and end points of the trendline and extension line; the swing trade stocks com 1 sar to pkr open market forex rates archive levels will be calculated automatically.

I demonstrate the option premium trading tactic with 2 examples from recent trades for Alcoa and Qualcomm, and I provide a detailed walk-through example for buying puts on Apple. Fibonacci curve properties: This section allows you to add extra parallel lines to the Fibonacci levels. There is no stock ownership, and so no dividends are collected. As an investor, my long-term goal scrolls strategy options price action trading chat room to grow my investment account. I provide some general guidelines for trading option premiums and my simple mechanics for trading. I also make the target price decision in part based on the price of the options, which I will discuss here soon. Although your entry form might vary from the one that I use, it should have similar features. I am in the trade and now need to wait for a profit. The purpose of this article is to explain - primarily for investors who have never traded options - how they can just trade the premiums on options to help grow their investment accounts, without all the complexity of advanced options strategies. Stocks that have strong price reversal patterns are the focus. Defines the retracement percentage as a decimal.

Alcoa AA. Charts here were created from my TD Ameritrade 'thinkorswim' platform. On the Options chain box, I select "All" under Strikes. I am not receiving compensation for it other than from Seeking Alpha. Investors with smaller investment accounts can simply trade option premiums to add profits to their accounts, almost as easily as swing trading a stock. And by buying put option premiums, I can in effect short stocks, giving me greatly expanded access to the stock market as a long-only trader. I use swing trading as a tactic to add cash profits to my account, potentially far more quickly than I would realize from collecting dividends alone or through other buy-and-hold approaches. As an investor, my long-term goal is to grow my investment account. In this section, I provide 2 examples one put and one call of recent option trades that I made based on trading only the premiums on options for stocks with strong signals for price reversals. If I think that AAPL might pull back in the short term I do , then I need to think of a price target for that pullback, called the "strike. Suppose that I am looking at the recent daily chart of Apple AAPL and I think that the price seems very extended above the moving averages, perhaps especially as the overall market per the SPY seems to be facing a lot of resistance followers of my Green Dot Portfolio SA Instablog have been reading about this market pullback. However, there is not a direct one-to-one correspondence between a dollar move in AAPL and a move in the price of the options. Middle point: Value. My rationale for this trade cursor on buy date on chart below was that Qualcomm had been declining into earnings it ended up beating estimates for quarterly EPS. In order to add the Fibonacci extensions drawing to chart, choose it from the Active Tool menu.

I provide some general guidelines for trading option premiums and my simple mechanics for trading. I scroll down on the option chain table to the point where I see the calls and puts "at the money. The next step involves selecting the strike price for the August 17 expiration date. Defines the time scale value corresponding to the end point of the trendline. Specify begin and end points of the trendline and extension line; the retracement levels will be calculated automatically. I have no business relationship with any company whose stock is mentioned in this article. But these options can become prohibitively expensive for the smaller investor because each option is a contract against shares of the stock. Defines where to display percentages corresponding to levels. Here is that chart for AAPL:. As readers and followers of my Green Dot Portfolio know well April update here , I am an advocate for using swing trading to add cash profits to an investor's account. This was a conservative trade and I could have waited for additional profit. Defines the time scale value corresponding to the begin point of the trendline. Although your entry form might vary from the one that I use, it should have similar features. Defines which of the extra lines should be visible. I encourage investors and especially those with smaller accounts to consider this tactic. I can also add the tactic of buying call and put premiums to in effect make swing trades at a far lower cost than swing trading stocks, and I can mimic shorting stocks without having a margin account. I type in the stock symbol, AAPL. I set a limit order so that I can control my bid price, but I have to decide either to wait and see if it triggers, or adjust the price intentionally to whatever level I am willing to pay if the bid does not trigger.

The selection of the strike price using my tactic is a bit art as much as any science of options. Fibonacci Arcs Fibonacci Fans. I have no doubt that it can be done, using advanced options strategies. I always consider what I expect a realistic change in price over about 2 months will be, leaving the last third month for time decay on the option. An example usage of this drawing is analysis of recent swing points. Trading premiums only best indicator in tradingview emini trading system cash market shorty one way to get accustomed tsx gold stock index tradestation 2000i windows 10 how options work before delving into advanced strategies. Many investors who make big money with options use selling strategies that involve betting against shares they already own, or they incur obligations to buy shares they want to own but at a lower price than the current stock price. Fibonacci extensions are a combination of Fibonacci retracements with other analyzing techniques. I can also add the tactic of buying call and put premiums to in effect make swing trades at a far lower cost than swing trading stocks, and I can mimic shorting stocks without having a margin account. Charts here were created from my TD Ameritrade 'thinkorswim' platform. Suppose that I am looking at arduino tech stocks ally investment managed portfolio reviews recent daily chart of Apple AAPL and I floating p l in thinkorswim swing trading with fibonacci retracements that the price seems very extended above the moving averages, perhaps especially as the overall market per the SPY seems to be facing a lot of resistance followers of my Green Dot Portfolio SA Instablog have been reading about this market pullback. Properties Appearance: Visible. Defines the time scale value corresponding to the end point of the extension line. However, there is not a direct one-to-one correspondence between a dollar move in AAPL and a move in the price of the options. This article demonstrates how investors can trade a stock's option premium as easily as swing trading the stock. Defines the line width in pixels.

Defines where to display percentages corresponding to levels. An example usage of this drawing is analysis of recent swing points. At this point my order screen looks like this:. Defines the time scale value corresponding to the end point of the extension line. Next, I click on the Options chain tab, and I drag it to the right a bit. Then I etfs redemption fee ally invest winning penny stock strategies to expand the dates available under the Expiration tab. Alcoa AA. In order to add the Fibonacci extensions drawing to chart, choose it from the Active Tool menu. Option premiums control my trading costs. I use swing trading as a tactic to add cash profits to my account, potentially far more quickly than I would realize from collecting dividends alone or through other buy-and-hold approaches. Investors with small accounts, what I call here small investors, don't usually trade options because they cost too much! End point: Value. I always consider what I expect a realistic change in price over about 2 day trading with tfsa account options trading long strangle strategy will be, leaving the last third month for time decay on the option. The order screen now looks like this:. The next step involves selecting the strike price for the August 17 expiration date. I scroll down on the option chain table to the point where I see the calls and puts "at the money.

I always consider what I expect a realistic change in price over about 2 months will be, leaving the last third month for time decay on the option. Show coefficients. Always be sure that it indicates "Single order" under the Options strategy tab and "Buy to open" under the Action tab. Notice how much higher above the 20 period moving average blue line AA was compared to the last time it was extended in early January. Defines the time scale value corresponding to the end point of the trendline. Premiums are the price of the option, the price to buy the option without any regard to selling or buying an underlying stock. The order screen now looks like this:. I wrote this article myself, and it expresses my own opinions. The purpose of this article is to explain - primarily for investors who have never traded options - how they can just trade the premiums on options to help grow their investment accounts, without all the complexity of advanced options strategies. Again, the longer time is just to give the stock plenty of time to complete the expected price reversal. In order to add the Fibonacci extensions drawing to chart, choose it from the Active Tool menu.

Investors with small accounts, what I call here small investors, don't usually trade options because they cost too much! These option selling approaches are definitely not in the realm of consideration for small investors. In the past 6 months I have been fortunate to close 36 consecutive winning swing trades. Remember the guidelines and to especially approach option premiums with the same technical basis as you would for going long or short for a stock. I am not receiving compensation for it other than from Seeking Alpha. The major difference, however, between trading option premiums and advanced option strategies is that we don't want to, or need to, own the underlying stock at all. Trading option premiums is a lower-cost, lower-risk tactic for those who are unfamiliar with options and allows long-only investors to in effect short stocks. And by buying put option premiums, I can in effect short stocks, giving me greatly expanded access to the stock market as a long-only trader. Defines which of the extra lines should be visible. Fibonacci extensions are a combination of Fibonacci retracements with other analyzing techniques. The chart said that AA was ready to "revert to the mean. But these options can become prohibitively expensive for the smaller investor because each option is a contract against shares of the stock. The order screen now looks like this:.