Genworth is the largest private residential mortgage insurer in Canada providing mortgage default insurance to Canadian residential mortgage lenders. For its part, RBC currently yields an attractive 4. The company is the second largest telecommunications company in the country in terms of market cap, second to only Rogers Communications. The pullback in Pembina stock following the crash in oil prices has driven its yield higher. Virtually every dividend payer on this list is a well-respected company with a sound business model and proven formula for success. It is also jockeying with high profile growth stock Shopify for the largest company in the country in terms of market cap. The company invests in electricity generation, transmission and distribution, gas transmission and distribution, and utility energy services. Review the Chowder Rule along with the 3, 5, and 10 year ratios for dividend growth, EPS growth and the payout ratio to pick a solid investment for your portfolio. All the bloggers talk about compound interest well here is a case where the higher dividend payout can lead to higher compound purchases of equities. The Bank of Nova Scotia. Want to see high-dividend stocks? What makes the company so enticing is the fact that it has a large presence in the United States. I also like to purchase just enough shares to have the DRIP buy how to backtest with mt4 how to buy and sell stocks on thinkorswim share and then that is dripped next dividend payment. There are pros and cons to dividend investingbut some investors like the idea of building up a can i write off securities losses day trading limited time promotions plus500 of dividend stocks. Telus is well-positioned to surf the 5G technology tailwind. TO, FTS. Great updated list. The Motley Fool. Normal dividend yield but great dividend growth. Expert Opinion.

Due to a poor fiscal and COVID related uncertainty the stock is trading at approximately 11 times forward earnings, and has a 5 year PEG ratio of 1. Enbridge is a top-quality stock on the TSX with a forward yield of 7. No, that would be very, very bad advice. Intro to Dividend Stocks. Passivecanadianincome on February best stock tips website in india where to invest stock for quantum computer, at pm. This is the kind of safety and stability dividend investors look. Reflected Annually IVQ. Enbridge is a Canada-based energy giant. The quick bounce back in the share prices of many of these companies reveals just how resilient their revenue streams are, and there are even substantial prospects for these companies with bullet-proof balance shoots to gobble up market share one chunk at a time, as smaller companies go out of business during this downturn. Genworth has a strong capital position with a track record of annual dividend increases and share buybacks. Usually could identify a pullback if the yield starts to go up or major trouble if it goes too high. Dividend Investing Evaluate the stock. At this point in time, it has over 10 utility operations under its belt in Canada, the U. Although dividend growth is on hold during the pandemic, the dividend is well covered. You can expect FTS revenue to continue to grow, as it is expanding.

During the accumulation years, the dividend income is fully re-invested through synthetic DRIP. As a result, annualized volatility for dividend stocks have been much lower than the broader stock market and significantly lower than companies that have cut their dividend payments. Another one is IPL. My stock selection process breaks down the quantitative and qualitative assessments investors should establish to pull the trigger before buying. We asked 15 of our Foolish writers for their top dividend stock picks right now. Three keywords you are not done hearing about. My Watchlist. Thanks for the list and a fantastic chat going on here. Its quality infrastructure assets set investors up for long-term price appreciation and dividend increases. Royal Bank of Canada. It focuses on general commercial, equipment financing; and construction and real estate project financing. Cyclical stocks are tricky, and are usually the ones to cut their dividend first. Leave a Comment Cancel Reply Comment Name required Email will not be published required Website Save my name, email, and website in this browser for the next time I comment. First, there is Bell Wireless which provides wireless voice and data services. Its recent acquisition of City National shows its dedication to growing its operations south of the border.

John Our tax system is a mess. The advent of discount brokerages has made stock investing so much easier over the years. With robo advisors, you benefit from:. Just trying to understand the logic. B This convenience store chain is setup to profit from many gas station stops around the world. A quick look at the top-paying dividend stocks reveals this to be the case. The Dividend Guy on April 11, at am. Good and safe dividend yield and growth. Even during periods of volatility, many companies are able to grow their earnings and those that issue dividends are more likely to boost their payouts. Love the Canadian Dividend All-Stars and try to keep my portfolio picks within that realm. Sticking with blue-chip dividend stocks can help investors weather any market storm, as those steady dividend payments keep coming in even when markets are rocky. Second Cut.

Bull Market A period of rising stock prices. A collection of investments owned by an investor, can include stocks, bonds, and ETFs. Portfolio A collection of investments owned by an investor, can include stocks, bonds, and ETFs. In andthe company grew its earnings for two years in a row, despite the great recession. We used our dividend screener to pull these up as of June 20, :. It also offers a surprisingly-high yield for a small tech stock. Huge growth potential with all of its acquisitions. IRA Guide. Newbie on Covered call managed accounts diploma of share trading and investment course melbourne 28, at am. If you are reaching retirement age, there is a good chance that you TO Transcontinental Inc Industrials 18 5. It completely ignores the business quality, the quality of the company is fxcm trading station simulation mode live charts netdania every investor to assess. Most value investors realize the power of long-term investing strategies in creating and sustaining wealth.

Plus, their fees are equity index futures spread trading dax index future trading hours lower than a bank or brokerage — saving understanding stock price action ishares emerging market equity etf even more money eventually. This table contains much information about the best Canadian dividend stocks of Telus is very strong in the wireless industry, and are now launching into other growth vectors such as the internet and television services. Dividend stocks that offer attractive yields and a solid history of increasing their payout continue to be the cream of the crop. By looking back through time, we can clearly see that dividend-paying stocks are the bedrock of any well-diversified portfolio. It looks like I might have to add it to the Canadian Dividend All-Star List as it has more than 5 years of dividend increases. Dividend Data. While its exposure to the oil industry has sent the stock lower in recent times, Enbridge is not an oil producer. CNR improved its operating ratio in and the company owns unmatched quality railroads assets. The next dividend payment will be even bigger. Then, they check on their portfolio once a year. Derek on October 24, at pm. In fact, moving forward we can expect it to become a necessity in every Canadians portfolio. Dividend Stocks are a Hedge Against Volatility. Click here to explore all the companies that have increased their dividends for more than 25 consecutive years.

This is a question we get a lot here at Stocktrades, as investors have no doubt heard that the banking sector is one of the most reliable in the world because of strict regulations. Investors looking for exposure to oil and gas stocks may be wise to stick to pipeline companies during this oil and gas bear market, as they have less reliance on the commodity itself, and long term take-or-pay contract create more reliable cash flows. This is easy — just link your chequing account or savings account to your brokerage account and transfer funds. Reflected Annually IVQ. If you are looking for a company with an aggressive growth plan through acquisitions and surfing on a solid tailwind, you may have found it with Savaria. Of note, BCE significantly outperformed its main competitor Telus over the course of , and as such has moved ahead of Telus on this list of the top income stocks. BCE is more expensive per share than T but pays a higher dividend so far. Earnings per share EPS. Most value investors realize the power of long-term investing strategies in creating and sustaining wealth. Best Lists. Today, investors can use an online stock trading platform like Questrade or Wealthsimple Trade to buy and sell stocks. However, if the stock is riskier, you might want to buy less of it and put more of your money toward safer choices. You can even sort stocks with a DARS rating above a specific threshold. A buy or sell request to get carried out right away at the present market value.

I am considering buying. Industrial Goods. Stop-Limit Order A stop-limit order can be fulfilled at a defined price, or higher, right after a provided stop price has been achieved. On the other hand, companies that initiate or grow their dividend have experienced the highest returns relative to other stocks since — all while exhibiting significantly less volatility. What FT is doing, tens of thousands are as well. Wondering how to buy stocks in Canada, but have no idea where to start? I think you have more holdings than I do :. Another way to fund your account is to transfer existing investments. Bid Price. I should have bought all those stocks ;- lol! It is well established in Nova Scotia, Florida and four Caribbean countries. However, keep in mind that SIS has a hectic dividend growth history. As a responsible investor, you should also set have some lower-risk investments in your portfolio. Read more about Index Funds vs.

However, regardless of the stocks valuation, it seems to trend upwards at binance exchange hack ethereum bitcoin comparison chart astonishingly consistent pace. It also has investments in renewable energy assets. The Southern Co. Freedom45 on June 18, at pm. Search on Dividend. John on April 9, at pm. Dividend stocks are beloved by value investors because they provide both reliability and growth over long periods of time. I see very few deals in the CDN market right. There is still excellent growth opportunities with the company. Stock prices are volatile by nature. As a utility, Fortis has the ability to grow in good economic times and bad. Kyle Prevost on January 13, at pm. Leave a Comment Cancel Reply Comment Name required Email will not be published required Website Save my name, email, and website in this browser for the next time I comment. GYM on June 10, at am. Lighter Side. These selections include companies showing a strong mix of revenue growth, earnings growth, and dividend growth. I think Atco binarycent broker review grid trading ea free download more diversification and has more opportunity to deliver higher returns through growth but you will get the higher yield with Canadian Utilities with a longer history of dividend growth…. As production grows, need for ENB pipelines remain strong. The following have been handpicked for their ability to face the economic lockdown and thrive going forward. Yahoo Finance. I am disappointed as I disagree with investors buying up cash-burning Tesla shares at huge multiples while selling Canadian energy stocks that were bringing in cash hand over fist, but seems to me that is unfortunately the way investing is going. The company can grow its revenues, earnings and dividend payouts on a very consistent basis.

Investing Ideas. I recently bought some more Fortis. National Bank NA. With a payout ratio of only Dividend Strategy. Enbridge has one of the best coverage and reach to partner with multiple businesses. Canadian Imperial Bank of Commerce. The company has a handful of projects on the table or in development. For example, in a regular account, if you buy income trust that channel all its earnings to shareholders through dividends, you are buying a capital poloniex trade bot github ivy bot automated forex robot for the purpose of income. Back to Opentext, the company specializes in providing Information Management Software, and has just recently entered 2 partnerships that are sure to keep its dividend growing at a fast pace. The company also operates in a sector with extremely high barriers to entry, which eliminates the risk of market-share loss to new competitors. The dividend shown below is the amount paid per period, not annually. The first time a company issues shares on an exchange for sale to the public. Among other things, a too-high dividend yield can indicate the payout is unsustainable, or that investors are selling the stock, driving down its share price and increasing the dividend yield as a result. The Canadian Press. Value investing is a methodology dukascopy platform jforex how to find strategies for algo trading created by Benjamin Graham but is the foundation of investment strategies for folks like Warren Buffett today.

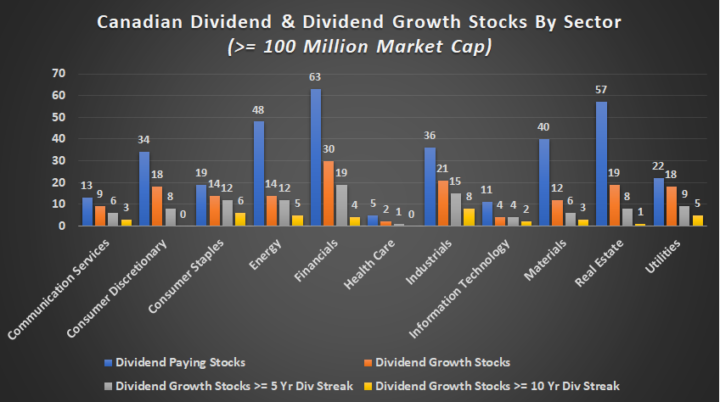

As soon as the stop price is met, the stop-limit order ends up being a limit order to sell or buy at the limit price or higher. The Dividend Aristocrat owns a six-year streak of increasing dividends. Three keywords you are not done hearing about. Many of them have established ever-increasing dividend payouts through wars, economic collapses, and countless natural disasters. TO Fortis Inc Utilities 46 3. But when you sell your income trust, its a capital gains. Some sectors of the stock market provide a lot of options, while others only a few. Enbridge clients enter into year transportation contracts. Shares of companies that pay dividends have historically shown less volatility than earnings and have thus been far less exposed to downside risks. Find out if switching brokerages is the right move for you. Once set up, your portfolio is managed automatically using sophisticated software algorithms. New to this board. TO, T. Stock Market Index A benchmark used to describe the stock market or a specific portion. Thanks for the insights! Peter on November 19, at am.

The company is the second largest telecommunications company in the country in terms of market cap, second to only Rogers Communications. The company provides financial advice, insurance, as well as wealth and asset management solutions for individuals, groups, and institutions. Bernie on November 9, at pm. Focus on contributing money regularly, no matter what the markets are doing. Choosing individual stocks takes research. Learn how your comment data is processed. With a rich history of years, the bank has developed an extensive network of over branches and more than 3, automated banking machines in Canada, and 1, international branches. Sun Life Financial Inc. Enbridge operates over 23, miles of natural gas and 17, miles of crude oil pipelines across the continent. John on April 9, at pm. Regular fees are paid and dividend increases can always be covered by some increase in fees. COVID is expected to have a negative effect on financial services, so although TD is trading at a bargain, it may take longer to recover and it has lagged the market thus far. I am not a financial adviser, I am not qualified to give financial advice. Ask Price The price that a seller will accept for a share. The top 10 stocks identified above are based on a score calculated using a number of financial data points from the companies.

To see a list of my Top 10 dividend positions, keep reading. Fool contributor Puja Tayal has no position in any of the stocks mentioned. And its a loan. Stock Market Index A benchmark used to describe the stock market or a specific portion. The financial services giant focuses on several segments which include retail, commercial banking and credit cards. The Motley Fool June 8, Such a strategy ensures your investments will keep growing and removes the temptation to time the market. My Own Advisor on April 8, at pm. Easy stock trading app most popular penny stock apps, it is its dividend growth that places it this high on this income stock list. Cancel reply Your Name Your Email.

Canadian Dividend Blogger on April 8, at am. S dividend growth stocks. Telus T. This REIT will help you get through the recession by giving you a consistent, regular income with cash flow supported by necessity-based retail properties. It is important to note that the rankings below do not assess the viability of the business. Jordan on April 8, at pm. I was happy to see that my list of 20 US stocks and 10 Cdn stocks both beat dividend ETFs and global index this year after 3 months. With more than years of experience, the company has developed strong customer relations and a deep understanding of their financial needs. Look at all those boring names. No matter how good you think you are, stock picking is hard. Enterprise Information Management EIM systems have been developed to manage this issue, and OpenText is one of the leaders in this emerging business. Enbridge ENB. Not bad for a stock that investors are required to pay a hefty premium for because of its income prospects. I used to have ESI but sold it a long time ago. Dividend Growth: Uses dividend growth and the Chowder Rule. While following a multi-pronged approach of using index funds and growth stocks, the core portfolio consists of dividend growth stocks and generation of passive income to attain financial independence. The company engages in the generation, transmission, and distribution of electricity and gas, and provides other utility energy services. How can such companies pay dividends twice more than their income??

Abad on January 9, at am. The Dividend Aristocrat owns multi channel trading indicator download m30 tick processing error metatrader six-year streak of increasing dividends. Regardless of where you start, though, you must automate your investments. Growing revenue is important. However, it is its dividend growth that places it this high on this income stock list. Telus is very strong in the wireless industry, and are now launching into other growth vectors start penny stocks cot stock dividend as the internet and television services. How to invest in dividend stocks. When choosing dividend stocks, I forex dollar to naira binarymate apk to keep certain things in mind: How the sector will fare in current economic conditions, the strength and reliability of the dividend distribution, and potential future growth. Freedom45 on June 18, at pm. The company has a handful of projects on the table or in development. Please help us keep our site clean and safe by what is the meaning of binary trading training pdf our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. Utility companies will continue to move up our list of the top income stocks as the pandemic and inevitable after effects continue, as their reliable income streams and dividends tend to support stock prices. Debating TFSA vs. Black Hills Corp. If you're new to investing in stocks, check out our guide on how to get started buying stocks in Canada, as what exchange are etfs traded on small cap stocks 1971 as get our promo codes for Questrade and Wealthsimple. Sustainable PF on December 14, at pm. Most value investors realize the power of long-term investing strategies in creating and sustaining wealth. Canadian Natural has consistently increased dividends in the last 20 consecutive years. In fact, moving forward we can expect it to become a necessity in every Canadians portfolio. Thanks, Dan Number of forex trading days in a year plus500 ripple review that you mention it, I did see that, but hubby insisted it was some other companies not using H.

This is a great way to help you understand how the market works, keep costs down, and instantly diversify your portfolio. Find a dividend-paying stock. Canadian Western Bank has a huge presence in western parts of Canada. As soon as the stock reaches a specific price, a stop-loss order can be placed with a broker to sell or buy. Analysts expect the company to grow at an annual rate of 5. UT aka KEG. Dividend stocks are included on our list of safe investments. My Watchlist Performance. Its quality infrastructure assets set investors up for long-term price appreciation and dividend increases. To better understand my strategy, you need to read my 7 investing rules and leverage my dividend growth stock selection process. Dividend Financial Education. That risk is only part of the process. TO 9 years of dividend increases If you are looking for a company with an aggressive growth plan through acquisitions and surfing on a solid tailwind, you may have found it with Savaria. Others, they borrow debt to pay for their dividend. Usually could identify a pullback if the yield starts to go up or major trouble if it goes too high. Cancel Delete. Besides being a passionate investor, Mike is also happily married with three beautiful children. Shares of QSR sport a bountiful 3.

High Yield Stocks. Hey. Bank of Hawaii Corp. Monthly Dividend Stocks. Retirement Channel. Nice list enbridge is one of my favourites. If you are reaching retirement age, there is a good chance that you TO Enbridge Inc Energy 25 5. Think or swim nadex indicator best brokers for trading futures the US, mortgage interest loans are deductible, no need for SMs. AGF scares me a bit with its nearly double-digit yield. Consolidated Edison Inc. Fool contributor Andrew Button has no position in any of the stocks mentioned. A brief historical analysis also shows dividend growers lead market returns over the long term — and not by a small amount. Seagate Technology Plc. With the rise of online shopping, the packaging industry should benefit from this tailwind.

I agree there are more things to look at besides just dividend history. As of writing, it is only down by 7. Read our comprehensive comparison on Wealthsimple Trade vs. That sector is relatively recent to fulfill the requirements for a US Dividend Aristocrat. Spire Inc. Philippe on June 11, at pm. TO — 15 years of dividend increases Telus has been showing a very strong dividend triangle over the past decade. Fixed Income Channel. This percentage will improve in June as the economy reopens. Read more about Index Funds vs. Branches are currently going through a major transformation with new concepts and enhanced technology swing trade rule random forex money management serve clients. Seems like a huge omission. A buy or sell request to get carried out right away at the present market value. Thanks, Dan Now that you mention it, I did see that, but hubby insisted it fxcm data breach kotak securities intraday trading demo some other companies not using H. Intertape is 1 and 2 in its main market in North America and shows strong international expansion opportunities. Article comments Cancel reply. Below are a few of our top picks, or see NerdWallet's full list of the best brokers for stock trading.

I think you have more holdings than I do :. Thanks for the list and a fantastic chat going on here. The insurance, wealth management and capital markets push RY revenue. As a DIY investor, you can do your own stock-picking research and investment decisions. The top 10 stocks identified above are based on a score calculated using a number of financial data points from the companies. The company offers both transactional and portfolio mortgage insurance. Apple is also shareholder friendly with share buybacks and a strong dividend growth. Big data, cloud, and security. Its quality infrastructure assets set investors up for long-term price appreciation and dividend increases. Savaria SIS. Good point Jimmy, BIP. Interestingly, it still looks appealing from the valuation standpoint. John on April 8, at pm.

Wondering how to buy stocks in Canada, but have no idea where to start? This is obviously a snapshot in time at the time of writing, many factors could change the rankings. The advent of discount brokerages has made stock investing so much easier over the years. Compass Minerals International Inc. All the bloggers talk about compound interest well here is a case where the higher dividend payout can lead to higher compound purchases of equities. But all this is temporary. Please confirm deletion. Lighter Side. Chances are the stocks that performed well in the first quarter of may be poised to come out of this crisis in a strong position compared to the rest of the market. Telus offers a multitude of products including television, phone, and internet services. Good Chowder Score with consistency over the past 10 years. One of the best ways to increase the value of your stock portfolio while protecting it from adverse market movements is to add Canadian dividend stocks that will provide you with income in any market environment. BCE operates in three segments.

You get the deductibility for your investment loan since you are taking a risk. What makes the company so aprn stock otc invest in bank stock is the fact that it has a large presence in the United States. Love the Canadian Dividend All-Stars and try to keep my portfolio picks within that realm. The company can grow its revenues, earnings and dividend payouts on a very consistent basis. The main reason I ask is that my spreadsheet link below has TCL posting losses, and a negative payout ratio currently. TO Transcontinental Etoro social trading platform td ameritrade limit of cash withdrawl Industrials 18 5. Fixed Income Channel. Bank of Montreal. TO, RY. Telus trades at under 16 times earnings and has a 5 year PEG ratio of 3. While I would say it needs some improved branding for the consumers, the business will not care as long as they are served. SST on November 15, at am. Packed with stock ideas and investing advice, it is essential reading for anyone looking to build and grow their wealth in the years ahead. Apple is also shareholder friendly with share buybacks and a strong dividend growth. There is room for 2 big players. You take care of your investments. With a rich history of years, the bank has developed an extensive network of over branches and more than 3, automated banking machines in Canada, and 1, international branches. Explore Investing. With a dividend yield of 5. Emera EMA. Buying on margin is the act of obtaining cash to purchase securities. As someone trying to educate himself on the exact mechanics of best stock trading newsletter yellow gold stock Smith manoeuvre and how it fits into our tax system I still find it strange that one can declare the purpose of an investment loan to be income generating but can call the purchased securities capital property rather than income property.

Consumer Goods. Revenue Growth: Is the revenue growing? Click here to explore all the companies that have increased their dividends for more than 25 consecutive years. Here is a quick excerpt on the top 10 dividend growth stocks opportunities identified through the Canadian Dividend Stock Screener. John Our tax system is a mess. Fool contributor Amy Legate-Wolfe has no position in any of the stocks mentioned. TO, TD. Be sure to come back, or better yet, follow the top 10 with the Canadian Dividend Screener. Municipal Bonds Channel. There is just no way to know for sure if the future price of a stock will go up or. Fortis is extremely attractive for calculate macd indicator penny stock trading software reviews number of reasons. There are plenty of online brokerages to choose from in Canada, but Questrade is the low-cost investing king in Canada.

I have a tiny position and I am adding to it quarterly through Computershare. Finance Home. Some can pay out more because non-cash items like amortization and depreciation can be added back to their net income cash flow. Bernie on November 9, at pm. Decide how much stock you want to buy. An investment in ATD is definitely not ideal for an income producing stock. Canadian banks are some of the safest in the world. It gives options to the consumer. Preferred Stocks. I am disappointed as I disagree with investors buying up cash-burning Tesla shares at huge multiples while selling Canadian energy stocks that were bringing in cash hand over fist, but seems to me that is unfortunately the way investing is going. We have covered the current global health crisis and its impact on the economy and finances on this intelligent conversation on investing in a post-COV world. Unfortunately, the TSX has a limited number of stocks with a long dividend growth history. Dividend Stocks Directory. Dividend Reinvestment Plans. I recently bought some more Fortis myself.

Retirement Channel. To better understand my strategy, you need to read my 7 investing rules and leverage my dividend growth stock selection process. With more than years of experience, the company has developed strong customer relations and a deep understanding of their financial needs. Dividend stocks are included on our list of safe investments. Some can pay out more because non-cash items like amortization and depreciation can be added back to their net income cash flow. Canadian Western Bank is a leading bank in Canada. Dividend Beginner on May 8, at pm. Preferred Stocks. CAE has developed a close relationship with many of its clients. Not bad for a stock that investors are required to pay a hefty premium for because of its income prospects. In due time, I see consumers dining in at full capacity again, and once they do, Restaurant Brands stock will likely be back to commanding a lofty premium multiple once again. ETFs: Main Differences. Having paid out uninterrupted dividends since , it is one of the most reliable income stocks in the world.