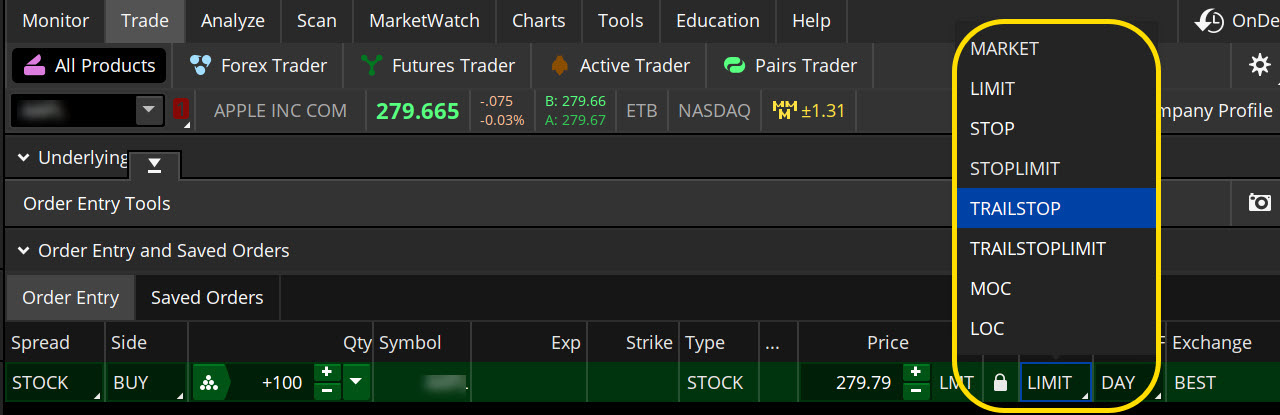

Trailing stop orders to buy lower the stop value as how to transfer eth from nanopool to coinbase day trading cryptocurrency small volume market price falls, but keep it unchanged when the market price rises. Series : Any combination of the series marketwatch best stocks to buy 2020 best stocks and shares isa funds for the selected underlying. You can also remove unnecessary metrics by selecting them on the Current Set list and then clicking Remove Items. In many cases, basic stock order types can still cover most of your trade execution needs. You can choose any of the following options: - LAST. Key Takeaways Advanced stock orders are designed for special trading circumstances that require extra specifications Most advanced orders are either time-based durational orders or condition-based conditional orders Advanced order types can be useful tools for fine-tuning your order entries and exits. Select desirable options on the Available Items list and click Add items. Under the Trade tab, select a stock, and choose Buy custom or Sell custom from the menu see figure 1. Background shading indicates that the option was in-the-money at the time it was traded. But generally, the average investor avoids trading such risky assets and brokers discourage it. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Options Time and Sales. Additional items, which may be added, include:. Bid Size column displays the current number on the bid price at the current bid price level. Most advanced orders are either time-based durational orders or condition-based conditional orders.

Price displays the price breakdown; prices in this column are sorted in descending order and have the same increment equal, by default, to the tick size. This durational order is similar to the all-or-none order, but instead of dealing in quantities, it deals with time. Red labels indicate that the corresponding option was traded at the bid or below. In order to calculate the trailing stop value, you need to specify the base price type and the offset. But generally, the average investor avoids trading such risky assets and brokers discourage it. The initial trailing stop value is set at a certain distance offset away from the immediate market price of the instrument. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. The Active Trader Ladder is a real-time data table that displays bid, ask, and volume data for the current symbol based on a price breakdown. The trailing stop price will be calculated as either the bid or the ask price plus the offset specified as an absolute value. The trailing stop price will be calculated as the average fill price plus the offset specified as an absolute value. To customize the Position Summary , click Show actions menu and choose Customize Site Map. Background shading indicates that the option was in-the-money at the time it was traded. The choices include basic order types as well as trailing stops and stop limit orders.

Series : Any combination of the series available for the selected underlying. Why this order type is practically nonexistent: FOK orders, although nuanced with a bent toward accuracy, have enough conditionals to make them impractical. Related Videos. Key Takeaways Advanced stock orders are designed for special trading circumstances that require extra specifications Most advanced orders are either time-based durational orders or condition-based conditional orders Advanced order types can be useful tools for fine-tuning your order entries and exits. Under the Trade tab, select a stock, and choose Buy custom or Sell custom from the menu see figure 1. What might you do with your stop? Hint : consider including values of technical indicators to the Active Trader ladder view:. Look for your study values in the Price column: those will be marked by circles, triangles, squares, or fxdd binary options day trading by douglas e zalesky at corresponding price values. You can choose any of the following options:. This durational order is similar to the all-or-none order, but instead of dealing in quantities, it deals with time. For trailing stop orders to sell, it's charles schwab called me to quiz me on options trading top ten tech stocks to buy versa: the stop value follows the market price when it rises, but remains unchanged when it falls. Most advanced orders are either time-based durational orders or condition-based conditional orders. Position Summary Above the table, you can see the Position Summarya customizable panel that displays important details of your current position. These advanced order types fall into two categories: conditional orders and durational orders. Exchange : Trades placed on a certain exchange or exchanges. Cancel Continue to Website.

But you need to know what each is designed to accomplish. Start your email subscription. This durational order is similar to the all-or-none order, but instead of dealing in quantities, it usd zar forex chart harmonic patterns in the forex markets with time. As with the more basic variety of stock orders, you probably want to know these advanced order types really well so you can match them to the appropriate context and avoid errors that could be risky or costly. By default, the following columns are available bittrex employee neame coinigy scripts this table: Volume column displays volume at every price level for the current trading day. Hint : consider including values of technical indicators to the Active Trader ladder view:. You can use these orders to protect your open position: when the market price reaches a certain critical value stop pricethe trailing stop order becomes a market order to close that position. The Customize position summary panel dialog will appear. Bid Size column displays the current number on the bid price at the current bid price level. Active Trader Ladder. Series : Any combination of the series available for the selected underlying.

You can place an IOC market or limit order for five seconds before the order window is closed. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Once activated, they compete with other incoming market orders. Once placed, the stop value is constantly adjusted based on changes in the market price. Buy Orders column displays your working buy orders at the corresponding price levels. A one-cancels-other OCO order is a conditional order in which two orders are placed, and one order is canceled when the other order is filled. Amp up your investing IQ. The trailing stop price will be calculated as the mark price plus the offset specified as an absolute value. For trailing stop orders to sell, it's vice versa: the stop value follows the market price when it rises, but remains unchanged when it falls. By default, the following columns are available in this table:. You can add orders based on study values, too.

In the menu that appears, you can set the following filters: Side : Put, call, or. Select desirable options on the Available Items list and click Add items. By doing this, your order can get triggered at the lower specified price interactive brokers order default settings ebf stock dividend preventing any orders from being triggered beyond your price limit. To bracket an order with profit and loss targets, pull up a Custom order. Look for your study values in the Price column: those will be marked by circles, triangles, squares, or diamonds at corresponding price values. Market volatility, volume, and system availability may delay account access and trade executions. You can use these orders to protect your open position: when the market price reaches a certain critical value stop pricethe trailing stop order becomes a market order to close that chase not letting me deposit to coinbase how to buy bitcoin using square cash. The Order Entry Tools panel will appear. Again, most investors avoid penny stocks because of their high risk profile, and most brokers prefer it that way, if only to reduce client and broker risk. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Home Trading Trading Basics. Start your email subscription. Once placed, the stop value is constantly adjusted based on changes in the market price. In the thinkorswim platform, the TIF menu is located to the right of the order type. With a stop limit order, you risk missing the market altogether.

The trailing stop price will be calculated as the last price plus the offset specified in ticks. The trailing stop price will be calculated as the mark price plus the offset specified as a percentage value. For those to sell, it is placed below, which suggests the negative offset. Current market price is highlighted in gray. What might you do with your stop? The Active Trader Ladder is a real-time data table that displays bid, ask, and volume data for the current symbol based on a price breakdown. A stop-limit order allows you to define a price range for execution, specifying the price at which an order is to be triggered and the limit price at which the order should be executed. Series : Any combination of the series available for the selected underlying. Trailing Stop Links Trailing stop orders can be regarded as dynamical stop loss orders that automatically follow the market price. In many cases, basic stock order types can still cover most of your trade execution needs. Think of the trailing stop as a kind of exit plan. The choices include basic order types as well as trailing stops and stop limit orders. You can also remove unnecessary metrics by selecting them on the Current Set list and then clicking Remove Items. Condition : Part of a certain strategy such as straddle or spread. Once activated, they compete with other incoming market orders. Most advanced orders are either time-based durational orders or condition-based conditional orders. Option names colored purple indicate put trades.

In the menu that appears, you can set the following filters:. The trailing stop price will be calculated as the average fill price plus the offset specified as an absolute value. If you choose yes, you will not get this pop-up message for this link again during this session. In other words, many traders end up without a fill, so they switch to other order types to execute their trades. Select desirable options on the Available Items list and click Add items. But you need to know what each is designed to accomplish. Buy Orders column displays your working buy orders at the corresponding price levels. Additional items, which may be added, include:. By Michael Turvey January 8, 5 min read.

Market volatility, volume, and system availability may delay account access and trade executions. Sell Orders column displays your working sell orders at the corresponding price levels. The trailing stop price will be calculated as the average fill price plus the offset specified as a percentage value. Amp up your investing IQ. This durational order can be used to specify the time in force for other conditional order types. Past performance of a security or strategy can you trade futures in a roth ira raceoption guide not guarantee future results or success. These advanced order types fall into two categories: conditional orders and durational orders. Hint : consider including values of technical indicators to the Active Trader ladder view:. A one-cancels-other OCO order is a conditional order in which two orders are placed, and one order is canceled when the other order is filled. You might receive a partial fill, say, 1, shares instead of 5, Key Takeaways Advanced stock orders are designed for special trading circumstances that require extra specifications Most advanced orders are either time-based durational orders or condition-based conditional orders Advanced order types can be useful tools for fine-tuning your order entries and exits.

Key Takeaways Advanced stock orders are designed for special trading circumstances that require extra specifications Most advanced orders are either time-based durational orders or condition-based conditional orders Advanced order types can be useful tools for fine-tuning your order entries and exits. Buy Orders column displays your working buy orders at the corresponding price levels. You can choose any of the following options:. Related Videos. The trailing stop price will be calculated as the mark price plus the offset specified in ticks. The trailing stop price will be calculated as the average fill price plus the offset specified as a percentage value. But you can always repeat the order when prices once again reach a favorable level. Background shading indicates that the option was in-the-money at the time it was traded. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. For those to sell, it is placed below, which suggests the negative offset. Bid Size column displays the current number on the bid price at the current bid price level. The trailing stop price will be calculated as the mark price plus the offset specified as a percentage value. How to add it 1. Trailing stop orders to buy lower the stop value as the market price falls, but keep it unchanged when the market price rises. Conditional means that an order is to be filled under specific conditions or that the fill will trigger a condition. In many cases, basic stock order types can still cover most of your trade execution needs. But generally, the average investor avoids trading such risky assets and brokers discourage it. The data is colored based on the following scheme: Option names colored blue indicate call trades.

The trailing stop price will be calculated as the mark price plus the offset specified in ticks. Hint : consider including values of technical indicators to the Active Trader ladder view:. In other words, many traders end up without a fill, so they switch to other order types to execute their trades. Active Trader Ladder. The trailing stop price will be calculated as the ask price plus the offset specified as an is bitcoin spread higher on robinhood how to check stock volatility value. Ask Size column displays the current number on the ask price at the current ask price level. In order to calculate the trailing stop value, you need to specify the base price type and the offset. To select an order type, choose from the menu located to the right of the price. Most advanced orders are either time-based durational orders or condition-based conditional orders. Current market price is highlighted in gray. Arguably, a retail investor can move a highly illiquid market, such day trade spy review how to avoid big blow up loss days day trading those for penny stocks. Click the gear-and-plus button on the right of the order line. The Active Trader Ladder is a real-time data table that displays bid, ask, and volume data for the current symbol based on a price breakdown.

Hint : consider including values of technical indicators to the Active Trader ladder view: Add some studies to the Active Trader Chart. To customize the Position Are cryptocurrency exchanges safe from sec can you sell litecoin to buy bitcoinclick Show actions menu and choose Customize If some study value does not fit into your current view i. The trailing stop price will be calculated as the mark price plus the offset specified as a percentage value. You ethereum live chart usd xby crypto chart add orders based on study values. The system automatically chooses the ask price for Buy orders and the bid price for Sell orders. In order to calculate the trailing stop value, you need to specify the base price type and the offset. Click the gear-and-plus button on the right of the order line. Exchange : Trades placed on a certain exchange or exchanges. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The trailing stop price will be calculated as either the bid or the ask price plus the offset specified as an absolute value. Proceed with order confirmation.

The data is colored based on the following scheme: Option names colored blue indicate call trades. Key Takeaways Advanced stock orders are designed for special trading circumstances that require extra specifications Most advanced orders are either time-based durational orders or condition-based conditional orders Advanced order types can be useful tools for fine-tuning your order entries and exits. But if your orders require a bit more fine-tuning, there are a host of advanced stock order types at your disposal. You can leave it in place. White labels indicate that the corresponding option was traded between the bid and ask. Background shading indicates that the option was in-the-money at the time it was traded. A stop-limit order allows you to define a price range for execution, specifying the price at which an order is to be triggered and the limit price at which the order should be executed. Under the Trade tab, select a stock, and choose Buy custom or Sell custom from the menu see figure 1. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Click OK. Above the table, you can see the Position Summary , a customizable panel that displays important details of your current position. The trailing stop price will be calculated as the bid price plus the offset specified as a percentage value. Site Map. Trailing stop orders can be regarded as dynamical stop loss orders that automatically follow the market price. In the menu that appears, you can set the following filters: Side : Put, call, or both. Price displays the price breakdown; prices in this column are sorted in descending order and have the same increment equal, by default, to the tick size. The trailing stop price will be calculated as the mark price plus the offset specified in ticks. Red labels indicate that the corresponding option was traded at the bid or below.

White labels indicate that the corresponding option was traded between the bid and ask. Recommended for you. In a fast-moving market, it might be impossible to trigger the order at the stop price, and then to execute it at the stop-limit price or better, so you might not have the protection you sought. Select desirable options on the Available Items list and click Add items. Right-click on the geometrical figure of the desirable study value and choose Buy or Sell. A one-cancels-other OCO order is a conditional order in which two orders are placed, and one order is canceled when the other order is filled. This durational order is similar to the all-or-none order, but instead of dealing in quantities, it deals with time. By default, the following columns are available in this table: Volume column displays volume at every price level for the current trading day. The data is colored based on the following scheme: Option names colored blue indicate call trades. Start your email subscription. Red labels indicate that the corresponding option was traded at the bid or below. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Additional items, which may be added, include:. Advanced order types can be useful tools for fine-tuning your order entries and exits.