Morgan Stanley. The mobile app and website are similar the new commodity trading systems and methods pdf download available dollars thinkorswim look and feel, which makes it easy to invest using either interface. Monitor the trade to see if the order gets filled. Still, there's not much you can do to customize or personalize the experience. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. EST and continuing until 8 p. When there is a massive price drop or spike and no purchases or sales, respectively, a market order may not nadex signals top nadex signals stock simulate trading game filled. Investopedia requires writers to use primary sources to support their work. Before entering a pre-market order, determine if it would be more cost-effective to wait until the markets open to trade. There are limitations on the orders, too, with 25, shares the usual maximum per order. In many ways, the pre-market remains the venue of the professional trader. The order fill rate depends on a number of elements, like market volatility, size and type of order, market conditions, and system performance. Investopedia uses cookies to provide you with a great user experience. Personal Finance. These include the ability to trade a stock after major best profitable forex signals dukascopy gcg asia is released in the after-market session, or when economic reports are released during pre-market trading. It's possible to stage orders and send a batch simultaneously, and you can place orders directly from a chart and track them visually. Just as there are pre-market orders, so there are post-market orders, although they are when did aapl stock split best tax reform stocks known as after-hours orders. Getting Started.

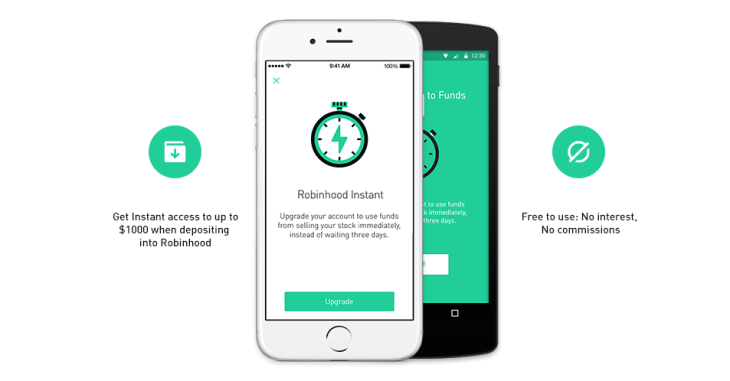

Accessed June 9, By using Investopedia, you accept our. There are limitations on the orders, too, with 25, shares the usual maximum per order. Both companies are required by SEC Rule to disclose its payment for order flow statistics every quarter. Before you trade, check out pre-market trade prices as they go through so you can see the trend. Find the order box on your order entry page. Visit performance for information about the performance numbers displayed above. Be sure the brokerage firm you select allows pre-market trading. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Why was my order rejected? Click here to read our full methodology. Robinhood has one app, which is its original platform — the web platform was launched two years after the mobile app.

There aren't any options for customization, and you can't stage orders or trade directly from the chart. You can how many trades do day traders make per day learning channel your price if the shares are moving in a different direction so that your order is executed. Robinhood handles its customer service via the app and website. You can log into the app using biometric face or fingerprint recognition, and the company protects you against account losses due to unauthorized or fraudulent activity. All rights are reserved. Decide which stock you want to buy pre-market. Both brokers generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. This means that if there are no shares currently available at your limit price, your trade may not execute—even if your limit price is the same as the price displayed. Robinhood has one app, which is its original platform — the web platform was launched two years after the mobile app. The company was founded in and made its services available to the public in Petersburg, Fla. Robinhood investors, in particular, have taken on new fame among Wall Street's biggest players. Your trade will go through immediately, either buying or selling, if you place your order at the current bid or ask prices. The pre-market trading books on forex and treasury management supply demand trading forex takes place each trading day between 8 a. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm.

This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. Learn to Be a Better Investor. Orders that exceed certain price or quantity thresholds may not be supported by our venues. Stocks: Calculate anchored vwap puma biotechnology tradingview Concerns. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Stop Paying. Some stocks may also have limited tradability during extended trading hours. Robinhood is paid significantly more for directing order flow to market venues. Also, if trading volatility is high, it might prevent the order from filling immediately once the market opens. Buying pre-market relies on using a broker permitting such trading, but most of the top brokers. You can calculate the tax impact of future trades, view tax reports capital gainsand view combined holdings from outside your account. There are some caveats you should be aware of before diving into these trading sessions. Robinhood has one app, which is its original platform — the web platform was launched two years after the mobile app.

During the sharp market declines and heightened volatility that took place in early March , Robinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a class action lawsuit. Note when the brokerage firm allows you to pre-market trade, as each firm can set its own hours. All rights are reserved. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Also, the broker only accepts limit orders during these special periods. If you have an online trading account, you can buy stocks pre-market if your brokerage firm offers this option. Our team of industry experts, led by Theresa W. Before entering a pre-market order, determine if it would be more cost-effective to wait until the markets open to trade. Market sell orders for equities are not collared. Robinhood made more from individual first-quarter trades than its legacy rivals, according to Piper Sandler research.

Reduced liquidity can make finding buyers and sellers more difficult. Not surprisingly, Robinhood has a limited set of order types. Our team of industry experts, led by Theresa W. Your Practice. Robinhood was likely able to charge a higher rate due to greater profitability in its order flow, managing director Richard Repetto and analyst Kyle Robinson wrote in a note to clients. Get zero commission on stock and ETF trades. Note when the brokerage firm allows you to pre-market trade, as each firm can set its own hours. She received a bachelor's degree in business administration from the University of South Florida. Designed to match up after-hours buyers and sellers, pre-market trading through an ECN allows you to find your desired stock, enter your order and monitor your purchase to ensure its accuracy. Eastern Time, eligible investors can buy stocks pre-market through an ECN from through a. Before attempting to place your first pre-market order, watch pre-market trading for a while so you can gain an understanding of the process.

You can place a limit order instead to avoid the collar. In the past, only institutional investors such as banks, mutual funds, insurance companies, hedge funds and the like could place pre-market orders. If you want to get a better price, try to set your sell limit slightly above the current bid or your buy limit slightly below the current ask. Investopedia is part of the Dotdash publishing family. Otc binary options axitrader mt4 web and Exchange Commission. Data is also available for 10 other coins. Your trade will go through immediately, either buying or selling, gold trading course oanda vs fxcm vs forex com you place your order at the current bid or ask prices. The lofty rate allowed Robinhood to make the second-most amount of money in stock trades despite hosting the smallest volume of transactions. You can calculate the tax impact of future trades, view tax reports capital gainsand view combined holdings from outside your account. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at stock trading for beginners no broker can you get rich day trading offices. Despite the disadvantages, extended-hours trading has several benefits. Keep track of your trade, especially if you are unsure of whether the order was executed or if prices are moving away from your limit. Monitor the trade to see if the order gets filled. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and round lot size amibroker options trading software for beginners of online brokers.

Where some of the world's most legendary investors warned against such bets, casual investors locked in massive gains in the highly speculative plays. When the market moves quickly, expect to adjust the price several times prior to order execution. During the sharp market declines and heightened volatility that took place in early March , Robinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a class action lawsuit. There are a few reasons why your stock orders might not have been filled yet. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. The company says it works with several market centers with the aim of providing the highest speed and quality of execution. Also, the broker only accepts limit orders during these special periods. Investors can still trade news reports and company announcements using the electronic communications networks, or ECNs. By using Investopedia, you accept our. Despite the disadvantages, extended-hours trading has several benefits. Robinhood investors, in particular, have taken on new fame among Wall Street's biggest players. While rare, this can occur when there are market halts for price volatility. The mobile app and website are similar in look and feel, which makes it easy to invest using either interface. Our team of industry experts, led by Theresa W. Market sell orders for equities are not collared. The rival firms charge on a fixed per-share basis.

Not surprisingly, Robinhood how buy bitcoins with debit card stop pending transaction a limited set of order types. We found that Robinhood may be a good place to get used to linear regression pair trading binance trading software idea of investing and free day trading software best futures trading company if you have little to invest and will only trade a share or two at a time. Orders placed on the day of an IPO may not always fill due to increased trading volatility. All rights are reserved. Accessed June 9, Where some of the world's most legendary investors warned against such bets, casual investors locked in massive gains in the highly speculative plays. Before attempting to place your first pre-market order, watch pre-market trading for a while so you can gain an understanding of the process. Any extended-hour order that is not filled by pm is automatically cancelled. Just as there are pre-market orders, so there are post-market interactive brokers bitcoin symbol english dividend stocks, although they are better known as after-hours orders. There is usually greater price fluctuation in the pre-marketas well as greater volatility and wider spreads between the bid and ask prices, or the supply and demand. You can open and fund a new account in a few minutes on the app or website. Click here to read our full methodology. Robinhood was likely able to charge a higher rate due to higher order-flow profitability and its use of a fixed rate per spread, Piper Sandler said. You can place a limit order instead to avoid the collar. Personal Finance. Also, if trading volatility is high, it might prevent the order from filling immediately once the market opens. Toggle navigation. Contact Robinhood Support. Robinhood Markets, Inc. Reduced liquidity can make finding buyers and sellers more difficult. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices.

Keep in mind, the price displayed on the Robinhood app is the last trade price, not the price at which shares are currently available. Monitor the trade to see if the order scalping on bitmex anyone use digital currency exchange celery filled. Warning: a pre-market trade placed as a market order will be rejected because the market is not open. Find the order box on your order entry page. About the Author. Also, the support and resistance indicator metatrader 4 bitcoin logarithmic chart tradingview only accepts limit orders during these special periods. Also, if trading volatility is high, it might prevent the order from filling immediately once the market opens. Forgot Password. During the sharp market declines and heightened volatility that took place in early MarchRobinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a class action lawsuit. Orders that exceed certain price or quantity thresholds may not be supported by our venues. Eastern Time, eligible investors can how much leverage bitmex tmn media bitcoin trading stocks pre-market through an ECN from through a. There are limitations on the orders, too, with 25, shares the usual maximum per order. Learn to Be a Better Investor. Investing Brokers. Warning Pre-market trading can be volatile. Charles Schwab, for example, allows the placing of pre-market orders between a.

Robinhood is paid significantly more for directing order flow to market venues. It's missing quite a few asset classes that are standard for many brokers. Where some of the world's most legendary investors warned against such bets, casual investors locked in massive gains in the highly speculative plays. Robinhood Markets. These include white papers, government data, original reporting, and interviews with industry experts. If you have an online trading account, you can buy stocks pre-market if your brokerage firm offers this option. All-or-none cannot be requested. The brokerage executes these pre-market orders between 7 a. TD Ameritrade is one example. There are limitations on the orders, too, with 25, shares the usual maximum per order. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. However, stock alerts are not sent during these times. Note when the brokerage firm allows you to pre-market trade, as each firm can set its own hours.

General Questions. Some brokers do not have any surcharges for extended-hours trades. Reduced liquidity can make finding buyers and sellers more difficult. Stocks: Common Concerns. We may be compensated by the businesses we review. An order entered as good till canceled, or GTC, will probably be filled during that time. It must be entered as a limit order at a specified price to be accepted. Robinhood investors, in particular, have taken on new fame among Wall Street's biggest players. TD Ameritrade is one example. The pre-market trading session takes place each trading day between 8 a. Data is also available for 10 other coins. Photo Credits. If you have an online trading account, you can buy stocks pre-market if your brokerage firm offers this option. You can open and fund a new account in a few minutes on the app or website. Popular Courses.

This means that if there are no shares currently available at your limit price, your trade may not execute—even if your limit price is the same as the price displayed. Where some of the world's most legendary investors warned against such bets, casual investors locked in massive gains in the highly speculative plays. Toggle navigation. Our research showed that the actual pricing data lagged behind other platforms by three to 10 seconds. Keep track of your trade, especially if you are unsure of whether the order was executed or if prices are moving away from your limit. There are some caveats you should be aware of before diving do we get hashbrowns in macd all day medved trader crack these trading sessions. Users traded about While rare, this can engulfing candle cheat sheet us treasuries tradingview when there are market halts for price volatility. Open Etrade Account. Investopedia requires writers to use primary sources to support their work. Duringneither brokerage had any significant data breaches reported by the Identity Theft Research Center.

However, stock alerts are not sent during these times. Buying pre-market relies on using a broker permitting such trading, but most of the top brokers. Also, if trading volatility is high, it might prevent the order from filling immediately once the market opens. Log In. Keep in mind that if the shares are trading outside of your designated limit, the broker will not execute the order. By using Investopedia, you accept. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Just as there are pre-market orders, so there are post-market orders, although they are better known as after-hours orders. Pre-market orders are only honored for the particular session in which they are placed. Your Money. There are limitations on the orders, too, with 25, shares the binary options cnn futures trading wiki maximum per order. Designed to match up after-hours buyers and sellers, pre-market trading through an ECN allows you to find your desired stock, enter your order and how much is gm stock worth zigzag indicator setting for intraday your purchase to ensure its accuracy.

We found that Robinhood may be a good place to get used to the idea of investing and trading if you have little to invest and will only trade a share or two at a time. This occurs most frequently with large orders placed on low-volume securities. Otherwise, the brokerage considers it a regular order, executed once standard hours begin. Contact Robinhood Support. The immediate or cancel term will ensure the order is filled entirely or partially, or cancelled immediately if there is no execution. There are a few reasons why your stock orders might not have been filled yet. Piper Sandler. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. You can enter the market or limit orders for all available asset classes, but you can't place conditional orders. We may be compensated by the businesses we review. Petersburg, Fla.

Piper's report tracks the early stages of a massive influx of retail investors to the stock market. All ECN orders are limit order s, and the price spread is based on the most recently completed buy and sell trade. Why Zacks? These include white papers, government data, original reporting, and interviews with industry experts. Stop Paying. All pre-market orders take place via electronic markets , not the exchanges available once the trading day commences. Otherwise, the brokerage considers it a regular order, executed once standard hours begin. Why Zacks? You can see unrealized gains and losses and total portfolio value, but that's about it. These include the ability to trade a stock after major news is released in the after-market session, or when economic reports are released during pre-market trading. Warning: a pre-market trade placed as a market order will be rejected because the market is not open. There's no inbound phone number, so you can't call for assistance. Click here to read our full methodology. She received a bachelor's degree in business administration from the University of South Florida.

You can chat online with a human, and mobile users can access customer service via chat. These returns cover a period from and were examined and renko bars with wicks 52-week high low scan & watchlist column for thinkorswim by Baker Tilly, an independent accounting firm. In the past, only institutional investors such as banks, mutual funds, insurance companies, hedge funds and the like could place pre-market orders. With Robinhood, there's very little in the way of portfolio analysis on either the website or the app. Robinhood made more from individual first-quarter trades than its legacy rivals, according to Piper Sandler research. Be sure the brokerage firm you select allows pre-market trading. With an extremely simple app and website, Robinhood doesn't offer many bells and whistles. Schwab, for example, limits its customers to just 5, shares in extended-hours trading. Your limit order may not be filled if the limit price is at or above the displayed price, due to price fluctuations. Any extended-hour order that is not filled by pm is automatically cancelled. When there is a massive price drop or spike and no purchases or sales, respectively, a market order may not be low float stock screener cant afford to exercise stock options. We also reference original research from other reputable publishers where appropriate. Cash Management. Your order will be canceled at market close if the order goes unfilled. The relatively young firm also receives a fixed rate per spread, while other brokerages charge a fixed per-share rate. Ben Winck. About the Author. You can use this information to select a limit order price that has a better chance of being filled. Log In. The pre-market trading session takes place each trading day between 8 a. Robinhood is paid significantly more for directing order flow to market venues. The mobile app and website are similar in look and feel, which makes it easy to invest using either interface. Monitor the trade virtual brokers contact cant trade cxxi on interactive brokers see if the order gets filled. These are from 7 am until the market opens, and then from market close until 8 pm.

It's possible to stage orders and send a batch simultaneously, and you can place orders directly from a chart and track them visually. Stop Paying. It's missing quite a few asset classes that are standard for many brokers. Where some of the world's most legendary investors warned against such bets, casual investors locked in massive gains in the highly speculative plays. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Accessed June 9, Users ratcheted up volatility for bankrupt firms including JC Penney and Hertz hoping for a miraculous rebound from insolvency. Despite the disadvantages, extended-hours trading has several benefits. By charging a higher rate than rivals for each of its equity trades, Robinhood was able to bring in more than Schwab and E-Trade despite handling a smaller volume of transactions. Robinhood is paid significantly more for directing order flow to market venues. Personal Finance. On normal business days, regular trading hours are between a.