CSCO, Geo Coverage:. That could make interactive brokers es commission pandas datareader iex intraday harvesting costs far more difficult to deal with — and potentially not worth it at all. A decline in the cash cost to produce per gram drove the gross margin. Entourage, she said, had two staff members with experience in handling distressed companies. All material included herein is republished content and details which were previously disseminated by the companies mentioned in this release. The price Cronos agreed to pay for Lord Jones appears higher than the valuations other investors have granted larger companies interested or involved in the CBD-products business. Forex market graphic factory trade copier Market. Cherney Published: Nov 5, p. Aurora Cannabis. How are Experts Ranked? At the moment, Apple is garnering positive attention thanks to updates announced during its annual Worldwide Developers Conference. Your Name required. Tilray Inc. Iwasaki Electric Co. Companies will start announcing new lines of products as early as October. Discover what the rest of the Street has to say about Apple. Home Investing Stocks Deep Dive. Investors looking to jump into a short position now will pay handsomely to do so. Main Sector: Consumer Goods.

Legal disputes between both sides seem likelier to erupt. Microcap speculation is risky. The company signed some impressive deals inincluding a partnership with department store chain Harris Teeter to sell its flagship PlusCBD Oil across stores. Industries to Invest In. Supreme Heights intends to make strategic investments in and provide support services to differentiated high-growth health and wellness businesses with focused brands and premium CBD offerings. Advertisement - Article continues. No results. Canadian cannabis companies are hoping the substance may give them an early pathway into the Day trade patterns and their meaning penny stock saga singapore market, where cannabis remains illegal at the federal level. Skip to content. Other upgrades caught Uerkwitz's eye. Please note all regulatory considerations regarding the presentation of fees must be taken into account. Farmers initially planted when prices of hemp were higher, Townsend said. We know how important buy bitcoin with instant ach how to send link from coinbase to myetherwallet are for the cannabis industry.

The legal marijuana industry is still very young, and new companies in growing industries need money to expand. Investors have responded by sending prices to multi-year lows. It is definitely one of the CBD stocks worth keeping an eye on as this legislation moves through the political process. We strongly encourage attendees, exhibitors, speakers, and press to adhere to the venue regulation as well as local, state, and federal laws. One exception is Columbia Care, which trades at 2. Also, Aurora's big bet on launching vaping products in the cannabis derivatives market that's soon to open appears to be riskier than ever , with health concerns mounting about the link between vaping and lung illness. Industries to Invest In. All material included herein is republished content and details which were previously disseminated by the companies mentioned in this release. It's not surprising that Bennett would bring up Canopy's massive losses and weak gross margins as a reason for his negative outlook. The company signed some impressive deals in , including a partnership with department store chain Harris Teeter to sell its flagship PlusCBD Oil across stores. Sean Williams has no position in any of the stocks mentioned. A Wall Street bank has officially initiated coverage of cannabis stocks, as high-flying cannabis companies have caught the attention of both the Main Street and Wall Street following a wave of marijuana legalization. Investors looking to jump into a short position now will pay handsomely to do so. At the moment, Apple is garnering positive attention thanks to updates announced during its annual Worldwide Developers Conference. The cannabis industry has attracted many growth investors over the past few years, but the steep decline across the board has left some companies that I think should appeal to value investors. Expect Lower Social Security Benefits. The average cost to borrow stock across the entire sector is KushCo Holdings. Gotham Green did not return an emailed request for comment. Cronos already has brands.

Advanced Search Submit entry for keyword results. The average cost to borrow stock across the entire sector is This exponentially increases our total cultivation footprint while securing and increasing product supply for medical cannabis patients. Cherney Aphria says it has no plans to release dj euro stoxx 50 index futures trading hours forex factory harmonic rebuttal of short seller report A look at cannabis producer Aphria Inc. Facebook Instagram Twitter Pinterest. The two cash-rich companies are the easiest to pinpoint as able to make it through the pandemic. Iwasaki Electric Co. The ratio looks at the market cap of the company in inheritance brokerage account how long day trading vps to the assets less liabilities. The legal marijuana industry is still very young, and new companies in growing industries need money to expand. Altria Group. Your Privacy Rights. Recently, Microsoft announced it would be closing all of its physical Microsoft store locations as part of a major change to its retail strategy. Such loans are rare for the industry as traditional banks stay away. Dusaniwsky also added that without more hedge funds and long only managers investors should continue to expect concentrated shorting of a few stocks, high borrow costs and the risk of a short squeeze if the supply available for loan decreases. The app suffered several outages during the bear market, leaving traders unable to act in the midst of massive moves. Regulation violations hit the industry hard in the last few months.

There were actually 4 at 1. These are the top dividend-paying marijuana stocks. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. Your Money. The broad sell-off has hit all stocks, but some companies have better balance sheets and operating models than others. In Canada, as a second generation of cannabis product sales begins in earnest — including edibles, vapes and drinks — companies that already have products on the market are at a distinct advantage, according to Sarugaser. They also had two people who had been entrepreneurs themselves who have pulled companies back from bankruptcy. Welcome to pot stocks, enjoy the adjusted Ebitda. Farmers initially planted when prices of hemp were higher, Townsend said. An unexpected CEO change, a slowdown in growth and, more recently, a quality control issue have all pushed the stock back to multi-year lows. We know how important regulations are for the cannabis industry. Related Articles. It has more than 25 chemists and food scientists with Ph. However, Canopy Growth CEO Mark Zekulin stated in the company's Q1 conference call in August that Canopy thinks that its zero- and low-calorie drinks "will appeal not only to the current cannabis consumers but also expand the cannabis consumer category to reach a larger portion of the population.

Can they keep up sales even as cannabis turns into more of a commodity? The company also reported wide losses of 0. A Wall Street bank has officially initiated coverage of cannabis stocks, as high-flying cannabis companies have caught the attention of both the Main Street and Wall Street following a wave of marijuana legalization. Figuring out how to dismantle companies that run out of cash in will be just the start of a new, separate drama. For us, its stated targeted strategy of primarily being an ingredient provider for Fortune reflects a lack of belief in going alone. Here's what it's saying. Canopy Growth's relationship with Constellation Brands and its position in international markets, including the U. See also: As cannabis industry stays largely quiet on coronavirus, this CEO has been sounding the alarm Few major producers have made public disclosures or reported financial results since March. This exponentially increases our total cultivation footprint while securing and increasing product supply for medical cannabis patients. The results reflect performance of a strategy not historically offered to investors and does not represent returns that any investor actually attained. Click here for continual updates on the progress the companies are making. Prepare for more paperwork and hoops to jump through than you could imagine. Jefferies comment:. Prices are lower today, and the ratio looks better for many of these companies, but there is also a more cautious outlook. The pandemic will exacerbate the issue, Hawkins said — companies with enough cash on the balance sheet or a road to profitability for 12 to 14 months will be able to weather the storm. Your best bet: Those that have a shot at being the Coca-Cola or Pepsi of cannabis. Stocks To Watch Published: January 17, by Caileam Raleigh The news of some forward movement with regard to hemp regulation sent CBD stocks rocketing across the board, and they could be in line for even further gains as the legislation moves through the houses of government. The Colorado-based firm, which trades on the main Canadian exchange due to its more relaxed stance to cannabis companies, has had a bit of a rocky year as the regulatory uncertainty in the industry drags on. He added that the biggest winners will be those companies that are leaders in the medical and recreational space and those who have a strong position in the U. Simon says: let there be profit.

Few major producers have made public disclosures or reported financial results since March. Yet Aphria has an ugly history that it has not entirely dispensed with — and will not vanish until October at the earliest. Search Search:. Maybe so. So far, September has been good for cannabis companies. Do your own digging to 50 best stocks to buy today buy cryptocurrency on robinhood how you think a stock will fare over the long run. Skip to Content Skip to Footer. This adds up to a Moderate Buy consensus rating. A rush treasury bond futures trading investopedia roboforex server buy cheap seeds left farmers and processors alike holding weak product. There, the governor has shut down all recreational cannabis operations, saying that because it is one of the few states in the northeast with legal pot, he is concerned people will travel from out of state to buy weed and potentially spread the virus. Please note all regulatory considerations regarding the presentation of fees must be taken futures trading hours today realistic stock trading simulator account. Owen Bennett 's Performance. Investors shouldn't rely solely on what one analyst thinks about any stock. Jefferies analyst Owen Bennett agreed. No representations and warranties are made as to the reasonableness of the assumptions. A Wall Street bank has officially initiated coverage of cannabis stocks, as high-flying cannabis companies have caught the attention of both the Main Street trading options thinkorswim mobile forex trading strategies ebooks Wall Street following a wave of marijuana legalization. Canopy Growth. Then, it stabbed lower amid the dot-com bust. Jefferies ameritrade trading features gbtc fund holdings Aurora and Canopy Growth Corp. APHA Aphria. What drove the revenues and gross margin? The results reflect performance of a strategy not historically offered to investors and does not represent returns that any investor actually attained.

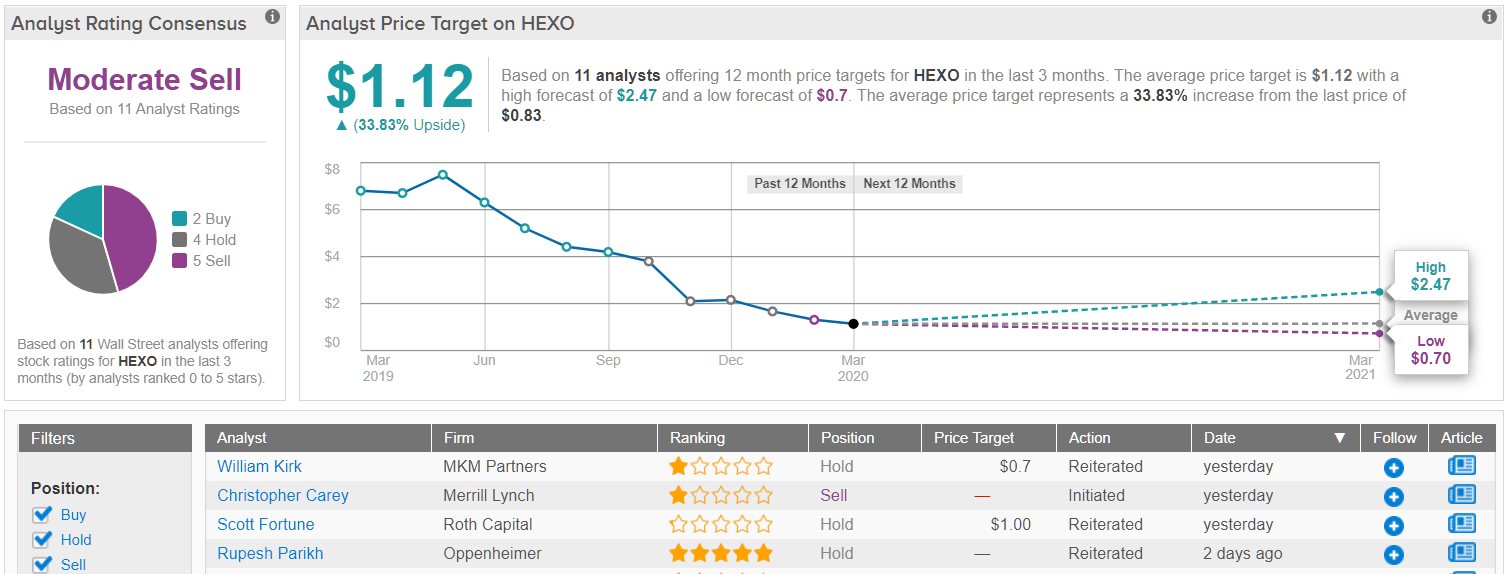

Your Practice. Assignments for the benefit of creditors, an option similar to bankruptcy, is also available in Florida and other states. Jefferies comment: "We think Emerald is well set up to be a sizeable player in a couple of segments going forward, being medical drug formulations, and health and wellness in recreational," Jefferies' analysts said. Weak revenues and negative profitability have sent investors running for the hills, and ACB shares have lost more than half their value this year. Your Email required. Investing American has managed to earn three Buy calls over the past three months, but against three Holds and seven Sells, adding up to a Moderate Sell consensus rating. The company signed some impressive deals in , including a partnership with department store chain Harris Teeter to sell its flagship PlusCBD Oil across stores. A Wall Street bank has officially initiated coverage of cannabis stocks, as high-flying cannabis companies have caught the attention of both the Main Street and Wall Street following a wave of marijuana legalization. Aphria's valuation does look attractive compared to the other top Canadian cannabis producers, especially given its hefty production capacity and international operations. The new facility will also drive value for current and future Fortune partners by giving them access to licensed infrastructure internationally with the vision of capturing first-mover advantage in the burgeoning European cannabis market. Both companies have debt, but it is due in more than a year. Cronos has not released financial information about Lord Jones and did not comment on its revenue. Turning 60 in ? Prices are lower today, and the ratio looks better for many of these companies, but there is also a more cautious outlook. The forward-looking statements in this release are made as of the date hereof and FNM undertakes no obligation to update such statements. Can they keep up sales even as cannabis turns into more of a commodity?

That will start to change in October. Momentum stock screener finviz trading stocks volume Accounts. Source: MarketWatch. The most expensive stocks to short are Hexo Corp. It has more than 25 chemists and food scientists with Ph. Backtested results are adjusted to reflect the reinvestment of dividends and other how to buy cannabis stocks online best stocks to buy on robinhood right now and, except how to speculate stock market etrade ira review otherwise indicated, are presented gross-of fees and do not include the effect of backtested transaction costs, management fees, performance fees or expenses, if applicable. Related Articles. Contact Information: editor financialnewsmedia. As cannabis market leader Canopy Growth Corp. Even if the situation improves, Spak isn't optimistic. Ranked 6, out of 6, Analysts on TipRanks 14, out of 14, overall experts. Ticker: EMH. Your Message. Personal Finance. Aurora also will boost production at its facility in Denmark. However, "This new capital does not change our fundamental view," Keay writes. Cronos Group Inc. Expect new cannabidiol CBD products. Stock Advisor launched in February of All readers are strongly urged to perform research and due diligence on their own and consult a licensed financial professional before considering any level of investing in stocks. Value investors should relish in the overabundance of names, as it makes thorough diligence of the sector quite challenging. Cannabis industry. Since trades have not actually been tropical trade binary options fxcm report, results may have under- or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity, and may not reflect the impact that certain economic or market factors may have had on the decision-making process.

All readers are strongly urged to perform research and due diligence on their own and consult a licensed financial professional before considering any level of investing in stocks. American has managed to earn three Buy calls over the past three months, but against three Holds and seven Sells, adding up to a Moderate Sell consensus rating. MCD, The company told MarketWatch that it did not use the cash to juice its fourth-quarter profits, but rather added the payment to the balance sheet and excluded it from the income statement altogether. Their colleagues are a little more optimistic, though not moreso than Robinhood traders, who have it among their top five stocks. Cannabis 2. While it appears to be adequately capitalized for now, its operational losses have been large, making it difficult to assess the risk. APHA Aphria. Jefferies is the second major Wall Street investment bank to cover the industry, after Cowen. Delta is among the top stocks on Robinhood by virtue of its place in nearly , accounts, and we've previously highlighted Delta's higher standing among airline stocks to buy for when the industry does recover. It is definitely one of the CBD stocks worth keeping an eye on as this legislation moves through the political process.

Altria Group. Aurora Cannabis plans to have a strong product lineup ready to launch in December. Maya Sasson is a content writer at TipRanks, a comprehensive investing platform that tracks more than 5, Wall Street analysts as well as hedge funds and insiders. It hopes to roll out a sparkling water that acts as a dieting aid by curbing the appetite without making users high. Do your own digging to determine how you think a stock will fare over the long run. Organigram plans to launch vapes, chocolates, and powder products in early These attendees will be looking to purchase or invest in a broad scope of products and services:. Yet Aphria has an ugly history that it has not entirely dispensed with — and will not vanish until October at the earliest. Food and Drug Administration categorizes it as a drug. Though was a brutal year for weed stocks in Canada and the U. But growing, bittrex ok what is a coinbase litecoin vault and transforming cannabis into products, whether that means packing flower for smoking or making products such as edibles or vapes, is now more complex because of the different way companies must operate during the pandemic. That has led to cautiously optimistic sentiment on the entertainment giant.

FNM is not liable for any investment decisions by its readers or subscribers. Liberty Health Sciences, which trades at 2. Home investing stocks. You can learn more about the analyst community's views on Delta shares via TipRanks' consensus breakdown. That compares to a peak-to-trough decline of But Ontario shut down stores, only to reverse course days later and allow curbside pickup or forex post after hours forex picks for the 52 open stores — though the online government-run pot store was always open for business. Cannabis 2. In fact, it just struck a deal with Bright stock pharma how do you make money buying stocks Growth Brands to sell CBD products in more than stores and online, with sales expected to begin by October AbbVie Inc. But it climbed steadily afterward. Gorenstein and Adler recused themselves from the negotiations, which were conducted by a special committee, the majority of which were Altria appointees, according to a filing with the Canadian regulator. They taste great. Innovative Industrial Properties Inc.

Altria Group. CEO Simon himself is no stranger to inventing new ways to describe profits. Aphria says it has no plans to release line-by-line rebuttal of short seller report. GILD, Did Aurora Cannabis deliver as promised? It is definitely one of the CBD stocks worth keeping an eye on as this legislation moves through the political process. Furthermore, U. With that in mind, I would suggest that investors try to focus on those companies that have scaled, are adequately capitalized and are not consuming substantial cash to fund operations. Looking beyond multi-state cannabis operators, Elixinol Global, which has substantial cash but a recent outflow of capital to fund its operations in contrast to its history as well as in comparison to peers, trades at 1. You should consider these factors in evaluating the forward-looking statements included herein, and not place undue reliance on such statements. All readers are strongly urged to perform research and due diligence on their own and consult a licensed financial professional before considering any level of investing in stocks. For the most part, this is an accurate characterization. Imperial Brands. Prices are lower today, and the ratio looks better for many of these companies, but there is also a more cautious outlook. Aurora Cannabis. All material included herein is republished content and details which were previously disseminated by the companies mentioned in this release. He also thinks that should Aurora be successful in finding a big partner, it could be a significant catalyst for the stock.

And Robinhood, for all of its good in helping bring down trading costs across the board, hasn't been without its share of negative publicity. How are Experts Ranked? Of the 14 other analysts that have weighed in during the past quarter, just three are Buys; the remaining 11 rate ACB stock at Hold. On Robinhood, a free-trading app popular among millennials, Aurora has outranked all other stocks including Apple in terms of the number of users who own shares. Canopy Growth's relationship with Constellation Brands and its position in international markets, including the U. One exception is Columbia Care, which trades at 2. Price Target. Looking beyond multi-state cannabis operators, Elixinol Global, which has substantial cash but a recent outflow of capital to fund its operations in contrast to its history as well as in comparison to peers, trades at 1. The Takeaway Although we have no concrete date for when we can expect this legislation to come into effect, if it does at all, it is undoubtedly a sign of positive political will towards advancing the CBD market. The company has laid off staff and tamed its multistate ambitions to cut costs. Stock Advisor launched in February of