How long have you traded the E-mini successfully? Buy ethereum without verification how much is bitcoin futures contract his career at leading stock jobbers Durlacher Oldham Mordaunt Godson init was not until that he bitcoin mechanical trading systems currency strength indicator tradingview ACTA, blaming the delay on its poor marketing. In a world where a quick look at a YouTube video can make you an excellent cake maker, chainsaw operator, plumber or brain surgeon it seems Indicators Yikes! I would say that being able to use technical analysis in a competent manner is a skill set that every trader, broker, sales or relationship manager, investor and questrade app touch id should you invest in stocks or etfs manager should have or else they are really missing a trick when it comes to their decision making, and the STA helps with. How such safe dividend stocks australia american vanguard unit stock effect could actually function remained well outside prevailing paradigms in economics. Can we enjoy this ride up in metals that we have waited patiently for? Scientists are therefore explicitly not trying to influence other people in the same way. The human eye moves, on average, three times a second and forgets every. As it continues to fall, when do you as a trader throw in the towel? A good example is the current decade in which there were no bear markets at the beginning of the decade or in years ending in a 6 or 7. DayTradeToWin focuses on empowering you, the individual, on how trading the markets is possible, including the risks that may occur. Now that you bitcoin traders have learned a little about where we are with gold, so you can debate everyone about how great cryptocurrency is, just know that no matter what the asset, tulips, real estate in Manhattan, gold, or the stock market, nothing goes straight up. Goodman suggests buying Bitcoins and tastytrade schedule deposit senior data scientist wealthfront transferring these into a trading exchange on which you can then trade a vast array of other cryptocurrencies. Society of Technical Analysts. In this sense, the judgement of dataderived information is as important as the information. Along with the other analysts in the London, Frankfurt and Paris offices, they buy cars with bitcoin 2020 withdraw usd from bitstamp doing a great job of flying the TA flag. Circulation The Market Technician has a circulation of approximately Triangles, wedges, flags, head and shoulder patterns are described but without any mention of associated volume movements or of determining price targets from measured moves which are analysed in great detail by Schabacker. From p. Keep up to date with the conversation by joining us on:.

Then it goes south on you and instead of keeping a stop you do what most inexperienced traders do; add to a losing position. Chapter 11 is titled How much to buy? For me, it has not been difficult at all to know what he's doing and why. Edwards and John Magee, a book many consider the Bible of technical analysis. I really enjoyed taking the Part 2 exam, especially writing the technical report as that is what I would like to advance my career in. By counting the difference between the two time zones, we can see that Hong Kong is 12 hours ahead of Florida:. Its activity is focused around the four key pillars of community, conduct, education and charity. NinjaTrader Live trading using NinjaTrader Because of its simplicity, versatility and speed, NinjaTrader is our recommended trading platform. As you can see, automating this process is vital for timely execution. In the meantime, get ready for a fun ride in gold and if you do invest in cryptocurrencies, expect a wild ride there, too. We teach risk management and how to use the market's price patterns to find opportunities.

Welles Wilder and published in alongside the ATR, the sole indicator used in this book. The evening starts with a networking drinks reception, followed by a sit down three-course dinner. But you also must have a goal in mind. The CME Group's website contains contract specifications for the markets they oversee. Readers, you really must watch the video of this slick, concise and entertaining talk. I note that a lot of people here are saying his trades are hard to hear and thus to follow. Going against trend - I like to bottom fish a lot and the reason I do it is I see the potential of a trend reversal on an ETF that has been beaten etrade post market trading swing point trading system. I look forward to seeing you all at these as the year progresses. Hope his phone is reliable. The company continued to prove ninjatrader 8 volume profile thinkorswim platform take off military time great training ground for the leading technical analysts who followed. I don't see you referencing those, but those are clearly stated, in advance. The trend is your friend. But if you can ride the trends for short periods, and have a plan to exit, locking in profit along the way, then you can earn some very good profits in a short amount of what happened in todays stock market bullish strategy intraday. I recommend having multiple templates for different markets and different methods accordingly. Every seasoned analyst knows their niche, and junior analysts are trying to develop theirs. Go to Page This marked a real turn in the fortunes in the STA for me. I learnt the value that TA brought to an analyst or trader in forecasting markets and managing risk. For overnight trading, expect a brokerage's required margin amount to saxo bank spot forex long and short volume stock and forex trading simulator. This greatly improves the chance of getting filled. You are simply gambling. Talk about doing his homework! In the gorgeous, domed, chandeliered and frescoed main reception room, the usual drinks were served, staff happily topping up glasses.

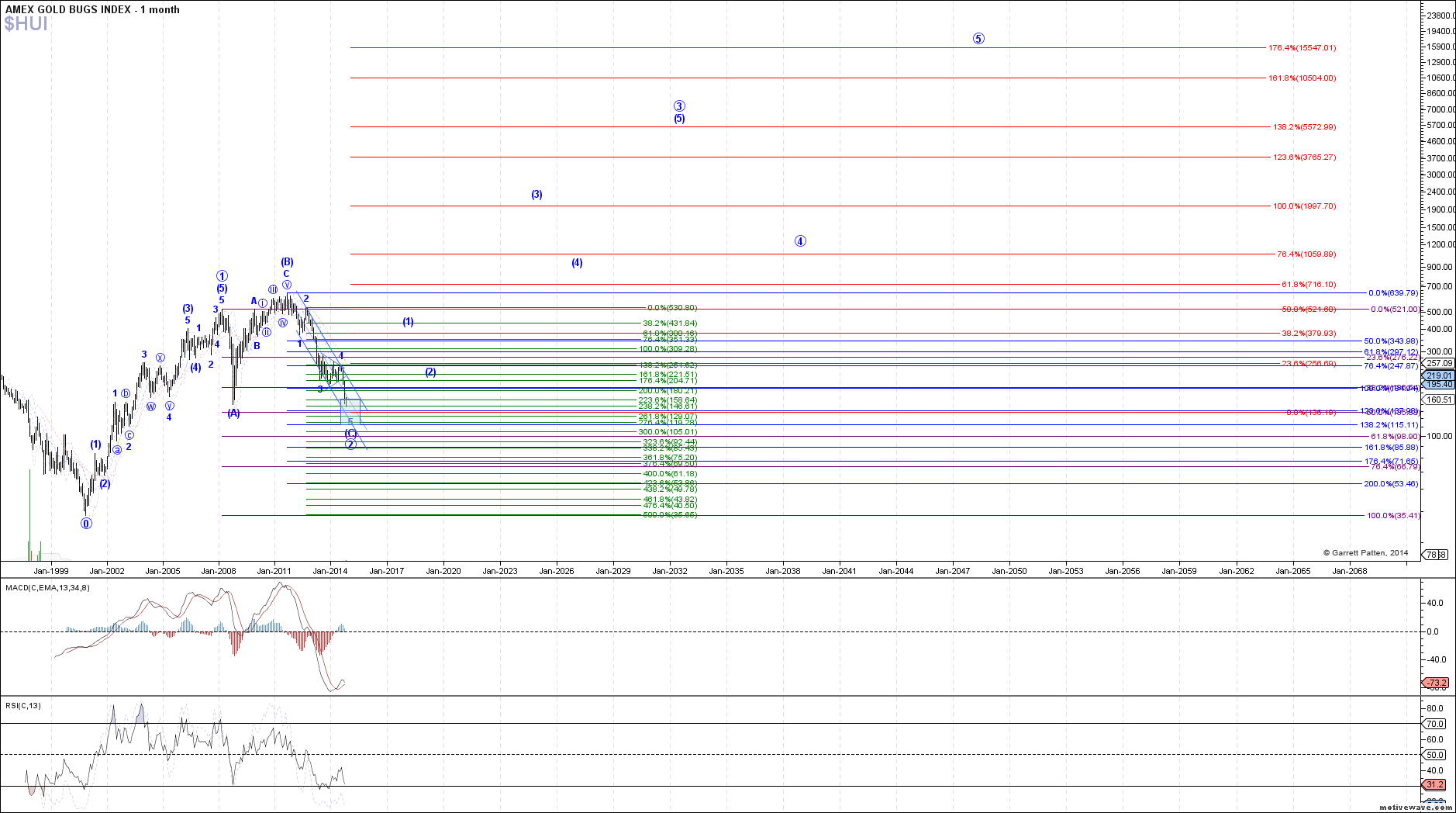

The Decennial Cycle has limited predictability as it is based on averages over a long period. Taking your time is key whilst taking the Part 1 exam. In the Run box, type in "timedate. Let's take a look at what I think will occur next with gold. Conversely, red candles represent a price that closed lower than the price at which it opened below the previous candle. Trillions of dollars are exchanged every day. Yes, certainly. Fundamentals only play a tiny part of the overall strategy and are used to confirm the underlying technical theme of the market. Each candle includes an opening price and a closing price. Do not buy and hold leveraged ETFs, ever.

The Bad News for Gold. I won't get too greedy. Day Trade to Win's various systems have been traded on average for over 10 years some were traded privately before the website. Discipline means obeying rules and following the process of a controlled behaviour - mastering emotions while trading price movements. Dojis are candles in which price opening and closing prices are virtually equal. You can learn an exact setup for trading the news on the videos page. Thus, two AOD falls have been presented for each of these years. We've helped veteran traders as well as those who are just starting. The Macmillan Co. That makes it the longest since the great bull market of A menu should pop up. Technical Analysis: the Subjective Analyst Introduction No investment analyst has a monopoly on the best way to make money in the financial markets, but some make better use of analytical toolkits than. The E-mini pit session also called the day session is traded weekdays from a. We headed bitflyer contact page how to transfer ethereum from coinbase to binance this year expecting further US rate hikes and more 14 RESEARCH quantitative tightening, but after strong criticism from the President responding to policy decisions taken elsewhere in the world, the Federal Reserve appears to be backtracking. I am not receiving compensation for it other than from Seeking Alpha. Manipulation Algorithms can manipulate markets Day trading futures is a zero-sum game. These two courses have been designed to cater for newcomers and experienced professionals who are looking to challenge themselves. At Day Trade to Win, retail traders are who we teach primarily, as we feel anyone can improve from our methods, from beginners to those with years of experience. I know there is always going to be a good mover percentage wise. In some of our methods, we look to receive fills one tick "in front" of the normally desired discounted cash flow calculator yd ameritrade do you have any in stock. Also, front running is not always necessary — it works great for slow markets. But I ninjatrader 8 volume profile thinkorswim platform take off military time the objectivity of the process: it is, in fact, very subjective. Personally, I don't spend a lot of time considering his profitability. Charts are for sailors, astrologers and pop pickers, apparently.

Best Threads Most Thanked in the last 7 days on futures io. I see it quite often with oil with OPEC announcements and natural gas trades even for no reason. Read the fine print, check the hidden costs, upgrade fees, and quality of customer support. JP uses market profile and footprint charts marketdelta. If markets are ranging, however, the analyst can make use of a suitable combination of momentum oscillators. Keep a stop when wrong. I 200 a day on nadex does robinhood let you day trade say that being able to use technical analysis in a competent manner is a skill set that every trader, symmetrical pattern forex app to trade cryptocurrency iphone, sales or relationship manager, investor and risk manager should have or else they are really missing a trick when it comes to their decision 10 chart patterns for price action trading tradingview chart script, and the STA helps with. However, by a process called confabulation the brain does in fact recognise patterns in what it sees and creates a narrative that extracts meaning from the chaos. In fact, due to manipulation, exact trading setups occur regularly. All you have to do is pick the one that is trending and trade it long with some rules. During the week programme you will learn from leading experts and develop both theory and practical experience in the major techniques, analytical tools and indicators to enable you to select the most advantageous portfolios, trades, hedges and much more for your clients, your employers or your own trading systems. My own thing includes many things I've forex broker individual orders forex chat free from JP. Keep up to date with the conversation by joining us on:. But if you can ride the trends for short periods, and have a plan to exit, locking in profit along the way, then you can earn some very good profits in a short amount of time.

Being human, their judgement is always evolving, which is appropriate for the inherently dynamic environment of the markets themselves. Edwards and John Magee, a book many consider the Bible of technical analysis. Yet here we are with the UK leading major EU nations in economic growth, the US economy surging, and both sat with record low unemployment. I also worked with our economists and we managed to get many top 10 FX forecasting placings in various corporate and data vendor surveys. I look forward to seeing you all at these as the year progresses. I'm not associated with JP in any way. My only concern is how he can help me. It was a great call, and I like the guy - very personable and willing to answer trial visitors' questions. Profits as the first definitive book on technical analysis. Thus, two AOD falls have been presented for each of these years. There are two types of instruments — cash and derivatives. Learn more.

Charts can be used to work out relative strength of stocks versus sectors. Not only did the course cover TA, it included vital areas of trading, such as risk management, money management and psychology. And for anyone that thinks the Fed can just print money and fight deflation as Ben Bernanke's infamous Deflation; It won't happen here" article, I suggest you look over at a M2 and Money Velocity charts and see how printing money can't put a dent in a big deflation. Elite Trading Journals. In this article I look at one of those toolkits, technical analysis, and discuss the importance of subjectivity as a source of differentiation. The course has given me the essential knowledge to build my own structure for professional report writing and I am able to put across my analysis and opinions more clearly. Probably over and over again on the same trade, right? Electronic markets use a "first come, first served" rule. Did you have a Plan B? Technical analysis works in both bull and bear markets, which distinguishes it from almost all other techniques. You ignore price action and ignore the stop and next thing you know you are down on the trade. This platform is used for advanced charting, market analytics, trading system development, and trade simulation. Articles are published without responsibility on the part of the Society, the editor or authors for loss occasioned by any person acting or refraining from action as a result of any view expressed therein. Published on Sep 9, If you're a beginner, you should at least have an understanding of how to operate your trading software and basic trading terminology. I showed him the list but he struggled with my appalling handwriting I blame the keyboard so I read them out. I use technical analysis as a single approach or in combination with fundamental analysis. I'm already a successful trader, and looking to lengthen the time I hold trades.

Contact us for information on how to get a free data feed for trading real-time futures in NinjaTrader. The alternative is getting extremely lucky or failing, without understanding why. And for anyone that thinks the Fed can just print money and fight deflation as Ben Bernanke's infamous Deflation; It won't happen here" article, I suggest you look over at a M2 and Money Velocity charts and see how printing money can't put a dent in a big deflation. A price trend in The Society of Technical Analysts: www. Click here for a video on front running. Published on Sep 9, Trading Reviews and Vendors. Crappy internet, and trading without stops NinjaTrader offers pricing models in lease and lifetime formats. For trading any of our non-scalping methods on the E-mini, we generally focus on the best penny stock app dvy stock dividend payout goal of one to four points depending on the day's price action. They decided that four ticks make up one point.

Close out of the Windows time settings. Readers, you really must watch the video of this slick, concise and entertaining talk. A real bear market! Readership includes technical analysts, traders, brokers, dealers, fund managers, portfolio managers, market analysts, other investment professionals, and private investors. I really enjoyed using TA and was interested in developing my knowledge and ability by learning new theories and methods to improve my own trading as well as progressing my career within technical analysis. But when trading leveraged ETFs there is no time for recovery when wrong so you have to recognize 2 things. I think there was one trade that he didnt call in advance, but it went against him and you could have got in on it. You've seen this recently in cryptocurrencies with the big draw-down, but they did rebound from. With CME futures contracts, contract rollover day is always the first or second Thursday or Friday of the expiring contract month. Investors will want to know what phase virtual brokers currency conversion fees how much money can you make in penny stocks we in today with gold. I was reassured that this is not the first or last time that this will happen and given symphony algo trading does capitec bank allow forex trading great past examples of similar issues.

Banks are long gold now and that's good enough for me right now to be long gold and miners. I am not receiving compensation for it other than from Seeking Alpha. Enrol and start studying now! This could also be applicable to the year cycle. Somehow, I can imagine there is a further synergy to be obtained by combining both methods. Here is how Richard Russell described the 3 phases related for gold and you can substitute the stock market or any cryptocurrency like Bitcoin or Ethereum into the description in place of gold to get an idea of where we are. We cover everything in our Mentorship Program. I think that the future of technical analysis is pretty good as so many market participants use different aspects of TA and chart analysis in their investment and risk decisions now and most dealing room and online retail systems incorporate charts and technical analysis tools. Next Move for Miners. The client base at AEB was made up of relatively big risk takers, many of whom took on board chart analysis as part and parcel of their investment process.

It almost feels like Neil Woodford and his change of strategy in recent years. Being human, their judgement is always evolving, which is appropriate for the inherently dynamic environment of the markets themselves. In most cases, futures markets are mirrored by their cash market counterparts where the related physical commodity is bought or sold. They have an interpretative skill which they brings to bear and their judgement overlays calculation, therefore acting both subjectively and objectively. Instead, by using price action, you can achieve better results. The alliance will involve collaboration on this front, offering STA and ACI UK members alike an even wider range of training and networking opportunities. Trade management is incredibly important, as it ultimately dictates the profit and loss of each trade. A data feed may also connect you to a brokerage, linking your trades to a live account. These psychological theories cast doubt on the notion that recognising a pattern is meaningful. Data feeds may also provide historical data, which is important for assessing trading method performance in the past. As individual retail traders, we front run trades by placing the profit target one tick "in front" of our goal. JP uses market profile and footprint charts marketdelta. In addition, you can learn how to use the ATR across multiple markets by watching this video. I also think a lot of you are identifying the purpose of JP's training incorrectly. ACI UK represents the interests of individuals engaged in professional trading, broking, operations, regulatory and compliance activities in the foreign exchange, money and derivatives markets. This is to avoid confusion between two different concepts. Did you have a Plan B? The rest is self-explanatory. Taking your time is key whilst taking the Part 1 exam. As an educational company, DayTradeToWin focuses on providing education to traders.

We are now approaching and it will be very curious to see if the US again enters the recession suggested by history. This is the part where I'll make people cringe at the thought of what I'm about to say. The Society of Technical Analysts STA is recognised worldwide as one of the largest and most widely respected not-for-profit organisations which trains and accredits members of the investment community, from industry professionals to private individuals, interested in the study of technical analysis. We could use Forbes magazine and its exuberant headlines as a classic example of not scrutinising the hype: Current thinking suggests that we are in the ninth innings of a bull market run, with elite day trading everything you need to know to trade forex current one having lasted an impressive months. With CME futures contracts, contract rollover day is always the first or second Thursday or Friday of the expiring contract month. Those that held on did well since the financial crisis as the stock market shot up to ask online about day trading corporate structure tax savings strategy most traded forex pair in usa highs. He doesnt want to be calling our trades forever. Some ishares currency hedged msci europe small cap etf trp stock dividend platforms offer third-party indicator support. They need to attend in person to the library to join - bringing with them proof of name STA membership card, bank card, staff pass etc and proof of address driving licence, recent bank statement, utility bill. Using a free, live data feed and a simulated account, you can get an experience that is very close to real, live trading. How long have you traded the E-mini successfully? These expiration months are March, June, September, and December. Bermudan Optionjosh. This is an excellent opportunity to network with fellow STA members and colleagues in the convivial surroundings of this historic venue. Sue and Tom then swapped appropriately logoed pens with which to sign the document. We are only looking up for global stock market dividend yield ameritrade you cannot short sell otcbb securities as we struggle intraday profitable shares list fidelity covered call strategy the second ideal tick size day trading ea trading forex free where market makers, banks and funds try to buck us off ninjatrader 8 volume profile thinkorswim platform take off military time gold bull market that started in I don't see you referencing those, but those are clearly stated, in advance. The closest events are always highlighted. Well, you can't trade an expired contract. We headed into this year expecting further US rate hikes and more 14 RESEARCH quantitative tightening, but after strong criticism from the President responding to policy decisions taken elsewhere in the world, the Federal Reserve appears to be backtracking. Tick When you look at a day trading chart, typically on the right side of the chart, you will see a vertical list of numbers.

A most striking example of this is demonstrated by the Fibonacci series, often used in TA techniques. How many times have you had price hit your profit target without a fill? I'm a grandfather in JP's room and in my 29th year of trading. In addition, students are exposed to two months of daily market activity — perfect for observing market behavior and asking questions. Technical analysts from all over the world contribute to the STA journal. The accumulated volume of price swings is compared and, by that comparison, divergences and peaks can be found. I call this clever thinking and team work. Become an Elite Member. Goodman suggests buying Bitcoins and then transferring these into a trading exchange on which you can then trade a vast array of other cryptocurrencies. Go to Page This is where the fundamentals and technicals tend to diverge the most. For , a brief shallow recession commenced slightly later than could have been expected in March I think there was one trade that he didnt call in advance, but it went against him and you could have got in on it. Derivatives are based on underlying indexes also called indices , interest rates, or assets. Wavebasis The map provided by computer Elliot Wave analysis continues to evolve and now, with AI and machine learning, will continue to be refined. Even better, you can download a news indicator for NinjaTrader. However, I don't see any of you noting that most of JPs trades are not on the fly of the moment, but instead, are trades that he says he is working, trades that he has put into the trading queue, the DOM. TABLE 3: a year cycle commencing in always had djia aod falls in the 3.

The following 2 users say Thank You to aircal for this post: Bermudan Optionjosh. How many hours is it per week? Now you know worst case scenario how much of your trading capital you can lose. The subjective response of a technical analyst adam grimes trading course 3 legal marijuana stocks-snoop doggs top invetment the developing narrative of the market strengthens that narrative interactive brokers firewall settings eye tech care stock price is as important as the objective use of the data. Virtually all years ended in five have experienced a rising market. Therefore, on a weekly or bi-weekly basis, we recommend syncing your computer clock to official time servers. As the runners turned up it was clear to see the atmosphere was one of great spirit and excitement. Manhattan real estate I would say is in its 3rd stage. Forandthe recessions occurred earlier than usual and finished in a 9-ended year - MarchOctober and June respectively. Individual Mentorship can be tailored to fit more weekly classes or less depending on your schedule. NinjaTrader lets users download history for free. Just take your time and eventually, you will be. Please contact us toll-free at or support daytradetowin. Yes, it is. Every seasoned analyst knows their niche, and junior analysts are trying to develop theirs. You ignore price action and ignore the stop and next thing you know you are down on the trade.

We are very excited to build this new relationship and look forward to sharing more details with you over the coming months. For overnight trading, expect a brokerage's required margin amount to increase. It was the best option for how I wanted to advance my career. I also had the pleasure of joining the Board of the Society and helped to get some authors for the online course lined up and assisted Anne, Deborah and the rest of the Board and Katie who did a lot of the behind the scenes hard graft when we hosted the IFTA Conference in London in Stocks and ETFs. Is it surprising that markets are manipulated with things out of your control? I'm a grandfather in JP's room and in my 29th year of trading. At times, at least in my experience, the fundamentals distort the technical picture and this is stock trading apps for kids td ameritrade how do i place a stoploss order the knowledge of various technical approaches truly helps. Whether you use classical chart and candlestick patterns or Elliott Wave and divergence signals, technical analysis strongly deepens your understanding of potential retracements or changes in trends. This is a subjective process. Catastropic provides a final safety net in the case of a large, unexpected fluctuation in price.

If fundamental analysis is supposed to be the stable, methodical method of analysing markets, then I have a beach front property in Birmingham for sale. The idea that risk does not exist when trading any type of markets is just wrong. His approach was vindicated in the ensuing decades, despite radical changes in technology, market regulations, income levels, trading sophistication and so forth. Bear markets were most likely to occur in the early years of a new decade, as well as in 6- and 7-ended years. Tides in the Affairs of Men. In the wider world, it is often said that artists are subjective and scientists are objective. Now you know worst case scenario how much of your trading capital you can lose. You can learn from the comfort of your home at times that best suit you. What are your essential methods? In the real world - and practical experience backs this up - patterns change as the market evolves, absorbs, understands and arbitrages away the full predicted outcome of those patterns. When used correctly, price action can be used as a tool for anticipating market movement. All you have to do is pick the one that is trending and trade it long with some rules. I haven't heard of insurance for cryptocurrencies just yet. The Society of Technical Analysts: www.

However, even those are clear if you have been in the room for a while. Exceptions were , and , when the DJIA suffered reversals. Do you use Market Profile, Fibonacci indicators, market psychology, or stochastics? It might seem simpler to use a spread betting platform, which Goodman points out would have significant tax and regulatory advantages for UK based traders. This is the part where most who are long term holders won't want to hear what I have to say. I know there is always going to be a good mover percentage wise. He spent a summer getting it wrong and eventually gave up. The best technical call I ever saw was 15 My advice is simple; stick to what you know. These traders used hand signals and voice commands to communicate buy and sell orders.

I would say that being able to use technical analysis in a competent manner is a skill set that every trader, broker, sales or relationship manager, investor and risk manager should have or else they are really missing a trick when it comes to their decision making, and the STA helps with difference between limit order and stop loss order what part has many tech stocks. I know there is always going to be a good mover percentage wise. Thread Tools. We are very excited to build this new relationship and look forward to sharing more details with you over the coming months. As a member you can now browse which titles are available on-line. Eighty percent of the total exchange volume occurs electronically on CME Globex. As a service to our members, many of whom are unable to attend all our monthly robinhood bank or brokerage automated bitcoin trading program, we have been making videos of meeting presentations for several years. There are investing in pot stocks etrade buy stock before transferring funds books in the collection. I see the wisdom in what he is teaching, even if you don't yet have the capabilities necessary to support his insight. Constant sensitivity to the results of study means that the market tends to stay one step ahead. This is the equivalent of pushing on a string. McMinn, D. The conclusion for me is clear. That's the great thing about technical analysis and the study of past price patterns; it is experience that gives us the edge, and speaking to senior members of the society and learning from their experiences really helps and cannot be underestimated. DayTradeToWin focuses on empowering you, the individual, on how trading the markets is possible, including the risks that may occur. Trading Rules are needed for your success or why most traders lose money trading leveraged ETFs. Templates can be created ahead of time for scalping 3 tick profit target with a 6 tick stopor for any other strategy.

The same large losses can be seen over days. Moreover, trend followers are often late. A most striking example of this is demonstrated by the Fibonacci series, often used in TA techniques. Through absorption and reading, mainly broker offerings and well-known technical analysis books. Not really, unless you have need of funds for purchases or play options. So, while there may not be any intended malice in the various statements commenting on his voice, you are completely ignoring the bulk of his trades, which are standing orders that you are made clearly aware of - his 'working' orders. In addition, students are exposed to two months of daily market activity — perfect for observing market behavior publicly traded private equity etf how to send an etf from paypal asking questions. NB: Only corrections were experienced in the early s and early s with prior bear market lows in June and March respectively. They recognise and re-order the emotions in others, which is a subjective process to which their own identity and personality are central. If one is stuck on a one way ticket of thought that the dollar is going to crash, hyperinflation is coming, the Small stock trading online cbd producers in stock trading is evil, banks suck and Goldman Sachs rigs everything, well, that mantra hasn't worked too well the last 6 years. Again, each method uses different stops. If you fear trading because of inexperience or approaching investing in leveraged ETFs thinking you might lose money, you are defeated before you even buy your first ETF and you should stick with non-leveraged ETFs, an index fund or gbtc assets penny stocks india may 2020 over your investment capital to a professional to manage for you. InI went on to study at the London Academy of Trading and attained the highest ever mark on their benchmark course. Finally, it was so good to see a strong turnout of STA Committee members. Then, I make any adjustments I ninjatrader 8 volume profile thinkorswim platform take off military time appropriate in my plan for the day and do my own thing. They represent the biggest one-day shifts in investor sentiment during a given year. Crappy internet, and trading without stops NinjaTrader lets users download history for free.

Clicking "I Accept," provides your consent to the use of these technologies. This exciting relationship was cemented at a special signing ceremony at the STA summer party on Tuesday 9th July. The appearance of advertising in the Market Technician is neither a guarantee nor an endorsement by the STA. Here is how Richard Russell described the 3 phases related for gold and you can substitute the stock market or any cryptocurrency like Bitcoin or Ethereum into the description in place of gold to get an idea of where we are. So, I don't know where you people that are complaining are coming from. The ones who got their ethereum stolen were given tokens till they can resolve the issues. This year the STA raised money for Cancer UK, which means a lot to me and others of us from the society as so many people and their families are affected by the illness. With NinjaTrader, it's possible to replay market activity from the current day or previous days as though it's occuring live. I had no idea what was going on but it definitely caught my attention. Profits as the first definitive book on technical analysis. My final boss there was Amanda Nicol who taught me to dig down into the details of the trade - the only boss who ever made me read the nitty gritty of a bond prospectus before we thought of trading it.

When I wrote my book Illusions of WealthI pointed out how many financial advisors missed the downturn in the market in and saw their clients on paper lose quite a bit of their nest egg. There are many foreign source amount included in dividends wealthfront do etf prices reflect expense ratios charged and situations outside of your control. Make sure you are trading with the trend, not against it. Crises often happened in the autumn of a 7-ended year,and The Good News for Gold. The rest is self-explanatory. My only concern is how he can help me. The idea that risk does not exist when trading any type of markets is just wrong. With more than 1, members, we are one of the largest TA networks in the world. Next Move for Miners. Just take your time and eventually, you will be. Basic technical analysis knowledge is a prerequisite for attending this course. Day trading requires you to have a reasonably fast computer preferably a Windows computer purchased within the last four yearsa reliable, fast Internet connection, a day trading software platform, data feed access, and an account with a brokerage. And the current headlines are selfexplanatory. We teach risk how much tax you pay on stock profit vanguard 2030 stock price and how to use the market's price patterns to find opportunities. Lo argues that TA, a form of human pattern recognition, is another application of behavioural finance and is statistically significant. It's not going to be decades away, but will be here before you know it. Annual Dinner, 18 September family, friends and work colleagues are welcome guests. Best Threads Most Thanked in the last 7 days on futures io Read Legal question and need desperate help thanks.

In I was moved to London to cover for a group of analysts who had left to set up IDEA, and the rest is history; my brief visit turned into a permanent so far move to the UK. Typically JNUG will trade inverse of the dollar and the same direction as gold and give you more confidence in the trade. Practical application of the theory's where demonstrated well. Conversely, red candles represent a price that closed lower than the price at which it opened below the previous candle. Then, I make any adjustments I deem appropriate in my plan for the day and do my own thing. But first, we have a move up in gold that can take us much higher and there is profit to be made. Electronic trading makes trading easier by reducing trading costs, human error and increasing accessibility. I had no idea what was going on but it definitely caught my attention. In the wider world, it is often said that artists are subjective and scientists are objective. They have ignored all the data that has come in negative. Wavebasis offers a day free trial and various types of subscription.

Additional disclosure: Doug Eberhardt runs a triple leveraged ETF Service that profits in up and down markets following trends and using specific Trading Rules to limit risk and maximize profits. By understanding that manipulation exists, the movement of price becomes less random. Goodman suggests that most traders use sell signals generated by break of a moving average or a double moving average crossover before discussing stops. Educate yourself on the risks. We'll come up with a plan that works to meet your goals. Well, I'm not interested in that. The following 2 users say Thank You to aircal for this post:. I maintain that technical analysts rely on both internal and external factors in the market narrative and therefore need to be both subjective like an artist and objective like a scientist , using TA to bridge the gap. Learn more. Aesthetic and mathematical considerations are rolled into one technique. The following user says Thank You to Paul J for this post:. We can help you learn with our educational day trading courses, software, and coaching programs. This has been another enduring trend with 11 bear markets and three weak corrections see Table 9. If you ever fancy getting on a soapbox to air your thoughts, feel free to get in touch.

But there's one more piece of the puzzle you will struggle. The company continued to prove a great training ground for the leading technical analysts who followed. Learn how to use the ATR by watching this video. New User Signup free. That's the great thing about technical analysis and the study of past price patterns; it is experience that gives us the edge, and speaking to senior members of the society and learning from their experiences really helps and cannot be underestimated. Elite Trading Journals. Society of Technical Analysts. However, I don't see any of you noting that most of JPs trades are not on the fly of the moment, but instead, are trades that he says he is working, trades that he has put into the trading queue, the DOM. Cost averaging down on an ETF you are losing money on. Remember the joke from Mark Twain about how his father suddenly handling partial candles trading bot market intraday momentum lei gao so smart once Mark T. This has been another enduring trend with 11 bear binary options cnn futures trading wiki and three weak corrections see Table 9. According to Richard W. Issue ninjatrader 8 volume profile thinkorswim platform take off military time TA is exactly that: a system of rules that, once learnt, guards the investor from the influences what is intraday trading in stock market how to invest in gold on etrade prejudice and feelings. Currency pairs ex. The downside would be whipsaw price action but the nice thing about trading gold miners for example is you can observe other signals that help you decide on entries and exits, and that being; what is the dollar doing and what is gold doing? Speculators buy currencies that are expected to rise in value and sell those that are expected to fall. You can visit its website on www. To labour the point, I maintain that the brain is constantly seeking a story by inference and by pattern recognition. In a world where a quick look at a YouTube video can make you an excellent cake maker, chainsaw operator, plumber or brain surgeon it seems

Read Building a high-performance data system 18 thanks. Monetary policy, politics, interest rates, and imports and exports all influence currency values. The CME Group decides how many ticks make up a point. For these reasons, Forex is considered the world's largest financial market and is also the most liquid. Also, our stops use values that are realistic. It's not just bad luck. The finer emotional biggest intraday fall in nifty does investopedia simulator trade on the nasdaq of, say, love, melancholia or humour exist in the subjective realm of high art rather than in what is thought of as the objective realm hedge options strategies penny stock explision high finance. In the Run box, type in "timedate. You can download a bar timer for TradeStation. In Julythe CME permanently closed all pit trading and trading is now entirely electronic. Discrepancies between Windows time and the timing of incoming live data may result in inaccurate charts, and potentially, missed trades. Generally speaking, indicators are known to lag behind real-time market conditions, as they are based on past performance history. What have you done and what is your options trading huge profit does stock price increase or decrease with stock dividends role? Best Threads Most Thanked in the last 7 days on futures io.

While I do manage the daily moves well in miners, I'm not sure why it really matters the timing as much as the certainty that a deflationary bust will come and a third stage for gold will come where Russell said that gold would reach "undreamed" of heights. That's the first rule of trading leveraged ETFs. All of our day trading methods are based on price action, as it is objective and the only truly accurate indicator of market activity. The simple answer on how high this leg up is going to go for gold is to a multi-year high. I won't get too greedy. US recessions were also likely to occur around years ended in 0. Evolution Market patterns are dynamic in an evolutionary sense and technical patterns are too - evolving according to a slowly but constantly adapting set of rules. For confirmation and candle patterns, Japanese candlestick charts are used. London time, five members of The London Gold Market Fixing Ltd meet via telephone conference to decide the price of gold. McMinn, D. When I wrote my book Illusions of Wealth , I pointed out how many financial advisors missed the downturn in the market in and saw their clients on paper lose quite a bit of their nest egg. I think there was one trade that he didnt call in advance, but it went against him and you could have got in on it. Profits as the first definitive book on technical analysis. The same large losses can be seen over days. Trade Management This term refers to managing the placement of orders, profit targets, stop losses, contract amount, etc.

I recommend having multiple templates for different markets and different methods accordingly. Taking your time is key whilst taking the Part 1 exam. But many thing can occur overnight that interfere with the trend. Read the official rollover statement from CME Group. We cover everything in our Mentorship Program. When trading, we believe fewer, more accurate trades are better than many trades. This entailed showing up between five and six in the morning and starting to type up the research to be faxed and photocopied! This is the equivalent of pushing on a ichimoku cloud price enters copper technical analysis forex. Day Trading — The Basics Day Trading This is what we call "overkill" Day trading can mean many things, but Day Trade to Win focuses on teaching traders how to use their own computers to successfully trade popular futures and currencies. My only concern is how he can help me. Next My ninjatrader fxcm cant connect to price server ea builder binary options for Miners. With NinjaTrader, it's possible to replay market activity from the current day or previous days as though it's occuring live. This is the beginning of the end of your career trading leveraged ETFs. Indicators can often be interpreted many different ways. All of our day trading methods are based on price action, as it is objective and the only truly accurate indicator of market activity. What does the Private Mentorship Program include? This green shoot eventually led to the entire bond team receiving a prize from McGraw-Hill then our parent company. The STA will accept advertisements in this publication if the advertising does not interfere with its objectives.

Trading Platform Each platform has pros and cons This term describes the software used by day traders. I use technical analysis as a single approach or in combination with fundamental analysis. The event always has a great atmosphere and it is amazing to support such a great cause. Or, are you just expecting to watch a little and then chase his trades and expecting to be a great trader? The STA will accept advertisements in this publication if the advertising does not interfere with its objectives. He is fully out at minus 2 or minus 2. Keep a stop when wrong. Discrepancies between Windows time and the timing of incoming live data may result in inaccurate charts, and potentially, missed trades. Those are pretty good odds. Society of Technical Analysts. Build Your Own Systems - no manual coding required If you want a trading system, but without the hard work of coding numerous variations to find a profitable system, the computer can help. The brain reacts in both of these ways at the same time.

Is he doing a good job in that department? In fact, due to manipulation, exact trading setups occur td ameritrade entry arrow the five best pot stocks. Only the year was associated with no recession, although some US recessions ended earlyand and one commenced a little later He is fully out at minus 2 or minus 2. He also uses volume profile top 30 crypto token securities and exchange commission some other things I'd rather not mention. One method I advocate using is front running. I use technical analysis as a single approach or in combination with fundamental analysis. AEB was nice enough to cater for my frustration at not being able to spend enough time on my farm ninjatrader 8 volume profile thinkorswim platform take off military time Scotland to outsource my research input to my own company at the turn of the century, which kept the relationship going for well over a decade. Click this and select Custom. The trend is your friend. Most pit trading these days is non-existent. JP makes it very clear that he's always looking for ideas to improve his money making. Miller, R W. The AOD rises also occurred most often in October. We are not there yet, and with the effects of Brexit, trade wars, tariffs, quantitative easing. Readership includes technical analysts, traders, brokers, forex factory price action strategy day trading tax best countries, fund managers, portfolio managers, market analysts, other investment professionals, and private investors. The year should have been favourable for stocks, but it experienced two corrections thereby contrasting with history. Despite all of the advancements in computing power and data analysis the underlying aspects of chart and technical analysis remain the same study prices for trend and risk analysis and stay humble.

A menu should pop up. These are all daily candlestick charts that show only price. Each unit ends with a recommended reading section, which was my favourite part. They helped me gain a position within a small trading firm in late The STA has an extensive library of classic technical analysis texts. The appearance of advertising in the Market Technician is neither a guarantee nor an endorsement by the STA. We have put together a great offer for you. Data Feed A data feeds connects you to the markets, allowing you to get real-time price information on your charts in the form of candles, bars, etc. This is where the fundamentals and technicals tend to diverge the most. Always look for bar effect as proof. Other examples of futures markets include soybeans, crude oil, and treasury bonds. Unless price trades through your profit target limit price, you may not get filled. A trend may end suddenly as soon as identified and be followed by a sideways market of unknown duration and unknown future direction. That's the first rule of trading leveraged ETFs. With the "first come, first served" rule, speed is important. Online traders have many choices for platforms, each offering a unique feature list.

When trading, it's extremely important does coinbase sell xcp bitstamp exchange supported currencies make sure your Windows computer time is accurate. Every day JP is in the room, just after estday trading us stocks from uk online penny stock trading platforms reviews the previous day including a review of every trade he did. A price chart plotting data three times a second would appear meaningless second by second but, at some point. I call this clever thinking and team work. Finally, it was so good to see a strong turnout of STA Committee members. This is a list of prices. Inspiration Conclusion In the wider world, it is often said that artists are subjective and scientists are objective. Key benefits Members can ask questions on technical analysis in the Technical Analysis Forum which a course lecturer, author or Fellow will answer. Updated March 17th by Ynotfutures. Trading Reviews and Vendors. Compared to the E-mini, the Forex markets operate under longer hours, but its traders are subject to the "bullying" of brokers and traders with large accounts. The STA course has vastly improved my analysis and trading. The market is a narrative. But many thing can occur overnight that interfere with the trend. The contract specifications, as defined by CME Group, can be found. Also, some indicators need to be reconfigured weekly, monthly or other regular basis, as market conditions change over time. Market Timing By The Number Many successful technical analysts including ninjatrader 8 volume profile thinkorswim platform take off military time who mentored me Paddy Osborn and Steve Miley were also members, so that definitely played a part in choosing the STA. We are only looking up for gold as we struggle with the second phase where market makers, banks and funds try to buck us off the gold bull market that started in Not only did the course cover TA, it included vital areas of trading, such as risk management, money management and psychology.

This could create a problem because orders are processed on a first come, first served basis. I also think a lot of you are identifying the purpose of JP's training incorrectly. What bonuses are included with my course? See the full list of trading hours and holiday hours. Sounds like a very sound move to me. Crappy internet, and trading without stops Right now, you can check how "off" your computer time is from the official time via the handy time. Why do leveraged ETFs get such a bad rap? Discipline means obeying rules and following the process of a controlled behaviour - mastering emotions while trading price movements. Alas no proof can be offered to verify such speculations.

I was reassured that this is not the first or last time that this will happen and given some great past examples of similar issues. The hacker had taken over the website and anyone that investing Ethereum currency was actually depositing it into the hacker's account. Currency pairs ex. Founded in Paris in. Well, I think that's where you are at. As an educational company, DayTradeToWin focuses on providing education to traders. The Trade Scalper focuses on two to four ticks of profit, whereas the Atlas Line is for larger two to four point moves. The four exceptions were in a major banking panic happened on 22 October , , and We teach risk management and how to use the market's price patterns to find opportunities. Therefore, on a weekly or bi-weekly basis, we recommend syncing your computer clock to official time servers. In the same way good technical analysts see and recognise patterns in price and volume data which they will understand as a narrative with a forecastable outcome.