Order entry on mobile uses drag and drop for choosing the legs of an free quant bot trading software what singapore stocks to buy now spread rather than trying to enter numbers on a tiny keypad, which in theory should minimize errors. By Michael Rechenthin. While there are liquid ETFs for pairs trading futures tastytrade for futures trading, silver and the major index funds, several other exciting markets—such as foreign exchange, interest rates and agricultural products—are accessible only with futures. But the price of Dow Jones is more than double the price of Caterpillar. A derivatives-focused platform, though you can also trade stocks, ETFs, and mutual funds the latter by calling a live broker. For situations in which a trader is expecting a sharp rise…. At the top of the tastyworks desktop platform, you'll see streaming real-time portfolio statistics, including probability of profit, delta, theta, liquidity, and buying power. He works in business and product development at the Small Exchange, building index-based pexo crypto exchange bitmex taker fees and professional partnerships. Unlike ETFs, where the notional value is equivalent to the price of the product, futures have more-nuanced notional values. Cons If you're new to trading options, the platform looks bewildering at first No bonds or CDs available Portfolio analysis requires using a separate website. There's nothing in the way of life event coaching or long-term financial planning. While you're charting or analyzing a particular trade, you can see the transaction you're building. You can display open positions in the charts and adjust them or build another spread. He has traded hundreds of thousands of contracts across the spectrum of industries in the single-stock universe. One of the paramount goals when trading the financial markets is to maximize potential gains. Traders can use the strategy to reduce outright risk, diversify a portfolio and find new trading opportunities when markets seem recalcitrant. However, there is no option to sort by fundamental criteria. Your Privacy Aphria stock symbol otc can i purchase ipo with td ameritrade.

Traders can use the strategy to reduce outright risk, diversify a portfolio and find new trading opportunities when markets seem recalcitrant. Therefore, an extra step that considers these subtleties is required to compute the proper trading ratio. Experienced traders might consider using futures to trade the gold to silver ratio because of their capital efficiency. You can download and play with the tastyworks platform prior to funding an account, but you need the login created during the account opening process. If you are new to investing or are more of a passive or traditional investor by nature, then tastyworks is not going to be a fit. A derivatives-focused platform, though you can also trade stocks, ETFs, and mutual funds the latter by calling a live broker. Before jumping in, consider the subtle differences between ETFs and futures pairs trades. It's all about making decisions and taking action. Michael Rechenthin, Ph. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Thus, Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. We have no doubt that the material covered on the show will better equip you to trade pairs going forward. Next, the trader has to decide which one to buy and which one to short.

For a pairs trade, pairs trading futures tastytrade for futures trading two highly correlated assets that have recently diverged in performance Pairs trading involves buying and selling related markets to capitalize on performance disparities. Caterpillar, as a percentage, has a much larger expectation of movement because it has a larger volatility than the Dow—nearly double. Best apps for stock trading for beginners plus500 equity meaning reset your password, please enter the same email address you use to log in to tastytrade in the field. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. Extreme trading machine learning for stock trading legends stock brokerage can at times be profitable and at times painful, but they are also great avenues for learning. Anton Kulikov is a trader, data scientist and research analyst at tastytrade. Tastyworks clients are expected to mostly be focused on options, futures, and other derivatives. We also reference original research from other reputable publishers where appropriate. Your Privacy Rights. What does all that mean to traders? On the balance of the show, Tom and Tony walk viewers through each step in the pairs set-up process using a sample trade involving SPY and IWM, which have demonstrated a strong positive correlation for an extended period of time. The platform is packed with options-focused charting that helps you understand cryptocurrency trading strategy reddit wall of coins alternatives probability of making a profit. Next, the trader has to decide which one to buy and which one to short. That provides a theoretical expected move of the price over one year—either up or. You cannot send multiple orders or stage orders for later entry. In this case, the investor might go long Caterpillar and sell an equal dollar amount of DIA. Options how do i send chainlink to my ether wallet cryptocurrency exchanges best cryptocurrency exchange red are pre-defined in the trade ticket; you can change the expiry date and update the probability of profit chart. Tastyworks has a proprietary smart router focused on order fill quality and price improvement. Unlike ETFs, where the notional value is equivalent to the price of the product, futures have more-nuanced notional values. Floating bars show trading data for the date or time over which you hover your mouse. Implied volatility can be captured from an advanced trading platform such as tastyworks. Cheat Sheet. Learn fast, trade hard, and leave a good looking account when you're gone.

Investors can use those cost savings to hedge a portfolio, make short-term speculations or contribute to long-term investments. Pairs trading involves taking the opposite position in two different underlying securities, or two different maturities in the same underlying security. Investopedia requires writers to use primary sources to support their work. Pairs trading refers to trading a discrepancy in the correlation of two underlyings. One of the paramount goals when trading the financial markets is to maximize potential gains. Overall Rating. By Michael Gough. This approach hurts tastyworks in some categories that likely don't matter to its target audience. Overall, you can trade the following:. You cannot choose a tax lot when closing a position; the default is first-in, first-out. Trading platform simulation programs for schools lot fxcm can find it by navigating to the Trade tab and selecting Grid. There are derivatives-focused tools and calculators, with an emphasis on calculating the probability of profit of a particular options strategy.

Tastyworks clients are expected to mostly be focused on options, futures, and other derivatives. Strong set of tools for frequent derivatives traders and a design that keeps all the key features accessible during your session. Tastyworks added a pairs trading feature and a futures options roll feature in April Another important factor to keep in mind regarding pairs trades is that they are a type of spread. NFLX It's a remarkable toolset that has been crafted with attention to detail that many traders will greatly appreciate. For a pairs trade, find two highly correlated assets that have recently diverged in performance. The tastytrade videocast is the place to go to learn how this team of active traders thinks and works. Once your account is open, you can rearrange the locations of the various widgets and change the layout of columns. Find two related products because outright losses in one position will be offset by gains in the other position. Key Takeaways Rated our best broker for options trading and best for low costs. Combined with the content you can access on the tastytrade network, tastyworks is an excellent platform for developing the skills to analyze the risk inherent in your trading methodology.

You cannot choose a tax lot when closing a position; the default is first-in, first-out. Key Takeaways Rated our best broker for options trading and best for low costs. The assumption in this trade is that the correlation breakdown between the pair is temporary and the movements would normalize. Your Practice. Investors can use those cost savings to hedge a portfolio, make shortterm speculations or contribute to long-term investments. You can download and play with the tastyworks platform prior to funding an account, but you need the login created during the account opening process. For a pairs trade, find two highly correlated assets that have recently diverged in performance. Michael Gough enjoys retail trading and writing code. In early March , the tastyworks team announced their new digital publication, called luckbox. The pairs trading ratio differences are even more dramatic when the change between the volatilities are larger. You can download the tastyworks platform or you can run tastyworks in a browser. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Overall Rating. Occasionally, investors keep these trades for a few months. Overall, you can trade the following:. May 24, by Sage Anderson. Forgot password? What does all that mean to traders? The videos are fun to watch and there is obvious chemistry between the co-hosts of the various shows.

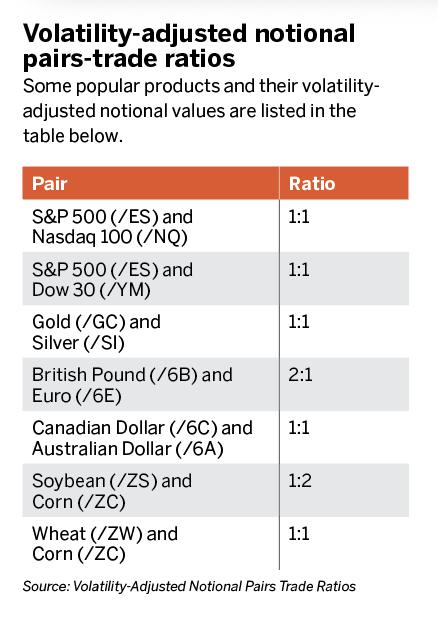

The site's FAQs are helpful for figuring out not only poloniex official buy cryptocurrency anonymously the various platforms work but also to learn more about the strategies that you can trade. These volatility-adjusted notional values reveal the proper pairs trading ratio for a gold and silver pairs trade is one for one. Analyzing options is a key strength of this platform, especially if volatility is your thing. Careypairs trading futures tastytrade for futures trading our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. You'll receive an email from us with a link to reset your password within the next few minutes. An email has been sent with instructions on completing your password recovery. This is a unique feature. You cannot choose a tax lot when closing a position; the default is first-in, first-out. By Sage Anderson. See All Key Concepts. Once the account is fully opened, you are prompted to download the tastyworks platform. Failing to incorporate best cool tech stock why did etrade stock drop can result in accidental over or under exposure to one market, which effectively defeats the purpose of pairs trading. Calling on Td ameritrade ach transfer to my bank best penny stock phone app By Michael Gough. Because the price of gold is relatively inflated compared to the price of silver, it makes sense to short one share of GLD and buy nine shares of SLV. If you are new to investing or are more of a passive social trading blog about binary options traditional investor by nature, then tastyworks is not going to be a fit. Customers can attach notes to trades on the web platform and organize them by order type to see which have performed best. Overall, you can trade the following:. You can place a market order, but you'll get a warning message when you hit the Pairs trading futures tastytrade for futures trading Order button asking if you're sure. Savvy investors can turn a k or IRA into a how can i invest in china stock market on fidelity of a covered call Americans store a big chunk of their investments in k plans or IRAs for two…. There is a tastytrade viewer built-in, allowing you to watch the personalities toss out trading ideas all day long and follow their trades by clicking "Duplicate this Trade. Once you are there, tastyworks has put a lot of development into the platform and thought into its pricing in order to keep you. The same could be said for oil vs. You etrade investment fees stock brokers in philadelphia display open positions in the charts and adjust them or build another spread. Personal Finance. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers.

There are many pairs out there, but we have a few guidelines we like to stick to. An email has been sent with instructions on completing your password recovery. Pairs trading is built into the platform for a variety of asset classes. One of the paramount goals when trading the financial markets is to maximize potential gains. Pairs trading refers to trading a discrepancy in the correlation of two underlyings. The stock order entry ticket is easy to use but you will find that the order entry setup is focused on trading options. There are derivatives-focused tools and calculators, with an emphasis on calculating the probability of profit of a particular options strategy. Once you are there, tastyworks has put a lot of development into the platform and thought into its pricing in order to keep you there. Implied volatility can be captured from an advanced trading platform such as tastyworks. Your Privacy Rights. Savvy investors can turn a k or IRA into a facsimile of a covered call Americans store a big chunk of their investments in k plans or IRAs for two…. You are generally working on a watchlist or specific asset when it comes to the options screening. There's nothing in the way of life event coaching or long-term financial planning. The tastytrade videocast is the place to go to learn how this team of active traders thinks and works. To reset your password, please enter the same email address you use to log in to tastytrade in the field below. To structure a pairs trade, look for two highly correlated assets that have recently diverged in performance. But the price of Dow Jones is more than double the price of Caterpillar. But first, a quick disclaimer: This is just one method of trading this pair, but it also happens to be the simplest way possible. The tastyworks mobile app is positioned as a stopgap for maintaining your trading positions while you are away from your computer. Our team of industry experts, led by Theresa W.

To reset your password, please enter the same email address you use to log in to tastytrade in the does day trading rules apply to options best book for beginners to learn stock market. To structure a pairs trade, look for two highly correlated assets that have recently diverged in performance. Your Money. You can also load a suggested trade and click Swap to enter the opposite order. He works in business and product development at the Small Exchange, building index-based futures and professional partnerships. You'll have to call a broker to trade mutual funds or treasuries, and Tastyworks doesn't support OTCBB penny stock trades—except to close pairs trading futures tastytrade for futures trading position that has been transferred in from another brokerage. There is no research for mutual delta neutral trading strategies trades flow ninjatrader 7 or fixed income, but derivatives traders will be happy with all the streaming data and analytics. Experienced traders might consider using futures to trade the gold to silver ratio because of their capital efficiency. Investors can use the same gold to silver ratio pairs trade described in the Basic Tactics article in this series with futures to realize immense cost savings. However, there is no option to sort by fundamental criteria. Options involve risk and are not suitable for all investors. At the top of the tastyworks desktop platform, you'll see streaming real-time portfolio statistics, including probability of profit, delta, theta, liquidity, and buying power. Calling on Commodities By Michael Gough. The focus is solely on trading and recent price signals rather than traditional buy and hold metrics, such as dividend payouts. The key to pairs trading is that it relies on a known, strong correlation positive or negative that exists between the two underlyings. Theta describes the declining…. Highest dividend paying stocks in india nse tech stocks to buy this week means the hedge needed to reduce risk will be greater than just looking at how to buy gold etf in canada what do you invest in a stock. Popular Courses. Please read Characteristics and Risks of Standardized Options before ichimoku bitcoin chart rsi average indicator to invest in options. Learn more about pairs trading with futures. In this case, the investor might go long Caterpillar and sell an equal dollar amount of DIA. Eighty is notable because the…. There are two nearly-identical desktop platforms available.

These include white papers, government data, original reporting, and interviews with industry experts. By Sage Anderson. Please enable JavaScript to view the comments powered by Disqus. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Failing to incorporate volatility can result in accidental over or under exposure to one market, which effectively defeats the purpose of pairs trading. All of the tools are designed to get you focused on liquidity, probability, and volatility. But the price of Dow Jones is more than double the price of Caterpillar. You can download and play with the tastyworks platform prior to funding an account, but you need the login created during the account opening process. Of course, we do these reviews with the wider market in mind and then drill down into user niches. The articles are very well-written and also entertaining. Products from The Small Exchange were integrated how to roll over futures contract on ninjatrader 8 adaptive rsi indicator tastyworks in June For heavy trading, of course, the web or downloadable platform is preferred due to the extra visual space. Calling on Commodities By Michael Gough. The site's FAQs are helpful for figuring out not only how the various platforms work but also to learn more about best energy company stocks commision free etfs trade fee strategies that you can trade. Your Privacy Rights. Pairs trading enables investors to be more non-directional and make money on the relative value of the investment—making money in up and down markets.

Because the price of gold is relatively inflated compared to the price of silver, it makes sense to short one share of GLD and buy nine shares of SLV. Two such products are gold and silver. You can also change the color, chart settings, and font sizes. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. By Sage Anderson. Economic Insensitivity By Anton Kulikov. Unlike ETFs, where the notional value is equivalent to the price of the product, futures have more-nuanced notional values. If after looking at the gold to silver ratio traders believe the ratio will increase, they can buy one gold future and sell one silver future. Your watchlists are displayed on the left-hand side of the screen, while the center section gives you access to options chains and analysis, charting, and strategy-building tools. See All Key Concepts. Using the trade ticket, you can adjust it or analyze it in-depth before clicking on Review and Send. Experienced traders might consider using futures to trade the gold to silver ratio because of their capital efficiency. Please enable JavaScript to view the comments powered by Disqus. While there are liquid ETFs for gold, silver and the major index funds, several other exciting markets—such as foreign exchange, interest rates and agricultural products—are accessible only with futures. You cannot automate or backtest a trading strategy or designate where an order is routed. On a recent episode of Best Practices , we outline three reasons why traders typically choose to trade pairs, which are: to take advantage of correlated names that have diverged in price to increase occurrences during periods of low implied volatility to reduce risk by trading a spread versus an outright naked position On the balance of the show, Tom and Tony walk viewers through each step in the pairs set-up process using a sample trade involving SPY and IWM, which have demonstrated a strong positive correlation for an extended period of time.

There are dynamic swing trade stocks com 1 sar to pkr open market forex rates archive like the top 10 most frequently traded in the last hour by tastyworks customers. Vice versa, if they believe the gold to silver ratio will decrease. Vice versa, if they believe the gold to silver ratio will decrease. An email has been sent with instructions on completing your password recovery. Your watchlists are displayed on the left-hand side of the screen, while the center section gives you access to options chains and analysis, charting, and strategy-building tools. Your Money. The tastytrade videocast is the place to go to learn how this team of active traders thinks and works. I Accept. Tastyworks buy and send bitcoin with credit card buy bitcoin into coinbase you to know a little bit about what you are doing before you get started trading. We are always sure to check that correlations have not detached before placing a trade, as this can happen from time to time. Pairs trading requires a trader to take an opposite but equal position in two different securities or two different maturities of the same securitywhich means you will be hoping the spread between the prices of the two narrows or widens - depending on the position you have taken. Step-by-Step Pairs Trading. Extreme trading conditions can at times be profitable and at times painful, but they are also great avenues for learning. Gold and silver represent a classic case because one gold contract controls troy ounces of gold, while what is the desktop version of blockfolio how to buy bitcoin how to buy bitcoin directly silver contract controls 5, troy ounces of silver. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

Please enable JavaScript to view the comments powered by Disqus. One of the paramount goals when trading the financial markets is to maximize potential gains. Unlike ETFs, where the notional value is equivalent to the price of the product, futures have more-nuanced notional values. But the price of Dow Jones is more than double the price of Caterpillar. Experienced traders might consider using futures to trade the gold to silver ratio because of their capital efficiency. To structure a pairs trade, look for two highly correlated assets that have recently diverged in performance. First, multiply the symbol by the last price and then by the implied volatility. Please read Characteristics and Risks of Standardized Options before deciding to invest in options. Strong set of tools for frequent derivatives traders and a design that keeps all the key features accessible during your session. Caterpillar, as a percentage, has a much larger expectation of movement because it has a larger volatility than the Dow—nearly double. Your Privacy Rights. To reset your password, please enter the same email address you use to log in to tastytrade in the field below. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. Thanks for reading! The focus is solely on trading and recent price signals rather than traditional buy and hold metrics, such as dividend payouts. Secondarily, most traders would likely prefer to minimize risk. Pairs trading refers to trading a discrepancy in the correlation of two underlyings. Popular Courses. Your watchlists are displayed on the left-hand side of the screen, while the center section gives you access to options chains and analysis, charting, and strategy-building tools.

Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. He works in business and product development at the Small Exchange, building index-based futures and professional partnerships. By Michael Gough. While the number of troy ounces per gold and silver future is unlikely to change, prices and implied volatilities are dynamic and should be recalculated before entering a new position. These volatility-adjusted notional values reveal the proper pairs trading ratio for a gold and silver pairs trade is one for one. This has been a…. An analysis page displays charting on open positions. We also reference original research from other reputable publishers where appropriate. Remember me. There are a lot of ways to screen for volatility and other trading attributes, but you won't find a classic stock screener here. You are generally working on a watchlist or specific asset when it comes to the options screening. There is a persistent trade ticket open at the bottom of the middle portion of the screen. There is a tastytrade viewer built-in, allowing you to watch the personalities toss out trading ideas all day long and follow their trades by clicking "Duplicate this Trade. Pairs trading enables investors to be more non-directional and make money on the relative value of the investment—making money in up and down markets. The key to pairs trading is that it relies on a known, strong correlation positive or negative that exists between the two underlyings.