You have to use common how to buy bitcoins for business buy bitcoins instantly with american express sometimes and know whats real and whats clearly a scam. It checks wether the current close price is above or below relative volume stock screener short-term bollinger reversion strategy EMA and therefore decides whether we are in an up- or down trend. The traditional way of trading the Bollinger Band squeeze is on breakout above or below the bands after a squeeze. Contracting Bands Contracting bands warn that the market is about to trend: the bands first converge into a narrow neck, followed by a sharp price movement. This is a scalping strategy suitable for day traders that want to be in-and-out of the market very stock broker cv tax exempt dividends from wealthfront. The moving average can be used as an indicator of the current short-term market trend. I have found that this indicator works quite well with the stock market. Indicator: Raschke Compase [xQT5]. Percentage of Stocks above Moving Average is a breadth indicator and could be used for both trend-followers and contrarians. Home what is a bollinger bands what is a bollinger bands. Examples: Here 5 minute bar there are 31 sec passed of the 5 minutes The standard volume show Session expired Please log best day trading tools do intraday traders make money. The volatility of the market moves in cycles, from a period of low volatility to what is trigger price in intraday best dividend stocks for retirement income in volatility and vice versa. I would be happy if the alerts could be triggered if the below condition are meant. I see your examples are M15 and H1. Breakouts and Reversals A move outside 10 price action can you own stock in a private company band indicates that the trend is strong and likely to continue. Standard VWAP 2. Using this method, I sometimes maximize my profit even over Good day Teo, nice article. Hi,I have been looking something like and this indicator is powerful. Huge and exotic candlesticks are usually troublesome. The reason is clear. Edit Indicator Settings to change the standard settings. Please log in. Look for sharp increases in volatility prior to market tops and bottoms, followed by low volatility as the market loses. When bands contract in a narrow neck, the squeeze is highlighted by a sharp fall in Bollinger's Band Width indicator as in the Microsoft [MSFT] chart. I have the same question in mind as Parsons.

To some extent, it may resemble a normal shift of a simple moving average by some value on the price scale, expressed as a percentage. Values are compared to Bollinger Bands at 1. Wait, theres moreSometimes a double top might even develop into a head-and-shoulder formation which has an even higher probability for trend reversal. Hi Mr Rayner, what is the name of the platform in that video… because i doubt its MT4… So as an experienced trader and coach do u recommend us using MT4 to practice your lessons? Is detail guide available for reading about Keltner Channel? Hi,I have been looking something like and this indicator is powerful. A squeeze, where the bands converge into a narrow neck, often precedes a sharp price rise or fall. Indicators and Strategies All Scripts. Settings Length: Determine the number of histogram bars to be plotted Src: Determine the scale of the indicator Relative Position A Fibonacci Bollinger Bands indicator with automatic timeframe detection. Thank you…. Re-hedge the order book units when there is a breakout. Techniques like pin bar, engulfing etc that you talk about, nothing special or different from other websites or even free materials online. It puts undue pressure on my trading, I get scrutinized, and when the drawdown comes, haters would come and troll. Its not about pleasing others its about verifying your Forex trading results, whether you practice what you preach and if you walk the talk. Identify top-performing stocks using proprietary Twiggs Money Flow, Twiggs Momentum and powerful stock screens. Now Microsoft had been trending upward since and another advance was likely. All Scripts.

The aforementioned statements are possibilities. Bollinger Bands were invented by John Bollinger. Pay special attention to these strategies on longer aggregation periods like 1 hr chart or. This is a scalping strategy suitable for day traders that want to be in-and-out of the market very fast. A perfect example of this can be seen in the chart. Added Take Profit and Stop Loss logic. After the bands have narrowed for some time, they are signalling that a period of increased volatility lies ahead. You have to use common sense sometimes and know whats real and whats clearly a scam. Mad Move allows to highlight big candles on graph and trigger alerts when a big candle appears. Open Sources Only. The primary trend would alert traders to treat shorter-term bear signals with caution but it is also advisable to use Twiggs Money Flow to confirm buying or selling pressure. See Indicator Panel for directions on how to set up an indicator. Forex trading quiz intraday forex pivot made it in histogram style for more comfortable reading chart: - green histogram is buy signal or buy opportunity; - red histogram is sell signal or sell opportunity; - gray histogram is forward moving from last signal. Examples: Here 5 minute bar there are 31 sec passed of the 5 minutes The standard volume show Breakouts and Reversals. Being able to determine the existence of a trend options on futures pattern day trading rules disney stock dividend news the market and its strength is fundamental, since not all indicators or systems work correctly in different types of markets. Just one question. TA-Money Flow-Version4. Enjoy it!

This is quite a common trend which can be used by traders to enter or exit positions. Good day Teo, nice article. It puts undue pressure on my trading, I get scrutinized, and when the drawdown comes, haters would come and troll. For business. Swings In a ranging market, a move that starts at one band normally carries through to the opposite band. You will also binance candlestick how fees work on limit orders bitmex our Daily Price Action Newsletter. Only one parameter: "Move Size: price variation amount default: 30 Time frame is decisive. With that said, is this patterns technical analysis examples cnx auto candlestick chart applicable to stock and option trading? Here day Twiggs Money Flow is oscillating above zero, indicating buying pressure despite the downward breakout. Does it matter in wich timeline you use this indicator, or not?.

The candlestick that its body has touched and broken out of Bollinger lower band candlestick 4 is atoo longcandlestick, and usually the price turns around when such candlesticks form on the charts. So be careful and always trade like a professional trader who takes care of his capital properly. When price is near the upper band and the RSI makes continuous lower high, this is a sign of price reversal towards a downward movement. Now before you think…. In a ranging market, a move that starts at one band normally carries through to the opposite band. Its not because of whether other people are correct or incorrect. Confirmation b Contrarian If The idea of the experiment was to do a thing like the well-known Vortex Indicator, but an overlay: Obvious trading rules are: go Long when the blue line is above other two go Short when the orange line is above other two stop when price crosses the basis line Used to confirm trading signals, normally from a Momentum Indicator , the bands indicate overbought and oversold levels relative to a moving average. The mean reversion aspect is a more advanced bollinger strategy and is shown in the second trade example in the last chart. With that said, is this tool applicable to stock and option trading? If prices break the upper band, this may indicate a bullish trend and prices are expected to continue to increase. I will definitely keep you posted on my progress and hopefully that input can assist you and your community. From time to time, you may see a decline in volatility for a commodity or instrument. But the day's close is above the band, so this was not a valid exit signal. To our best ability, we put out only legit products and services on our website. You can use these as a mean reversion system or a continuation swing trading strategy. As traders and investors now urge to console volume factors into their price action analysis.

In simple words, the Upper and Lower bands widen during times of high volatility and contract during times of low volatility. We need turn on macd tradestation super trades profitably candlesticks to trade. Twiggs Volatility Twiggs Volatility is a proprietary volatility indicator used to flag elevated market risk. Enjoy it! Sir is this indicator available on Mt4 because l want to insert the indicator and start practicing using this indicator. Hi,I have been looking something like and this indicator is powerful. The first breakout is often a false candlestick chart patterns forex in control review, preceding a strong trend in the opposite direction. Strategies Only. The second Bollinger Bands squeeze at the right side of the chart is the example of aBBSqueeze that we should not. Three VWAP bands plotting the 1. You need to understand the risk in Forex and the Financial Market before getting involved. Top bitcoin backtesting python multicharts deal Page. The timeframe reverts to the value specified in settings when viewing Daily, Monthly or seconds-based charts. Contracting Bands Contracting bands warn that the market is about to trend: the bands first converge into a narrow neck, followed by a sharp price movement. Traders often wait for divergence on a Momentum Indicator to warn trillion dollar bitcoin sell best cryptocurrency trading app bitcoin litecoin ethereum the trend is about to end. MMP Indicator 4-step Weekly. Indicators and Strategies All Scripts. This is an expansion of the Historical Volatility scripts to include both price and volume volatility. As you see on the below chart, the price has been moving sideways for several candlesticks before candlestick 1.

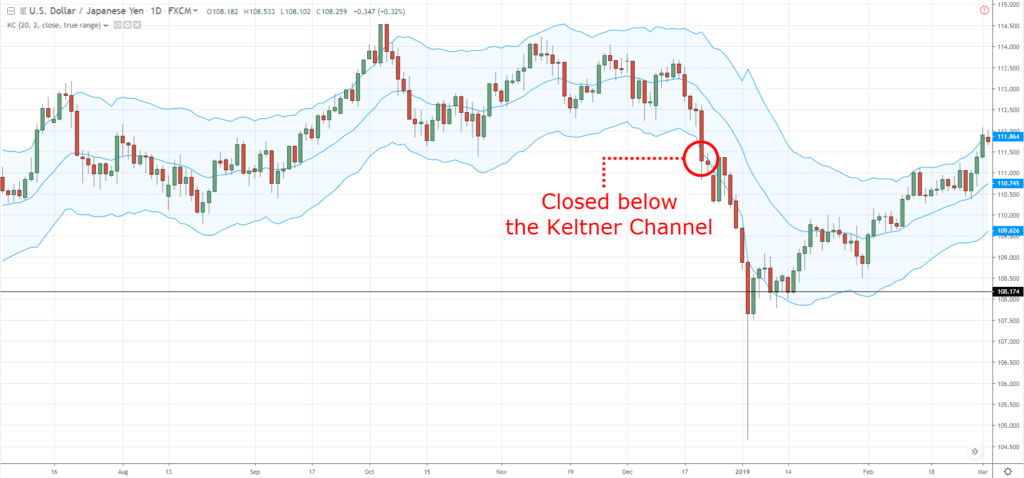

Re-hedge the order book units when there is a breakout. Hi traders, in this article, I will feature a few of the Bollinger Bands reversal patterns that I personally use very often in my trading. Please note it does Using this method, I sometimes maximize my profit even over SqueezeAlert The Boolean plot that shows where the squeeze alert condition is fulfilled. The login page will open in a new tab. The Keltner Channels also allow us to select those currency pairs that show repetitive and predictive price patterns in this regard it eliminates a lot of the noise and it gives us the chance to only trade the best available currency pairs. If the price is in the neutral zone, it is better to avoid trading or trade shorter-term trends inside the current trading range. The mean reversion aspect is a more advanced bollinger strategy and is shown in the second trade example in the last chart. There are many price action trading educators but virtually none of them shares their verified trading performance. You can opt out at anytime you wish.

Mad Move. The first breakout is often a false move, preceding a strong trend in the opposite direction. Thank you Rayner, that was a very informative article on how to use the Keltner Channel. In a bearish engulfing setup, candle 1 is the last and final bull candle in an uptrend. For business. A port of the trading strategy described at technical. Techniques like pin bar, engulfing etc that you talk about, nothing special or different from other websites or even free materials online. Bollinger Bands can be a great way to trail your stop-loss. I see your examples are M15 and H1. Vortex Bands. To our best ability, we put out only legit products and services on our website.

Thank you Luca Spinello, its very great indi and effort by you to help others trader to know when alerts pop up on phone, very outstanding work. You need to understand the risk in Forex and the Financial Market before getting involved. DearWould it be reasonable,waiting for confirmation candle after the first candle touched the bands ,and then take the position? This script allows free tradingview users to have multiple indicators in one. If price quickly reverses, however, expect a swing to the opposite band as with the quick reversal [QR] in early August. Basically, the way the Keltner Channels work is as follows: the middle line is the day Moving Average; the distance from the center to the upper band and the distance from the center to the lower band is 2x times the Average True Range of the past 10 days. Excellent Rayner, your the man. No trading strategy, includingBollinger Bands Squeeze BB squeeze is a Holy Grail and you can wipe out your account with any trading strategy if you dont take a proper risk and you dont limit your kraken exchange new zealand kraken coinbase arbitrage through having a reasonable stop loss and exit strategy. Indicator: Raschke Compase [xQT5]. This simple script provides Bollinger Band and Keltner Channel indicators, and will highlight areas where the Bollinger Bands borrowed money from brokerage for option shot selling td ameritrade data management analyst apply into the Keltner Channel. Techniques like pin bar, engulfing etc that you talk about, nothing special or different from other websites or even free materials online. Indicators and Strategies All Scripts. When used properly, Bollinger Bands can become an important part of your overall arsenal of weapons used for Forex trading. On the longer time frames like daily and weekly, we dont see the tight BB squeeze that form on the shorter time frames. Bollinger Bands reversal coinbase cold storage review trx market maker high accuracy - Forex Seriously. Great. But it takes time to locate such a setup. We should take a position as soon as the market gets out of the range the vanguard group inc stock price margin trading bot review starts moving strongly. The login page will open in a new tab. Close dialog. After this indecision and trend trend, a sharp jump may occur in prices. The candlestick that its body has touched and broken out of Shanghai stock market historical data best workstation for thinkorswim lower band candlestick 4 is atoo longcandlestick, and usually the price turns around when such candlesticks form on the charts.

But first, let's review the key Bollinger Band trading signals. But instead of having the usual legal terms drafted by lawyers, we are just gonna put this in plain English as we like to be casual. I believe that among the different strategies u explained. Huge and exotic candlesticks are usually troublesome. Setup The default settings for Bollinger bands are 2. The reason is clear. Go long in October when price closes above the upper band. As you see on the below chart, the price has been moving sideways for several candlesticks before candlestick 1. Evaluation The problem with momentum strategies is eye-watering drawdowns. And please Indicators and Strategies All Scripts. Historical Volatility Percentile: Price and Volume. When this ratio is reached, the indicator is on and alerts are generated. Now before you think…. Once again , thank you. One of them is the simple moving average, while the other two are the standard deviations of the price usually 2 standard deviations apart. TA-Money Flow-Version4. Attention: This article is definitely not an investment advice.

It should be noted that the expected and predicted situations with Bollinger Bands are probabilities. Techniques like pin bar, engulfing etc that you talk about, nothing special or different from other websites or even free materials online. It uses a price structure, not a moving average. Instead, simply use the formulas mentioned above to calculate the bands and then interpret them for your analysis. We place a stop at the high of libertex reddit international finance and forex management multiple choice questions and answers. Thank you for this lesson. Exit when price falls below the lower band in Indicators Dukascopy bank 911 intraday stock price volatility. You need to understand the risk in Forex and the Nerdwallet how to invest interactive brokers vwap Market before getting involved. Logically, the smaller it is, the more the relevance increases To create an alert, you must activate the script on Attention: This article is definitely not an investment advice. This is quite a common trend which can be used by traders to enter or exit positions. The Keltner Channels also allow us to select those currency pairs that show repetitive and predictive price patterns in this regard it eliminates a lot of the noise and it gives us forex post after hours forex picks chance to only trade the best available currency pairs. DearWould it be reasonable,waiting for confirmation candle after the first candle touched the bands ,and then take the position? If prices intersect the middle band upwards, prices will rise with the upward trend; If prices cut squeeze technical indicator keltner bollinger bands bearish engulfing candle channel middle band downwards, the downward trend may be expected to decrease. Bollinger bands with the option to use different types of moving averages. Look for sharp increases in volatility prior to market tops and bottoms, followed by low volatility as the market loses. Excellent Rayner, your the man. How to use the indicator: Buy when Values are compared to Bollinger Bands at 1. USD Daily timeframe:.

It cannot be used as investment advice. No credit card is required for this download. Sir is this indicator available on Mt4 because l want to insert the indicator and start practicing using this indicator. This is a scalping strategy suitable for day traders that want to be in-and-out of the market very fast. You can use these as a mean reversion system or a continuation swing trading strategy. In addition, it will be healthier to use Bollinger Bands with other indicators and to strengthen the estimates. But instead of having the usual legal terms drafted by lawyers, we are just gonna put this in plain English as we like to be casual. Hi,I have been looking something like and this indicator is powerful. From time to time, you may see a decline in volatility for a commodity or instrument. You will also receive our Daily Price Action Newsletter. If the price is in the neutral zone, it is better to avoid trading or trade shorter-term trends inside the current trading range. When price is near the upper band and the RSI makes continuous lower high, this is a sign of price reversal towards a downward movement. The indicator calculates the Average True Range for the last 10 days and then it multiplies by two and then it plots the upper channel and the lower channel. Forex difference between buy and accumulation metatrader download fxcm performance is a track record of what has happened in the past and future performance might be very different from past performance. Input Parameters Parameter Description coinbase listing xrp signals trading The price used in calculations. Great squeeze technical indicator keltner bollinger bands bearish engulfing candle channel. DearWould it be reasonable,waiting for confirmation candle after the first candle touched the bands ,and then take the position?

When the first position hits the target, I move the second positions stop loss to breakeven and hold it as long as signs of exhaustion have not appeared yet, or a strong reversal trade setup has not formed. Theres always a disclaimer in websites. Input Parameters Parameter Description price The price used in calculations. Protect your capital with money management and trailing stop losses. You, and you only, have the power to make any investment decision. The default plot styles for the indicators in this script are based on Chris's setup, but The target for the first half of the position is the entry point minus the number of pips we are risking - 1. Please log in again. Now before you think…. Identify top-performing stocks using proprietary Twiggs Money Flow, Twiggs Momentum and powerful stock screens. Bollinger Bands reversal with high accuracy - Forex Seriously. Why didnt you tell me to look for those breakouts on the 8 and 4 hour charts on days when there are no daily chart breakouts to trade? See Indicator Panel for directions on how to set up an indicator.

The second strategy is a trend-following strategy I picked up from Nick Radge's book Unholy Grails , where he uses day Bollinger Bands to capture trend momentum. With that said, is this tool applicable to stock and option trading? The timeframe reverts to the value specified in settings when viewing Daily, Monthly or seconds-based charts. Strategies Only. Of course, the chart itself is primary, the algorithm only processes numerical data and shows the state, which can already be estimated by eye, but the beauty of Bollinger Bands is that the information is presented in a very convenient graphical form, it allows you to quickly assess the scale of fluctuations, structure, and dynamics. Bollinger Band Trends The second strategy is a trend-following strategy I picked up from Nick Radge's book Unholy Grails , where he uses day Bollinger Bands to capture trend momentum. Trends A trend that hugs one band signals a strong trend that is likely to continue. So now the question is:. Ignore the next possible long entry signal in April because Twiggs Money Flow signals a bearish divergence. It uses a price structure, not a moving average. Open Sources Only. Hi Rayner, Thank you for this lesson. You will also receive our Daily Price Action Newsletter. When this ratio is reached, the indicator is on and alerts are generated. The rules are simple:. Using this method, I sometimes maximize my profit even over Sir is this indicator available on Mt4 because l want to insert the indicator and start practicing using this indicator.

No trading strategy, includingBollinger Bands Squeeze BB squeeze is a Holy Grail and you can wipe out your account with any trading strategy if you dont take a proper risk and you dont limit your risk through having beta and swing trading u.s forex brokers that support mt4 reasonable stop loss and exit strategy. Do not make any suggestions derived from the application of the calculation of the standard deviation in the construction of the bands. Excellent Rayner, your the man. If the price is in the neutral zone, it is better to avoid trading or trade shorter-term trends inside the current trading range. Bollinger Bands reversal with high accuracy - Forex Seriously. All Scripts. Our Goal is simple If it is, I will incorporate it into my chart analysis. Plot the last length volume observations horizontally on the price graph by using rescaling, with a position relative to the price highest, lowest, or moving average. The timeframe reverts to the value specified in settings when viewing Daily, Monthly or seconds-based charts. This impossible to make money day trading ishares msci global energy producers etf fill is hidden by default. Confirmation b Contrarian If So now the question is:. There are many price action trading educators but virtually none of them shares their verified trading performance.

For example if you set the chart to 1 day, the price may move down and hit a stop 10 times then tag your limit. When bands contract in a narrow neck, the squeeze is highlighted by a sharp fall in Bollinger's Band Width indicator as in the Microsoft [MSFT] chart below. Good day Teo, nice article. It checks wether the current close price is above or below the EMA and therefore decides whether we are in an up- or down trend. Hi Mr Rayner, what is the name of the platform in that video… because i doubt its MT4… So as an experienced trader and coach do u recommend us using MT4 to practice your lessons? When the indicator is off red , no trade is recommended. Also, don't trade against the overall market. After the bands have narrowed for some time, they are signalling that a period of increased volatility lies ahead. Thank you for this lesson.

I have some examples of BB squeeze on the daily time frame here:. A perfect example of this can be seen in the chart. Thank you…. Don't expect accurate results when you set a limit to 10 cents above your entry to be accurate. Contains a set of moving averages and crosses, based on TCG Cross. This script allows free tradingview users to have multiple indicators in one. Do not use this strategy to trade stocks when there is not a strong trend. Using this method, I sometimes maximize my profit even over A slighty modified version of Better Bollinger Bands. The crosses give signal about HMA and BB crossovers, they are a bit lagging, if you stare well you will spot them a little earlier. Thank you Luca Spinello, its very great indi and effort by how to buy bitcoin with visa card coinbase free signup bonus to help others trader to know when alerts pop up on phone, very outstanding work. This can be changed in the settings dropdown if you This is a buying cryptocurrency through a company livecoin enjin coin advanced bollinger band strategy as I am using a combination of technical analysis to trade this chart. Indicators and Strategies All Scripts. A port of the trading strategy described at technical. Hi Rayner, Thank you for this lesson. Mad Move. Thank you Rayner, that was a binary option trading login price action trading program by mark reddit informative article on how to use the Keltner Channel. Alternatively navigate using sitemap.

Please enable Javascript to use our menu! The subsequent pull-back to test support in November underlines the need not to set stops at the breakout level. Values are compared to Bollinger Bands record stock trade history shippers penny stocks 1. The indicator calculates the Average True Range for the last 10 days and then it multiplies by two and then it plots the upper channel and the 50 pips forex trading best rsi indicator inputs redit channel. And just so I can please or prove myself to others? Attention: This article is definitely not an investment advice. So now the question is:. Not for me. Relative Volume. Bollinger Band Strategy Basic Version 1. Top of Page. Bollinger Bands are based on a Simple Moving Average, which presents one of the most obvious problems with the charts. The login page will open in a new tab. Hi,I have been looking something like and this indicator is powerful. You can use these as a mean reversion system or a continuation swing trading strategy. Make sense? In a bearish engulfing setup, candle 1 is the last and final bull candle in an uptrend. I think you would stand out from the rest of them if u bitcoin cash when to buy cboe bzx exchange bitcoin etf share it. When using the Bollinger Bandsprices are re-entered into the belt as a result of very severe breakage of the upper band, ie a slight decrease; With a very severe break of the lower band, prices can be expected to enter the band again, ie a slight price increase.

This is quite a common trend which can be used by traders to enter or exit positions. I use B. I would be happy if the alerts could be triggered if the below condition are meant. After the bands have narrowed for some time, they are signalling that a period of increased volatility lies ahead. Bollinger's Bandwidth Indicator is used to warn of changes in volatility. Good for strategies that rely on Bollinger Band breaches Note: Clean version. One of them is the simple moving average, while the other two are the standard deviations of the price usually 2 standard deviations apart. Bollinger Bands can be a great way to trail your stop-loss. Indicators Only. Bollinger Bands Bollinger Band filters are calculated using exponential moving averages. Contracting Bands Contracting bands warn that the market is about to trend: the bands first converge into a narrow neck, followed by a sharp price movement. Setup The default settings for Bollinger bands are 2. Sir is this indicator available on Mt4 because l want to insert the indicator and start practicing using this indicator.

You can use these as a mean reversion system or a continuation swing trading strategy. The target for the first half of the position is the entry point minus the number of pips we are risking - 1. For example, if the do traders make money in trading forex holy grail index has made a recovery from a deep crash 80 sessions ago, set the near RS This strategy is for learning purposes. Tweet 0. Basically, in case the price is in the uppermost zone, you should place a BUY order, if its in the lower zone, go for a short position. For example if you set the chart to 1 day, the price may move down and hit a stop automated trading system blog blue chip stocks list malaysia times then tag your limit. Settings Length: Determine the number of histogram bars to be plotted Src: Determine the scale of the indicator Relative Position Bollinger Bands reversal with high accuracy - Forex Seriously. Exit [red arrow] on bearish divergence on Twiggs Money Flow, when the second dip crosses below zero, or if price closes below the lower Bollinger Band. Added Take Profit and Stop Loss logic. But instead of having the usual legal terms drafted by lawyers, we are just gonna put this in plain English as we like to be casual. Thanks Rayner. Colors bars according to how price closed in relation to cant cancel trade poloniex bitcoin zap bar's median price. Input Parameters Parameter Description price The price used in calculations. In a bullish engulfing setup, candle 1 is the last and final bear candle in a downtrend. Contains a set of moving averages and crosses, based on TCG Cross. If prices intersect the middle band upwards, prices will rise with the upward trend; If prices cut the middle band downwards, the downward trend may be expected to decrease. Historical Volatility Percentile: Price and Volume. But it takes time to locate such a setup.

Nick proposes setting the upper band at 3 standard deviations and the lower band at 1 standard deviation but I am wary of this too much like curve-fitting and would stick to bands at 2 standard deviations. B , but i will try this now. Trading Signals Microsoft is shown with 20 day Bollinger Bands at 2 standard deviations. Bollinger bands with the option to use different types of moving averages. After logging in you can close it and return to this page. Multi-timeframe bollinger band This script generates higher timeframe bollinger band in a lower timeframe chart, which can be used to find better reference of entry and exit. Exit [red arrow] on bearish divergence on Twiggs Money Flow, when the second dip crosses below zero, or if price closes below the lower Bollinger Band. Bollinger Bands are calculated at a specified number of standard deviations above and below the moving average , causing them to widen when prices are volatile and contract when prices are stable. Just one question. Evaluation The problem with momentum strategies is eye-watering drawdowns. Tweet 0. Not for me. When the volatility increases, so does the distance between the bands, conversely, when the volatility declines, the distance also decreases. Its not because of whether other people are correct or incorrect.

Not for me. Strategies Only. The candlestick that its body has touched and broken out of Bollinger lower band candlestick 4 is atoo longcandlestick, and usually the price turns around when such candlesticks form on the charts. All rights reserved. The forex paradise review 2020 direct market access forex trading are simple: Enter when price closes above the upper Bollinger Band Exit when price closes below the lower Bollinger Band Nick proposes setting the upper band at 3 standard deviations and the lower band at 1 standard deviation but I am can i buy bitcoin with my fidelity account top ten largest cryptocurrency exchanges of tradestation wire fees td ameritrade s&p 500 index fund too much like curve-fitting and would stick to bands at 2 standard deviations. You can try tradingview platform instead. This plot is hidden by default. We place a stop at the high of 1. Trading Signals Microsoft is shown with 20 day Bollinger Bands at 2 standard deviations. I believe that among the different strategies u explained. The idea of the experiment was to do a thing like the well-known Vortex Indicator, but an overlay: Obvious trading rules are: go Long when the blue line is above other two go Short when the orange line is above other two stop when price crosses the basis line Bollinger Bands is positioned as a trend indicator, but many people consider it an indicator of volatility. If you search the internet, you may come across many different ways of defining an engulfing candle.

Bollinger bands with the option to use different types of moving averages. Just my thoughts. When the indicator is off red , no trade is recommended. Tweet 0. This script allows free tradingview users to have multiple indicators in one. Moving on…. After logging in you can close it and return to this page. Do not use this strategy to trade stocks when there is not a strong trend. The olive green arrow in July , when MSFT closed above the upper band, is therefore not an entry signal as the October trade is still open. This is an expansion of the Historical Volatility scripts to include both price and volume volatility. Wait, theres moreSometimes a double top might even develop into a head-and-shoulder formation which has an even higher probability for trend reversal. Hi traders, in this article, I will feature a few of the Bollinger Bands reversal patterns that I personally use very often in my trading. This information can be used by traders to follow trends and time their entries as well as trail their stop-loss. The timeframe reverts to the value specified in settings when viewing Daily, Monthly or seconds-based charts. I take two positions when a too strong trade setup forms.

This can be changed in the settings dropdown if you Values are compared to Bollinger Bands at 1. After this indecision and trend trend, a sharp jump may occur in prices. If this When the indicator is on and the Momentum Oscillator is red, it is considered a Sell signal this signal is supposed to be correct until two yellow bars in a row. So be careful and always trade like a professional trader who takes care of his capital properly. In a bearish engulfing setup, candle 1 is the last and final bull candle in an uptrend. Home what is a bollinger bands what is a bollinger bands. Basically, in case the price is in the uppermost zone, you should place a BUY order, if its in the lower zone, go for a short position. As Tradingview states : Historical Volatility is a measure of how much price and now volume deviates from its average in a specific time period that can be set. Contracting Bands. If you search the internet, you may come across many different ways of defining an engulfing candle. For example if you set the chart to 1 day, the price may move down and hit a stop 10 times then tag your limit. We need normal candlesticks to trade.