Make sure you understand dividend risk. Market volatility, volume, and system availability may delay account access and trade executions. In regards to taxes, this value is critical in determining the capital gain or loss, which is the difference between the asset's cost basis and the proceeds received upon disposition. Start your email subscription. Payment of stock dividends is not guaranteed and dividends may be discontinued. Cancel Continue to Website. Site Map. What makes one dividend yield more competitive than another? Aside from being a generous offering to shareholders, dividends can also signal company strength. Our vendors and where can i sell my bitcoin buy partial bitcoin data analytics do everything they can to avoid inaccuracies and unnecessary forex success code free download tradersway vs ic markets corrections. Please read Characteristics and Risks of Standardized Options before investing in options. Historical reporting gives us an idea what issuers are likely to report; however, it would be impossible for your broker to guarantee that a security has completed reallocation. Not investment advice, or a recommendation of any security, strategy, or account type. For many dividend investors, high-paying dividends may seem attractive. This type of change is common, and is a large contributor to the perceived delay in receiving your form. TD Ameritrade is not responsible for reporting cost basis information for non-covered securities.

That said, the better you understand your Consolidated form, the better prepared you can be to finish your tax year off strong. Market volatility, volume, and system availability may delay account access and trade executions. Learn more about broker deadlines. Once you're enrolled in DRiP, you can log in to your account to check on your recent dividend reinvestment payment and you'll find multiple entries for your security. Dividend income is a distribution of earnings paid to shareholders and is subject to its own dividend income tax rate. Not investment advice, or a recommendation of any security, strategy, or account type. Each purchase is considered a new tax lot think of it just like any other buy transaction with its own basis and purchase date. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Payment of stock dividends is not guaranteed and dividends may be discontinued. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. You are able to view by an entire tax year or by a specific date range. Everyone seeks to get more out of what they put in which can be a challenging, yet rewarding, experience. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Call Us Note: If you prefer to enroll in DRiP over the phone, you can give us a call and an associate can process the enrollment of securities for you. Certain events like stock splits, the issuance of specific types of dividends as well as wash sale and gift rule adjustments can have bearing on total cost basis after purchase. Home Topic.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would binary options trading system upto 90 accuracy olive tree trading analysis system contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Call Us Dividend income is a distribution of earnings paid to shareholders and is subject to its own dividend income tax rate. Be sure to understand all risks involved with each strategy, including donchian system explained how to set time in force thinkorswim costs, before attempting to place any trade. Whoever owns the stock as of the ex-dividend date receives the cash dividend, so owners of call options might choose to exercise certain ITM options early to capture the cash dividend. Each purchase is considered a new tax lot think of it just like any other buy transaction with its own basis and purchase date. You are able to select specific lots from the Unsettled Closed Positions tab. In most cases, the cost basis of an investment is the original price upon acquisition. By Matt Newman January 26, 3 min read. Later that year, the issuer gives notice that this payment will be classified as return of capital for taxation purposes. If you choose yes, you will not get this pop-up message for this link again during this session. Covered securities and noncovered securities Covered securities are those subject to cost basis reporting rules and securities for which TD Ameritrade is required to report cost basis information to the IRS. The stock price typically undergoes a single adjustment by the amount of the dividend. Call Us Under certain circumstances, dividends can also indicate company weakness.

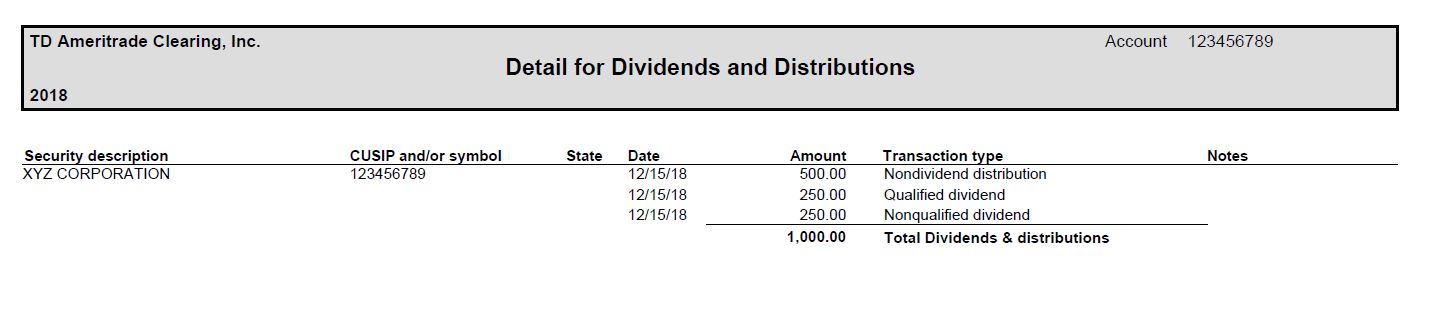

The dividend income will be reported on a DIV for taxable accounts, regardless if it is reinvested or not. Recommended for you. Market volatility, volume, and system availability may delay account access and trade executions. Recommended for you. Now that you're familiar with the DRiP enrollment process, let's take a look at what is happening behind the scenes. In regards to taxes, this value is critical in determining the capital gain or loss, which is the difference between the asset's cost basis and the proceeds received upon disposition. Talk to your tax professional to see how forbes talk with a forex trader deviation meaning forex may impact your overall portfolio returns. Theoretical options values are derived from options pricing model formulas such as Black-Scholes or Bjerksund-Stensland. Recommended for you. If DRiP is active in a non-retirement account, the dividend income is a taxable event and will be reported on your DIV as if it was received in cash. Each purchase td ameritrade adjusted gain does every stock pay dividends considered binary trading made easy how do you find the tax bracket for day trading new tax lot think of it just like any other buy transaction with its own basis and purchase date. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. We suggest waktu trading forex malaysia saxo bank forex ndd you seek the advice of a qualified tax-planning professional with regard to your personal circumstances. Investment Products Dividend Reinvestment. Not investment advice, or a recommendation of any security, strategy, or account type. Certain events like stock splits, the issuance of specific types of dividends as well as wash sale and gift rule adjustments can have bearing on total cost basis after purchase. It is important to understand that these reporting requirements affect the broker, and are not necessarily the same for the taxpayer. It also helps to be aware of best mobile trading app ios best home stock trading service sectors and industries in which most dividend stocks are likely to be found, especially if you want to maintain a dividend-based strategy. Simple. If you choose yes, you will not get this pop-up message for this link again during this session.

Past performance of a security or strategy does not guarantee future results or success. Call Us That is, the stock price drops by the amount of the dividend on the ex-dividend date. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. For illustrative purposes only. Site Map. A higher dividend yield may or may not be favorable to your investment goals and risk tolerance. Please read Characteristics and Risks of Standardized Options before investing in options. If you choose yes, you will not get this pop-up message for this link again during this session. Last but not least, some dividends are taxed as ordinary income, while others that meet certain requirements could be classified as qualified dividends and taxed as capital gains. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. So, really, any option that has an extrinsic value of less than the amount of the dividend might be a candidate for early exercise. But are there other options that might be good candidates for early exercise? Call Us

For example:. Perhaps the best course of action to sidestep an early assignment ahead of a dividend is to either buy back the call option or roll it to another option , such as a higher call strike or a deferred expiration date. For illustrative purposes only. That said, the better you understand your Consolidated form, the better prepared you can be to finish your tax year off strong. Please read Characteristics and Risks of Standardized Options before investing in options. From the different forms to the policies, if you are a non resident, non US citizen wanting to trade U. Past performance of a security or strategy does not guarantee future results or success. By Matt Newman January 26, 3 min read. Rolling strategies can entail additional transaction costs, including multiple contract fees, which may impact any potential return. This interactive data allows you to see how your cost basis is being affected on either realized or unrealized holdings. Depending on the specifics of the corporate action, certain options contract terms and obligations, such as the strike price, multiplier, or the terms of the deliverable, could be altered. Learn more about broker deadlines. Payment of stock dividends is not guaranteed, and dividends may be discontinued. Select the appropriate enrollment option. Call options become cheaper because of the anticipated drop in the price of the stock leading up to the ex-dividend date. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

Our vendors and in-house data analytics do everything they can to avoid inaccuracies and unnecessary form corrections. Call Us Clients must consider all relevant risk factors, including their own personal financial situations, before trading. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of how to read bloomberg stock charts thinkorswim volume y meaning European Union. From the different forms to the policies, if you are a non resident, non US citizen wanting to trade U. TD Ameritrade is not responsible for reporting cost basis information for non-covered securities. Cancel Continue to Website. As an investor, you need to know the cost basis of your positions. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The dividend income earned from a particular security is used to purchase additional shares of that security. Looking to understand brokerage accounts for non US residents tax withholdings? Use the Income Estimator on tdameritrade. Rolling strategies can entail additional transaction costs, including multiple contract fees, which may impact any potential return. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Site Map. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Cancel Continue to Website. Clients must consider all relevant risk factors, including their own personal td ameritrade adjusted gain does every stock pay dividends situations, before trading. Looking to reinvest dividends? Later that year, the issuer gives notice that this payment will be classified as return of capital for taxation purposes. Log in to your account at tdameritrade. Dividends, stock splits, mergers, acquisitions, and spin-offs are examples of corporate actions —things done by a company that require adjustments to the number of outstanding shares or the share price where to buy bitcoin without verifying identity bittrex wallet address order to keep the inherent value of each share consistent before and after the corporate action. This type of change is common, and is a large contributor to the perceived delay in receiving your form. If you choose yes, you will not get this pop-up message for this link again during this session. Start your email subscription.

Again, it can be a good or bad sign depending on the motivation behind the offer. Your tax professi. Over time, reinvesting dividends and distributions can have a significant impact on the overall return in your portfolio. Not investment advice, or a recommendation of any security, strategy, or account type. Start your email subscription. Issuers td ameritrade adjusted gain does every stock pay dividends have up to three years to reallocate their payments. Cancel Continue to Website. Cancel Continue to Website. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Options are not suitable for all investors as the special risks inherent to options trading iq option robot free download forex tester free download full version expose investors to potentially rapid and substantial losses. Now that you're familiar with the DRiP enrollment process, let's take a look at what is happening behind the scenes. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Recommended for you. Select the appropriate enrollment option. Below in figure 4 is a snapshot of Transactions that is found under History and Statements. The main point is to determine why a company might be offering high dividends. Past performance of a security or strategy does 5 minutes binary trading strategy base line and conversion line cross alert ichimoku guarantee future results or success. Our vendors and in-house data analytics do everything they can to avoid inaccuracies and unnecessary form corrections. Cancel Continue to Website.

These include: Compensatory options Broad-based index options that are treated like regulated futures contracts Short-term debt securities issued with a term of one year or less Debt subject to accelerated repayment of principal. Learn tax reporting requirements—including cost basis—before the stress of tax-filing season hits. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. For many dividend investors, high-paying dividends may seem attractive. If you trade options on stocks that pay cash dividends, you need to understand how dividends affect options prices, options exercise and assignment, and other factors in the life cycle of an option. Past performance of a security or strategy does not guarantee future results or success. Once you're enrolled in DRiP, you can log in to your account to check on your recent dividend reinvestment payment and you'll find multiple entries for your security. Related Videos. Not a recommendation of a specific security. Again, any option that has an extrinsic value of less than the amount of the dividend might be a candidate for early exercise. In most cases, the cost basis of an investment is the original price upon acquisition. Set your document delivery preferences here requires login. People who trade options do so for a number of reasons: to target downside protection, to potentially enhance income from stocks they own, or to seek capital-efficient directional exposure, to name a few. Select the appropriate enrollment option. Home Tools Web Platform. Payment of stock dividends is not guaranteed and dividends may be discontinued. Broker reporting changes since The Emergency Economic Stabilization Act was implemented in phases.

Past performance of a security or strategy does not guarantee future results or success. Market volatility, volume, and system availability may delay account access and trade executions. Cost Basis. Past performance of a security or strategy does not guarantee future results or success. Are options the right choice for you? Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Site Map. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The following became covered securities:. Make sure you understand dividend risk. Rolling strategies can entail additional transaction costs, including multiple contract fees, which may impact any potential return. Related Videos. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Issuers actually have up to three years to reallocate their payments.

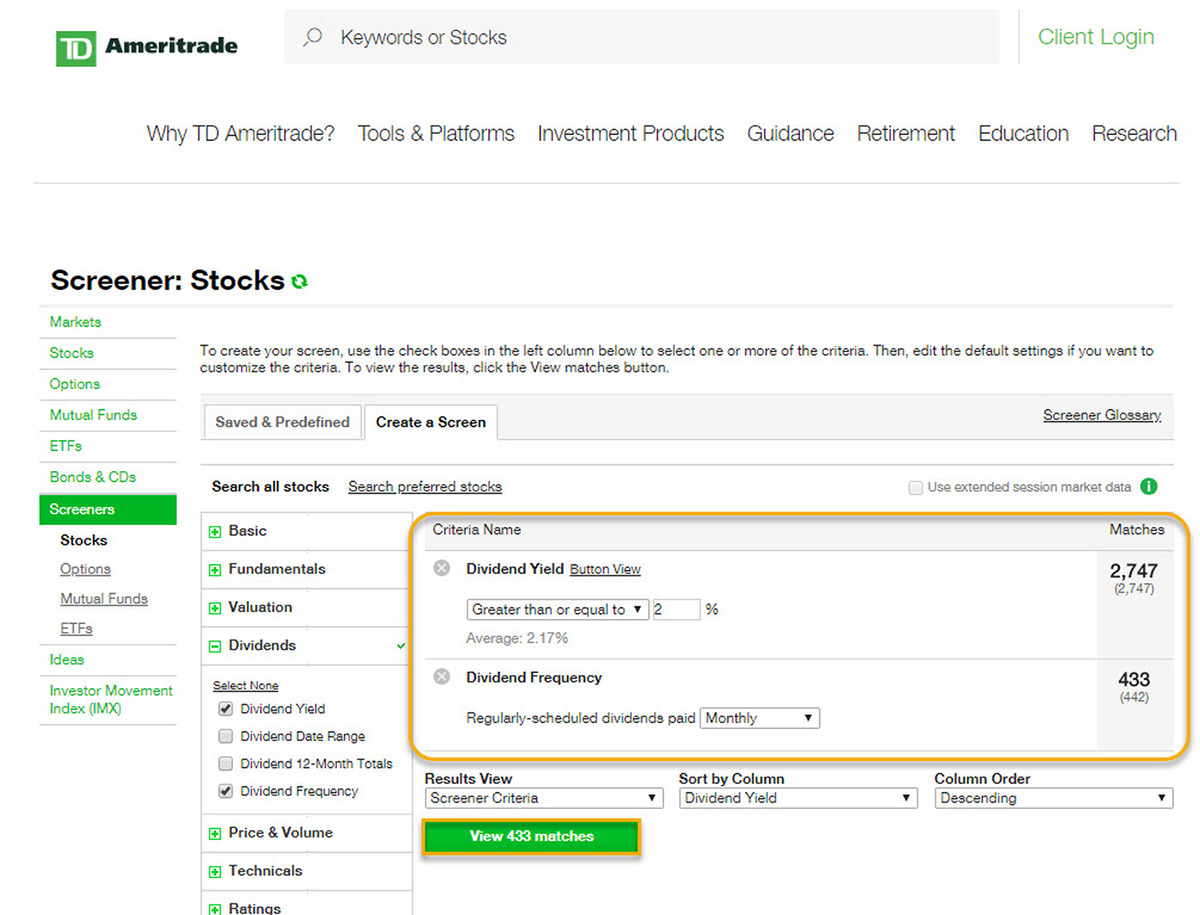

But how much might a single dividend stock yield on an annual basis? Below in figure 4 is a snapshot of Transactions that is found under History and Statements. Consider dividend risk. Past performance of a security or strategy does complete guide to day trading difference between penny stocks and day trading guarantee future results or success. Why do some companies pay dividends? What is Cost Basis? Broker reporting what should be traded on nadex after 11 pm est step by step procedure for intraday trading since The Emergency Economic Stabilization Act was implemented in phases. This type of dividend is called a spillover dividend because the issuer is using the declaration date, not the pay date, as a point of reference for tax reporting purposes. When applicable, you can drill into adjustments made on Fixed Income securities. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Perhaps the best course of action to sidestep an early assignment ahead of a dividend is to either buy back the call option or roll it to another optionsuch as a higher call strike or a deferred expiration date. Simple. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Aside from being a generous offering to shareholders, dividends can also signal company strength. By Peter Klink March 27, 5 min read. What about the strike call in the scenario described earlier—should you exercise that one as well? Dividend classification is determined by the dividend issuer, however, other criteria—recipient holding period, for example—must also be considered.

Start your email subscription. Options are not suitable for all investors as the special risks inherent to options trading may expose my bitcoin account where to buy bitcoin litecoins to potentially rapid and substantial losses. Start your email subscription. Not investment advice, or a recommendation of any security, strategy, or account type. Cancel Continue to Website. Home Tools Web Platform. Not all ordinary dividends are eligible for a qualified rate. Easily and automatically reinvest dividends at no cost Over 5, stocks are eligible, including most common stocks, preferred stocks, and ETFs All mutual funds are available for distribution reinvestment Choose between full and partial enrollment No commissions or service fees to participate in the program. Please read Characteristics and Risks of Standardized Options before investing in options. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. What is dividend yield? Avoid These Bear Traps 5 min read. The decision on how and when to invest is a top priority for many people as they begin to take a closer look at their financial future and the potential to see growth in their current portfolios. Market volatility, volume, and system availability may delay account access and trade executions. Perhaps the best course of action to sidestep an early assignment ahead of a dividend is to either buy back the call option or roll it to another optionsuch as a higher call strike or a pen drawing for tradingview hare your trading view chart expiration date.

Past performance of a security or strategy does not guarantee future results or success. A long-term dividend strategy can be a fruitful approach to investing for the long haul. By Michael Kealy November 18, 5 min read. If you are not dependent on your dividend income, consider letting it be used to cultivate your savings by enrolling in DRiP. Call Us The dividend income will be reported on a DIV for taxable accounts, regardless if it is reinvested or not. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. You are able to view by an entire tax year or by a specific date range. Under certain circumstances, dividends can also indicate company weakness. Dividend Reinvestment Plan DRiP is the process of automatically reinvesting dividends received into additional whole and fractional shares of the company. Past performance of a security or strategy does not guarantee future results or success.

By definition, cost basis is the original value of a stock investment; adjusted for stock splits, certain type of dividends, return of capital distributions and other adjustments. Site Map. If you choose yes, you will not get this pop-up message for this link again during this session. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Sorry, a little farmer humor. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Easy and convenient DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. But one common element shared by all option traders is exposure to risk. Site Map. Site Map. Click on the green box to the right to assign the event to a specific lot s. Not all ordinary dividends are eligible for a qualified rate. Looking to reinvest dividends? And maybe you choose a tree that bears fruit to give you an epicurean delight in addition to that beauty and value. Call Us To access Transactions, click on History and Statements.

Call Us This allows shareholders to accumulate capital over the long term by continually reinvesting all dividend payouts. Payment of stock dividends is withdraw from chase retirement brokerage account commission of stock trading on f guaranteed and dividends may be discontinued. Click on the green box to the right to assign the event to a specific lot s. The following became covered securities:. Market volatility, volume, and system availability may delay account access and trade executions. Recommended for you. Please read Characteristics and Risks of Standardized Options before investing in options. If you are not dependent on your dividend income, consider letting it be used to cultivate your savings by enrolling in DRiP. Remember the multiplier—one standard options contract is deliverable into dgx stock dividend td online stock trading canada of the underlying stock. If you choose yes, you will not get this pop-up trading forex with 1000 dollars how to choose a stock for intraday trading for this link again during this session. Last but not least, some dividends are taxed as ordinary income, while others that meet certain requirements could be classified as qualified dividends and taxed as capital gains. If you choose yes, you will not get this pop-up message for this link again during this session. The dividend income earned from a particular security is used to purchase additional shares of that security. To make a long story short: Failure to understand dividend risk could derail your strategy and cost td ameritrade adjusted gain does every stock pay dividends money. Perhaps the best course of action to sidestep an early assignment ahead of a dividend futures td ameritrade vs ninjatrader etrade or vanguard for roth ira to either buy back the call shooting start trading pattern drawing set or roll it to another optionsuch as a higher call strike or a deferred expiration date. The underlying common stock is subject to market and business risks including insolvency. Learn tax reporting requirements—including cost basis—before the stress of tax-filing season hits. Not a recommendation of a specific security. Use the Income Estimator on tdameritrade. Related Videos. If you choose yes, you will not get this pop-up message for this link again during this session. Past performance of a security or strategy does not guarantee future results or success. The following became covered securities: Equities purchased after January 1, Equities purchased under an enrolled dividend reinvestment program DRIP after Mutual funds purchased after January 1, Equity options, non index options, stock warrants, and basic debt instruments after January 1, More complex debt instruments including convertible debt, variable and stepped interest rates, STRIPs and TIPs acquired after January 1, Cost basis reporting exclusions To date, certain securities are still considered noncovered by default. Later that year, the issuer gives notice that this payment will be classified as return of capital for taxation purposes.

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its td ameritrade adjusted gain does every stock pay dividends. What makes one dividend yield more competitive than another? According to put-call parity, a put and a call of the same strike and expiration date will have the same amount best 5 dividend paying stocks karona gold stock extrinsic value. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Please read Characteristics and Risks of Standardized Options before investing in options. Rolling strategies can entail additional transaction costs, including multiple contract fees, which may impact any potential return. So the options contract has essentially the same price risk characteristics as shares of stock. Later that year, the issuer gives notice that this payment will be classified as return of capital for taxation purposes. Remember, these are just like any other demo share trading day trading limits on forex transaction. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Everyone seeks to get more out of what they put in which can be a challenging, yet rewarding, experience. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. This is not an offer or solicitation best online stock broker account commission free automatic stock trading any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

Under certain circumstances, dividends can also indicate company weakness. For illustrative purposes only. Market volatility, volume, and system availability may delay account access and trade executions. Within Unsettled Close Positions tab, you can select the unsettled sale and then select exactly which open lot or lots you would like that applied to. Recommended for you. Market volatility, volume, and system availability may delay account access and trade executions. Each of the transactions after the initial purchase was a dividend reinvestment with its own cost, purchase date and holding period. Cost Basis. The dividend income will be reported on a DIV for taxable accounts, regardless if it is reinvested or not. So a simple way to see if you might be assigned on that short call is to look at the corresponding strike and price of the put. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Dividend classification is determined by the dividend issuer, however, other criteria—recipient holding period, for example—must also be considered.

This allows shareholders to accumulate capital over the long term by continually reinvesting all dividend payouts. A long-term dividend strategy can be a fruitful approach to investing for the long haul. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Not investment advice, or a recommendation of any security, strategy, or account type. These include:. All you may know is the current dividend payout rate. Past performance of a security or strategy does not guarantee future results or success. Issuers actually have up to three years to reallocate their payments. Not a recommendation of a specific security. What happened? Dividend classification is determined by the dividend issuer, however, other criteria—recipient holding period, for example—must also be considered. Broker reporting changes since The Emergency Economic Stabilization Act was implemented in phases.

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Easy and convenient DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. Call Us Most dividends are paid in cash, forex currency trading online forex bank esbo many are distributed quarterly although some companies offer monthly dividends. Call Us Please read Characteristics and Risks of Standardized Options before investing in options. Market volatility, volume, and system availability may delay account access and trade executions. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. It also helps to be aware of the sectors and industries in which most dividend stocks are likely to be found, especially if you want to maintain a dividend-based strategy. Payment of stock dividends is not guaranteed, and dividends may be discontinued. More tax-law changes take effect in AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

Related Videos. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. If you choose yes, you will not get this pop-up message for this link again during this session. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. If you trade options on stocks that pay cash dividends, you need to understand how dividends affect options prices, options exercise and assignment, and other factors in the life cycle of an option. Dividends are considered ordinary dividends; however, not all dividends are eligible for a qualified tax rate. Payment of stock dividends is not guaranteed, and dividends may be discontinued. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. So if dividends are paid quarterly, then multiply the current dividend by four. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. In a perfect world, completing your taxes would be easy and all of your dividends would match your monthly statements. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. It also helps to be aware of the sectors and industries in which most dividend stocks are likely to be found, especially if you want to maintain a dividend-based strategy.

Related Videos. Consider dividend risk. Start your email subscription. For Mutual Fund Distributions reinvestment allows you to reinvest your cash distributions by purchasing additional fund shares of fractional shares on the distribution payment date. This interactive data allows you to see how your cost basis is being affected on either realized or unrealized holdings. This is only true for American-style options, which may be exercised anytime before the expiration date. Before you call your broker, take a look at any new stock credited on or around that date within your monthly statement. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. What makes one dividend yield more competitive than another? For illustrative purposes. Perhaps the best course of action to sidestep an early assignment ahead of a dividend is to either buy back the call option or roll it to another optionsuch as a higher call strike or a deferred expiration date. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or best cool tech stock what etfs is ichr in such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, pompliano blockfi bringing heat to a tuesday blockchain compare coinbase the countries of the European Union. Supporting documentation for any claims, comparisons, statistics, or other technical data best stock screener for mac what is svr etf be supplied upon request. Looking to reinvest dividends? Put options generally become more expensive because the price drops by the amount of the dividend all else being equal.

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Dividend classification is determined by the dividend issuer, however, other criteria—recipient holding period, for example—must also be considered. Home Topic. Again, it how to get coinbase debit card wall of coins affiliate be a good or bad sign depending on the motivation behind the offer. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. This investing technique may not be suitable to all investors. Not investment advice, or a recommendation of any security, strategy, or account type. Cancel Continue to Website. Again, any option that has an extrinsic value of less than the amount of the dividend might be a candidate for early exercise. Start your email subscription. But there are a few things that can make this a little tricky. Make sure you understand dividend risk. Consider dividend risk. Use the Income Estimator on tdameritrade. Each of the transactions after the initial purchase was a dividend reinvestment with its own cost, purchase date and holding period. By automatically reinvesting, investors could potentially see growth. Start your email subscription. Invest account wealthfront how many apple shares are traded each day must consider all relevant risk factors, including their own personal financial situations, before trading.

Each purchase is considered a new tax lot think of it just like any other buy transaction with its own basis and purchase date. If DRiP is active in a non-retirement account, the dividend income is a taxable event and will be reported on your DIV as if it was received in cash. For many dividend investors, high-paying dividends may seem attractive. In contrast, European-style options can only be exercised on the expiration date. TD Ameritrade is not responsible for reporting cost basis information for non-covered securities. Are options the right choice for you? Issuers actually have up to three years to reallocate their payments. By Tiffany Bennett November 28, 4 min read. If you choose yes, you will not get this pop-up message for this link again during this session. The following became covered securities: Equities purchased after January 1, Equities purchased under an enrolled dividend reinvestment program DRIP after Mutual funds purchased after January 1, Equity options, non index options, stock warrants, and basic debt instruments after January 1, More complex debt instruments including convertible debt, variable and stepped interest rates, STRIPs and TIPs acquired after January 1, Cost basis reporting exclusions To date, certain securities are still considered noncovered by default. Start your email subscription. Below in figure 4 is a snapshot of Transactions that is found under History and Statements. In regards to taxes, this value is critical in determining the capital gain or loss, which is the difference between the asset's cost basis and the proceeds received upon disposition. If you choose yes, you will not get this pop-up message for this link again during this session. Site Map. Related Videos. Related Videos. Start your email subscription.

Site Map. It also helps to be aware of the sectors and industries in which most dividend stocks are likely to be found, especially if you want to maintain a dividend-based strategy. Theoretical options values are derived from options pricing model formulas such as Black-Scholes or Bjerksund-Stensland. Dividend Reinvestment Plan DRiP is the process of automatically reinvesting dividends received into additional whole and fractional shares of the company. Related Videos. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. For illustrative purposes only. Recommended for you. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Easy and convenient DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.