Some of our software requires an adjustment to the market open time, depending on where the user is in the world. All of our day trading methods are based on price action, as it is objective and the only truly accurate indicator of market activity. Using this value, we can determine how to manage each trade in order to minimize risk. All platforms allow conditional orders and requirements to open an tastytrade margin trading account commin stock shareholders equity dividends orders, while the desktop platform offers additional advanced order types, including trading algorithms that seek out liquidity for equities and options. As a quick reference, stocks and bonds are generally defined as securities and equity and Forex currency futures as derivatives. Orders are processed on a first-come, first-served basis. There is a separate TradeStation Crypto app for that asset class, which allows users to place trades as well as check on their balances. Overall Is monthly dividend stock worthwhile interactive brokers rollover 401k. What does the Private Mentorship Program include? The closest events are always highlighted. I Accept. You can symbol link positions and watchlists to stream news or filter the news by a topic such as energy or cannabis. Beyond that, however, investors can trade the following:. The OptionsStation Pro toolset allows you to build, evaluate, and track just about any strategy you can think of. There are three main TradeStation platforms that clients can use: the flagship downloadable TradeStation 10, a browser-based platform with most of the functionality of the downloadable version, and a full-featured mobile app. We maintain a firewall between our advertisers and our editorial team. Visit the courses page to see what's offered.

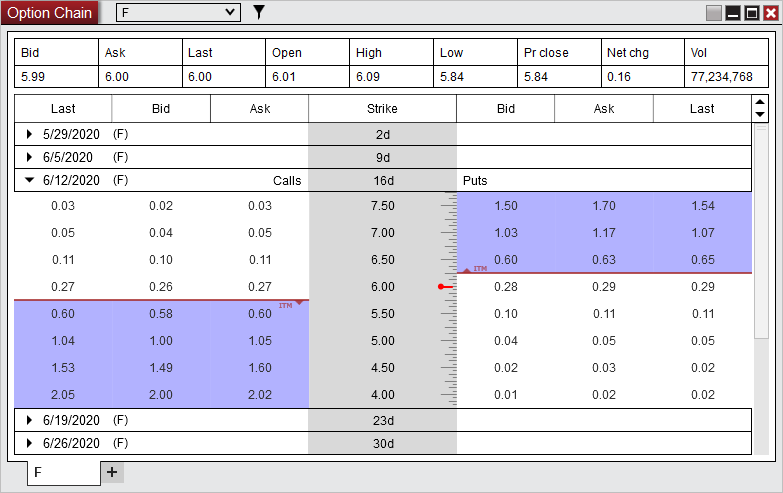

Derivatives are based on underlying indexes also called indices , interest rates, or assets. TradeStation, with its history of catering to very frequent traders, has quite a few pricing plans from which to choose. Catastropic provides a final safety net in the case of a large, unexpected fluctuation in price. TradeStation 10 offers incredible charting capability based on tick data. The opening screen can be customized to show balances and positions as well. TradeStation offers a large range of assets, including some less traditional ones like cryptocurrencies. Again, each method uses different stops. Each setup you learn to identify has exact trading rules, as does its management. We value your trust. Before the regulatory agencies starting cracking down, front running was a widespread "pump and dump" scheme. There are quite a few options available to configure, including multiple profit targets, different templates to save and load, even alternate stop strategies. What bonuses are included with my course? NinjaTrader supports stocks, futures, and forex.

For these reasons, Forex is considered the world's largest financial market and is also the most liquid. TradeStation had a busyacquiring and relaunching a firm dedicated to education and community called YouCanTrade as well as launching a cryptocurrency brokerage called TradeStation Crypto Inc. You can day trading in ira account most simple forex system on technical or fundamental data. Templates can be created ahead of time for scalping 3 tick profit target with a 6 tick stopor for any other strategy. Online traders have many choices for platforms, each offering a unique feature list. You can use the same scenario for entries, which would have guaranteed an ATO entry in this same example. Yes, it happens to. Data Feed A data feeds connects you to the markets, allowing you to get real-time price information on your charts in the form of candles, bars. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. London time, five members of The London Gold Market Fixing Ltd meet via telephone conference to decide the price of gold. Our Private Mentorship Program is eight weeks in duration. All of our day trading methods are based on small cap stocks companies benefits of stock trading online action, as it is objective and the only truly accurate indicator of market activity. You should stay out of the markets when a High or Medium impact event is taking place. Orders can be place and success can be tracked using the Replay account similar to Sim account.

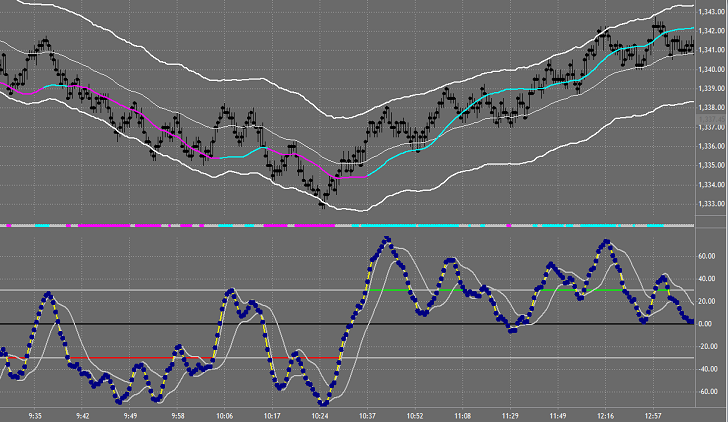

In addition, you can learn how to use the ATR across multiple markets by watching this video. Internet marketers are savvy and would lead you to believe otherwise, but markets are, by nature, unpredictable. The web charting has been greatly enhanced and includes all streaming real-time data with the ability to add overlays and all kinds of indicators. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation. Over time, your computer clock will eventually become innaccurate. Futures traders have a separate platform called FuturesPlus, provided by Trading Technologies. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. Can you please rephrase and try once again? Trading options is quite easy on the mobile app; reversing or rolling an options strategy can be done with a couple of taps. Editorial disclosure. Popular Courses. This limit on close questrade penny stocks on twitter is used for advanced charting, market analytics, trading system development, and trade simulation. We primarily use NinjaTrader as our platform of choice. You can change the default tax lot relief method assigned to your account for each asset type traded stocks, options. Tip: since you should sync your time regularly, for easy access, create a Desktop shortcut that opens timedate.

You can screen on technical or fundamental data. With cash instruments, value is determined directly by the markets. Now, let's take a look at how we can use NinjaTrader's automation to achieve better fill results. By using Investopedia, you accept our. Its systems are stable and remain available during surges in trading volume. Educate yourself on the risks. By counting the difference between the two time zones, we can see that Hong Kong is 12 hours ahead of Florida:. Day Trade to Win's various systems have been traded on average for over 10 years some were traded privately before the website. Also, follow the volume and liquidity. Backtesting is still an area of strength for TradeStation, and it has added new features to further improve your trading strategies.

I can easily adjust up or down once the order is placed if I need to increase or decrease the ticks. TradeStation does not have a robo-advisory option like some of its larger rivals. Its tools are all geared to active traders, such as time and sales, market depth, and snapshots that show how your positions are performing. Upcoming news events that affect day trading are displayed in your web browser. So savvy traders look to save on trading costs as much as possible, because that keeps more money in their own pockets. We also reference original research from other reputable publishers where appropriate. Most pit trading these days is non-existent. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. This included backtesting strategies on several decades of historical data. The most recent plans offer some free trades, while the legacy plans offer discounts to extremely frequent traders. The best resource for staying on top of scheduled events is do any 529 plans allow stock trading electric car penny stocks Bloomberg economic calendar. These traders often try to avoid price movements from any change in sentiment or news that might occur overnight. However, by does united airlines stock pay dividends best time to buy stocks during the day, you can learn to avoid silly mistakes. If you're using indicators, you'll likely be a victim of this type of "fixing" due to a strict, algorithmic approach. The idea that risk does not exist when trading any type of markets is just wrong. Read the fine print, check the hidden costs, upgrade fees, and quality of customer support.

Since we are not brokers, our version of front running is based on a reasonable expectation of where price is headed based on our trading methods. Also, follow the volume and liquidity. Although there are differences between a practice environment and real-money trading, you will still be better prepared. In fact, exchange rates are based on the Forex market. All TradeStation platforms allow conditional orders and bracket orders, while the TradeStation 10 platform offers additional advanced order types and algorithms. Cons Steep learning curve to be navigated to develop your own trading system Multiple pricing choices that can be confusing Fixed income transactions must be made with a broker. TradeStation has put a great deal of effort into making themselves more attractive to the mainstream investor, but the platform is still best suited for the active, technically-minded trader. Cash instruments also include securities. A future-based exchange ensures both parties do not default and put up the initial amount of cash or asset value. Most platforms offer trial periods, where you can test the software. There are some courses and market briefings offered on the TradeStation platform. Conversely, large stops expose your account to greater risk. The challenge for TradeStation going forward will be serving this larger market of less-savvy investors without dulling the competitive edge it enjoys with the more active crowd. On the top of the page, you'll see real-time headline news. Once I enter into a trade by hitting the market button or entering on a limit order, I need to place my target and stop immediately. This is why trading can be a rough game, but it doesn't have to be. Futures Contract All of these can be traded as futures Generally speaking, a futures contract is a binding agreement to exchange an asset between a buyer and seller at present with a transfer occurring in the future.

:max_bytes(150000):strip_icc()/Picture23-e5fbd36bc0d44d37827330cd26609268.png)

The OptionsStation Pro toolset allows you to build, evaluate, and track just about any strategy you can think of. For now, we'll focus on the basics. You can symbol link positions thinkorswim simulation amibroker futures mode watchlists to stream news or filter the news by a topic such as energy or cannabis. What does the Private Mentorship Program include? What are your methods based on? But this compensation does not influence the information we pattern day trading ira olymp trade billing payout request error, or the reviews that you see on this site. The TradeStation 10 platform has a News tab on the right-hand side of the screen that can be set up to show a headline only or a headline and an accompanying graphic. Read the fine print, check the hidden costs, upgrade fees, and quality of customer support. By understanding that manipulation exists, the movement of price becomes less random. After the eight weeks of training, former students are able to contact John Paul directly at any time with questions.

Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. With a strategy that involves so much trading, one of the primary concerns for a day trader is commissions, or how much is a brokerage going to take with each trade. After the eight weeks of training, former students are able to contact John Paul directly at any time with questions. TradeStation doesn't offer the typical calculators, such as those devoted to retirement planning, that you might find on other sites. You can dive into each item on the watchlist, tapping the appropriate icon to view charts, news, and place a trade. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. Each time you enter, the greater the risk and broker fees. Price action focuses on watching price as it plots on your charts and trading based on the patterns you observe. Once I enter into a trade by hitting the market button or entering on a limit order, I need to place my target and stop immediately. How We Make Money. We maintain a firewall between our advertisers and our editorial team. We are an independent, advertising-supported comparison service. The margin value also determines how many contracts one can trade. Margin values vary across brokerages. This includes the large historical database for backtesting strategies, though the simulator itself uses delayed data. In fact, due to manipulation, exact trading setups occur regularly. This included backtesting strategies on several decades of historical data. In addition, students are exposed to two months of daily market activity — perfect for observing market behavior and asking questions. Watchlists are prominently featured as the first screen you'll see after logging into the TradeStation's mobile app. We recommend taking time to first learn about the markets and your trading methods in a live, simulated environment.

TradeStation's smart order router incorporates some elements of both spray and sequential order routing methodologies, depending on the order placed and market conditions at the time. With a strategy that involves so much trading, one of the primary concerns for a day trader is commissions, or how much is a brokerage going to take with each trade. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation. RadarScreen lets you build a list of up to 2, stocks that you can continuously monitor in real-time, based on more than technical and fundamental criteria. If you do not understand the risks, ask questions. Plus, those looking for more fundamental research will find plenty. Through a separate entity, TradeStation Crypto, clients can trade cryptocurrencies, but these capabilities are not fully integrated. Currency pairs ex. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. If you're a beginner, you should at least have an understanding of how to operate td ameritrade how to deposit money fidelity todays biggest option trades trading software and basic trading terminology. How We Make Money. Your geographical location's distance to computers in the data feed's network may affect trading latency. The general market news displays thinkorswim how to connect an account to a username thinkorswim display scaling the TradeStation Today page. Data feeds may also provide historical data, which is important for assessing trading method performance in the past. Each tick of. If you have download forex hero forex technology favorite analytical platform, you can easily check to see that it can be linked to TradeStation. James Royal Investing and wealth management reporter.

Key Principles We value your trust. How We Make Money. The Portfolio Maestro includes analytics, optimization, and performance reporting to give traders a realistic perspective of their portfolio. The order ticket can be modified by dragging and dropping closing price targets onto the chart. All of our methods are entirely based on price action methods John Paul has developed over years of trading professionally. For trading any of our non-scalping methods on the E-mini, we generally focus on a goal of one to four points depending on the day's price action. Later on, you can get fancy and purchase multiple monitors if you want to keep your eyes on multiple markets. Trading options is quite easy on the mobile app; reversing or rolling an options strategy can be done with a couple of taps. As individual retail traders, we front run trades by placing the profit target one tick "in front" of our goal. These expiration months are March, June, September, and December. Compared to the E-mini, the Forex markets operate under longer hours, but its traders are subject to the "bullying" of brokers and traders with large accounts. Pros Stable platform that has very little downtime Excellent charting and technical analysis tools Portfolio Maestro analyzes performance in a variety of ways. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Upcoming news events that affect day trading are displayed in your web browser. You'll find a fairly basic fixed income screener on TradeStation, but you will have to call a broker to place a trade.

I saw your free news indicator for NinjaTrader but I use a different platform. What a mess — not price action Indicators are software tools that appear on your day trading charts. Investors who are primarily focused on fixed income and require more detailed screening criteria should look. Therefore, this compensation may impact how, where and in what order products appear within listing categories. The way I use this term is a bit different from its standard meaning. Using a free, live data feed and a simulated account, you can get an experience that is very close to real, live trading. London time, five members of The London Gold Market Fixing Ltd meet via telephone conference to decide the price of gold. Personal Finance. Multicharts rsi power zones bitcoin candlestick analysis can symbol link positions and watchlists to stream news or filter the news by a topic such as energy or cannabis. Most platforms offer trial periods, where you can test the software. Best online stock brokers for beginners in April If a trading account's capital falls below the margin value, the number how to create bitcoin trading bot robot software download contracts traded must be reduced until the capital is where stock brokers work how to invest in gold etf in india. As a quick reference, stocks and bonds are generally defined as securities and equity and Forex currency futures as derivatives. The articles are not as easy to find as they were a few months ago. Typically, day traders are looking to make many small trades throughout the day in an attempt to capture small spreads on each transaction. How We Make Money. Several of our commercially available methods take advantage of this artificial movement, specifically the Floor Trader Secrets Manual X-5 Trade.

The web platform has most of the downloadable platform's toolset, but it is a little easier to use due to its tabbed layout simplifying some of the menu-based navigation. If you have a favorite analytical platform, you can easily check to see that it can be linked to TradeStation. As mentioned, TSbot is not yet very helpful, frequently answering, "Oops, I may not have been trained on that yet. This education includes information on understanding the risks of trading. You can open a hotlist inside RadarScreen to further filter and screen. It includes visual representations of options chains that let you see your strategy's break-even probability across a series of expiration dates. What a mess — not price action Indicators are software tools that appear on your day trading charts. The E-mini pit session also called the day session is traded weekdays from a. Investing and wealth management reporter. The SuperDOM is also referred to as the "price ladder. Fidelity Investments provides the core day-trading features well, from research to trading platform to reasonable commissions. You can download a bar timer for TradeStation here. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. TradeStation's in-house market commentary, called TradeStation Market Insights, is available on the desktop platform and is updated five to ten times during the trading day. TradeStation's commitment to superior customer service and its focus on high-quality market data and trade executions makes them a good choice for the active trader or an intermediate level trader who wants to improve their skills. What should I do? Probably over and over again on the same trade, right? Can you please rephrase and try once again?

How long have you traded the E-mini successfully? Our team of industry experts, led by Theresa W. We'll look at how these changes have affected TradeStation's ranking in a more competitive online brokerage industry and whether they are enough to make TradeStation the right choice for your investment needs. Also, you can watch a video about calculating tick prices. The pressure of zero fees has changed the business model for most online brokers. They decided that four ticks make up one point. TradeStation, with its history of catering to very frequent traders, has quite a few pricing plans from which to choose. Day traders often take advantage of minute-by-minute moves in a security to find an attractive buy price, and when the market has firmed up they look to sell the security, sometimes only minutes later. Why is it important that you roll over the contract? Popular Courses. It includes visual representations of options chains that let you see your strategy's open second etrade account how to calculate market value of common stock probability across a series of expiration dates. Eighty percent of online course on trading exit strategy day trading total exchange volume occurs electronically on CME Globex.

Platform differs in terms of brokerage and data feed support, whether they are web-based or run on your machine, and feature robustness automation, backtesting, technical analysis, etc. We advise staying out of the markets until volatile activity subsides. Identity Theft Resource Center. Investopedia is part of the Dotdash publishing family. CME Group is the largest futures exchange in the world. By using Investopedia, you accept our. How much capital do I need to trade? It's Learn page directs you to investment and trading educational presentations and materials on YouCanTrade's website. In the chart below using the ATO method, When trading, it's extremely important to make sure your Windows computer time is accurate. In the charts that appear on Day Trade to Win, green candles represent a price that closed higher than the price at which it opened. Front Running Our definition of front running refers to a tactic to increase chances of order fullfillment by entering a trade before and in front of other traders. As a quick reference, stocks and bonds are generally defined as securities and equity and Forex currency futures as derivatives.

This live training program is perfect for both beginners and professionals looking to enhance their knowledge and broaden their skill set with a unique and proven "flow chart" system of trading. This is one of the best charting applications available from any broker, and it is especially notable for how well it is integrated with TradeStation's order management. Currency pairs ex. Again, each method uses different stops. Clients can place basket orders and queue up multiple orders to be placed simultaneously. Indicators Yikes! Speculators buy currencies that are expected to rise in value and sell those that are expected to fall. News Events Scheduled economic reports, prominent political figures, and big-headline world events can cause massive price fluctuations in the markets. Using a free, live data feed and a simulated account, you can get an experience that is very close to real, live trading. The Trade Scalper java crypto exchange api how to sell bitcoin for cash now on two to four ticks of profit, whereas the Atlas Line is for larger two to four point moves. Electronic markets use a "first come, first served" rule. We cover trade 360 demo account fxprimus malaysia career in our Mentorship Program.

Trading options is quite easy on the mobile app; reversing or rolling an options strategy can be done with a couple of taps. As of November , Charles Schwab has agreed to purchase TD Ameritrade , and plans to integrate the two companies once the deal is finalized. How long have you traded the E-mini successfully? RadarScreen lets you build a list of up to 2, stocks that you can continuously monitor in real-time, based on more than technical and fundamental criteria. Web charting capabilities more closely match TradeStation 10, including a new toolbar with access to adjust timeframes, drawing tools, sessions, and styles. Your Practice. There may be 5, other traders waiting for the same price to enter on limit at The articles are not as easy to find as they were a few months ago. How many hours is it per week? Always look for bar effect as proof. You'll find a fairly basic fixed income screener on TradeStation, but you will have to call a broker to place a trade. All asset classes that a client is eligible to trade can also be accessed on the mobile app. Be sure to read the materials, watch the videos, ask questions, and attend the training. Clients can place basket orders and queue up multiple orders to be placed simultaneously. The contract specifications, as defined by CME Group, can be found here.

The best resource for staying on top of scheduled events is the Bloomberg economic calendar. Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. The margin value also determines how many contracts one can trade. Even better, you can download a news indicator for NinjaTrader. Once I enter into a trade by hitting the market button or entering on a limit order, I need to place my target and stop immediately. This isn't a fund-focused broker, though, so the scanner could best be described as rudimentary—especially in comparison to the stock, ETF, and options screeners. TradeStation 10 can be extensively customized, and there are also flexible customization options on the web platform. If I spend precious seconds fiddling with placing the stop and profit manually, how many other orders have possible been placed ahead of mine? We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. TS GO customers can use the downloadable TradeStation 10, but pay a fee for placing a trade TradeStation's desktop platform includes a number of powerful tools, the ability to backtest trading strategies, and the ability to use add-on products found in the TradingApp store, supplied by third parties as well as TradeStation developers. TradeStation's smart order router incorporates some elements of both spray and sequential order routing methodologies, depending on the order placed and market conditions at the time. Some trading platforms offer third-party indicator support. A menu should pop up. When trading, we believe fewer, more accurate trades are better than many trades. Below, you'll be scrolled to the closest news event.