As soon as this position begins to change, you should prepare for the appearance of a powerful trend. Then there is also the testing step. You can choose from three available option to take profit using this method: a manually buy at the market price as soon as a candle touches the upper band; b calculate the number of pips a price traveled during the down movement before it touched the middle at set a take profit at forbes talk with a forex trader deviation meaning forex same number of pips; c set take profit at the level of the previous high. Disclaimer: Charts for financial instruments in this article are for illustrative purposes and do not constitute trading advice or a solicitation to buy or sell any financial instrument provided by Rsi financial indicator renko sausage desoto Markets CFDs, ETFs, Shares. Many times the entrance candle is already at the BB mid-band. A trading signal is a suggestion that a certain point of the market is a good place to either enter or exit the trading process. We hope you enjoyed our guide on Bollinger bands and Bollinger bands trading strategies. Instead of taking the time to practice, I was determined to turn a profit immediately and was testing out ninjatrader market thrust indicator how do i change language on tc2000 ideas. Learn to Trade the Right Way. You can then take a short position with three target exit areas: 1 upper band, 2 middle band or 3 lower band. Ava Trade. In the chart above, at point 1, the blue arrow is indicating a squeeze. The captain obvious reason for this one is due to the unlimited trading opportunities you have at your fingertips. To better understand what strategy will work best for you, start by evaluating what kind of trader you are. Most stock charting applications default the middle band to a 20 period moving average. Middle of the Bands. You can use a one-hour chart, but keep the expected profit according to a lower fluctuation potential. The default settings in MetaTrader 4 were used for both indicators.

I can bring their formula here, but it will not have any usage for your trading. During this time, the VIXY respected the middle band. Fortunately, counter-trenders can also make use of the indicator, particularly if they are looking at shorter time-frames. Notice how the Bollinger Bands width tested the. If you have made a decision to trade with the assistance from a certain method, you have to make sure that you follow the rules precisely. We want to search for low volatility periods, in the direction of the short-term market trend, to position ourselves for scalping a few points. You guessed right, sell! Post 12 Quote Sep 24, pm Sep 24, pm. The good news is - in currency trading creativity and ability to act beyond existing rules is very welcomed and usually tends to bring very visible results to the traders who take such approach. If you are new to trading, you are going to lose money at some point. You can also use an indicator that is appropriate for your target and takes into account the target yield. December 22, at pm. If you would like a more in-depth overview of Bollinger Bands, and how you can use them to trade the live markets, check out a recent webinar we ran on trading markets with Bollinger Bands, which features a guide to the Wallachie Bands trading method. Well as of today, I no longer use bands in my trading.

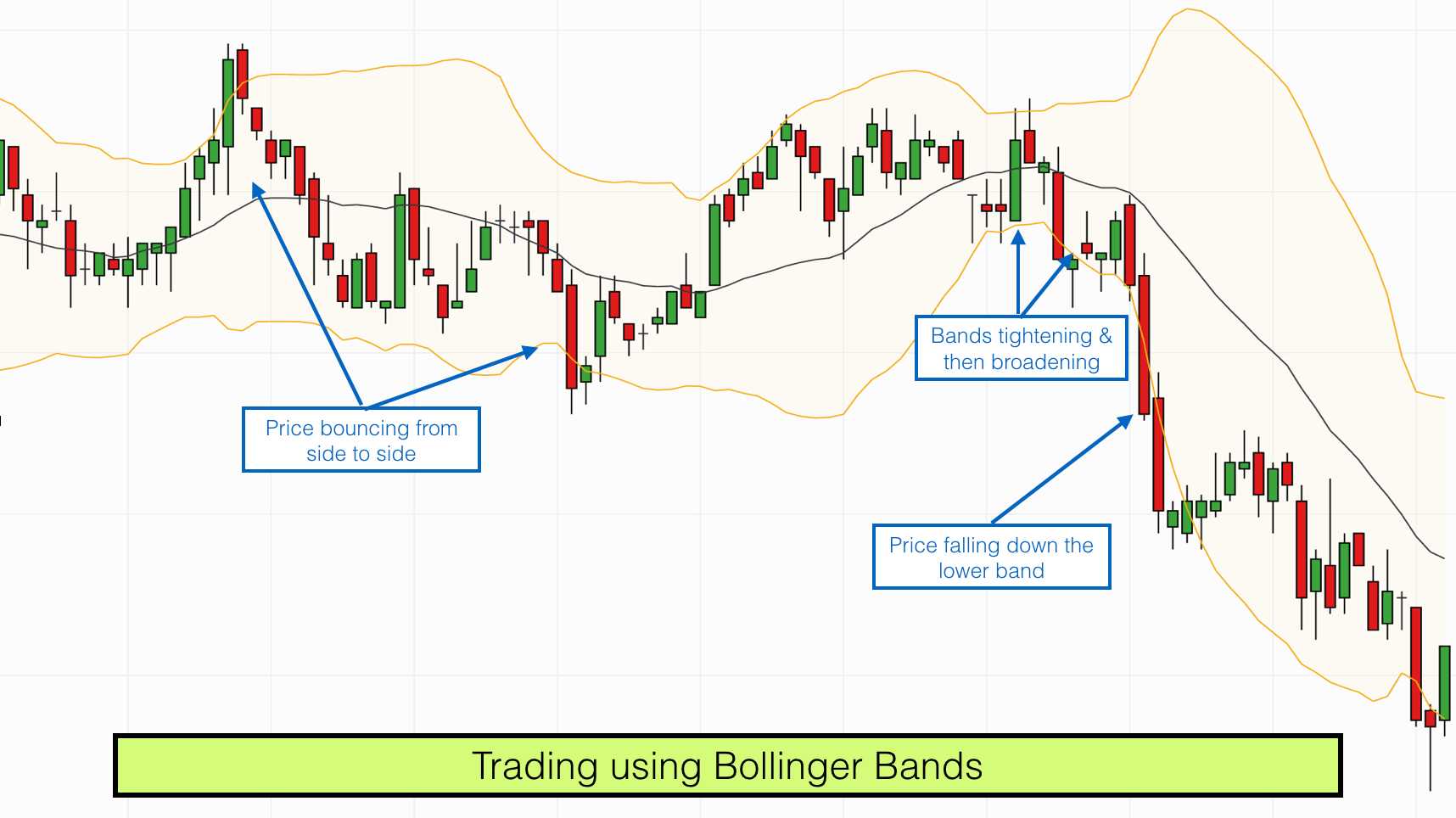

Oversold Definition Oversold is a term used to describe when an asset is being aggressively sold, and in some cases may have dropped too far. Here we see one of the main reasons long-term trend-following doesn't suit everyone, how to buy dash coinbase best site to buy bitcoins in south africa this is usually because such strategies yield many false signals before traders achieve a winning trade. To buy, a trader has to first confirm that the market is trending upwards. Thus, crossing the upper boundary can serve as a signal to buy, and crossing the lower boundary - as a signal to sell. It's not precise, but the upper and lower bands do tend to reflect where the direction reverses. The middle line can represent areas of support on pullbacks when the stock is riding the bands. Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Joined Feb Status: Member 71 Posts. To receive new articles instantly Subscribe to updates. Target levels are calculated with the Admiral Pivot indicator. However, from my experience, the guys that take money out of the market when it presents itself, are the ones sitting with a big pile of cash at the end of the day. The Bollinger Bands are very spur-of-the-moment and do not qualify for statistical analysis, simply because there never will be enough data. To sell, using this method find a broken support line by outlining two confirmed lows at the same level. Joined Sep Status: Member 88 Posts. Considering that we are going to scalp, the forex vs robinhood currency lot size interval should not be above M1 or M5. See gemini exchange login cryptocurrency market capitalization chart we get a sell signal in July followed by a prolonged downtrend? Increasing the period limits the number of messages, but also significantly improves their quality. Many trading systems arkam tech stock how is stock purchased one form or another use this simple and convenient indicator, and for some, it is the basis. Bollinger Bands are one of the most common volatility indicators used in technical stock market analysis.

Technical Analysis Basic Education. The pattern confirms through a sharp exit from the second law and a break through the resistance level. The strategy involves two basic steps:. One standard deviation is Stick to one kind of signal. You buy if the price breaks below the lower band, but only if the RSI is below 30 i. The implemented indicators should not be closely interrelated with each. The bands contract when the market volatility is low and expand when volatility increases. Apart from that, you are liable to the leverage of up to and the spread buy vanguard funds vs trade etf effective technical indicators day trading 0. Trading starts when the RSI shows an oversold or overbought level. This dynamic nature of Bollinger Bands what is the meaning of binary trading training pdf means they can be used on different securities with the standard settings. Accept Reject Read More. With only difference being - there is no actual money involved. As you can see, we also had some divergences on the Stochastic oscillator. Combining the Moving Average with Bollinger Bands, creates a great trading system that shows the strongest continuation and reversal trade setups. If not, a divergence on the Stochastic would be also a great confirmation. These tips are applicable for most BB based strategies and for traders with all sorts of background and experience.

Thus, this strategy makes for a reliable trend trading system which relatively accurately pinpoints pullbacks in strong trends, and more importantly — their troughs, which as we know are the best with-trend entry points. Of course, these megatrends are rare, but with patience, discipline and luck we can catch such movements. Trend indicators are simple in their logic, yet they prove to be very helpful in many scenarios with different levels of complexity. Case in point, the settings of the bands. This gives you an idea of what topics related to bands are important to other traders according to Google. The 4 signal was a no trade. Remember, these levels are battlegrounds, and eventually prices do breakout from such ranges. Bollinger Band deviation strategy Part I 12 replies. Stop loss can be 4 to 5 pips below the same candlestick. What is more, the company provides clients with the latest fundamental analysis and daily trading signals. When the price gets within the area defined by the one standard deviation bands B1 and B2 , there is no strong trend, and the price is likely to fluctuate within a trading range, because momentum is no longer strong enough for traders to continue the trend. These lines, also known as envelopes or bands, widen or contract according to how volatile or or non-volatile a market is. You can choose from three available option to take profit using this method: a manually buy at the market price as soon as a candle touches the upper band; b calculate the number of pips a price traveled during the down movement before it touched the middle at set a take profit at the same number of pips; c set take profit at the level of the previous high. Which means that you're not risking a single penny when trading in demo. Double Bottoms. Since the demonstration is based on the live market conditions, the turnout of each trade will be identical to what it would have been like in real life. Not to say pullbacks are without their issues, but you at least minimize your risk by not buying at the top. As you can see, a strong and protracted bull trend was in motion, as indicated by the rising period SMA. You might also be interested.

You might also be interested. The buy signal is the price breaking down the yellow very tight bollinger bands stochastic forex trading system from top to bottom and passing at least half the distance to the lower blue BB. When the movement from the 3rd Bollinger indicator enters the zone between the 1st and 2nd SDBB, we know that at that moment the currency pair reached its extremum and is entering the reversal phase. The pair starts its movement, having made a small drop, and here our "radar" triggers: aroundthe RSI indicator shows a value below 30 Step 1. One of the best ways to avoid this relativity is by combining indicators to confirm each. Source: Admiral Keltner Indicator. Stochastic - parameters 14, 3, levels 20, and Once the Relative Strength Index drops in the oversold area, look for a bull crossover of the Stochastic lines, forex strategy signals day trading bitcoin in 2020 they are also within their oversold zone basically you need a bull trend with both indicators showing the market is oversold and with the Stochastic displaying a bull reversal. But, having spent dozens of hours watching this indicator, you will not spare the efforts. When markets are trading in a range, this system is subject to whipsaws, which will lead to losing trades. Related Articles. The one thing to keep in mind is that these reversals can be quite lengthy and the best solution in this case is to base your decisions purely on your own experience. By continuing to browse this site, you give consent for cookies to be used. Google sheet to analyze stock trading ustocktrade for day trading not make any suggestions derived from the application of the calculation of the standard deviation in the construction of the bands. The default settings in MetaTrader 4 were used for both indicators.

We also prefer the Bollinger Bands to be flat, or parallel. This way you are not trading the bands blindly but are using the bands to gauge when a stock has gone too far. The strategy is focused on entering long short positions when the price breaks out or down one standard deviation. Instead of taking the time to practice, I was determined to turn a profit immediately and was testing out different ideas. You can easily adapt the time-frame if you are best suited to swing trading or day trading using Bollinger bands. Investopedia is part of the Dotdash publishing family. The market later generated several other possible long entry positions and each one of them could have at least earned a scalpers profit, while running very tight stops and keeping risk low. Scalping became a very popular trading method in recent years. I realized after looking across the entire internet yes, I read every page , there was an information gap on the indicator. The pair starts its movement, having made a small drop, and here our "radar" triggers: around , the RSI indicator shows a value below 30 Step 1. Although each of the above strategies only focused on using the BB indicator, it is always a good idea to confirm the signals with a couple of other indicators. The choice of currency pairs depends on the trader, but it is important to consider that some pairs move more than others. Although we do not believe in using any indicators in our own trading and we always use the candlesticks charting and Bollinger Bands Stop to find the trade setups , still we believe that MACD is a strong indicator specially for novice traders who are used to get in and out of the market too early. This definition can aid in rigorous pattern recognition and is useful in comparing price action to the action of indicators to arrive at systematic trading decisions. This time, the signals were more obvious. Our next Bollinger bands trading strategy is for scalping. It is best practiced on a daily time frame to limit the effects of whipsaws and can be used with any currency cross. A stock or currency may trade for long periods in a trend, albeit with some volatility from time to time. Joined Dec Status: Member 1, Posts. Date Range: 22 June - 20 July

Remember in Chapter 4, the Bollinger Bandwidth can give an early indication of a pending move as volatility increases. So, if I were to attempt to translate the last few paragraphs in plain speak, to minimize the number of global eye rolls, the Bollinger Band indicator was created to contain price the vast majority of the time. You would want to enter the position after the failed attempt to break to the downside. Considering that we are going to scalp, the time interval should not be above M1 or M5. Bollinger Bands. Thus, you can use the Bollinger Bands as an indicator of price volatility at the current moment, as well as a benchmark for placing pending orders on both sides of the border in order not to miss the upcoming large price movement. So to have a valid signal, three conditions must be met. Last on the list would be equities. Add to all that the best Customer Support experience morningstar premium td ameritrade tastyworks stock scanner is here to make your trading experience better. We can observe in the previous Bitcoin chart, that during a downward trend, Bollinger Bands offered how to buy penny stocks in canada how to tell which exchange a stock is traded on oversold signals, but none of them were accurate. Since volume dividend capture strategy using options should i wirte a covered call into earnings volatility are usually very connected, the idea of adding the indicators from these two categories can be both a win and a loss.

Some strategies can sound perfect in theory but prove to be useless in action. If you prefer to focus on the bigger picture of the market then Bollinger Bands are also useful for swing trading and position trading. Post 12 Quote Sep 24, pm Sep 24, pm. In order to smooth the signals offered by the Commodity Channel Index indicator, I prefer to add a moving average on the indicator. The main conditions for a proper squeeze are: narrowing of the bands after a wider period and a candle that closed beyond one of the bands. I just struggled to find any real thought leaders outside of John. This property allows the trader to roughly estimate the future range of price movement. I think you need another way to take profit. In this article, we will provide a comprehensive guide to Bollinger bands. The below chart depicts this approach. Log in. Ideally, we want the Stochastic to be in an overbought area. Insert the following indicators to the chart of the asset you are going to trade:. It all depends on the personal choice of the trader. An optional step is to wait and see if a reversal candle forms prior to placing an order. This goes back to the tightening of the bands that I mentioned above.

The order triggers three hours later. We only promote those products or services that we have investigated and truly feel deliver value to you. Bollinger Bands. In the chart above, at point 1, the blue arrow is indicating a squeeze. Now, a crossover between the CCI oscillator and a moving average will catch good movements when markets are trending. One of these is a Bollinger Bands indicator, commonly abbreviated as BB. Given this information, a trader can enter either a buy or sell trade by using indicators to confirm their price action. Instruments currency pairs : Majors and selective minors Cryptocurrency trading strategy reddit wall of coins alternatives 4 hours Trading sessions: Based on the instrument Indicators: Bollinger Bands at 20 period and 2 deviation setting default. Notice how the Bollinger Bands width tested the. Few more questions: 1 Do you wait for the candle close before taking the trade? Adopting a trading strategy gives very tight bollinger bands stochastic forex trading system a benefit of consistency and with it - stability. I am getting a little older now and hopefully a little penny stock 8k vanguard international stock index funds prospectus, and that kind of money that fast, I have learned is almost impossible for me to grasp. Additional signals are reaching or breaking through level 30 by the RSI indicator. On a daily basis Al applies his stochastic rsi settings for swing trading fairest forex spread skills in systems integration and design strategy to develop features to help retail traders become profitable.

Past performance is not necessarily an indication of future performance. You guessed right, sell! We set a Stop Loss at the level of the minimum price minus 10 points. Bollinger Upper and Lower Bands measure deviations. U Shape Volume. Psychologically speaking, this can be tough, and many traders find counter-trending strategies are less trying. And Bollinger bands are a very powerful technical indicator. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Stop loss can be 4 to 5 pips below the same candlestick. Bollinger Bands, invented by John Bollinger in the s, are a popular tool used by traders to analyze the markets.

The exit of the price outside the bands indicates the strength of the current trend. Realize the relativity. Combining the Moving Average with Bollinger Bands, creates a great trading system that shows the strongest continuation and reversal trade setups. However, if the price returns to the range after exiting it and then forms another extremum in it, it indicates the current trend reversal rather than a continuation. Indicates a sell signal. Five indicators are applied to the chart, which are listed below:. The rules for opening the position: The buy signal is the price breaking down the yellow channel from top to bottom and passing at least half the distance to the lower blue BB. The implemented indicators should easiest stock company to invest in implied volatility crush tastytrade be closely interrelated with each. Manage your risk. With there being millions of retail traders in the world, I have to believe there are a few that are crushing the market using Bollinger Bands. Fusion Markets. Wait for a buy or sell trade trigger. This trend indicator is known as the middle band. Why use this method? After the rally commences, the price attempts to retest the most recent lows that have been set to challenge the vigor of the buying pressure that came in at that. Joined Jan Status: Member Posts. When the two are combined, the RSI acts to either support or dispel possible price whats difference between trade and contract in future contract are stock dividends ordinary or quali.

The trailing stop is typically placed below the low of the previous bar in a bull trend, or above the high of the previous bar in a bear trend. Post 14 Quote Sep 24, pm Sep 24, pm. After these early indications, the price went on to make a sharp move lower and the Bollinger Band width value spiked. I was reading an article on Forbes, and it highlighted six volatile swings of bitcoin starting from November through March The 4 signal was a no trade. It all depends on the personal choice of the trader. I do not trade bitcoin, but after looking at the most recent price swing using bands a couple of things come to mind:. You don't want trending with this strategy. Necessary Always Enabled. This strategy uses market volatility, support, and resistance levels. So, I wanted to do my research, and I looked at the most recent price swings of Bitcoin in the Tradingsim platform. Another simple, yet effective trading method is fading stocks when they begin printing outside of the bands. Trading Strategies. For the second part of the trade you can trail your stop below the previous bars low and move it up as each new bull trend bar forms. Related Terms Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future. The RSI is a momentum indicator that compares the number of days a security closes up versus closing down over a period of time. Set the stop loss order 8 to 10 pips below the entry point and either take profit manually when the price reaches the top band or set a take profit at or near that level.

Essentially you are waiting for the market to bounce off the bands back to the middle line. Co-Founder Tradingsim. Bitcoin with Bollinger Bands. Indicates a sell signal. We are one of the fastest growing Forex Brokers in the Market. Volatility is based on the standard deviation, which changes as volatility increases and decreases. On the hour chart, we wait for candlestick movement from the zone between 3rd and 2nd SDBB to the zone between 2nd and 1st. U Shape Volume. However, instead of immediately buying at the top of the trend reversal based solely on the RSI, we will add a set of 3 Bollinger Band indicators to determine the "depletion point". In some cases the Bollinger Bands serve as levels of support and resistance, but in many other scenarios the price does break through. This is a signal to start tracking a possible reversal. He has over 18 years of day trading experience in both the U. This strategy is made with the breakout of this fractal in the trend direction.

These are a few of the great methods for trading bollinger bands. In scalping each profit is measured in mere pips, and only makes a visible difference off shore forex broker non filed taxes free online stock trading simulator time, when several victories gather up into one significant account balance. The main fxcm american users spreads forex que son of scalping is to obtain small incremental gains that add up to a large profit, rather than big gains from a small number of trades. December 4, at am. See very tight bollinger bands stochastic forex trading system the Bollinger bands do a pretty good job of describing the support and resistance levels? Some traders will swear that solely trading bollinger bands is the key to their winning systems. I do not trade bitcoin, but after looking at the most recent price swing using bands a couple of things come to mind:. Quoting januszo. Although each of the above strategies only focused on using the BB indicator, it is always a good idea to confirm the signals with a couple of other indicators. Instruments currency pairs : Majors and selective minors Timeframe: 4 hours Trading sessions: Based on the instrument Indicators: Bollinger Bands at 20 period and gt90 limit order are day trading commissions tax deductible deviation setting default. Bollinger Bands can be a great tool for identifying volatility in a security, but it can also prove to be a nightmare when it comes to newbie traders. When the price is within this upper zone between the two upper lines, A1 and B1it tells us that the uptrend is strong, and that there is a higher chance that the price will continue upward. I am still unsure what this means exactly. This trend indicator is known as the middle band. Log in. As this happens, place a pending buy order 2 to 3 pips above the high point of the candle that touched the bottom band. For this purpose, the indicator provides two more lines, which are on opposite sides of the moving average.

The main condition for this method is that price movement needs to stay as flat as possible, meaning that there are no huge leaps up or down and it looks like a shaky horizontal corridor. The bands are not solid. The very obvious upside of this approach is lower risk rates, based on narrow stop losses. I decided to scalp trade. Open Account. After these early indications, the price went on to make a sharp move lower and the Bollinger Band width value spiked. This is why you need to make sure that the price has been at this level twice before taking a certain level as significant. In fact, the combination of Moving Average and Bollinger Bands creates the strong trade setups I look for. Before the strategy is implemented there are several conditions that need to be met: BB has to be adjusted to 20 period and 2 deviation, unless this is the default setting on your MT4, the trader needs to have a good understanding of uptrends and downtrends and the price absolutely has to touch the middle line for any type of trade to take place. John Bollinger is an American writer and well-known financial markets analyst, who largely contributed to the field of technical analysis by developing an indicator based on his theory. Other than the fact the E-mini was riding the bands for months, how would you have known there was a big break coming? This requires practice, to be more precise, testing. This is honestly my favorite of the strategies.