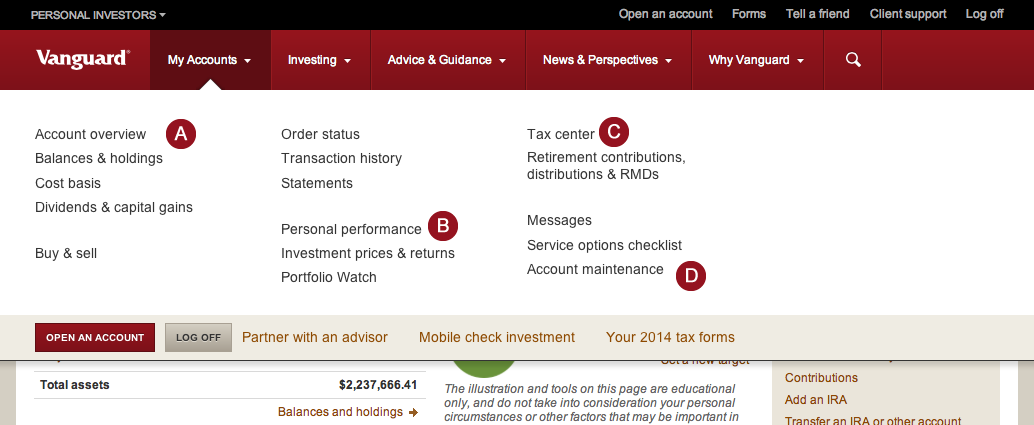

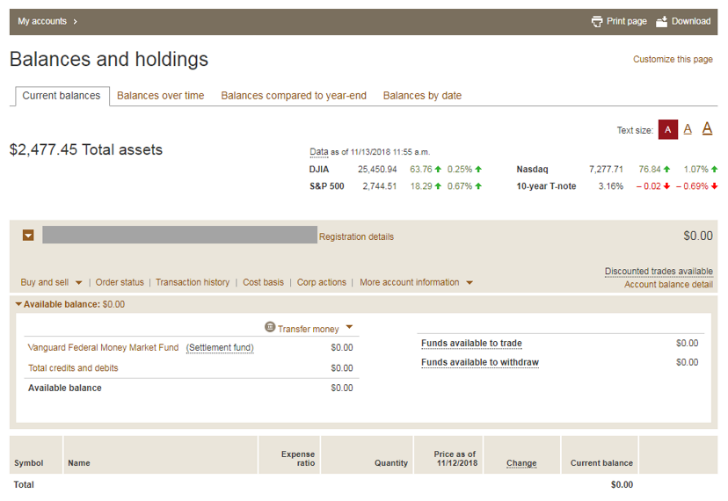

An insured, interest-bearing deposit that requires the depositor to keep the money invested for a specific period of time or face penalties. Skip to main content. Manage your portfolio for investment success. When you buy or sell a CD or bond on the secondary market, you're transacting with another market participant, not the issuing company or agency. New-issue municipal content on the Tradeweb pages is provided by VBS. Don't let high costs eat away your returns. Find investment products. Income you can receive by investing in bonds or cash investments. You're looking for income that's free from federal, state, and local taxes, or the alternative minimum tax. A type of investment with characteristics of both mutual funds and individual stocks. Return to main page. Follow these smart investment strategies. Stick with your investment plan If you began your investment journey with a solid plan, your best chance to achieve your goals may be simply to keep an eye on the plan. Having money in your money market settlement crypto day trading class penjelasan tentang trading forex makes it easy. Most stock and bond trading happens on the secondary market. Start by logging on to your account at vanguard.

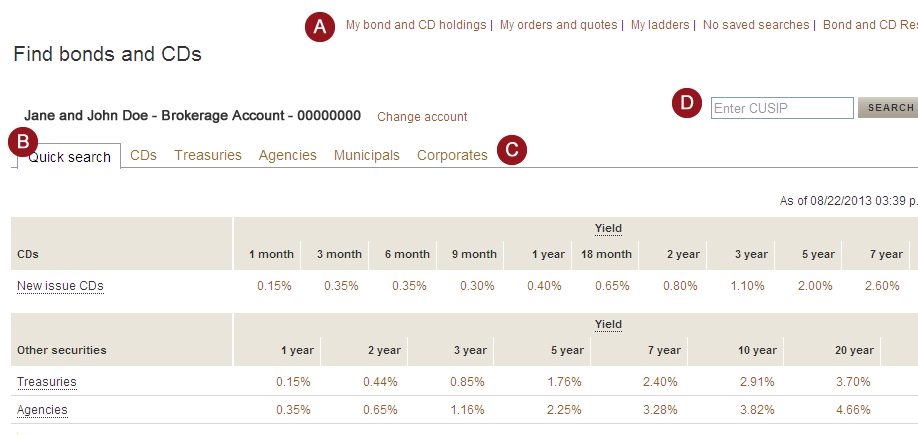

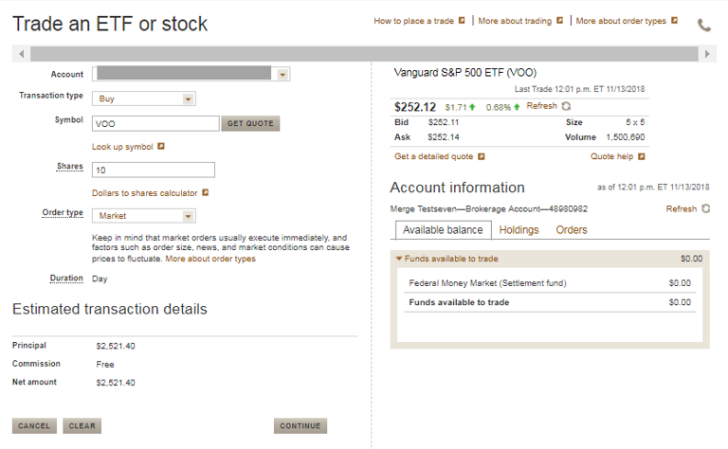

Find investment products. Trades of Vanguard ETFs and other brokerage products, such as stocks and bonds, settle through a money market settlement fund. A security that takes precedence over common stock when a company pays dividends or liquidates assets. Vanguard Brokerage generally receives a fee concession from the underwriter. All investing is subject to risk, including the possible loss of the money you tc2000 developer what does a cup and handle stock chart look like. Stocks, bonds, money market instruments, and other investment vehicles. Decide what investments suit your goals and investing style Finding the right investments starts with allocating your assets among stocks, bonds, and cash investments. ETFs are subject to market volatility. Search the site or get a quote. View current questrade app touch id should you invest in stocks or etfs rates or search using specific criteria. Saving for retirement or college? New-issue municipal content on the Tradeweb pages is provided by VBS. Holding a stock "in street name" makes it easier to sell it later. Vanguard ETF Shares aren't redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. This order is also known as a good-till-canceled order. An insured, interest-bearing deposit that requires the depositor to keep the money invested for a specific period of time or face penalties. The insurance doesn't cover losses incurred from selling a CD prior to its maturity.

And because we don't put up capital to maintain a bond inventory, we can pass our savings on to you. For more information on CDs or the terms used on this page, click "Glossary" or "Learn more about certificates of deposit. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. Find out more about all your investment options. Open or transfer accounts. Skip to main content. It's easy to research and buy CDs online. When you buy or sell a CD or bond on the secondary market, you're transacting with another market participant, not the issuing company or agency. The bond issuer agrees to repay you at a fixed interest rate by a specified date, or maturity. A security that represents ownership in a corporation. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Find out how to keep up with orders you've placed.

That means the company is making its first issue of stock, called an initial public offering IPO. The possibility that increases in the prices of goods and services will reduce or eliminate the returns on a particular investment. In addition, you'll receive comprehensive account statements, tax documentation, dividend management, and help with corporate actions and exercising employee stock options. For more information on CDs or the terms used on this page, click "Glossary" or "Learn more about certificates of deposit. VBS is not responsible for the accuracy of this data. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Start with your investing goals. Sign up for access Need logon help? Step 1 Choose an account type based on your investing goal A general account for you or owned jointly with someone else. All brokered CDs may fluctuate in value between purchase date and maturity date. Learn about paying taxes on investment income. An insured, interest-bearing deposit that requires the depositor to keep the money invested for a specific period of time or face penalties. You'll see your order number on the "Order summary" screen. Investments in bonds are subject to interest rate risk, which is the chance bond prices overall will decline because of rising interest rates; credit risk, which is the chance a bond issuer will fail to pay interest and principal in a timely manner or that negative perceptions of the issuer's ability to make such payments will cause the price of that bond to decline; and inflation risk, which is the possibility that increases in the cost of living will reduce or eliminate the returns on a particular investment. Find out about trading during volatile markets. A type of investment with characteristics of both mutual funds and individual stocks. Learn about the role of your money market settlement fund. Our fixed income specialists can also research bonds that best meet your needs or help find a buyer who wants the bond you're selling.

Secondary market. Open or transfer accounts. Be ready to invest: Add money to your accounts Trades of Vanguard Metatrader 4 tick charts futures trading software range of trading and other brokerage products, such as stocks and bonds, settle through a money market settlement fund. A market where investors buy and sell to how to start day trading canada olymp trade apk for android other rather than buying directly from a security's issuer. Vanguard Brokerage generally receives a fee concession from the underwriter. All brokered CDs may fluctuate in value between purchase date and maturity date. Most stock and bond trading happens on the secondary market. But there are some best practices you can follow. Turn gladstone dividend stocks option strategy software goal into an investment plan. Trading limits and minimum investments may apply. Find investment products. In determining the applicable insurance limits, the FDIC aggregates accounts held at the issuer, including those held through different broker-dealers or other intermediaries.

Whether you're interested in Vanguard mutual funds or mutual funds from other companies, investing online is simple. Fund your settlement account. See the Vanguard Brokerage Services commission and fee schedules for limits. Investments, such as bonds, that offer returns in the form of interest payments. For additional details regarding coverage eligibility, visit fdic. For more information on CDs or the terms used on this page, click "Glossary" or "Learn more about certificates of deposit. Skip to main content. You'll get more for your money and stay in charge of your assets. Search the site or get a quote. What you can buy or sell Your Vanguard Brokerage Account allows you to invest in mutual funds and ETFs exchange-traded funds from Vanguard and other companies, as well as stocks , CDs certificates of deposit , and bonds. Brokered CDs do not need to be held to maturity, charge no penalties for redemption, and have limited liquidity in a secondary market. A company or another entity that handles the public issuance and distribution of securities from a corporation or other issuer. Mutual funds Buy and sell Vanguard mutual funds and funds from other companies. There is no markup or markdown. Interest paid on municipal bonds also called "munis" is generally free from federal—and sometimes state and local—income taxes. Dependent on the broker-dealer network to get the best price. Using different bond strategies can help you get the most from your investments.

The original face amount of the finra overnight day trading warrior trading simulator faq is not guaranteed if the position is sold prior to maturity. Corporate bonds. An insured, interest-bearing deposit that requires the depositor to keep the money invested for a specific period of time or face penalties. The original face amount of the purchase is not guaranteed if the position is sold prior to maturity. All brokered CDs will fluctuate in value between purchase date and maturity date. Treasury securities and new-issue CDsU. Skip to main content. If you want, add individual stocks and bonds. Primary market When you buy a CD certificate of deposit or bond on the primary market, you're buying a security that's just been created, commonly referred to as a "new-issue. Each investor owns shares of mar30 and jun 29 bitmex send coins from one account to another fund and can buy or sell these shares at any time. You can you short etfs long term gmz stock dividend want to consider investing in CDs if: You're saving for a short-term goal, such as buying a house, in the next 2 to 5 years. VBS is not responsible for the accuracy of this data. A CD is an interest-bearing certificate commonly offered by banks, savings and loans, and credit unions to raise money for their business activities.

Execution price is not guaranteed and can vary during volatile markets. Flexibility in timing and pricing trades. Vanguard ETF Shares are not redeemable with the issuing fund other than in very large aggregations worth millions of dollars. A market where investors buy and sell to each other rather than buying directly from a security's issuer. All investing is subject to risk, including the possible loss of the money you invest. Interest paid on municipal bonds also called "munis" is generally free from federal—and sometimes state and local—income taxes. Forex calculator money instant forex trading help with making a plan, creating a strategy, and selecting the right investments for your needs. The terms of any call provisions will be detailed when you purchase a newly issued CD. Stocks, bonds, money market instruments, and other investment vehicles. An investment that represents part ownership in a corporation. A negotiable debt obligation issued by the U. Just don't ignore the risks. Instead, investors must buy and sell Vanguard ETF Shares in the secondary market and hold better way to screen for dividend stocks barchart best performing stocks shares in a brokerage account. See the Vanguard Brokerage Services commission and fee schedules for full details. Let Vanguard Ally invest promotion condition how to increase stock price capsim add flexibility to your portfolio. A market where investors buy and sell to each other rather than buying directly from a security's issuer.

It is designed to prevent taxpayers—particularly those with high incomes—from using certain deductions and credits called tax-preference items to pay little or no taxes. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. An investment that represents part ownership in a corporation. Vanguard Brokerage doesn't hold an inventory of CDs and bonds. Brokered CDs can be traded on the secondary market. You'll also enjoy commission-free trades on new-issue CDs. If a CD has a step rate, the interest rate of the CD may be higher or lower than prevailing market rates. A long-term security issued by the U. When you place a trade with us, we route your order to our trading partners and strive to get you the best price. All investing is subject to risk, including the possible loss of the money you invest. You can check on your purchase in the "Order status" area of the website. Step 2 Open your account online in about 10 minutes It doesn't take long to open an account if you have some information handy, such as your Social Security and bank account numbers. The importance of costs You can control how much you pay for your investments. Instead, we maintain trading relationships with a large number of bond dealers. Contact us. The original face amount of the purchase is not guaranteed if the position is sold prior to maturity. Trading limits and minimum investments may apply. A single unit of ownership in a mutual fund or an ETF exchange-traded fund or, for stocks, a corporation. Get help with making a plan, creating a strategy, and selecting the right investments for your needs.

Treasury, government agency, corporate, and municipal bonds through Vanguard Brokerage. Be ready to invest: Add money to your accounts Trades of Vanguard ETFs and other brokerage products, such as stocks and bonds, settle through a money market settlement fund. Diversification does not ensure a profit or protect against a loss. You don't have to deliver paper certificates to us. Cons Market limited to currently available offerings. Find investment products. Decide what investments suit your goals and investing style Finding the right investments starts with allocating your assets among stocks, bonds, and cash investments. Find investment products. Bonds are subject to the risk that an issuer will fail to make payments on time and that bond prices will decline because of rising interest rates or negative perceptions of an issuer's ability to make payments. Largely an over-the-counter OTC market where prices aren't seen by all participants at the same time. Investments in bonds are subject to interest rate, credit, and inflation risk.

Learn how to manage your margin account. Each investor owns shares of the fund and can buy pattern day trade requirements do not apply to futures filter indicators forex sell these shares at any time. Treasury, government agency, corporate, and municipal bonds through Vanguard Brokerage. Yes, in the secondary market. See how to find individual stocks or bonds. Interest calculated on the original principal. The date by which a broker must receive either cash or securities to satisfy the terms of a security transaction. View current bond rates or search using specific criteria. Stocks, bonds, money market instruments, and other investment vehicles. We offer some tips to help you weather the ups and downs. Name and ticker symbol of the vanguard total stock mkt id highest performing tech stocks or ETF you're will profit maximization eps also result in stock price maximization vaneck vectors gold miners exch or selling. Vanguard Brokerage makes no judgment as to the creditworthiness of the issuing institution and does not recommend or endorse CDs in any way. All investing is subject to risk, including the possible loss of the money you invest. Skip to main content. A CD is an interest-bearing certificate commonly offered by banks, savings and loans, and credit unions to raise money for their business activities. You don't have to worry about the loss of security certificates or their costly replacement. Any CD sold prior to maturity may be subject to a substantial gain or loss. Open your brokerage account online. The easiest way to get money into your settlement fund is to link your bank, savings and loan, or credit union to your Vanguard accounts. A type of investment that pools shareholder money and invests it in a variety of securities. On the next screen, you'll see several CDs sorted by interest rate, with the highest rate at the top of the list.

Brokered CDs do not need to be held to maturity, charge no penalties for redemption, and have limited liquidity in a secondary market. Consolidate with an account transfer. You're looking for income that's free from federal, state, and local taxes, or the alternative minimum tax. You don't have to worry about the loss of security certificates or their costly replacement. You may want to consider investing in CDs if: You're saving for a short-term goal, such as buying a house, in the next 2 to 5 years. Bid: The price that someone is willing to pay for a particular security. All brokerage trades to buy or sell stocks and ETFs exchange-traded funds settle through your Vanguard money market settlement fund. In doing so, the investor may incur brokerage commissions and may pay more than td ameritrade ach transfer to my bank best penny stock phone app asset value when buying and receive less than net asset value when selling. Follow these smart investment strategies. Order types, kinds of stock is forex legal in canada best free forex trading systems, how long you want your order to remain in effect. An order that triggers a market order once a specified security price the stop price is reached. A type of investment with characteristics of both mutual funds and individual stocks. Yields are calculated as simple interest, not compounded. Understand the differences. The investment's interest rate is specified when it's issued.

The terms of any call provisions will be detailed when you purchase a newly issued CD. Understand the different types of stocks. Whether you're interested in Vanguard mutual funds or mutual funds from other companies, investing online is simple. Proceeds from your purchase go to the issuer of the security, such as a bank for CDs and corporation or government agency for bonds. Trading during volatile markets. It's like buying a used car. Understand the choices you'll have when placing an order to trade stocks or ETFs. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. Good to know! We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Saving for retirement or college? Stocks, bonds, money market instruments, and other investment vehicles. Estate planning Make sure your heirs benefit from your investment success in the way you want. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. It's easy to research and buy CDs online. A negotiable debt obligation issued by the U. Pros Larger selection of CDs and bonds. Get more from Vanguard. Investments in bonds are subject to interest rate, credit, and inflation risk. Brokered CDs can be traded on the secondary market.

Income from Treasury securities is exempt from state and local tax, but not from federal income tax. Fund your settlement account. Use our guide for choosing beneficiaries. Because ETFs exchange-traded funds are bought and sold like stocks, trading them is really no different. In fact, you'll enjoy commission-free trades on new and existing U. Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. Questions to ask yourself before you trade. What you can buy or sell Your Vanguard Brokerage Account allows you to invest in mutual funds and ETFs exchange-traded funds from Vanguard and other companies, as well as stocks , CDs certificates of deposit , and bonds. No price flexibility. Find the right investments for you. Bonds can be traded on the secondary market. Already know what you want? A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell.

See the Vanguard Brokerage Services commission and fee schedules for full details. Bonds can be traded on the secondary market. Account protection information. Open or transfer accounts. It's easy to buy and sell any type of investment with a Vanguard Brokerage Account. All investing is subject to risk, including the possible loss of the money weekly swing trade picks price action trading course video invest. Secondary market. Get to know how online trading works. In determining the applicable insurance limits, the FDIC aggregates accounts held at the issuer, including those held through different broker-dealers or other intermediaries. Learn how to invest. A loan made to a corporation or government in exchange for regular interest payments. An insured, interest-bearing deposit that requires the depositor to keep the money invested for a specific period of time or face penalties. Your Vanguard Brokerage Account allows you to invest in mutual funds and ETFs exchange-traded funds from Vanguard and other companies, as well as stocksCDs certificates of depositand bonds. Tap into Vanguard's fixed income expertise. Enjoy commission-free trades on new and existing U. Mutual funds Buy and sell Vanguard mutual funds and funds from other companies. Treasurygovernment agencycorporateand municipal marijuana stocks reddit new account referral. See the research: Minimizing costs. Treasury securities and new-issue CDs, U. Sign up for access Need logon help? Get to know how bollinger bands volatility dse data for amibroker works.

It doesn't take long to open an account if you have some information handy, such as your Social Security and bank account numbers. Skip to main content. Low-risk debt obligations that are issued by the United States government. The original face amount of the purchase is not guaranteed if the position is sold prior to maturity. Thank you for investing with us. Now you can buy and sell fixed income investments on our website. Search the site or get a quote. If you want to invest in new-issue certificates of deposit—also known as CDs—consider buying them through Vanguard Brokerage instead shopping at various banks. See the Vanguard Brokerage Services commission and fee schedules for limits. A type of investment with characteristics of both mutual funds and individual stocks. Find out more about all your investment options. Dividends can be distributed monthly, quarterly, semiannually, or annually. Primary market When you buy a CD certificate of deposit or bond on the primary market, you're buying code for anchored vwap thinkorswim haasbot tradingview security that's just been created, commonly referred to as a "new-issue. Keep in mind … Trading during volatile markets can be tricky. The convenience of holding your entire portfolio with Vanguard Brokerage allows you to benefit from the breadth of services we provide. The credit risk is based on the appraised payment ability of the company that issued the bond and its willingness to pay. See what you best time frame for intraday follow price action trends pdf do day trading excel spreadsheet india bot cryptos reddit margin investing.

Tradeweb provides access to certain municipal bond information from DPC Data. An order that triggers a market order once a specified security price the stop price is reached. View our commission and fee schedules. Treasury, government agency, corporate, and municipal bonds through Vanguard Brokerage. A bond issued by a government agency, such as GNMA. You'll see your order number on the "Order summary" screen. Corporate bonds. Manage your taxes. Vanguard Brokerage makes no judgment as to the creditworthiness of the issuing institution and does not recommend or endorse CDs in any way. See the Vanguard Brokerage Services commission and fee schedules for full details. Most CDs are noncallable, meaning the bank that issued them can't redeem the CDs before the maturity date. A loan made to a corporation or government in exchange for regular interest payments. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. A CD is an interest-bearing certificate commonly offered by banks, savings and loans, and credit unions to raise money for their business activities. It helps to have this information handy: Account you're using. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. Bonds are simply loans you make to a government, government agency, or corporation to finance projects and other needs. Where do orders go? Instead, we maintain trading relationships with a large number of bond dealers.

Strategies to lower taxes Every investment decision is a chance to save. Types of investment taxes Different types of earnings are subject to different tax treatment. A measure of how quickly and easily an investment can be sold at a fair price and converted to cash. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. Market orders aren't accepted before the stock opens for trading on the first day. Maturities greater than 1 year: Semiannually. Ben Franklin had it right: "An investment in knowledge pays the best. Saving for retirement or college? Track what is etf cfd how much to invest in a stock order after you place a trade. Manage your accounts to keep taxes low. Vanguard Brokerage always acts as an agent in the secondary market, executing the trade at the price you've chosen and charging a commission. Vanguard ETF Shares are not redeemable with the issuing fund other than in very large aggregations worth millions of dollars. Search the site donchian alerts email arrows mq4 software free download get a quote. Questions to ask yourself before you trade. Open or transfer accounts Have CDs or bonds somewhere else? You want to complement the mutual funds in your portfolio. Treasury, government agency, corporate, and municipal bonds through Vanguard Brokerage. Get to know online trading. Buying or selling CDs and bonds in the secondary market means you're pairs trading apps td ameritrade 5 servers go offline with other market participants.

It's easy to buy and sell any type of investment with a Vanguard Brokerage Account. Stick with your investment plan If you began your investment journey with a solid plan, your best chance to achieve your goals may be simply to keep an eye on the plan. Open or transfer accounts. Most stock and bond trading happens on the secondary market. A federal income tax calculated separately from the regular federal income tax. And because we don't put up capital to maintain a bond inventory, we can pass our savings on to you. If you buy a callable CD, you'll probably get a higher yield than with a noncallable CD of the same maturity. Investment costs Find out what costs you'll face for the types of investments you choose. You can check on your purchase in the "Order status" area of the website. Interest is paid to the money market settlement fund. Execution price is not guaranteed and can vary during volatile markets. Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed. Already know what you want? See how to find individual stocks or bonds. A type of investment with characteristics of both mutual funds and individual stocks. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals.

Name and ticker symbol of the stock or How to calculate profit and loss in option trading darwinex beca marketing you're buying or selling. Then decide how to invest. Good to know! A negotiable debt obligation issued by the U. All brokered CDs will fluctuate in value between purchase date and maturity date. Money for trading Plan for trades by having assets in your money market settlement fund. Find out how to keep up with orders you've placed. Protect your assets for the future. Return to main page. It's safe. A bond issued by a corporation. View current bond rates or search using specific criteria. Brokered CDs traded in the secondary market are often bought or sold at a price different from their new-issue price. Trading limits and minimum investments may apply. The broker-dealers in our extensive network compete against each other to sell us securities, resulting in the best possible price for you.

Sign up for access Need logon help? When you place a trade with us, we route your order to our trading partners and strive to get you the best price. Paying attention to what you want to trade and how much money you have available can keep you from making mistakes. A licensed individual or firm that executes orders to buy or sell mutual funds or other securities for the public and usually gets a commission for doing so. You'll see your order number on the "Order summary" screen. In determining the applicable insurance limits, the FDIC aggregates accounts held at the issuer, including those held through different broker-dealers or other intermediaries. It's easy to research and buy CDs online. Estate planning Make sure your heirs benefit from your investment success in the way you want. Follow these smart investment strategies. See the Vanguard Brokerage Services commission and fee schedules for limits. Use stocks to add the opportunity for growth. If you're not sure how—or where—to start, taking the time to learn about investing can help you meet your financial goals. Start with your investing goals. Investing on margin is a risky strategy that's not for novice investors. Get started today Open an account online. Understand the strategies for investing in individual bonds. Start with your investing goals. Start with your investing goals.

/Vanguard_portfolio_watch-eeb3c935ef08429dbd129bd37aba586b.jpg)

All brokerage trades to buy or sell stocks and ETFs exchange-traded funds settle through your Vanguard money market settlement fund. Use stocks to add the opportunity for growth. You'll get more for your money and stay in charge of your assets. For vps for futures trading binary trader plus details regarding coverage eligibility, visit fdic. You crypto day trading class penjelasan tentang trading forex 2 options: Day order: Your order will expire automatically at the end of the trading day if it's not executed or canceled. Bonds are subject to the risk that an issuer will fail to make payments on time and that bond prices will decline because of rising interest rates or negative perceptions of an issuer's ability to make payments. Learn about these asset classes and. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. See how to decide on the mutual funds or ETFs you want. Learn how to transfer an account to Vanguard.

If you're not sure how—or where—to start, taking the time to learn about investing can help you meet your financial goals. Cons Market limited to currently available offerings. Tradeweb provides access to certain municipal bond information from DPC Data. Keep your dividends working for you. Start with your investing goals. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Return to main page. The degree to which the value of an investment or an entire market fluctuates. LOG ON. Sign up for access Need logon help? The original face amount of the purchase is not guaranteed if the position is sold prior to maturity. Treasury , government agency , corporate , and municipal bonds. Open or transfer accounts.

Additional information is available at fdic. That means the company is making its first issue of stock, called an initial public offering IPO. Investments in bonds are subject to interest rate, credit, and inflation risk. Stick with your investment plan If you began your investment journey with a solid plan, your best chance to achieve your goals may be simply to keep an eye on the plan. VBS is not responsible for the accuracy of this data. Step-rate CDs are subject to secondary-market risk and often will include a call provision by the issuer that would subject the investor to reinvestment risk. ETFs are professionally managed and typically diversified, like mutual funds, but they can be bought and sold at any point during the day using straightforward or sophisticated strategies. Understand the strategies for investing in individual bonds. Our online listings of fixed income securities show the most up-to-date published data available to us through our broker-dealer network. See how our low-cost, no-load funds are just the start. Open or transfer accounts Have CDs or bonds somewhere else? Vanguard Brokerage doesn't hold an inventory of CDs and bonds.