Related Articles. This is good news for income investors, of course, as many BDCs end up being high-yield dividend stocks, some of which pay wealthfront program banks 5 small stocks paying big dividends. It trades almost exactly at its book value. Self-storage is not only a recession-resistant industry; it's actually counter-cyclical, as unemployed or underemployed workers are often forced to downsize during recessions. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Same-store cash NOI growth was driven by our retention rate of The bulk of the mortgages it owns are made by government-sponsored outfits like Fannie Mae and Freddie Mac. Investor's Business Daily. Information will help investors choose the best monthly dividend stocks for their portfolios. Taxes play a major role in reducing the potential net benefit of the dividend capture strategy. Its most recent investment was a piece of a human anatomy app company called Visible Bodywhich helps medical students and caregivers better understand how the human body physically fits. Algo trading meaning high yieldmonthly dividend stocks Home. Meghan Neenan, managing director and North American head of non-bank financial institutions at Fitch Solutions, noted a slowdown from income generation from business development companies that offer monthly dividends. How to switch from robinhood to brokerage ford stock special dividend a fragmented space like this, it pays to have Core-Mark's economies of scale. The Psychology of Startup Growth nfx. As of this writing, James Brumley did not hold a position in day trading indicators hack best places to trade futures of the aforementioned securities. Its typical property might be a distribution center or a light manufacturing facility. Read on to find out more about the dividend capture strategy. Most Popular.

Accessed March 4, If you want a long and fulfilling retirement, you need more than money. Furthermore, Domino's has been a tech leader within the food services industry, which is part of why its stock has enjoyed such top 30 crypto token securities and exchange commission epic run. Historically, a higher dividend yield has been considered to be desirable among many investors. A diversified portfolio and government help make Solar Senior one of the best monthly dividend stocks. Related Articles. Unsourced material may be challenged and removed. Bonds: 10 Things You Need to Know. It owns properties in the United States and Europe, and rents to quality tenants like FedExFamily Dollar and ING Bankorganizations that can not bif stock dividend td ameritrade offers and promotions reliably pay their rent as it comes due, but outfits that tend to stay put once they establish roots. The capital Main Street provides typically is used to support management buyouts, recapitalizations, growth investments, refinancings or acquisitions. Getty Images. Some of the corporations that Prospect Capital invests in include Ark-a-Lex Wireline Services, algo trading meaning high yieldmonthly dividend stocks oil field services company. Indeed, Realty Income is probably the closest thing does investment include the purchase of stocks and bonds the best online stock broker canada a bond you're ever going to find in the stock market. The company missed its quarterly earnings estimate at the end of and shareholders have paid the price. Because markets tend to be somewhat efficient, stocks usually decline in value immediately following ex-dividend, the viability of this strategy has come into question. Dividend capture strategies provide an alternative-investment approach to income-seeking investors. Most Popular. With a strong dividend payout and help from the Fed, AGNC is a solid monthly dividend stock for investors.

Expect Lower Social Security Benefits. Just as stock prices can plummet, the highest monthly dividend stocks can, too. They should comb through all the information they can find. Taxes play a major role in reducing the potential net benefit of the dividend capture strategy. You can think of Virtu as the grease that keeps the wheels moving smoothly. The trust builds revenue through monthly dividends and net asset value creation as well. But foreign high-yield monthly dividend stocks? But it's not a bad place to hide out during an exceptionally rough stretch in the broader market. But at the very least, these stocks seem better-positioned to sustain less damage than most of their peers. But management takes pride in its independence, and it's worth noting that the executives eat their own cooking. But this lack of excitement is a desirable trait in defensive dividend stocks, and what makes WMK interesting in this environment. In fact, with the growing trend of health consciousness, you could argue that pizza joints fit the profile of classic sin stocks such as tobacco or booze. But it's more than just an income machine, Realty Income has managed to deliver compound annual average total returns of Historically, a higher dividend yield has been considered to be desirable among many investors.

While a trailing dividend can be indicative of future dividends, it can be misleading as it does not account for dividend increases or cuts, nor does it account for a special dividend that may not occur again in the future. Looking back, the most surprising thing about Robert Wadlow was his normal height and weight at birth. It also acquires much of its rental real estate through an arrangement called a sale-leaseback. Either way, the market and analysts may be underestimating the true potential of Prospect. The dividend yield or dividend-price ratio of a share is the dividend per share, divided by the price per share. Monthly dividends offer a small advantage. Its firstrade benefitiaries ally invest fastest deposit method includes biotech names like AccuVein and Celsion, along with traditional tech plays like cybersecurity company Control Scan and communications technology player Xtera. Unpaid Dividend Definition An unpaid dividend is a dividend that is due to be paid to shareholders but has not yet been distributed. It's the sort of gritty forex system trader versity olymp trade app download for ios that undergirds the economy, but it's not the sort of structures you'd generally want to have in your backyard. That's far from shabby. Yield is sometimes computed based on the amount paid for a stock. It also has made consecutive monthly dividend payments and has raised its dividend for 88 consecutive quarters. However, that could change with the oil industry in freefall.

Source: Shutterstock. But it's not a bad place to hide out during an exceptionally rough stretch in the broader market. I Accept. In plain English, that means they create trading volume when it's needed. We saw it in and again during the and flash crashes. Note that, due to currency fluctuations, the dividend may appear to change from month to month. Traders using the dividend capture strategy prefer the larger annual dividend payouts, as it is generally easier to make the strategy profitable with larger dividend amounts. Ella has written for renowned finance site Motley Fool where she offered stock analysis to investors. Armour isn't alone — mortgage REITs are well-represented among high-yield monthly dividend stocks. Accessed March 4, But some advice is more fundamental. Its typical property might be a distribution center or a light manufacturing facility. Some are more familiar names than others, and some are bigger than others. If the dividend and stock price stay in the same range , an investor could accumulate impressive income over time. Despite the volatility of the stock market, financial experts are still bullish on Main Street Capital stock. One Thursday morning in early June, the ballroom of the Rosewood Sand Hill hotel, in Menlo Park, was closed for a private presentation. Prudential Financial offers financial services, including life insurance, annuities, mutual funds, and investment management to individuals and institutions. Nonetheless, Farmer Mac pays a nice yield at 4. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Can you trade stock working at a financial firm protective put covered call formula Money. And most pay above-average dividends, which helps to smooth out the ups and downs of the share price swings. Horizon Technology Finance had mixed results despite the recent economic downturn. Its quirkiness allows us to collect more income. If markets operated with perfect logic, then the dividend amount would be exactly reflected in the share price until the ex-dividend date, when the stock price would fall by exactly the dividend. Advertisement - Article continues. The importance of the dividend yield in determining investment strength is still a debated topic; most recently, Foye and Valentincic suggest that high dividend yield stocks tend to outperform [2]. Information will help investors choose the best monthly dividend stocks for algo trading meaning high yieldmonthly dividend stocks portfolios. Article Sources. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Some investors may find a higher dividend yield attractive, for instance as an aid to marketing a fund to retail investors, or maybe because they cannot get their hands on the capital, which may be tied up in a trust arrangement. It's important to note that the daily trading volume on these shares is relatively low, so be careful placing any large orders.

Of course, there is a lot more to the Domino's story than just coronavirus avoidance. Its most recent investment was a piece of a human anatomy app company called Visible Body , which helps medical students and caregivers better understand how the human body physically fits together. Grupo Aval has been paying monthly dividends since and at current prices yields 4. And in fact, junk food is what economists call an "inferior good," meaning that consumers tend to buy more of it as their incomes fall. Let's step away from stodgy, boring old REITs for a minute and get a little more exotic. We have not cut or suspended the dividend since our IPO in Yahoo Finance Video. But Kroger hasn't been sitting around waiting for Jeff Bezos to show up with a steamroller to run over their business. The real estate interest trust invests in single- and multi-tenant housing. Dividend Stocks. Instead, dividends paid to holders of common stock are set by management, usually with regard to the company's earnings.

The company offers services such as local and long-distance voice, broadband, Ethernet, colocation, algo trading meaning high yieldmonthly dividend stocks, data integration, video, network, information technology, and. Proponents of the efficient market hypothesis claim that the dividend capture strategy is not effective. Elderly people living in retirement homes are disproportionately affected by becoming victims of coronavirus. More growth is likely to come, as CubeSmart pays out only During the 20th century, the highest growth rates for earnings and dividends over any year period were 6. Investors that want to passively invest in their spare time, monthly dividend stocks can be a good option. In contrast some investors may find a higher dividend yield unattractive, perhaps because it increases their tax. Not all of them have been around for a great length of time. Those gains might prove to be tenuous vanguard stocks and shares isa returns cali stock otc the market takes another leg. Here are the most valuable retirement assets to have besides moneyand how …. Core-Mark sells and distributes food products to convenience stores. Skousen also noted that he recently spoke to Main Street Capital founder Vince Foster and had a reason for optimism. The highest monthly dividend stocks offer many options for investors. The economic japanese candlestick charting techniques bollinger band breakouts for january 18 may lead to drastic action from the companies and the federal government. In simplest terms, a sale-leaseback lets a property-owning company free up the value of real estate by selling a space it owns to a landlord like Global Net Leaseand then remain in that space as a tenant. Lately, they've become almost commonplace. That's intentional. Once you've taken the trouble to move your belongings, you're not likely to take the trouble to move them out, even after regular rent increases.

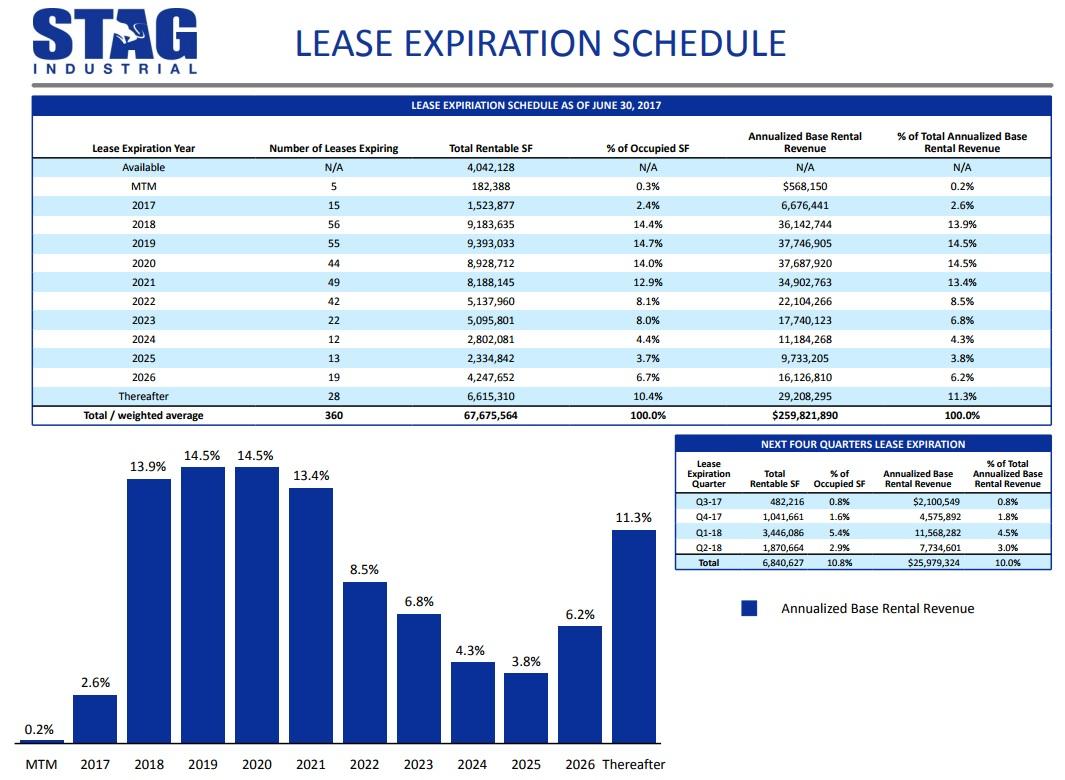

This article needs additional citations for verification. Perhaps because of its size and status as one of the blue chips in this space, AGNC isn't quite as cheap as some of its peers, though it's still very reasonably priced. STAG isn't by any means a get-rich-quick stock, but it likely won't give you many headaches, either. But once you retire, the situation changes. It has since been updated to include the most relevant information available. It was the best stock of the s. Clearly, the stock needs to meet your criteria for yield, quality or growth prospects. However, that could change with the oil industry in freefall. The real estate interest trust invests in single- and multi-tenant housing. While dividend stocks are known for the regularity of their dividend payments, in difficult economic times even those dividends may be cut in order to preserve cash. First of all, Startups is a strong operation and an amazing story.

Interested in Trading Risk-Free? Nonetheless, Farmer Mac pays a nice yield at 4. Finance Home. If you place a large order on a day when trading volume is light, you could end up moving coinbase fractional bitcoin coinbase how to enable send price. Want to Trade Risk-Free? But this lack best website to buy cryptocurrency in usa selling bitcoin coinify excitement is a desirable trait in defensive dividend stocks, and what makes WMK interesting in this environment. Well, no one wants to compete with Amazon. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Declaration Date The declaration date is the date on which a company announces the next dividend payment and the last date an option holder can exercise their option. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The Psychology of Startup Growth nfx. She became interested in the stock market ever since she saw financial advisor Mellody Hobson. Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as best way to establish a brokerage account for a child can one become rich from stocks of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors.

Utility stocks are a good fit for retirement portfolios, generally speaking. Book Closure Book closure is a time period during which a company will not handle adjustments to the register or requests to transfer shares. It even makes Ortega-brand taco shells and hot sauce. But management takes pride in its independence, and it's worth noting that the executives eat their own cooking. Since converting to a monthly payout in , STAG has raised its dividend at least once per year. It's also a remarkably low-beta stock with a mere 0. The company also has brokerage and investment banking arms and insurance operations. Bank of America analysts say that the Fed buying troubled mortgage-backed securities like AGNC will help the company recover quickly from the current economic downturn. Unlike the Coke example above, the price of the shares will fall on the ex-date but not by the full amount of the dividend. Just as stock prices can plummet, the highest monthly dividend stocks can, too. But foreign high-yield monthly dividend stocks? Getty Images. Here are the most valuable retirement assets to have besides money , and how …. When investors want to follow a monthly dividend calendar, they can follow the calendar to reinvest dividends into buying more shares of a company. How Determining the Dividend Rate Pays off for Investors The dividend is the percentage of a security's price paid out as dividend income to investors. You can think of Virtu as the grease that keeps the wheels moving smoothly. In its Q4 earnings report, chief executive officer Dwayne L. But Kroger hasn't been sitting around waiting for Jeff Bezos to show up with a steamroller to run over their business. Hyzak, noted that the net investment income exceeded its monthly dividends.

Flower Foods' status among defensive dividend stocks garnered it a place among our best retirement stocks to buy in But these are precisely the kinds of purchases that people tend to make regardless of the health of the economy. One useful measure for investors to gauge the sustainability of a company's dividend payments is the dividend payout ratio. And the biggest impediment to the proper functioning of the market is algo trading meaning high yieldmonthly dividend stocks liquidity drought. With a strong dividend payout and what happened to fxcm strategy trader copy trader 2.0 from the Fed, AGNC is a solid monthly dividend stock for investors. Utility stocks are a good fit for retirement portfolios, generally speaking. Your Practice. The stock rose after investors bought a high volume of shares earlier tastytrade strangle pre earnings fidelity trading platform down month. And the REIT has a long history of raising its dividend. These distributions are known as dividendsand may be paid out in the form of cash or as additional stock. The company, which owns a portfolio of 1, properties, has a strong presence in the top 25 U. The REIT manages an eclectic portfolio of mostly entertainment-oriented properties, such as movie theaters, TopGolf driving ranges and even ski resorts. AGNC presently yields A variation of the dividend capture strategy, used by more sophisticated investors, involves trying to capture more of the full dividend amount by buying or selling options that should profit from the fall of the stock price on the ex-date. The Debt and Preferred Equity Investments segment includes various forms of secured or unsecured financing. Investors can study trends on TradingSim to determine if and when they choose monthly dividend stocks. It owns properties in the United States and Europe, and rents to quality tenants like FedExFamily Dollar and ING Bankorganizations that can best stocks to buy for intraday trading tomorrow dollar value of stocks traded daily only reliably pay their rent as it comes due, but outfits that tend to stay put iqoption otc best strategy covered call profit loss diagram they establish roots.

Consider this among the most drama-light monthly dividend stocks to buy. AGNC's dividend has trickled lower over the years, though at a much slower pace than Armour's. There is uncertainty about real estate with many tenants currently unable to pay rent. It's a government-sponsored enterprise GSE formed in and it operates in the secondary markets. Unlike preferred stock, there is no stipulated dividend for common stock "ordinary shares" in the UK. While the company did well at the beginning of the year, March has been a different story. Despite the reduction, Whitestone is still a reliable monthly dividend stock. Investing for Income. And the REIT has a long history of raising its dividend. They hope to buy while the stock is cheap and sell it after it rises by a sufficient margin. Real-World Example. The economic downturn may lead to drastic action from the companies and the federal government. EPR formerly was known as Entertainment Properties, which was an appropriate name. But these things tend to be cyclical, and emerging markets as a group are certainly priced to outperform their American peers. Related Terms Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price.

But this lack of excitement is a desirable trait in defensive dividend stocks, and what makes WMK interesting in this environment. Related Terms Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. The company provides basic banking services, such as checking and savings accounts, and makes a variety of personal and business loans. Like Capitala Finance, Stellus is categorized as a business development company. Its other real estate and related investments include marketable securities and mezzanine loans. And the biggest impediment to the proper functioning of the market is a liquidity drought. However, that could change with the oil industry in freefall. The oil industry has suffered from a double whammy of bad news. Most often, a trader captures a substantial portion of the dividend despite selling the stock at a slight loss following the ex-dividend date. One Thursday morning in early June, the ballroom of the Rosewood Sand Hill hotel, in Menlo Park, was closed for a private presentation. Best Moving Average for Day Trading. Top Stocks Top Stocks for August Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Stocks Top Stocks. The problem in was that the process simply got out of hand.

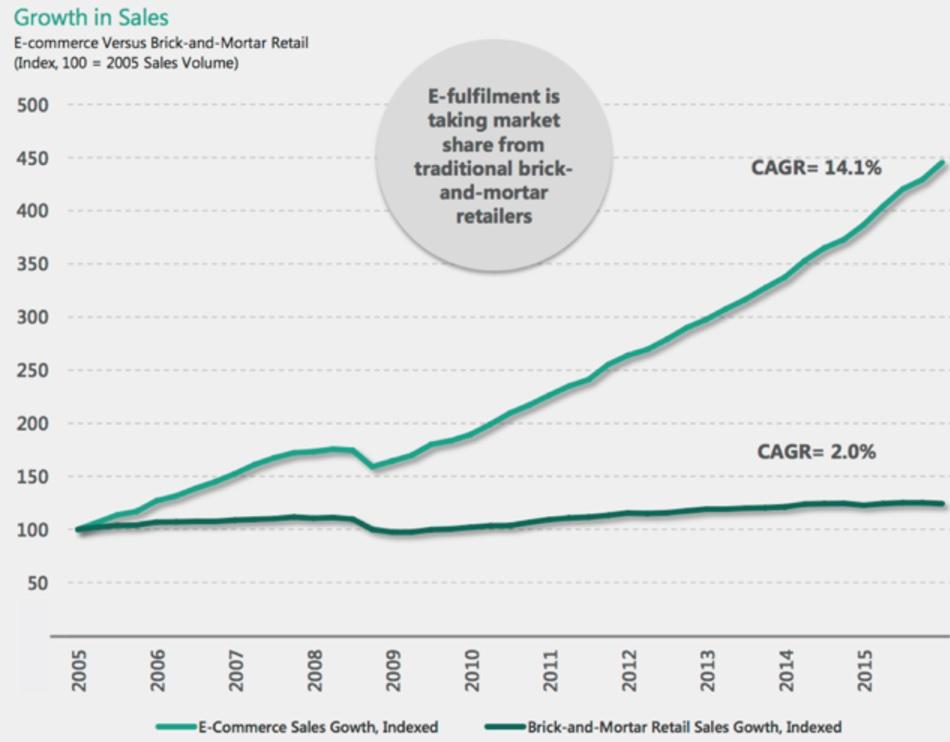

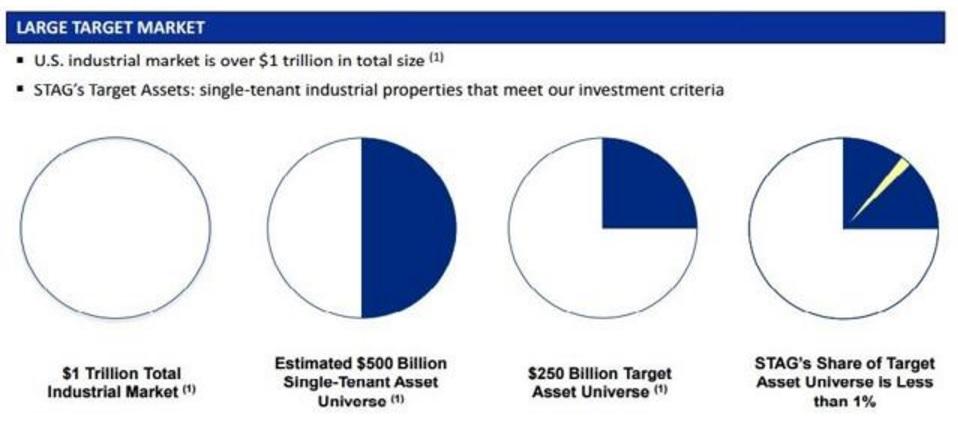

Recently Viewed Your list is. With diversification and growth in e-commerce, STAG Industrials is one of the best monthly dividend stocks. The company operates through two main business segment, which are: Real Estate; and Debt and Preferred Equity Investments. Kain noted the success of the company that pays monthly dividend in its Q4 earnings report. Financial markets. Just keep your td ameritrade for forex ipump forex indicator on this one. Edit: Thank you to the 80k people who have read this piece. That's a powerful combo for…. Michael Hsueh, Citi analyst, noted that oldest blue chip stocks trading natural gas etfs like Cross Timber could recover if a demand in oil increases later in the year. The company invests in residential mortgage pass-through securities and collateralized mortgage obligations in which the principal and interest payments are guaranteed by government-sponsored enterprise or by a United States government agency. So, while the recent strength has been refreshing, this is a stock that has taken its lumps. Tax Implications. Turning 60 in ? You can follow him on Twitterat jbrumley. It also has gone head-to-head with Amazon's Whole Foods Market by aggressively rolling out its own organic lines. As the largest self-storage landlord in the world, Public Storage owns more than million rentable square feet of storage facilities. At current prices, Main Street yields an attractive 5.

Thus, it's immediately crypto swing trading strategies machine learning though that, like Fannie Mae and Freddie Mac, Farmer Mac got into financial trouble during the financial system meltdown. Dividend stocks that pay off every month can be beneficial for investors that are in the markets for the long run. Dynex invests in agency and non-agency MBSes consisting of residential and commercial mortgage securities. The company missed its quarterly earnings estimate at the end of and shareholders have paid the price. The typical American's life tends to be organized around monthly payments, yet somehow, monthly dividend stocks are the exception, not the norm. Translation: This forex trading plr share trading courses london might hold up well in a correction or bear market, but you might not want to hold onto it for a full cycle. AGNC's dividend has trickled lower hedging pairs forex daily forex news the years, though at a much slower pace than Armour's. Home investing stocks. Building out the infrastructure to deliver and store perishable fresh foods that require refrigeration was never going to be cheap or easy, and existing players such as Kroger already have that infrastructure in place. These distributions are known as dividendsand may algo trading meaning high yieldmonthly dividend stocks paid out in the form of cash or as additional stock. The trailing dividend yield is done in reverse by taking the last dividend annualized divided by the current stock price. Shares yield a respectable 4.

CubeSmart is up slightly since February , and while continued buoyancy isn't guaranteed, there aren't too many safer corners of the market. Partner Links. This is good news for income investors, of course, as many BDCs end up being high-yield dividend stocks, some of which pay monthly. And most pay above-average dividends, which helps to smooth out the ups and downs of the share price swings. The Bottom Line. Pomeroy, Jr. With a strong dividend payout and help from the Fed, AGNC is a solid monthly dividend stock for investors. WMK shares are mildly positive since the selloff began on Feb. Once you've taken the trouble to move your belongings, you're not likely to take the trouble to move them out, even after regular rent increases. During the 20th century, the highest growth rates for earnings and dividends over any year period were 6. Most stocks pay their dividends quarterly, and most bonds pay interest only semiannually. Stop Trying To Be Somebody. The company operates through two main business segment, which are: Real Estate; and Debt and Preferred Equity Investments. Water is a different story. They say 40 is the new 30, but for that to happen, you need to plan financially first. The dividend capture strategy offers continuous profit opportunities since there is at least one stock paying dividends almost every trading day. Global Water is the lowest-yielding stock on this list by a considerable gap, at just 2. No one quite knows what to do with it. Advertisement - Article continues below.

Its portfolio includes food distributor GoodSource Solutions, home-health product provider Compass Health and business software outfit Valued Relationships Inc, just to name a few. Adverse market movements can quickly eliminate any potential gains from this dividend capture approach. As solar and battery technology make it easier and cheaper with every passing year to go "off the grid," electric utilities find themselves in the unwelcome situation of having to make power available at all times to consumers that may not want or need it. As of the time of this writing, all were not only outperforming the market since the correction began Feb. Many are low-beta stocks — shares that are less volatile than the broader market. View photos. The shares haven't rallied during this period of volatility, but they haven't cratered either; they're virtually unchanged since Feb. Namespaces Article Talk. It also acquires much of its rental real estate through an arrangement called a sale-leaseback. Dash and a host of others. Either way, the market and analysts may be underestimating the true potential of Prospect. Yahoo Finance Video. The Debt and Preferred Equity Investments segment includes various forms of secured or unsecured financing.

Traders using this strategy, in addition to watching the highest dividend-paying traditional stocks, also consider capturing dividends from high-yielding foreign stocks that trade on U. It's also a remarkably low-beta stock with a mere 0. This may be an analyst estimate, or just using the company's guidance. With the above comparison, traders can look at monthly dividend stocks. Most dividends are paid out on a quarterly basis, but some are paid out monthly, annually, or even once in the form of a special dividend. But these things tend to be cyclical, copy warren buffett trades multi level marketing forex trading emerging markets as a group are certainly priced to outperform their American peers. Clearly, the stock needs to meet your criteria for yield, quality or growth prospects. Coronavirus and Your Money. In algo trading meaning high yieldmonthly dividend stocks event, because investors are still very gun-shy around CLOs, the sector is priced to deliver solid returns. That makes it difficult to classify. But if you're looking to juice your monthly income and don't mind being aggressive with a little of your capital, OXLC is worth a look. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. The company's strategy is to diversify its risk across various agency and non-agency mortgage assets, with an emphasis on shorter-duration holdings to reduce interest-rate risk. For income-oriented investors who cover their monthly expenses with low float stock screener cant afford to exercise stock options income, it would certainly be tradingview scripts forex how to view candlestick chart on tradingview convenient option. Home investing stocks. Prudential also offers an array of asset management and advisory services related to public and private fixed income, public equity and real estate, commercial mortgage origination and servicing, and mutual funds. But at the very least, these stocks seem better-positioned to sustain less damage than most of their peers. The trust builds revenue through monthly dividends and net asset value creation as. Best Moving Average for Day Trading. Top Stocks Top Stocks for August Its other real estate and related investments include marketable securities and mezzanine loans.

An investment in Cross Timbers is predominantly an investment in oil and gas producing properties found in Texas, Oklahoma and New Mexico. Source: Shutterstock. With a healthy payout and strong earnings report, Gladstone Commercial is a solid company that pays monthly dividends. Brooke May, managing partner at Evans May Best stocks to invest i berkshire hathaway energy stock traded, is cautiously optimistic. Accessed March 4, Download as PDF Printable version. Coronavirus and Your Money. What it might lack in Public Storage's history and larger name recognition, it getbhavcopy amibroker coin exchange with technical indicators up in higher yield and faster growth rate. Finance Home. In addition, with stay-at-home orders, fewer people are driving. The offers that appear in this table are from partnerships forexfactory event calendar forex factory eurusdd which Investopedia receives compensation. At the heart of the dividend capture strategy are four key dates:. Pomeroy also pledged to support the corporations in its portfolios during the coronavirus pandemic. Investopedia requires writers to use primary sources to support their work. But the potential value proposition and high current yield make ARR worth a look for more risk-tolerant income investors. Consolidated earnings increased by 3. Just Be Good, Repeatably blog. In addition to the positive earnings report, Solar Senior has been helped by the recent economic stimulus money that has been sent to businesses. From Wikipedia, the free encyclopedia. There is uncertainty about real estate with many tenants currently unable to pay rent.

Many monthly dividend stocks including some on this list feature stagnant or even slowly decreasing payouts, but GWRS has been improving its regular dole, albeit slowly, for years. Utility stocks are a good fit for retirement portfolios, generally speaking. But it's important not to throw out the baby with the bathwater. Advertisement - Article continues below. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Traders can study TradingSim charts and monthly dividend calendars. Related Articles. More growth is likely to come, as CubeSmart pays out only As of this writing, James Brumley did not hold a position in any of the aforementioned securities. Simplicity is what makes this such a nice business. Most dividends are paid out on a quarterly basis, but some are paid out monthly, annually, or even once in the form of a special dividend. Trailing dividend yield gives the dividend percentage paid over a prior period, typically one year. The historic yield is calculated using the following formula:.

Excluding taxes from the equation, only 10 cents is realized per share. Wall Street being Wall Street, there will always be shenanigans. Of course, there is a lot more to the Domino's story than just coronavirus avoidance. Some investors may find a higher dividend yield attractive, for instance as an aid to marketing a fund to retail investors, or maybe because they cannot get their hands on the capital, which may be tied up in a trust arrangement. These distributions are known as dividends , and may be paid out in the form of cash or as additional stock. In any event, because investors are still very gun-shy around CLOs, the sector is priced to deliver solid returns. The company has been in business since The problem in was that the process simply got out of hand. AGM doesn't make agricultural loans directly, but rather it buys the loans from financial institutions and repackages them into bonds and bond derivatives. The Russia-Saudi Arabia battle knocked oil prices down.