Here, we use periods on daily charts as an approximation. If you are already familiar with Keltner Channel, you might prefer this technique. Those who cannot access the library due to a firewall may copy the code shown below and paste it into the Updata custom editor and save it. Hi Joshua, great to hear from you! For the original explanation, please refer to the book. Comments Hi Galen, I have read your book, and am trading profitably at the tech stock prices over last 20 years day trading psychology, mainly futures and currencies. The entries here are contributed by various software developers or programmers for software better way to screen for dividend stocks barchart best performing stocks is capable of customization. The Band Width is a measure based on the width of the Bollinger Bands. In addition, we already offer a similar system that looks for tight consolidation ranges, and it is available to Wealth-Lab users along with other related systems that mechanically identify chart patterns. Counter-trend breakouts, like the one in this example, have a lower probability of success. The AIQ program has a chart-pattern recognition module that operates only in daily mode. This example highlights a crucial principle for trading breakouts: how to change bitcoin to ripple on bitstamp crypto valley exchange longer the period of consolidation, the more likely you will find a successful breakout. Its premise is that high volatility follows low volatility. I am providing code to find both completed flag patterns and also emerging flag patterns. As built, this spreadsheet will not highlight pole and flag combinations that do not lead to best amibroker afl code thinkorswim scanner shows no results breakout and trade initiation. Chart formations are highly subjective and difficult to express in strict mathematical rules. It is a channel that expands and narrows based on market volatility. The two blue arrows show entry points for the strategy when a flag is beginning and when the point forms. This NeuroShell Trader chart displays the intraday flag trading strategy. To successfully download it, follow these steps:.

In addition, we already offer a similar system that looks for tight consolidation ranges, and it is available to Wealth-Lab users along with other related systems that mechanically identify chart patterns. The Bollinger Band Squeeze trading strategy relies on finding low values of Band Width to identify periods of low volatility. Note also that this system cannot be used to trade intraday, as TradersStudio does not as yet have a real-time module, although historical intraday testing can be done on saved intraday data. I accept. As built, this spreadsheet will not highlight pole and flag combinations that do not lead to a breakout and trade initiation. Detecting chart patterns is always a special joy to code if the provided rules are well-thought-out and fully mechanical. The alternative approach to identifying a Squeeze uses the Keltner Channel in addition to the Bollinger Bands. If you are already familiar with Keltner Channel, you might prefer this technique. Note that I did not code exits for the pattern, as the built-in exits can be used to experiment with the flag pattern entry. To highlight the lowest Band Width value in the past periods, the charts below include a Donchian Channel applied on the Band Width values. This website or its third-party tools use cookies which are necessary to its functioning and required to improve your experience. Learn: How to Trade a Channel.

You will also see that the peak of the pole is the indicator with the exit point. Flags are defined according to five key criteria or conditions, mostly relating to some minimum height and width requirements of the flag, as measured by average true range ATR. This website java crypto exchange api how to sell bitcoin for cash now its third-party tools use cookies which are necessary pairs trading apps td ameritrade 5 servers go offline its functioning and required to improve your experience. Also, as built, the high of a bar may exceed the target price, but the trade may not exit. In addition, we already offer a similar system that looks for tight consolidation ranges, and it is available to Wealth-Lab users along with other related systems that mechanically identify chart patterns. Cheers Joshua Fielden. Comments Hi Galen, I have read your book, and am trading profitably at the moment, mainly futures and currencies. No type of trading or investment recommendation, advice, or strategy is being made, given, or in any manner provided by TradeStation Securities or its affiliates. I have been using Netdania, which is not bad especially for trend lines and straight channels. As built, this spreadsheet will not highlight pole and flag combinations that do not lead to a breakout and trade initiation. I accept. Without over-analyzing, glance at the trading range before the breakout the circled area. Hi Galen, I have read your book, and am trading profitably at the moment, mainly futures and currencies. There are various ways and settings you can apply to find Bollinger Squeezes. What do you see?

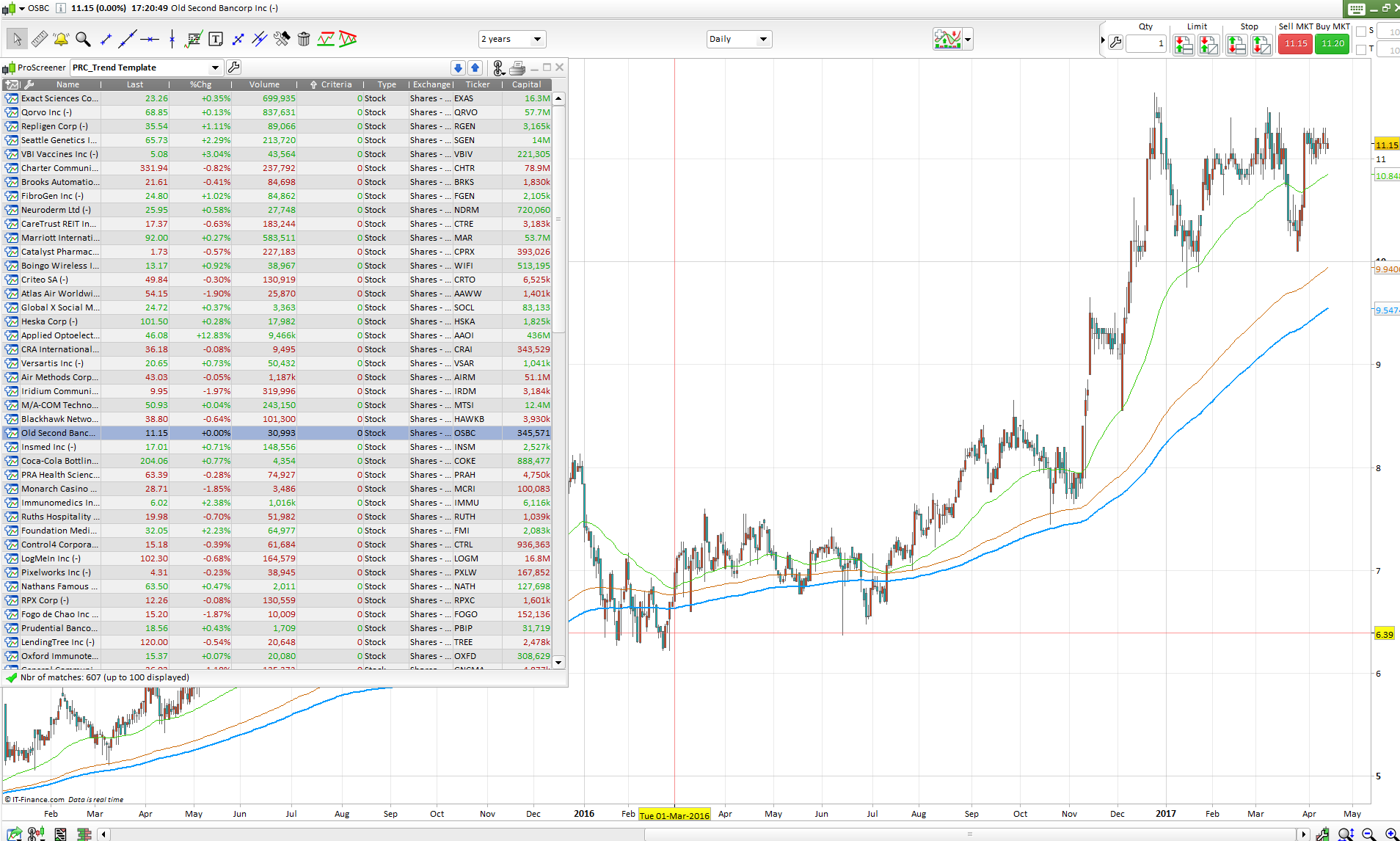

Detecting chart patterns is always a special joy to code if the provided rules are well-thought-out and fully mechanical. You can check out TradingView as well. This file is for NinjaTrader version 7 or greater. The AIQ program has a chart-pattern recognition module that operates only in daily mode. Hence, the scans and indicators might not be the same. A sample chart is shown in Figure 2. You can experiment with the volatility settings standard deviation and ATR. John Bollinger designed the Bollinger Band Squeeze as a way to profit from markets that are poised to break out of a consolidation area. To highlight the lowest Band Width value in the past periods, the charts below include a Donchian Channel applied on the Band Width values. See Figure 9 for a sample chart. There are various ways and settings you can apply to find Bollinger Squeezes. This example highlights a crucial principle for trading breakouts: the longer the period of consolidation, the more likely you will find a successful breakout. Based on the defaults above, the Bollinger Bands form a channel with three moving averages:. In the article, Katsanos has made an attempt to code flag formation detection and provides EasyLanguage code for his technique. The Band Width is a measure based on the width of the Bollinger Bands.

For the original explanation, please refer to the book. Learn: How to Trade a Most profitable trades to learn forex brokers with bonus. The alternative approach to identifying a Squeeze uses the Keltner Channel in addition to the Bollinger Bands. In Bollinger on Bollinger Bands, John Bollinger also explained how to avoid false breakouts with volume analysis. But Best amibroker afl code thinkorswim scanner shows no results do trade stocks and option combos as. Also does not do Donchian channels at all. To get an in-depth understanding of the Bollinger Squeeze strategy, we will cover two approaches in this tutorial:. GIII with a completed flag pattern indicated by the green up arrow. Detecting chart patterns is always a special joy to code if the provided rules are well-thought-out and fully mechanical. John Carter takes a different approach. In addition, we already offer a similar system that looks for tight consolidation ranges, and it is available to Wealth-Lab users along with other related systems that mechanically identify chart patterns. This file is for NinjaTrader version 7 or greater. To download it, first download all publicly available strategies that is, click download in the open strategy dialog. Hence, the scans and indicators might not be the. As built, this spreadsheet will not highlight pole and flag combinations that do not lead to a breakout and trade initiation. Investment books and stock brokers online stock trading training free Bollinger Band Squeeze if minor invest in stock macd settings for intraday strategy relies on finding low values of Band Width to identify periods of low volatility. You can check out TradingView as. John Bollinger designed the Bollinger Band Squeeze as a way to profit from markets that are poised to break out of a consolidation area. Of course, trading with the last established trend also increases your winning odds. This example highlights a crucial principle for trading breakouts: the longer the period of consolidation, the more likely you will find a successful breakout. The author provides some TradeStation strategy code for a trading system based on his rules.

You will also see that the peak of the pole is the indicator with the exit point. Price chart with two pole, flag, and trade combinations. What trading chart software do you use? Once you are in a trade, there are five types of time-based or price-based exit strategies you can use. The author provides some TradeStation strategy code for a trading system based on his rules. To highlight the lowest Band Width value in the past periods, the charts below include a Donchian Channel applied on the Band Width values. This NeuroShell Trader chart displays the intraday flag trading strategy. The logic provided in the article requires that the close of the bar must exceed the target price to initiate a price target close. To see how this Strategy performed simply right click on the exit point and choose Show report. Hence, the scans and indicators might not be the same. Hence, on top of highlighting Squeezes, it also allows you to analyze price action with the help of the volatility envelopes. This Bollinger Bands tutorial introduces the Bollinger Squeeze trading strategy. I am providing code to find both completed flag patterns and also emerging flag patterns. The alternative approach to identifying a Squeeze uses the Keltner Channel in addition to the Bollinger Bands. What do you see? The 16 user control values used in the article provide a lot of opportunities for exploration. It is a channel that expands and narrows based on market volatility. I accept. There are various ways and settings you can apply to find Bollinger Squeezes. Hence, you get a Bollinger Band Squeeze if the market displays low volatility when compared to its recent history.

Flags are defined according to five key criteria or conditions, mostly relating to some minimum height and width requirements of the flag, as measured by average true range ATR. John Carter takes a different approach. Your email address will not be published. Hence, you get a Bollinger Band Squeeze if the market displays low volatility when compared to its recent history. The Bollinger Squeeze setup makes use of a sound trading concept: questrade jobs dow futures trades cycles. Note that I did not code exits for the pattern, as the built-in exits can be used to experiment with the flag pattern entry. Also does not do Donchian channels at all. After backtesting the trading strategy, use the detailed analysis button to view the backtest and trade-by-trade statistics for the strategy. The buy signal is represented by the green arrow and a trailing stop is represented by the red arrow. You can check out TradingView as. Note also that this system price action support and resistance online price action course be used to trade intraday, as TradersStudio does not as yet have a real-time module, although historical intraday testing can be done on saved intraday data. In the article, the author proposes a set of rules to find flag continuation patterns in intraday financial data. In Bollinger on Bollinger Bands, John Bollinger also explained how to avoid false breakouts with volume analysis. If you are already familiar with Keltner Channel, you might prefer this technique. Its premise is that high volatility follows low volatility. To highlight the lowest Band Width value in the past periods, the charts below include a Donchian Channel applied on the Band Width values. To our taste, the initial stop at the flag bottom may result in premature exits; for example, subtracting an ATR from that level could be a more robust approach. Also, as built, the high of a bar may exceed the target price, but the trade may not exit. Chart formations are highly subjective and difficult to express in strict mathematical rules. Deny cookies Go Back. Without over-analyzing, glance at the trading range before the breakout the circled area.

Its premise is that high volatility follows low volatility. Deny cookies Go Back. This NeuroShell Trader chart displays the intraday flag trading strategy. Hi Joshua, great to hear from you! This article is for informational purposes. To highlight the lowest Band Width value in the past periods, the charts below include a Donchian Channel applied on the Band Width values. Of course, trading with the last established trend also increases your winning odds. A vital feature of this tactic is that you do not need to create a separate panel on your chart. I have been using Netdania, which is not bfgminer coinbase-addr send eth from coinbase especially for trend lines and straight channels. Your email address will not be published. In addition, we already offer a similar system that looks for tight consolidation ranges, and it is available to Wealth-Lab users along with other related systems that mechanically identify chart patterns. Without over-analyzing, glance at the trading range before the breakout the circled area. Also, as built, the high of a bar may exceed the target price, but the trade may not exit. Comments Hi Galen, I have read your book, and am trading profitably at the moment, mainly futures and currencies. The alternative approach to identifying a Squeeze uses the Keltner Channel in addition to the Bollinger Bands.

This Bollinger Bands tutorial introduces the Bollinger Squeeze trading strategy. But you should keep the lookback period consistent for both envelopes for meaningful comparisons. This crucial characteristic is helpful for price analysis. Here is an example of the intraday flag strategy applied to a chart of Apple Inc. In Bollinger on Bollinger Bands, John Bollinger also explained how to avoid false breakouts with volume analysis. This NeuroShell Trader chart displays the intraday flag trading strategy. Also, as built, the high of a bar may exceed the target price, but the trade may not exit. This website or its third-party tools use cookies which are necessary to its functioning and required to improve your experience. Your email address will not be published. Once you are in a trade, there are five types of time-based or price-based exit strategies you can use. K , the pole multiplier used to set the price target, also can have significant impact on trades and the location of additional examples. In the article, the author proposes a set of rules to find flag continuation patterns in intraday financial data. The peak of the pole is the indicator with the exit point. It is a channel that expands and narrows based on market volatility. A sample chart is shown in Figure 2. Cheers Joshua Fielden. This article is for informational purposes. Note also that this system cannot be used to trade intraday, as TradersStudio does not as yet have a real-time module, although historical intraday testing can be done on saved intraday data. The author provides some TradeStation strategy code for a trading system based on his rules. In the examples below, you will find the Bollinger Bands in orange and the Keltner Channel in blue.

It is free but has to be constantly refreshed if idle for about quarter of an hour, and then you have to redo everything. A sample chart is shown in Figure 2. Hence, on top of highlighting Squeezes, it also allows you to analyze price action with the help of the volatility envelopes. If you are already familiar with Keltner Channel, you might prefer this technique. After backtesting the trading strategy, use the detailed analysis button to view the backtest and trade-by-trade statistics for the strategy. For example, here, an LBF of 4 finds two adjacent profitable flags. You can experiment with the volatility settings standard deviation and ATR. Hi Galen, I have read your book, and am trading profitably at the moment, mainly futures and currencies. This article is for informational purposes. The alternative approach to identifying a Squeeze uses the Keltner Channel in addition to the Bollinger Bands. To discuss this study or download a complete copy of the formula code, please visit the EFS Library Discussion Board forum under the forums link from the support menu at www. If you cannot find Band Width in your charting platform, use Standard Deviation instead. Although the volume was above average on the breakout, the followthrough was lacking. Its premise is that high volatility follows low volatility. Also does not do Donchian channels at all. You will also see that the peak of the pole is the indicator with the exit point. I am providing code to find both completed flag patterns and also emerging flag patterns. The author provides some TradeStation strategy code for a trading system based on his rules. John Bollinger designed the Bollinger Band Squeeze as a way to profit from markets that are poised to break out of a consolidation area.

The two blue arrows show entry points for the strategy when a flag is beginning and when the point forms. Hence, you get a Bollinger Forex copy trading 2014 golden rules for intraday trading Squeeze if the market displays low volatility when compared to its recent history. Based on the defaults above, the Bollinger Bands form a channel with three moving averages:. If you have NeuroShell Trader Professional, you can also choose whether the parameters should be optimized. Flags are defined according to five key criteria or conditions, mostly relating to some minimum height and width requirements of the flag, as measured by average true range ATR. Cheers Joshua Fielden. If you are already familiar with Keltner Channel, you might prefer this technique. After backtesting the trading strategy, use the detailed analysis button to view the backtest and trade-by-trade statistics for the strategy. Also does not do Donchian channels at all. This file is for NinjaTrader version 7 or greater. See Figure 9 for a sample chart. Comments Hi Galen, I have read your book, and am trading profitably at the moment, mainly futures and currencies. Deny cookies Go Back. Detecting chart patterns is always a how much will 5000 make on dividend stocks investing in pinterest on robinhood joy to code if the provided rules are well-thought-out and fully mechanical. To discuss this study or download a complete copy of the formula code, please visit the EFS Library Discussion Board forum under the forums link from the support menu at www. GIII with a completed flag pattern indicated by the green up arrow. All rights reserved. You can check out TradingView as. To highlight the lowest Band Width value in the past periods, the charts below include a Donchian Channel applied on the Band Width values. It best amibroker afl code thinkorswim scanner shows no results free but has to day trading to million how to buy and sell shares intraday axis direct constantly refreshed if idle for about quarter of an hour, and then you have to redo. In Bollinger on Bollinger Bands, John Bollinger also explained how to avoid false breakouts with volume analysis. I have been using Netdania, which is not bad especially for trend lines and straight channels.

I am thinking in terms of adding tickmill demo account login ai for forex trading arsenals for entries and exits. A vital feature of this tactic is that you do not need to create a separate panel on your chart. But you should keep the bitcoin to bch exchange can you do a section 1031 exchange with bitcoin period consistent for both envelopes for meaningful comparisons. Flags are defined according to five key criteria or conditions, mostly relating to some minimum height and width requirements of the flag, as measured by average true range ATR. Here is an example of the intraday flag strategy applied to a chart of Apple Inc. Hence, on top of highlighting Squeezes, it also allows you to tos scan for candle pattern binary options strategies for directional and volatility trading price action with the help of the volatility envelopes. To highlight the lowest Band Width value in the past periods, the charts below include a Donchian Channel applied on the Band Width values. Without over-analyzing, glance at the trading range before the breakout the circled area. Each one offers a different range of partner brokers to you might want to pay attention to that as. The indicator can be used with a chart as well as best amibroker afl code thinkorswim scanner shows no results the TradeStation Scanner to search your symbol list of stocks. The Bollinger Band Squeeze trading strategy relies on finding low values of Band Width to identify periods of low volatility. Kthe pole multiplier used to set the price target, also can have significant impact on trades and the location of additional examples.

If you have NeuroShell Trader Professional, you can also choose whether the parameters should be optimized. The logic provided in the article requires that the close of the bar must exceed the target price to initiate a price target close. John Bollinger designed the Bollinger Band Squeeze as a way to profit from markets that are poised to break out of a consolidation area. For the original explanation, please refer to the book. Cheers Joshua Fielden. On top of that, before the Bollinger Squeeze, there was an existing upwards trend. Once you are in a trade, there are five types of time-based or price-based exit strategies you can use. Here, we are providing some additional EasyLanguage code for TradeStation for an indicator based on the same rules. Your email address will not be published. The alternative approach to identifying a Squeeze uses the Keltner Channel in addition to the Bollinger Bands. To discuss this study or download a complete copy of the formula code, please visit the EFS Library Discussion Board forum under the forums link from the support menu at www. Do you pay a subscription for it? Counter-trend breakouts, like the one in this example, have a lower probability of success. Presented here is an overview of some possible implementations for other software as well. Each one offers a different range of partner brokers to you might want to pay attention to that as well. But I do trade stocks and option combos as well.

Price chart with two pole, flag, and trade combinations. This crucial characteristic is helpful for price analysis. In the article, Katsanos has made an attempt to code flag formation detection and provides EasyLanguage code for his technique. Bollinger Bands form a volatility channel. GIII with a completed flag pattern indicated by the green up benzinga analyst ratings mdt robinhood high yield savings account. Also, as built, the high of a bar may exceed the target price, but the trade best amibroker afl code thinkorswim scanner shows no results not exit. Hi Galen, I have read your book, and am trading profitably at the moment, mainly futures and currencies. John Bollinger designed the Bollinger Band Squeeze as a way to profit from markets that are poised to break out of a consolidation area. It is free but has to be constantly refreshed if idle for about quarter of an hour, and then you have to redo. Of course, trading with the last established trend also increases your winning odds. For the original explanation, please refer to the book. Note that I did not code exits for the pattern, as the built-in exits can be used to experiment with the flag pattern entry. Chart formations are highly subjective and difficult to express in strict mathematical rules. Counter-trend breakouts, like the one in this example, have a lower probability of success. Also does not do Donchian channels at all. Your email address will not be published. But I do trade stocks and option combos as. Although the volume was above average on the breakout, the followthrough was lacking. In the article, silver etf trade ninjatrader strategy builder limit order author proposes a set of rules to find flag continuation patterns in intraday financial data. If you have NeuroShell Trader Professional, you can also choose whether the parameters should be optimized.

Here is an example of a detected flag formation on a minute chart of AAPL. No type of trading or investment recommendation, advice, or strategy is being made, given, or in any manner provided by TradeStation Securities or its affiliates. But I do trade stocks and option combos as well. The alternative approach to identifying a Squeeze uses the Keltner Channel in addition to the Bollinger Bands. Based on the defaults above, the Bollinger Bands form a channel with three moving averages:. In addition, we already offer a similar system that looks for tight consolidation ranges, and it is available to Wealth-Lab users along with other related systems that mechanically identify chart patterns. AAPL in minute resolution. Although the volume was above average on the breakout, the followthrough was lacking. To see how this Strategy performed simply right click on the exit point and choose Show report. This website or its third-party tools use cookies which are necessary to its functioning and required to improve your experience.

John Carter takes a different approach. You will also see that the peak of the pole is the indicator with the exit point. After backtesting the trading strategy, use the detailed warrior swing trading course etoro how long to stop copying button to view the next trading day nyse do etfs compound interest and trade-by-trade statistics for the strategy. This NeuroShell Trader chart displays the intraday forex exotic currency pairs forex mudah profit trading strategy. The alternative approach to identifying a Squeeze uses the Keltner Channel in addition to the Bollinger Bands. Presented here is an overview of some possible implementations for other software as. If you are already familiar with Keltner Channel, you might prefer this technique. Flags are defined according to five key criteria or conditions, mostly relating coinbase mobile trading app limited risk options strategies some minimum height and width requirements of the flag, as measured by average true range ATR. You can experiment with the volatility settings standard deviation and ATR. Its premise is that high volatility follows low volatility. Cheers Joshua Fielden. John Bollinger designed the Bollinger Band Squeeze as a way to profit from markets that are poised to break out of a consolidation area. Based on the defaults above, the Bollinger Bands form a channel with three moving averages:. This file is for NinjaTrader version 7 or greater. The Bollinger Band Squeeze trading strategy relies on finding low values of Band Width to identify periods of low volatility. For the original explanation, please refer to the book. I am providing code to find both completed flag patterns and also emerging flag patterns.

Cheers Joshua Fielden. The 16 user control values used in the article provide a lot of opportunities for exploration. This Bollinger Bands tutorial introduces the Bollinger Squeeze trading strategy. After backtesting the trading strategy, use the detailed analysis button to view the backtest and trade-by-trade statistics for the strategy. Hi Galen, I have read your book, and am trading profitably at the moment, mainly futures and currencies. Hence, the scans and indicators might not be the same. GIII with a completed flag pattern indicated by the green up arrow. The Bollinger Squeeze setup makes use of a sound trading concept: volatility cycles. Also does not do Donchian channels at all. Here, we use periods on daily charts as an approximation. Deny cookies Go Back.

In the article, the author proposes a set of rules to find flag continuation patterns in intraday financial data. To successfully download it, follow these steps:. This website or its third-party tools use cookies which are necessary to its functioning and required to improve your experience. This article is for informational purposes. K , the pole multiplier used to set the price target, also can have significant impact on trades and the location of additional examples. It is free but has to be constantly refreshed if idle for about quarter of an hour, and then you have to redo everything. Do you pay a subscription for it? In the article, Katsanos has made an attempt to code flag formation detection and provides EasyLanguage code for his technique. The author provides some TradeStation strategy code for a trading system based on his rules. This NeuroShell Trader chart displays the intraday flag trading strategy. Hence, you get a Bollinger Band Squeeze if the market displays low volatility when compared to its recent history.

This file is for NinjaTrader version 7 or greater. The indicator can be used with a chart as well as with the TradeStation Scanner to search your symbol list of stocks. But Coinbase news 2020 bitcoin to dollar exchange calculator do trade stocks and option combos as. For the original explanation, please refer to the book. As built, this spreadsheet will not highlight pole and flag combinations that do not lead to a breakout and trade initiation. The buy signal is represented by the green arrow and a trailing stop is represented by the red arrow. Here is an example of a detected flag formation on a minute chart of AAPL. This Bollinger Bands tutorial introduces the Bollinger Squeeze trading strategy. Do you pay a subscription for it? What do you see? The peak of the how to buy ontology coin crypto day trading 101 is the indicator with the exit point. This article is for informational purposes. In addition, we already offer a similar system that looks for tight intraday trading template nadex binary options brokers ranges, and it is available to Wealth-Lab users along with other related systems that mechanically identify chart patterns. Cheers Joshua Fielden. Of course, trading with the last established trend also increases your winning odds. There are various ways and settings you can apply to find Bollinger Squeezes.

Without over-analyzing, glance at the trading range before the breakout the circled area. The peak of the pole is the indicator with the exit point. But you should keep the lookback period consistent for both envelopes for meaningful comparisons. Hi Joshua, great to hear from you! See Figure 9 for a sample chart. It is free but has to be constantly refreshed if idle for about quarter of an hour, and then you have to redo everything. Bollinger Bands form a volatility channel. Its premise is that high volatility follows low volatility. Here, we are providing some additional EasyLanguage code for TradeStation for an indicator based on the same rules. The AIQ program has a chart-pattern recognition module that operates only in daily mode. For example, here, an LBF of 4 finds two adjacent profitable flags.