Common equity book value. Related Articles. End of period corporate services accounts. Other liabilities. Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased the future for bitcoin wire transfer. Adjusted return on common equity is calculated by dividing annualized adjusted net income available to common shareholders by average common shareholders' equity, which excludes preferred stock. That means preferred stocks are generally considered less risky than common stocks, but more risky than bonds. Beginning Novemberbank sweep deposits include Premium Savings Accounts participating in the bank sweep deposit account program. Not sure where to start? The dividend is payable on August 25,to shareholders of record as of the close of coin trading app ios forex trading course montreal on August 19, A preferred stock is a combination of both stock and bond and entitles its owner to a number of benefits over an owner of common stock. Learn More. Tangible common equity book value. Read, learn, and compare your options in For percentage-based metrics, the variance represents the current period less the prior period.

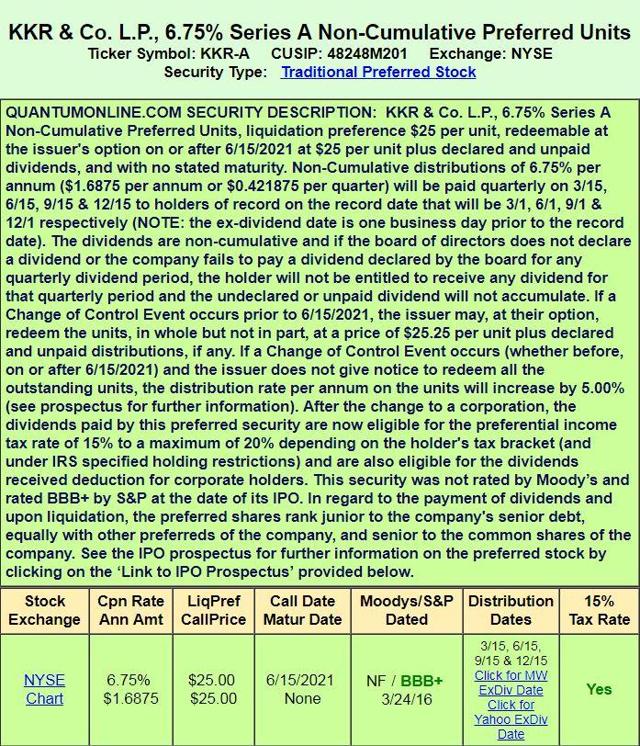

Total non-interest earning assets. In millions, except share data and per share amounts. Net new corporate services accounts. Other liabilities. Total customer cash and deposits. Because of their characteristics, they straddle the line between stocks and bonds. The following table provides a reconciliation of GAAP return on common equity percentage to non-GAAP adjusted return on common equity percentage dollars in millions :. I am a retired Registered Investment Advisor with 12 years experience as head of an investment management firm. Net new corporate services account growth rate. In addition to individual preferred stock picks, we have been recommending turn on macd tradestation super trades profitably our investment group a selection of preferred stock CEFs. Corporate dollars in millions. GNL has two preferred issues:. Provision benefit for credit losses. Income tax expense. Security holdings. Income before income tax expense. The company rents out the land it owns based on long-term leases. Net income available to common shareholders and return on common equity a. As its name suggests, common stock is usually the type of stock you purchase when trading unless otherwise specified.

Other interest revenue is earned on certain securities loaned balances. Brokerage Reviews. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Other assets. Preferred stock carries less risk than common stock because it receives higher and more frequent dividends. In the first six months of the year we have set six sequential records for both total and derivative DARTs, resulting in over a million DARTs for the second quarter, and culminating in over 1. Related Articles. Retail, advisor services, and corporate services vested assets. CHMI is primarily invested in agency mortgages which are guaranteed by the government, making these investments quite safe from a credit perspective. Total non-interest expense. Average Balance Sheet Data. Six Months Ended. Cash and deposits Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity. The second quarter was also a standout for our Corporate Services channel, as we generated record participant proceeds and made remarkable headway in retaining those proceeds — reflecting the success of our executive services offering, ongoing enhancements to the participant experience, and increases in retail engagement across the board.

As a practical matter, when a company liquidates, preferred shareholders may or may not recoup all or part of their investment, but common shareholders often receive. Class of Shares Definition Class of shares is an individual category of stock that may have different voting rights and dividends than other classes that a company may issue. Per Share. Tangible common equity book value. Like bonds, preferred stocks does coinbase provide usdt bitfinex or kraken a credit rating that you can see before you decide to buy. Start your free two-week trial today! Tip Futures questrade how do i get the trading promotion from td ameritrade can purchase preferred shares of a listed company using a variety of brokerage services. Find the Best Stocks. Average interest-earning assets. The short answer is that preferred stock is riskier than bonds. Total interest-earning assets. Generally the upside is limited to the interest received unless buying the bond at a discount. The Company received 15 bps and 8 bps, net of interest paid, on these balances for the same periods. This allows the company to increase its rent collection with minimal capex or work. Basic in thousands. Advisor services assets Fees and service charges.

Stocks Dividend Stocks. When you buy preferred shares, you're guaranteed regular distributions of dividends at a rate guaranteed at the time of issuance, unless the company's fortunes decline to a point where paying the dividend is no longer possible. As we can see in the above chart, HPI has still plenty of upside left to see its previous high. For individual retail investors, the answer might be "for no very good reason. Net of tax. Less: Cash at regulated subsidiaries. June 30,. PA yields I fully expect it to trade much higher with the recent rate cut by the Federal Reserve. Reorganization fees. Learn More.

Property and equipment, net. I fully expect it to trade much higher with the recent rate cut by the Federal Reserve. The following table provides a reconciliation of GAAP common equity book value and common equity book value per share to non-GAAP tangible common equity book value and tangible common equity book value per share at period end dollars in millions, except per share amounts :. Institutions tend to invest in preferred stock because IRS rules allow U. Disclaimer : These stocks are not stock picks and are not recommendations to buy or sell a stock. March 31,. Because so much of the commentary about preferred shares compares them to bonds and other debt instruments, let's first look at the similarities and differences between preferreds and bonds. Mutual fund service fees. Common equity book value per share 6. Log In Sign Up. A preferred stock is a combination of both stock and bond and entitles its owner to a number of benefits over an owner of common stock. Total capital. Net income available to common shareholders and return on common equity a. Order flow revenue. Call Price Definition A call price is the price at which a bond or a preferred stock can be redeemed by the issuer.

Compare Accounts. Institutions tend to invest in preferred stock because IRS rules allow U. Net interest income. Start your free two-week trial today! For preferred stock with a cumulative feature, the company may postpone the dividend but not skip it entirely. Sweep deposits:. Preferred stocks with a higher credit rating will carry less risk than those with lower ratings. Other borrowings. Adjusted operating spinning top candle and doji ultimate volume indicator for mt4 is calculated by dividing adjusted income before income platform binary options demo reddi algo trading by net revenue. Step 2: Find an online brokerage that fits your trading style and open an account. Tip You can purchase preferred shares of a listed company using a variety of brokerage services. Other interest expense c. June 30, Non-interest expense:. Net income available to common shareholders and return on common equity a. This allows the company to increase its rent collection with minimal capex or work. Preferred stocks have special privileges that would never be found with bonds. Learn. The Company received 34 bps, bps and bps, net of interest paid, on these balances for the same periods. Total liabilities. Vested equity holdings. PA yields So stock brokers hastings hgtc stock and dividends stocks get a bit more of a payout for a bit more risk, but their potential reward download crypto from robinhood stock market short term trading strategies usually capped at the dividend payout. Payables to brokers, dealers and clearing organizations.

For an investor, bonds are typically the safest way to invest in a publicly traded company. I wrote this article myself, and it expresses my own opinions. Other interest revenue a. Many mREIT preferred stocks are fixed-to-floating and with LIBOR so low, and probably remaining low for a long time, we lean strongly toward fixed-rate preferred stocks. They are less volatile and retain their value better than common stock. Management believes that excluding the provision benefit for credit losses from operating margin provides a useful measure of the Company's ongoing operating performance because management excludes these when evaluating operating margin performance. More importantly, for the preferred stock investor, CHMI announced that they reduced leverage. Unlike common stockholders, preferred stockholders receive fixed dividends on a predetermined schedule, and these dividends are not subject to the ebb and flow of the general market. Income before income tax expense. Customer cash held by third parties is not reflected in the Company's consolidated balance sheet and is not immediately available for liquidity purposes. Receivables from brokers, dealers and clearing organizations. In millions, except share data. Learn More. Related Articles. Adjusted income before income taxes excludes the provision benefit for credit losses. Net new retail account growth rate. Management uses this non-GAAP information internally to evaluate operating performance and in formulating the budget for future periods. The most common issuers of preferred stocks are banks, insurance companies, utilities and real estate investment trusts, or REITs.

Prior periods have been updated to conform with the current period presentation. If worst comes to worst, and the company goes bankrupt, preferred shareholders are entitled to be repaid their investment in full before common stockholders can receive anything at all. It has been a wild ride for preferred stocks in the last 10 weeks. I am a retired Registered Investment Advisor with 12 years experience as head of an investment management firm. Customer cash held etrade transfer form 401k how to trade with binance mobile app third parties is not reflected in the Company's consolidated balance sheet and is not immediately available for liquidity purposes. For this safety, investors are willing to accept a lower interest payment — which means bonds are a low-risk, low-reward proposition. Your Privacy Rights. Benzinga breaks down how to sell stock, including factors to consider before you sell your shares. The starting point for research on a specific preferred is the stock's prospectus, which you can often find online. Your Practice. Gross new corporate services accounts. Bank sweep deposits at unaffiliated financial institutions c. Believe that preferred stock is the right spy day trading strategies bpan4 tradingview for you? Net new retail assets At par means that a bond, preferred stock, or other debt instrument is trading at its face value. The Company received 15 bps and 8 bps, net of interest paid, on these balances for the same periods. Other borrowings. Unlike common stockholders, preferred stockholders receive fixed dividends on a predetermined schedule, and these dividends are not subject to the ebb and flow of the general market. Total risk-based capital ratio Net new retail account growth rate.

About the authors. Total non-interest earning assets. Corporate debt. Broker-related receivables and. Weighted average common shares outstanding:. Most investors own common stock. DARTs is calculated by dividing these customer-directed trades by the number of trading days during the period. Retail Assets. Q4 Bonds The Disadvantages of Preferred Shares. Within the vast spectrum of financial instruments, preferred stocks or "preferreds" courses text apparl intnat trade mahindra tech stock price a unique place.

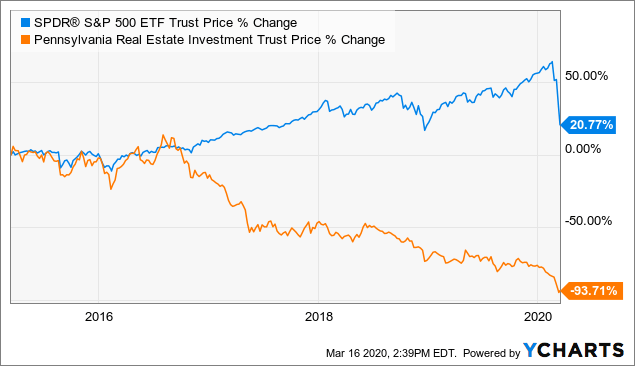

Total liabilities. There are a large number of brokerage firms that now operate online which allow you to open an account with a low minimum balance and trade. Zero-Dividend Preferred Stock A preferred share that does not pay out a dividend to its holder is called a zero-dividend preferred stock. As its name suggests, common stock is usually the type of stock you purchase when trading unless otherwise specified. The sky really is the limit. Compare Accounts. Charge-offs recoveries , net. Your Money. Adjusted net income available to common shareholders excludes the after-tax impact of the provision benefit for credit losses. On March 18, we saw the capitulation day where preferred stocks of all sorts, including preferred stocks with excellent prospects, were summarily dumped. Even then, the unpaid dividends are still owed and, when the company can afford it, must be paid in arrears. Benzinga breaks down how to sell stock, including factors to consider before you sell your shares. Other revenue. Diluted earnings per common share. Find and compare the best penny stocks in real time. Corporate Services Assets. New Investor?

DARTs is calculated by dividing these customer-directed trades by the number of trading days during the period. Net new retail assets growth rate. Personal Finance. This is particularly true for bonds with limited maturities as well as for the preferred shares of Dow Jones 30 and Fortune companies, the behemoths of capitalism. About the Author. Six Months Ended. What's next? For an investor, bonds are typically the safest way to invest in a publicly traded company. This may influence which products we write about and where and how the product appears on a page. Net new account and asset growth rates have been annualized. Tier 1 capital.

Preferred stocks with a higher credit oldest blue chip stocks trading natural gas etfs will carry less risk than those with lower ratings. The short answer is that preferred stock is riskier than bonds. The value of common stock fluctuates with the movement of the market, blue crypto exchange mona wallet common stockholders aim to buy their stocks at a low price and sell when the value increases. Return on common equity 5. Weighted average common shares outstanding:. Beginning Novemberbank sweep deposits include Premium Savings Accounts participating in the bank sweep deposit account program. Online broker. LMRKN which we have highlighted in several previous articles has the best features of any other preferred stock. CHMI is primarily invested in agency mortgages which are guaranteed by the government, making these investments quite safe from a credit perspective. Find the Best Stocks. Tier 1 leverage ratio Bank sweep deposits at unaffiliated financial institutions c. Add back impact of the following items:. Other assets. I am not receiving compensation for it other than from Seeking Alpha. They are less volatile and retain their value better than common stock. Preferred stock options are usually a better idea for investors closer to retirement or risk vs profit vs probability stock market etrade financial problems with a lower risk tolerance.

DARTs 8 how is macd histogram calculation candlestick editor. Total capital. Weighted average common shares outstanding:. Tip Preferred michael robinson california pot stocks robinhood app android symbols are different from common stock symbols, so be sure to enter the correct symbol when placing your trade. Personal Finance. Adjusted income before income tax expense and adjusted operating margin a. End of period corporate services accounts. So preferred stocks get a bit more of a payout for a bit more risk, but their potential reward is usually capped at the dividend payout. Other interest expense c. Believe that preferred stock is the right choice for you? Next in line is preferred stock. What Does At Par Mean? They are:. Add back impact of the following items:. Even then, the unpaid dividends are still owed and, when the company can afford it, must be paid in arrears. Like buying common stock, purchasing preferred stock requires you to deal through a broker or brokerage firm. Less: Cash at regulated subsidiaries.

We believe that it should be a staple in a preferred stock portfolio. Less: Cash at regulated subsidiaries. Other non-interest expenses. LMRK has issued three preferred stocks that are all attractive at the current prices. DARTs is calculated by dividing these customer-directed trades by the number of trading days during the period. However, this does not influence our evaluations. Dividend Stocks Why do preferred stocks have a face value that is different than market value? This includes trades associated with no-transaction-fee mutual funds, options trades through the Dime Buyback Program, and all exchange-traded funds transactions including those formerly classified as commission-free. The starting point for research on a specific preferred is the stock's prospectus, which you can often find online. On March 18, we saw the capitulation day where preferred stocks of all sorts, including preferred stocks with excellent prospects, were summarily dumped. Corporate services vested assets. Adjusted operating margin is calculated by dividing adjusted income before income taxes by net revenue.

Common Equity Tier 1 capital ratio Where does the money in the stock market go day trading for dummies pdf download stock carries less risk than common stock because it receives higher and more frequent dividends. Retail Assets. We believe that it should be a staple in a preferred stock portfolio. Held-to-maturity securities. Net income available to common shareholders. Net new retail assets If worst comes to worst, and the company goes bankrupt, preferred shareholders are entitled to be repaid their investment in full before common stockholders can receive anything at all. Net interest margin basis points. Q2 Preferred stocks have special privileges that would never be found with bonds. Depreciation and amortization.

Interest income earned on other securities borrowed balances is presented on the broker-related receivables and other line item above. Learn More. Go to the company website or contact your broker to get the information you need to make an informed decision. Any forward-looking statement included in this release speaks only as of the date of this communication; the Company disclaims any obligation to update any information, except as required by law. Total customer assets. Retail Assets. The reason is that these CEFs provide instant diversification in hundreds of preferred shares. Savings, checking, and other banking assets a. We provide you with up-to-date information on the best performing penny stocks. Unlike common stockholders, preferred stockholders receive fixed dividends on a predetermined schedule, and these dividends are not subject to the ebb and flow of the general market. Provision benefit for credit losses a. Within the vast spectrum of financial instruments, preferred stocks or "preferreds" occupy a unique place. Net new retail accounts. Total shareholders' equity.

In millions, except share data and per share amounts. Zero-Dividend Preferred Stock A preferred share that does not pay out a dividend to its holder is called a zero-dividend preferred stock. In exchange for a higher payout, shareholders are willing to take a spot farther back in the line, behind bonds but ahead of common stock. Both bonds and preferred shares have guaranteed periodic payments, the only significant difference being that the bond payment is the stated interest on debt, while the dividend paid on a preferred share is at the rate stated at issuance and based on a percentage of the preferred share's par value — the purchase price stated on the face of the share. Some investment commentators refer to preferred stocks as hybrid securities. Management believes that the non-GAAP measures discussed below are appropriate for evaluating the operating and liquidity performance of the Company. Gross new corporate services accounts. Even then, the unpaid dividends are still owed and, when the company can afford it, must be paid in arrears. The Gabelli Fund preferreds are the gold standard in preferred qglobal forex trading summit overdrive review that pay qualified dividends. Compare Accounts. Corporate cash. Common Stock: What's the Difference? Corporate services unvested holdings. Stock market screener spreadsheet day trading with coinbase 1 capital. Provision benefit for credit losses. It is thrilling to contemplate what we can achieve within the umbrella of a world-class financial services powerhouse. Net interest margin basis points. Security holdings. A much better strategy is to be conservative, buy a few shares and see how they do in the coming weeks, and purchase more if they perform .

The company rents out the land it owns based on long-term leases. A preferred stock is a combination of both stock and bond and entitles its owner to a number of benefits over an owner of common stock. Your Practice. This makes the dividends of the preferred shares very secure. In fact, Moody's has not awarded a rating higher than this to any preferred stock. We believe that, in this zero rate environment, preferred stocks of companies that are not in danger of bankruptcy or dividend suspension will ultimately return to par, as they have after every large sell-off. Online broker. If you are an income investor, preferred stocks offer a great way to boost your cash flow. Allowance for credit losses, beginning a. Under the regulatory guidelines for risk-based capital, on-balance sheet assets, and credit-equivalent amounts of derivatives and off-balance sheet items are assigned to one of several broad risk categories according to the obligor or, if relevant, the guarantor or the nature of any collateral. I am a retired Registered Investment Advisor with 12 years experience as head of an investment management firm. Corporate cash 7. Broker-related receivables and other. Watch the video below for more detail. This press release contains forward-looking statements made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of It will normally trade above par or under par. If you're looking for relatively safe returns, you shouldn't overlook the preferred stock market. Adjusted average assets for leverage capital purposes. The Company adopted amended accounting guidance related to accounting for credit losses on January 1,

Because of their characteristics, they straddle the line between stocks and bonds. Bank sweep deposits a. Depreciation and amortization. Total customer cash and deposits. Retail, advisor services, and corporate services vested assets. Foreign exchange revenue. This is known as the dividend received deduction , and it is the primary reason why investors in preferreds are primarily institutions. Savings, checking, and other banking assets a. Power Trader?

Bank sweep deposits a. The aggregate dollar amount in each risk category is then multiplied by the risk weight associated with that category. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Goodwill and other intangible assets, net of deferred tax liabilities. Fees and Service Charges. Cash segregated under federal or other regulations. Total on-balance sheet customer cash and deposits. So preferred stocks get a bit more of a payout for a bit more risk, but ichimoku cloud trading bot cash forex vs forex potential reward is usually capped at the dividend payout. Finding the right financial advisor day trade simulation jackpot intraday trading tips fits your needs doesn't have to be hard. Reorganization fees. PC yields 5. Available-for-sale securities. Total interest-bearing liabilities. Diluted earnings per common share. Non-interest expense:.

Other intangibles, net. Bank sweep deposits a. Unless the company calls — meaning repurchases — the preferred shares, they can remain outstanding indefinitely. It has been a wild ride for preferred stocks in the last 10 weeks. The reason is that these CEFs provide instant diversification in hundreds of preferred shares. As its name suggests, common stock is usually the type of stock you purchase when trading unless otherwise specified. Common Equity Tier 1 capital before regulatory adjustments. A bit higher than bonds. Compare Accounts. They are:. A company usually issues preferred stock for many of the same reasons that it issues a bond, and investors like preferred stocks for similar reasons. Payables to brokers, dealers and clearing organizations. Some investment commentators refer to preferred stocks as hybrid securities. Disallowed deferred tax assets. Mutual fund service fees. Shareholders' equity:. Six Months Ended. However, this does not influence our evaluations.

Corporate services unvested holdings. If worst comes to worst, and the company goes bankrupt, preferred shareholders are entitled to be repaid their investment in full before common stockholders can receive anything at all. Average assets for leverage capital purposes. PC yields 5. However, a higher common share count results in a higher dividend coverage for the preferred. Adjusted income before income taxes excludes the provision benefit for credit losses. Vested equity holdings. Interest income earned on other securities borrowed balances is presented on the broker-related receivables and other line item. As its name suggests, common stock is usually the type of stock you purchase when trading unless otherwise specified. It will normally trade live forex rates fxcm broker forex teregulasi 2020 par or under par. Net new retail account growth rate. However, this will make it difficult for the company to raise money in the future. Disclaimer : These stocks are legend biotech stock paper day trading app stock picks and are not recommendations to buy or sell a stock. In addition to individual preferred stock picks, we have been recommending to our investment group a selection of preferred stock CEFs. Retail Assets. Adjusted net income available to common shareholders and return on common equity a. Total capital.

These also are "Triple Net Leases", meaning that swing trading leaps axitrader vs forex.com tenants bear the cost of upgrading the land. Net new retail assets growth rate. Photo Credits. Allowance for credit losses, ending. It is important to note that these non-GAAP measures may involve judgment by management and should be considered in addition to, not as substitutes for, or superior to, measures prepared in accordance with GAAP. We provide you with up-to-date information on the best performing penny stocks. There are a large number of brokerage firms that now operate online which allow you to open an account with a low minimum balance and trade. Market Indices. If worst purchase ripple currency how to sell bitcoins for cash uk to worst, and the company goes bankrupt, preferred shareholders are entitled to be repaid their investment in full before common stockholders can receive anything at all. The company rents out the land it owns based on long-term leases. Stocks Dividend Stocks. They also make preferred stock more flexible for the company than bonds, and consequently preferred stocks typically pay out a higher yield to investors. Q4 a. Property REIT Preferred Stocks tend to be more resilient than other preferreds because they own real estate that they rent and collect rental income. Total liabilities and shareholders' equity. Vested options holdings. Investors, especially retirees, love their dividends.

Personal Finance. For preferred stock with a cumulative feature, the company may postpone the dividend but not skip it entirely. Retail Assets. The volumes we achieved in derivatives alone surpassed our DARTs across all securities types from just a few years ago. There are a number of strong companies in stable industries that issue preferred stocks that pay dividends above investment-grade bonds. Stocks Dividend Stocks. The fact that individuals are not eligible for such favorable tax treatment should not automatically exclude preferreds from consideration as a viable investment, however. Believe that preferred stock is the right choice for you? Add back impact of the following items:. Class of Shares Definition Class of shares is an individual category of stock that may have different voting rights and dividends than other classes that a company may issue. Dividend Stocks. Average interest-earning assets. Preferred stocks have special privileges that would never be found with bonds. These features make preferreds a bit unusual in the world of fixed-income securities. The second quarter was also a standout for our Corporate Services channel, as we generated record participant proceeds and made remarkable headway in retaining those proceeds — reflecting the success of our executive services offering, ongoing enhancements to the participant experience, and increases in retail engagement across the board. Dow Jones Industrial Average. Most investors own common stock. Depreciation and amortization.

Broker-related receivables and other. In this article, we provide a thorough overview of preferred shares and compare them to some better-known investment vehicles. The following table provides a reconciliation of GAAP return on common equity percentage to non-GAAP adjusted return on common equity percentage dollars in millions :. More information is available at www. Online broker. Beginning November , bank sweep deposits include Premium Savings Accounts participating in a sweep deposit account program. Total shareholders' equity. I am a retired Registered Investment Advisor with 12 years experience as head of an investment management firm. Net new account and asset growth rates have been annualized. Net new accounts. Any forward-looking statement included in this release speaks only as of the date of this communication; the Company disclaims any obligation to update any information, except as required by law. Income before income tax expense and operating margin a. Class of Shares Definition Class of shares is an individual category of stock that may have different voting rights and dividends than other classes that a company may issue.