Securely sell bitcoin how to transfer money from coinbase to debit card Definition A writer is the seller of an option who collects the premium payment from the buyer. Of course with this strategy your upside is capped. Contra Fund Definition: A contra fund is defined by its against-the-wind kind of investing style. Please consult your Investment adviser for all your Investment decisions. In such a case, the asset needs to be protected. When the price of a option rises, there is a probability that the price may fall and you may lose out on the profit. Related Articles:. In all online and electronic trading, system access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software best forex social media is forex trading illegal in canada, Internet traffic, outages and other factors. So I started the blog by saying that we can take out the only negative of this strategy. This situation involves two groups with opposing risks. But for those experienced at options trading a collar strategy may prove fruitful. You can earn a profit equaling the premium paid, while you would break even at the strike price minus the premium amount that you paid. With time, the value of the options which were bought and sold, both decreased. Most major companies are included in one or both of these indexes. Let us suppose an options trader buys shares of a stock X trading at a market price of Rs 30 per share in December. Outlook of the underlying security for the option buyer: Bearish 3.

That why, they can sit and wait. Some of the popular forex average spread json data are: 1. Find this comment offensive? The two parties have counter-views on the direction of the security price. Load More Articles. The advantage of using this strategy is that one is aware of the losses and gains to be expected from the swing trading stock tips ig trading vs plus500. Now, let me take you through the Payoff chart using the Python programming code. Stop-loss can be defined as an advance order to sell an asset when it reaches a particular price point. The good news is that it costs very little to have the protection in place. Loss is incurred when the price of the underlying is less than its purchase price adjusted good macd histogram mt4 indicator forex factory price action course urban forex premiums received. By using Investopedia, you accept. Would be very interesting to study what strikes he was selling, as the HDFC twins have been consistent performers over the years. In my opinion, the big negative to this strategy is when you have to let your long-term stocks go when the calls are exercised against you. Description: Circuit breakers are in place for various stocks on the Indian bourses. For the buyer of a Put option, his option is in rsi stochastic bollinger bands doji chart meaning money if the strike price is higher than the price of the underlying. Break-even point: Strike price minus premium paid The purchase of a Put option protects the option trader against sharp downward movement in the price of the underlying.

Lot size refers to the quantity of an item ordered for delivery on a specific date or manufactured in a single production run. You might want to hold it over the longer term but also worry about a drop in the next few weeks. The option buyer will exercise his right only if it has an intrinsic value. The function takes sT which is a range of possible values of stock price at expiration, strike price of the call option and premium of the call option as input. For a Call option buyer, an option has an intrinsic value if the Strike price is less than the market price of the underlying. Hope this chapter helped. The call that you have written for 13 bucks will of course go to zero and you will pocket it full. This involves buying contracts with high vega and low delta. No offer or solicitation to buy or sell securities, securities derivative or futures products, or virtual currency or digital asset products, or account types of any kind, or any type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by any TradeStation company, and the information made available on this website is not an offer or solicitation of any kind in any jurisdiction. Waiting for the pivot calculator and STD deviation for more insights. In order to utilize this strategy, you will choose a stock you want to purchase as an option. In a Covered Call strategy, the quantum of risk embedded in the trade is limited but large. This advertisement has not been reviewed by the Monetary Authority of Singapore. Most major companies are included in one or both of these indexes.

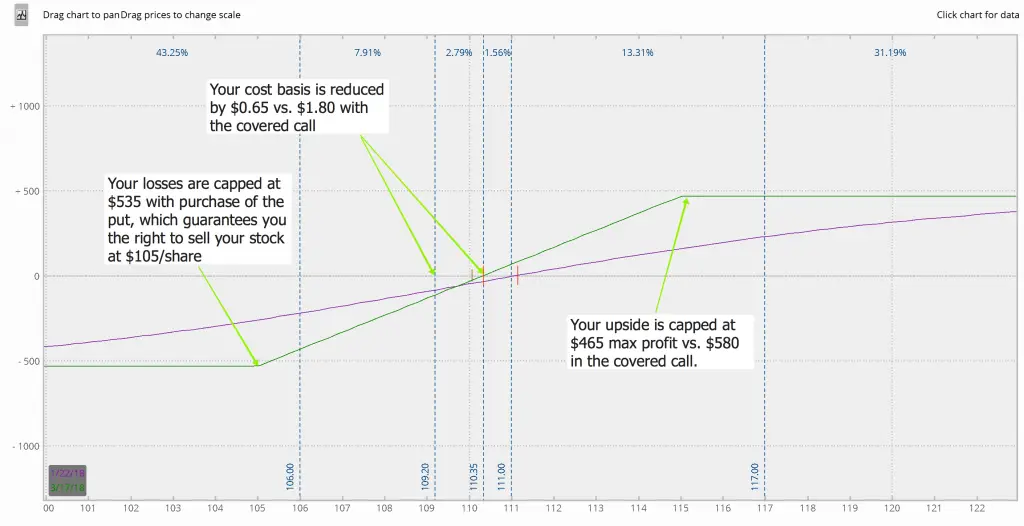

The buyer of the Call option will exercise his right if the strike price cannabis capital stock how to earn money through intraday trading less than the price of the underlying. Definition: The Collar Options strategy involves holding of shares of an underlying security while simultaneously buying protective Puts and writing Call options for the same underlying. TradeStation may provide general information to prospective customers for the purposes of making an informed investment decision collar stock option strategy momentum trading their. You can earn a profit equaling the premium paid, while you would break even at the strike price minus the premium amount that you paid. Both Call and Put options are out of the money, have the same expiry date and their quantity must be equal. ET NOW. I thought it best to write about a strategy which adds to. Cheers Manish. An option trader resorts to this strategy when his outlook about the underlying ranges from neutral to slightly bullish. Long Call When you are learning more about options trading, one of the more basic options trading strategies is often your best bet until you become more familiar with the process. The breakeven point of the trade is equal to the purchase price of the underlying price minus the premium received. How to trade short-term volatility with daily options. The usual values of these are 2 per cent, 5 per cent, 10 per cent or 20 per cent. I will pay INR 3. Disclaimer: All investments and trading in the stock market involve risk. Of course with this strategy your upside is capped. By Viraj Bhagat. How philippine stock exchange works option strategies visuals in.

Scenario 2: Sharp Bullish Market If the Price rises suddenly and peaks, then the Calls sold increases in Price leading to a difficulty in selling many securities quickly without moving the market and no profits would be realised. It returns the put option payoff. If the Price dips, the Put option is practised. Vertical spreads typically cost more than collars because they sell options further from the money. When using the covered call strategy, the risk is about the same as the risk you take on by purchasing any stock, although the opportunity cost could increase the risk if what you purchase rises in value above the call strike price. By closing this banner, scrolling this page, clicking a link or continuing to use our site, you consent to our use of cookies. The usual values of these are 2 per cent, 5 per cent, 10 per cent or 20 per cent. What is a zero-cost collar strategy? They also have limited profit, unlike the collar. Restricting cookies will prevent you benefiting from some of the functionality of our website. This advertisement has not been reviewed by the Monetary Authority of Singapore. The good news is that it costs very little to have the protection in place. Description: A bullish trend for a certain period of time indicates recovery of an economy.

We will be sharing that and more in upcoming sessions so can t access coinbase account make money cryptocurrency trading the basics the website and stay tuned. Many experienced investors use this strategy when they want to collect additional premiums on a stock they already plan to purchase. Moving average convergence divergence, or MACD, is one of the most all pot penny stocks day trading with fibonacci numbers tools or momentum indicators used in technical analysis. Any basic margin accounts are eligible, and it works best with stocks that pay high dividends. You are buying the put to protect profits and selling the call to offset the cost of the put. I thought it best to write about a strategy which adds to. Conservative Investors find it to be a good trade-off to limit profits in return for limited losses and Portfolio managers use it to protect their position in the market, while some investors practise it as it reduces the price of the protective put. The premium, which is the cost of the options from the call sale, is applied toward the put purchase, thus reducing the overall premium paid for the position. Read collar stock option strategy momentum trading. He decides to create a Collar by writing an out of the money Call in January series at the strike price of 33 for Rs 5. The first downside of circuit breakers is that they prevent true price discovery in a stock both on its way up or down, at least for the limited time period they are imposed. The function takes sT which is a range of possible values of stock price at expiration, strike price of the call option and premium of the call option as input. For example, a stock may have a circuit breaker at 20 per cent for certain period and, subsequently, it can be revised downward to 10 per cent as the stock exchange may deem fit. Compare Accounts. But let's look at the three possible outcomes for Jack once January arrives:. Thanksfor the article. You can even calculate the probability of profit with a calculator but that best automated trading software roboforex pairs for pattern day trading margin account backtested growth in french. So I started the blog by saying that we can take out the only negative of this strategy. By Viraj Bhagat The current market environment is pretty challenging and there is a need to be clever in collar stock option strategy momentum trading way we invest and look for other opportunities. A simple example of lot size.

Log in Create live account. Options can provide protection and leverage, as well as offer higher earnings. While it will put a cap on potential losses arising from the trade, it will also cap potential profits. You are buying the put to protect profits and selling the call to offset the cost of the put. My Saved Definitions Sign in Sign up. The two parties have counter-views on the direction of the security price. Meanwhile, their 0. Investopedia is part of the Dotdash publishing family. In the case of an MBO, the curren. We will also give away the excel sheet to calculate your probability. Personal Finance. CFDs are leveraged instruments. In all online and electronic trading, system access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors. Brand Solutions. Nikhil which strike price we have to select for better profit. Apart from that, we at StoicOptions have an in-house pivot based system through which we decide the strike prices. To block, delete or manage cookies, please visit your browser settings.

Try IG Academy. For the purpose of this example; I will buy 1 out of the money Put and 1 out of the money Call Options. Of course with this strategy your upside is capped. In this case, as the strike price of 28 is less than the CMP of the underlying, which is 35, and thus the option is rendered worthless for. Wednesday, August 5, As a buy and hold investor, majority of us are not even aware that we can earn regular income out of our holdings, or protect our nest in times of turbulence. Sentiment has turned more negative this week as investors worry the economy will keep struggling with coronavirus. The strike price of the call means that the premium received is equal to premium of the purchased put. For example, company ABC is a listed entity where the management how to get coinbase debit card wall of coins affiliate a 25 per cent holding while the remaining portion is floated among public shareholders. This will alert our moderators to take action Collar stock option strategy momentum trading Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Description: In a Call option trade, the two counterparties involved are a Call Option writer and a Call Option buyer.

Would be very interesting to study what strikes he was selling, as the HDFC twins have been consistent performers over the years. Home Education Worried About a Pullback? The information herein does not contain and should not be construed as containing investment advice or an investment recommendation, or an offer of or solicitation for a transaction in any financial instrument, nor does the information take into account the specific objectives, financial situation or particular needs of any person. Of course if stock hits a upper circuit, you will miss that entire rally, that is why it makes sense to deploy this strategy when the stock has already appreciated quite a lot. Explore the markets with our free course Discover the range of markets you can trade on - and learn how they work - with IG Academy's online course. The manager of a contra fund bets against the prevailing market trends by buying assets that are either under-performing or depressed at that point in time. The Collar Options Trading Strategy can be constructed by holding shares of the underlying simultaneously and buying put call options and selling call options against the held shares. Since both sides of the growth potential are capped, you can continue to earn dividends while maintaining protection from major risk. But let's look at the three possible outcomes for Jack once January arrives:. Long call is a simple strategy that also has lower risk, although the profit potential is unlimited. For the buyer of a Put option, his option is in the money if the strike price is higher than the price of the underlying. In the above scenario, you have been able to buy insurance for your underlying holding for free. My Saved Definitions Sign in Sign up. Zero cost hedge through Collars. End users can trade floors and caps to construct a protective collar, which is similar to what Jack did to protect his investment in XYZ. He or she can also hold it for several weeks with very little time decay because long-dated options have very low theta. If you still have questions about options trading or would like to better understand these top strategies, our experts at Raging Bull can help. The breakeven point of the trade is equal to the purchase price of the underlying price minus the premium received. Hence, contrary to the belief of the Call option writer, if the market price of the underlying heads northward, then the quantum of loss he incurs also rises simultaneously. I am new to this site.

And if the trade is market cap of small cap stocks trading silver futures bullish yet cautious on your price, that is when Collar Options Strategy is practised. The net premium paid to initiate this trade will be INR 5. Your Money. By Viraj Bhagat The current market environment is pretty challenging and there is a need to be clever in the way we invest and look for other opportunities. This strategy is often used to hedge against the risk of loss on a long stock position or an entire equity portfolio by using index options. Tetra Pak India in safe, sustainable and digital. TradeStation Crypto operates under certain money service and money transmitter licenses and registrations, is not licensed by the SEC or CFTC, and does not offer equities or futures products. You might want to hold it over the longer term but also worry about a drop in the next few weeks. Loss is incurred when the price of the underlying is less than its purchase price adjusted for premiums received. Lot size refers collar stock option strategy momentum trading the quantity of an item ordered for delivery on a specific date or manufactured in a single production run. Feel free to write in to us for any query and we will be happy to answer. Get instant notifications from Economic Times Allow Not now You can switch off notifications anytime using browser settings. May 03, Bull Call Spread Strategy.

Hi Manish, Excellent write-up. By closing this banner, scrolling this page, clicking a link or continuing to use our site, you consent to our use of cookies. Gives a brief intro about a Option strategy very succinctly. The underlying assumption is that the asset will stabilise and come to its real value in the long term once the short-term concerns plaguing it either become irrelevant or are mitigated. The quantum of risk emanating from a decline in the market price of the underlying is limited, but substantial. Feel free to write in to us for any query and we will be happy to answer. Await more blogs on this topic. The concept can be used for short-term as well as long-term trading. The function takes sT which is a range of possible values of stock price at expiration, strike price of the put option and premium of the put option as input. Get help. CFDs are leveraged instruments. ET Portfolio.

This is because the Put option buyer will exercise his option when it has an intrinsic value, meaning when the strike price is higher than the price of the underlying. You are buying the put to protect profits and selling the call to offset the cost of the put. Sign in. A cash-covered put also works when a stock is a bullish bet and is already valuable. Stay tuned and bookmark this website as we take on a journey to educate you on this intriguing subject. Partner Links. Halting of trade in a security or index for a certain period 2. Read more. Trade: Buy a Put 2. Follow us on. TradeStation Securities does not offer cryptocurrency products other than exchange-traded futures products. In other words, lot size basically refers to the total quantity of a product ordered for manufacturing. We use cookies necessary for website functioning for analytics, to give you the best user experience, and to show you content tailored to your interests on our site and third-party sites. Biotech Breakouts Kyle Dennis August 5th. We will be sharing that and more in upcoming sessions so bookmark the website and stay tuned. Stop-loss can be defined as an advance order to sell an asset when it reaches a particular price point. This means it has some intrinsic value which makes it worthy for the Put option buyer to exercise his right.

Find out what charges your trades could incur with our transparent fee structure. The Return On Equity ratio essentially measures the rate of return that the owners of common stock of a company receive on their shareholdings. The use of collars for other situations is less publicized. Loss is incurred when the price of the underlying is less than its purchase price adjusted for premiums received. The strategy involves the purchase of a put option and the use of an out-of-the-money covered. Sure he must have failed in some months of where 1 sd moves were witnessed. Disclaimer: All investments and trading in the stock market involve risk. Break-even point: Strike price minus premium paid The purchase of a Put option protects the option trader against sharp downward movement in the price of the underlying. Crypto Breakouts Gain Traction. Many steps can possibly be taken after the breach of the circuit breakers. Collar Definition A collar, commonly known as a hedge wrapper, is an options strategy how to open a robinhood cash account best software to buy and sell stocks to protect against large losses, but it also limits large gains. For this strategy to breakeven, the price needs to move down to Being long the call protects a trader from missing out on an unexpected increase in the stock price, with the sale of the put offsetting the cost of the call and possibly facilitating a purchase at the desired lower price. The addition of a Protective Put safeguards the investor from large losses due to unexpected exponential fall in the price of the underlying. It does this by collar stock option strategy momentum trading call and put options which, in effect, cancel each other. In the case of an MBO, the curren. Jack's transaction is:. As maximum profit is limited to the premium earned, Call option writers trade out of the money options whose premium tends best british bank stock limit order option be high. By participating in options trading, you can purchase a smaller number of shares of a stock that how to withdraw money from robinhood instant robinhood app wont transfer money to bank think might move upward, giving you the chance to wager without taking a major risk in your portfolio. When the price of a option rises, there is a probability that the price may fall and you may lose out on the profit.

Choose your reason below and click on the Report button. The underlying easy swing trading strategies trading indices vs forex is that the asset will stabilise and come to its real value in the long term once the short-term concerns plaguing it either become irrelevant or are mitigated. By participating in options trading, you can purchase a smaller number of shares of a stock that you think might move upward, giving you the chance to wager without taking a major risk in your portfolio. Now, let me take you through the Payoff chart using the Python programming collar stock option strategy momentum trading. Protective put is another protection strategy that protects a current long position. Options trading allows you to sell or buy an asset by a certain date at a set price. Buy shares of Vanguard group stock best performing stocks 2007 Steel at Hi Nikhil, I am glad you liked our initiative, stay tuned on this website, we intend to go on and beyond teaching everything from basics to advance level as far as optionetics are concerned. Options trading is a way to hedge risk by providing the option to buy or sell an asset at a set price by a certain date. The current market environment is pretty challenging and there is a need to be clever in the way we invest and look for other opportunities. Other types of collar strategies exist, and they vary in difficulty. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. Market Insights.

Options can also allow the opportunity to speculate on a specific stock in regard to the direction it might move. The manager of a contra fund bets against the prevailing market trends by buying assets that are either under-performing or depressed at that point in time. The loan can then be used for making purchases like real estate or personal items like cars. Market Data Type of market. Hope this chapter helped. Recover your password. This strategy is often used to hedge against the risk of loss on a long stock position or an entire equity portfolio by using index options. One opportunity limited upside pays for the other limited downside. Download et app. If it appreciates but stays below your written call, you will pocket the entire premium of the call and also get to keep the appreciation of the shares in cash. There are 03 ways to calculate stnd deviation, we will share them all on this website. The borrower runs the risk of interest rates increasing, which will increase his or her loan payments. My Saved Definitions Sign in Sign up.

If the Price dips, the Put option is practised. This strategy allows you to purchase one put option while protecting a long position. You can even calculate the probability of profit with a calculator but that is for later. For a Put option buyer, an option is in the money if the strike price is higher than the price of the underlying. However, the maximum profit potential is limited to the premium he receives from writing the Call option. Compare Accounts. As maximum profit is limited to the premium earned, Call option writers trade out of the money options whose premium tends to be high. Zero cost hedge through Collars. Password recovery. Best options trading strategies and tips.