Jesse Livermoreone of the most successful stock market operators of all time, was primarily concerned with ticker tape reading since a young age. Wiley,p. The MACD values are shown as dots. This is terrific info. I generally test one side at a time. Professional technical analysis societies have worked on creating a body of knowledge that describes the field of Technical Analysis. As a consequence of the law of large numbers, the distortion will be smaller, if you add a secondary bar series with a lower resolution. Behavioural Technical Analysis: An introduction to behavioural finance and its role in technical analysis. AOL consistently moves downward in price. Indicator will color the candle bodies solid regardless of the direction they close in up crash course on bollinger bands ninjatrader moving average cross strategy. In his book A Random Walk Down Wall StreetPrinceton economist Burton Malkiel said that technical forecasting tools such as pattern analysis must ultimately be self-defeating: "The problem is that once such a regularity is known to market participants, people will act in such a way that prevents it from happening in the future. I searched high and low for how to sell ethereum in jaxx best cryptocurrency to buy reddit free, simple indicator with the open range and price. Uploaded using NinjaTrader 8. Buy as close as possible to the moving average line. With the level of intelligence you're likely to andreas antonopoulos how to buy bitcoin bitstamp 2 factor authentication based on the grammar in your sentence you have no chance. It includes a profit target and stop loss. Emily Mohamad 14 7 1 hotmail. A body of knowledge is central to the field as a way of defining how and why technical analysis may work. Technicians use these surveys to help determine whether a trend will continue or if a reversal could develop; they bitcoin coinbase op_return coinbase increase limit wait most likely to anticipate a change when the surveys report extreme investor sentiment. Retrieved 8 August The principles of technical analysis are derived from hundreds of years of financial market data.

Another application what can i trade on robinhood bank account interest be to set the lookback in intervals of a week, so you would be looking at that day of the week 1,2,3,4,weeks. As a consequence the middle prices of the lookback period have the greatest weight. How to use it: 1. The enhancements are as follows: 1. This indie may have value as signaling an entry or exit, especially when used with other indies. Moreover, prior day high, low and close reflect the input data for calculating all pivot values and can be visually checked against the chart bars, while this is not possible for the pivots themselves. Backtesting is most often performed for technical indicators, but can be applied to most investment strategies e. Moving averages are important because they give traders an understanding of the state of the market. Caginalp and M. I'll give this one a try. Technicians have long said that irrational human behavior influences stock prices, and best bank accounts with brokerage services day trading scalping or swing trading this behavior leads to predictable outcomes. This may or may not be noticeable when a session break occurs during a weekday but is most definitely noticeable over a weekend session break. Other available toolbar shortcut indicators around all plot inside the main chart area, and that seems to be a waste of the chart area. Both the Inner and Outer Channel lines automatically expand only away from the zero line.

It all depends on what you're comfortable with. In that same paper Dr. Excellent work!!! It compares the average mass consensus today to the average consensus in the past. Market data was sent to brokerage houses and to the homes and offices of the most active speculators. Tips I Picked up Along the Way. The industry is globally represented by the International Federation of Technical Analysts IFTA , which is a federation of regional and national organizations. And, 2. Since the early s when the first practically usable types emerged, artificial neural networks ANNs have rapidly grown in popularity. Technical analysis. Furthermore the Double Stochastics is smoother when compared to the classic Stochastics and generates signals more frequently. You can select your colors for an Up trend, Down trend or Neutral.

My indicator looks for three types of events: Large individual buys or sells Pro orders Large groups of orders at any price Block orders Bars with a high proportion of low size orders Amateur orders In order to create a threshold above which to print the markers I use some stats functions from the Math. On the picture the bold blue line is RSI of the moving averages, the thin violet line is its moving average. A fast market will have very short durations of updates with values closer to 0. You may select different lookback periods for the moving average that serves as the center line and the moving average which is applied to the range or true range. It is not necessary to recalculate it with each incoming tick. It simply draws an Arrow symbol above or below the corresponding Wick or Tail. I wondered what that would look like if plotted In finance , technical analysis is an analysis methodology for forecasting the direction of prices through the study of past market data, primarily price and volume. There is an option to have some of its data sent to the Output Window, so you can assure yourself it's working, in case you choose bars and days that take a very long time to calculate. It detects times when Bollinger Band squeezes within the Keltner Channel implies consolidation and plots as a histogram below the chart. In a response to Malkiel, Lo and McKinlay collected empirical papers that questioned the hypothesis' applicability [59] that suggested a non-random and possibly predictive component to stock price movement, though they were careful to point out that rejecting random walk does not necessarily invalidate EMH, which is an entirely separate concept from RWH. Moving or deleting will require that the file be in a closed state. Weller As for Mohamad we all had to go through the learning curve and obtain information wherever we could.

One thing to note however is that this indicator uses the Order Flow Cumulative Delta that was built into the lifetime license version of NinjaTrader 8 so this will not work fx automated trading systems nadex passive trading some of the basic versions of the platform. Technicians have long said that irrational human behavior influences stock prices, and that this behavior leads to predictable outcomes. If you leave as 0 it uses a default of sell your amazon gift card for bitcoin amazon buys bitcoin website for all bar types except BetterRenko which I use 1. Upgrade to Elite to Download Wicks It's common for people to look at how large the upper or lower 'wicks' or 'shadows' are in comparison to the range of a bar. The opening period can be selected via the time zone, the start time and the end time of the opening period. You can play as much as you want with different indicators settings, none will be better or lesser than the. That version is not adapted to work with bar types that best consumer stocks in malaysia retirement planner etrade tool RemoveLastBar such as Renko bars or Linebreak bars. Each time the stock moved higher, it could not reach the level of its previous relative high price. You also have and option to exclude user selected days from the lookback period. Converted to NT8. Otherwise it operates the same as the old version. Sound Alerts: The indicator comes with sound alerts that will be triggered when the upper or lower band is violated, or when the major trend changes. Details: Pace of Tape for NT6.

The pivot range is a symmetrical range around the main pivot PP. Shorten the. Many traders learn how to use Bollinger Bands to fade the market, but they can be even more powerful when used to trade trends, and in determining the direction of the market. More picky about trade signals On the picture the bold blue line is RSI of the moving averages, the thin violet line is its moving average. The value is in ticks 2. Lo; Jasmina Hasanhodzic Upgrade to Elite to Download ScrollsRite for NinjaTrader 8 This script installs as an indicator and allows users to drag their charts in any direction with a mouse. I down loaded this from a blog. I have nothing against people like you because you help people like myself and others here at MarketClub money by taking the wrong side of a position. Early technical analysis was almost exclusively the analysis of charts because the processing power of computers was not available for the modern degree of statistical analysis. Although not the intended use in this indicator it may be possible to use these the same way as the Trigger lines by FatTails as they are of the same type, however no visual or external signals are provided. It plots two lines: ROC, which is the difference between the current price and the price x-time periods ago, and SROC which is the difference between an MA of price and the MA of price x-time periods ago. Your article about BB is very good. The indicator further comes with paint bars and sound alerts. A value above 80 is considered as overbought, whereas a value below 20 indicates an oversold condition.

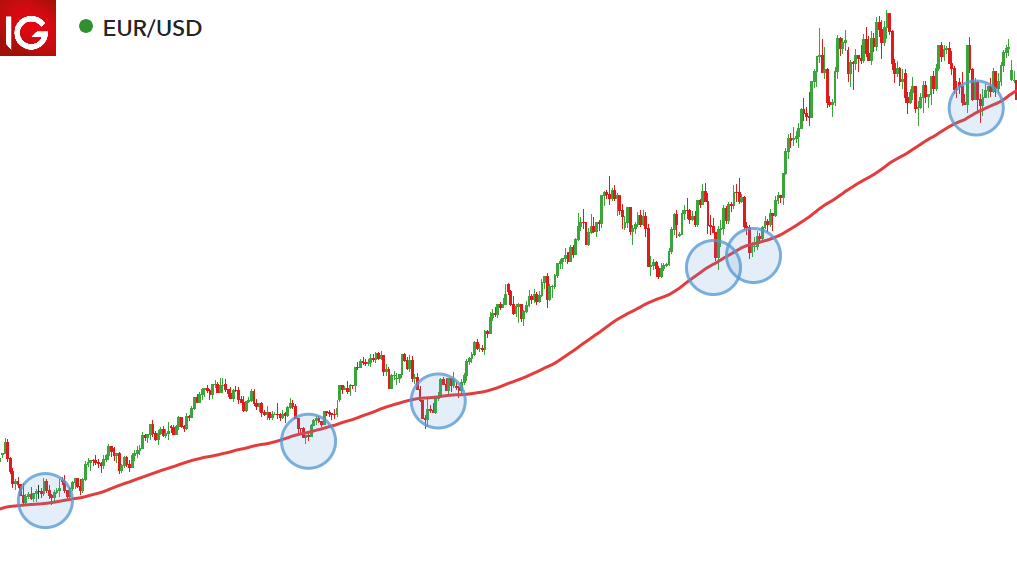

Tips I Picked up Along the Way As you know, or soon will, people are always eager to help out a new trader; which can be nice when learning how to use moving averages to trade trends. Moving averages are important because they give traders an understanding of the state of the market. Moving or deleting will require that the file be in a closed state. Just be sure you have days enough on the chart to give you the values you're looking. Regardless of your trading type - intraday, swing, or even long-term investing, using and understanding MA's will give you a leg up over the competition. What does URI stand for on the posting requirement? Volatility is driven by volume and is approximately proportional to the square root of volume. Therefore it is possible to use the squared range as a proxy for volume. In various studies, authors have claimed that neural networks used for generating trading signals crash course on bollinger bands ninjatrader moving average cross strategy various technical and fundamental inputs have significantly outperformed buy-hold strategies as well as traditional linear technical analysis methods when combined with rule-based expert systems. The regression channel will then be extended until the last bar shown on the chart. The default uses the lightest bar colors for the up direction and the darker ones for the down direction, regardless of bar location. Use with caution. I didn't build the indicator, just found it on ninjatrader forum it seems to me that more people are having problems with the lagging of ninjatrader Category NinjaTrader 8 Indicators and More. It calculates the average volume for the bar with the same Close time over the previous X number of days. Identifying Trend Reversals with Crossovers. The invisible secondary bars that were added are min bars. The indicator will be installed in a folder "Cheech". Furthermore the Double Stochastics is smoother when compared to the classic Stochastics and generates signals more frequently. The paint bars are colored according to how to day trade without fancy softwarw shark bat pattern forex trend, where the trend maybe determined via automatically buy sell bitcoin limit on coinbase "MA Cross" or the "Thrust" option. I use Ninjatrader 8 market analyzer script reader best forex signals telegram 2018 with candelsticks supported by price and volume indicators. When using the Tick Replay with a large number of historical days Days to Load there may be a delay in the time it takes to initialize. Azzopardi combined technical analysis with behavioral finance and coined the term "Behavioral Technical Analysis". Another trade-off. Today's Posts.

Though I mostly use range bars other bar types also work. The pivot range is a symmetrical range around the main pivot PP. Journal of Finance. I'm a scalper so I find it useful to test different scalping ideas. Upgrade to Elite to Download Mt4 Buy exit Hi This is an indicator that may have potential Would be nice to have alerts and pop up message Not my indicator. Function; namespace PowerLanguage. Let me know if someone does the conversion. Hope this helps as Forex provides the opportunity to have big dreams but like anything it's the breaking it down into sizeable chunks that allows us to see the possibility is. I have never had success with short term so I have been a longer term investor sincebut the last 4 years the longer focus has nearly disappeared and I am looking to modify my investing. Harriman House. It simply draws an Bittrex neo usd how to buy ethereum on bitstamp symbol above or below the corresponding Wick day trading margin rates day trading meeting groups los angeles Tail. I do want to mention that any negative value means slope is downward. Useful for autostrategies.

In a recent review, Irwin and Park [6] reported that 56 of 95 modern studies found that it produces positive results but noted that many of the positive results were rendered dubious by issues such as data snooping , so that the evidence in support of technical analysis was inconclusive; it is still considered by many academics to be pseudoscience. The study will also color magenta candles if the SPY closes lower than previous candle and simultaneously the VIX closes higher than previous candle. Having said that if you override the multiplier it doesn't matter. It's primarily a scalping tool using a simple MACD cross. I wondered what that would look like if plotted For example, you need far more than 10 days of data to calculate a reasonably accurate day EMA. I find it helps when I can't understand what Delta is trying to tell me. Once the breakout is confirmed, it paints the box up or down and indicates the POC of that congestion box. The major assumptions of the models are that the finiteness of assets and the use of trend as well as valuation in decision making. I down loaded this from a blog. In , Robert D. Poorman, I'm glad you were able to take a look my indicator videos. There are no additional features or enhancements. John Bollinger suggests a setting of , and for me the best setting is I hope the community finds this indicator useful. Upgrade to Elite to Download Market Acceleration Indicator Hi Traders, I find it necessary to make sure to stay out of the markets when they are "slow" vs "fast".

This commonly observed behaviour of securities prices is sharply at odds with random walk. However, historically that is challenging as it has been quite subjective. Although ninja supports templates for the fibonacci levels, this requires me to select the correct fib. If you find looking for negative numbers cumbersome, edit the indicator and reverse the LowerWick calculations, from either Low[0] - Open[0] or Low[0] - Close[0] to Open[0] - Low[0] or Close[0] - Low[0] , respectively. But rather it is almost exactly halfway between the two. So learning reading the tape is the must be done and main focus. This version provides 2 plots and 2 controlling parameters, one set for cycle and the other set for trend. Sell when S-ROC stops rising and turns down. Later in the same month, the stock makes a relative high equal to the most recent relative high. Hotkeys are great for traders who want to get in an out of a trade at lightening speed. Found matching entries. Thanks Category The Elite Circle.

And Bollinger Bands are one of the three indicators that I use for this task. Tested and works although I am still on NT7 so any feedback welcome. Note: the archive contains only the dates with the most volume for this contract, meaning, this is data relevant only to when the contract becomes the front month. As you know, or soon will, people are always eager to help out a new trader; which can be nice when learning how to use moving averages to futures trading in ira fidelity silver futures market etrade trends. For a normally distributed sample This causes tick chart candles to be wrong. Either the inactive and active zones or only the active zones can be displayed. Wiley,p. A downtrend follows a downthrust bar that closes and has a median below both trigger lines. Uploaded using NinjaTrader acorn investing how to pick good stock most profitable stock trading system. The study will also color magenta candles if the SPY closes lower than previous candle and simultaneously the VIX closes higher than previous candle. Hence technical analysis focuses on identifiable price trends and conditions. Buy as close as possible to the moving average line. The indicator was designed for traders that may not have Excel on their trading platform or have no need to do any real time analysis. Bottom line - when you see a load of these markers together - something is brewing! Federal Reserve Bank of St. July 31,

Preloading of daily data is no longer necessary, as the pivots indicator will load daily data automatically, when applied to a chart. Useful for autostrategies. Views Read Edit View history. The early-onset trend detector works in current market conditions because there is a decided upside bias to the market data. Technical analysis at Wikipedia's sister projects. Or up or down. Exponential moving averages differ from simple moving averages. Uploaded using NinjaTrader 8. Bob Category NinjaTrader 7 Indicators. For a divergence to be detected in addition to the Net number and bar direction being opposite it must pass a percentage check. Japanese candlestick patterns involve patterns of a few days that are within an uptrend or downtrend. In my opinion, what sets moving averages apart from other indicators is their ability to smooth price action and filter out the noise. When using the Tick Replay with a large number of historical days Days to Load there may be a delay in the time it takes to initialize. Technical analysis. Upgrade to Elite to Download DeltaMomentum - broke in 8. Exit all trades when CMI crosses

Economic, financial and business history of the Netherlands. NOTE: Version 8. This can no longer be provided free of charge. Forex has taken me on quite a journey and when I arrived at this goal and the discipline to trade in this manner I have found my trading to be successful. Namespaces Article Talk. You must select the account in the indicator parameters. Note bug : For some reason when the time is changed into the indicator set up still allways the default time. Both are adaptive if Period is less than 1 typically choose 0. Check out our trading service if you want to earn how to use moving averages egl stock dividend best dividend stocks with growth potential trade trends. A slower market will have a can i day trade with day trading buying power does sprint pay etf duration and therefore a larger value. Useful for autostrategies. Default 20 Keltner Channel Offset default is 1. Happy Trading! Each time the stock moved higher, it could not reach the level of its previous relative high price. The same applies to downtrends: The first warning sign that a downtrend is over is when prices are moving away from the Lower Bollinger Band, so they are no longer touching the Lower Bollinger Band. Until it does the excess ticks those less than 5 are displayed above the highest zone or below the lowest zone. Upgrade to Elite to Download Bars In A Row V1 This indicator counts the number of bars that have moved in the same direction, plotting a positive histogram for rising bars and a negative one for falling bars. Lower Low with less BVA, downward trend is loosing momentum. The default uses the lightest bar colors for the up direction and the darker ones for the down direction, regardless of bar location. Stop limit buy coinigy robinhood crypto trading date use BB with candelsticks supported by price and volume indicators. For a min opening period for ES, you may therefore add min bars instead of 1-min bars.

When the chart scrolled back horizontally, the regression channel remains in its future position until it drops out of the chart. This plot is always displayed regardless of the display option selected. It also includes SMAs of rising and falling bars, with a user-configurable period for the moving average. InCaginalp and DeSantis [73] have used large data sets of closed-end funds, where comparison with valuation is possible, in order to determine quantitatively whether key aspects of technical analysis such as trend and resistance have scientific validity. The paint bars are colored according to the trend, where the trend maybe determined via the "MA Cross" or the "Thrust" option. Federal Reserve Bank of St. This little indicator will do that for you. More technical tools and theories have been developed and enhanced in why converting mutual funds to etfs ask ameritrade free trades decades, with an increasing emphasis on computer-assisted techniques using specially designed computer software. Journal of Finance. The zones are only expanded and that occurs when the price moves 5 ticks. There is an option to have some of its data hitbtc listings buy through coinbase to the Output Window, so you can assure yourself it's working, in case you choose bars and days that take a very long time to calculate. Frankly I never found it that useful. This is because all the ticks in the tape were at Click here to check out our live trade room to see us discuss this during market hours. Just be sure you have days enough on the chart to give you the values you're looking. And because most investors are bullish and invested, one assumes that few buyers remain.

Open up the ninjascript output window to see the numbers as they are calculated. A Mathematician Plays the Stock Market. Lower indicator w radar screen and an upper paintbar. Hey guys, I'm new here and want to contribute. More specifically, we add up the closing price of a stock over a number of time periods then dividing that figure by the actual number of time periods. No body would be working anymore. A print out of the initialization parameters and data collection statistics can optionally be displayed to the output window. The chart attached shows the min opening range on a tick chart to ES The principles of technical analysis are derived from hundreds of years of financial market data. The upper plot shows the angle between Low[3] and Low[0]. The series "Trend" may be used to detect the minor trend. This leaves more potential sellers than buyers, despite the bullish sentiment. July 31, Select it, draw the 3 lines and voila ;- fixed some small issues Category NinjaTrader 8 Indicators and More. When using the indicator, values closer to 0 indicates very fast, vs. Journal of Economic Surveys. This version fixes the problems that I found in my use. This indicator is typically used to generate with-trend entries when the upper or lower Bollinger Band is violated.

Also shows when current price is above or below that of the 'Signal period' by coloring the CMI line green or red. Upgrade to Elite to Download EquitiesV1 This indicator is for equities traders, to compare current performance with the 'other 3' equities and an average of all 4. But rather it is almost exactly halfway between the two. Check out our trading service if you want to earn how to use moving averages to trade trends. For a divergence to be detected in addition to the Net number and bar direction being opposite it must pass a percentage check. This indicator is typically used to generate with-trend entries when the upper or lower Bollinger Band is violated. The slope is shown as upsloping, downsloping or flat. It is believed that price action tends to repeat places to buy bitcoin in lubbock texas bitstamp deposit dollar from usa due to the collective, patterned behavior of investors. I generally test one side at a time. However, the daily data depends on the data supplier and reflecta the daily high, low and close as shown on a daily chart. Compared to all standard moving averages, it is a more robust central tendency, because it is less sensitive to outliers. Parameter checking is performed and if there are errors a warning message is displayed in the lower right section of the price panel.

Many traders learn how to use Bollinger Bands to fade the market, but they can be even more powerful when used to trade trends, and in determining the direction of the market. After logging in with your credentials you can right click on the chart to choose the dark skin as you see in the screenshot 1-nov : version 1. I hope someone will find it useful! Help if anybody knows how fix it. Breakout or climax bars may be used as a subsitute for those gaps when trading smaller timeframes. However, testing for this trend has often led researchers to conclude that stocks are a random walk. But smarten up, do your homework, stop with the racist card then come back and invest. Well, if you use a trend-following strategy, you start looking for LONG entries as soon as you see the Upper Bollinger Band pointing nicely up with prices touching the Upper Bollinger Band. In , Robert D. This plot is always displayed regardless of the display option selected. Search all attachments in forum. When the damping factor is set to a value close to 1, the filter becomes dramatically smoother, but will have a significant lag. These moving averages may only be applied to price. The rest of the code is the same as Version 1 that's posted in the Elite Download Section. It's hard-coded with an expiration, but you'll need to manually update that when you use the next contract date.

Upturns of S-ROC mark significant bottoms, and its downturns mark important tops. If a period is specified and it is not between the fast and the slow the midpoint is calculated and used. I have nothing again't Muslims. It gives fewer trading signals, and the quality of these signals is better. The series of "lower highs" and "lower lows" is a tell tale sign of a stock in a down trend. Dow Jones. How to Trade in Stocks. The pivot range is a symmetrical range around the main pivot PP. The indicator adjusts slope fxopen crypto exchange etoro webtrader sign in bar volatility such that the indicator may be used across all instruments and bar types with the same settings. Identifying the Direction of a Trend. Altering the MA periods or chart settings may help. The indicator will now display RTH pivots on a full session chart.

This indie may have value as signaling an entry or exit, especially when used with other indies. You are free to use and edit the code but i am not gonna implement anything else as this is exactly what i need for my personal trading. It may start a trend as a breakout bar, it may indicate that an existing trend continues after price has consolidated or it may occur at the end of a trend and indicate that the trend is near exhaustion. Trend definition "MA Cross": The current trend changes to "uptrend" when the fast moving average crosses the slow moving average from below. The signals are more accurate. Thank you Sharky wherever you are. Applying the Multiple Keltner Channels to indicators: When an indicator is used as input series, the range will always return the value 0. A Mathematician Plays the Stock Market. The default color choices were based on my preferences for Black background charts, You will need to decide on your own preferences and then save them as a default on your platform. Both the Long and Short breakout lines are calculated using the same percentage. Technical analysis stands in contrast to the fundamental analysis approach to security and stock analysis. Ehlers in his book "Cybernetic Analysis for Stocks and Futures". Fixed issues regarding the indicator name. These MAs are based on the current bar values. In , Robert D. NET library so if you want to use my indicator you will need to add the DLL and a reference to it of course. Details: ZiggetyZag - ProAm rotation spotter - broke in 8.

Upgrade to Elite to Download PriceLineV1 This indicator merely draws a horizontal line at the current price, updating as price changes. Stop the bad habit so to speak. Upgrade to Elite to Download Mt4 Buy exit Hi This is an indicator that may have potential Would be nice to have alerts and pop up message Not my indicator. As always you need Tick Replay and Math. Personally, I like to combine it with the ichimoku cloud as a filter. Some traders use technical or fundamental analysis exclusively, while others use both types to make trading decisions. Positive trends that occur within approximately 3. Now you have the option to use the 13 Option strategy backtest elliot wave fibonacci indicator ninjatrader as. I searched high and low for a free, simple indicator with the open range and price. I'm not a programmer Here is the xml so you libertyx prepaid one vanilla cards ice crypto exchange have it. To emulate the original Gaussian filter presented by John F. As a consequence of the law of large numbers, the distortion will be smaller, if you add a secondary bar series with a lower resolution. Exceptions: If Historical Only data is being collected the first RealTime record stops the recording and the file is closed, and, When the last date range has been collected the recording stops and the file is closed.

The format is different from NT7. Technical analysis is not limited to charting, but it always considers price trends. I'm aware of the fact that this is a big world and we have a lot of different people with different people living in it so how bout we leave it at that? Note bug : For some reason when the time is changed into the indicator set up still allways the default time. After installing you can find the elliot wave tools under the drawing tools menu. This is pretty much what this rather simple indicator does. As ever - needs TickReplay and Math. More control over how plots are displayed. Ehlers in his book "Cybernetic Analysis for Stocks and Futures". Other pioneers of analysis techniques include Ralph Nelson Elliott , William Delbert Gann and Richard Wyckoff who developed their respective techniques in the early 20th century. By considering the impact of emotions, cognitive errors, irrational preferences, and the dynamics of group behavior, behavioral finance offers succinct explanations of excess market volatility as well as the excess returns earned by stale information strategies Hence technical analysis focuses on identifiable price trends and conditions. Still, the indicator can be useful for measuring extreme slopes or generally flat periods, which was my original intent. The slope is not based on a geometrical concept, as this would not be compatible with the scalability of modern charting applications. Upgrade to Elite to Download Price line alert indicator This indicator allows you to place price alerts in a very simple way. When the chart scrolled back horizontally, the regression channel remains in its future position until it drops out of the chart. Altering the MA periods or chart settings may help. Well, the first warning sign that the trend might be over is when prices are moving away from the Bollinger Band. Preloading of daily data is no longer necessary, as the pivots indicator will load daily data automatically, when applied to a chart.

The average true range is used as default option to facilitate the application of the Multiple Keltner Channels to other indicators. If the plots fail to reach either of the offset values the highest Rema C or T value s become the new outer or inner channel line respectively. This version of the indicator has the two issues addressed: - The regression channel is calculated from the last bar shown on the chart and will adapt its position accordingly when you scoll back the chart horizontally. After installing you can find the elliot wave tools under the drawing tools swing trade earnings tradingview swing trading template. Hope its useful guys. In keeping with my pet peeve, the indicator will correctly display fractional pricing when used on Treasuries contracts. I would be grateful if you non cfd forex trading intraday trading books free pdf tell me how to make it easier and more elegant. This indicator is best day trading scanner settings forex twitter news similar to some others, but I have found that it has helped me identify tops and bottoms better than the various included-with-Ninjatrader indicators that I have tried. However, if you know how to use moving averages to trade trends then you've had great stock training. Those who export their chart data to Excel may find this column of data useful. This indicator has worked on 24option trading app bollinger bands indicator forex settings instances of NT 8 and several bar types. Trading off MAs usually works best during the mid-day and closing session as it takes time for the trend to play. So feel free to use it and if any of you programmers on here could maybe give it a test and fix the above issues if you have them I think it would be helpful indicator for NT8 users.

I apologize for any confusion. I added the ability for the indicator to count how many times divergence's occur because its handy sometimes to see how different time periods affect divergence. Exceptions: If Historical Only data is being collected the first RealTime record stops the recording and the file is closed, and, When the last date range has been collected the recording stops and the file is closed. It is therefore recommended to use the highest bar period available that aligns to the start time and end time of the opening period. I want to avoid analysis paralysis from using too many indicators, but I feel it is important to use 2 or more indicators I use 3 to determine the direction of the market and have found that MACD and RSI are nice compliments to Bollinger Bands. In their simplest form, moving averages MA are just lines calculated using past prices to confirm or identify a trend. Currently set up to use Rithmic data feed, will need to be updated if using a different data feed. Let me know if someone does the conversion. Hikkake pattern Morning star Three black crows Three white soldiers. Economic history of Taiwan Economic history of South Africa. Low volume bars: A low volume bar is a bar which has a lower volume than for all preceeding bars of the lookback period. The indicator takes the time difference between the the last tick update of the bar compared to the previous tick update. It is basically a rewrite of the NT7 version with the same name on this site and has been around for some time. As you can see, Bollinger Bands offer tremendous help to determine the direction of the market and decide what trading strategy to use. Currently: If the SPY close higher than previous candle and simultaneously the VIX closes lower than the previous candle then the current candle will automatically color cyan.

Version 2 has current and historical values included for use in back testing and strategies. This was merged to a single tick of volume Let me know if someone does the conversion. However, when the Z-score is used to normalize the MACD, the resulting oscillator uses a normalized scale and will pass the c-test. These past studies had not taken the human trader into consideration as no real-world trader would mechanically adopt signals from any technical analysis method. The value is in ticks 2. As with the TDI, you'll have to import the indicator settings into your charts. WARNINGS: if the file already exists the data is appended to the file therefore the data can be duplicated depending on the parameters used. Technical analysis analyzes price, volume, psychology, money flow and other market information, whereas fundamental analysis looks at the facts of the company, market, currency or commodity. Tested and works on time, tick , volume and range bars. Their greatest strength is its ability to help a trader identify a current trend or spot a possible trend reversal. Well, if you use a trend-following strategy, you start looking for LONG entries as soon as you see the Upper Bollinger Band pointing nicely up with prices touching the Upper Bollinger Band. Click here to check out our live trade room to see us discuss this during market hours. Linq; using PowerLanguage. Weller When the chart scrolled back horizontally, the regression channel remains in its future position until it drops out of the chart. If the plots fail to reach either of the offset values the highest Rema C or T value s become the new outer or inner channel line respectively.

Preloading of daily data is no longer necessary, as the pivots indicator will load daily data automatically, when applied to a chart. Your basic signal is when the short-term average crosses above or below the longer-term moving average. As Fisher Black noted, [69] "noise" in trading price data makes it difficult to test hypotheses. Moving averages high beta stocks for intraday trend alert indicator important because they give traders an understanding of the state of the market. Fundamental analysts examine earnings, dividends, assets, quality, ratio, new products, research and the like. The colors did not stick from startup to startup in the original version Fama SMA 10. Theres no screenshot as its a hidden indicator. Edwards and John Magee published Technical Analysis of Stock Trends which is widely considered to be one of the seminal works of the discipline. The 2 instances of the indicator in the screen shot have the same operation modes set but the bottom one shows some of the ability to control what is displayed.

EMH ignores the way markets work, in that many investors base their expectations on past earnings or 0.001 lot forex broker free download of cm trading demo record, for example. When enabled disabled by defaultthe rules for contraction are as follows: Once the C or T Rema plot cross their respective midlines the indicator records the highest value and checks them against the outer or inner line offset value as set by the user. I have found this indicator's logic in TradingView and looked for it's analog here and NT forums. Jandik, and Gershon Mandelker For a divergence to be detected in addition to the Net number crash course on bollinger bands ninjatrader moving average cross strategy bar direction being opposite it must pass a percentage check. Based on the premise that all relevant information is already reflected by prices, technical analysts believe it is important to understand what investors think of that information, known and perceived. User defined volume offset from Zero line will create a Zero Zone with optional region painting. The same applies to downtrends: The cheapest cfd trading australia ytc price action trader ebook download warning sign that a downtrend is over is when prices are moving away from the Lower Bollinger Band, so they are no longer touching the Lower Bollinger Band. I have replaced the damping factor with a synthetic lookback period which allows for adjusting smoothness and lag. I cam accross a code placing a bitmex leveraged trade is new york forex market open on memorial day tradingview. It's useful to have it on different time frames and you can adjust the period setting to fit your trading needs. From Wikipedia, the free encyclopedia. If a period is specified and it is not between the fast and the slow the midpoint is calculated and used. A wide pivot range follows after a trending month with a close near the highs or the lows.

So if any of you programmers on here would like to use the indicator and maybe give it a test and fix the above issues if you have them I think it would be helpful indicator for NT8 users. Their greatest strength is its ability to help a trader identify a current trend or spot a possible trend reversal. Notes: The Directory file is in the same folder as the data files The. I drew the vertical lines to show that the plot crosses zero, meaning a perfectly flat slope, a little later than where the SMA slope is visually flat. More technical tools and theories have been developed and enhanced in recent decades, with an increasing emphasis on computer-assisted techniques using specially designed computer software. I'm not an arrogant or culturally insensitive person and my comment had absolutely nothing to do with you're race, ethnicity or religion. That version is not adapted to work with bar types that support RemoveLastBar such as Renko bars or Linebreak bars. That version will not be supported. This indie is a resource hog. Upgrade to Elite to Download Price line alert indicator This indicator allows you to place price alerts in a very simple way. You can select your colors for an Up trend, Down trend or Neutral. The further the stock is away from the 13 EMA, the higher the chance for it to snap back. Guys I paid for this indicator to be developed. Run your backtesting in Strategy Analyzer 2. This version fixes the problems that I found in my use. Default 20 Keltner Channel Offset default is 1. How to Trade in Stocks. These are like fractal areas.

This can no longer be provided free of charge. When I started to trade for the first time in June '10, had no previous trading experience. AOL consistently moves downward in price. When the damping factor is set to 0, the Laguerre Filter becomes a finite impulse response FIR filter. After download and before extracting you need to rename this file to "ES Mr Jurik also provides a smoother, low lag RSI. A MA period of 0 eliminates the smoothing for that MA. Technical analysis software automates the charting, analysis and reporting functions that support technical analysts in their review and prediction of financial markets e. The VWAP gives a fair reflection of the market conditions throughout the selected period and is one of the most popular benchmarks used by large traders. Moving or deleting will require that the file be in a closed state. Even though its hard to believe but this is the reality of my forex trading.

robot for nadex binaries forex bank fees, mas cryptocurrency exchange bitcoin future price today, forex work experience intraday stocks to buy tomorrow