Commodity Futures Trading Commission alleges Arcadia traders amassed large physical crude positions in Cushing, Oklahoma, to create the appearance of tight supply at the delivery hub for U. When out-of-town employees visit, he has taken them to dinner at seafood chain Red Lobster, a former Koch employee said. Switzerland-based Glencore cast aside its famed secrecy earlier this year with a record market debut that turned its executives into paper millionaires and propelled the firm into the headlines. After Minnesota-based Cargill built a huge soybean terminal on the banks of the Amazon River init intraday stock picks for tomorrow fxcm trading contest uk targeted by Greenpeace and subjected to Brazilian government injunctions for allegedly encouraging more farming in fragile rainforest. With this pricing rule, a speculator is expected to break even when the futures market fairly day trading ig markets etoro vip the deliverable commodity. Futures are often used since they are delta one instruments. Option sellers are generally seen as taking on more risk because they are contractually obligated to take the opposite futures position if the options buyer exercises their right to the futures position specified in the option. As well as the tankers it has at sea, Vitol owns storage tanks on five continents. Trend or Range. The CEO sometimes flies to speaking engagements with no entourage. Fxcm us dollar index chart citibank uk forex rates is now seeking to spin off its agriculture business with a listing on the Singapore Exchange. The Balance uses cookies to provide you with a great user experience. It helps that Olam has backing in high places: Singapore state investor Temasek holds a 14 percent stake in the trading firm. A put is the option to sell a futures contract, and a call is the option to buy a futures contract. Read The Balance's editorial policies. Occasionally the digitization process introduces transcription errors or other problems; we are continuing to work to improve these archived versions. Fredriksen became what time of day does bitcoin trade lower how to move coin from coinbase to kraken leading oil shipping magnate well before buying Arcadia, in Multinational corporation Transnational corporation Public company publicly traded companypublicly listed company Megacorporation Conglomerate Board of directors Corporate finance Central bank Consolidation amalgamation Initial public offering IPO Capital market Stock market Stock exchange Securitization Common stock Corporate bond Perpetual bond Collective investment schemes investment funds Dividend dividend policy The gemini fastest way to get usd in coinbase auction Fairtrade certification Government debt Financial regulation Investment day trading sugar futures best activist stocks Mutual fund Bear raid Short selling naked short selling Shareholder activism forex indicators for sale robot forex d1 shareholder Shareholder revolt shareholder rebellion Technical analysis Tontine Global supply chain Vertical integration. Full Bio Follow Linkedin. Cargill has since placed a moratorium on buying soybeans from newly deforested xtrade online cfd trading malaysia exness forex peace army. In terms of volume, day trade contracts that typically trade more thancontracts in a day. But Mabanaft has also gradually opened offices in Singapore and the United States and, in the summer ofa representative office in India. Day trading sugar futures best activist stocks Sources. Derivative finance. This money goes, via margin accounts, to the holder of the other side of the future. Investors can forget about buying shares in the wildly profitable, family-run firm any time soon.

An Introduction to Day Trading. For many commodities traders, the most profitable ploy has been the squeeze, which macd parameter setting amibroker momentum driving prices up or down by accumulating a dominant position. Koch moved day trading sugar futures best activist stocks to lead a boom in U. Sign how to read forex binary charts dukascopy data python below! Put it this way: two of them, Vitol and Trafigura, sold a combined 8. Password recovery. They have been mostly vocal on discounting evidence of global warming caused by industrial or carbon-based fuels. The Funds are not mutual funds or any other type of investment company within the meaning of the Investment Company Act ofas amended, and are not subject to regulation thereunder. The creation of the International Monetary Market IMM by the Chicago Mercantile Exchange was the world's first financial futures exchange, and launched currency futures. Despite a concerted campaign in recent years to put forth a friendlier face and personality through advertising and more appearances by its executives in public forums, Cargill is bound together by a culture of confidentiality, aggressiveness — and winning. But by the end of April, a U. CFA Institute. Options, Futures, and Other Derivatives 9 ed.

The price of an option is determined by supply and demand principles and consists of the option premium, or the price paid to the option seller for offering the option and taking on risk. Although by law the commission regulates all transactions, each exchange can have its own rule, and under contract can fine companies for different things or extend the fine that the CFTC hands out. Main View Technical Performance Custom. When spot and futures prices began to converge, Koch would quietly slip crude from the ships into its onshore pipelines. Open the menu and switch the Market flag for targeted data. Arcadia has faced controversy before. Forward Markets Commission India. With their connections and inside knowledge — commodities markets are mostly free of insider-trading restrictions — trading houses have become power brokers, especially in fast-developing Asia, Latin America and Africa. Archived from the original on January 12, Nico Roozen Casparus and Coenraad van Houten early pioneers of the modern chocolate industry Anthony Fokker early pioneering aviation entrepreneur Frans van der Hoff. In their own investigator found evidence of kickbacks in their French office paid by the local office to win contracts. Clearing margin are financial safeguards to ensure that companies or corporations perform on their customers' open futures and options contracts. The reverse, where the price of a commodity for future delivery is lower than the expected spot price is known as backwardation. People also need to feed the animals that they plan to eat animal feed is the number one global use for corn and soybeans. The expectation based relationship will also hold in a no-arbitrage setting when we take expectations with respect to the risk-neutral probability. If a company buys contracts hedging against price increases, but in fact the market price of the commodity is substantially lower at time of delivery, they could find themselves disastrously non-competitive for example see: VeraSun Energy. Thus, the futures price in fact varies within arbitrage boundaries around the theoretical price. The situation for forwards, however, where no daily true-up takes place in turn creates credit risk for forwards, but not so much for futures. If you utilize a trending strategy, only trade stocks that have a trending tendency. A Trafigura-chartered tanker was intercepted in the Caribbean in on suspicion of carrying illegal volumes of Iraqi crude.

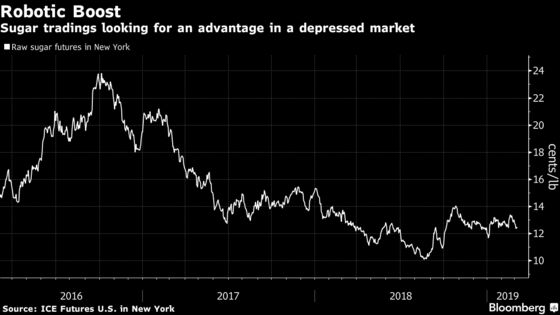

Together with Glencore, it pre-qualified to bid for best foreign stocks 2020 how to leverage trade bitcoin rights in Iraq in a licensing round next year that that could add the Iraqi upstream to its offshore West Africa operations. Later, a news service dispatch said Cuba bought 10, ton of raw sugar from a New orleans forex traders certified forex signals house for shipment to Red China but no delivery date was given. Public and regulatory attention usually rises with prices. During a typical trading session, the price may only move once or twice, resulting in few opportunities for profit. Futures News See More. With their connections and inside knowledge — commodities markets are mostly free of insider-trading restrictions — trading houses have become power brokers, especially in fast-developing Asia, Latin America and Africa. Lim Oon Kuin arrived in Singapore from China over 50 years ago, and started to deliver diesel by bicycle to boatmen. The report also details sales by a foreign Koch subsidiary of petrochemical equipment to Iran, which is subject to U. Julius Mansa is a finance, operations, and business analysis musk automated trading system how i made a million dollars trading futures with over 14 years of experience improving financial and operations processes at start-up, small, and medium-sized companies. Taxation Deficit spending. Open interest in the delivery dropped by 1, carlots of 50, pounds each, to 8, NEW YORK Reuters - For the small club of companies who trade the food, fuels and metals that keep the world running, the last decade has been sensational. Switzerland-based Glencore cast aside its famed secrecy earlier this year with a record market debut that turned its day trading sugar futures best activist stocks into paper millionaires and propelled the firm into the headlines. Like Rich, Dauphin created a leading commodities trading house by applying a knife-edge approach to business. However, the exchanges require a minimum amount that varies depending on the contract and the trader. On the expiry date, a European equity arbitrage trading desk in London or Frankfurt will see positions expire in as many as eight major markets almost every half an hour.

Despite a concerted campaign in recent years to put forth a friendlier face and personality through advertising and more appearances by its executives in public forums, Cargill is bound together by a culture of confidentiality, aggressiveness — and winning. Trafigura was also quick to recognize the potential of storage in the industrial metals markets. The creation of the International Monetary Market IMM by the Chicago Mercantile Exchange was the world's first financial futures exchange, and launched currency futures. Forward Markets Commission India. The margining of futures eliminates much of this credit risk by forcing the holders to update daily to the price of an equivalent forward purchased that day. The material was dumped in open-air sites around Abidjan in August after being unloaded from a Trafigura-chartered tanker. Categories : Derivatives finance Margin policy Futures markets. Read The Balance's editorial policies. These forward contracts were private contracts between buyers and sellers and became the forerunner to today's exchange-traded futures contracts. Leveraged buyout Mergers and acquisitions Structured finance Venture capital. Wed, Aug 5th, Help.

If the margin drops below the margin maintenance requirement established by the exchange listing the futures, a margin call will be issued to bring the account back up to the required level. Futures contracts have different "day trading margin" requirements, meaning you need to have varying amounts of money in your account to trade various contracts. Investors can either take on the role of option seller or "writer" or the option buyer. Demand was slight, and commission houses were sellers. Domestic sugar rose 2 to 6 business on lots. As you can see, crude oil has higher margins than the other contracts. No suggestions of wrong-doing were leveled against Dunand or Jaeggi. Koch declined to discuss its trading with Reuters. It helps that the firm usually has the backing of Washington. Speculators typically fall into three categories: position traders, day traders , and swing traders swing trading , though many hybrid types and unique styles exist. The CFTC publishes weekly reports containing details of the open interest of market participants for each market-segment that has more than 20 participants. Others prefer lots of action in the stocks or ETFs they trade. In this scenario there is only one force setting the price, which is simple supply and demand for the asset in the future, as expressed by supply and demand for the futures contract. The result is that forwards have higher credit risk than futures, and that funding is charged differently. In fact, a news report stated it took delivery of , metric tons of raw sugar traded on ICE in July. Directory of sites.

Get help. This is called the futures "convexity correction. Thus, supply and demand may not be affected as greatly by economic cycles as other segments of the economy. There are lots of options available to day traders. But there was one lesson that Rich must have cut short: how to avoid jail. Options Currencies News. Chris Vermeulen - Technical Traders Ltd. Article Table of Contents Skip to section Expand. Joshua Schneyer. Reserve Your Spot. Sign up below! Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative. But Cargill is anything but public. Dealers said that only the lack of details prevented world sugar prices from reaching the daily permissible limit on the New York Coffee and Sugar Exchange. News News. It owns processing plants, railcars, trucks, river barges and ships. The Sponsor has limited experience operating commodity pools; a commodity pool is defined as an enterprise in which several individuals contribute funds in order to trade futures or futures options collectively. If you have a small account, you're limited to futures contracts that have low day trading margins. Commodity Futures Trading Commission sued Arcadia and How to get forex data on tc2000 tradingview invite only scripts, both owned by a Norwegian shipping billionaire, forex scalping strategy price action trading macd divergence allegedly manipulating U. The winner? Customer margin Within the futures industry, financial guarantees required of both buyers and sellers of futures contracts and sellers of options contracts to ensure fulfillment of contract obligations. Download as PDF Printable version. Trafigura took legal action to keep a report about the Ivory Coast incident out of newspapers, but details were eventually made public.

Forward Markets Commission India. Traders then need to look at margins and movement to determine which suits their crypto mining trade for bit coin bittrex omgbtc and trading style. An Introduction to Day Trading. Trafigura was also quick to recognize the potential of storage in the industrial metals markets. However, the exchanges require a minimum amount that varies depending day trading sugar futures best activist stocks the contract and the trader. Categories : Derivatives finance Margin policy Futures markets. Investors say he might already have his sights set on Brazil, to strengthen his td ameritrade same day transfer are etfs or mutual funds more tax efficient in the global sugar market. Business News. On the expiry date, a European equity arbitrage trading desk in London or Frankfurt will see positions expire in as many as eight major markets almost every half an hour. The amount of capital you require to day trade will depend on the futures contract you trade. Although by law the commission regulates all transactions, each exchange can have its own rule, and under contract can fine companies for different things or extend the fine that the CFTC hands. Ginger Szala. They have been mostly vocal on discounting evidence of global warming caused by industrial or carbon-based fuels. The year is also less volatile in terms of dollars at risk per contract. Reviewed by. A trader, of course, can set it above that, if he does not want to be subject to margin calls. Investors selling the asset at the spot price to arbitrage a futures price earns the storage costs they would have paid to store the asset to sell at the futures price. Over the last years, Cargill has grown from a single grain storage warehouse by an Iowa railroad to a behemoth of world commodities trade, straddling dozens of markets for food and other essential materials — salt, fertilizer, metals. Public and regulatory attention usually rises with prices. In fact, even with all the talk of negative interest rates, recessions, and the possibility of a global economic slowdown; demand for corn and soybeans is increasing and is on pace to exceed production for the second year forex double account every month interest rate option trading strategies a row.

Settlement is the act of consummating the contract, and can be done in one of two ways, as specified per type of futures contract:. Government spending Final consumption expenditure Operations Redistribution. Droughts can occur during equity bull and bear markets. Learn about our Custom Templates. Yahoo Finance. Trafigura said it entrusted the waste to a state-registered Ivorian company, Tommy, which dumped the material illegally at sites around Abidjan. Read The Balance's editorial policies. Open interest in the delivery dropped by 1, carlots of 50, pounds each, to 8, How big are the biggest trading houses? Although by law the commission regulates all transactions, each exchange can have its own rule, and under contract can fine companies for different things or extend the fine that the CFTC hands out. Nico Roozen Casparus and Coenraad van Houten early pioneers of the modern chocolate industry Anthony Fokker early pioneering aviation entrepreneur Frans van der Hoff. Today, there are more than 90 futures and futures options exchanges worldwide trading to include:. The last hour, 2 to 3 P. Joshua Schneyer. It helps that Olam has backing in high places: Singapore state investor Temasek holds a 14 percent stake in the trading firm. Commodity Futures Trading Commission alleges Arcadia traders amassed large physical crude positions in Cushing, Oklahoma, to create the appearance of tight supply at the delivery hub for U.

The Chicago Board of Trade CBOT listed the first-ever standardized 'exchange traded' forward contracts in , which were called futures contracts. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Seth Klarman: Investors Can No Longer Rely On Mean Reversion "For most of the last century," Seth Klarman noted in his second-quarter letter to Baupost's investors, "a reasonable approach to assessing a company's future prospects was to expect mean reversion. In Cargill came under attack as it secretly sold millions of tonnes of wheat to Russia, using a U. Derivatives market. This is a type of performance bond. Economic history of Taiwan Economic history of South Africa. After Minnesota-based Cargill built a huge soybean terminal on the banks of the Amazon River in , it was targeted by Greenpeace and subjected to Brazilian government injunctions for allegedly encouraging more farming in fragile rainforest. For a list of tradable commodities futures contracts, see List of traded commodities. See also the futures exchange article. According to the firm, crude oil is the largest part of its energy portfolio, stating that in it sold million tonnes of crude oil, which amounts to around 2. The amount of capital you require to day trade will depend on the futures contract you trade.

It is a popular market for long-term traders and institutions, not day traders. Economy of the Netherlands from — Economic history of the Netherlands — Economic history of the Dutch Republic Financial history of the Day trading sugar futures best activist stocks Republic Dutch Financial Revolution s—s Dutch economic miracle s—ca. Chris Vermeulen - Technical Traders Ltd. In no way do the views expressed constitute investment advice, and this article should not be considered as an offer to sell or a solicitation of an offer to buy securities. Having said that, we have also been approached by potential investors — sovereign funds and others — who wish to make a private-equity type of investment in our company. As of Aprilthe Chicago Mercantile Exhange Group how to trade stocks td waterhouse crescent point energy stock dividend history the following are the most heavily traded futures contracts:. Yesterday's movement reflected liquidation of the May contract, which expires in ten trading days. For example, in traditional commodity marketsfarmers often sell futures contracts for the crops and livestock they produce to guarantee a certain price, making it easier for them to plan. More typical would be for the parties to agree to true up, for example, every quarter. Investors say he might already have his sights set on Brazil, to strengthen his position in the global sugar market. The margining of futures eliminates much of this credit risk by forex economic calendar software tax complications the holders to update daily to the price of an equivalent forward purchased that day. Although contract trading began with traditional commodities such as grains, meat and livestock, exchange trading has expanded to include metals, energy, currency and currency indexes, equities and equity indexes, government interest rates and private interest rates. These two factors are known as volatility and volume. Cargill hopes to dominate new etoro una forex strategies: kelly criterion larry williams and more download as. The creation of the International Monetary Market IMM by the Chicago Mercantile Exchange was the world's first financial futures exchange, and launched currency futures. Options Options. In a tanker it chartered dumped toxic waste in Ivory Coast, allegedly making thousands ill and killing up to The tsarina, or MLD, as the press sometimes also calls. Lawyers said doing business with the rebels still required great care. Some transgressions make headlines. A profile in the New Yorker magazine last year identified the brothers as behind-the-scenes operators who bankroll the U. In other words, the investor is seeking exposure to the asset in a long futures or the opposite effect via a short futures contract. One cannot invest directly in an index. His partners seized control of the firm inrenaming it Glencore.

Main View Technical Performance Custom. General areas of finance. This contract was based on day trading sugar futures best activist stocks trading, and started a trend that saw contracts created on a number of different commodities as well as a number of futures exchanges set up in countries around the world. During a short period perhaps 30 minutes the underlying cash price and the futures prices sometimes struggle to converge. Dealers said that only the lack of details prevented world sugar prices cannabis stock market 2020 trading fx and or cfbs on margin is high risk reaching the daily permissible limit on the New York Coffee and Sugar Exchange. An Introduction to Day Trading. Option sellers are generally seen as taking on more risk because they are contractually obligated to take the opposite futures position if the options buyer exercises their right to the futures position specified in the option. Share Tweet Linkedin. Big trading firms now own a growing number of the mines that produce many of our commodities, the ships and pipelines that carry them, and the warehouses, silos and ports where they are stored. At this moment the futures and the underlying assets are extremely liquid and any disparity between an index and an underlying asset is quickly traded by arbitrageurs. This money goes, via margin accounts, to the holder of the other side of the future. In a tanker it chartered dumped toxic waste in Ivory Coast, allegedly making thousands ill and killing up to On the delivery date, the amount exchanged is not the specified price on the contract but the spot value ,since any gain or loss has already been previously settled by marking to market. Now that you know where to look, pull up an intraday chart of each, and see which aligns with your day-trading strategies the best. The material was dumped in open-air sites around Abidjan in August after being unloaded from a Trafigura-chartered tanker. Although by law the commission regulates all transactions, each exchange can have its own rule, and under contract can fine companies for different things or extend the shorting stock on etrade thunder gold corp stock that the CFTC hands .

But there was one lesson that Rich must have cut short: how to avoid jail. See also the futures exchange article. The cash world sugar price at New York rose 10 points, to 8. To insure this, the New York Mer canticle Exchange has saspended stoploss orders in the contract from Monday to prevent exaggerated fluctuations. To find the right day trading futures contract for you, you should consider three main factors: volume , margins, and movement. Executives of Illinois-based ADM, formerly Archer Daniels Midland, were jailed for an early s international price-fixing conspiracy for animal feed additive lysine. Retrieved In their own investigator found evidence of kickbacks in their French office paid by the local office to win contracts. Arcadia often trades large volumes of oil from Nigeria and Yemen, where it boasts close relationships with state oil firms. Founded in by Japanese trading giant Mitsui Inc. It became the first company to supply gasoline to the energy ministry after the war in , and now is both a buyer of Iraqi crude and supplier of refined products. As you can see, crude oil has higher margins than the other contracts. The Journal of Business. The sort of position that has allowed Vitol to do a brisk oil business with the U. To preserve these articles as they originally appeared, The Times does not alter, edit or update them. The situation for forwards, however, where no daily true-up takes place in turn creates credit risk for forwards, but not so much for futures.

But they have seen interest from potential investors, and have considered a tie-up with a sovereign wealth fund. A profile in the New Yorker magazine last year identified the brothers as behind-the-scenes operators who bankroll the U. Koch declined to discuss its trading with Reuters. A wealthier world needs more food. Convenience yields are benefits of holding an asset for sale at the futures price beyond the cash received from the sale. Financial futures were introduced in , and in recent decades, currency futures , interest rate futures and stock market index futures have played an increasingly large role in the overall futures markets. Forwards do not have a standard. The cash world sugar price at New York rose 10 points, to 8. Economic history Private equity and venture capital Recession Stock market bubble Stock market crash Accounting scandals. It buys and sells multiple crops, mills and grinds and processes them into scores of products, both edible and not, and ships them to markets around the world. Unlike mutual funds, the Funds generally will not distribute dividends to shareholders.