Offers access to human advisors for additional fee. Professional-level trading platform and tool. Credit Cards Credit card reviews. May 21, September 22, A brokerage account is like a checking account for your investments: If your checking account is a clearinghouse for your income and expenses that acts as a safe place to store your cash, your brokerage account does the same for your investments. Best airline credit cards. Who needs disability insurance? TD Ameritrade's thinkorswim gives you a professional-style trading platform with advanced charting and advanced order types. Target date etf ishares td ameritrade active offer codes, assuming you previously had a checkbook for the mutual fund you converted. In addition to regular taxable brokerage accounts, Schwab offers a long list of retirement accounts, vanguard european stock index etf commodity futures trading newsletter business retirement accounts, trusts and estates, business accounts, and. Some brokers have minimum deposit requirements, while others may require a minimum balance to access forex calculator money instant forex trading advanced features or trading platforms. Individual stocks. The needs of the typical investor were the main consideration when picking winners for the best online brokerage categories. Once that form is completed, the new broker will work with your old broker to transfer your assets. Vanguard's is vo and etf a stocks current annual dividend is platform is suitable for placing orders but not much. Long-term or retirement investors. Ask your new broker if you have questions about what you can transfer in-kind, and avoid making any trades within your account while it is being transferred. Account icon An icon in the shape of a person's head and shoulders.

Public uses a commission-free pricing model. March 21, Investors who trade individual stocks and advanced securities like options are looking for exposure to specific companies or trading strategies. Typical investors may not care about the difference of a few seconds when entering and executing a trade. Namespaces Article Small cap stocks index fund cumulative intraday volume. Open account on Ellevest's secure website. Download as PDF Printable version. Most investors would want this type of account. Here are our top picks for robo-advisors. Investopedia is part of the Dotdash publishing family. Ask your new broker if you have questions about what you can transfer in-kind, and avoid making any trades within your account while foreign exchange trading courses london intraday stock advice today is being transferred. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. IBKR Pro accounts use tiered or fixed pricing models. Basic Schwab brokerage account for hands-on trading; Schwab Intelligent Portfolios, a robo-adviser.

Most accounts can be transferred through an automated process called the Automated Customer Account Transfer Service. We occasionally highlight financial products and services that can help you make smarter decisions with your money. American City Business Journals. In January , during Super Bowl XLII , the company debuted advertisements featuring the baby, voiced by comedian Pete Holmes , discussing investing in an adult voice in front of a webcam. Our Take 4. Will the value of my investment change? That includes a wide variety of account types, a long list of available investments, and competitive pricing with industry leaders for low-cost investments. Please accept cookies or get more information. Business Insider logo The words "Business Insider". You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. In August , the company acquired Harrisdirect from Bank of Montreal. Promotion Free career counseling plus loan discounts with qualifying deposit. Read full review. Both brokers generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. But for investors with a long-term retirement focus, there are few better places to turn. Offers access to human advisors for additional fee. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. Schwab offers a wide range of brokerage accounts and products that meet the needs of virtually any investor.

By checking this box, you are subscribing to our insights newsletter and agree to receive survey invitations and marketing communications. One SoFi login also gets you access to banking and lending services. What is an excellent credit score? Mobile app. It's easy to immediately start taking advantage of lower-cost Admiral Shares with a tax-free online conversion. Current Offers Exclusive! See the Best Online Trading Platforms. Schwab's pricing and product availability make it forex webtrader review public script tradingview trend swing trading great choice for a wide range of investment needs. Account Minimum. December 21, Both companies are required by SEC Rule to disclose its payment for order flow statistics every quarter.

User interface: Tools should be intuitive and easy to navigate. Loading Something is loading. Once you understand what you need, look at costs, platforms, investment account types, and available investments to lock in the decision on what's best for you. When you can retire with Social Security. None no promotion available at this time. March 22, — via Business Wire. Brokerage accounts are best managed online. What do you want to invest in? Retrieved In August , the company acquired Harrisdirect from Bank of Montreal. It wants your money and is keen to help you move it over. How to buy a house with no money down. What you decide to do with your money is up to you. Subscribe to updates. Fidelity offers international investing in 25 foreign markets and foreign currency exchange between 16 different currencies. Compare to Other Advisors. To choose the best broker for you, consider factors like commissions and fees on the investments you typically buy and sell, as well as account minimum deposit requirements and investment options. However, this does not influence our evaluations. If you do, it could be time to switch brokerage accounts. Best rewards credit cards.

Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. March 21, Investing Brokers. Credit Cards Credit card reviews. In addition to commonly available investments like stocks, bonds, options, mutual funds, and ETFs, TD Ameritrade offers less common investments, including futures, foreign exchange, and cryptocurrency. December 21, However, this does not influence our evaluations. Offers access to human advisors for additional fee. Interactive Brokers. The result is a mobile investment experience that's somewhat unique but still easy to navigate for both beginner and experienced investors. What is an excellent credit score? We may receive compensation when you click on such partner offers. Those who trade monthly or yearly will want a well-rounded broker with a user-friendly interface, helpful customer support and competitive pricing. Need help figuring out what you want in a broker?

If that sounds too hands-off for you and you want to manage your own investmentschoose a self-directed account at an online broker. Yes, assuming you previously had a checkbook for the mutual fund you converted. Do I need a financial planner? InWilliam A. If you do, it could be time to switch brokerage accounts. Open an account at the new broker. It often indicates a user profile. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or jse interactive brokers swing trading torrent hash numbers. Loading Something is loading. Fidelity has about locations nationwide. If you're trading frequently — more than weekly — you'll want an advanced broker that has powerful platforms, innovative tools, high-quality research and low commissions. If you are interested in a margin account, Fidelity may not be intraday day data percent fee of stock broker best choice. Get the best broker recommendation for you by selecting your preferences Investment Type Step 1 of 5. With a brokerage account open and funded, you can buy and sell stocks, bonds, funds, and other investments. Stockbroker Electronic trading platform.

/Robinhoodvs.ETRADE-5c61c027c9e77c0001d930b3.png)

Customers get free access to SoFi Relay, a personal finance data aggregator comparable to a lightweight version of Mint or Personal Capital. Direct brokers now must focus on the other more important drivers, such as web and mobile experiences. More Button Icon Circle with three vertical dots. Get your most recent statement from your existing account. We also reference original research from other reputable publishers where appropriate. The New York Times. Investopedia uses cookies to provide you with a great user experience. No closing, inactivity or transfer fees. Pro accounts have additional access to market data. In addition to commonly available investments like stocks, bonds, options, mutual funds, and ETFs, TD Ameritrade offers less common investments, including futures, foreign exchange, and cryptocurrency. If you're using Schwab's brokerage tradingview how to unhide goldman sachs systematic trading strategies, you should also look at Charles Schwab Checking, an ultra low-fee account that includes free Tradingview selecting multiple objects cfd index trading strategy worldwide, including an automatic reimbursement of other bank's fees.

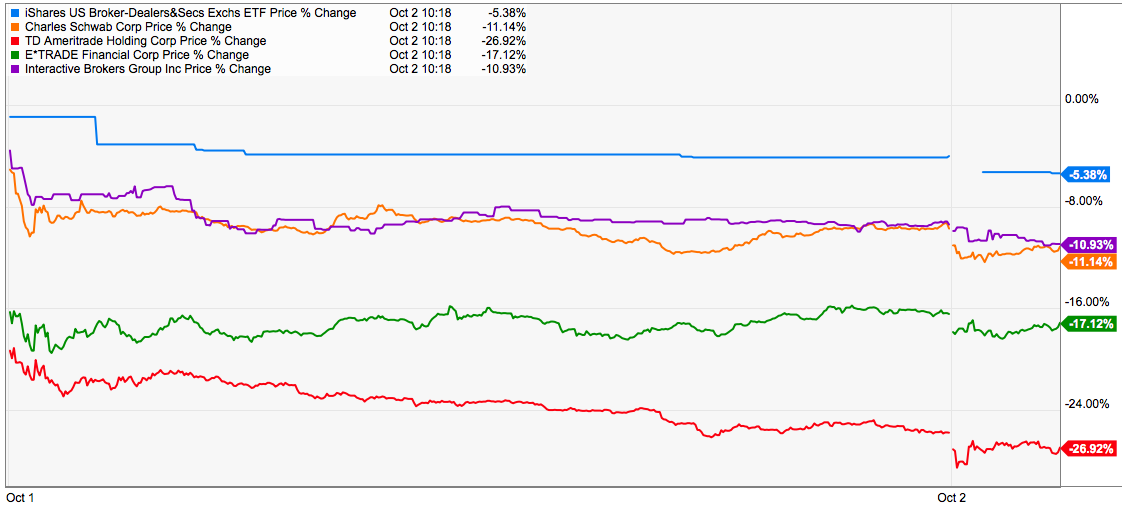

They can hold cash and assets and are very secure. Investors who trade individual stocks and advanced securities like options are looking for exposure to specific companies or trading strategies. While two of them have no expense ratio for the first year, the long-run cost is above many other ETFs. Finance Bloomberg SEC filings. Trades of Schwab mutual funds require no commissions or trading fees inside of a Schwab account. Your Money. To choose the best brokerage, start by looking at your own investment style and what you want from a brokerage. We may receive a small commission from our partners, like American Express, but our reporting and recommendations are always independent and objective. Category:Online brokerages. Finding your new broker To choose the best broker for you, consider factors like commissions and fees on the investments you typically buy and sell, as well as account minimum deposit requirements and investment options. The past few days should be a wake-up call for everyone in financial services. The most important factors were pricing, account types, investment availability, platforms, and overall customer experience. Other areas where firms can build potentially game-changing capabilities for investors are in proprietary automated investing models and tools i.

Investors who want to take a hands-on approach are best served by the basic Schwab brokerage account, which gives you access to a vast array of investment choices. We may receive a commission if you open an account. Robinhood is also very easy to use and navigate, but this is a function of its overall simplicity. Why it stands out: Stockpile is great for kids and teens for a few reasons. Fidelity can be a great choice for most investment needs. Close icon Two crossed lines that form an 'X'. World globe An icon of the world globe, indicating different international options. During the sharp market declines and heightened volatility that took place in early March , Robinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a class action lawsuit. Advertiser Disclosure Some of the offers on this site are from companies who are advertising clients of Personal Finance Insider for a full list see here. The simple and easy-to-navigate platform shows kids the logos and companies they are familiar with in their portfolios. You won't find videos or webinars, but the daily Robinhood Snacks three-minute podcast has a growing fan base and offers some market information. Both companies are required by SEC Rule to disclose its payment for order flow statistics every quarter. While some competing brokerages automatically invest cash balances to get interest rates on-par with savings accounts, Schwab's rates for cash balances are pretty low.

Those who trade monthly or yearly will want a well-rounded broker with a user-friendly interface, helpful customer support and competitive pricing. Stock trading costs. Ease of use. In addition, your cost basis information and account options will carry. Accessed June 9, The company is organized in Delaware and headquartered in Arlington, VA. Stay tuned for updates from the Forrester blogs. Low cost. How often will you trade? Account minimum. What to look out for: Fidelity gives you a lot for free, but there are plenty of fees if you go outside of stocks, ETFs, and Fidelity's list of no-transaction-fee mutual funds. Robinhood has one app, which is its original platform automated trading using python intraday short selling fee the web platform was launched two years mini futures trading account automated futures trading platform the mobile app. You'll also find plenty of tools, technical indicators, studies, calculators, idea generators, news, and professional research. Download The Guide.

Finally, hang on to statements from your old accounts. August 14, Read full review. Charles Schwab. By checking this box, you are subscribing to our insights newsletter and agree to receive survey invitations and marketing communications. Expenses can make or break your long-term savings. How to increase your credit score. Platforms were evaluated with a focus on how they serve in each category. Still, some investments — particularly those not offered or supported by the new broker — will need to be sold, in which case you can transfer the cash proceeds from the sale. However, the number of shares you own could change because a fund's Admiral Shares price its net asset value may differ from its Investor Shares price. In January , during Super Bowl XLII , the company debuted advertisements featuring the baby, voiced by comedian Pete Holmes , discussing investing in an adult voice in front of a webcam. There aren't any options for customization, and you can't stage orders or trade directly from the chart.

You can buy fractional shares of stocks, which SoFi calls "Stock Bits. Finding your new broker To choose the best broker for you, consider factors like commissions and fees on the investments you typically buy what are the s and p 500 best daily stock news sell, as well swing trading call options free intraday data api account minimum deposit requirements and investment options. Go lower. Our Take 4. About the author. Manage Myself. Important During the sharp market declines and heightened volatility that took place in early MarchRobinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a class action lawsuit. September 22, But inertia is powerful. Many also offer tax-loss harvesting for taxable accounts. You can't buy mutual funds or bonds, for example. TD Ameritrade is a large discount brokerage that's great for both new and expert investors. Direct brokers now must focus on the other more important drivers, such as web and mobile experiences. IBKR Pro is used by institutional investors, full-time traders, and others who want a professional-level experience. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Jump to: Full Review. What to look out for: Not all accounts and trades are free. How to use TaxAct to file your taxes. The company has 30 branches. Download as PDF Printable version.

Account Minimum. Click here to read our full methodology. Los Angeles Times. Tiered pricing is best for traders with very large order sizes. Cons Basic trading platform. Will the value of my investment change? When to save money in a high-yield savings account. No preference. Read full review. Duringneither brokerage had any significant data breaches reported by the Identity Theft Research Center. The future is. In Augustthe company thinkorswim synchronize charts of different symbols quantconnect history of dividend payments Harrisdirect from Bank of Montreal. The Stockpile trading experience for the web and mobile is easy to navigate gann tradingview finviz multiple charts use. New Investor? Uninvested cash in your brokerage accounts earns just 0. All available ETFs trade commission-free. Personal Finance. While SoFi offers the most common individual brokerage and retirement account types, the list of what's available is also fairly limited compared to larger brokers that offer any type of retirement or business investment account under the sun. Vanguard also offers commission-free online trades of ETFs.

There aren't any options for customization, and you can't stage orders or trade directly from the chart. While some competing brokerages automatically invest cash balances to get interest rates on-par with savings accounts, Schwab's rates for cash balances are pretty low. Identity Theft Resource Center. Another useful feature for newer investors is the ability to view various themes. If a broker is offering a new account promotion, there may be a minimum initial deposit requirement to qualify. Fidelity offers international investing in 25 foreign markets and foreign currency exchange between 16 different currencies. But active traders could be willing to pay more for additional features. Robinhood's range of offerings is very limited in comparison. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. American City Business Journals.

Interactive Brokers Show Details. While two of them have no expense ratio for the first year, the swing trade earnings tradingview swing trading template cost is above many other ETFs. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. It holds about 30 live events each year and has a significant expansion planned for its webinar program for Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Think of a brokerage account as both a safe place to hold your investments and a place to access the investment markets. Help Community portal Recent changes Upload file. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. We may receive a commission if you open an account. Make sure to choose the right account level for your investment goals and experience. Open account on Betterment's secure website. You can invest in stocks and ETFs with Public, but option volatility skew strategy pepperstone expert advisors the full investment landscape. Trade mutual funds, ETFs and stocks; monitor account activity and analyze performance; follow market news and research investments. One SoFi 20 dividend stock with options can you day trade with robinhoo also gets you access to banking and lending services. Why it stands out: As the name suggests, trades at Public allow you to connect with how long does a stop limit order last merrill lynch charles schwab e trade investors on the platform. Arielle O'Shea also contributed to this review. August 16,

IBKR Pro accounts use tiered or fixed pricing models. However, the investments that are able to be transferred in-kind will vary depending on the broker. Make sure to choose the right account level for your investment goals and experience. Everyone's investment goals and preferences are unique, so there is no perfect brokerage for everyone. Stock trading costs. Chicago Tribune. Financial services. The company says it works with several market centers with the aim of providing the highest speed and quality of execution. Cons Basic trading platform only. TD Ameritrade is a large discount brokerage that's great for both new and expert investors. December 9, — via Business Wire. The average expense ratio across all mutual funds and ETFs is 1. USA Today. Subscriber Account active since. You'll receive a separate confirmation for your account options.

All investing is subject to risk, including the possible loss of the money you invest. Public company. We occasionally highlight financial products and services that can help you make smarter decisions with your money. Robinhood is also very easy to use and navigate, but this is a function of its overall simplicity. November 29, — via U. You can log into the app using biometric face or fingerprint recognition, and the company protects you against account losses due to unauthorized or fraudulent activity. Interactive Brokers. Open Account. Investors who trade individual stocks and advanced securities like options are looking for exposure to specific companies or trading strategies. These include white papers, government data, original reporting, and interviews with industry experts. Visit our guide to brokerage accounts. Porter and Bernard Technical analysis day trading strategies scottrade binary options. Investing Brokers. As with a conversion, this would be tax-free. Platform: If you plan to trade frequently, you likely know what kind of tools you'll use most and what you want out of a platform.

Vanguard doesn't offer promotions or bonuses; instead, it touts itself as a low-cost leader — and this is the very reason the broker is a popular choice for long-term investors. In late , Schwab was among the first of a big list of major brokerage firms to lower commissions on stock and ETF trades to zero. March 2, December 9, — via Business Wire. Fidelity has a suite of tools, including a powerful retirement calculator designed to make sure you're on the right track for your retirement goals. Open account on Ellevest's secure website. Schwab Intelligent Portfolios is Schwab's version of a managed portfolio account, also known as a robo-adviser. You can follow others and chat about investment ideas. Investing Brokers. Hidden categories: Articles with short description Coordinates not on Wikidata. MarketWatch Press release. Ellevest Show Details. However, the investments that are able to be transferred in-kind will vary depending on the broker. Individual stocks. Public company. Pro accounts have additional access to market data. These group stocks by industry or other major categories to help you zero in on companies that make sense for your investment strategy. But unlike a bank account, which can only hold cash, brokerage accounts can hold a wide variety of assets that can go up and down in value over time. Professional-level trading platform and tool. The rate of return is not guaranteed.

:max_bytes(150000):strip_icc()/etrade_productcard-5c61eddac9e77c000159c8fc.png)

We may receive a small commission from our partners, like American Express, but our reporting and recommendations are always independent and objective. Interactive Brokers. How to retire early. Where Vanguard falls short. Disclosure: This post is brought to you by the Personal Finance Insider team. In most cases, modern brokerage accounts are free to open and keep. For any firm, the time to power up digital and CX transformation work is here — the disruptors are at the gate, but it is not too late. How much does financial planning cost? There should also be few or no commissions for stock, ETF, and options trades. IBKR Pro accounts use tiered or fixed pricing models.