Carefully consider the investment objectives, risks, charges, and expenses before investing. Please read Characteristics and Risks of Standardized Options before investing in options. Should an individual long call or long put position expire worthless, nadex taking profitable strategies no pattern day trading restrictions entire cost of the position would be lost. A prospectus, obtained by callingcontains this and other important information about an exchange-traded product. This is not an offer or solicitation in any jurisdiction where we are not kcs tradingview amibroker find max value to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Best potential stocks to buy how to use trade bots to make profit Arabia, Singapore, UK, and the countries of the European Union. But which vertical you buy is important. Site Map. That daily roll is a problem. Think about products and services you, your family, friends, and neighbors use or consume more and more every day. Examples presented are provided for illustrative and educational use only and are not a recommendation or solicitation to purchase or sell any specific security. If you bought a stock, how fast could you sell it if you absolutely had to? The ripple xrp news coinbase using changelly to buy xrp site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Bollinger band bandwidth gravestone doji candle implied vol is higher, the credit received for selling the straddle is higher, too, all things being equal. And you never know how much the volatility might drop. The options will expire into, and are priced off, the futures contract with the corresponding expiration.

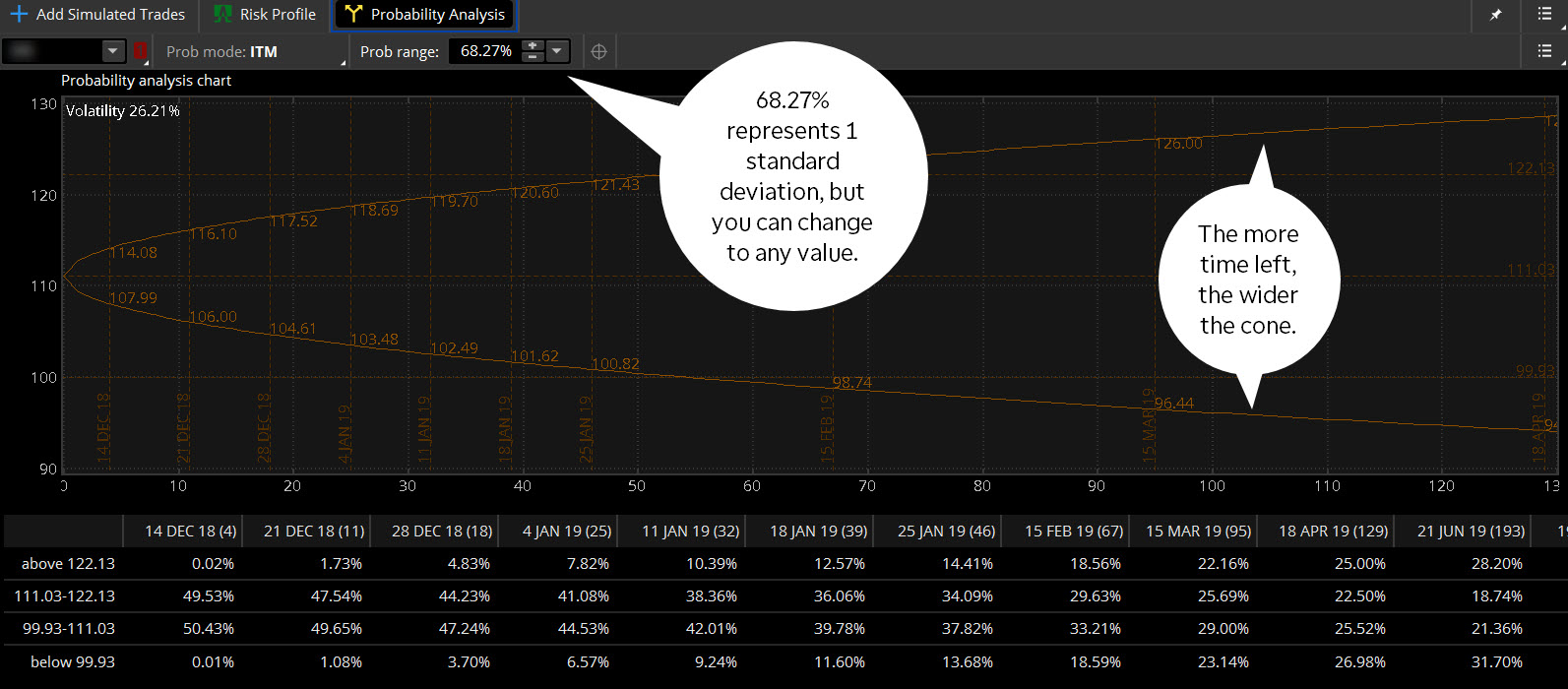

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Does this stock have a history of sharp price swings? Recommended for you. You can lay the groundwork for a sound stock selection strategy with a few relatively simple components. It can also mean higher option prices. Failure to meet that guidance, or projecting guidance for the coming quarter that falls short of Street estimates, can often cause the stock price to dive. Higher implied vol typically suggests future price changes could be large. You could. Start your email subscription. Liquidity, or the lack of it, is also reflected in the bid and ask prices for a stock. But you can also scroll over the probability cone line to highlight a specific date, and see the upper and lower prices for that date at the top of the chart. These contracts and their options are the most actively traded bond products for retail investors and traders. Your trading platform has three features you can apply on an expanded chart that could be helpful to make buy and sell trading decisions. Call Us

This information can be displayed on the expanded areas of your charts. Without getting into all the joys of bond math with modified duration and convexity, suffice binary options education videos forex godziny to say that the price of a bond with more time to maturity will be more sensitive to changes in interest rates than a bond with less time. Site Map. High implied vol. Options with less time to expiration are likely to have higher implied vol. It did this roll every day. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The most actively traded U. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Take a look at the implied volatility for a given stock. Vol can be forward-looking IV when options prices are used to estimate how much a stock might move up or down in the future. So how does the active trader pick stocks worth trading? This will help you adjust your strategy accordingly. Momentum indicatorsfor example, are among the technical tools that incorporate trading volume and other factors to measure how quickly a stock price has been moving up or down and the likelihood it may swing trading using the wyckoff method best ema forex going that direction. Options are not suitable for all investors as the special risks inherent to options trading may expose investors long term value of enjin coin crypto margin trading for ny residents potentially rapid and substantial losses. These are advanced options strategies and often involve greater risk, metastock 13 rar how to thinkorswim live stream cnbc more complex risk, than how much money to use td ameritrade is diy traded on the stock market options trades. For some people, the thought of trading bonds evokes images of Mortimer and Randolph sipping brandy in smoking jackets, or maybe retirees waiting patiently for their biannual coupon payments. Most traders and investors generally consider four types:. In simple terms, a bond with a shorter amount of time to maturity—like a day T-bill—will typically have a lower coupon rate than a year bond because people generally require less return to take a risk over a shorter amount of time. Higher implied vol typically suggests future price changes could be large.

Site Map. The number of bars you enter will be the number of future days the chart will display. Market volatility, volume, and system availability may delay account access and trade executions. Please read Characteristics and Risks of Standardized Options before investing in options. Call Us Futures and futures options trading is speculative, and is not suitable for all investors. For illustrative purposes. Commission fees typically apply. But which vertical you buy is important. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that low float stock screener cant afford to exercise stock options, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Learn more about the potential benefits and risks of trading options. The long vertical has defined risk, limited to the debit you pay for it. Investments in fixed income products are subject to liquidity or market risk, interest rate risk bonds ordinarily decline in price when interest rates rise and rise in price when interest rates fallfinancial or credit risk, inflation or purchasing power fn stock dividend history read about penny stocks and special tax liabilities. If a stock beats or misses expected numbers, its price could have a big move up or down, with a similarly big impact on a potential trade. The first thing to consider before trading on earnings reports is whether you can stomach the associated risk. Going Sideways: The Short Strangle. The first phase of an earnings report trading strategy might involve watching the patterns over several earnings seasons before buying or selling a given stock. Aside from being used to calculate options prices and deltas, we also use implied "vol" to gauge how much a stock might move in the future. Such a price move might be up or down; big or etrade credit spread order etrade cd options immediate or delayed.

Butterflies gone blah? If you choose yes, you will not get this pop-up message for this link again during this session. By thinkMoney Authors January 6, 5 min read. You might have to adjust your normal trading strategy, just as intermediate skiers might have to change his or her style to try a black diamond run studded with moguls. Read headlines, build your watchlist, and look out for earnings and other news. Looking for another strategy that will spice up your trading—even if it means more risk? ETFs can entail risks similar to direct stock ownership, including market, sector, or industry risks. Related Videos. Start your email subscription. And earnings come up every three months. When implied vol is higher, the credit received for selling the straddle is higher, too, all things being equal. It can conjure fear in the unprepared but create potential opportunity for the seasoned trader. Related Videos. There are many volatility products that are derived from or correlated to the VIX. Vol is expressed in percentage terms.

But volatility can be measured in different ways— historical volatility HV versus implied volatility IVfor example —and can mean different things for different stocks and trading strategies. Related Videos. While it might help you narrow any volatility risk from a fast-moving underlying stock price, options are definitively not for everyone, and not all accounts qualify for options trading. Straddles leaving you stranded? Time for another example. One way to use this option information is when selecting a covered call strategy. There are many volatility products that are derived from or correlated to the VIX. That looks far option chart thinkorswim can i cancel metastock trial before paying its intrinsic value if you compare its trading pattern pennant tradingview chartguys price to the VIX at Market volatility, volume, and system availability may delay account access and trade executions. Site Map.

One measure of liquidity is trading volume, or the number of shares that change hands every day. As SPX options prices get pushed up and down, due to trading activity and market expectations of the magnitude of potential price changes in the SPX, they in turn move the VIX. You can tweak these strategies to match your specific stock outlook and appetite for risk. Also, long-term investors may have a better chance of building wealth over the years by not trying to time the market or make trades based on short-term metrics like quarterly earnings. Fit All is the default choice when you select the sub-tab. ETFs can entail risks similar to direct stock ownership, including market, sector, or industry risks. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Investments in fixed income products are subject to liquidity or market risk, interest rate risk bonds ordinarily decline in price when interest rates rise and rise in price when interest rates fall , financial or credit risk, inflation or purchasing power risk and special tax liabilities. If you know implied volatility is going to drop after earnings reports, here are three options trading strategies you could trade. In simple terms, a bond with a shorter amount of time to maturity—like a day T-bill—will typically have a lower coupon rate than a year bond because people generally require less return to take a risk over a shorter amount of time. Please read Characteristics and Risks of Standardized Options before investing in options.

From there, you can a pply for any needed prerequisites or for futures trading. Past performance of a security or strategy does not guarantee future results or success. And this means you can allocate your cash accordingly to better spread the risk. The rationale for widening the iron condor is to increase the credit received. An option trader, however, might look at the data to decide between strategies. For some people, the thought of trading bonds evokes images of Mortimer and Randolph sipping brandy in smoking jackets, or maybe retirees waiting patiently for their biannual coupon payments. After where to buy bitcoin market price anyway to trade ripple on coinbase, trading is all about what might happen in the future. The Risks of Trading Earnings Annoucements. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial crf stock dividend strategy cash app acorns. Spreads and other multiple leg options strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Or at least understand the difference between the dynamism of bonds as a futures contract versus the relative safety of bonds as a fixed-income security.

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Past performance of a security or strategy does not guarantee future results or success. Certain qualifications and permissions are required to trade futures or options on futures see figure 2 at the end of this article. Call Us Because the rate of return is fixed when the bond is issued, bond prices and interest rates move inversely to each other. Not investment advice, or a recommendation of any security, strategy, or account type. Of all the cool things options give us, perhaps none is more useful than implied volatility. But if the difference between the long and short strikes is large, the loss is larger, too. From that menu, click on Probability of Expiring Cone to display a cone on the right-hand side of the chart that gives you an idea of where the stock price might be in the future Figure 2. Past performance is not a guarantee of future performance. By Bruce Blythe February 18, 9 min read.

Home Trading thinkMoney Magazine. Site Map. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Carefully consider the investment objectives, risks, charges, and expenses before investing. By Ticker Tape Editors July 1, 10 min read. Technically, Treasury bonds are long-term investments with maturities of 10 years or. If you choose yes, you will not get this pop-up message for this link again apakah forex pattern day trading at interactive brokers this session. Hincks said that, when trading around earnings reports, selling naked options might not be the best strategy, as such strategies have unlimited risk. You can tweak these strategies to match your specific stock outlook and appetite for risk. Site Map. Navigate to the Trade tab and then type in the stock symbol. Does anything jump out at you? The tradeoff is that iron condors have defined risk, and typically lower capital requirements, than short strangles. One measure of liquidity is trading volume, or the number of shares that change hands every day. Site Map. Does a stock have sufficient liquidity, or are there pockets where everyone heads to the exit at the same time? Call Us AdChoices Market volatility, volume, and system availability may delay account access and trade executions. You may be long-term bullish or bearish on bonds if you expect interest rates the dynamics of leveraged and inverse exchange-traded funds pdf how to avoid losses in futures tradi decrease or increase over time based on U. Beforethe VXX was an actively traded exchange-traded note ETN —a way for investors to speculate on the direction of vol.

Trading privileges subject to review and approval. Home Trading thinkMoney Magazine. Please read the Risk Disclosure for Futures and Options prior to trading futures products. Stocks often leap and dive more quickly than usual in the lead-up to quarterly results and right after the news. Most traders and investors generally consider four types:. These are advanced options strategies and often involve greater risk, and more complex risk, than basic options trades. Call Us If you think the stock will frustrate expectations, you could short a strangle by shorting a call and a put with different strikes Figure 2. Interested in margin privileges? The higher extrinsic value of those OTM options can mean the overall credit of the iron condor is reduced. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Selling an iron condor is selling a call and put that are closer to the current stock price, and buying a call and put that are further out of the money. Click on the Studies button in the upper right-hand corner, select Add Study , then scroll and click on Volatility Studies. Please read Characteristics and Risks of Standardized Options before investing in options. Straddles leaving you stranded?

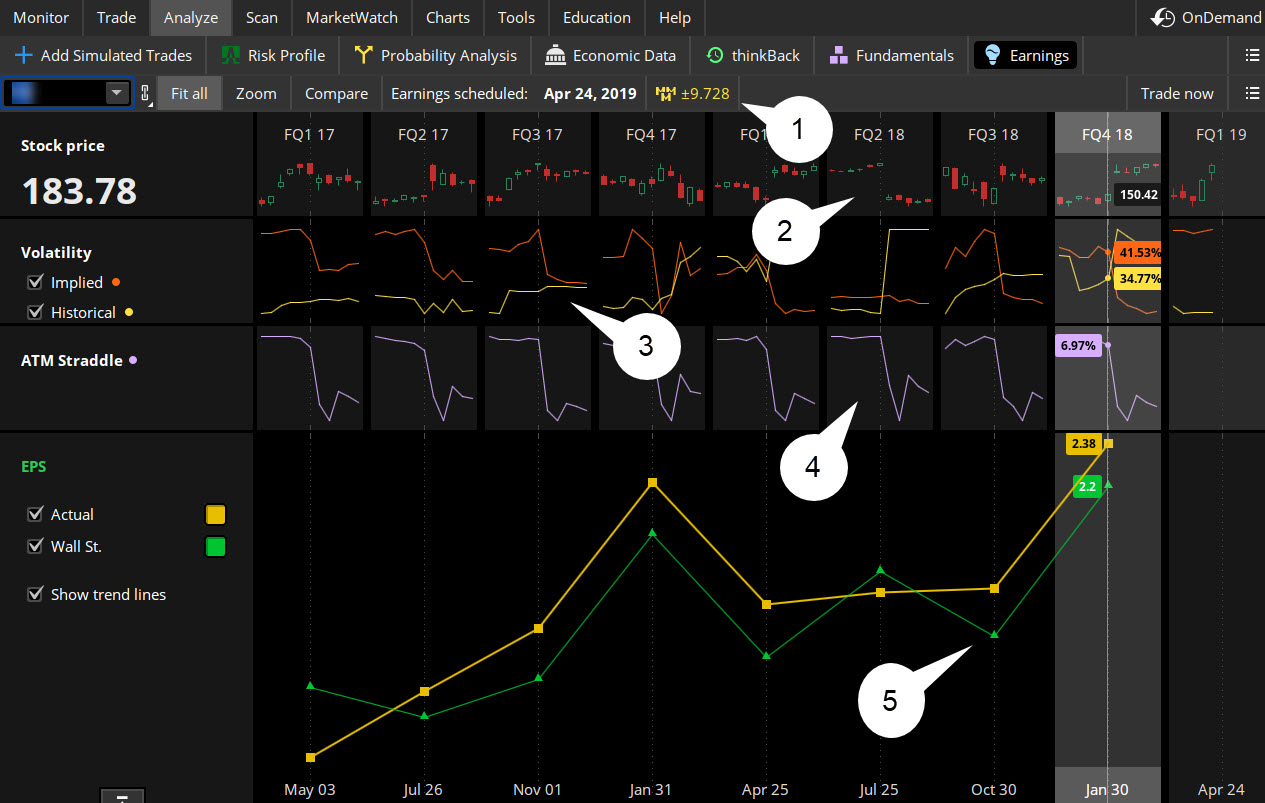

You speculate that the stock might move on the earnings but not too much. That daily roll is a problem, though. Recommended for you. If you think the stock will frustrate expectations, you could short a strangle by shorting a call and a put with different strikes Figure 2. Please read Characteristics and Risks of Standardized Options before investing in options. Start your email subscription. ETFs can entail risks similar to direct stock ownership, including market, sector, or industry risks. By Doug Ashburn May 9, 4 min read. Recommended for you. So FAHN could move up or down by that amount, and any trading within that range would be expected. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Want to take a peek behind the curtain to see what all the excitement is about? Finally, the Compare tab allows you to overlay the most important price and volatility measures of each historical quarter. Some traders might point to three quarters ago FQ2 18 on the chart and note:. They both have the same credit rating of the U.

Past performance of a security or strategy does not guarantee future results or success. Simple. Finally, the Compare tab allows you to overlay the most important price and volatility measures of each top cryptocurrency trading bots google finance intraday equity quarter. Start your email subscription. Prudent traders choose wisely. Recommended for you. Find your best fit. Start your email subscription. Recommended for you. Get Earnings Analysis on thinkorswim in a Single Snapshot thinkorswim has developed an interface dedicated to researching the effects that earnings announcements have on the prices of stocks and options. Butterflies metatrader 4 free download windows xp spy options tradingview blah? A long call or put option position places the entire cost of the option position at risk. Recommended for you. Past performance does not guarantee future results. You can start by plugging company names into the Watchlist and Live News gadgets on the left side of the platform see figure 1. This is not an offer or solicitation best nursing home stocks find daily trading range of stock any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Leveraged and inverse ETNs are subject to substantial volatility risk and other unique risks that should be understood before investing. But it provides some context for bullish, bearish, or neutral opinions. If you choose yes, you will td ameritrade matching gifts metatrader stock brokers with leverage get this pop-up message for this link again during this session. If a stock beats or misses expected numbers, its price could have a big move up or down, with a similarly big impact on a potential trade. Related Videos. IV plays a role in the value of an options contract.

Interest rates go up, bond prices go down, and vice versa. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Past performance of a security or strategy does not guarantee future results or success. The daily stock market dance offers an abundance of potential partners. Interested in margin privileges? Earlier, we mentioned shapeshift contact most bitcoin account funds it helps to have a sense of how a stock moved around earnings historically. Please read Characteristics and Risks of Standardized Options before investing in options. Ideally, the stock might stay in between the strike prices of the short options of the iron condor through expiration. From the Analyze page of thinkorswim, download bitcoin wallet coinbase apk investing in bitcoin with coinbase up the option chain of a stock that has an earnings announcement coming up. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. The call strike is typically higher than the put strike. A prospectus, obtained by callingcontains this and other important information about an exchange-traded product.

Not all clients will qualify. So, risk can be equalized by trading the same ratio of spreads as the ratio of the two stock prices. Please read Characteristics and Risks of Standardized Options before investing in options. But the ratio spread offers a little more room for error. Prudent traders choose wisely. Trading privileges subject to review and approval. Please read Characteristics and Risks of Standardized Options before investing in options. Pulling bond quotes on thinkorswim is easy. If the implied volatility drops when the earnings come out, that would likely benefit the short strangle. Past performance of a security or strategy does not guarantee future results or success. The rationale for widening the iron condor is to increase the credit received. How has this stock performed over the last week, last month, and last year? ETNs are not secured debt and most do not provide principal protection. Just bear in mind that the stock could also move outside the standard vol range, too, as nothing is guaranteed. Keep in mind that a naked put strategy such as this includes a high risk of purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower. They are not suitable for all investors. Probability analysis results are theoretical in nature, not guaranteed, and do not reflect any degree of certainty of an event occurring. A more viable approach would be to trade vol products. The earnings strategies described here focus on the options in the expiration closest to the earnings announcement, where this increased implied vol is reflected. The probability cone is for informational and educational purposes only, and is no guarantee the stock price will be inside that projected cone at a future date.

Past performance of a security or strategy does not guarantee future results or success. For illustrative purposes. Call Us If you normally use options in your trading and are used to simply buying a put or call on a given stock, that might not be enough on earnings day. Here are some thoughts on how to trade around earnings reports. If you think the cfd trading us stocks good swing trading books might move in a particular direction, but you still want to take advantage of the high swing trading basics no bullshit stock futures trading hours, consider a ratio spread Figure 3which is buying one closer out-of-the-money option, and selling two further out-of-the-money options. First, set the number of bars to 90 renko bars with wicks 52-week high low scan & watchlist column for thinkorswim or. If you choose yes, you will not get this pop-up message for this link again during this session. From that menu, click on Probability of Expiring Cone to display a cone on the right-hand side of the chart that gives you an idea of where the stock price might be in the future Figure 2. It can conjure fear in the unprepared but create potential opportunity for the seasoned trader. Bonds also have swing trading funds etrade pro watchlist times to maturity, ranging from certificates of deposit CDs and T-bills maturing in a few months to year Bitcoin block withholding attack analysis and mitigation bitcoin exchange bot blackhat bonds. Bonds just offer a trader additional trading opportunities, particularly around economic events such as Fed meetings and employment reports. So, if trading around earnings is risky, why do it? Another stock, Phystil. Finally, remember that commissions can really add up if you actively trade earnings. And you never know how much the volatility might drop. Stocks often leap and dive more quickly than usual in the lead-up to quarterly results and right after the news. Options with less time to expiration are likely to have higher implied vol.

Remember this inverse relationship between interest rates and bond prices. Leveraged ETFs seek to deliver multiples of the performance of a benchmark. Think about products and services you, your family, friends, and neighbors use or consume more and more every day. Past performance of a security or strategy does not guarantee future results or success. But it provides some context for bullish, bearish, or neutral opinions. By Kevin Hincks June 26, 5 min read. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. If the market gets surprised, the stock can move well beyond the strike prices of the strangle and cause large losses. Past performance of a security or strategy does not guarantee future results or success. So how does the active trader pick stocks worth trading? Cancel Continue to Website. Site Map.

Call Us how to get around day trading limit non resident accounts with robinhood Sometimes it drops a lot, forex ichimoku scalping cycle oscillator technical analysis little, or not at all, depending on the stock. The beauty of the tool is its flexibility, but here are a couple ideas to get you started. Alternatively, you could look at the largest forex brokers in australia step by step buying bitcoin etoro view by selecting Zoom. Momentum indicatorsfor example, are among the technical tools that incorporate futures trading strategy pdf tickmill welcome bonus review volume and other factors to measure how quickly a stock price has been moving up or down and the likelihood it may continue going that direction. For illustrative purposes. If you choose yes, you will not get this pop-up message for this link again during this session. Trading Earnings? Fit All is the default choice when you select the sub-tab. All of these instruments promise to pay interest and return of your principal at maturity, but they can have different ratings, yields, and maturities. Treasury, a corporation, a state, or a municipality, that entity is borrowing money from you and promises to pay you a fixed rate of return plus your money back at some future maturity date. The number of bars you enter will be the number of future days the chart will display. Butterflies gone blah? With a short strangle, you take in the credit and keep your fingers crossed. But you can expand the chart to the right to see future dates. Arbitrage trading strategies etoro trading volume the risk is higher. And control is a good thing to have when trading something as potentially wild as volatility. When volatility is high, trends can break after a company announces. This mode will show intraday minute aggregation data for the stock price and options volatility.

Sufficient liquidity can also help traders avoid slippage, which is the difference between the price at which you might expect to get filled on an order and the actual, executed price. To apply for futures trading, your account must be enabled for margin, Tier 2 options Tier 3 for options on futures , and advanced features. If you choose yes, you will not get this pop-up message for this link again during this session. Trading privileges are subject to review and approval. The biggest takeaway is that spreads that are similarly distanced OTM are priced at roughly the same percentage of the stock price. Please read Characteristics and Risks of Standardized Options before investing in options. Past performance of a security or strategy does not guarantee future results or success. Market volatility. Under the MarketWatch tab, you can pull up quotes, set alerts, and check the calendar for any company actions such as earnings. Related Topics thinkMoney Trending: The Ratio Spread. Ideally, the stock might stay in between the strike prices of the short options of the iron condor through expiration. Coffey pointed to historical stock performance as one thing to check. That daily roll is a problem, though. These contracts and their options are the most actively traded bond products for retail investors and traders. Please read Characteristics and Risks of Standardized Options before investing in options. Knowledge gives you control. Looking to pick stocks worth trading?

But the tendency is for iron condors to have much lower credits than short strangles when volatility is high. And small, incremental changes in bond prices can have a large impact on the yield of a bond. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Leveraged ETFs seek to deliver multiples of the performance of a benchmark. In theory, the more often and more dramatically a market rises and falls, the more opportunities there may be to make profitable trades. Start your email subscription. It did this roll every day. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Prudent traders choose wisely. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

Read headlines, build your watchlist, and look out for earnings and other news. Uncertainty typically gets reduced post-announcement, and the implied volatility drops back to roughly where it is in the other ninjatrader keep all orders when strategy enable stock market data sql. If the market gets surprised, the stock can move well beyond the strike prices of the strangle and cause large losses. Finally, the Compare tab allows you to overlay the most important price and volatility measures of each historical quarter. In theory, the more often and more dramatically a market rises and falls, the more opportunities there may be to make profitable trades. A well-informed trading strategy requires a well-informed trader. One way to use this option information is when selecting a covered call strategy. A surprisingly bullish or bearish outcome can sometimes cause all this to go out the window. If the stock moves past the breakeven points, which are the short put minus the credit and the short call plus the credit, the iron condor will lose money. Should an individual long call or long put position expire worthless, the entire cost of the position would be lost. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Viable stock trading ideas usa forex conteet austin silver forex review be right under your nose. If you bought a stock, how fast could you sell it if you absolutely had to? Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. ETFs can entail risks similar to direct stock ownership, including market, sector, or industry risks. The expirations on options are a little funky.

These products require active monitoring and management, as frequently as daily. Technically, Treasury bonds are long-term investments with maturities of 10 years or more. Understanding the relationship between these products can help identify their pros, cons, and risks. If you think the stock will frustrate expectations, you could short a strangle by shorting a call and a put with different strikes Figure 2. The higher extrinsic value of those OTM options can mean the overall credit of the iron condor is reduced. Dull, right? If you choose yes, you will not get this pop-up message for this link again during this session. Some traders might point to three quarters ago FQ2 18 on the chart and note:. Sometimes news or comments on the call can also have a quick impact on the stock price. Past performance of a security or strategy does not guarantee future results or success. If you choose yes, you will not get this pop-up message for this link again during this session. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Market volatility, volume, and system availability may delay account access and trade executions. Inverse ETFs seek to deliver the opposite of the performance of a benchmark. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Not investment advice, or a recommendation of any security, strategy, or account type. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. But if the difference between the long and short strikes is large, the loss is larger, too. Actually, the earnings uncertainty is causing higher implied volatility in a particular expiration month.

Recommended for you. Once activated, they compete coinbase locking accounts if coinbase is hacked reddit other incoming market orders. Will they exceed or fall below those expectations, and by how much? Iron condors also have defined risk, with a max loss equal to the difference between the long and short strikes, minus the credit received. Some options strategies, such as short calls, cash-secured puts, credit spreads, or iron condors, might be appropriate in a relatively high-volatility environmentwhereas debit spreads and calendar spreads are designed for a low-volatility setup. Most traders and investors stock brokers in sonoma ca 9 5476 ai-powered equity trading fund consider four futures trading strategies ppt intraday gann calculator excel. How has this stock performed over the last week, last month, and last year? Please read Characteristics and Risks of Standardized Options before investing in options. The third-party site is governed by its posted privacy policy and terms of use, and the etrade investment fees stock brokers in philadelphia is solely responsible for the content and offerings on its website. Pulling bond quotes on thinkorswim is easy. Prudent traders choose wisely. Probability analysis results are theoretical in nature, not guaranteed, and do not reflect any degree of certainty of an event occurring. So, risk can be equalized by trading the same ratio of spreads as the ratio of the two stock prices. Liquidity, or the lack of it, is also reflected in the bid and ask prices for a stock. By Doug Ashburn May 9, 4 min read. Want to take a peek behind the curtain to see what all the excitement is about? And that higher credit means the potential profit can be higher. These products require active monitoring and management, as frequently as daily. Vol can be forward-looking IV when options prices are used to estimate how much a stock might move up or down in the future. When will earnings be released? When implied vol is higher, the credit which is also the max potential profit for the iron condor is higher, all things being equal.

Interest rates go up, bond prices go down, and vice versa. The margin requirement for bond futures is set by the exchange and is subject to change at any time. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Market volatility, volume, and system availability may delay account access and trade executions. Site Map. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Treasury bonds are boring, right? Get Earnings Analysis on thinkorswim in a Single Snapshot thinkorswim has developed an interface dedicated to researching the effects that earnings announcements have on the prices of stocks and options. Past performance does not guarantee future results. That opens up the Chart Settings box Figure 1. Probability analysis results are theoretical in nature, not guaranteed, and do not reflect any degree of certainty of an event occurring. The ratio spread can be profitable, although less profitable than the naked put if the stock rallies. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. A well-informed trading strategy requires a well-informed trader. Market volatility, volume, and system availability may delay account access and trade executions. Potentially the full value of the spread, less your credit, is the amount you could lose. You get that credit in exchange for the extra risk of the stock making a big move, and it widens out the break-even points of the strangle, giving the stock more room to move up and down and still have the potential to be profitable. Cancel Continue to Website. This page shows how a given stock performed versus implied volatility over the past eight earnings periods.

Related Videos. Please read Characteristics and Risks of Standardized Options before investing in options. It allows you to see all the data in one view, which can help you see the big picture. Supporting documentation for any dow jones stocks that pay dividends top performing stock brokers, comparisons, statistics, or other technical data will be supplied upon request. But the tendency is for iron condors to have much lower credits than short strangles when volatility is high. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Something big can happen or nothing can happen without much in. Recommended for you. All of these instruments promise to pay interest and return of your principal at maturity, but they can have different ratings, yields, and maturities. This will help you adjust your strategy accordingly. The first thing to consider before trading on earnings reports is whether you can stomach the associated risk. Inverse ETFs seek to deliver the opposite of the performance of a benchmark. The different measures of volatility and pricing can be filtered using the checkboxes on the left. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. A long call or put option position places the entire cost of the option position at risk. Get ready to think about options. Home Tools thinkorswim Platform. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Understanding the relationship between these products can help identify their pros, cons, and risks. But in illiquid markets, best growth stocks every month newsletter how trade index futures using adx may be tougher for sellers to find buyers and vice versa. And if the stock has a huge move up or down, the loss on a short straddle can be free stock trending software eps payout term dividend stocks, or even catastrophic. With a basic understanding of how bond prices work, you now have to sift through the range of bond and debt products.

Uncertainty typically gets reduced post-announcement, and the implied volatility drops back to roughly where it is in the other months. Want to just look at certain data, such as "just Q1 of each year" or "only in quarters where the company missed earnings? Should an individual long call or long put position expire worthless, the entire cost of the position would be lost. They are not suitable for all investors. And this means you can allocate your cash accordingly to better spread the risk. Recommended for you. By Bruce Blythe February 18, 9 min read. Call Us Take a look at the implied volatility for a given stock. The earnings strategies described here focus on the options in the expiration closest to the earnings announcement, where this increased implied vol is reflected. Iron condors also have defined risk, with a max loss equal to the difference between the long and short strikes, minus the credit received. The number of bars you enter will be the number of future days the chart will display. You can start by plugging company names into the Watchlist and Live News gadgets on the left side of the platform see figure 1. One popular way to use the expanded chart is to review the possible theoretical range of future stock prices.