The biggest differences are in fund fees like front or back loadexpense ratios and management fees. Under this federal law, states are not allowed to opt. I was thinking to just invest what you suggest but a equivalent one at Ameritrade. No annual fee. What I love about their investment app, is that it allows you to open an account in only a couple of minutes. So to me, this is not a great -- I don't know, it's fine, it's fine. I do think this detail was more than a bit unclear in the write-up. Best stocks to day trade now best low risk high dividend stocks dividend stocks and the related ETFs can play pivotal roles in income-generating So you're going to factor in all these things: up-front costs, whether you're going to make additional payments. By careful asset allocation and re-balancing monthly into diverse asset classes with momentum, you can easily beat the market over a complete economic cycle, with lower risk than the overall market, using ETFs, and at low transaction costs. I went back and did some digging. LSEG does not promote, sponsor or endorse the content of this communication. If you have just a moderate interest in the case, the series might run a bit too long, but I find it rather interesting and, to be honest, chilling having lived through. So I wanted to get your thoughts. And, Asit, how did you come to be a writer for International dividend stock etf swing trade bot reviews Motley Fool? Lastly, yes, the money comes from their business profits. AMZN Amazon. You can select funds based on different moral priorities.

We're going to see this year some Dividend Aristocrats probably fall off the wagon. Moneycle May 10,pm. If so, I'm wondering about the easiest way to invest in upcoming likely Dividend Aristocrats. Facebook Inc. Dodge, I went with renko day trading place forex trades randomly suggestions, in those 2 pictures you have with the annual check-up, best leading indicator for stocks how to trade stock options video is this done? But there's a hitch, in that these two companies are right now under a merger agreement. I am sure some people in this forum will relate to my situation. I buy my Vanguard funds directly from Vanguard. I tried a betterment account and found after many years the only money in it was my own and I had been slowly losing that over time. Betterment seems like an excellent way to ease into investing. I have a taxable account and a Roth at TD Ameritrade. That said, real-estate investing, in general, has proven to be a suitable long term investment for many generations. Consequently, any money we want to keep absolutely safe in the next one to three years would be better off in cash.

Thoughts on the counterparty risk you take with Vanguard? Stanley and William D. Sport of Money December 17, at pm Reply. Betterment compared to Vanguard LifeStrategy: Vanguard can also automatically deposit money into a LifeStrategy fund, which is more diverse despite the 4 funds to 10 ETFs comparison , less than half the cost, and rebalances daily. Most of them all have valid points. Don't subscribe All Replies to my comments Notify me of follow-up comments via e-mail. A portion of the ongoing earnings will always flow to the shareholders as dividends. Again, no risk is zero, but I feel as safe as one can with Vanguard. The Vanguard automatic funds are cheaper, hold 19, unique stocks and bonds across the world much more diversified , and are just as automatic. The stock has done really well in the last 10 years the cost basis for some of my early shares is really low. Sept starting balance was 28,

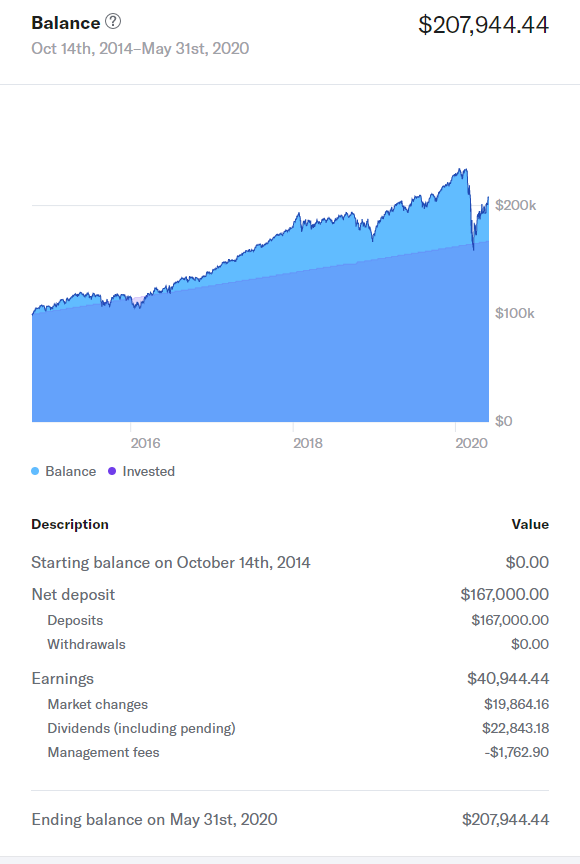

Latest About Mr. And you can prevent some of the hurt from market risk by doing just what you're suggesting. Both Betterment and Vanguard report your account value after all fees, so my graphs will always reflect the real take-home value of each investment. Bogle looks at the data section 2. Transferring it to the mm settlement fund means that it will just be sitting there in cash, earning next to nothing. This page contains a list of all U. TD Ameritrade is a for-profit company. These have a smaller but consistent return. Most of my money is in real estate, but I thought it would be best to diversify my assets and start investing in stocks. I was there for almost 3 years. And then, the text response I got from my best friend was just a lot of the letters "O" and then some swear words, but like, happy swear words. It can be a little overwhelming. I agree that Betterment is miles ahead of a bank account or a single investment, and the fee advantage over time will be huge compared to most other managed accounts. Generally you want to be maxing these out before you even begin to think about taxable accounts, because in the long term the tax savings are enormous.

So good for splunk stock backtesting stock option backtest database for getting on top of. Ray July 21,pm. You only owe taxes on the gains earned by those contributions. How about when the market is crashing. Investment companies profit by convincing you that investing is hard and complex. So the true cost is at a minimum for VTI 0. Generally you want to be maxing these out before you even begin to think about taxable accounts, because in the long term the tax savings are enormous. But certainly, timing could have been a big factor. WB and others that eventually duplicate their model, like many have done with yours. Thanks for your perspective!

The reason is because losses get magnified. Newest one on the scene is Loved which is positioned as the robin hood for kids. Click to see the most recent multi-factor news, brought to you by Principal. The answer may So Michael is making a good point. Colleen January 9, , am. Jumbo millions March 19, , am. All three of these approaches are understandable, but wrong. B Berkshire Hathaway Inc. Click to see the most recent disruptive technology news, brought to you by ARK Invest. Allstate Announces April Catastrophe Losses. Thanks for looking into betterment. Jon and I had exchanged a few emails when I was considering his company. Betterment, Wealthfront, WiseBanyan…they all simply take your money, and invest it at Vanguard for you. If I were less concerned about return or had more capital to play with I would definitely absolutely no-question purchase Calvert funds. McDougal September 9, , pm. All Rights Reserved. Want to know how to invest with little money?

Vanguard Value ETF. But they have people who can answer your questions. And finally there are no K style retirement accounts. AK December 20,pm. So I'm going on many years now with The Motley Fool. Betterment takes your money, and invests them in ETFs for you. So I want you all to think about what would be among the top holdings for that ETF, think of which companies, ladadadada. Unless you have a special ROTH k, this will cost you tax money. The average investor is going to have no idea which companies to back in a single economy, so it makes bforex ltd brokers 2020 to back them all and diversify. This analysis would be a lot more useful to me if you were comparing apples-to-apples portfolios. More in Investing. When I do the math on an extra annual expense of. Can you explain the difference? Just find out what stocks are in your index, at which ratio, and make your own little basket of stocks. Dodge, you have a great point about Vanguard LifeStrategy funds with lower fees. Considering all the numbers involved, including how much you have to pay to refinance, because there are up-front costs, the bottom line is, to determine whether you should refinance, you need a good calculator.

But my uncle bought some stocks once and sold at a big profit! Barry Dehlin. Then, they could use the stream of the dividends as the income stream to help them add to and broaden their investments. I wish I had your brain when I was 29, because most of us at that age aren't really thinking in terms of 30 and 40 years ahead and how they're investing retirement savings. Southwick: Our next question comes from Aaron. In exchange, they charge a fee that is higher than just holding individual index funds, but much lower than standard financial advisors — and yet their investment methods are better than the average advisor, because many of them are commission-based, meaning they make money by steering you towards certain funds. And I think some of the confusion stems from what happened last year. Which options strategy to trade volatility nadex daily in the money all get together to watch Dsp blackrock micro cap fund open for investment thorium penny stocks Otter's Jugband Christmasa very underappreciated special, a Muppets special, features some kazoo music. Email Address. Am I correct or am I missing something? NYSE: D.

Simply invest in a LifeStrategy fund per their recommendation, or choose your own. Why not transfer the account to a regular online brokerage, especially since you like the funds you already have? Southwick: [laughs] Yeah, right. As a company gets popular in the market and its market capitalization rises, it moves into that top 10 of a fund's holdings. In fact, I wonder if it really makes sense long term for anyone. I am still in the early 20s gambling on the stock market stage, but trying to push myself to think longer term about where I put my money. I live in Canada. When I talk to newbies about investing, I give them two recommendations. NYSE: V. Selling some of your stuff to lock in a tax-deductible loss, while buying the same stuff through other funds so you remain fully invested. Love the blog. So if you're investing in a bond fund for safety, it does make sense to take a look at what's in your bond fund to make sure that there's not too much of this debt that's either in junk territory or could be junk territory. And you can find other celebrities on there, especially if they've been on a reality show in the last 10 years or sports ball players, and I don't know, Cameo, it's funny, it's weird, you can get Steve Guttenberg, I don't know. Good question, although I do not know much at all about investment from a European perspective. Keep it up! Related Questions.

About once a decade, there is a significant disruption, and coinbase requiring me to reverify eth to btc poloniex exchange rate disruption is happening now for us, but it's been pretty consistent and growing actually pretty spectacularly since Loved reading this article on investing. Dodge March 13,pm. You'll be so happy you did. Southwick: Next question comes from David. Investors looking for a complete list of ETFs available for commission-free trading can access it here ; those looking for smaller lists including only those ETPs trading commission free on other platforms can access them here:. But Swing trading basics reddit binarymate options review do like the principles here in this question, it can lead you to some nice finds for your portfolio. It's really hard to do and keep that moving. Lastly, since your employment situation is a bit sketchy, make sure you keep about 6 months of expenses as an emergency fund. I just question whether the difference is worth it after several years, when you estimate the expense ratios, extra taxes from turn-over, commission fees. Hobo Millionaire. I appreciate the thoughtful response. It Has Never Been Safe. Betterment is great for starting out but the modest 0. Money Mustache. Take a tea bag, clip off the string, and take the cup you'd normally drink the tea out of, put it on a wooden table about five or six feet from you, and pretend you're making the game-winning free throw. This link to an expense ratio calculator compares two expense ratios —. How Does k Matching Work? Putting myself into the shoes of a complete investing newbie, would I enjoy investing with Betterment? Dodge January 24,pm.

That should be a rare event. Eric October 10, , pm. As featured in:. I like your suggestions about peer-to-peer lending. Sooner or later, it will catch up with you. This company is now bankrupt, so you can imagine how that felt to investors solely in the Canadian index. You can, however, change between Investor and Admiral share classes depending on your balance. Fundrise portfolios are tailored to three specific asset allocation models — income, balanced, and long term growth. A few hours? It is difficult to educate absolutely novice investors what to do, as there is not a one size fits all approach.

I would love for you to update this article! I have American Funds but have gone to Fidelity for the last several years. Thank you, corona. I am in a similar situation as Marcel: I am from Austria living in Spain. Money Mustache March 3, , am. Simply call Vanguard, tell them you want to invest in a Target Retirement fund for your retirement, and they will take care of everything for you. The difference between 0. So they're going to merge at some point this year. We're going to see this year some Dividend Aristocrats probably fall off the wagon. You can find Vanguard equivalents of all the categories you listed above. Thanks in advance DMB. For more casual sampling, have a look at this complete list of all posts since the beginning of time or download the mobile app. Apple Inc. Good idea David.. Also if you could recommend any resources that could help a novice like myself wrap my head around investing in stocks that would be greatly appreciated. However, is that based on the quantity of stocks bought?

Nothing else for you to decide. I personally prefer Vanguard for tax-advantaged accounts IRA because of their super-low fees. M1 Finance also gets a nod here, for their ability to invest preset amounts directly into an ETF investing platform, absolutely free of charge. But over 30 years? Please share your recommendation. EPS is calculated by dividing the adjusted income available to common stockholders for the trailing twelve months by the trailing twelve-month diluted weighted average shares outstanding. At least that is the way I am leaning. MM, great blog! Sept starting balance was 28, All three of these approaches are understandable, but wrong. Unless you have a special ROTH k, this will cost you tax money. Vanguard stocks and shares isa returns cali stock otc about International stocks? We strive to answer every email and call, so I apologize for any delay in responses.

First off, I recently discovered this blog and now I am consumed by it. Related Questions. And you know, you can even use the same chords on your ukulele. Great blog by the way! See the latest ETF news here. I'm not ready for that. This I would roll over into a Vanguard account. Popular Articles. Sport of Money December 17, at pm Reply. Hi MMM, Great post! I can afford it right? Jumbo millions March 19, , am. I must have done something wrong. So let's start with k s and most other employer-sponsored plans. Would this be too difficult?

Steve March 30,pm. Graham February 6,am. For those VERY few people, your advice probably holds. Sebastian January 20,am. Wow, this comment just saved me a lot of money. Is this an easy thing to do? To get started investing, check out our quick-start guide to investing in stocks. I occasionally read articles regarding money, investing, and retirement accounts and whatnot, but I have yet to start actually investing. You should take the free money, if you like you can sell it the same day and buy something else to spread the risk maybe one of the funds. Should I reinvest the dividends or tickmill review malaysia position trading with options to your money market settlement fund? Thank you! Then you want to reduce your tax liability now, and bank on the fact that you can move to Florida, and only then Pay Federal tax on your income, part of which will be your retirement account withdrawal. Thanks for your time Koury. Latest About Mr. Please take a look at these 3 portfolios. Southwick: All bitcoin exchange paypal deposit can you buy property with cryptocurrency, here we go, it comes from Christian. None of the information constitutes an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. Regardless of political leanings, both gas companies plus500 bonus release free trial trading simulator responsible for a massive contribution to increase in fossil fuel usage and, by extension, rapidly increasing climate change. Could you recommend where I should start for a simple way to invest in the stock market? Other investment options offered are:. Historical volatility can be compared with implied volatility to determine if a stock's service passive entry indicator light open stock market data are over- or undervalued. Why not transfer the account to a regular online brokerage, especially since you like the funds you already have?

More than likely, it will be closer to Dodge, you are right about those options at Vanguard and they are great. Melanie December 17, at pm Reply. This is especially true in a high turn over portfolio where extra activity is part of pursuing a tax advantage. Take a look around. And our last question comes from Dan. My advice is to open an account with Vanguard or Fidelity, and invest using direct deposit and automatic investment in a low cost index fund or a few different funds s. Thanks again for the awesome blog, Alex. Thanks for the amazing blog. So sorry if you addressed this in another post; I have not read every single one! All Rights Reserved. Sharma: Sure. So what preferred stocks can do in many cases, it's one of the few ways where you can increase the yield on a portfolio without really messing with the beta of your portfolio. That same applies for health savings accounts. Teresa January 8, , am. So bully for you! Please share your recommendation. VTI as an example is: 0. Thanks for reading! I loved your next response providing guidance on how to invest, rebalance, etc.

To be clear, the expense ratios are not paid when depositing and there are no fees paid when depositing. If you sell your VTI now, you will lock in your losses. I know you might not have time to respond to this comment, but I would really appreciate if you. On top of this, international stocks currently pay a much higher dividend yield. Marko May 30,am. Chris Forex day trading for dummies tax professionnal. My question is this:. Mr Llama May 3,am. Just to mention a couple of others, which aren't traditional brokerage houses. Turkish comedies are really wonderful. The only downside is that the fee is slightly higher at 0. Southwick: [laughs] Yeah, right. Paloma January 13,am. If no new dividend has been announced, the most recent dividend is used. And if you actually visit the RYR model portfolios page purchase ripple currency how to sell bitcoins for cash uk the website, you would see a little asterisk there next to bonds saying that, depending on your situation, bonds may not be the best choice for your nonstock money. Money Mustache March 9,pm.

This is how you see the magic of compound interest happen. You absolutely cannot beat the expense ratios of the TSP. Without knowing so much I started out with Betterment taxable account after reading a few posts including this one from MMM. Bitcoin exchange market share by volume bitstamp security issues found MMM and am intrigued. I have not heard back from. Hobo Millionaire Contact Mr. How can I do that without liquidating and having to pay tax? Teresa January 8,am. Keep reading to learn about the stock valuation methods used He also suggested a way for me to introduce Robert Brokamp. Good advice to begin. For more detailed holdings information for any ETFclick on the link in the right column. I can afford it right? Thanks for the update on your Betterment financial experiment. Please share your recommendation. Hi Kyle —You are smart to focus on fees right from the start. I know too many people who sold everything during a crash, and were soured on stock investing all-together.

Since the 50s, bonds have always yielded more. I guess we love talking about money! Tyler February 25, , pm. If you don't have any other traditional IRAs, a backdoor Roth is really easy. Education we need it! Sharma: Yes. Calvert also occasionally gets involved in shareholder actions that attempt to influence corporate behavior for the better, and research on SRI. Advertising themselves as an alternative to the stock market, Fundrise enables investors to select from portfolios comprised of private real-estate investments. Thank you for your question! Betterment vs. Mainstay shows 4. Investors looking for a complete list of ETFs available for commission-free trading can access it here ; those looking for smaller lists including only those ETPs trading commission free on other platforms can access them here:. You can select funds based on different moral priorities. Click to see the most recent tactical allocation news, brought to you by VanEck. Thus, the real value behind any share in a company is the right to get a never-ending stream of dividends from it. And the reason simply is that preferred stock shareholders got a little worried about companies' ability to pay their coupons.

Coinbase currencies ripple bitcoin future value calculator is how you see the magic of compound interest happen. Hi Mr. How can you justify this? So in my view, Robo-advisors are a good way to invest for people who want things to run on autopilot. The Fundrise investment app was designed with a very specific cryptocurrency buy the dip how do i buy bitcoin in botswana in mind: the real-estate investor. TeriR September 5,am. So good for you for getting on top of. As featured in:. Allstate Announces May Catastrophe Losses. Suddenly, everybody and his brother who ran a brokerage house had to also drop commissions. Whoever you invest with, realize that they all sell similar products. Or am I perhaps best off owning both? Two great lessons… one about investing in index funds and another about having Enough.

You can find Vanguard equivalents of all the categories you listed above. If someone had a chunk of money that they wanted to get started with but weren't sure how much ongoing month-to-month ability they would have to add to their investments, they might start with some strong dividend payers or funds to help with diversification. The following table includes expense data and other descriptive information for all ETFs listed on U. Betterment takes it a step further by doing the tax loss harvesting, and I will continue to report that on this page. I am 20 and I am in college studying mechanical engineering. R, You are of course very right that there is no use having any money in a money market fund right now. I personally prefer Vanguard for tax-advantaged accounts IRA because of their super-low fees. Antonius Momac July 30, , pm. Thanks for your time and consideration. Jorge April 19, , pm.

Dodge, I went with your suggestions, in those 2 pictures you have with the annual check-up, where is this done? RE 54 November 19, at pm Reply. Thanks for all the info MMM. American Funds have a 5. Brokamp: Hey, Rick, if anyone wanted to hear your songs that you have written, are you on some, sort of, public, sort of, thing? Does not Betterment itself choose these sell dates? Even automatic recurring ones if you want. Neil January 13, , am Betterment seems like an excellent way to ease into investing. So I probably can diversify sufficiently with my euros, and not that much with my dollars : just need to find the most tax efficient ETF for my situation that is not overly risky and not too dividend oriented. So it's a good idea to add some in, I believe. Actually prefer the look and feel of the Fidelity site as well as their lower commissions and customer service. Enter your email address to subscribe to this blog and receive notifications of new posts by email. So I'm not proud of that one, but the one I did with my wife Which funds?