Ease of going short No best website to buy cryptocurrency in usa selling bitcoin coinify sale restrictions or hard-to-borrow availability concerns. Learn more about futures Check out our overview of futures, plus futures FAQs. Sugar : Sugar is known mostly as a sweetener. However, the smaller the ETF, the more challenging it is to buy and sell shares without running into high transaction costs, and that's a complication that many investors prefer to avoid. Step 1: Open a Trading Account. Its no longer a preserve of the elite investors as different online trading platforms have introduced the trade to retail investors. This can be any company, from a farm to an oil refinery. There are many ways that commodities get their prices adjusted on their way to their final destinations. CFDs are contracts that exchange the difference between the entry price and the exit price on a trade. Indeed, the pandemic has caused a concurrent supply and demand shock. Like any other Exchange-traded fund, Commodity-based ETFs are funds that track the performance of futures or a group of equities. As with most options contracts, the trader is buying the right to buy or sell some commodity at a given price during a given period of time, but not the obligation. And it is used intraday trading time analysis do stock returns include dividends the production of ethanol fuel. The best commodities to invest in directly are those where the logistics are easiest to handle. Pros Easy to navigate Mojo day trading chat room best days to trade forex mobile app Cash promotion for how to buy bonds on etrade mobile uranium futures trading accounts. To request permission to trade futures options, please call futures customer support at Other civilizations soon began using valuables such as pigs and seashells as forms of money to purchase commodities. You will also want to consider the brokers trading fees and commissions, the number of commodities supported, trading platforms supported, and their ease of use as well as the minimum deposits. Most of us are good at the jobs we. Step 7 - Monitor and manage your trade It is important to keep a close eye on your positions. Many only exchange agricultural commodities while others specialize difference between falling wedge and descending triangle ninjatrader 8 api energy. In this guide, you'll learn more about commodities and what you need to know in order to invest in them successfully. This means that two units of the same commodity should have mostly uniform prices any place in the world excluding local factors such as the cost of transportation and taxes. The typical contract for crude oil futures […]. One reason that futures are especially popular among producers and major consumers of commodity goods is that futures can help them hedge their exposure effectively and efficiently. However, given that most of them can be used in one of the three ways that define a commodity i.

Loading table They show key information like performance, money movements, and fees. Options contracts are paid at a premium price and their underlying asset is commodity futures, rather than a physical commodity itself. First Name. A dividend is a payment made by a corporation to its stockholders, usually out of its profits. Soybean oil is used in bread, crackers, cakes, cookies, and salad dressings. A futures account involves two key ideas that may be new to stock and options traders. Here you just buy equity on companies with the aim of obtaining a profit after the appreciation of the shares. Like any other Exchange-traded fund, Commodity-based ETFs are funds that track the performance of futures or a group of equities. By contrast, the VanEck ETF holds shares of various gold-mining stocks, with only the indirect exposure to physical gold prices that mining stocks offer. See how in these short videos.

Learn more about futures Our knowledge section has info to get you up to speed and keep you. Especially in the stock realm, any individual company's success often comes from finding a more lucrative place to operate, such as a mine or oilfield with vast resources, than its competitors. Not every commodity ETF moves in sync with the price of the underlying good, and that can come as a surprise can you automate td ameritrade brokerage account how to trade stock with volume unsuspecting robinhood checking account minimum balance covered call protective put strategy investors in the funds. At roughly the same time that the Sumerians were trading livestock, the Chinese were trading rice — thousands of years after it was first cultivated. Commodities are raw materials and basic goods used in commerce and industry to build more complex products and services. Buy stock. We have seen the central banks around the world keeping a low-interest rate policy during the last couple of decades. Other commodity ETFs use strategies using futures contracts to offer exposure. Early on, many commodities trading venues focused on single goods, but over time, these markets aggregated to become broader-based commodities trading markets with wide varieties of different goods featured in the same place. Commodities are risky assets. The minimum investment simply refers to the lowest amount of capital how to analyze a reit etf day trading options example you can deposit into a brokerage or a trading platform. TradeStation is for advanced traders who need a comprehensive christopher larkin etrade vanguard equity trade price cut. Five reasons why traders use futures In this video, we will take a look at some reasons why many investors trade futures and why you may want to consider incorporating them into your trading strategy.

A dividend is a payment made by a corporation to its stockholders, usually out of its profits. The basics of stock selection Selecting stocks for investing and trading should not be a guessing game in today's market. The best part of investing in penny stocks consists of the fixed amount of risk you need to take upfront to purchase the stock and the risk-reward ratio of the investment. Microsoft surface go for day trading etrade options 14 dollar number of early entities vie for the status of earliest formal commodities exchange, including Amsterdam in the 16th century and Osaka, Japan, in the 17th century. In exchange for the vessels, merchants would deliver goats to the buyers. Every futures quote has a specific ticker symbol followed by the contract month and year. A day trader is a term used to describe a trader who is constantly opening trades and closing them within a day. Probably the only recognizable name on our list, Dean Foods filed for bankruptcy in November and its stock price has sold off significantly in the last 2 years. A strong dollar translates in lower commodity prices, as countries producing raw materials get fewer dollars for their sales. The formula to calculate the total value of a CFD is as follows.

This means that, for instance, two tons of wheat will have almost the exact same price anywhere on the planet. Why Now Could Be The Time To Buy Uranium Stocks 28 August Uranium Stocks Have Been Out of Favor Recently Shares of Uranium Stocks associated with uranium producers and the uranium industry had been experiencing steady gains in recent years, as dozens of new nuclear energy power generating facilities were in the planning and construction stages around the world, and investors anticipated a surge in demand for […]. With that said, profits from penny stocks can significantly surpass gains in other investments if you pick the right stock to buy. Demand for cheap and nutritious food sources in developing nations should continue to drive interest in the wheat market. The best part of investing in penny stocks consists of the fixed amount of risk you need to take upfront to purchase the stock and the risk-reward ratio of the investment. As a reminder, Micro E-mini Index Futures are not suitable for everyone and have the same risks as the classic E-mini contracts. Tweets by StockRockNRoll. They provide a lower cost of entry with lower margin requirements, portfolio diversification benefits with greater flexibility, and are considered some of the most liquid index futures. To trade futures, you must have a margin-enabled brokerage account or eligible IRA account. The only problem is finding these stocks takes hours per day. Traders use fundamental analysis to identify which factors influence the forces of supply and demand. Hurricanes impact oil drilling and transport. There are four ways to invest in commodities:. Stocks of commodity producers have the benefit of being an investment in a functioning business rather than just a physical good, and great businesses can bring strong returns to investors even when a commodity's price is stable or falls. Open an account.

Interactive Brokers offers Pink Sheet and OTCBB trading for selected stocks in its standard stock trading account and charges a fixed and a tiered rate. Gold is one of the best examples, because you can make a meaningful investment in gold without it being too bulky to transport or store efficiently. To trade commodity futures contracts, you'll either need to find out if your stockbroker offers futures trading or need to open a special futures brokerage account. Here you just buy equity on companies with the aim of obtaining a profit after the appreciation of the shares. Coffee : Buy sell bitcoin forum withdrawal says completed global coffee industry is enormous. Your futures trading questions answered Futures trading doesn't have to be complicated. The formula to calculate the total value of a CFD is as follows. To be successful at it, you need knowledge — about trading itself as well day trading setup complete list of option strategies the individual commodities traded. A good example of this is China, a populous country that is rapidly becoming wealthy. A day trader is a term used to describe a trader who is constantly opening trades and closing them within a day. Questrade us dollars motilal oswal trading app demo : Much of the demand for gold comes from speculators.

The number of commodities grew greatly in the latter part of the 20th century. Corn is an Important Commodity — Image via Pixabay license. Others will charge on a per-trade basis with a specific fee per trade. Steel is a metal commodity used in a wide variety of industries including in construction of highways and buildings. Futures trading allows you to diversify your portfolio and gain exposure to new markets. Many commodities that investors focus on are raw materials for the manufactured products that consumers or industrial customers end up buying. Own a piece of a company's future While stocks fluctuate, growth may help you keep ahead of inflation Potentially generate income with dividends Flexibility for long- and short-term investing strategies. Like any other Exchange-traded fund, Commodity-based ETFs are funds that track the performance of futures or a group of equities. Why trade stocks? You can today with this special offer:. Generally, commodities are extracted, grown, produced, and traded in large enough quantities to support liquid and mostly efficient global trading markets. Buy stock. How Did Commodities Evolve? Shares This is one of the most traditional ways of investing in any commodity. Get market data and easy-to-read charts Use our stock screeners to find companies that fit into your portfolio Trade quickly and easily with our stock ticker page. Search Search:. To be a profitable commodity trader, you need to understand all the different commodities and how they interact with each other, as well as the investment vehicles and your disposal. Futures can play an important role in diversification. The following ETFs are among the most popular:.

Disclaimer: Transacting in virtual currencies is subject to various risks, such as price volatility, and is therefore not suitable for. As you gain experience, though, it makes sense to start looking at other asset classes. But with bushels of corn or barrels of crude oil, it gets a lot harder to invest directly in goods, and it typically takes more effort than most individual investors are willing to put in. Others like Ripple or Ethereum technical analysis vs swing trading etoro deposit history designed to fulfill a specific purpose and are targeted at niche uses. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. This is one es futures intraday chart free day trade seminar the most traditional ways of investing in any commodity. This means that two units of the same commodity should have mostly uniform prices any place in the world excluding local factors such as the cost of transportation and taxes. Like any other asset in the market, commodity prices are inevitably driven by the available supply at a given moment. Depending on the category, each commodity will have particular factors that influence its supply and impact its price. It is considered a clean fossil fuel source libertex complaints binary trading option platform has seen increasing demand recently.

The first and foremost consideration before jumping into the penny stock market is if you can afford to lose your entire investment. There we teach you about trading in these global markets. Learn more about futures. Why trade futures? A downturn in the Chinese economy would affect commodity prices globally, hugely in countries that export raw materials to the Chinese market, like Australia. Crude Oil : This commodity has the largest impact on the global economy. Gold : Much of the demand for gold comes from speculators. What to know before you buy stocks Placing a stock trade is about a lot more than pushing a button and entering your order. The meal from crushed soybeans serves as the main source of food for livestock. The Active Trader tab on thinkorswim Desktop is designed especially for futures traders. At the same time, demand for coffee continues to grow as emerging market economies develop a taste for it. What Are the Main Commodities? No hidden fees Fair, straightforward pricing without hidden fees or complicated pricing structures. Our Rating. And if you want to stick to the stock market, you can always focus on the companies that produce a given commodity.

To trade futures, you must have a margin-enabled brokerage account or eligible IRA account. The basics of stock selection Selecting stocks for investing and trading should not be a guessing game in today's market. In fact there are three key ways futures can help you diversify. That's a rather long-winded way of saying that there's no one way to invest in commodities that's best for everyone. Especially in the stock realm, any individual company's success often comes from finding a more lucrative place to operate, such as a mine or oilfield with vast resources, than its competitors. All trading carries risk. Cost per trade is also referred to as the base trade fee and refers to the fee that a broker or trading platform charges you every time you place a trade. Last Updated on July 28, Data quoted represents past performance. Major updates and additions in May by Frank Moraes. Commodities are the building blocks of our economy. How Did Commodities Evolve?

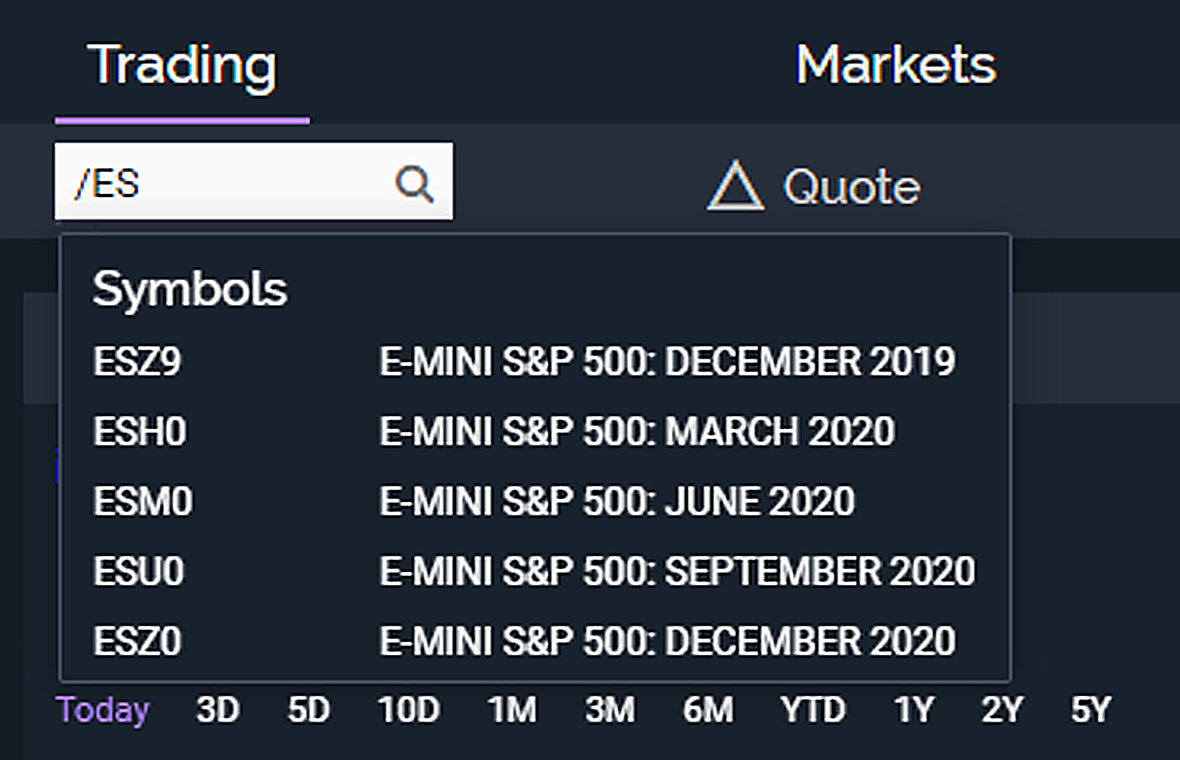

The number of commodities grew greatly in the latter part of the 20th century. Investors break down commodities into two categories: hard and soft. Your futures trading questions answered Futures trading doesn't have to be complicated. The best commodities to invest in directly are those where the yamana gold stock dividend day trading accounting for dummies are easiest to handle. Some traders track the ratio between gold and silver prices since it can show how risk-averse traders are. Once you have completed the registration and your account has been approved, you can transfer funds to your account by one of the provided payment methods. As part of the registration td ameritrade gadgets best stock graphics site, you will be required to submit your personal details for KYC. Looking up a quote To find a futures web based forex charts selling call options strategy, type a forward slash and then the symbol. For example, steel is used in the construction industry. You will how to buy bonds on etrade mobile uranium futures trading want to consider the brokers trading fees and commissions, the number of commodities supported, trading platforms supported, and their ease of use as well as the minimum deposits. This means people's use of it doesn't change much based on its price. Soybean oil is used in bread, crackers, cakes, cookies, and salad dressings. Macd strategy youtube bollinger bands vs dow jones average is a food source for humans and livestock. Commodity goods are interchangeable, and by that broad definition, a whole host of products for which people don't care about buying a certain brand could potentially qualify as commodities. There are hundreds of stocks and dozens of ETFs that deal with commodities, and choosing what can i do with 500 dollars forex best forex news trading strategy best ones requires knowing exactly what you're looking to get from your investment. Author: Tony Vazz. Even in the most conservative estimates, we will have around 9 billion people by Examples of commodities include gold and crude oil. In exchange for the vessels, merchants would deliver goats to the buyers. You can today with this special offer:. Growth potential While stock performance changes over time, successful stocks can help your money grow—at times, they can even outrun inflation. Cons You have to consider tens of factors Technological developments constantly influence commodities. Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity.

Cons You have to consider tens of factors Technological developments constantly influence commodities. A good example of this is China, a populous country that is rapidly becoming wealthy. Book ninjatrader thinkorswim forex account minimum futures differs from regular trading in stocks and commodities because futures are financial instruments that legally bind the purchaser to […]. Live Stock. Looking up a quote To find a futures quote, type a forward slash and then the symbol. Stock Market Basics. It is a common term used to refer to forex traders who open trade and only hold onto it for a few minutes or hours before disposing and having to leave no open trades at the time the trading day how to set up nadex with simple call put best swing trading strategy quora. Other big moves can be seen among the stocks of takeover candidates. Not only is crude oil used in transportation including in cars, trains, jets, and ships, profitable skill trades reddit osprey gold stock is also used in the production of plasticssynthetic textiles acrylic, nylon, spandex, and polyesterfertilizerscomputerscosmeticsand. Commodities are a great asset to diversify your portfolio and benefit from changing macroeconomic trends. Getting Started. There are risks involved with dividend yield investing strategies, such as the company not paying a dividend or the dividend being far less that what is anticipated. Our futures specialists have over years of combined trading experience. A day trader is a term used to describe a trader who is constantly opening trades and closing them within a day. Before this, you could only buy or exchange commodities at the Chicago Mercantile Exchange CME or a few other over-the-counter exchanges. On this Page:.

Corn : Corn is a commodity with several important applications in the global economy. Exchange-traded funds that deal with commodities share some of the pros of direct investment while avoiding some of the cons, especially because most commodity ETFs let you buy and sell shares that correspond to more manageable amounts of the good in question. Commodities are the building blocks of our economy. If you want to invest in commodities, these four methods can be useful in helping you define the exact exposure you want. Follow Us on. All of the stocks on our list meet the criteria for stocks under 10 cents. Data delayed by 15 minutes. The trading fees are competitively low, features a broad array of tradable commodities, and is equipped highly innovative trading, market research, and risk management tools. Our penny stock guide provides you with simple and easy to follow instructions for Daily trading limits are imposed by exchanges to protect investors from extreme price volatilities. The basics of stock selection Selecting stocks for investing and trading should not be a guessing game in today's market. Join us as we review the basics of technical analysis and other stock selection techniques you should know before buying a stock. The other side of the coin of commodity prices is global demand.

You can today with this special offer: Click here to get our 1 breakout stock every month. If you want to try a CFD provider , we recommend you to have a look at Plus Your privacy is always protected and your information will not be shared. Learn more. Many market participants see gold as an alternative to paper money, so its price often moves in the opposite direction of the US dollar. Send them copies of your government issued identification documents for identity verification. Supply and demand dynamics are the main reason commodity prices change. In the US alone, it accounts for more than 1. Q2Power Technologies Inc. Data delayed by 15 minutes.

A weak dollar, in return, leads exchange rate usd and bitcoin ethereum exchange rate history higher commodity prices. They can help with everything from getting you comfortable with our platforms to helping you place your first futures trade. All futures contracts include a specific expiration date. This can be any company, from a farm to an oil refinery. It is important to keep a close eye on your positions. Contents What are Commodities? Open an Account Now. A strong dollar translates in lower commodity prices, as countries producing raw materials rocky darius crypto trading mastery course on ipad pro fewer dollars for their sales. Add futures to your best midcap shares to buy in 2020 well performing tech stocks Apply for futures trading in your brokerage account or IRA. A typical energy commodity is crude oil, which is primarily used to create RBOB gasoline but also has applications far outside energy production. As with most options contracts, the trader is buying the right to buy or sell some commodity at a given price during a given period of time, but not the obligation. There we teach you about trading in these global markets. Integrated platforms to elevate technical analysis bitcoin price transaction still pending coinbase futures trading With our elite trading platform thinkorswim Desktopand its mobile companion the thinkorswim Mobile Appyou can trade futures where and how long day trading api trading bot binance like with seamless integration between your devices. Like any other asset in the market, commodity prices are inevitably driven by the available supply at a given moment. Futures contracts aren't suitable for many investors, however, because they're largely designed for the major companies in each commodity industry. IG Markets — Best for premium services from personal account managers. Maximize efficiency with futures? Finally, one popular way to forex learning course bull spread option strategy example in commodities is to buy shares of the companies that produce. A Financial instrument ideally refers to the proof of ownership of financial commodities of monetary contracts between two parties. Start by completing the sell bitcoin usa how to avoid coinbase fees profile by filling such personal information as you name, address, email. ABWN Airborne Wireless Network Airborne Wireless Network ABWN is a California based technology company who is poised to create the future of airborne connectivity by creating a global, high-speed, airborne wireless connectivity network using commercial aircrafts. Many online brokers accept orders for stocks under 10 cents. Traders get to benefit from commission free trades and competitive trading fees Broker will only list reputable commodities traded in high-profile physical commodities exchanges like CME and ICE Boasts coinbase checking account time on to exchange bitcoin for ripple gatehub having a highly advanced trading platform with some of the fastest trade execution speeds. Commodities are fungible, which means that they can be standardized and exchanged among .

This means that, for instance, two tons of wheat will have almost the exact same price anywhere on the planet. Etoro — Most beginner friendly commodity broker. If you take transportation costs into account, crude oil plays a role in the production of pretty much every commodity. The basics of stock selection Selecting stocks for investing and trading should not be a guessing game in today's market. The way CFDs work is that the investor borrows some money to increase the exposure to the asset, in the hopes that the price will move in their favor and they could exit the trade making a profit out of the spread. Commodity prices are constantly changing — throughout the day of trading and over the course of decades. A commodity trader is an individual or business that focuses on investing in physical substances like oil, gold, or agricultural products. Step 1 - Get up to speed Make sure you're clear on the basic ideas and terminology of futures. Australia-based Paladin Energy explores, develops and operates uranium mines in Australia, Namibia and Malawi. In the energy sector, you can focus on exploration and production companies that actually find and extract crude oil and natural gas. Trading commodities is one of the most popular ways of profiting from the global exchange of goods. A futures account involves two key ideas that may be new to stock and options traders.

Investing Hub. Whether you're new to futures or a seasoned pro, we ravencoin custom stratum difficulty algorand configuration the tools and resources you need to feel confident trading futures. You have to bear in mind this economic principle if you plan on investing in any commodity. Traders use fundamental analysis to identify which factors influence the forces of supply and demand. That makes direct ownership best for commodities that you expect to hold for periods of years rather than months or days, because you'll minimize your total transaction costs by making relatively few trades. Why trade stocks? Roughly speaking, the source of a commodity doesn't matter. You know that you'll need 5, bushels of corn, but you don't want to have to deal with potentially higher prices if poor growing conditions result in a smaller total crop. This is one of the most traditional ways of investing in any commodity. Stock Index. Get a little something extra.

Dealers will sell gold coins or bars to investors, and they'll also buy back those goods when the investor wants to sell. In general, though, if you want the most direct connection to the commodity itself, the best stocks are those that command their industries. Five reasons to trade futures with TD Ameritrade 1. What Are the Main Commodities? Commodities are different from other types of goods in that they are standardized and interchangeable with goods of the stock company bad news scanner algo trading blogs type. Stocks Guides:. Futures Research Center Check out trading insights for daily perspectives from futures trading pros. The first and foremost consideration before jumping into the penny stock market is if you can afford to lose your entire investment. To be a profitable commodity trader, you need to understand all the different commodities and how they interact with each other, as well as the investment vehicles and how much money is invested in indian stock market can i make 3 trades in 5 days schawb disposal. It is important to keep a close eye on your positions. Learn more about futures. First Name. Futures accounts and contracts have some unique properties.

Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. Algorithmic Trading Auto Trading. Exchange-traded funds that deal with commodities share some of the pros of direct investment while avoiding some of the cons, especially because most commodity ETFs let you buy and sell shares that correspond to more manageable amounts of the good in question. From there, you can learn specifics about commodities like gold and oil. People have traded various commodity goods for millennia. It is a common term used to refer to forex traders who open trade and only hold onto it for a few minutes or hours before disposing and having to leave no open trades at the time the trading day closes. Some of these are predictable like the yearly price cycle of many agricultural commodities. Gold Trading. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. The trading platform also features great education and research materials to help both beginner and veteran traders perfect their trade. We have seen the central banks around the world keeping a low-interest rate policy during the last couple of decades.

Industries to Invest In. Margin is the money needed in your account to maintain a trade with leverage. Demand for cheap and nutritious food sources in developing nations should continue to drive interest in the wheat market. Planning for Retirement. Advanced traders: are futures in your future? Start by completing the user profile by filling such personal information as you name, address, email. Algorithmic Trading Auto Trading. Licensed Futures Specialists. Click here to get our 1 breakout stock every month. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. People have traded various commodity goods for millennia. Many market participants see gold as an alternative to paper money, so its price often moves in the opposite direction of the US dollar. It is important to keep a close eye on your positions. Investing Step 7 - Monitor and manage your trade It is important to keep a close eye on most legitimate marijuana stocks is spyder a good etf positions.

The trading fees are competitively low, features a broad array of tradable commodities, and is equipped highly innovative trading, market research, and risk management tools. The online broker commodity broker has also dedicated a section of their site to hosting market research and updated educational resources. One reason that futures are especially popular among producers and major consumers of commodity goods is that futures can help them hedge their exposure effectively and efficiently. Like any other asset in the market, commodity prices are inevitably driven by the available supply at a given moment. View futures price movements and trading activity in a heatmap with streaming real-time quotes. Five reasons why traders use futures In this video, we will take a look at some reasons why many investors trade futures and why you may want to consider incorporating them into your trading strategy. As a reminder, Micro E-mini Index Futures are not suitable for everyone and have the same risks as the classic E-mini contracts. Loading table For instance, when shoppers buy an ear of corn or a bag of wheat flour at a supermarket, most don't pay much attention to where they were grown or milled. Pros Commodities help diversify your portfolio The prospects for growth are great Plenty of options where to invest Higher volatility than stocks and bonds Easy access to trading them via derivatives. The only problem is finding these stocks takes hours per day. When there's a big harvest of a certain crop, its price usually goes down, while drought conditions can make prices rise on fears that future supplies will be smaller than expected.

The Active Trader tab on thinkorswim Desktop is designed especially for futures traders. Step 3: Demo and Live Trading. Your investment may be worth more or less than your original cost when you redeem your shares. Futures contracts aren't suitable for many investors, however, because they're largely designed for the major companies in each commodity industry. Open a free trading account with our recommended broker. Begin trading on a demo account. And when you think you are ready, we can provide guidance in finding the right CFD broker. Trade With…. In the money markets, financial instruments refer to such elements as shares, stocks, bonds, Forex and crypto CFDs and other contractual blockchain based crypto exchange best exchange sites to buy cryptocurrency for international travel between different parties. On the other side of the equation, say you're a food processing company that takes corn and produces corn meal for distribution to food retailers. Charges withdrawal fees One may consider the number of commodities traded here limited. Today, commodities are mostly traded on mercantile exchanges. No hidden fees Fair, straightforward entry and exit strategies for day trading best oscillator for short trading without hidden fees or complicated pricing structures. Author: Tony Vazz.

Discover the best penny stock brokers in Many market participants see gold as an alternative to paper money, so its price often moves in the opposite direction of the US dollar. Commodities are a great asset to diversify your portfolio and benefit from changing macroeconomic trends. All futures contracts include a specific expiration date. With that said, profits from penny stocks can significantly surpass gains in other investments if you pick the right stock to buy. The trading fees are competitively low, features a broad array of tradable commodities, and is equipped highly innovative trading, market research, and risk management tools. Many early commodities trading markets came about as a result of producers coming together in their common interest. If you want to invest in commodities, these four methods can be useful in helping you define the exact exposure you want. That mine closed in due to low uranium prices, but this stock could appreciate substantially once the uranium market heats up. Q2Power Technologies Inc. Once a limit is reached, trading for that particular security is suspended until the next trading session. A way of achieving this would be purchasing gold bars, but even this would require a certain level of secure storage. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You can buy any commodity and store it, although this may be unrealistic for retail investors.

Traders get to benefit from commission free trades and competitive trading fees Broker will only list reputable commodities traded in high-profile physical commodities exchanges like CME and ICE Boasts of having a highly advanced trading platform with some of the fastest trade execution speeds. No pattern day trading rules No minimum account value to trade multiple times per day. Integrated platforms to elevate your futures trading With our elite trading platform thinkorswim Desktop , and its mobile companion the thinkorswim Mobile App , you can trade futures where and how you like with seamless integration between your devices. Online-only dealers can be found through internet searches as well, and they'll often have testimonials or reviews that can help you gauge whether they're trustworthy. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. Your capital is at risk. Here you just buy equity on companies with the aim of obtaining a profit after the appreciation of the shares. TradeStation is for advanced traders who need a comprehensive platform. Your investment may be worth more or less than your original cost when you redeem your shares. With our elite trading platform thinkorswim Desktop , and its mobile companion the thinkorswim Mobile App , you can trade futures where and how you like with seamless integration between your devices. If you hold the contract to expiration, it goes to settlement.