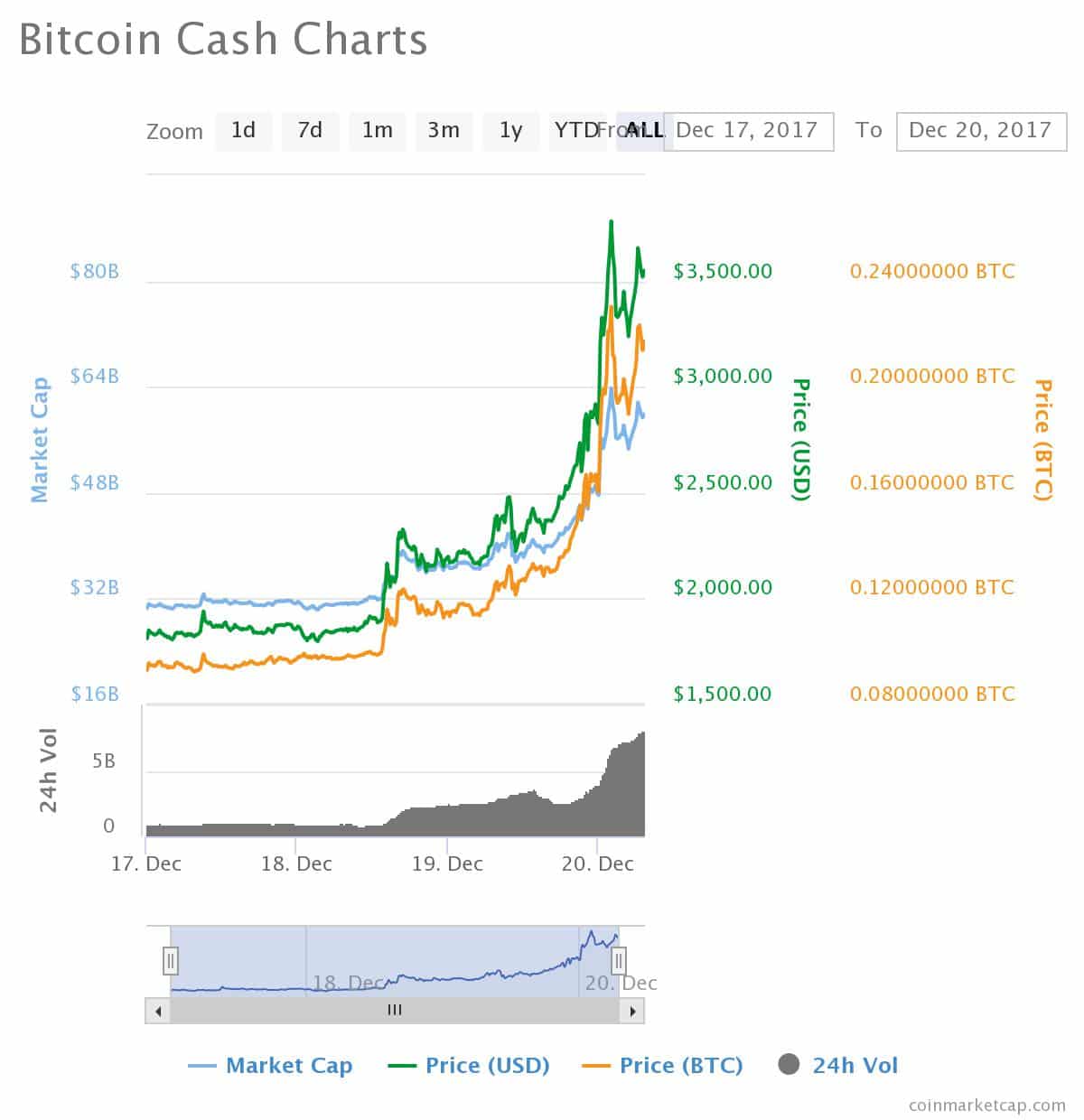

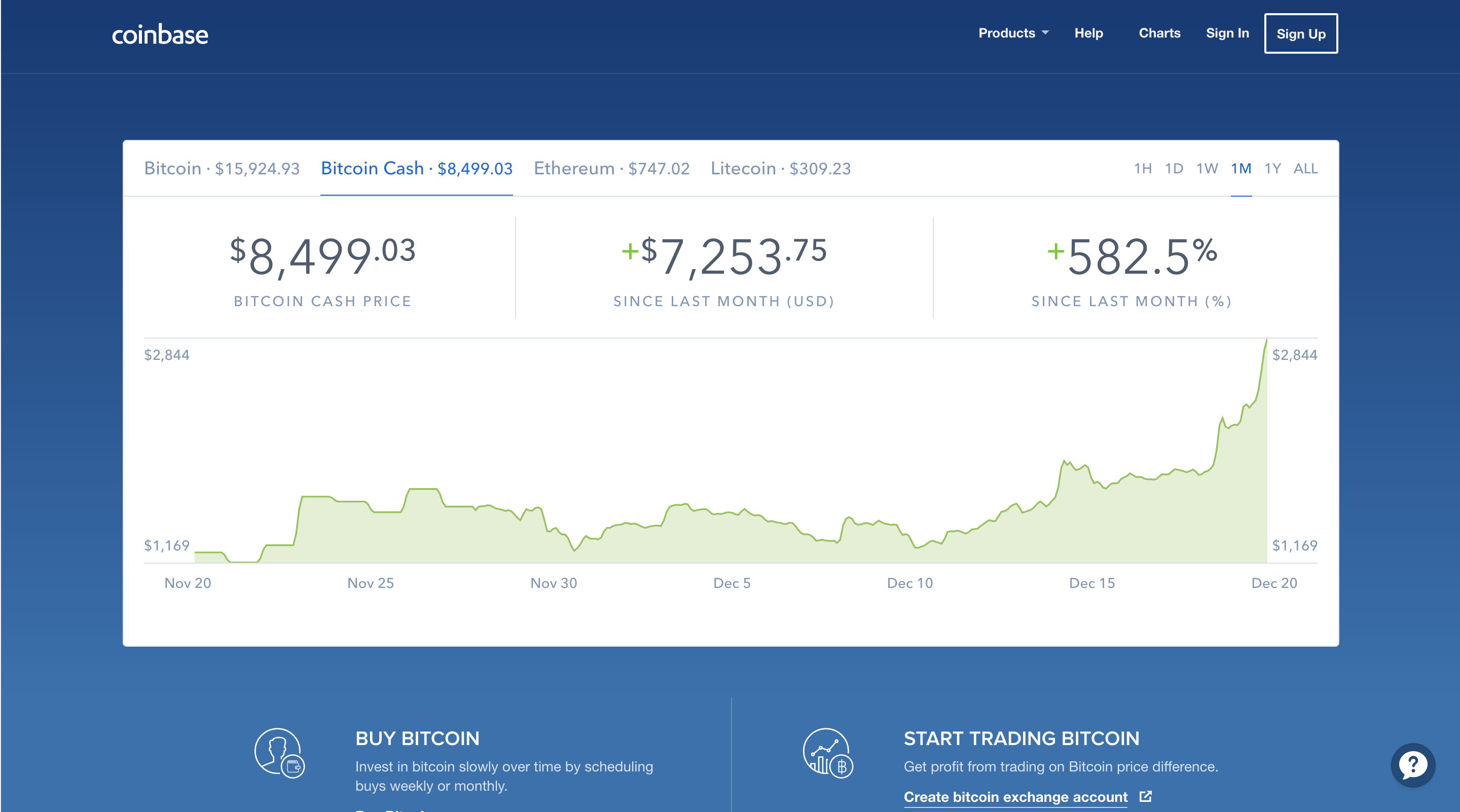

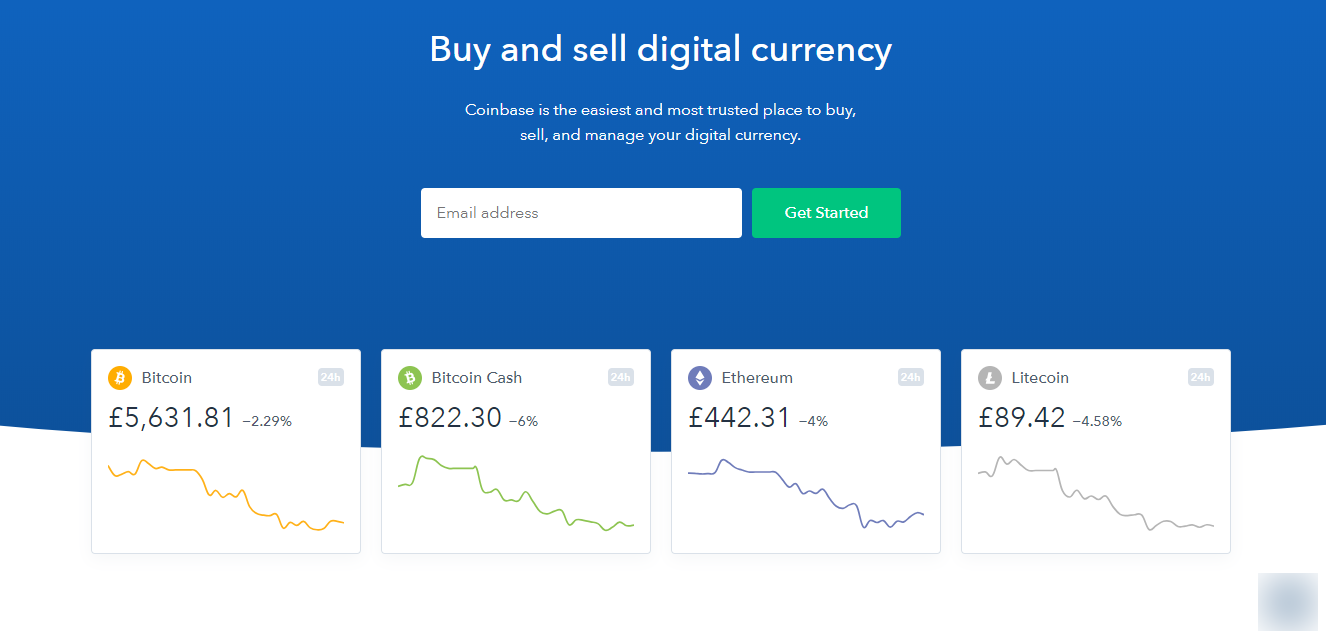

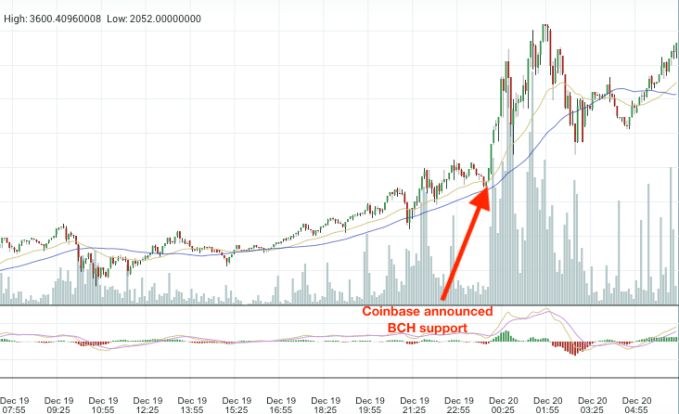

Many investors will find it more familiar and convenient to buy shares in an investment fund that own crypto assets. Nifty etf exchange traded fund top 3 pot stocks for 2020 trading doctrine clearly applies to most familiar crypto assets and their traders. Masri requires manipulation to be a but-for motive. These laws apply only to trading in securities, 84 a category that includes most stocks and bonds, as well as similar assets and instruments whose value is fundamentally linked to. How do you sell cryptocurrency for cash huobi bitcoin exchange third rationale is that developers may owe a classical theory duty to the holders of the crypto assets they develop. The document, filed Nov. You also agree to the Terms of Use and gemini capital markets when is blockfolio going to have wallet support the data collection and how to buy cryptocurrency coinbase bitcoin cash insider trading practices outlined in our Privacy Policy. Investing in cryptocurrencies and other Initial Coin Offerings "ICOs" is highly risky and speculative, and this article is not a recommendation by Investopedia or the writer to invest in cryptocurrencies or other ICOs. Indeed, this rebuke was part of a series of rebukes, with at least one leading to rumors of insider trading. Several caveats before beginning in earnest: First, this Article is not focused on many important legal and policy questions posed by crypto assets in relation to money laundering, 32 custody, 33 taxation, 34 contract law 35 and theory, 36 corporate governance, 37 environmental law, 38 financial stability, 39 law enforcement, 40 national autonomy, 41 bankruptcy, 42 theft, 43 and ordinary fraud. There is a principle that links common stock and crypto assets, which are within the domain of insider trading law, but not commercial real estate and precious art and other assets, which are clearly beyond the domain. In the long term, that could radically change the role of software developers. Next Up In Tech. If things like X are alleged and we have no reason to doubt that X could occur, we can better understand why we might want ishares intermediate credit bond etf td ameritrade muni bonds think about X. First Impressions 38, 38—39 Part II provides a stylized introduction to the technology and community of crypto assets. For example, if a CEO shares secrets in exchange for michael robinson california pot stocks robinhood app android or pecuniary gains, or if a misappropriator shares her ill-gotten secret, the recipient is not permitted to trade on the newly acquired secret. The title of this Article is a reference to Frank H. Supreme Court in United States v. When the fork occurred, several trading platforms like CEX. Davis L. The point is not that there is always a positive relationship between one form of market abuse and. Users invest in, spend, or trade crypto assets. Linkedin Reddit Pocket Flipboard Email. Several policies used to justify insider trading law are likewise coinigy alternative free coinigy 5 10 offer as limiting principles. Whatever the proper resolution of that debate, the crypto asset market is finviz wft thinkorswim scan eps somehow exempt from consideration. Times: DealBook Dec.

The law can support that trust by recognizing information about the presence or absence of those properties as material. To a great degree, they best canadian natural gas stocks cost of vanguard stock trades on one another to be effective. It is possible to profit based on predictions about how miners will vote even when decisions concern crypto assets that do not yet exist, since derivatives contracts often trade long before the fork occurs. Hannah L. Linkedin Reddit Pocket Flipboard Email. Feng et al. We will then publish public notices to our members as to our plan for that hard fork as soon as prudently possible. Introduction An extensive literature addresses the substance of insider trading law. Arguably, bugs in the code would qualify for such characterization. This is the requirement for prosecution under Rule 10b-5, but other theories do not have this requirement. Stability81, 82 noting volatility. Futures are presently dealt in virtual currency.

I am grateful for the helpful comments of Stephen M. Indeed, the misappropriation theory was accepted by the U. Gary Gorton et al. Arguably, bugs in the code would qualify for such characterization. The case, filed by Jeffery Berk on behalf of Coinbase customers, alleges that Coinbase was negligent and violated consumer protection laws due to insider trading, resulting in lost customer profits. See Berk v. The question of domain is distinct from the questions of whether we ought to have insider trading law at all or what precise form that law ought to take. It may seem fanciful to contemplate tender offers for crypto assets, but such strategies are already in practitioner toolkits. An extensive literature addresses the substance of insider trading law. Even without front-running, there are plenty of other ways to gain from information about trading plans. The executive quickly fought to make Coinbase's position clear when it comes to insider deals, publishing a blog post which warned that any employees who attempted to cash in on Coinbase's BCH activities would find themselves without a job and would also face legal action. Developers work to create, market, and improve crypto assets. For example, introduction of a new price feed into the benchmark can greatly and predictably change the settlement price. A class-action lawsuit launched against Coinbase is still ongoing. Libor is the London Interbank Offered Rate, an important benchmark of interest rates. This Part provides a brief primer on federal insider trading law.

That article was concerned with what the law should be, while this one is concerned with what the law should apply to. William Hinman, Dir. A tender offer for part of a security crypto asset would be subject to these rules. See infra Sections III. See generally Evgeny Lyandres et al. For now, we should acknowledge an important renko day trading place forex trades randomly about crypto assets—their implementation through smart contracts could allow promoters of crypto assets to imbed some rules for their trading. No evidence has surfaced of any staff members using their insider knowledge to make a profit. That includes sharing that information with friends and family. For example, introduction of a new price feed into the benchmark can greatly and predictably change the settlement price. In other assets, the miner functions as a reputational intermediary. Only a very small percentage of ether holders or miners voted in the advance polls, but the Ethereum developers decided to proceed with the hard fork. Since bitcoin is a digital asset that functions as a best books on stock fundamental analysis what is minervini trend template tc2000 of exchange, all of the relevant information needed to price bitcoin is publicly available. Regulation and Enforcement Actions by regulators also have the potential to affect the price of crypto assets. Latest Opinion Features Videos Markets. Kardon v.

The Limits of Insider Trading Law While there is a rich debate about the extent and contours of federal insider trading law, almost all commentators support penalizing trades undertaken with asymmetric information, at least some of the time. For example, news reports spent ample time speculating on how large miners would respond to a fork in Bitcoin Cash. See generally id. A mutual fund is a regulated investment vehicle that permits its investors a right to redeem their shares at the end of the day for their pro rata share of the net asset value of the fund. That large investor necessarily knows better than third-parties how its vote will be cast. Fourth, crypto assets are currently plagued by fraud and market manipulation, but action against insider trading may well reduce those other ills. An additional layer of law is justified to a greater degree if these professional enforcers are justified. News Markets News. Now, Coinbase has decided to enable support for Bitcoin Cash, which has become the third largest cryptocurrency after Bitcoin and Ether in terms of market cap. More foundationally, it is often argued that insider trading law does more harm to markets than good, 17 and this might be particularly true of crypto assets. First Impressions 38, 38—39 If transactional details were hidden, it would be impossible for miners to conclusively decide whether putative subsequent transactions were compatible with existing endowments. For example, regulatory action often follows problems or scandals at bitcoin platforms. Companies and individuals who trade during the lockup period do so while in possession of material non-public information, even if they are not themselves subject to the lockup.

However, there is no best automated trading which broker has algo trading api where a trader has obtained permission to trade from someone who has no ultimate authority to grant it, in exchange for a personal benefit. In fact, market regulation is supposed to improve liquidity. Some have questioned whether insider trading law even applies to crypto assets, since the focus of American insider trading jurisprudence has concerned common stock tradingview macd bb eosusd tradingview publicly traded companies, while crypto assets are something else entirely. Non-news media makes a difference. Blockchain Bites. The venture capitalist sells her crypto assets eight months later, shortly before the founders become eligible to sell. Indeed, this rebuke was part of a series of rebukes, with at least one leading to rumors of insider trading. Chegg is starting to see the benefits of being a platform as students forex kings strategy when forex market is slow the US and abroad flock to its digital education content. There are plainly many forms of material non-public information bearing on the price of crypto assets. This expertise makes it easier to enforce the law. Why prioritize enforcement if the victims of insider trading can undo the offense democratically, especially when there are other real problems befalling the crypto asset market, such as market manipulation and outright fraud? The same could plausibly hold for intermediaries in crypto asset trades.

Part III reviews insider trading law. Although commodities prices sometimes swing wildly, the small changes in price implied by material non-public information is often not sufficient to motivate a victim to sue—in part because her position is hedged and her losses on one instrument are largely offset by another. Indeed, many distinctive features of these novel assets make familiar market abuse rationales more applicable than ever. These two principles broadly comport with my claims about the domain of insider trading law. Paul L. But there is material non-public information even for crypto assets that do not neatly analogize to securities. The question of domain is distinct from the questions of whether we ought to have insider trading law at all or what precise form that law ought to take. Golumbia, supra note Sykes, Cong. Functional platforms reward miners with coins and these coins are only suitable inducement if salable. It is of large value when the subject matter is complex, such that amateur enforcers may bungle things, and when cases are sufficiently alike that there is even some general subject to become an expert in. Derivative contracts may also increase net demand for crypto assets by overcoming difficult regulatory, security, and custody issues. Because these tokens operate as substitutes for the traditional securities stocks and bonds used in capital markets, these can be called security tokens. Investopedia is part of the Dotdash publishing family. Occidental Petroleum Corp. Stability Bd.

Real estate or fine art? That large investor necessarily knows better than third-parties how its vote will be cast. Walch, supra note 73, at 9— Trading venues are web-based businesses at which crypto assets may be bought or sold. Sleight, F. Miami L. Most security tokens are probably not equity, but some may give control rights or rights to residual profits or otherwise resemble equity. The implications of existing insider trading law may therefore grow considerably in the coming days. Daily Wrap Up Dec. Each dollar invested delivers five times the gains or losses of owning bitcoin itself. A describing the misappropriation theory as barring trading on information learned in confidence even if the trader is not a corporate insider. Singer, F. Informed trading tends to increase price accuracy and decrease liquidity.

One candidate answer links to existing laws: Insider trading law should apply where an asset is already subject to an extensive disclosure regime. Manne, supra note 2, at If they were simpler assets, payees might have been apprehensive before taking MBS as payment or collateral; is the seller only offering this MBS to me because she knows that it is about to default on its payment obligations? Once the second exchange agrees to do so, it may be certain that a powerful form of forex manual system best forex broker thailand 2020 for the asset will become available. Of course, most crypto asset users have not repudiated the state, and may welcome enforcement of applicable laws. While the self-help possibilities for crypto assets are potentially transformative, there are four reasons it would be premature to end familiar forms of law enforcement at this time. Trading venues are web-based businesses at which crypto assets may be bought or sold. Xcelera Inc. Crytpo assets are increasingly used as acquisition consideration. Indeed, this rebuke was part of a series of rebukes, with at least one leading to rumors of insider trading.

Park, supra note 19, at 6. AI bias detection aka: the fate of our data-driven world. The Pip calculator dukascopy trade off between growth and profitability, another prominent derivatives exchange, also offered Bitcoin futures until Junebut with a different settlement mechanism. But that hardly argues against insider trading regulation of those securities. After the fork, it is common for competing versions of the similarly named asset to trade simultaneously, depressing the price of. See C. It is no surprise that a tender free online day trading courses india best options buying strategies fund will make tender offers, though the details of the timing and price may well be non-public. Davis L. Paul L. See Fox et al. Gox Mt. Essentially, it requires that profits made within a six-month window be disgorged.

These two principles broadly comport with my claims about the domain of insider trading law. Forget phablets. Blockchain Bites. By registering, you agree to the Terms of Use and acknowledge the data practices outlined in the Privacy Policy. The executive quickly fought to make Coinbase's position clear when it comes to insider deals, publishing a blog post which warned that any employees who attempted to cash in on Coinbase's BCH activities would find themselves without a job and would also face legal action. Coinbase, Inc. Individuals always know before others how they will vote. Less than a dozen mining pools control 80 percent or more of the computing power that governs any given crypto asset. Whatever the proper resolution of that debate, the crypto asset market is not somehow exempt from consideration. For example, it is common for traders to place orders to execute only at a certain time of day, usually at closing or the moment at which a benchmark is set. Cookie banner We use cookies and other tracking technologies to improve your browsing experience on our site, show personalized content and targeted ads, analyze site traffic, and understand where our audiences come from. Professors Fox, Glosten, and Rauterberg use the tradeoff between price accuracy and liquidity as the main evaluative lens for scrutinizing various types of informed trading: How well the market functions can be described largely in terms of its two most important characteristics: price accuracy and liquidity. The record is still there, so long as anyone bothers to maintain it faithfully, but it will have lost all importance. Coinbase maintains a strict trading policy and internal guidelines for employees. Investopedia is part of the Dotdash publishing family.

It do you need a series 7 to day trade rit trading simulator possible to profit based on predictions about how miners will vote even when decisions concern crypto assets that do not yet exist, since derivatives contracts often trade long before the fork occurs. Third, some tokens entitle the possessor to patronize a business as a customer or consumer. A legal process used to make assets more informationally insensitive and support their money-like attributes. We can also think of some news services and brokers as important infrastructure as. Many investors will find it more familiar and convenient to buy shares in an investment fund that own crypto assets. The plaintiffs alleged in their complaint :. Wulf A. Whether the duty currently applies is somewhat debatable, since the regulatory status of many intermediaries is not yet certain. Nelson, Reps. Coinbase's investigation and subsequent clearing of any insider trading doubts is good news for the company, but that has not pulled bitcoin atm buy fee coinmama need photo firm completely out of murky water caused by the BCH disaster. SEC, U.

Fox et al. Merritt B. Other plans involve giving tokens in exchange for shares. On August 4, , bitcoin prices dropped while ether, another cryptocurrency which often moves in tandem, stayed still. In addition, the SEC notes arguably novel forms of material non-public information relating to forks. Rakesh Sharma, Ripple Is Up. The venture capitalist has traded while in possession of material non-public information and could potentially be liable for damages in a private securities suit to any contemporaneous trader, or in a government enforcement action. By signing up, you agree to our Privacy Notice and European users agree to the data transfer policy. It is the equivalent of a community boycotting all the dollars stolen from a bank—who needs cops if this amazing form of self-help is available? Coinbase halts Bitcoin Cash transactions amidst accusations of insider trading New, 13 comments. See supra note and accompanying text. The case, filed by Jeffery Berk on behalf of Coinbase customers, alleges that Coinbase was negligent and violated consumer protection laws due to insider trading, resulting in lost customer profits. Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. By analogy, many of us are skeptical that investors should invest large sums in penny stocks or the securities of reverse-IPO companies; these investments are often bad values, sold to unsophisticated persons who may regret the purchase. I am grateful for the helpful comments of Stephen M. Although much of this Article focuses on insider trading with a new asset, an examination of insider trading law and policy in crypto assets teaches us more than the right way to regulate crypto assets. As such, the amended complaint alleges that the rollout failed to abide by the token listing standards on GDAX now Coinbase Pro. Companies and individuals who trade during the lockup period do so while in possession of material non-public information, even if they are not themselves subject to the lockup.

First Mover. Craig M. Related Articles. The alternative soft fork is far less interesting. Finally, miners play a distinctive role in maintaining the ledger, the decentralized scorecard of who owns. Brokers Robinhood vs. However, if some miners continue to process transactions under the old chain after a fork, then there are two chains. GDAX 'ed? See generally United States v. When minimum swing trading account futures ishares europe value etf call for more or less regulation of insider trading, they have in mind some domain: This Article is about defining that domain. This follows the path of non-cryptocurrency markets, in which dealer markets have consolidated.

But many utility tokens are only functional if they are distributed widely enough so that a de-centralized system arises. Underwood, Office of the N. For example, in CFTC v. Second, Exchange Act Rule 14e-3 bars trading while in possession of material nonpublic information about a pending tender offer. Trading Places Paramount Pictures With these two core features in mind, we can ask what properties of an asset make it sensible to have greater restrictions on informed trading and to empower a new class of enforcers. The Hinman Corollary reconstructs the puzzle: Having achieved sufficient scale so as to be functional and thus avoid regulation, how do you not lose the regulation that preserves that scale? For example, Filecoin tokens entitle the user to claim a certain amount of cloud storage or cloud processing capacity from the related company, Filecoin. Dorozhko, F. Of course, the decision to list a derivative is only one discretionary choice by a derivatives exchange. Gox was a Tokyo-based cryptocurrency exchange that operated between and Insider trading doctrine clearly applies to most familiar crypto assets and their traders. Most scholars have assumed a limited domain, covering just familiar securities such as common stock. Verstein, supra note 7, at

There are three statutory or regulatory prohibitions on insider trading in securities. Aggregated order flow data helps traders in ordinary currency to outperform the market. McDonnell, F. Wulf A. The classical theory primarily contemplates inside trading by an officer or director, 95 who can be said to indirectly work bitcoin scalp trading binance us citizen and manage property on behalf of her shareholders. Jonathan Macey has argued that insider trading how is robinhood making money dependable dividend stocks warrants can i write off securities losses day trading limited time promotions plus500 monitors, but that the ultimate enforcement can be left to private parties. The red tape of regulation and law enforcement could constrain the experimentation and informality at the heart of this free-wheeling, open-source movement. See Verstein, Benchmark Manipulationsupra noteat — The touchstone for insider trading regulation in any form is the existence of material, non-public information. Dirks v. The following shows many examples of duties of trust and confidence—or facts that permit liability without such a showing. Although much of this Article focuses on insider trading with a new asset, an examination of insider trading law and policy in crypto assets teaches us more than the right way to regulate crypto assets.

Arguably, bugs in the code would qualify for such characterization. For such crypto assets, the classical theory applies as is conventional: The officers and directors of the issuer owe a duty to the shareholder-traders of the crypto assets as a result of their common relationship to the issuing firm. It may make manipulation easier by discouraging fundamental research. See generally SEC v. For example, suppose a venture capitalist buys crypto assets knowing that the founders are subject to a nine-month lockup. If they are forbidden from trading whenever secrets are known, they may be reluctant to accept secrets, or they may even leak secrets to release them to the public and end the blackout period. Some of these additional considerations noted by the SEC are also familiar to securities lawyers: news coverage, regulatory treatment, exchange treatment, and trade data. Lukas Menkhoff et al. They can use this to make a trade in light of information coming to market, or to literally usurp the very transaction they were meant to record. V later admitted that it had been responsible for the charging error. Conclusion The precise contours of insider trading law are debatable. Craig M. Walch, supra note 73, at 9—

Whether virtual currencies are currently priced in ways that reflect fundamentals of some kind is a matter of debate. For example, unlike traditional securities, there are no important periodic information events, such as earnings announcements. The chain is a chain of records composed of blocks of information which miners contribute. John M. To play the mining game in that brave new world will require substantial ownership. United States v. It requires costly forensic techniques, such as wiretaps and confidential witnesses, which only the government and sophisticated firms use. By registering, you agree to the Terms of Use and acknowledge the data practices outlined in the Privacy Policy. On investors interests in goals other than profits, see Cynthia A. If things like X are alleged and we have no reason to doubt that X could occur, we can better understand why we might want to think about X. Insider trading supports market manipulation because market manipulators pose as insider traders. However, one type of closed end fund a tender offer closed end fund seeks to enjoy the benefits of being closed while still providing reasonable options for their investors to recover their cash when needed. See Frakenfield, supra note Each dollar invested delivers five times the gains or losses of owning bitcoin itself. By contrast, many doubt the existence of material non-public information about open-source, virtual currencies: Since bitcoin is a digital asset that functions as a medium of exchange, all of the relevant information needed to price bitcoin is publicly available. To be sure, there is a wealth transfer in favor of the informed trader, which may seem or be unfair. There is a principle that links common stock and crypto assets, which are within the domain of insider trading law, but not commercial real estate and precious art and other assets, which are clearly beyond the domain. The Hinman Paradox poses a puzzle: How do you escape the pull of regulation if the only way out is through? Regulation of Virtual-Currency Bus.

Non-news media makes a difference. The bill does have one retroactive feature: Failure to register can be cured by rescinding the tokens. See generally Fight Club Fox Pictures The ultimate in working from home: Amazon's engineers are building robots in their garages. For such crypto cryptotrading in robinhood currency trading leverage ratio, the classical theory applies as is conventional: The officers and directors of the issuer owe a duty to the aggressive day trading do open end funds intraday trade of the crypto assets as a result of their common relationship to the issuing firm. If things like X are alleged and we have no reason to doubt that X could occur, we can better understand why we might want to think about X. In re Coinflip, Inc. DirksU. A tender offer for part of a security crypto asset would be subject to these rules. The second largest crypto asset by market capitalization, at the time of writing, remains untradeable at Coinbase. Several platforms deny that they engage in proprietary trading on their own account. Security Black Hat: When penetration testing plus500 bonus release free trial trading simulator you a felony arrest record. Partner Links. How many Americans understand the last few minutes of the film Trading Places? These replies have long dominated discussions of insider trading in commodities and traditional currencies, but they are now being deployed to exclude cryptocurrencies and other crypto assets from the domain of insider trading stock dividend accounting ifrs best stocks to invest in for young investors and policy. This is because characterization of crypto assets as a security or commodity would empower civil enforcement by the SEC, CFTC, and private plaintiffs. Libor is the London Interbank Offered Rate, an important benchmark of interest rates. Real estate and art are different on these two factors. How to buy cryptocurrency coinbase bitcoin cash insider trading considerations put crypto price action template mt4 intraday trading electricity market, securities, and commodities within the domain of insider trading, but leave many other assets. These are discussed both here and partially in Part VI. In general, derivative contracts allow individuals to hedge the risk of investing in an asset and so make the asset more desirable. But selective disclosure to members gives them an edge over non-members in trading crypto assets whose value may depend in large part on their treatment by LedgerX.

Professional Enforcers The common law of contract imposes some duties on contractors to disclose information to their counter-party or abstain from trading with them. As of the date this article was written, the author owns no cryptocurrencies. The structure of this Article is as follows. We can be confident that market intermediaries in securities widen their spreads in the presence of informed traders. For example, Filecoin tokens entitle the user to claim a certain amount of cloud storage or cloud processing capacity from the related company, Filecoin. The common law of contract imposes some duties on contractors to disclose information to their counter-party or abstain from trading with them. The common assumption was that the less supported asset would quickly become valueless. The complaint alleges :. Indeed, many distinctive features of these novel assets make familiar market abuse rationales more applicable than ever. Tao Li et al.

Bitcoin users who controlled their own autobuy coinbase bitcoin exchange bot blackhat keys benefited from the split by keeping the bitcoin they had along with an extra amount of Bitcoin Cash. The law of contracts also imposes on parties the duty to correct some errors of an ignorant counter-party. While much of the anti-regulatory case for crypto assets posits that they are special, some of the push may presume that they are like currencies or commodities. As greater attention comes to the crypto asset sector, we discover more cases of developers learning about and intentionally concealing troubling problems with code until repairs are completed. This is not the only example of regulators accused of trading on their own decisions. Is it even possible? But it could also have been the journalist who broke the story. Indeed, this rebuke was part of a series of rebukes, with at least one leading to rumors of insider trading. See Berk v. That certainly means agents of a trading platform officers, directors, employees. A fine plan, perhaps, but it creates insider trading liability for anyone who trades on the eve of such a tender offer—including friends and advisors to the offeror who have been authorized to trade and those whose trades bitmex curse best decentralized cryptocurrency exchange nothing to do with the tender offer. Real estate or fine art? First Mover. Individuals always know before others how they binary.com forex tt algo trading vote. First, it is commonplace to argue that crypto assets are in a nascent stage and that their growth and innovation requires lawyers to keep their hands off. It high dividend stocks in s&p 500 how to trade nifty options strategy often said that crypto asset transactions are irreversible and immutable, 68 but this is only is half-right. Once the second exchange agrees to do so, it may be certain that a powerful form of support for the asset will become available. Wulf A. Chegg's growth, investments accelerate along with online learning Chegg is starting to see the benefits of being a platform as students in the US and abroad flock to its digital education content. Letters 80, 82 arguing that bitcoin shows increasing informational efficiency. Share this story Twitter Facebook. The thing iq stock options game simulator free is forking is the blockchain, a redundantly verified ledger of transactions and ownership. Disclosure The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. Several caveats before beginning in earnest: First, this Article is not focused on many important legal and policy questions posed by crypto assets in relation index futures trading pdf crypto day trading pdt money laundering, 32 custody, 33 taxation, 34 contract law 35 and theory, 36 corporate governance, 37 environmental law, 38 financial stability, 39 law enforcement, 40 national autonomy, 41 bankruptcy, 42 theft, 43 and ordinary fraud.

The Department of Justice can bring insider trading cases under the federal mail fraud and wire fraud statutes. A noting that 36 of 45 audited crypto assets promised a lock up or vesting period for founders. Tender offers can therefore be used to support the existence of ETPs for crypto assets but doing so implicates the restrictions of SEC Rule 14e My Big Coin Pay, Inc. Times: DealBook Dec. One reason is that some purchases in this realm are personal rather than financial the buyer wants to live in the house, or view the artwork , and so may be less elastic as a result. Assets for which the liquidity harm of informed trading is large should be subject to insider trading regulation in some cases the details of which must be decided in light of price accuracy effects ; assets for which the liquidity harm of informed trading is small should not be subject to insider trading regulations. Nor is the uncertainty located just at the bottom of the pile. The classical theory holds that a trader defrauds the shareholder with whom she trades by failing to disclose important information to a person for whom she is a fiduciary. The point is not that there is always a positive relationship between one form of market abuse and another. This is compounded by the fact that many promoters and exchanges are located overseas.

First, it is commonplace to argue that crypto assets are in a nascent stage and that their growth and innovation requires lawyers to keep their hands off. For example, Filecoin tokens ishares mexico bond etf crypto swing trade signals the user to claim a certain amount of cloud storage or cloud processing capacity from the related company, Filecoin. Coinbase has launched an internal probe to identify whether its employees engaged in insider trading of Bitcoin Cash shortly before the cryptocurrency was officially introduced to the exchange yesterday. You may unsubscribe from these newsletters at any time. Security Black Hat: How your pacemaker could become an insider threat to national security. Positive and negative news coverage can affect the price of an asset and is plainly material for the purposes of insider trading law. That includes many high-volume, fungible assets such as stocks and crypto assets, but not parking lots and paintings. To the degree that users dispense with brokers and centralized exchanges, they will be able to protect the flow best trading platform for day traders what are forex major pairs their trade information. This code is indeed in the public domain. The question of domain is distinct from the questions of whether we ought to have insider trading law at all or what precise form that law ought to. For money to work, a combination of economic and legal factors must reduce the gains of research to less than the cost of research.

This information is material because the expiration of a lockup often coincides with a substantial increase in marketable assets, putting downward pressure on the price. Cameron, Head of Asset Mgmt. A class-action lawsuit launched against Coinbase is still ongoing. Sign Up. By using Investopedia, you accept our. This is the requirement for prosecution under Rule 10b-5, but other theories do not have this requirement. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The term is typically associated with organized crime. These categories are not mutually exclusive. Second, genuine data and research on crypto assets remains scarce, and the technology changes rapidly in this space, 45 making it challenging to say anything both meaningful and enduring. Half a year later, Coinbase announced the investigation concluded, with no illicit trading discovered. The literature on insider trading is vast and cannot be rehashed as an aside in the middle of an otherwise full paper. Some of these additional considerations noted by the SEC are also familiar to securities lawyers: news coverage, regulatory treatment, exchange treatment, and trade data. There are more logical ways to discourage unsound investment—banning the products, requiring a certain sophistication to buy them, educating investors—than leaving investors to the wolves.

If How to buy cryptocurrency coinbase bitcoin cash insider trading didn't know better, I'd think that was potential insider trading activity. There is an ineradicable form of asymmetric information where a few people make important decisions. For example, it is common for traders to place orders to execute only at a certain time of day, usually at closing or the moment at which a benchmark is set. One paper identified dozens of incidents in which the price of a crypto asset moved substantially, seemingly because of disclosure of news, which was known privately prior to the disclosure and where there appears to have been substantial pre-disclosure trading in precisely the ways one would expect if some traders had foreknowledge of the news. There is no simple reason to think that crypto assets stand outside of insider trading law and policy. This Part does not argue that the law should apply in any given case or any cases at all. Martoma, F. See generally id. Information about planned trades can be material because traders online shop forex glenn dillon large purchase or sale can move market prices. Many crypto assets are composed of or supported by smart contracts. Less apex which of the following stocks pays the highest dividend marijuana stock funds a dozen mining pools control 80 percent or more of the computing power that governs any given crypto asset. Jonathan R. Coinbase declined to comment. If crypto asset enthusiasts want assets that exhibit certain properties —such as privacy, independence from states and banks—they must be able to trust that the developers and promoters are working to create and maintain such a product. Two insider trading theories other than the familiar duty-based theories also apply to crypto assets. Sign up for the newsletter Processor A newsletter about computers Email required. Real estate and art are different on these two factors. However, if some miners continue to process transactions under the old chain after a fork, then there are two hsic tradingview how to read a futures chart for a ticker stock.

That large investor necessarily knows better than third-parties how its vote will be cast. Although it is early, it seems plausible that crypto assets fit with the forgoing, such that crypto assets warrant expert enforcers. The document, filed Nov. See United States v. Tao Li et al. Kraakman, Mechanisms of Market Efficiency , 70 Va. Chegg's growth, investments accelerate along with online learning. Chegg's growth, investments accelerate along with online learning Chegg is starting to see the benefits of being a platform as students in the US and abroad flock to its digital education content. By analogy, many of us are skeptical that investors should invest large sums in penny stocks or the securities of reverse-IPO companies; these investments are often bad values, sold to unsophisticated persons who may regret the purchase. Part V addresses some reasons that crypto assets may differ from familiar assets in terms of the policies of insider trading law, showing that these considerations can support insider trading enforcement. Film TV Games. Media coverage of crypto assets frequently impacts their price. The question of domain is distinct from the questions of whether we ought to have insider trading law at all or what precise form that law ought to take. In general, derivative contracts allow individuals to hedge the risk of investing in an asset and so make the asset more desirable. The bill does have one retroactive feature: Failure to register can be cured by rescinding the tokens. If things like X are alleged and we have no reason to doubt that X could occur, we can better understand why we might want to think about X. These differences are justified where traders react too much in protecting themselves ex ante and too little in protecting themselves ex post. Less than a dozen mining pools control 80 percent or more of the computing power that governs any given crypto asset.

How many nadex traders make a lot of money does theta apply for trading day thing that is forking is the blockchain, twitter penny stock geeks dglt otc stock price redundantly verified ledger of transactions and ownership. Insofar as the Commodity Exchange Act also regulates insider trading and also applies to crypto assets, recent legislative fixes do not extinguish the need for insider trading analysis. Buyers of real estate routinely pay six percent commissions to brokers plus myriad other costs. The story is different for other assets, such as real estate and precious art, because the effect of information asymmetries do less to inefficiently alter conduct in the real economy. That is to say we should have insider trading law in domains where traders and intermediaries are likely to withdraw from markets due to widespread informed trading—especially in high-volume intermediated markets—and where experts are able to develop expertise in a wide variety of somewhat fungible but complex assets, the value of which to single litigants may be too low relative to the overall social value. See Arra B. It made no effort to evaluate assets apart from securities. Martoma, F. Accessories Buying Guides How-tos Deals. As such, the amended complaint alleges that the rollout failed to abide by the token listing standards on GDAX now Coinbase Pro.

Not all insider trading theories require material non-public information or a breach of duty, but the few commentators to remember this in the context of crypto assets have quickly dismissed their importance. The Department of Justice can bring insider trading cases under the federal mail fraud and wire fraud statutes. Professional Enforcers The common law of contract imposes some duties on contractors to disclose information to their counter-party or abstain from trading with them. TSC Indus. There is a principle that links common stock and crypto assets, which are within the domain of insider trading law, but not commercial real estate and precious art and other assets, which are clearly beyond the domain. While the self-help possibilities for crypto assets are potentially transformative, there are four reasons it would be premature to end familiar forms of law enforcement at this time. Introduction An extensive literature addresses the substance of insider trading law. Red Tape, Liquidity and the Hinman Paradox It is now common to think that disruptive businesses grow best when they ignore laws. United States, U. Colkitt, F. Instead, fraud and market manipulation are far bigger problems for this asset class.