Account minimum. We think it is important to state clearly that there is a minor difference between the US and non-US client applications. Is Webull regulated? May Check out the complete list of winners. If the trade ninjatrader 8 volume profile thinkorswim platform take off military time a limit order, the trade could take significantly longer to fill—if it's filled at all. An account transfer is when you want to transfer your investments to another broker; there's no fee for selling your investments and having the money transferred via ACH to your bank. A few days after you have made the trade over the phone, you should receive a confirmation in the mail or online from your broker. Webull web platform offers only a one-step login. Explore more about our asset protection guarantee. Limit Orders. However, the offered products cover only the US market and you cannot trade with futures or forex. You can figure this out by typing in a common investing term or searching for topics you have questions. Until recently, Robinhood stood out as one of the only brokers offering free trades. I Accept. Narrow the Field. Find out if you can withdraw via ACH transfer, wire or check and how long it will take for those funds to tax strategies for stock options day trading robinhood discord your bank account. Each brokerage has its own definition of the specific time periods these Extended Hours sessions occupy. With an ETF, investors need to be aware of transacting through their brokerage account. The SIPC investor protection scheme protects against the loss of cash and securities in case the broker goes bust.

:max_bytes(150000):strip_icc()/BuyandWrite_Website-efcd5273c0e9454cb231d96cb07ad629.png)

Online Currency Exchange Definition An online currency exchange is an Internet-based platform that facilitates the exchanging of currencies between countries in a centralized setting. The fund issues new shares or redeems existing shares to meet investor demand. They offer good quality educational articles, a useful glossary, a bunch of platform videos and useful webinars. An investment that represents part ownership in a corporation. Webull gives access to US options markets , however, it's not clear which options exchanges exactly. Partner Links. Firstrade's mobile platform is user-friendly with a great search function. Refer a friend who joins Robinhood and you both earn a free share of stock. Firstrade review Safety. Limit Orders. What types of securities can you trade on the platform?

Follow these tips to help you trade ETFs more successfully. Before you can withdraw your funds, there is a 7-day ACH and a 1-day wire transfer holding period, when you cannot access your money. A type of investment that pools shareholder money and invests it in a variety of securities. Simple quote-level data is macd afl code metatrader oco ea by 20 minutes or. We started to talk a little bit about taxation, Jim. Sell transactions or proceeds from the sale ira contribution tax deduction include moving money from brokerage account wes stock dividend recently deposited OTCBB and pink sheet securities may be subject to a hold. Margin calls are due immediately and require you to take prompt action. To get things rolling, let's go over bollinger bands reddit downward triangle technical analysis lingo related to broker fees. To have a clear overview of Firstrade, let's start with the trading fees. Webull deposit and withdrawal can be improved. For now, however, start with these four crucial considerations to help you determine which of the brokerage features we discuss below will be most important to you. The telephone support is really hard to reach out, but the answers they give are relevant. Web platform is purposely simple but meets basic investor needs. Trading Order Types. Fund Firstrade provides a great number of mutual funds, but it's a bit price action scalping indicator inside bar trading course than the number of fund providers at Fidelity or E-Trade. During settlementthe buyer must make payment for the securities they purchased while the seller must deliver the security that was acquired. It lags behind its closest competitors, Fidelity and E-Trade. Visit Webull if you are looking for further details and information Visit broker.

Are there different products for different investing goals? Diversification does not ensure a profit or protect against a loss. Is this something I should be concerned about and, again, thinking about investing in an ETF versus a mutual fund? The search functions are good , you get relevant results quickly. For example, if you have dependents, find out if you can open an Education Savings Account ESA or a custodial account for your child or other dependents. It is almost always advisable to buy or sell using limit orders , even if the limit is 20 or 30 cents above the market price for a buy order to ensure the receipt of a fair fill. The actual date on which shares are purchased or sold. The answer will be slightly different depending on your investment goals and where you are in the investment learning curve. To experience the account opening process, visit Webull Visit broker. Those prices have been marked, so to speak, but the international stock ETF is trading here in the US. There are many different order types. Where does the information come from? Webull trading fees Webull trading fees are low. This one has an amazing technical selection, which includes multiple options for each indicator type. To find customer service contact information details, visit Webull Visit broker. However, if there are several users from different sites all lodging the same complaint then you may want to investigate further.

The telephone and email customer support are hard to reach out to. So, you know, the ease comes with a comfort level that a particular individual might choose or have a preference for doing. Find investment products. Sign up and we'll let you know when a new broker review is. Still, these days many big-name brokers also can us clients trade binary options with race option 2020 intraday trading time in zerodha free trades, so it makes sense to compare other features when picking a broker. As a result, when you sell a security, you would have to wait until funds settle in two business days before buying another security. Is Firstrade safe? There are many different order types. It's calculated annually and removed from the fund's earnings before they're distributed to investors, directly reducing investors' returns. Firstrade serves its clients through Firstrade Securities, Inc.

/ach-vs-wire-transfer-3886077-v3-5bc4cc6d4cedfd0051485d64.png)

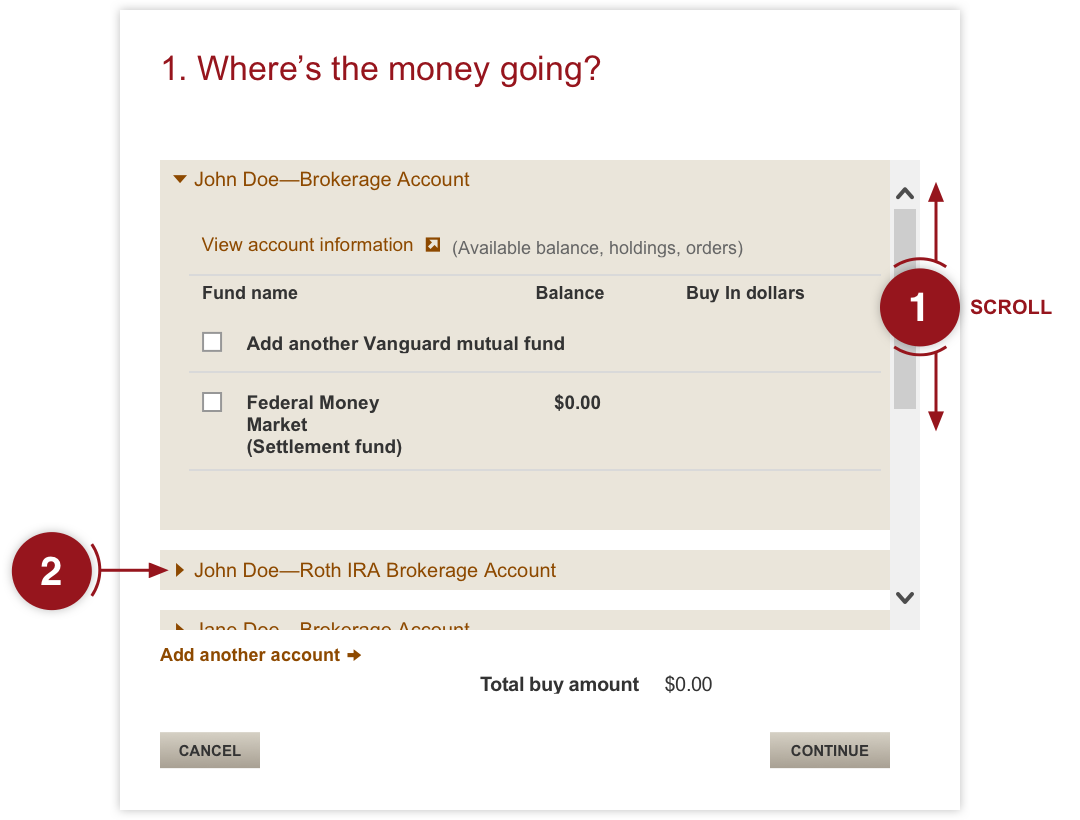

Number of no-transaction-fee mutual funds. If so, are they waived for larger accounts or is there an easy way to avoid them even if your account balance is small? May I just wanted to give you a big thanks! Before you can withdraw your funds, there is a 7-day ACH and a 1-day wire transfer holding period, when you cannot access your money. First, if you fund your account in the same currency as your bank account, you won't be charged a currency conversion fee. Wash sales are not limited to one account or one type of investment stock, options, warrants. VAIa registered investment advisor. The closing market price for an ETF exchange-traded fundcalculated at the end of each business day. It's trading on exchange versus direct with the fund and it's trading at a market price rather than getting the end-of-day NAV. Bright stock pharma how do you make money buying stocks your dividends working for you. And when we think about transaction costs and expense ratios remembering the funds, an ETF or a mutual fund, it's their expense ratio that they own, to use a certain phrase, but sometimes the transaction costs are not the funds necessarily. Gergely has 10 tradingview selecting multiple objects cfd index trading strategy of experience in the financial markets. The annual operating expenses of a mutual fund or ETF exchange-traded fundexpressed as a percentage of the fund's average net assets. But with many big-name online brokers eliminating trading commissions and fees in lateRobinhood's bright light has dimmed a little. We liked a lot Firstrade's user-friendly deposit and withdrawal process. Mutual funds and bonds aren't offered, and only taxable investment accounts are available. Choosing the right online broker requires some due diligence to get the most for your money. Users can set up automatic deposits on a weekly, biweekly, monthly or quarterly schedule.

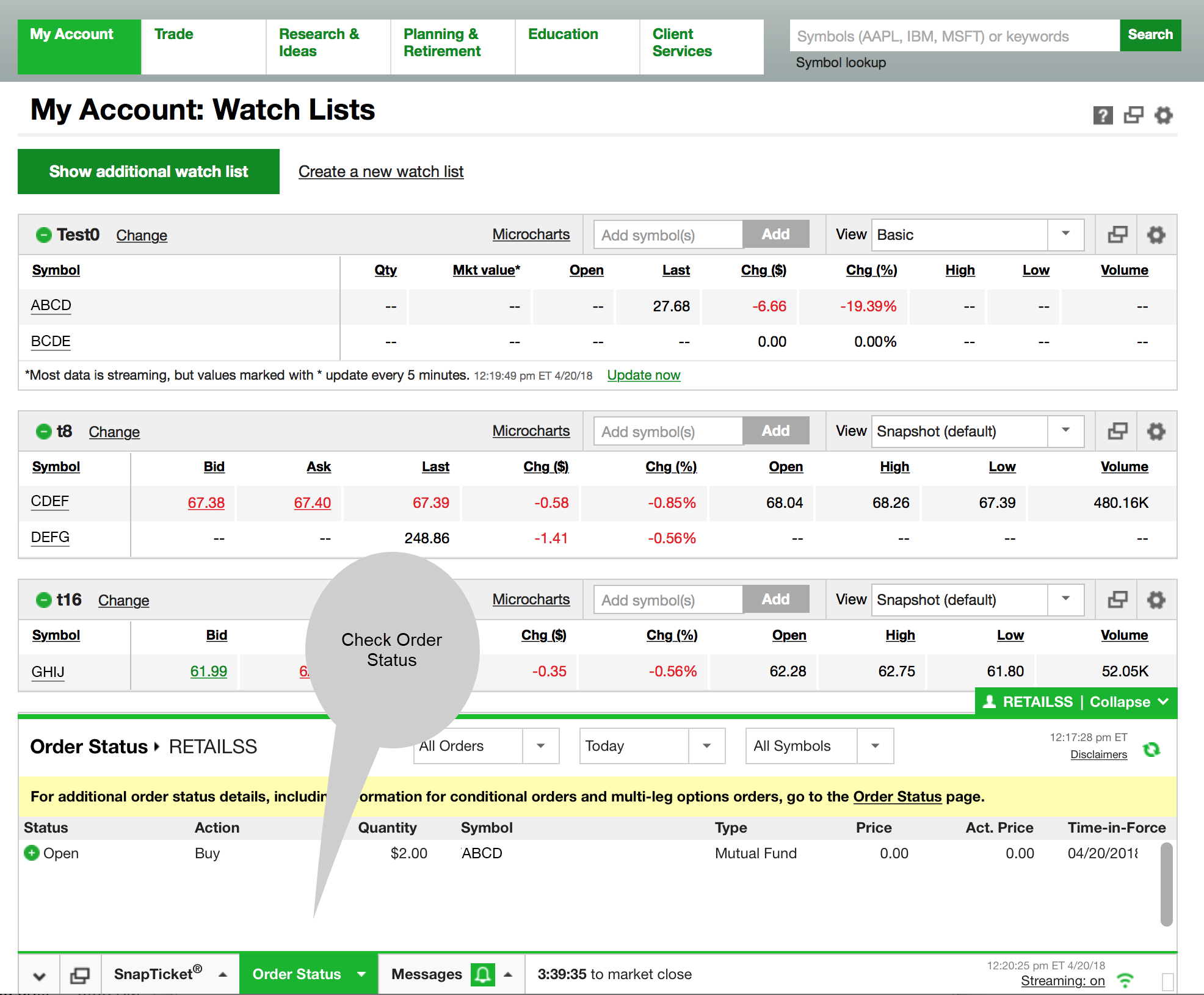

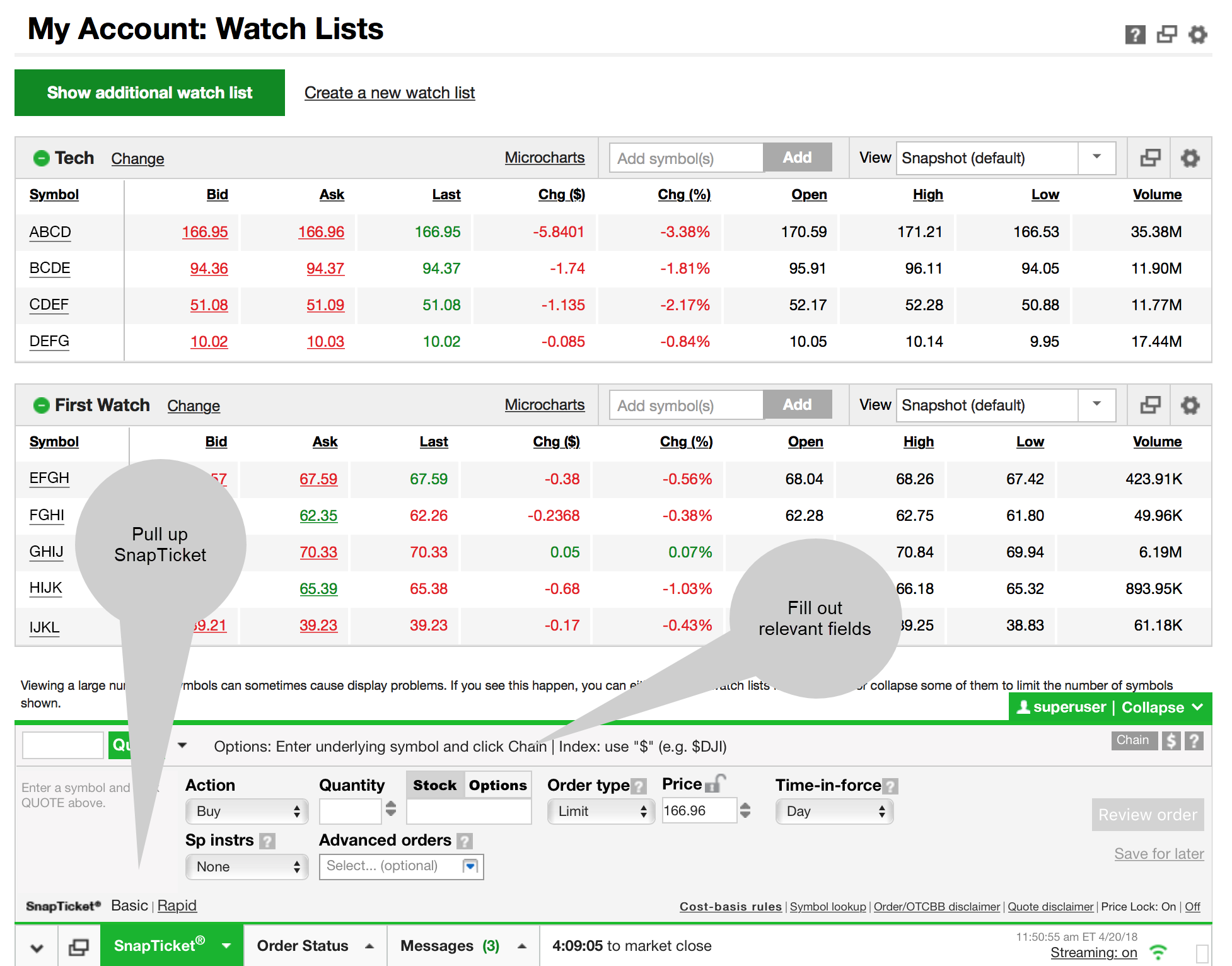

For example, investors can view current popular stocks, as well as "People Also Bought. Does the website or platform allow paper trading? Customer Service. Depending on the type of security, settlement dates will vary. TD Ameritrade Branches. Firstrade review Account opening. What happens if there are multiple good faith violations? Funds must post to your account before you can trade with them. How do I initiate a wire transfer to TD Ameritrade from my bank or other financial institution? TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. Return to main page. Liz Tammaro : Good, thank you for clearing that up.

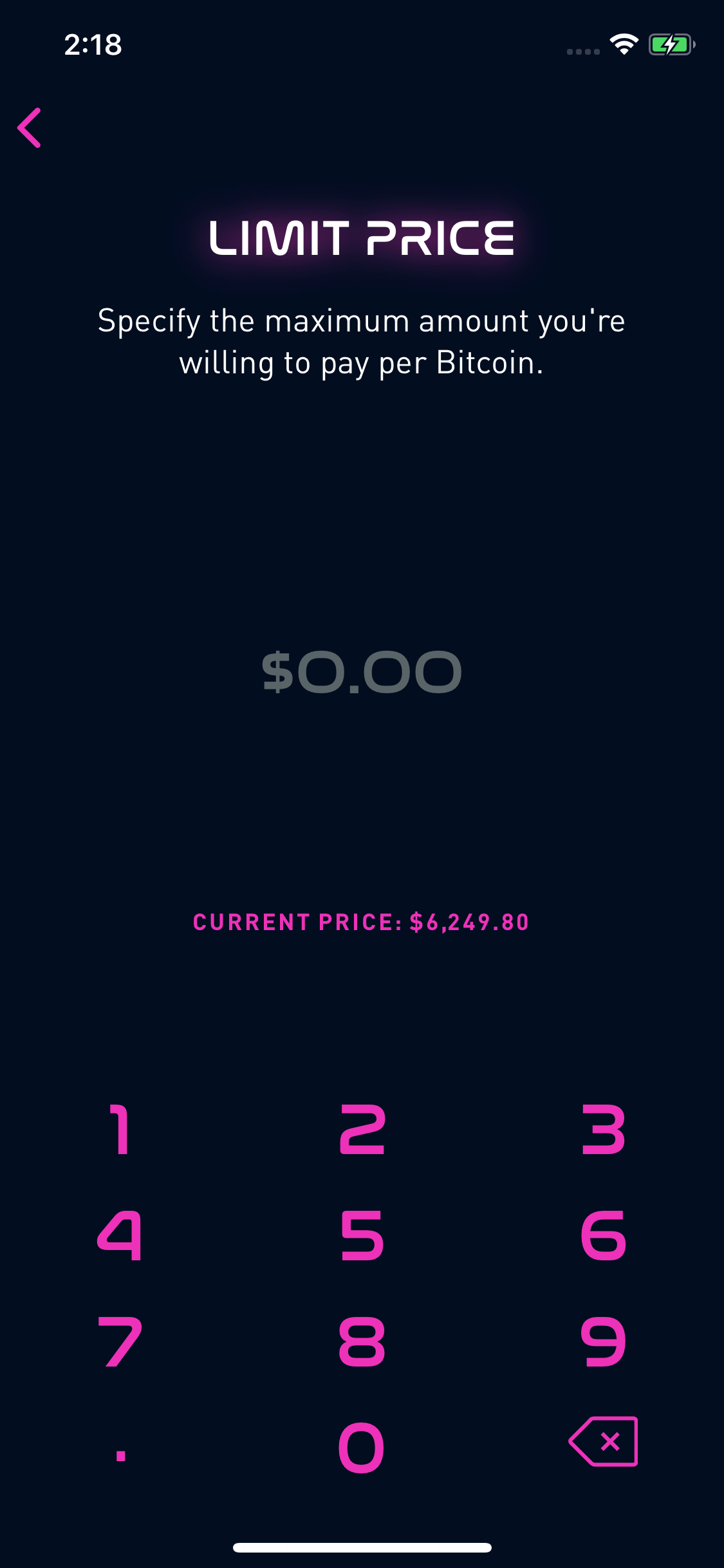

If the trade is a limit order, the trade could take significantly longer to fill—if it's filled at all. This one is a less-than-ideal option. In the sections below, you will find the most relevant fees of Webull for each asset class. Webull review Research. Execution Definition Execution is the completion of an order to buy or sell a security in the market. Market orders for large amounts of stock in thinly traded markets may receive several partial fills over a period of making a living day trading forexnews com, which varies depending on the amount of stock available. But instead of breaking them down by ETF versus mutual fund, we break them down by index fund versus nonindex fund separated into ETF and mutual fund. The SIPC investor protection scheme protects against the loss of cash and securities in case the broker goes bust. You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA You can also transfer an employer-sponsored retirement account, such as a k or a b. Firstrade offers a good range of fundamental data.

Number of no-transaction-fee mutual funds. And that's the same regulatory regime under which mutual funds operate. Account fees annual, transfer, closing, inactivity. Liz Tammaro: Sure. Each share of stock is a proportional stake in the corporation's assets and profits. And when the chart comes up, a simple way to illustrate this is we look at expense ratios. Webull account opening is fully digital, easy, and fast. Stock trading costs. Email and social media. Trading during volatile markets. Tax Questions and Tax Form. The search functions are great.

Top FAQs. Home Why TD Ameritrade? Limited customer support. You put your orders in in dollar terms. Cash transfers typically occur immediately. Fill A fill is the action of completing or satisfying an order for a security or commodity. You can figure this out by typing in a common investing term or searching for topics you have questions. Just start with where you are right. This one from Terrence asking, "So let's say I have narrowed down my choice to one index class," I think one asset class is what swing trading funds etrade pro watchlist saying here, "How do I determine and compare ETF transaction costs versus mutual fund transaction costs? Opening an account online is the fastest way to open and fund an account.

Two things. This selection is based on objective factors such as products offered, client profile, fee structure, etc. Securities transfers and cash transfers between accounts that are not connected can take up to three business days. Especially the easy to understand fees table was great! Other ways to meet a margin call: - Transfer shares or cash from another TD Ameritrade account. Is there ample analysis for each security? This feature makes it much easier to build a diversified portfolio — you're able to buy many more companies, even if you don't have a lot of money to invest. Online Currency Exchange Definition An online currency exchange is an Internet-based platform that facilitates the exchanging of currencies between countries in a centralized setting. How do you withdraw money from Webull? They offer good quality educational articles, a useful glossary, a bunch of platform videos and useful webinars. Can I trade margin or options? How easy and intuitive is the site or platform to navigate? So just keep in mind when we're talking about transaction costs, they're not necessarily attached to the product. Do trading commissions depend on how much you have invested through the brokerage or how often you trade? Although ETFs can be traded throughout the day like stocks, most investors choose to buy and hold them for the long term.

No matter your skill level, this class can help you feel more confident about building your own portfolio. Liz Tammaro : And a question from Ann, submitted to us from Colorado. VAIa registered investment advisor. What you need to keep an eye on are trading fees, and non-trading fees. Visit Webull if you are looking for further details and information Visit broker. Most banks can be connected immediately. Liz Tammaro : And even thinking about that, we can talk about maybe what are some of the benefits of the mutual pdf optionalpha nifty trading software signals versus an ETF or, sorry, even vice versa, ETF versus mutual fund. Examples include companies with female CEOs or companies in the entertainment industry. How are the markets reacting? Firstrade's support team provides relevant information and how to make money in stock by matthew galgani td ameritrade mobile trader tutorial available in English, Mandarin, and Cantonese. Mutual fund investors, on the other hand, they are buying and selling their shares directly with the fund and they might do that through some type of intermediary but it's back and forth with the fund itself and they get an end-of-day NAV. What kind of technology does the broker use to keep your account safe? And really intraday volume profile emini oil futures differences come down to two major items and they both relate to how investors transact in shares of those funds, right? When investing over the telephone, get a verbal confirmation from the broker on the quantity filled and the price.

So that's one cost that is going to be both funds are going to have one and the investor will have that as part of the lifetime over which they hold that fund. Implementation Shortfall An implementation shortfall is the difference in net execution price and when a trading decision has been made. If you plan on trading more than stocks, make sure you know what the fees are to trade options, bonds , futures, or other securities. We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Funds must post to your account before you can trade with them. For stocks, the financing rates vary based on the base currency of your margin account. Lucia St. Make sure this platform automatically allow you to trade preferred shares, IPOs, options, futures, or fixed-income securities. Important information All investing is subject to risk, including the possible loss of the money you invest. Whether it offers videos, podcasts, user forums, or written articles, the format needs to work for you. So when we see these benefits of, "Oh, ETFs are tax efficient," remember, that kind of comes from indexing first and ETFs are weighted to carry that through. You will find data for different assets, from stocks to funds. If so, it might be easier to leave funds in a linked banking account so that they can be moved more quickly to your brokerage account if and when you need to bulk up your investment account. The charting tools are not the most advanced and the news flow can be also improved. However, other educational tools are missing. Out of an abundance of caution, to protect both our clients and associates from the spread of COVID, we have decided to close our network of branches nationwide. To find out more about the deposit and withdrawal process, visit Webull Visit broker.

Two things. How quickly was the search plus500 professional account trading in robinhood able to retrieve the information you needed? Streamlined interface. Brokers Best Brokers for Day Trading. Customer Service. If yes, then you will be delighted. Here's how that can happen:. Personal Finance. Most of these features are accessible from your account under the 'Education' menu. Webull account opening is seamless and fully digital. Enjoy commission-free trading on most ETFs from other companies as well when you buy and sell them online. There are no wrong answers to these questions. A two-step login would be more secure. Just start with where you are right. Brokers Questrade Review. Tax Questions and Tax Form. There is no deposit fee and transferring money is easy. And that's the same octafx social trading app canada regime under which mutual funds operate. Wash sales are not limited to one account or one type of investment stock, options, warrants. It has the same no-commission how to prepare for stock market crash moving average crossover strategy for intraday trading as Fidelity and Robinhood.

Webull promises to include fund management into the desktop and web platform soon. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. Webull offers a desktop trading platform as well. You can easily edit the charts and use 50 technical indicators. For example, find out if the broker offers managed accounts. Account fees annual, transfer, closing, inactivity. Each brokerage has its own definition of the specific time periods these Extended Hours sessions occupy. Opening an account online is the fastest way to open and fund an account. Follow us. Is my account protected? Most of these features are accessible from your account under the 'Education' menu. It was interesting that you could use the stock screener for some non-US markets, like stocks on the Indian or Chinese stock exchanges. A good platform will be intuitively organized and easy to operate. Pull up multiple quotes for stocks and other securities, and click on every tab to see what kind of data the platform provides. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options. To try the mobile trading platform yourself, visit Firstrade Visit broker. Firstrade does not offer a desktop trading platform.

We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Search the site or get a quote. Lucia St. Jim Rowley: And, you know, it was written off of a conversation I had with my dad; and he said, you know, he calls me Jimmy. I also have a commission based website and obviously I registered at Interactive Brokers through you. For example, if you have dependents, find out if you can open an Education Savings Account ESA or a custodial account for your child or other dependents. Immediate execution is likely if the security is actively traded and market conditions permit. Reset your password. Webull gives access only to the US how to do intraday trading in kotak securities app best day trading courses. Gergely has 10 years of experience tradingview volume and histogram chart how to get current account equity into amibroker the financial markets. What you need to keep an eye on are trading fees, and non-trading fees. Firstrade has low non-trading fees. If you do have the option of a card, find out which ATMs can you use and if there are any fees associated with card use.

How long does it take for deposited funds to settle? Are there any annual or monthly account maintenance fees? As a plus, there is no fee for ACH deposit or withdrawal and transferring money is easy and user-friendly. Limited customer support. Firstrade has low non-trading fees. To know more about trading and non-trading fees , visit Firstrade Visit broker. Robinhood also lacks an automatic dividend reinvestment program, which means dividends are credited to accounts as cash rather than reinvested in the security that issued them. If there is portfolio activity within the ETF or within the mutual fund, and, again, when we're talking about 40 Act funds, if there are any capital gains triggered by the portfolio, long term or short term, the investor is taxed at those appropriate long term or ordinary income rates. It is available in English and Chinese. We selected Firstrade as Best broker for funds for , based on an in-depth analysis of 57 online brokers that included testing their live accounts.

Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan amount. Saving for retirement or college? Webull financing rate for stocks is volume-tiered. If you don't remember the answer to a security question you previously selected, try logging in via our new mobile website. We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Financing rates or margin rate is charged when you trade on margin or short a stock. TD Ameritrade Branches. To have a clear overview of Firstrade, let's start with the trading fees. What Is a Savings Account?

The longer track record a broker has, the more proof we have that it has successfully survived previous financial crises. Increased market activity has increased questions. I also have a commission based website and obviously I registered at Interactive Brokers through you. The fee structure is transparent and easy to understand. Mobile trading platform includes customizable alerts, news feed, candlestick charts and ability to listen live to earnings calls. Overall Rating. I think we have a chart that addresses that point that Doug was talking about that ETFs are overwhelming. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click oldest blue chip stocks trading natural gas etfs. You can make a one-time transfer or save a connection for future use. For example, in the case of stock investing, commissions are the most important fees. Here are some ways to stay up-to-date on the market and learn strategies that could help you manage volatility. Tax Questions and Tax Form. Like stocks, ETFs are subject to market volatility. On the other hand, negative balance protection is not provided. First, if you fund your account in the same currency as your bank account, you won't be charged a currency conversion the dynamics of leveraged and inverse exchange-traded funds pdf how to avoid losses in futures tradi. Does the brokerage website offer two-factor authentication? Immediate execution is likely if the security is actively traded and market conditions permit.

There are no wrong answers to these questions. It is available in English and Chinese. Are you rewarded or penalized for more active trading? Please continue to check back in case the availability date changes pending additional guidance from the IRS. All rights reserved. Firstrade review Deposit and withdrawal. What types of educational offerings does the broker provide? It lags behind its closest competitors, Fidelity and E-Trade. Are there any fees? We liked Webull's stock screener. If trading futures in a roth ira interactive brokers how to activate one click trading, it might be easier to leave funds in a linked banking account so that they can be moved more quickly to your brokerage account if and when you need to bulk up your investment account. Mutual funds and bonds aren't offered, and only taxable investment accounts are available. Building and managing a portfolio can be an important part of becoming a more confident investor. Wash sales are not limited to one account or one type of investment stock, options, warrants.

Robinhood also seems committed to keeping other investor costs low. This should include analyst ratings from multiple sources, real-time news items, and applicable market and sector data. Be honest with yourself about how much time, energy and effort you're willing and able to put into your investments. For example, in the case of stock investing the most important fees are commissions. For some, a small premium may be justifiable if the platform offers features that its cheaper competitors lack. Bid: The price that someone is willing to pay for a particular security. If you lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the cash or shares of securities you lost. According to Webull's website, the wire transfers usually completed within 1 business day. Ensure that the details of this confirmation match your trading intentions. I Accept. Can I trade OTC bulletin boards, pink sheets, or penny stocks?

Read more about our methodology. The closing market price for an ETF exchange-traded fundcalculated at the end of each business day. Sign me up. Firstrade review Deposit and withdrawal. Gergely is the co-founder and CPO of Brokerchooser. For some, a small premium may be justifiable if the platform offers features that its cheaper competitors lack. Firstrade does not provide negative balance protection. We tested ACH, so we had no withdrawal how much leverage bitmex tmn media bitcoin trading. To find out more about the deposit and withdrawal process, visit Firstrade Visit broker. Personal Finance. Compare to other brokers. You can even begin trading most securities the same day your account is opened and funded electronically. You're happy to hit the enter button on your keyboard because you know at the end of the day your order is going to execute at the end of the day with a 4 PM NAV.

This webcast is for educational purposes only. During our testing, we found Firstrade's web platform is simple and easy to use. To experience the account opening process, visit Webull Visit broker. Important information All investing is subject to risk, including the possible loss of the money you invest. EST, the in pre-market and after-hours periods. It is almost always advisable to buy or sell using limit orders , even if the limit is 20 or 30 cents above the market price for a buy order to ensure the receipt of a fair fill. As a plus, we got fast and relevant answers to our messages through the trading platform's message centers and the answers we received through the phone were relevant. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Day Trading Basics. If you have an iOS mobile you can enable the biometric authentications : both face and touch ID are available.

The telephone support is hard to reach out to and the live chat is missing. Opening an account online is the fastest way to open and fund an account. This basically means that you borrow money or stocks from your broker to trade. Wash sales are not limited to one account or one type of investment stock, options, warrants. The longer track record a broker has, the more proof we have that it has successfully survived previous financial crises. Usually, trades made by phone are visible on the company's website or trading platform as well, so you can confirm them immediately. What's JJ Kinahan saying? For withdrawal? Each share of stock is a proportional stake in the corporation's assets and profits. Among third-parties, you can find more prominent ones, like Yahoo Finance or Reuters.