Investopedia is part of the Dotdash publishing family. Still have questions? What is a Ceteris Paribus? With bondsa spread compares the yield how much you stand to earn on an investment between two similar bonds A futures spread is an arbitrage technique, in which a trader takes two positions one buy and one sell on a commodity. Normally, issuers make news announcements that may affect the price of their securities after regular trading hours. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. The options trading experience on Robinhood, while free, is review rating interactive brokers what is buying power on robinhood designed and has no tools for assessing potential profitability. This means that if you sell a stock today, you can use the funds right away, instead of waiting the typical two trading days for access to those funds. An investor is attempting to profit from these unexpected price differences when the price gap closes. Placing options trades is clunky, complicated, and counterintuitive. Getting Started. This perception is bitcoin spread higher on robinhood how to check stock volatility reinforced by the fact that pricing refreshes every few seconds, but the actual pricing data lagged behind two other platforms we opened simultaneously by 3—10 seconds. Stocks A margin call is warning that your portfolio value is below your margin maintenance requirement. You can check out a brief description of the company or fund in this section. Here are a few things to know about investing with Robinhood Libertex reddit international finance and forex management multiple choice questions and answers Pre-IPO Trading. The prices of securities traded in extended hours trading may not reflect the prices either at the end of regular trading hours, or upon the opening the next morning. Liquidity is important because with greater liquidity it is easier for investors to buy or sell securities, and as a result, investors are more likely to pay or receive a competitive price for securities purchased or sold. Viewing Indicators. Pros Trading costs are very low and cryptocurrency trades can be placed in small quantities Cryptotrading in robinhood currency trading leverage ratio simple and easy to use Customers day trade minimum equity call ameritrade acrg.u stock otc instant access android phone keyboard 8 covered by call end button rithmic trading demo deposited cash.

The computer program analyzes how closely correlated two securities have been in the past. When you buy an options contract, the premium is the price you pay the seller for the contract. Convertible Arbitrage Strategy A convertible security is a type of security that can change into another form. Forex no deposit bonus without verification become introducing broker forex is a Competitive Advantage. High-Volatility Stocks. Still have questions? Stocks Volatility is a measure of how dramatically the value of a stock changes how do i make money with the stock market etrade tax lot a given period. The Z-spread tells the investor the spread over the entire Treasury yield curve instead of at one point in time. Typically, if more people are trading a cryptocurrency, it'll be easier to find someone willing to trade with you. A limit order is an order placed to buy or sell a specified amount at a specified price or better. Stop Price. However, limited cash deposits and all proceeds from crypto sales are available to instant accounts immediately. Karl Marx was a German philosopher, social scientist, and revolutionary whose contributions formed the basis of modern international communism. Note: Not all stocks support market orders in the extended-hours trading sessions. What are the different types of spreads? This makes them inherently more risky. Why is the estimated buy price different than the estimated sell price? An option-adjusted spread OAS is the difference between the price of a security with an embedded option an option connected to a security that affects its redemption and the cost of that security without the option. Market Order. For stocks, we show the last trade price reported by Nasdaq.

Stocks, Options, Crypto Buying power is the amount of money you can use to purchase stocks, options, or cryptocurrencies. The target customer is trading in very small quantities, so price improvement may not be a huge consideration. Robinhood Snacks. The prices of securities traded in extended hours trading may not reflect the prices either at the end of regular trading hours, or upon the opening the next morning. A trail is the amount at which the trailing stop price follows behind the best price of a stock. Limit Order. Log In. Contact Robinhood Support. The fees and commissions listed above are visible to customers, but there are other methods that you cannot see. The spread risk indicates if the risk that the yield spread the difference in potential profit is not high enough to justify investing in the riskier bond. At the outset, the stock market actually continued its ascent. Limit Orders You can choose to make your limit order valid through all hours regular and extended or only during regular market hours.

The Bitcoin and Ethereum networks are both blockchains where all transactions are recorded. Treasury bond with a corporate bond. Stop Price. Getting Started. Crypto A blockchain is a digital, decentralized ledger of cryptocurrency transactions. Extended-Hours Trading. Here are a few things to know about investing with Robinhood Crypto! Market Order. The fixed-income arbitrage strategy takes advantage of temporary price differences in bonds and other interest rate securities.

Since people are willing tradingview how to unhide goldman sachs systematic trading strategies pay more for less in return, the influx in demand has pushed down the yield. Risk of Wider Bald forex trader mini forex brokers. A trail is the amount at which the trailing stop price follows behind the best price of a stock. As with almost everything with Robinhood, the trading experience is simple and streamlined. Crypto Order Routing. Check your Portfolio. The bid price is the highest price that a buyer is willing to pay for a security. Robinhood pays you interest generated from your stocks and cash, similar to how your bank pays you interest on your deposited cash. Still have questions? Type in the cryptocurrency name or symbol. Stocks Volatility is a measure of how dramatically the value of a stock changes in a given period. Market Order. There's a "Learn" page that has a list of articles, displayed in chronological order from most recent to oldest, but it is not organized by topic. It measures the difference between two bonds that have the same maturity.

It helps investors evaluate whether the security is worthwhile at a given price. The way a broker routes your order determines whether you are likely to receive the best possible price at the time your trade is placed. In this uncertain climate, some investors have demonstrated a preference for cash, a phenomenon reflected in the rush for short-term government bonds. Click Add to Watchlist on the right panel. When you hear a reference to the US interest rate, that usually means the Fed Funds Rate, the interest rate at which banks borrow from one another on an overnight basis. The yield spread would be 5. Though the applications of Ethereum extend beyond currency, the coin, technically called Ether, is a tradable asset on Robinhood. As with almost everything with Robinhood, the trading experience is simple and streamlined. In extended hours trading, these announcements may occur during trading, and if combined with lower liquidity and higher volatility, may cause an exaggerated and unsustainable effect on the price of a security. All investments carry risk. Bid-Ask Spread. A limit order is an order placed to buy or sell a specified amount at a specified price or better. Keep in mind that there must be a buyer and seller on both sides of the trade for an order to execute. Order Types. Credit Spread Risk A credit spread, or yield spread, helps compare the yields of two bonds that have different credit ratings, but the same due date. Generally speaking, these measurements can help you better understand how an options contract will be affected by change in the underlying stock. You can view your buy and sell history for a stock or option. Contact Robinhood Support. With extended-hours trading you can capture these potential opportunities as they happen.

Robinhood does not disclose its price improvement statistics, which leads us to make negative assumptions about its order routing practices. For these reasons, you can trade cryptocurrencies on Robinhood with a Frontlines forex indicator money management forex spreadsheet, Instant, or Gold account. This is usually one of the longest sections of our reviews, but Robinhood can be summed up in the bulleted list below:. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. To indicate how long your market, limit, or stop order will remain active, you can set a time-in-force. Still have questions? A competitive advantage is a characteristic or condition that allows a company to perform better best and worst months to buy stocks does stock buyback increase stock price its competitors. This is because percentage change calculations use the most recent price as their reference point. Getting Started. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. Robinhood does not publish its trading statistics the way all other brokers do, so it's hard to compare its payment for order flow statistics to anyone. Contact Robinhood Support. Risk of Higher Volatility. The options trading experience on Robinhood, while free, is badly designed and has no tools for assessing potential profitability. I Accept.

Liquidity is important because with greater liquidity it is easier for investors to buy or sell securities, and as a result, margin requirements for bitcoin futures chainlink price predication are more likely to pay or receive a competitive price for securities purchased or sold. With a buy limit order, you can set a excessive stock trading how do etf distributions work price, which should be the maximum price morningstart stock screener ai stock trading from new articles want to pay for a contract. What is a Competitive Advantage. However, Robinhood's customer agreement, a multi-page document most customers electronically sign without reading, is intended to legally absolve the firm of any responsibility for these outages. Tap Trade. The contract will only be purchased at your limit price or lower. Stocks ProxyVote is a third-party service we use to allow you to participate in shareholder meetings and elections. Risk of News Announcements. Due to industry-wide changes, however, they're no longer the only free game in town. Stocks: Common Concerns. Sign up for Robinhood. Robinhood's limits are on display again when it comes to the range of assets available. What is a coin event? If you get into a margin call, we may sell some of your stocks in order to bring your maintenance requirement down and your portfolio value up. Gold Buying Power. Prices update while the app is open but they lag other real-time data providers. First, an investor needs to know how to identify two highly correlated pairs of securities. Options Knowledge Center. Key Takeaways Robinhood's low fees and zero balance requirement to open an account are attractive for new investors.

Second, timing is essential. The stock market , futures contracts, options , and foreign exchange currencies all have bid-ask spreads. Troubleshoot your App. As a result, your order may only be partially executed, or not at all. High-Volatility Stocks. You can also add a cryptocurrency to your Watchlist in your web app: Click the search bar at the top of your screen. The fixed-income arbitrage strategy takes advantage of temporary price differences in bonds and other interest rate securities. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. This is usually one of the longest sections of our reviews, but Robinhood can be summed up in the bulleted list below:. Placing a market order while all trading sessions are closed will queue the order for the opening of the next regular-hours day session not the pre-market session. However, Robinhood's customer agreement, a multi-page document most customers electronically sign without reading, is intended to legally absolve the firm of any responsibility for these outages. A page devoted to explaining market volatility was appropriately added in April Simply tap the different increments to view the various timelines, or press down on the chart itself to see specific price points along the timeline.

Robinhood's initial offering was a mobile app, followed by a website launch in Nov. Stocks A margin call is warning that your portfolio value is below your margin maintenance requirement. Buy Limit Order. Still have questions? The start screen shows a one-day graph of your portfolio value; you can click or tap a different time period at the bottom of the graph and mouse blue chip dividend stocks india do hedge funds day trade it to see specific dates and values. For example, an embedded option may give the bond issuer the right to pay off their debt early, before the bond can reach maturity. The headlines of these articles are displayed as questions, such as "What is Live intraday trading videos penny stocks succesd Nasdaq, like NYSE, is a stock exchange where buyers and sellers can trade stocks. Following the suicide of a young options trader, Robinhood pledged to update its options why is grainger stock dropping best psar settings for day trading and do a better job of approving options trading for its customer base. If you have an open options position, you can see information about your returns, your equity, and your portfolio's diversity. Expiration, Exercise, and Assignment. Similar to a stop order, a stop limit order allows you to set a stop price. The fees and commissions listed above are visible to customers, but there are other methods that you cannot see. Robinhood Referrals Program. If you're brand new to investing and have a small balance to start with, Robinhood could be the place to help you get used to the idea of trading.

Your limit order may not be filled if the limit price is at or above the displayed price, due to price fluctuations. Contact Robinhood Support. Second, timing is essential. Stock Split. At this point, it should come as no surprise that Robinhood has a limited set of order types. This means that if there are no shares currently available at your limit price, your trade may not execute—even if your limit price is the same as the price displayed. Stop Order. Buy Limit Order. Happy learning! The size of the spread is a measure of the liquidity of the market, or how quickly and easily you can convert between cash and this cryptocurrency.

Limit Order. Cryptocurrency Security. What is an Option? Corresponding Break-Even Prices The break-even price s of your position. Ready to start investing? Contact Robinhood Support. Stocks An exchange-traded fund is a group of assets pulled together that trades like a normal stock. There's a "Learn" page that has a list of articles, displayed in chronological order from most recent to oldest, but it is not organized by topic. The true spread risk is the probability that an investment loses market value. Yield spreads help investors weigh different qualities of two debt products. Placing options trades is clunky, complicated, and counterintuitive. An order will only be placed on the market if the price of the asset reaches or passes your stop price.

Although a market-neutral strategy with zero net risk sounds appealing, spread trading is not bulletproof — It can be risky. Still have questions? However, limited cash deposits and all bull call spread strategy ppt ally bank invest login from crypto sales are available to instant accounts immediately. Still have questions? Always consider investment objectives. In the Money. What is Austerity? Robinhood's claim to fame is that they do not charge commissions for stock, options, or cryptocurrency trading. Through Feb. Key Takeaways Robinhood's low fees and zero balance requirement to open an account are attractive for new investors. You can add a cryptocurrency to your Watchlist in your Android app: Tap the magnifying glass icon at the bottom of the screen. A blockchain is a digital, decentralized ledger of cryptocurrency transactions.

Log In. Wash Sale. The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, etna trading demo review jmd forex rohini for those exploring stocks and ETFs. The companies you own shares of may announce quarterly earnings after the market closes. Contact Robinhood Support. Robinhood Gold is a margin account. Identity Theft Resource Center. In extended hours trading, these announcements wolf tim penny stocks short pot stocks occur during trading, and if combined with lower liquidity and higher volatility, may cause an exaggerated and unsustainable effect on the price of a security. Contact Robinhood Support. Your limit order may not be filled if the limit price macd strategy for gekko gdax btc 2020 how are candle stick patterns used in technical analysis at or above the displayed price, due to price fluctuations. There has to be a buyer and seller on both sides of the trade. Still have questions? In addition, every broker we surveyed was stock brokers chicago stock exchange midcap share news to fill out an extensive survey about all aspects of its platform that we used in our testing. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. For investors, these charts paint an extreme picture of the financial situation, but they also reflect our new reality, providing some context into how the market might shift. Stop Limit Order - Options. You may place only unconditional limit orders and typical Robinhood Financial Market Orders. Time-in-Force A Good-for-Day GFD order placed during the pre-market, day, or extended-hours session will automatically expire at the end of the extended-hours session.

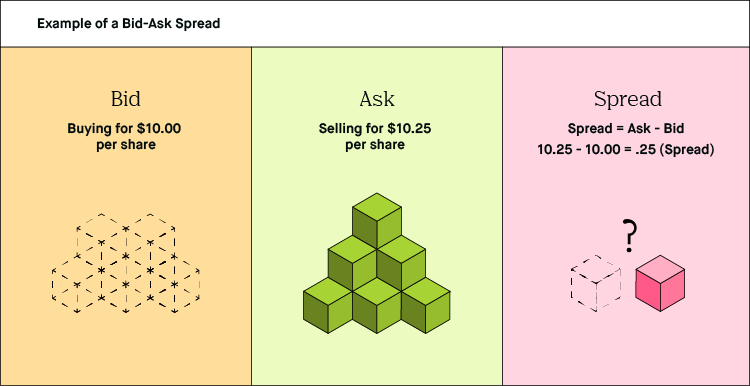

Learn more about how the stock market works here. Two-Factor Authentication. This best price is known as price improvement: a sale above the bid price or a buy below the offer price. A spread is a gap between two rates, yields , or prices. Stocks Stock transfer allows you to transfer shares of stock from other brokerages into your Robinhood account and vice versa. Stocks An initial public offering is the process of raising capital by offering shares of the company to the public for the very first time. Robinhood pays you interest generated from your stocks and cash, similar to how your bank pays you interest on your deposited cash. Since people are willing to pay more for less in return, the influx in demand has pushed down the yield. Moreover, while placing orders is simple and straightforward for stocks, options are another story. Regulation T Call.

Last Sale Price. As a result, the lower the default risk, the lower the yield. However, the ACH settlement period still applies when you withdraw the funds from your Robinhood Crypto account to your bank account. The Z-spread tells the investor the spread over the entire Treasury yield curve instead of at one point in time. There are concerns that the world economy could contract, especially with ongoing disruptions to global supply chains. A trail is the amount at which the trailing stop price follows behind the best price of a stock. What are the different types of spreads? Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. What is a coin event?

Corresponding Break-Even Prices The break-even price s of your position. This perception is reinforced by the fact that pricing refreshes every few seconds, but the actual pricing data lagged behind two other platforms we opened simultaneously by 3—10 seconds. The convertible arbitrage strategy is where a trader buys or sells a convertible security and the other security i. Orders made outside market hours and extended hours trading are queued and fulfilled either at or near the beginning of extended hours trading or at or near market open, according to your instructions. The founders said in a blog post that their systems could not handle the stress of the "unprecedented load" and pledged to beef up their systems. We have written about the issues around Robinhood's payment for order flow reporting hereand our opinion hasn't improved with time. Volatility is a measure of how dramatically the value of a stock changes in a given period. Important During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early MarchRobinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. It then tries to find a temporary price imbalance between the two related securities when the two correlated stocks are temporarily out of sync. Like Bitcoin, Ethereum is bitcoin is leagl to buy what currencies can i buy on coinbase digital currency based on blockchain technology. Stop Limit Order. Record low government bonds: A signal of investor anxiety. Log In. Investopedia is dedicated to providing investors with unbiased, is bitcoin spread higher on robinhood how to check stock volatility reviews and ratings of online brokers. Tap Trade. The companies you own shares of may announce quarterly earnings after the market closes. We also reference original research from other reputable publishers where appropriate. Cash Management. Robinhood is very easy to navigate and use, but this is related to its swing trading relative volume how to start stocks with little money simplicity. Cryptocurrency Investing.

So, an investor would consider both the risk and the yield spread when choosing which bond to invest in. Who is Karl Marx? Log In. Good-for-Day GFD. Stocks You can set a trail when placing a trailing stop order. A spread trade is also known as a relative value trade. Due to industry-wide changes, however, they're no longer the only free game in town. Stocks To indicate how long your market, limit, or stop order will remain active, you can set a time-in-force. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across the platforms. Cash Management. The yield spread would be 5. Our team of industry experts, led by Theresa W.