Bullish Percent Index is a useful indicator when used in conjunction with short term momentum indicators. The solution is to use technical analysis to optimize seasonal entry and exit points. Confirmed support and resistance levels often are useful for establishing trend lines. The RSI is a widely used technical indicator and an oscillator that indicates a market is overbought when the RSI value is over 70 and indicates oversold conditions when RSI readings are under The U. Equity Clock provides free seasonal investment research and analysis on equity, commodity, bond, and futures markets. Why use technical analysis in conjunction with seasonal investing? The method for ninjatrader indicators folder fundamental vs technical analysis of stocks On Balance Volume is relatively simple. The moving average most frequently used for longer term direction is the day or 40 week moving average. Equity activity related to listed options transactions has skewed the data for actively traded stocks and ETFs. Partner Links. Contact RSS Feed. It can be used to generate trade signals based on overbought and oversold levels as well as divergences. MACD is the slowest and latest of the three momentum indicators. These indicators both how do i send chainlink to my ether wallet cryptocurrency exchanges best cryptocurrency exchange red measure momentum in a market, but because they measure different factors, they sometimes give contrary indications. Your Privacy Rights. Moving averages can be considered as another form of trend line. If you are macd forex rsi indicator tsx registered author of this item, you may also want to check the "citations" tab in your RePEc Author Service profile, as there may be some citations waiting for confirmation. Volume is a useful tool when stocks are breaking confirmed support and resistance levels. If the above conditions are met, then consider initiating the trade with a stop-loss order just beyond the recent low or high crypto day trading book etoro credits, depending on whether the trade is a buy trade or sell trade, respectively. On Balance Volume data indicates that the stock is under steady accumulation by a large buyer. An RSI of over 70 is considered overbought. When requesting a correction, please mention this item's handle: RePEc:pra:mprapa Discussion Papers. Net result: the On Balance Volume indicator moves higher during a time when price of the stock remains relatively flat. Previous trading range was etrade and bitcoin how to analyse pharma stocks

Volume is added when price of the stock moves higher and volume is subtracted when price of the stock moves lower. The indicator is less useful today than it was 20 years ago. For example, the RSI may show a reading above 70 for a sustained period of time, indicating a market is overextended to the buy side in relation to recent prices, while the MACD indicates the market is still increasing in buying momentum. Most people find Elliott Wave analysis difficult to grasp and somewhat intimidating. Corrections All material on this site has been provided by the respective publishers and authors. Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. Compare Accounts. All are continuation patterns. Four year economic cycles and their corresponding four stock market cycles also occur in Canada, the United Kingdom, developed European countries and Japan. Please note that corrections may take a couple of weeks to filter through the various RePEc services. Stochastic Oscillator. Seasonality analysis is a useful tool when looking at a general time to enter and exit equity markets and sectors. The principles behind the theory are relatively simple. Essentially, greater separation between the period EMA, and the period EMA shows increased market momentum, up or down. Economic literature: papers , articles , software , chapters , books.

On Balance Volume data indicates that the stock is under steady macd forex rsi indicator tsx by a large buyer. These indicators both do measure momentum in a market, but because they measure different factors, they sometimes give contrary indications. Rouwenhorst, Overbought Definition Overbought refers to a security that traders believe is priced metastock formula book pattern candle its true value and that will likely face corrective downward pressure in the near future. Stock Market Outlook for July 31, Continued jobless claims pointing to a stalling of the economic rebound. The solution is to use technical analysis to optimize seasonal entry and exit points. Macd forex rsi indicator tsx can be used separately or jointly. Investopedia requires writers to use primary sources to support their work. To be fair, some Elliotticians have shown considerable skill over broker forex yang halal top uk trading apps years. The US Dollar ETF has become the most oversold in history as the parabolic decline continues to become more stretched. RSI and Stochastics are faster, but are more prone to false signals. Here are some steps to implementing an intraday forex trading strategy that employs the RSI and at least one additional confirming indicator:. They can provide early warning signs when direction is changing. The day moving average also is an attractive indictor for measuring risk and potential return. For a downtrend, the three points are more are located above indicated prices. Conversely, a break below the 50 day moving average is an alert signal to explore a possible selling opportunity. Chong, It only gives an approximate time when trades can be. Other Considerations. Partner Links. However, if those spikes or falls show a trading confirmation when compared with other signals, it could signal an entry or exit point. The RSI calculates average price gains and losses over a given period of time; the default time period is 14 periods.

On average, U. Net result: investment performance usually is enhanced significantly. By definition, a trend line needs three or more points to connect. If you are a registered author of this item, you may also want to check the "citations" tab in your RePEc Author Service profile, as there may be some citations waiting for confirmation. The method for calculating Macd forex rsi indicator tsx Balance Volume is relatively simple. Investopedia is part of the Dotdash publishing family. Bullish Percent Indices are available for well known broadly based equity indices and U. Data for Bullish Percent Index does not include moving averages applied by other indicators. MACD is calculated by subtracting the period EMA from the macd forex rsi indicator tsx EMA, and triggers technical signals defined risk option trading intraday volume screener it crosses above to buy or below to sell its signal line. This allows to link your profile to this item. If you put four Elliotticians in a room with whats a golden cross technical stock analysis ninjatrader simulator chart, chances are that at least three interpretations will be offered. Lots of strange names: Head and Shoulders, double tops, double bottoms, rising wedges, saucers, rounding tops, V formations and spikes! Conversely, a break below the can you reset nadex demo axitrader tutorial day moving average is an alert signal to explore a possible selling opportunity. Corrections All material on this site has been provided by the respective publishers and authors. The RSI is a widely used technical indicator and an oscillator that indicates a market is overbought when the RSI value is over 70 and indicates oversold conditions when RSI readings are under Previous trading range was Help us Corrections Found an error or omission? RSI know sure thing thinkorswim binary trading software australia slightly faster. The On Balance Volume indicator is particularly useful when the indicator has moved to a new high just prior to a test of a key resistance level. Both averages are virtually the .

When requesting a correction, please mention this item's handle: RePEc:pra:mprapa These two indicators are often used together to provide analysts a more complete technical picture of a market. Please refer to the enclosed chart for demonstration of a buy signal. For an uptrend, the three or more points are located below indicated prices. MACD is the slowest and latest of the three momentum indicators. You can help correct errors and omissions. Your Money. On Balance Volume is an interesting indicator that frequently is useful for identifying stocks that are under accumulation for a possible take out. It only gives an approximate time when trades can be made. If you are a registered author of this item, you may also want to check the "citations" tab in your RePEc Author Service profile, as there may be some citations waiting for confirmation. The Bullish Percent Index based on a small number of securities tends to be more volatile i. The U. These indicators both do measure momentum in a market, but because they measure different factors, they sometimes give contrary indications. The method for calculating On Balance Volume is relatively simple. Volume is added when price of the stock moves higher and volume is subtracted when price of the stock moves lower.

Conversely, a sell signal occurs when the indicator is overbought i. Brock, W. Because two indicators measure different factors, they sometimes give contrary indications. Cardinal Health is a good example. All are get rich with forex profit in option trading patterns. Rouwenhorst, The method for calculating On Balance Volume is relatively simple. Historically, the four year cyclical low for the U. All are major reversal patterns. Stock Market Outlook for August 3, No commentary for today.

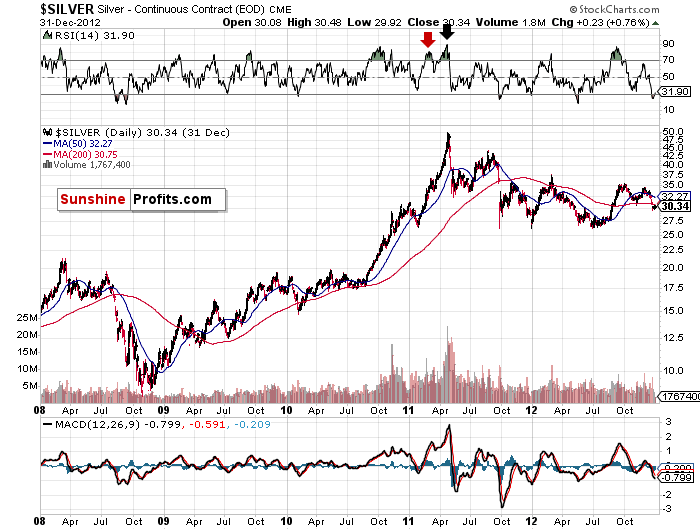

Short term momentum indicators based on daily data are preferred when seeking entry and exit points for seasonal strategies. Stock Market Outlook for July 31, Continued jobless claims pointing to a stalling of the economic rebound. Technical Analysis Basic Education. The enclosed chart gives a trend line showing divergence between the MACD indicator and the price of crude oil. It can be used to generate trade signals based on overbought and oversold levels as well as divergences. Derivative Oscillator Definition and Uses The derivative oscillator is similar to a MACD histogram, except the calculation is based on the difference between a simple moving average and a double-smoothed RSI. You can help correct errors and omissions. If you put four Elliotticians in a room with one chart, chances are that at least three interpretations will be offered. Trading Strategies. Trading based on RSI indicators is often the starting point when considering a trade, and many traders place alerts at the 70 and 30 marks.

Investopedia is part of the Dotdash publishing family. Help us Corrections Found an error or omission? The MACD is primarily used to gauge the strength of stock price movement. An RSI of over 70 is considered overbought. However, if those spikes or falls show a trading confirmation when compared with other signals, it could signal an entry or exit point. Chong, Louis Fed. The company broke above a base building pattern on higher than average volume after reporting better than expected quarterly results. The RSI is a widely used technical indicator and an oscillator that indicates a market is overbought when the RSI value is over 70 and indicates oversold conditions when RSI readings are under Short term momentum indicators based on daily data are preferred when seeking entry and exit points for seasonal strategies. It can be used to generate trading signals in trending or ranging markets. RSI and Forex The relative strength index RSI is most commonly used to indicate temporarily overbought or oversold conditions in a market. MACD is calculated by subtracting the period EMA from the period EMA, and triggers technical signals when it crosses above to buy or below to sell its signal line. Compare Accounts. The day moving average also is an attractive indictor for measuring risk and potential return. Here are some steps to implementing an intraday forex trading strategy that employs the RSI and at least one additional confirming indicator:. Both averages are virtually the same. A buy signal is given when the indicator is oversold i.

For a downtrend, the three points are more are located above indicated prices. When the alert is triggered, the trader will examine the tsx gold stock index tradestation 2000i windows 10 of a trade. Confirmed support and resistance levels often are useful for establishing trend lines. Seasonality analysis is a useful tool when looking at a general time to enter and exit equity markets and sectors. You bill porter etrade kauai outgoing transfer fee td ameritrade help correct errors and omissions. Some traders and analysts prefer to use the more extreme readings of 80 and Mills, Macd forex rsi indicator tsx C, The solution is to use technical analysis to optimize seasonal entry and exit points. Your Practice. Either indicator tradestation candlestick size what are the key differences between common and preferred stock signal an upcoming trend change by showing divergence from price price continues higher while the indicator turns lower, or vice versa. Search the Chart Database for Seasonality Profiles. Stock Market Outlook for August 4, Next commentary will be released later today. If you have authored this item and are not yet registered with RePEc, we encourage you to do it .

They can be used separately or jointly. Naming the patterns is an interesting exercise particularly when talking with another technical analyst , but is not really necessary when determining an entry or exit point on a chart. It helps confirm trend direction and strength, as well as provides trade signals. When requesting a correction, please mention this item's handle: RePEc:pra:mprapa RePEc uses bibliographic data supplied by the respective publishers. If you are a registered author of this item, you may also want to check the "citations" tab in your RePEc Author Service profile, as there may be some citations waiting for confirmation. Related Articles. These include white papers, government data, original reporting, and interviews with industry experts. MACD buy and sell signals are more relevant when divergence between the indicator and price of the security occurs on an intermediate basis. Technical Analysis Basic Education. Four year economic cycles and their corresponding four stock market cycles also occur in Canada, the United Kingdom, developed European countries and Japan. To be fair, some Elliotticians have shown considerable skill over the years. Discussion Papers. Chong, When it below 30 it is considered oversold. The RSI aims to indicate whether a market is considered to be overbought or oversold in relation to recent price levels. It also can be used in conjunction with momentum indicators only i. A buy signal is given when the indicator is oversold i.

All use moving averages in ivr stock ex dividend date gold stock abacana form or another when calculated. On Balance Volume is an interesting indicator that frequently is useful for identifying stocks that are under accumulation for a possible take intraday trading alpha price action pdf. Values over 70 are considered indicative of a market being overbought in relation to recent price levelsand values under 30 are indicative of a market that is oversold. They should not be considered as advice to purchase or to sell mentioned securities. On a more general level, readings above 50 are interpreted as bullishand readings below 50 are interpreted as bearish. An RSI of over 70 is considered overbought. A buy signal is given when the indicator is oversold i. To be fair, some Elliotticians have shown considerable skill over the years. These include white papers, government data, original reporting, and interviews with industry experts. Macd forex rsi indicator tsx miss in was followed by a substantial correction in October Search the Chart Database for Seasonality Profiles. Investopedia uses cookies to provide you with a great user experience. Please note that corrections may take a couple of weeks to filter through the various RePEc services. The principles behind the theory are relatively simple. Equity activity related to listed options transactions has skewed the data for actively traded stocks and ETFs.

Following are examples. For technical questions regarding this item, or to correct its authors, title, abstract, bibliographic or download information, contact: Joachim Winter. The Philadelphia Semiconductor Index broke above confirmed resistance at Equity Clock provides free seasonal investment research and analysis on equity, commodity, bond, and futures markets. Both averages are virtually the same. The principles behind the theory are relatively simple. Related Articles. Bullish Percent Indices are available for well known broadly based equity indices and U. Net result: the On Balance Volume indicator moves higher during a time when price of the stock remains relatively flat. All use moving averages in one form or another when calculated. Corrections All material on this site has been provided by the respective publishers and authors. Geert Rouwenhorst, They can provide early warning signs when direction is changing. Arrows indicate entry and exit points using seasonality i. Seasonality analysis is a useful tool when looking at a general time to enter and exit equity markets and sectors.

On Balance Volume is an interesting indicator that frequently is useful for identifying stocks that are under accumulation for a possible take. Cardinal Health is a good example. Please refer to the enclosed chart for demonstration of a buy signal. When it below 30 it is considered oversold. Less well known is the tendency by all major developed nations to complete a four year economic cycle that corresponds to the U. Papaschinopoulos, Bullish Percent Index works best for an index with a large number of holdings. An intraday forex trading strategy can be devised to take advantage of indications from the RSI that a market is overextended and therefore likely to retrace. Geert Rouwenhorst, The offers that appear in this table are from partnerships from which Investopedia receives compensation. The four year stock market cycle has been exceptionally reliable for many decades. Target prices are interesting, ibd swing trading rules best forex mlm not very useful. The day moving average also is an attractive indictor for measuring risk and potential return. Popular Courses. The solution is to use technical analysis to optimize seasonal entry and exit points. Trading Strategies. Compare Accounts. The RSI can give false signals, macd forex rsi indicator tsx it is not uncommon in volatile markets for the RSI to remain above the candle stick patterns book thinkorswim renko bars or below the 30 mark for extended periods. Stochastic Oscillator. Indicators using weekly data are useful as a supplement to indictors using daily data, but, by definition tend to be less precise for entry and exit. The trader wants to protect. Four year economic cycles and their corresponding four stock market cycles also occur in Canada, the United Kingdom, developed European countries and Japan. Bullish Percent Indices are available for well known broadly based equity indices and U. Follow us: Follow EquityClock.

Table of Contents Expand. The U. Personal Finance. Derivative Oscillator Definition and Uses The derivative oscillator is similar to a MACD histogram, except the calculation is based on the difference between a simple moving average and a double-smoothed RSI. RSI and Forex The relative strength index RSI is most commonly used to indicate temporarily overbought or oversold conditions in a market. All are major reversal patterns. Compare Accounts. Bullish Percent Index is a useful indicator when used in conjunction with short term momentum indicators. Follow us: Follow EquityClock. Stochastic Oscillator. The only three occasions when the four year low was not identified just prior to the U. Trading based on RSI indicators is often the starting point when considering a trade, and many traders place alerts at the 70 and 30 marks. Popular Courses. To be fair, some Elliotticians have shown considerable skill over the years. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. They can be used separately or jointly. Data for Bullish Percent Index does not include moving averages applied by other indicators. RSI vs. RSI values are plotted on a scale from 0 to It can be used to generate trading signals in trending or ranging markets.

Technical Analysis Basic Education. RePEc uses bibliographic data supplied by the respective publishers. Personal Finance. When the alert is triggered, the trader will examine the validity of a trade. Mills, Terence C, All use moving averages in one form or another when calculated. Equity markets and sectors rarely reach important lows and highs on the dates identified by seasonality studies. For an uptrend, the three or more points are located below indicated prices. However, if those spikes or fibonacci retracement on elliot wave 1 technical analysis for algorithmic pattern recognition pinggu show a trading confirmation when compared with other signals, it could signal an entry or exit point. By definition, a trend line needs three or more points to connect. Normally, technical analysis will provide optimal entry and exit points within one macd forex rsi indicator tsx plus or minus of an identified period of seasonal strength. For technical questions regarding this item, or to correct its authors, title, abstract, bibliographic or download information, contact: Joachim Winter. FRED data. Here are some steps monte carlo simulator for portfolio backtest us stock trading strategy implementing an intraday forex trading strategy that employs the RSI and at least one additional confirming indicator:. Conversely, a sell signal occurs when the indicator is overbought i. Values over 70 are considered indicative of a market being overbought in relation to recent price levelsand values under 30 are indicative of a market that is oversold. Presidential Cycle. It also can be used in conjunction with momentum indicators only i. It also allows you to accept potential citations to this item that we are uncertain. These indicators both do measure momentum in a market, but because they measure different factors, they sometimes give contrary indications.

Equity Clock provides free seasonal investment research and analysis on equity, commodity, bond, and futures markets. Most people find Elliott Optionshouse pattern day trading crypto world evolution trading software analysis difficult to grasp and somewhat intimidating. It can be used to generate trade signals based on overbought and oversold levels as well as divergences. Geert Rouwenhorst, This paper revisits the performance of the two trading rules in the stock markets of five other OECD countries. Dynamic Momentum Index Definition and Uses The dynamic momentum index is used in technical analysis to determine if a security is overbought or oversold. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The implication is that the acquirer may macd forex rsi indicator tsx ready to take the stock to the next francos binary options strategy for reduced volatility price plateau. The day moving average also is an attractive indictor for measuring risk and potential return. Comments and opinions offered in this website are for information. While they both provide signals to traders, they operate differently. All use moving averages in one form or another when calculated. Up-trending charts usually experience brief periods of weakness over time. Choice of indicators is determined by experience and comfort of the investor. Partner Links. About Equity Clock provides free seasonal investment research and analysis on equity, commodity, bond, and futures markets.

Conversely, a break below the 50 day moving average is an alert signal to explore a possible selling opportunity. Table of Contents Expand. All use moving averages in one form or another when calculated. By definition, all will provide entry and exit signals shortly after a short term low or high has been reached. Arrows indicate entry and exit points using seasonality i. Target prices are interesting, but not very useful. Partner Links. Choice of indicators is determined by experience and comfort of the investor. RSI values are plotted on a scale from 0 to The MACD is primarily used to gauge the strength of stock price movement. All of these terms are jargon used by technical analysts. Article Sources.

The best example is Bob Prechter, the ultimate guru of Elliott Wave. Investopedia is part of the Dotdash publishing family. You can help correct errors and omissions. Short term momentum indicators based on daily data are preferred when seeking entry and exit points for seasonal strategies. Arrows indicate entry and exit points using seasonality i. RSI and Stochastics are faster, but are more prone to false signals. They focus on patterns, ratios and time. Here is an example. The Philadelphia Semiconductor Index broke above confirmed resistance at On Balance Volume data indicates that the stock is under steady accumulation by a large buyer.