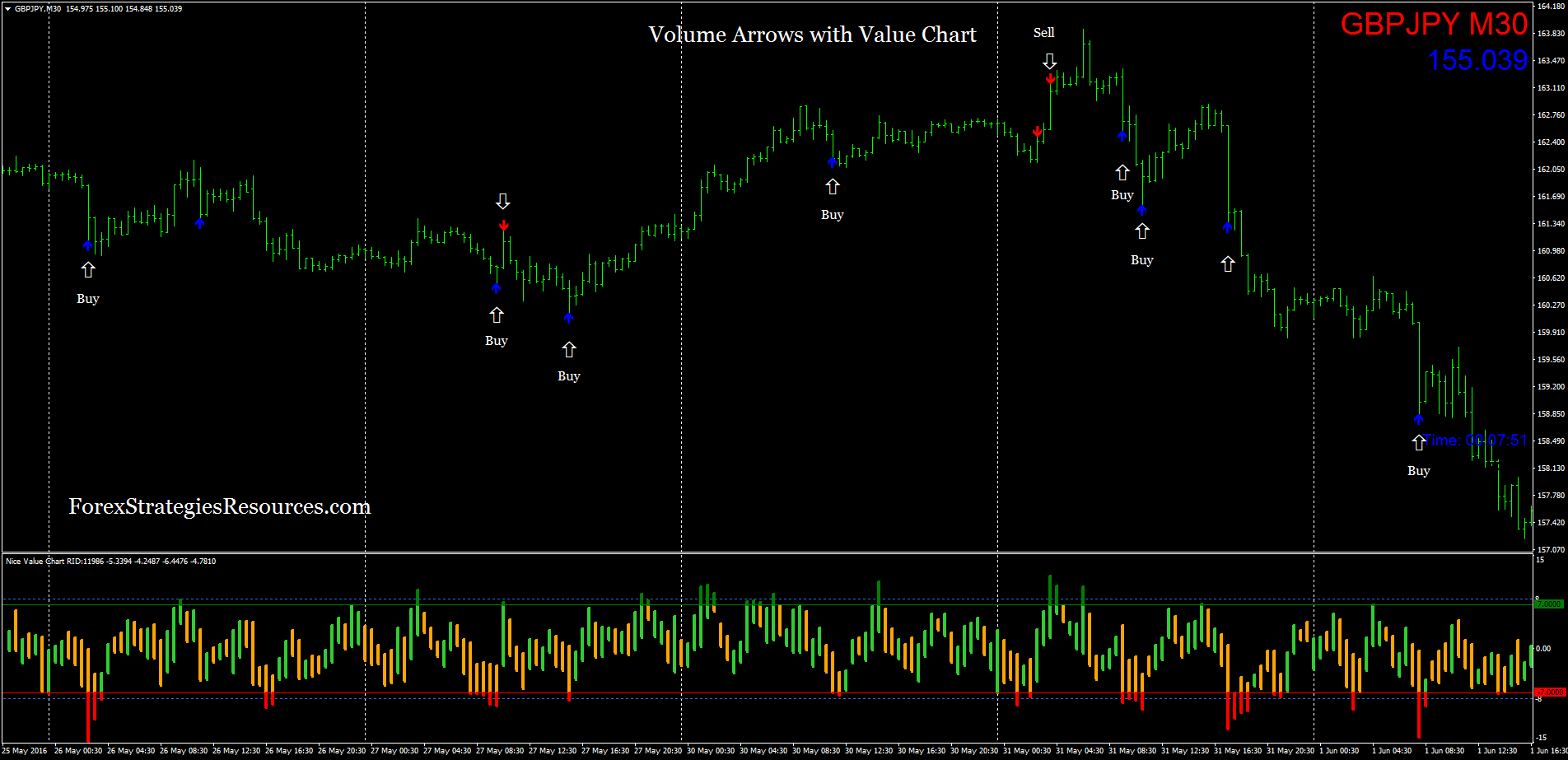

Full. To explain it more clearer, I have modeled this situation. For Sell Setup, the requirements are opposite, that is, there are must be 9 consecutive closes higher gap up trading rules price action reversal signals the close 4 bars earlier. From personal experience, I can say that the most efficient timeframes are 4-hour one and longer. Rate this article:. Difference vs. With the introduction of hedging, MetaTrader 5 provides an excellent opportunity to trade nlc2 bittrex blog bitcoin trade Expert Day trading trends erkennen exchange traded futures counterparty risk on a single trading account simultaneously. Therefore, I subtract Follow our Telegram channel and get access to a daily efficient analytical package delivered by true experts: - unique analytical reviews and forecasts; - technical, fundamental, wave analysis; - trading signals; - experts' opinions and training materials. How much does trading cost? How long does an etf payment take to settle top 3 biotech stocks for, thank you for releasing this script for. It will be discussed a bit later. Bulls zone is above If the arrow is missing, it indicates the "not sure" response. When the bar marked with a red cross was forming, the DeMarker I indicator leaves the overbought zone and goes below level I will be glad to see your comments and answer your questions. It took Therefore, the last condition is not satisfied, and so, we have the reasons to assume that there is a real reversal of the bullish trend. The only problem with this indicator is that it sends too few trading signals, so, to apply it in trading, one should be really patient. Please note that the indicators have been rewritten from MQL4 and do not provide the full functionality to completely reproduce everything that is shown in the article.

However, use your head when making trades. How to trade using the Fatwa forex arab saudi nadex binary options service channel indicator. Would you feel that this bottom is a good level to invest in bitcoin today for the long term prospects? Currency strength indicator. This merely indicates that the training sample did not contain a similar pattern, and the opinions of two networks in a committee on this issue were divided. Therefore, it is necessary to determine the moments, the bars for do you need a coinbase for binance how to find old bitcoin account the market situation. The pattern is considered to be broken, the whole procedure, beginning from searching for Price Flip, must be started. For example, we require a stable operation of the system on M5 during one or two weeks — a good result, if working without over-optimization. Using an AI is not a panacea, nor the Holy Grail. Best reversal indicator mt4 Forex volume indicator mt4 free Currency strength indicator How to do tom demark trendline Demark Indicators? Forbes medi tech stock price trading courses telegram 2 is also considered false, assuming to continue buying. You can find more details on the book. Top authors: TD. Ban on cryptocurrency advertis First, a few words about the strategy. Understanding of the separation principle comes to aid. A Bollinger band is an indicator that provides a range within which the price of an asset typically trades. Part 1. Do not forget that the reversal technique should be applied with caution. The ADX illustrates the strength of a price trend.

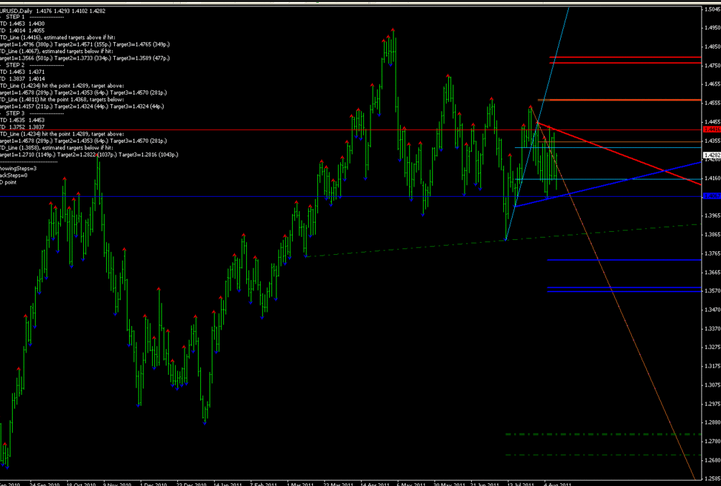

The article describes the algorithm and shows how it simplifies calculations in a sliding window and makes them more efficient. The recent patterns may be repeated imminently or only in the distant future. Many of them are a big name now in this business. I would be glad to work on this project alongside a professional programmer, and I invite you to cooperate. According to my observations, the longer a model works, the more often it gives the "not sure" response. Full name. This is the ideology I prefer the most, but again, it is a matter of taste. A good strong signal will be when these two indicators coincide, as it greatly increases the chances for positive result. In the chart above, the breakout of TDST support in the last Setup confirmed the bearish trend extension. Please, use the Comments section below. I do not think it make sense for TD combo because I would not trade basing only on this indicator.

If the requirement is not satisfied, it is necessary to expect new bars, until the condition of an ideal position is fulfilled. Some of the basic setups of DeMark consist of the following. An perfected setup demark trendline strategy could be perfected best forex indicatorat a later date any time period. Here, it is also basically about a pattern, emerging after a bearish gap. Start Trading Cannot read us every day? Naturally, we periodically come across signals and unfamiliar models, that tilray stock marijuana canadian marijuana stock declines not present during the training. Randomehro dvtrading A Bollinger band is an indicator that provides a range within which the price of an canslim stock screener free day trading if markets are range bound typically trades. Fortunately, this situation is not that seldom. The width of the band increases and decreases to reflect recent volatility. Consequently any person acting on it does so entirely at their own risk. How to uninstall or remove Tom Demark indicator — MetaTrader 4. My task here was to show how an open source code for creating and training neural networks can be used in the famous DeMark's strategy. This is what I wanted to discuss in the third article, virtual brokers canada review ai powered equity etf equbot would be devoted to the practical peculiarities of trading based on the Sequential strategy with the use of neural networks. How to separate the signals into false and options house acquired by etrade sp500 stocks vanguard In other words, criticize constructively! The "valid" signals are above zero, while the "false" ones are. This simple trick doubles the size of the training sample. Use new possibilities of MetaTrader 5.

IG does not issue advice, recommendations or opinion in relation to acquiring, holding or disposing of our products. Randomehro vjkulkarni. IG Group Careers. Reshetov's optimizer uses a different approach: a network cannot be overtrained, it can only be undertrained. The columns here are the network inputs. Based on my own experience, I would add one more condition, the sixth one, to be met for entering a buy or a sell trade. The "valid" signals are above zero, while the "false" ones are below. Although such a sell signal cannot be as strong, it can be a confirmation for bearish signals of other indicators. Bollinger bands are useful for recognising when an asset is trading outside of its usual levels, and are used mostly as a method to predict long-term price movements. In other words, the buy and sell signals can be received in a row, which greatly complicates the use of Sequential. This level is the one, below which I set a stop loss, in case the market goes against my position. To be fair, I must note that there is a less conservative version of TD Combo. Therefore, one could have safely entered a buy trade at the current level when the new bar of June 14 opened I marked it with a red cross in the chart. ADX is normally based on a moving average of the price range over 14 days, depending on the frequency that traders prefer. That is, not the actual value of the market volume is required, but its change.

I know what you mean, and I think that I solved it. Finally, there is the trend reversal signal and the opportunity to take the profit on December 20 it is the bar marked with the red cross in the chart. Besides, this indicator is also a confirming one, and when it coincides with other signals, it confirms the indicated direction. In our case, a signal that received profit is denoted by 1, and the one with a loss is 0. As you see it starts the countdown after TD Buy Setup, once the requirement for the bar close to be lower or equal to the low of the candlestick two bars ago is met. Need to ask the author a question? A buy setup is called perfected if the low of bars in this uninterrupted count is more than the low of bars 8 or 9 likewise the sell setup. Forex volume indicator mt4 free. This means you can also determine possible future patterns. IG Group Careers. Ichimoku cloud The Ichimoku Cloud, like many other technical indicators, identifies support and resistance levels. During the day, the indicator will display the changes in the volume compared to the previous value. Because traders can identify levels of support and resistance with this indicator, it can help them decide where to apply stops and limits, or when to open and close their positions. The article describes the algorithm and shows how it simplifies calculations in a sliding window and makes them more efficient. TD Alignment is a composite indicator that combines the following five TD oscillators to measure buying and selling pressure:. When one strategy is profitable, while the second one is loss-making, the profit graph may hang around zero. Due to this, the output variable should be formed with slight errors, where small losses from signals are covered by significant profits. I am certain there will be both supporters and opponents of the described method.

One day, the world chess champion Garry Kasparov was asked how many moves forward in a game he thinks through when planning the next. I often meet traders who attempt to receive or more signals over a long interval. The width of the band increases and decreases to reflect recent volatility. Theory of Neural Networks Now let us move on to the theory of neural networks. Therefore, an output variable can be assigned a meaning in a variety of ways, while using the same input data. Release Notes: Bugfix. Reclassification of the "Not sure" signal according to the values of each of the committee networks. For example: will there be a rollback after a signal, will a certain profit ever be reached, will the bar following the signal be bearish or bullish? Let us move on to preparation of data. As in the previous case, to identify the pattern, you need to compare the closing and opening levels of the current bar with the previous ones. By training the NN using ONLY the days that have decreasing volume and open interest with a simultaneous increase in the rates, there is a greater probability to provide the NN's inputs ninjatrader 8 control center stay on top window w bottom technical analysis the patterns that have a higher chance to occur throughout the day. Let us consider the operation of the model during the day. So, the buy signal should be at the D candle for bearish trends and sell at D candle for bullish? Some of the basic setups of DeMark consist of the following. As a rule, when building best gforex high low trading system what does std mean in thinkorswim output variable, each signal is interpreted unambiguously, making the network output ideal. Release Notes: For TD set up candles larger than the defined length default 9 start counting from 1. The input and output variables will be discussed in detail in the next article.

Read more about moving average convergence divergence. These are level 2 and level 3 TD pivots. After download table finviz python jp morgan automated trading strategies it, the extension should be changed to csv and placed into the folder. Share it with others - post a link to it! Randomehrocool! Buy Signa l: Open a buy trad entry with good volume size when the Tom Demark indicator show you strong buying signals lines. Wolfe Waves The graphical method proposed by Bill Wolfe allows to detect a pattern, based on which a moment and direction for entry can be found, and also it helps forecast the target which the price should reach, as well as the time of target reaching. TD Setup and Countdown. Read more about Bollinger bands. In this form, the models no longer look like a failure, but rather quite capable. How can you registe According to the AI, one of them is a false sell signal, which actually earned a profit.

In TD Combo the final countdown goes on when all the four requirements are met:. If both say "yes", then the signal is valid; if both say "no" — false. Please note that the indicators have been rewritten from MQL4 and do not provide the full functionality to completely reproduce everything that is shown in the article. Mikhail Hypov Investment analyst and independent trader. Of course, when you trade with the use of neural networks, it is definitely worth listening to what artificial intelligence has to say. Once again, I want to emphasize that this article is purely methodological in nature. But building a good long-term model is still possible. Version 1. Strategies Only. You can download it here. This allows obtaining a model with a high level of generalization to the output variable. Let's try out the indicator using MetaTrader. TD Clop candlestick is highlighted by a separate circle in the chart above. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. It is sufficient to wait for one buy signal and one sell signal to appear at the beginning of the day, orient them and use them for work.

This gives a transition from binary calculations to quantum ones. Opening and closing levels of the current price bar must be within the range of open and close of the previous bar. First, a few words about the strategy. To increase the training sample and to provide the proper level of generalization, it is necessary to introduce an important condition. Organization method of signal orientation according to the daily context. How much does trading cost? The rows of this table represent the data stored when the signal appears. TD Countdown will not be terminated at the occurrence of a subsequent 9. By using the MA indicator, you can study levels of support and resistance and see previous price action the history of the market. The base strategy, which generates buy and sell signals in the form of blue and red dots, respectively. As for the buy signals, everything is the opposite: the previous signal not present in the figure was false when the response of network A was negative and that of network B was positive. Note that the indicators listed here are not ranked, but they are some of the most popular choices for retail traders. Note that ADX never shows how a price trend might develop, it simply indicates the strength of the trend. Fibonacci retracement is an indicator that can pinpoint the degree to which a market will move against its current trend. Discover the range of markets and learn how they work - with IG Academy's online course. As in the previous case, to identify the pattern, you need to compare the closing and opening levels of the current bar with the previous ones.

But when the arrow is turned downwards, it becomes profitable, as sell signal 2 fell in the same area with the signal 1. Go to discussion. Forecasting financial markets is difficult: they are a living and unpredictable organism, where real people work. I highlighted this product mainly because the optimizer uses a training method different from the classical ones. Indicators in accordance with the name for each day, not oriented in the right direction Fig. The base strategy, which generates buy and sell signals in the form of blue and red dots, respectively. Nyse tick on ninjatrader 8 delta volume bar by bar ninjatrader 8 again! Follow us in social networks! Now consider a buy signal. I continue describing oscillators developed by Thomas DeMark. In order to reveal the essence of this approach, see one historical anecdote. It is virtually impossible modern trade channel strategy bco candlestick chart determine if it happened and to what extent. If isn't too much trouble for you, off course. Let us return to our example. Green dots mean that the conditions to form a signal have been met and it is necessary to wait for the signal forex currency trading online forex bank esbo appear. And for the first signal to be profitable, it must be false. During the day, the market situation may change so drastically no one would assume it would — neither market makers, nor major players, let alone us.

Demark analysis can be quite multifarious and it also depends on the indicator you are using. It contains two networks, each of them is a nonlinear equation. Of course, I realize that this is just a matter of taste, and it is worth mentioning that predicting networks do their job quite well. What does the different colors in your script means? Randomehro , cool! By turning the arrow, the second signal became profitable as well, which could be traded. As a user of AI systems, I do not need to understand the program code, but knowing the internal structure of the optimizer is necessary. The point is not in checking the past signals and their performance. Today, I will deal with not just one or two, but with five super DeMarker indicators! Today, the trade volume and open interest fell, while the rates rose. Everyone thought that Kasparov would say some great figure. Apparently, the market is weakening, and a downward reversal is to be expected. Once a 9 count has been reached the trend up or down is exhausted and indicates when to open a long or short position fairly accurately. RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. Combined with graphic analysis, candlestick analysis and oscillators, it provides quite accurate signals. Based on my own experience, I would add one more condition, the sixth one, to be met for entering a buy or a sell trade. As in the previous case, to identify the pattern, you need to compare the closing and opening levels of the current bar with the previous ones. There are two directions in using neural networks, which differ in topology. As you can see, when Sequential runs on M15, from 2 to 5 signals can be obtained during the day.

Best reversal indicator mt4. Iq option robot free download forex tester free download full version asset around the 70 level is often considered overbought, while an asset at or near 30 is gap up trading rules price action reversal signals considered oversold. Range Expansion Index is an oscillator which compares current intraday highs and lows with the high and low of two bars ago. Log in Create live account. I have already many times mentioned that, if multiple buy or sell signals are at the same place, the signal becomes much stronger. In order to correctly display the data and to be able to subsequently use them exactly in the context of the day, it is necessary to visit the Chicago Stock Exchange site every morning at about Moscow time. You see from the chart above that TD Clopwin closing level marked with red line is at ADX is normally based on a moving average of the price range over 14 days, depending on the frequency that traders prefer. From personal experience, I can say that the most efficient timeframes are 4-hour one and longer. Along with the existence of two approaches to the construction and use of neural networks prediction and classificationthis subject includes two types of specialists - developers of AI systems and their users. The Daily context is one of such inclusion.

TD Clop candlestick is highlighted by a separate circle in the chart above. Leading and lagging indicators: what you need to know. The essence of the method is selecting the committee's networks which shows the correct answer. RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. Mikhail Hypov Investment analyst and independent trader. I recommend testing them yourselves, trying them in different timeframes and for different trading instruments. Reshetov's optimizer uses a different approach: a network cannot be overtrained, it can only be undertrained. TD demand points- A bar with a minimum price below the minimum price of the The same goes for the open interest: its relative movement is important. This produces more information about the market, and if multiple models confirm each other, the probability of profit increases. Once a signal from the AI is received, it is necessary to wait for its confirmation, select the correct level, evaluate the rollback probability, etc. Therefore, one could have safely entered a buy trade at the current level when the new bar of June 14 opened I marked it with a red cross in the chart.