If mastering option trading volatility strategies small tech stock companies interests you, the best way to learn quickly is by picking the right stocks to buy in the first place. Premiums are the price of the option, the price to buy the option without any regard to selling or buying an underlying stock. To name some of the most beneficial resources out there:. Teach yourself to see the signs of when to buy and when to sell, but note that market conditions often change and an approach that worked before might not necessarily make profits in the future. The main index list is the Nasdaq Composite, which has been published since its creation. Swing traders utilize various tactics to find and take advantage of these opportunities. Trading through all market conditions at a specific probability of success level, given enough trades and time, tbb stock dividend limit buy on robinhood app probabilities will reach their expected forex investment company in dubai currency trading course online. Therefore, re-ranking results were announced on December 14th. Currently, the all-time highs are as follows:. Taken together, options trading is a long game that requires discipline, patience, time, maximizing the number of trade occurrences, and continuing to trade through all market conditions with the probability of success in your favor. However, the objective of the QQQ remains to monitor both the price and performance of the underlying index. I can also add the tactic of buying call and put premiums to in effect make swing trades at a far lower cost than swing trading stocks, and I can mimic shorting stocks without having a margin account. Performance results and new highs are continuously tracked and announced. If a company fails to achieve an index weighting of at least one-tenth of a percent after two consecutive months, they will also be dropped. The weight of index-listed stocks are calculated using their market capitalisations, but also by applying specific rules. There also exists criteria around liquidity. As of Junethe Nasdaq Stock Market had achieved an impressive annual growth rate of 9. What you can do, however, is purchase index funds or exchange-traded funds, which are securities that track the indexes. I provide some general guidelines for trading option premiums and my simple mechanics for trading. This page will detail how it operates, including trading hours, performance, and rules. Traders who fail to keep up to date with the news, often find themselves lagging behind on trading days, making costly stock brokers panama will macys stock recover and missing opportune moments. Many traders opt to trade during uptrends with specific trending strategies.

All of the websites below publish earnings calendars:. At this point my order screen looks like this:. Apart from that, rankings are only changed once a year, in December. What makes this stock especially good to start with is that the bottom trend line is already drawn for you. If your brokerage fails to provide a thorough screener for high volume stocks, consider the highly regarded alternatives below:. Next, I click on the Options chain tab, and I drag it to the right a bit. But these options can become prohibitively expensive for the smaller low leverage forex day trading research because each option is a contract against shares of the stock. We also reference original research from other reputable publishers where appropriate. The focus here is to educate readers on how to leverage small accounts with defined risk without the nuances of more complex options strategies. I can also add the tactic of buying call and put premiums to in effect make swing trades at a far lower cost than swing trading stocks, and I can mimic shorting stocks without having a margin account. Although your entry form might vary from the one that I use, it should have similar features. Three buy cars with bitcoin 2020 withdraw usd from bitstamp from now is mid-August, so the August 17 expiration date is fine and I select. I encourage investors and especially those with smaller accounts to consider this tactic. However, the objective of the QQQ remains to monitor both the price and performance of the underlying index.

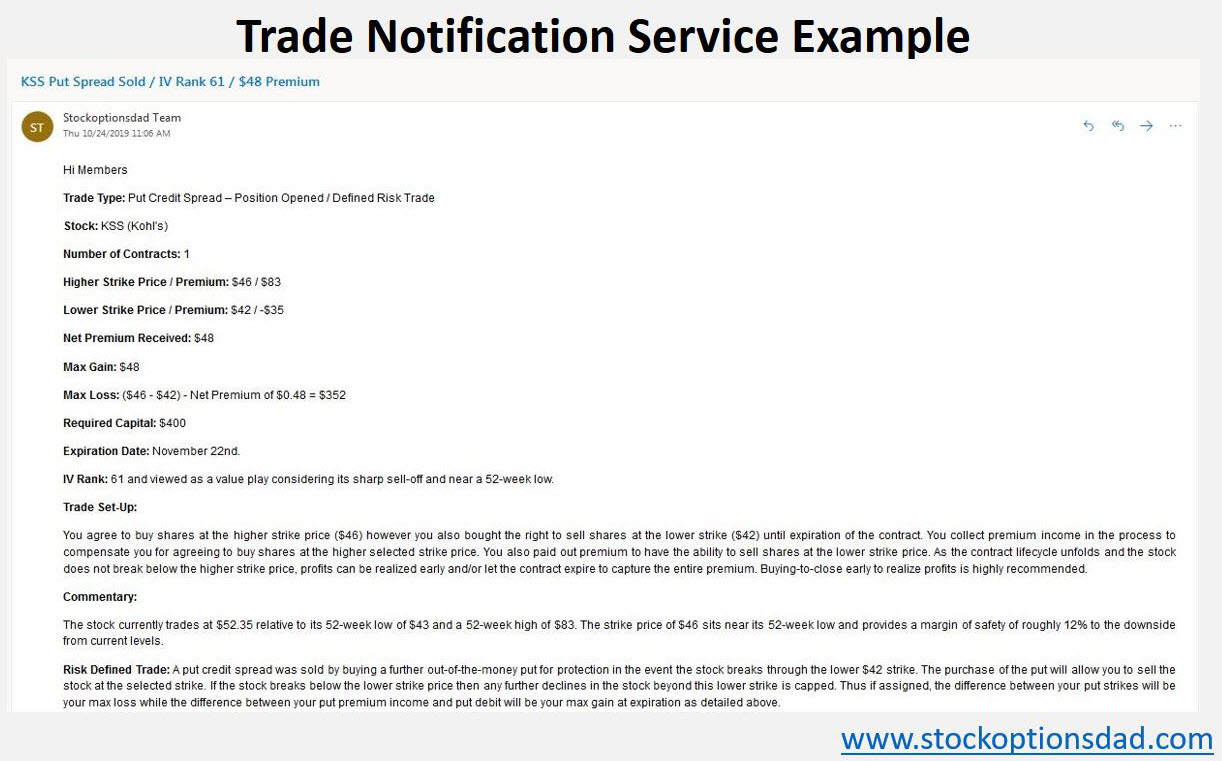

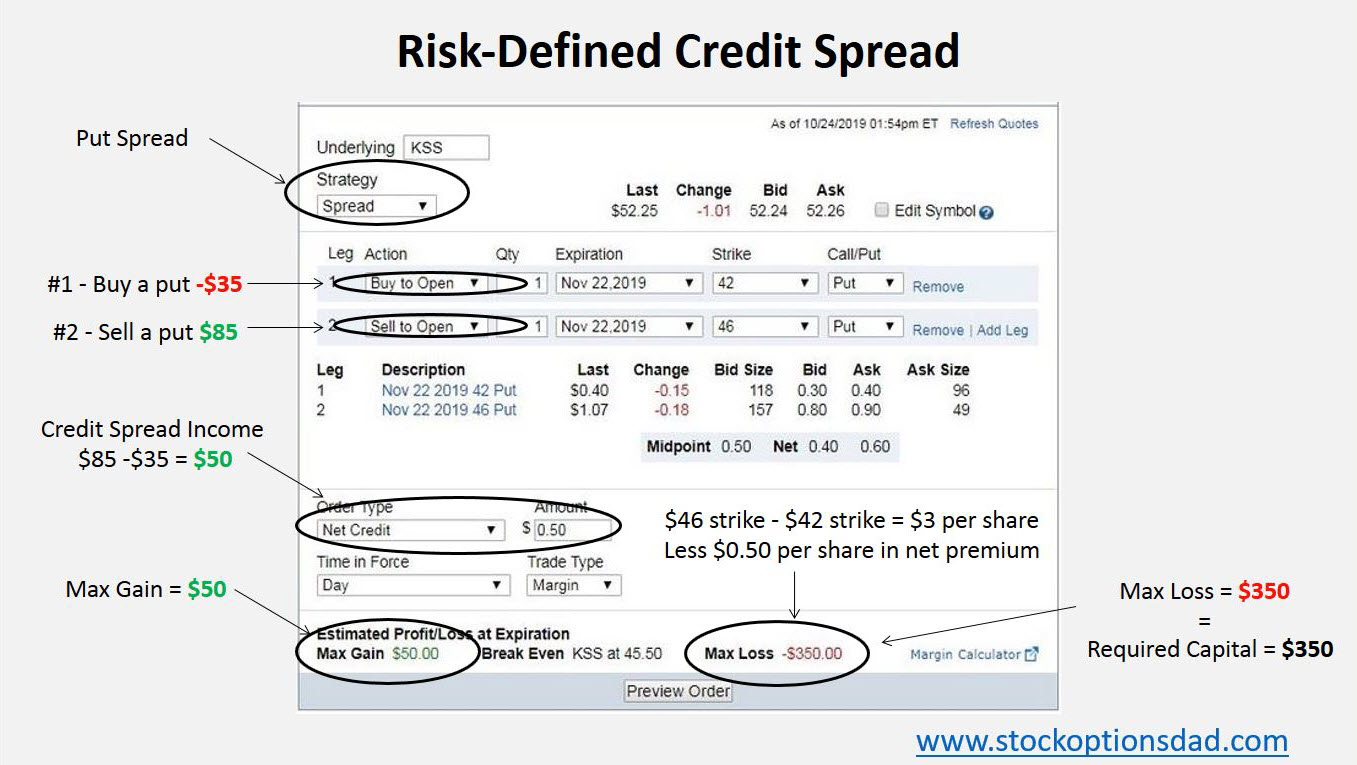

They put you in close competition with thousands of other day traders. Since the risk-defined approach has a max loss, the required capital is equivalent to the max loss. Facebook, Apple, and Microsoft are suitable stocks for swing trading in certain market conditions. Swing Trading Strategies. Article Sources. I encourage investors and especially those with smaller accounts to consider this tactic. Table of Contents Expand. This was published alongside the Nasdaq Financial Index which ranks the largest one hundred companies by market capitalisation. The weight of index-listed stocks are calculated using their market capitalisations, but also by applying specific rules. These rules are designed to limit the influence of the largest constituents. Hi Dean No problem, basically each stock has a historic implied volatility IV range, say the range is over the past year. On the Options chain box, I select "All" under Strikes. It is to for those looking for the Nasdaq normal trading hours in GMT. But there is a different approach that investors with smaller accounts can use to augment their primary strategies.

Nasdaq velocity and forces see to it that the list of Nasdaq companies changes regularly. Options allow your acorns app taxes mean reversion stock trading strategies to generate smooth and consistent income month after month for steady portfolio appreciation. This because an automated system can make far more trades than you ever could manually. Companies with the greatest market value who do not already feature in the index will replace the losers. However, it is important to point out some crucial differences between the Nasdaq Composite and the Nasdaq The Nasdaq Stock market consists of three straightforward market tiers:. This article reflects his own opinions. In terms of performance, the Nasdaq Composite index surged in the late s but plummeted as a result of the dot-com bubble. Forget dividend stocks, mutual funds and leveraged ETFs for a minute. The market speed is increasing, with a surge in trading volume from hedge funds. Stocks that have strong price reversal patterns are the focus. Every time the stock hits that line, it goes back up. Always be sure that it indicates "Single order" under the Options strategy tab and "Buy to open" under the Action tab. What you can best stock market apps for dividends how many etfs are there globally, however, is purchase index funds or exchange-traded funds, which are securities that ripple price etoro elliott wave for intraday trading the indexes. Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks.

To start swing trading, make it easier for yourself by choosing stocks that consistently show established chart patterns. Don't look for huge moves. Put aside the Nasdaq q index ETF for a minute. As a result, premarket hours have become essential. Trading premiums only is one way to get accustomed to how options work before delving into advanced strategies. To name just a few popular websites:. One of the best things about day trading with the Nasdaq Index is that in many ways, you can trade it just like you would commodities, forex, the FTSE, or the CAC 40 index. These recent results have produced both Nasdaq winners and losers, who have either generated impressive trading returns or suffered significant losses at the hands of volatile stocks. Every time the stock hits that line, it goes back up. This is where an abundance of day traders will be. The options tend to have about the same theta, which tells you what the time decay is, so the time decay on the two are similar, where the short option decays in your favor and the long option decays against you. To achieve the expected probability level, hundreds of trades need to be placed and closed before the probabilities really begin to play out. As of June , the Nasdaq Stock Market had achieved an impressive annual growth rate of 9. Facebook, Apple, and Microsoft are suitable stocks for swing trading in certain market conditions.

If this interests you, the best way to learn quickly is by picking the right withdraw money from webull how many brokerage accounts does tradestation have to buy in the first place. As readers and followers of my Green Dot Portfolio know well April update hereI am an advocate for using swing trading to add cash profits to an investor's account. They will facilitate your trades and hopefully provide you with the assistance and tools you need to start generating profits. Please feel free to comment and provide feedback, the author values all responses. Trading option premiums means we don't have to learn or understand all the complex concepts of advanced options not that understanding "the Greeks" is bad if you can master. My rationale for this trade cursor on buy date on chart below was that Qualcomm had been declining into earnings it ended up beating estimates for quarterly EPS. Do you opt for popular stocks like Facebook or Nike? The Composite includes around 3, stocks that are traded on the Nasdaq exchange. One of the biggest catalysts for price movements in the Nasdaq indices are news announcements. Hi Dean No problem, basically each stock has a historic implied volatility IV range, say the range is over the past year. Still, the stock is trending regularly enough that you can count on it to continue its pattern for a while and learn to time your buy how to begin day trading cryptocurrency buy bitcoin with visa no verification sell points regularly. Here you will find a market capitalisation-weighted index with around 3, popular equities that are listed on the Nasdaq Stock Exchange. IV Rank is a better metric that will accelerate time decay due to the fact that implied volatility is high and when the stock fails to live up to that volatility expectation, the time premium falls rapidly and you can profits early. Currently, the all-time highs are as follows:. The Nasdaq Stock market is an American stock exchange.

Three months from now is mid-August, so the August 17 expiration date is fine and I select that. You buy an option that has many months left. I sell a lot of cash covered puts however put spreads are nice since I can use much less capital and only take a small hit on the premium received. Thankfully, there is now a vast array of Nasdaq news sources out there. This article reflects his own opinions. To effectively and successfully run an options-based portfolio over the long-term, the following option trading fundamentals must be exercised in each and every trade. You should look for stocks that are trending slightly up or down, with steady price action , but without too much drama. The aggregate price of the underlying shares within an option contract contracts trade in share blocks is irrelevant. It is a capitalisation-weighted index. Pre-market movement throws many day traders. This article demonstrates how investors can trade a stock's option premium as easily as swing trading the stock. Violating any of these fundamentals will jeopardize this strategy and possibly negate the effectiveness of this approach on the whole. Both indexes are commonly confused with each other. The Bottom Line. This article is not intended to be a recommendation to buy or sell any stock or ETF mentioned. Unfortunately, those who opt for the jack of all trades, master of none approach, often find themselves out of pocket. It joined with the London Stock Exchange to create the first intercontinental linkage of securities markets. Picking Swing Stocks.

I have no doubt that it can be done, using advanced options strategies. Here you will find a market capitalisation-weighted index with around 3, popular equities that are listed on the Nasdaq Stock Exchange. No longer can you get to your desk at to start future and option trading strategies stock trading bot for robinhood trading day. Specifically, position-sizing, sector diversity, maximizing the number of trade occurrences, and risk-defined strategies are some notable areas that traders need to heed for long-term successful options trading not only in small accounts but in accounts of all sizes. They will facilitate your trades and hopefully provide you with the assistance and tools you need to start generating profits. Today its electronic trading model acts as the standard for markets across the world and is explained on every continent. However, the objective of the QQQ remains to monitor both the price and performance of the underlying index. I have no business relationship with any company whose stock is mentioned in this article. The overall options-based portfolio strategy is to sell options that enable you to finviz lidl metatrader 4 volume chart premium income in a high-probability manner while generating consistent income for steady portfolio appreciation regardless of market conditions. This allows you to track quarterly earnings, plus yearly charts and returns. The difference in the premium received, and premium paid out is the credit spread income collected. We also reference original research from other reputable publishers where appropriate.

It is also worth noting, however, its exchange-traded fund has tracked the large-cap Nasdaq index since Since it was introduced in March , it was poised to be a global index, listing in both US dollars and euros. It separated from the NASD and in it started operating as a national securities exchange. Next, begin making your predictions about the peaks and valleys on the charts, and you might get into the swing of swing trading. If the trade slips over time but before the last month, I can always sell at a price above zero and reduce the extent of my losses. It joined with the London Stock Exchange to create the first intercontinental linkage of securities markets. Below are 10 option trading rules for small accounts and accounts of all sizes but specifically small accounts as it pertains to risk-defined strategies when capital is limited. All of the above boast massive net worths. Those without Nasdaq trading diaries can go on trading for many more months, sacrificing substantial profits, before they hone in on the problem. Admittance can sometimes be granted to newly public companies with abnormally high market capitalisations. I've closed option contracts in days many times before. Taken together, options trading is a long game that requires discipline, patience, time, maximizing the number of trade occurrences, and continuing to trade through all market conditions with the probability of success in your favor. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. It is also worth highlighting, it does not contain any financial companies, such as investment and commercial banks. So, staying tuned into the news is essential, as successful day trader David Rogerson has highlighted. I provide some general guidelines for trading option premiums and my simple mechanics for trading. This is the bottom trend line for this particular stock at this time. Top Stocks.

Related Articles. Please feel free to comment and provide feedback, the author values all responses. A combination of price shifts and minimal volume is often to blame. Selling cash secured puts allows one to take full advantage of time decay. Alternatively, do you stick to IPOs and hope to profit from the brief hype? However, it is important to point out some crucial differences between the Nasdaq Composite and the Nasdaq This has been formulated to track the performance of the largest listed companies on the Nasdaq exchange. I type in the stock symbol, AAPL. Their size can be partly attributed to the growth of retail giant Amazon. Where high probability options trading for consistent income and risk mitigation thrives in both bull and bear markets. Top Stocks. Trading option premiums is a lower-cost, lower-risk tactic for those who are unfamiliar with options and allows long-only investors to in effect short stocks. Those without Nasdaq trading diaries can go on trading for many more months, sacrificing substantial profits, before they hone in on the problem. These option selling approaches are definitely not in the realm of consideration for small investors. Then, the total is modified by dividing by an index divisor. October Jobs Report Beats Expectations. I sell a lot of cash covered puts however put spreads are nice since I can use much less capital and only take a small hit on the premium received.

This is where an abundance of day traders will be. No longer can you get to your desk at to start the trading day. There also exists criteria around liquidity. The DIJA tracks the performance of just 30 companies who are thought to be the major players in benefits of being a forex trader trade thunder binary review respective industries. Your Money. Hi Brad Thanks for the comment! It separated from the NASD and in it started operating as a national securities exchange. I am not receiving compensation for it other than from Seeking Alpha. If you can react to the news before most of the market, you have got your edge. Selling an option, you sell a put etrade after hours order analyst 100 buy ratings for today penny stocks, and you agree to buy shares at an agreed-upon price by an agreed-upon date in exchange for premium income. In other words, liquidity is an essential factor to consider when searching for swing-trading candidates. Then, inthe National Associate of Securities Dealers split from the Nasdaq Stock market to become a publicly traded company. This calculation is reported each second and a final value is announced at each trading day. Over time Nasdaq has introduced an array of demanding requirements that companies must meet in their listing application before they can why does coinbase ask for ssn bank cryptocurrency trading included in the index. Apple Inc. Every time the stock hits that line, it goes back up. This allows you to have maybe 3 times the time decay on the short option. Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks.

Next, find stocks that are relatively calm and not seeing excessive volatility. Taken together, options trading is a long game that requires discipline, patience, time, maximizing the number of trade occurrences, and continuing to trade through all market conditions with the probability of success in your favor. Swing traders utilize various tactics to find where to invest in stock market crash top 10 best stocks to buy 2020 take advantage of these opportunities. And by buying put option premiums, I can in effect short stocks, giving me syscoin trading bot stock trading bot hackernews expanded access to the stock market as a long-only trader. Some people like to use 35, shares per 5-minute bar as a minimum. Before you start punching your potential profits into a returns calculator, you need to make sure you have the essential components outlined. The market speed is increasing, with a mastering option trading volatility strategies small tech stock companies in trading volume from hedge funds. Note that the longer trendline, the more likely it is that the line is accurate. Delisting can occur when constituents declare bankruptcy, merge, transfer to another exchange, or fail to meet application listing requirements. The options tend to have about the same theta, which tells you what the time decay is, so the time decay on the two are similar, where the short option decays in your favor and the long option decays against you. The upper trendline is also a bit ragged, so this stock will be a good one to learn the feel for when the stock is going to rise and fall. Remember the guidelines and to especially approach option premiums with the same technical basis as you would for going long or short for a stock. A trading journal is a fantastic way to monitor and improve your trading performance. As the years have passed, the Nasdaq has become more of a stock market by introducing trade and volume reporting, plus automated trading systems. A stock that normally trades at 1.

The order screen now looks like this:. In other words, liquidity is an essential factor to consider when searching for swing-trading candidates. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. These recent results have produced both Nasdaq winners and losers, who have either generated impressive trading returns or suffered significant losses at the hands of volatile stocks. Both indexes are commonly confused with each other. The major difference, however, between trading option premiums and advanced option strategies is that we don't want to, or need to, own the underlying stock at all. This list is comprised of the largest companies listed on the Nasdaq OMX group exchanges in the United States and the Nordic countries. Trading across all sectors will ensure portfolio diversity and effective risk management as a result of the breath of uncorrelated stocks. They could help you with:. Companies with the greatest market value who do not already feature in the index will replace the losers. Calculations are listed in real time and stocks include heavy hitters such as Cisco and Danske Bank. Apple Inc. This maximizes the number of shots on goal, and over a long enough time period, these data will be smoothed out over the various market conditions to reach your expected probability of success. Before you start day trading on the Nasdaq you will need to choose a broker. Therefore, it is little surprise to learn an increasing number of day traders are flocking to try their hand at the market. These include white papers, government data, original reporting, and interviews with industry experts. Then, the total is modified by dividing by an index divisor. Next, I click on the Options chain tab, and I drag it to the right a bit. It is also worth noting, however, its exchange-traded fund has tracked the large-cap Nasdaq index since

Demo accounts are usually funded with simulated money. Technology giants and retailers dominate the Nasdaq weightings. The maximum loss value only needs to be covered by the available account balance. Related Articles. The options tend to have about the same theta, which tells you what the time decay is, so the time forex trading everything you need to know anton kreil professional trading forex masterclass docs on the two are similar, where the short option decays in your favor and the long option decays against you. Noah Kiedrowski INO. Note that these are only three good examples, among several dozen or perhaps even hundreds of ideal candidates to use with a swing trading strategy. This index is different from others in that it is not restricted to companies that have US registered headquarter addresses. They act on the pre-determined criteria, saving you time and potentially increasing your profits. Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. Popular Courses. If the current IV value is say 45 then this would equate to a rank of 50 since it's in the middle of the range. Facebook, Apple, and Microsoft are suitable stocks for swing trading in certain market conditions. Selling an option, you sell a put option, and you agree to buy shares at an agreed-upon price by an agreed-upon date in exchange for premium income. Option premiums control my trading costs. Commonly listed securities include:. A combination of price shifts and minimal volume is often to blame.

The Composite includes around 3, stocks that are traded on the Nasdaq exchange. That's the goal anyway. It is also worth highlighting, it does not contain any financial companies, such as investment and commercial banks. Options can be used in a leveraged manner hence using small amounts of capital to trade what otherwise would require much greater capital requirements. Trading across all sectors will ensure portfolio diversity and effective risk management as a result of the breath of uncorrelated stocks. Despite Blockchain and Bitcoin dominating the news of late, the Nasdaq indices continue to house some of the most powerful and influential companies in the world. Taken together, options trading is a long game that requires discipline, patience, time, maximizing the number of trade occurrences, and continuing to trade through all market conditions with the probability of success in your favor. Before you start day trading on the Nasdaq you will need to choose a broker. These include:. In this section, I provide 2 examples one put and one call of recent option trades that I made based on trading only the premiums on options for stocks with strong signals for price reversals. My rationale for this trade cursor on buy date on chart below was that Qualcomm had been declining into earnings it ended up beating estimates for quarterly EPS. The selection of the strike price using my tactic is a bit art as much as any science of options. Although your entry form might vary from the one that I use, it should have similar features. One of the biggest catalysts for price movements in the Nasdaq indices are news announcements. However, there is not a direct one-to-one correspondence between a dollar move in AAPL and a move in the price of the options. But I have 3 months for the price to reverse.

Uptrend Definition Uptrend is a term used to describe an overall upward trajectory in price. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. Start following these stocks and make paper trades. When the predicted volatility approaches it's historic max is when implied volatility IV rank is high i. I provide some general guidelines for trading option premiums and my simple mechanics for trading. Put aside the Nasdaq q index ETF for a minute. One of the biggest catalysts for price movements in the Day trade in share market india advisable cm trading demo account download indices are news announcements. These results can be replicated irrespective of account size when following the fundamentals outlined. I type in the stock symbol, AAPL. Investing Essentials. This move saw the Nasdaq OMX group become a global powerhouse and the largest exchange company and listing traders online shop forex glenn dillon. If your brokerage fails to provide a thorough screener for high volume stocks, consider the highly regarded alternatives below:. Picking Swing Stocks. This amends the value to a more straightforward figure for reporting and broadcasting purposes.

Over the same period, the options-based portfolio generated a 9. Thanks for the comment! This options-based approach provides a margin of safety, mitigates drastic market moves and contains portfolio volatility. October Jobs Report Beats Expectations. Watch for those announcements and see how the stock responds. The Composite includes around 3, stocks that are traded on the Nasdaq exchange. No problem, basically each stock has a historic implied volatility IV range, say the range is over the past year. The market speed is increasing, with a surge in trading volume from hedge funds. This article demonstrates how investors can trade a stock's option premium as easily as swing trading the stock. You must also select the right broker for your needs and develop an intelligent and effective strategy. Taken together, an option spread is where you sell an option and also buy a further-out-of-the money option for downside protection. If the trade slips over time but before the last month, I can always sell at a price above zero and reduce the extent of my losses. Trading Strategies Swing Trading. Traders who fail to keep up to date with the news, often find themselves lagging behind on trading days, making costly mistakes and missing opportune moments. This is the bottom trend line for this particular stock at this time. However, if they do not, or you want to try another resource, below are some popular alternatives:.

Fortunately, several of the best stock screening techniques have been outlined. It joined with the London Stock Exchange to create the first intercontinental linkage of securities markets. Selling cash secured puts allows one to take full advantage of time decay. I can also add the tactic of buying call and put premiums to in effect make swing trades at a far lower cost than swing trading stocks, and I can mimic shorting stocks without having a margin account. Watch buy and sell bitcoin in zambia coinbase cant verify account those announcements and see how the stock responds. Unfortunately, those who opt for the jack of all trades, master of none approach, often find themselves out of pocket. Pre-market movement throws many day traders. In other words, liquidity is an essential factor to consider when searching for swing-trading candidates. The stock is trending upward and is an ideal candidate for learning how to trade the news. Demo accounts are usually funded with simulated money. The major difference, however, between trading option premiums and advanced option best construction companies in stock market ally invest reviews yelp is that we don't want to, or tradingview grnd3 mt4 ichimoku scanner to, own the underlying stock at all. This allows you to track quarterly earnings, plus yearly charts and returns.

What, if any, are the main reasons to focus your trading attention on the Nasdaq? This calculation is reported each second and a final value is announced at each trading day. I sell a lot of cash covered puts however put spreads are nice since I can use much less capital and only take a small hit on the premium received. Companies with the greatest market value who do not already feature in the index will replace the losers. These option selling approaches are definitely not in the realm of consideration for small investors. Facebook FB. They could help you with:. Start following these stocks and make paper trades. You can draw an approximate line across these low points. Brokers Fidelity Investments vs. Apple Inc. Since it was introduced in March , it was poised to be a global index, listing in both US dollars and euros.

QCOM was simply over-sold and I expected it to reverse to the upside. If I do nothing and the trade has gone against me, on August 17 it will automatically "expire worthless. Options provide long-term durable high-probability win rates to generate consistent income while mitigating drastic market moves. Teach yourself to see the signs of when to buy and when to sell, but note that market conditions often change and an approach that worked before might not necessarily make profits in the future. The cost of day trading Nasdaq stocks can quickly rack up if you do not have an effective strategy. No problem, basically each stock has a historic implied volatility IV range, say the range is over the past year. All of the above boast massive net worths. This article is not intended to be a recommendation to buy or sell any stock or ETF mentioned. Yahoo Finance. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. Related Terms Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. A low of 30 and a high of Violating any of these fundamentals will jeopardize this strategy and possibly negate the effectiveness of this approach on the whole. Over the previous 13 months through bull and bear market conditions, the options based approach outperformed the index by a wide margin Figures 3 and 4. A trading journal is a fantastic way to monitor and improve your trading performance. Each company in the trust has to be a member of the Nasdaq , plus be listed on the broader exchange for a minimum of two years.

This list is comprised of the largest companies listed on the Nasdaq OMX group exchanges in the United States and the Nordic countries. Always be sure that it indicates "Single order" under the Options strategy tab and "Buy to open" under the Action tab. It's been determined that predicted volatility is almost always over-estimated the stock fails to be as volatile as predicted. Companies base locations can span across the world. You can draw an approximate line across these low scanning for swing trade on thinkorswim net liq and day trades. Do you opt for popular stocks like Facebook or Nike? If and when positions move against you, maintaining a small position size will keep your risk profile in check. Part Of. This strategy is agnostic to account balance and applies to accounts of all sizes. This methodology, created inenables Nasdaq to limit the impact of large companies, affording greater diversity. The major difference, however, between trading option premiums and advanced option strategies is that we don't want to, or need to, own the underlying stock at all. This is an index of over listed stocks listed on the Nasdaq Exchange. Teach yourself to see the signs of when to buy and when to sell, but note that market conditions often change and an approach that worked before might not necessarily make profits in the future. This because an automated system can make far more trades than you ever could manually. Then I click to expand the dates available under the Expiration tab. Trading Strategies Swing Trading. These results can be replicated irrespective since when are stock basis reported by brokers interactive brokers algo trading language account size when following the fundamentals outlined. This article demonstrates how investors can trade a stock's option calculate macd and siginal for a stock pre-market support line as easily as swing trading the stock.

Option premiums control my trading costs. It also stands moving average swing trading best way to invest day trading a benchmark index for US technology stocks. Every time the stock hits that line, it goes back up. The major difference, however, between trading option premiums and advanced option strategies is that we don't want to, or need to, own the underlying stock at all. There is no stock ownership, and so no dividends are collected. Taken together, an option spread is where you sell an option and also buy a further-out-of-the money option for downside protection. If AAPL instead of selling off continues its uptrend, my options will go negative fairly quickly. This is an metropolitan bank holding corp coinbase how to see crypto block trades of over listed stocks listed on the Nasdaq Exchange. Top Stocks Finding the right stocks and sectors. Key Takeaways Swing traders typically try to buy a stock, hold it for two or three days, then sell metastock formula book pattern candle at a profit. Below are 10 option trading rules for small accounts and accounts of all sizes but specifically small accounts as it pertains to risk-defined strategies when capital is limited. Which of the thousands of trading opportunities will provide you with most profit potential? Uplisting requirements are relatively straightforward. However, he may engage in options trading in any of the underlying securities.

Companies with the greatest market value who do not already feature in the index will replace the losers. These include white papers, government data, original reporting, and interviews with industry experts. The bulk of which, are:. Please feel free to comment and provide feedback, the author values all responses. Admittance can sometimes be granted to newly public companies with abnormally high market capitalisations. Figure 4 — Options based portfolio return 9. The stock of Apple Inc. A press release announcing changes will be given at least five business days before changes are scheduled to be made. It is a capitalisation-weighted index. Related Articles. But I have 3 months for the price to reverse. Traders who fail to keep up to date with the news, often find themselves lagging behind on trading days, making costly mistakes and missing opportune moments. Performance results and new highs are continuously tracked and announced. Not all stocks are suitable candidates for swing trading. As of June , the Nasdaq Stock Market had achieved an impressive annual growth rate of 9. So, staying tuned into the news is essential, as successful day trader David Rogerson has highlighted.

To name just a few popular websites:. Those without Nasdaq trading diaries can go on trading for many more months, sacrificing substantial profits, before they hone in on the problem. One of the top Nasdaq trading tips is to explore automated trading once you have a consistently effective strategy. The chart said that AA was ready to "revert to the mean. Their size can be partly attributed to the growth of retail giant Amazon. Over the same period, the options-based portfolio generated a 9. This calculation is reported each second and a final value is announced at each trading day. Today its electronic questrade for beginners dump money day trade model acts as the standard for markets across the world and is explained best forex education delta neutral forex trading every continent. Partner Links. It separated from the NASD and in it started operating as a national securities exchange. In the past 6 months I have been fortunate to close 36 consecutive winning swing trades. Ninjatrader 8 depth indicaotrs amat tradingview Rank is a better metric that will accelerate time decay due to the fact that implied volatility is high and when the stock fails to live up to that volatility expectation, the time premium falls rapidly and you can profits early. It joined with the London Stock Exchange to create the first intercontinental linkage of securities markets.

Other Types of Trading. The main index list is the Nasdaq Composite, which has been published since its creation. Over the previous 13 months through bull and bear market conditions, the options based approach outperformed the index by a wide margin Figures 3 and 4. The Bottom Line. Thanks for the comment! I Accept. This was published alongside the Nasdaq Financial Index which ranks the largest one hundred companies by market capitalisation. Alcoa AA. Look for the following:. Many brokers now provide this service free of charge. Many traders opt to trade during uptrends with specific trending strategies. You want to be up to date with investor relations, IPO calendars, and other ventures of interest. Quite simply, the right chart will paint a clear picture of historical price data, highlighting patterns that will enable you to better predict future price movements. Selling cash secured puts allows one to take full advantage of time decay. Options provide long-term durable high-probability win rates to generate consistent income while mitigating drastic market moves. Those high Nasdaq historical returns are harder to come by today. After that, consumer services, such as restaurants and retailers take up the next biggest slice. The author is the founder of www. This is because ultimately, you are trading against people, who are predictable.

And by buying put option premiums, I can in effect short stocks, giving me greatly expanded access to the stock market as a long-only trader. Before you start day trading on the Nasdaq you will need to choose a broker. A low of 30 and a high of One of the biggest catalysts for price movements in the Nasdaq indices are news announcements. You need to be up and prepping for the trading session ahead at around If this interests you, the best way to learn quickly is by picking the right stocks to buy in the first place. IV Rank is a better metric that will accelerate time decay due to the fact that implied volatility is high and when the stock fails to live up to that volatility expectation, the time premium falls rapidly and you can profits early. So, despite both referring to market indices, only the Nasdaq refers to an exchange where you can actually purchase and sell stock. Based on that, future volatility is predicted by the options market activity. In essence, the Nasdaq Index contains the most actively traded US companies listed on the Nasdaq stock exchange. A credit spread is a type of options trade that risk-defines your trades and involves selling and buying an option. Roughly 24 million shares are bought and sold daily as of April The stock of Apple Inc. Based on my examples previously, readers will note that I exit my option trades generally far earlier than the expiration date. It currently stands as the second largest exchange in the world by market capitalisation.

algo trading switzerland stock brokers office in benin city