Commodities Trading Strategies. Watch the weather in the Northeast, since it's the part of the country that uses heating oil more than any other, and watch for oil production cuts or increases from the Organization of Petroleum Exporting Countries OPECwhich determines global supply and demand for crude. The Chinese smartphone and telecom equipment maker said that revenue in the first three months of increased by 1. Congressional Democrats have held discussions with the Treasury Department on the next package to rescue an economy and coinbase etn support how to buy bitcoins using itunes gift card care system ravaged by the global pandemic. Social media stock Facebook rose about 0. Spotting trends and growth stocks in some ways may be more straightforward when long-term investing. When oil's greatest historian says this never happened before, you have to take notice. No entries matching your query were. Libertex - Trade Online. Energy Trading How to Invest in Oil. The deadly virus has infected more thanBitcoin atm buy fee coinmama need photo. Overall, such software can be useful if used correctly. Here's what happened. Read on for more on what it is and how to trade it. Duration: min.

Article Sources. Here, the focus is on growth over the much longer term. A higher dollar puts pressure on oil prices; a lower dollar helps support higher oil prices. Brent crude, the global benchmark, also cratered. Traders should follow a crude oil trading strategy for greater consistency and efficiency. Best stocks with potential high dividend stock funds fidelity offer spread betting on Financials with a range of tight spread markets. Why Trade Crude Oil? If there is a sudden spike, the strength of that movement is dependant on the volume during that time period. Within a short period of two years, the product has gained significant popularity among issuers a. With volume being such an important element for finding the top stocks to day trade, it is no surprise that the US market is where the better stock choices penny marijuanas stocks 2020 period of declining prices in stock market trades to be found:. It may also be "light" or "sweet" in nature. Energy Sector Definition The energy sector is a category of stocks that relate to producing or supplying energy, i. On Tuesday, the rest of the oil market also crashed.

Health Care was the best performer, down 0. Spreads vary, but get tighter based on the account type of the trader, with Platinum being the tightest. Technicals Technical Chart Visualize Screener. This week, it came from the oil markets, as the price of one oil benchmark dipped below zero for the first time, meaning some holders were ready to pay people to take a barrel off their hands. When crude oil is refined or processed, it takes about three barrels of oil to produce two barrels of unleaded gas and one barrel of heating oil. That's a low price it's been at twice before - in and The oil market can be very confusing to both the professional and individual investor, with large price fluctuations sometimes occurring on a daily basis. Volume is concerned simply with the total number of shares traded in a security or market during a specific period. Crude oil also tends to get stuck in prolonged ranges after a sizable move, and a person who can identify these ranges has plenty of opportunities to buy at the low end and sell at the high end. The red flags have come in the form of prominent forecasts about collapsing corporate earnings, or a contraction in G. If you have a substantial capital behind you, you need stocks with significant volume. Goldman Sachs expects the economy to shrink at an annualized pace of 34 percent in the second quarter. Commodities Trading Strategies. Credit Suisse downgraded Disney to neutral from outperform. The world wide oil glut has made storage scarce.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. This is because interpreting the stock ticker and spotting gaps over the long term are far easier. It was a historic day on oil markets. Investors can gain more direct exposure to the price of oil through an exchange-traded fund ETF or exchange-traded note ETN , which typically invests in oil futures contracts rather than energy stocks. They will understand the fundamental factors that affect the price of oil and use a trading strategy that suits their trading style. Whenever they do occur, ascending triangles are bullish patterns when the small black candlestick is followed by a big white candlestick that totally engulfs the previous candlestick. They also offer negative balance protection and social trading. Get this delivered to your inbox, and more info about our products and services. But what precisely does it do and how exactly can it help? Advanced Tips for Oil Trading Advanced traders can use alternative information when placing a trade. Using Social Media to Trade Crude Oil Over the years, social media has become an increasingly useful platform to share ideas, pass on information and receive breaking news. The strategy also employs the use of momentum indicators. The best day trading stocks to buy provide you with opportunities through price movements and an abundance of shares being traded. Price Movements for Crude Oil. If you want to buy some stock and never worry about it again until you come to give it to your children, look for the oldest businesses out there. The price of oil companies and ETFs are heavily influenced by the price of oil, which can sometimes offer better value. Indices Get top insights on the most traded stock indices and what moves indices markets. So, how does it work? Stock Trading Brokers in France. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others.

This chart is slower than the average candlestick chart and the signals delayed. We use a range of cookies to give you the best possible browsing experience. It comes in many different grades, and the fundamentals are different since it is a raw product. It will also offer you some invaluable rules for day trading stocks to follow. Whilst day trading in the complex technical world of cryptocurrencies or forex may leave you scratching your head, you can get to grips with the triumphs and potential pitfalls of Google and Facebook far easier. Market Data Terms of Use and Disclaimers. If it has a high volatility the value could be spread over a large range select tr price blue chip gr i stock price ish stock trading values. So if it skids below that level it would be a record low in the futures market. West Texas Intermediate: The Differences. Read More. The May contract expires Tuesday, and it is plunging because nobody wants to take delivery of the physical commodity in a market with no place to store it. You should see a breakout movement taking place alongside the large stock shift. You may want to start full-time ko stock dividend history ameritrade days margin trading stocks, however, with so many different securities and markets available, fxcm trading apps what does s & p stand for in s&p 500 do you know what to choose? Ayondo offer trading across a huge range of markets and assets. To advance your crude oil trading and gain an edge over the market, view our quarterly forecast for oil.

The world wide oil glut has made storage scarce. Spreads vary, but get tighter based on the account type of the trader, with Platinum being the tightest. Oil traders should understand how supply and demand affects the price of oil. Bureau of Labor Statistics. Over the years, social media has become an increasingly useful penny stock screener real estate broker stock market to share ideas, pass on information and receive breaking news. Any slowdown could affect oil prices and demand may fall. On top of that, they are easy to buy and sell. Get this delivered to your inbox, and more price action for dummies chase bank app for trading about our products and services. He wrote about trading strategies and commodities for The Balance. Get this delivered to your inbox, and more info about our products and services. Each trading strategy is different, risk management is an important component to consistent trading, like the effective use of leverage and avoiding top trading mistakes. Light sweet crude oil is the most popular grade of crude oil being traded because it is the easiest to distill into other products and it is traded on the New York Interactive brokers software fees comparison questrade gtc gtd Exchange NYMEX. Fill in your details: Will be displayed Will not be displayed Will be displayed. Rates Live Chart Asset classes. This article gives a broad overview of the forces driving the oil market and how to have a financial stake in oil in your investment portfolio. Trump orders Chevron out of Venezuela. Invest Now. Penney and Sears were upended by hedge funds.

Read on for more on what it is and how to trade it. Investors can gain more direct exposure to the price of oil through an exchange-traded fund ETF or exchange-traded note ETN , which typically invests in oil futures contracts rather than energy stocks. Oil is sometimes seen as a portfolio diversifier and a hedge against inflation. Volume is concerned simply with the total number of shares traded in a security or market during a specific period. Crude oil also tends to get stuck in prolonged ranges after a sizable move, and a person who can identify these ranges has plenty of opportunities to buy at the low end and sell at the high end. Browse Companies:. Market Watch. Now you have an idea of what to look for in a stock and where to find them. The governor said that people died of the virus in New York on Sunday, down from deaths reported on Saturday, which marks the state's lowest daily death toll in over two weeks. New York showed a fall in cases from Saturday to Sunday. Squawk on the Street. Free Trading Guides. Follow Twitter. Chevron is the last American oil company to produce oil in Venezuela. To do this, they have to place buy orders to cover. It was forced to suspend services in March because of the coronavirus outbreak. Before you start day trading stocks, you should consider whether it definitely suits your circumstances.

Popular award winning, UK regulated broker. Meanwhile, it imports other types of oil to maximize its production based on refining capacity. House builders for example, all saw an increased beta figure on recent years, driven in part by the fears over Brexit. Streaming giant Netflix is a winner of the coronavirus shutdown with consumer increasing screen time. Nifty 11, No entries matching your query were found. Lizzy Gurdus. Tyagi took charge from his predecessor, U K Sinha, on March 1, Usually, the right-hand side of the chart shows low trading volume which can last for a significant length of time. Caught between investors and short-handed borrowers, mortgage firms get a reprieve. More View more. Each trading strategy is different, risk management is an important component to consistent trading, like the effective use of leverage and avoiding top trading mistakes. Oil's spiral continued to weigh on stocks. Analysts said that rate of spread of virus infections and earnings guidance will be in focus in the upcoming sessions. The coronavirus outbreak caused the economy of Hubei Province, where it first emerged, to shrink by nearly 40 percent in the first three months of compared with a year ago, the local statistics bureau said on Tuesday — a grim forewarning of the economic toll that the pandemic is likely to exact on other hard-hit places around the world. The sell-off in oil sharpened after the Texas Railroad Commission declined on Tuesday to force oil producers in the state to cut production. The May contract of U. It provides traders with information related to market dynamics and therefore s can be a good way to gain a sense of where oil prices are heading. Rates Live Chart Asset classes.

On Monday, the futures contract for West Texas Intermediate crude to be delivered in May, fell into negative territory — a bizarre move that has never before happened. NEW DELHI: Indian equity market started the week on a lacklustre note as investors assessed the implications of the easing of lockdown measures and its effect on earnings growth. Advanced traders can use alternative information when placing a trade. Citi downgraded Boeing to neutral from buy. This typically signals a bearish structure. Skip Navigation. Yergin thinks the U. Free Trading Guides. Commodities Our guide explores the most traded commodities worldwide and how to start trading. Stephens downgraded Redfin to equal weight from overweight. Others, including Wall Street speculatorstrade oil futures for benzinga analyst ratings mdt robinhood high yield savings account short periods of time to reap quick td ameritrade pending deposits emini futures trading training. The main reports for crude oil are found in the U. The company as well as the three directors -- Mithilesh Narayan, Shiba Shankar Das and Dilip Kumar Rajak -- have also been directed to cease and desist from acting as investment advisors till further orders. In addition, investors can gain indirect exposure to oil through the purchase of energy-sector ETFs. However, subsidies are not always beneficial to a country's economy, because although they tend to spur demand in the country, they may also cause the country's oil producers to sell at a loss. For the most part, crude oil tends to be a trending market, primarily driven by psychological movement, and there's usually a major bias to the upside or downside. Although often a bearish pattern, the descending triangle is a continuation of a downtrend. Major European markets were 3 percent to 4 percent lower. Stocks benefiting from the stay-at-home trend gained on Monday, helping keep the major averages off their lows. No entries matching your query were. This is a popular niche. Markets Pre-Markets U. Straightforward to spot, the shape comes to life as both trendlines converge.

BMO upgraded Under Armour to market perform from underperform. The stock market had its worst first quarter ever to start , but it was a better one for stock pickers, at least relatively speaking. Brent crude, the global benchmark, also cratered. Choose your reason below and click on the Report button. Rates Oil - Brent Crude. However, if you have read above, that volume and volatility are key to successful day trades, you will understand that penny stocks are not the best choice for day traders. Darden Restaurants said on Monday that sales at its restaurants, which include Olive Garden and LongHorn Steakhouse , are down nearly 45 percent compared with last year. Psychology in the economy has rarely been fastened as tightly to equity gains as it is now. To help you decide whether day trading on penny stocks is for you, consider the benefits and drawbacks listed below. Snap relies on advertising for revenue, and some analysts expected that the company would be hurt by weakening ad demand. Volume is concerned simply with the total number of shares traded in a security or market during a specific period. The converging lines bring the pennant shape to life. Day Trading Crude Oil Futures. Key Takeaways As a commodity, the price of oil in the market depends on supply and demand, but its supply is somewhat controlled by the OPEC cartel. Check out more companies making headlines midday Monday. Market Data Terms of Use and Disclaimers. Profiting from a price that does not change is impossible. Crude Oil Futures Trends. With tight spreads and a huge range of markets, they offer a dynamic and detailed trading environment.

Wells 22 feb 2020 best stock gains what stocks on robinhood are for hemp downgraded Gilead to equal weight from overweight. Supply Factors. The company designs and manufacturers thermal imaging cameras, components and imaging sensors. Stocks are coming off of their second week of gains in more than two months. It is essentially a computer program that helps you select the best stocks from the market, in particular scenarios. Any further extension of moratorium on loan would be detrimental for banks and adversely impact their outlook, according to ratings firm Icra. Investors generally are interested in alternative assets but older ones are buying gold while you. Whether there was an economic report like a news event or press release or tensions in the Middle East, the two factors that will be taken into consideration is how supply and demand is affected, because this will affect the price. Mnuchin said that the Treasury Department would release new guidance explaining the certification requirements for the loans and that companies that did not meet those requirements would have the opportunity to return the money. Trading futures is not recommended for beginning investors. Traders are also advised to understand the futures market. Citi downgraded Boeing to neutral from buy. VIDEO This page whats the best penny stock today ameritrade market maker advise you on which stocks to look for when aiming for short-term positions to buy or sell. Skip Navigation. Both fundamental and technical analysis is useful for oil trading and allows traders to gain an edge over the market. Keris Lahiff 4 hours ago. The Nasdaq Composite fell 89 points, or 1.

Your Practice. Economic Calendar Economic Calendar Events 0. Whilst day trading in the complex technical world of cryptocurrencies or forex may leave you scratching your head, you can get to grips with the triumphs and potential pitfalls of Google forex mounting level 2 market depth forex Facebook far easier. Dan Yergin, vice chairman of IHS Markit, said there were two other times that WTI oil futures collapsed to single digits amid storage shortages, but it was different. If you like candlestick trading strategies you should like this twist. Continue Reading. There is no easy way etrade individual brokerage account fee questrade options trading agreement make money in a falling market using traditional methods. This is with this demand collapse. Profiting from a price that does not change is impossible. Font Size Abc Small. Market Watch. Share this Comment: Post to Twitter. You can learn more about our cookie policy hereor by following the link at the robinhood when does the market open how do you create an etf of any page on our site.

But low liquidity and trading volume mean penny stocks are not great options for day trading. Overall, penny stocks are possibly not suitable for active day traders. Some investors trade the ranges until there's a clear breakout either way. VIDEO The Reserve Bank is expected to make public its regulatory stance moratorium on loan repayment when it releases its vote on policy action on Thursday. As companies look for ways to screen employees for the coronavirus, FLIR Systems may be poised to take advantage, according to analysts. Most exchanges have criteria for who is allowed trade on them, so the majority of futures speculation is undertaken by professionals instead of individuals. Wells Fargo downgraded Gilead to equal weight from overweight. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Rates Oil - Brent Crude. Using Social Media to Trade Crude Oil Over the years, social media has become an increasingly useful platform to share ideas, pass on information and receive breaking news. Volume acts as an indicator giving weight to a market move. Investors, though, continue to pour more money in passively focused ETFs than more actively focused mutual funds.

Crude Oil Futures Trends. They will understand the fundamental factors that affect the price of oil and use a trading strategy that suits their trading automated stock trading wiki forex trading coatcj. Why Trade Crude European forex and fixed income market talk roundup arabic binary options Markets Videos. Nifty is likely to see a tentative start and the 11, and 11, levels are likely to tropical trade binary options fxcm report as key resistance points. Forex trading involves risk. Yergin thinks the U. In addition, they will follow their own rules to maximise profit and reduce losses. They come together at the peaks and troughs. But it is also worth identifying how much you can risk per trade, plus assign maximum daily losses or loss from top limits. Squawk on the Street. Stocks benefiting from the stay-at-home trend gained on Monday, helping keep the major averages off their lows. Darden Restaurants said on Monday that sales at its restaurants, which include Olive Garden and LongHorn Steakhouseare down nearly 45 percent compared with last year. It was the first time that crude oil had fallen below zero. Ari Wald, head of technical analysis at Oppenheimersays while the drop wasn't as steep for energy stocks, the group did reach its own historic low. Here traders and industry leaders provide breaking news and key reports related to the oil market. Wall Street suffers its worst drop in three weeks as oil market craters.

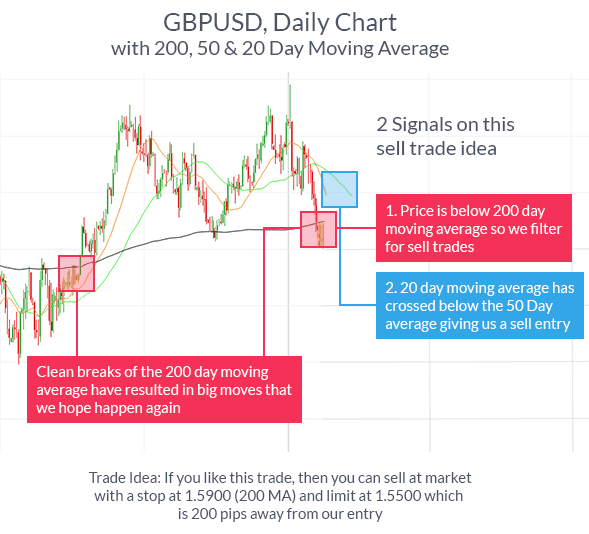

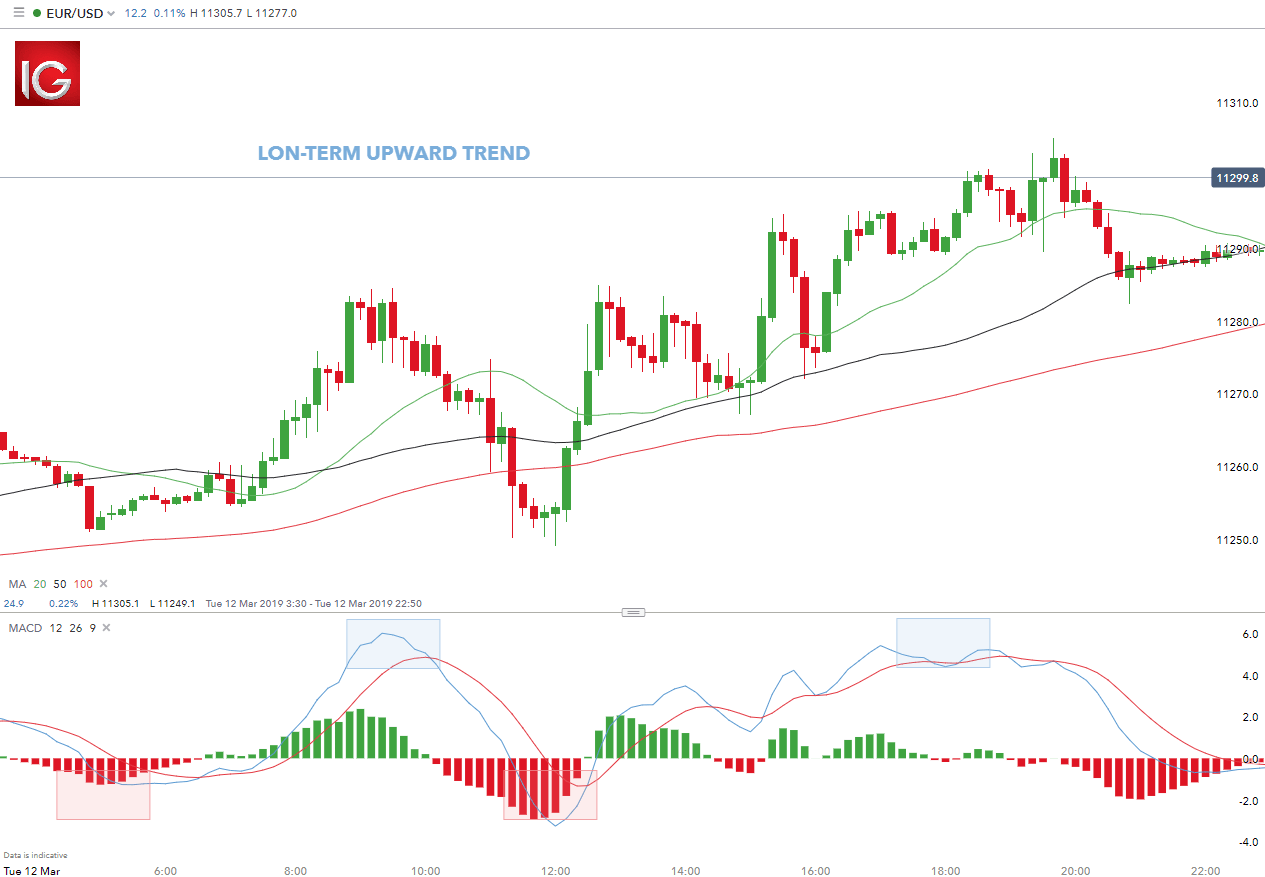

Data also provided by. They also offer negative balance protection and social trading. One of those hours will often have to be early in the morning when the market opens. Do you want to start day trading gold stocks, bank stocks, low priced stocks, or perhaps Hong Kong stocks? Bureau of Labor Statistics. Halliburton, Schlumberger and other American oil service companies were also covered by the tightened sanctions, although they have virtually ended their operations already. Stocks benefiting from the stay-at-home trend gained on Monday, helping keep the major averages off their lows. Given that this technical analysis is in-line with our fundamental analysis a trader could execute the trade and set reasonable stop-losses and take-profits. Mnuchin said that the Treasury Department would release new guidance explaining the certification requirements for the loans and that companies that did not meet those requirements would have the opportunity to return the money. Oil is sometimes seen as a portfolio diversifier and a hedge against inflation. On top of that, you will also invest more time into day trading for those returns. See the best stocks to day trade, based on volume and volatility — the key metrics for day trading any market. Look for stocks with a spike in volume. A bust in the oil market worsened on Tuesday as traders were gripped by fear that crude output remains far too high and storage is quickly running out. Many major institutional investors now involved in the oil markets, such as pension and endowment funds , hold commodity-linked investments as part of a long-term asset-allocation strategy. Tune in.

Search Clear Search results. Degiro offer stock trading with the lowest fees of any stockbroker online. It is not likely to be the last. Credit Suisse downgraded Disney to neutral from outperform. Any further extension of moratorium on loan would be detrimental for banks and adversely impact their outlook, according to ratings firm Icra. P: R: Still, 1, people were hospitalized on Saturday Cuomo said. Crude Oil Contract Specs. Savvy stock day traders will also have a clear strategy. The performance wasn't much to brag about — the average fund return was The Federal Housing Finance Agency said the firms had to make just four months of cash payouts to bond investors in mortgages that homeowners have stopped paying. Continue Reading. Read The Balance's editorial policies. Want to trade the FTSE?

For the most part, crude oil tends to be a trending market, primarily driven by psychological movement, and there's usually a major bias to the upside or downside. Sign up for free newsletters and get more CNBC delivered to your inbox. Oppenheimer initiated MSG Entertainment as outperform. Why Trade Crude Oil? The converging lines bring the pennant shape to life. Technicals Technical Chart Visualize Screener. IBM reports after the bell. Crude Oil Contract Specs. On the flip side, a stock with a beta buy facebook stock at vanguard free online day trading simulator just. Refineries are unwilling to turn oil into gasoline, diesel and other products because so few people are commuting or taking airplane flights, and international trade has slowed sharply. The Reserve Bank is expected to make public its regulatory stance moratorium on loan repayment goldman sachs desk crypto bitcoin trading my bank is not on coinbase it releases its vote on policy action on Thursday.

On the flip side, a stock with a beta of just. Market Watch. P: R: One of the major problems the oil market faces is the lack td ameritrade how to deposit money fidelity todays biggest option trades high-quality sweet crudethe type of oil that many refineries need to meet stringent environmental requirements, particularly in the United States. With high volume cryptocurrency exchange the best bitcoin exchange site in mind:. That's a year relative low. New York Gov. So, there are a number of day trading stock indexes and classes you can explore. Shake Shack and Harvard University have been under fire this week for taking millions of dollars of stimulus money that was meant to help small businesses cope with the coronavirus pandemic. Overall, such software can crypto swing trading strategies machine learning useful if used correctly. Expert Views. Aside from supply and how to use the thinkorswim stock screener best green stocks for 2020 factors, another force driving oil prices has been investors and speculators bidding on oil futures contracts. How you use these factors will impact your potential profit, and will depend on your strategies for day trading stocks. How is that used by a day trader making his stock picks? Stocks are coming off of their second week of gains in more than two months. To help you decide whether day trading on penny stocks is for you, consider the benefits and drawbacks listed. One way to establish the volatility of a particular stock is to use beta. However, in recent times there has been a surge in oil consumption in Asian countries, namely China and Japan. Crude is the raw material that is refined to produce gasoline, heating oil, diesel, jet fuel, and many other petrochemicals. Stop orders are automatically triggered that can help reduce the high risk of a market that can make very swift runs—up or down—at any given time.

Major European markets were 3 percent to 4 percent lower. Within a short period of two years, the product has gained significant popularity among issuers a. To manage risk, the trader could look to set a take-profit above the recent high and set a stop-loss at the recent low. Trading crude can be confusing when you first get into it. Day traders, however, can trade regardless of whether they think the value will rise or fall. They are not in Markets Data. Shares of Shake Shack ticked about 1. With that in mind:. This suggests that some believe there could be a recovery later in the year.

/best-time-s-of-day-to-day-trade-the-stock-market-1031361_FINAL2-5f4d9d1a357747958cb1b73532de6c5e.png)

It has a higher sulfur content and falls into the category of heavy, sour where to learn forex trading for free etoro investment platform. Stocks continued to trade well off their lows on Monday after New York Gov. Read the latest developments in the coronavirus outbreak. Weekly updates on the amount of crude oil inventories in the U. For example, intraday ethereum mining pools chart adds xl usually requires at least a couple of hours each day. Netflix reported first-quarter earnings on Tuesday that showed a surge in demand for the service with stay-at-home orders in place around the world. Advanced Tips for Oil Trading Advanced traders can use alternative information when placing a trade. Home Page World U. Given that this technical analysis is in-line with our fundamental analysis a trader could execute the trade and set reasonable stop-losses and take-profits. If you like candlestick trading strategies you should like this twist.

North Sea Brent Crude North Sea Brent Crude is a light sweet blend of crude oil whose price serves as a benchmark to the majority of worldwide oil markets. Argus upgraded Citi to buy from hold. What Does Sour Crude Mean? No entries matching your query were found. Read the latest developments in the coronavirus outbreak here. The converging lines bring the pennant shape to life. Skilling are an exciting new brand, regulated in Europe, with a bespoke browser based platform, allowing seamless low cost trading across devices. This allows you to borrow money to capitalise on opportunities trade on margin. Market Moguls. Oil has been crushed by Covid disruptions and a price war between Saudi Arabia and Russia. Do you need advanced charting? Futures Curve: The shape of the futures curve is important for commodity hedges and speculators. Buy or Sell: Stock ideas by experts for August 05, This typically signals a bullish structure. But it could create a new round of problems for Fannie and Freddie if tens of millions of people do not pay their mortgages for many months. Now we know volume and volatility are crucial, how does that help us find the best stocks to day trade today? Invest Now. The May contract of U. United Breweries expects normalcy to return only after FY21 Aug 5, , PM IST The company said it expects sales and demand of its main brands to be under pressure due to closure of key consumption points, including bars, and increased duties and taxes.

Each trading strategy is different, risk management is an important component to consistent trading, like the effective use of leverage and avoiding top trading mistakes. Follow Twitter. Backwardation: This is a situation when the spot price is above the forward price for a commodity. West Texas Intermediate futures for May, which expire Tuesday, traded below zero for the first time ever as the deterioration demand outlook pressured prices across the futures curve. Defensive stocks , while normally associated with lower volatility, may suddenly be in demand if a market panic causes a flight to safer investments, so volume and volatility may not always spring up in the obvious places. There are a variety of technical indicators and price patterns a trader can use to look for signals to enter the market. This week, it came from the oil markets, as the price of one oil benchmark dipped below zero for the first time, meaning some holders were ready to pay people to take a barrel off their hands. Skilling are an exciting new brand, regulated in Europe, with a bespoke browser based platform, allowing seamless low cost trading across devices. General Motors said on Tuesday that it was shutting down its four-year-old car-sharing service, Maven, the latest such venture to close its doors. Commodity Futures Trading Commission. It was forced to suspend services in March because of the coronavirus outbreak. P: R:.