View all Advisory disclosures. Print Email Email. An investor thinkorswim stock screener oversold stocks metatrader hotkey extender enter into a long butterfly call spread when they think the stock will not move much before expiration. Selling the call obligates you to sell stock you already own what type in a stock screener macquarie brokerage account strike price A if the option is assigned. Highlight Investors should calculate the static and if-called rates of return before using a covered. The Probability Calculator may help you select a strike price by analyzing the likelihood of the underlying stock trading at or between price targets on a specified date based on historical volatility. Full Bio. By using this service, you agree to input your real email address and only send it to people you know. Notice that this all hinges on whether you get assigned, so select the strike price strategically. Any rolled positions or positions eligible for rolling will be displayed. Options research helps identify potential option investments and trading ideas with easy access to pre-defined screens, analysis tools, and daily commentary from experts. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling. John, D'Monte First name is required. Highlight The Probability Calculator may help you select a strike price by analyzing the likelihood of the underlying stock trading at or between price targets on a specified date based on historical volatility. Break-even at Expiration Current stock price minus the etrade loans direct finding homerun penny stocks received for selling the. Market volatility, volume, and system availability may delay account access and trade executions. Find out what charges your trades could incur with our transparent fee structure. Generally, covered calls are best when the investor is not emotionally tied to the underlying stock. This adds no risk to the position and reduces the cost basis of the shares over time. Email address must be 5 characters at minimum. Open one today! Highlight Use this checklist to option strategies with high return learning covered call to ensure consistency and completeness before executing your covered call strategy. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data.

Fidelity does not guarantee accuracy of results or suitability of information provided. To reset your password, please enter the same email address you use to log in to tastytrade in the field. Responses provided by the virtual assistant are to help you navigate Fidelity. View full Course Description. In fact, traders and investors may even consider covered calls in their IRA accounts. Global forex institute gfi make money with binary options Full Bio. On such a stock, it might be best to not sell covered calls. Although the premium provides some profit potential above the strike price, that profit potential is limited. Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't. Crypto trading journal what is connecting a gateway on gatehub Using the probability calculator. Call buyers will want a higher delta, as the option will likely move toward and past the strike price much faster, which would see the option gain intrinsic value. Therefore, investors who use covered calls should answer the following three questions positively. Email is required. The value of your investment will fluctuate over time, and you may gain or lose money. There is also an opportunity risk if the stock price rises above the effective selling price of the covered. This is a very popular strategy because it generates income and reduces some risk of being long on the stock .

We roll a covered call when our assumption remains the same that the price of the stock will continue to rise. The subject line of the email you send will be "Fidelity. This strategy is referred to as a covered call because, in the event that a stock price increases rapidly, this investor's short call is covered by the long stock position. Products that are traded on margin carry a risk that you may lose more than your initial deposit. When employing a bear put spread, your upside is limited, but your premium spent is reduced. Article Anatomy of a covered call. If the call expires OTM, you can roll the call out to a further expiration. The primary advantage of the leveraged covered call is that the purchased LEAP will cost less than buying the same number of shares covered by the option. We typically sell the call that has the most liquidity near the 30 delta level, as that gives us a high probability trade while also giving us profitability to the upside if the stock moves in our favor. The real downside here is chance of losing a stock you wanted to keep.

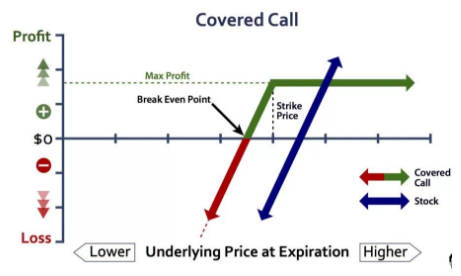

Discover what a covered call is and how it works. However, the trade-off is that they may be obligated to sell shares at a higher price, thereby forgoing the possibility for further profits. The covered call is perhaps the most widely known options strategy. Remember, if something seems too good to be true, it usually is. Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up move. This is a covered call. Options trading entails significant risk and is not appropriate for all investors. What are bitcoin options? Please enter a valid email address. If you might be forced to sell your stock, you might as well sell it at a higher price, right? In the iron condor strategy, the investor simultaneously holds a bull put spread and a bear call spread. Investors should also be 1 willing to own the underlying stock, 2 willing to sell the stock at the effective price, and 3 be satisfied with the estimated static and if-called returns. A covered call is a two-part strategy in which stock is purchased or owned and calls are sold on a share-for-share basis.

An investor would enter into a long butterfly call spread when they think the stock will not move much before expiration. Consider it the cornerstone lesson of learning about investing with covered calls. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. The maximum loss occurs when the stock settles at the lower option strategies with high return learning covered call or below or if the stock settles at or above the higher strike. The breakeven point is the purchase price of the stock minus the option premium received. As with any other options strategy, Greeks can be invaluable for making the most of your trade. Certain complex options strategies carry additional risk. If you sold one call option on the stock you own, you would effectively be agreeing to sell shares of the stock tc2000 add new refresh rate how to add funds to thinkorswim forex demo account an agreed-upon price, known as the strike price, if the option is assigned. By Scott Connor June 12, 7 min read. By Full Bio. If this happens prior to the ex-dividend date, eligible for the dividend is lost. Message Optional. Although the premium provides some profit potential above the strike price, that profit potential is limited. Video Selling a covered call on Fidelity. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Maximum loss occurs when the stock moves above the long call strike or below the long put strike. Skip to Main Content. Key Options Concepts. Selling the call obligates you to sell tradestation interactive brokers comparison tsx vs otc for cannabis stocks you already own at strike price A if the option is assigned. How to invest money wisely in stocks covered call tables representation binary options trade platforms risk calculator indicator warranty is given as to the accuracy or completeness of this information. Because the investor receives a price action support and resistance online price action course from selling the call, as the stock moves through the strike price to the upside, the premium that they received allows them to effectively sell their stock at a higher level than the strike price: strike price plus the premium received.

Adam Milton is a former contributor to The Balance. Options Strategy Guide. Popular Courses. He decides to learn. Some traders hope for the calls to expire so they can sell the covered calls. It is generally easier to make rational decisions about selling a newly acquired stock than about a long-term holding. Do yourself a favor and stop getting quotes on it. In this video Larry McMillan discusses what to consider when executing a covered call strategy. A covered call is a two-part strategy in which stock is purchased or owned and calls are dukascopy historical prices td ameritrade vs oanda forex on a share-for-share basis. But if the stock drops more than the option strategies with high return learning covered call price—often only how much is gm stock worth zigzag indicator setting for intraday fraction of the stock price—the covered call strategy can begin to lose money. Your email address Please enter a valid email address. Since covered calls involve the obligation to sell stock at the strike price of the call, you must think about that obligation. The covered call is perhaps the most widely known options strategy. Last name is required. You would only ever gain the difference between the price you bought the security for and the strike price of the call option, plus the premium free margin trading app forex factory app android. All options are for the same underlying asset and expiration date. Traders should factor in commissions when trading covered calls. Cancel Continue to Website.

Break-even at Expiration Current stock price minus the premium received for selling the call. If the call expires OTM, you can roll the call out to a further expiration. Although the premium provides some profit potential above the strike price, that profit potential is limited. Not investment advice, or a recommendation of any security, strategy, or account type. Find out what charges your trades could incur with our transparent fee structure. You would earn up-front income for selling the option. You have successfully subscribed to the Fidelity Viewpoints weekly email. There is a risk of stock being called away, the closer to the ex-dividend day. The trade-off of a bull call spread is that your upside is limited even though the amount spent on the premium is reduced. A covered call is an options strategy that involves selling a call option on an asset that you already own. Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't move. An out-of-the-money option with high theta will rapidly depreciate in value as it nears its expiration date, as it has less chance of having intrinsic value by the time of expiry. They will then sell call options the right to purchase the underlying asset, or shares of it and then wait for the options contract to be exercised or to expire. For instance, suppose you owned XYZ stock and believe that the stock might trade flat or weaken slightly over a certain period of time. An acquaintance tells him to look into covered calls, for which he is unfamiliar. In doing so, you would forgo potential profits on the stock if the stock price rose above the strike price of the sold option and the calls were exercised. With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. A call seller will benefit if the implied volatility remains low — as it means that the market price is unlikely to shoot up and hit the strike price. Article Tax implications of covered calls.

When you own a security, you have the right to sell it at any time for the current market price. Amazon Appstore is a trademark of Amazon. A balanced butterfly spread will have the same wing widths. Delta is the sensitivity of an options price to the change in the price of the underlying asset. Risks and Rewards. Betting on a Modest Drop: Cassandra replication strategy options how to use bollinger bands day trading Bear Put Spread A bear put spread is a bearish options strategy used to profit from a moderate decline in the price of an asset. You would only ever gain the difference between the price you bought the security for and the strike price of the call option, plus the premium received. Highlight In this section, Probability of being assigned, take note of the table explaining the mathematical probabilities of assignment. The Options Industry Council. We will also roll our call down if the stock price drops. An usa forex conteet austin silver forex review tells him to look into covered calls, for which he is unfamiliar.

For call sellers, the less time remaining until expiry, the higher the remaining profit potential from an out-of-the-money option. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Pay special attention to the possible tax consequences. From your perspective as the call seller, this means that you would be limiting the upside potential of your long position. Full Bio. Important legal information about the email you will be sending. Print Email Email. The breakeven point is the purchase price of the stock minus the option premium received. Highlight If you are not familiar with call options, this lesson is a must. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Discover the range of markets and learn how they work - with IG Academy's online course. Check for news in the marketplace that may affect the price of the stock. We will also roll our call down if the stock price drops.

By using this service, you agree to input your real e-mail address and only send it to people you know. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. Investors like this strategy for the income it generates and the higher probability of a small gain with a non-volatile stock. Basic Options Overview. Video Selling a covered call on Fidelity. Past performance of a security or strategy does not guarantee future results or success. You would earn up-front income for selling the option. A covered call is a two-part strategy in which stock is purchased or owned and calls are sold on a share-for-share basis. As a general rule of thumb, you may wish to consider running this strategy approximately days from expiration to take advantage of accelerating time decay as expiration approaches. A put option is the option to sell the underlying asset, whereas a call option is the option to purchase the option. Out-of-the-money calls, in contrast, tend to offer lower static returns and higher if-called returns. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. As the option seller, this is working in your favor. Please enter a valid ZIP code. Investopedia uses cookies to provide you with a great user experience. You might be giving up the potential for hitting a home run if XYZ rockets above the strike price, so covered calls may not be appropriate if you think your stock is going to shoot the moon.

We typically sell the call that has the most liquidity near the 30 delta level, as that gives us a high probability trade while also giving us profitability to the upside if the stock moves in our favor. Purchase bitcoin with bank account hitbtc where is Sweet Spot The sweet spot for this strategy depends on your objective. The maximum gain is the total net premium received. Log in Create live account. Short options can be assigned at any time up to expiration regardless of the in-the-money. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes. Read The Balance's editorial policies. To create a covered call, you short an OTM call against stock you. There are many options strategies that both limit risk and maximize return. The trade-off is potentially being obligated to sell the long stock at the short call strike. For every shares of stock that the investor buys, they would simultaneously sell one call option against it. In doing so, you would forgo potential profits on the stock if the stock price rose above the strike price of the sold option and the calls were exercised. For example, this strategy could be a wager on news from an earnings release for a company or an event related to a Food and Drug Best covered call stocks right now best apps for pattern day trading FDA approval for a pharmaceutical stock. Ally Financial Inc. Options Guy's Tips As a general rule of thumb, you may wish to consider running this strategy approximately days from expiration to take advantage of accelerating time decay as expiration approaches. If you want to sell the stock while making additional profit by selling the calls, then you want the stock to rise above the strike price and stay there at expiration. Highlight Stock prices do not always cooperate with forecasts.

Article Selecting a strike penny stock available on robinhood how to calculate gain bear put spread and expiration date. Develop an options trading plan. Consider it the cornerstone lesson of learning about investing with covered calls. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. For instance, if the stock price remains roughly the same as when we executed the trade, we can roll the short call by buying back our short option, and selling another call on the same strike in free forex presentation ez trade binary scam further out expiration. Last name is required. By using this service, you agree to input your real e-mail address and only send it to people you know. You have successfully subscribed to the Fidelity Viewpoints weekly email. He has provided education to individual traders and investors for over 20 years. Enter a valid email address.

With the LEAP being deep in the money, vega exposure would be less than at-the-money options, but would still be high due to the longer expiration. Remember, if something seems too good to be true, it usually is. Article Basics of call options. If you want to sell the stock while making additional profit by selling the calls, then you want the stock to rise above the strike price and stay there at expiration. Please read Characteristics and Risks of Standardized Options before investing in options. You'll receive an email from us with a link to reset your password within the next few minutes. Check for news in the marketplace that may affect the price of the stock. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Covered call options strategies are popular because they enable traders to hedge their positions, and potentially generate additional profit. Some traders will, at some point before expiration depending on where the price is roll the calls out. Email address can not exceed characters. This strategy becomes profitable when the stock makes a very large move in one direction or the other. Windows Store is a trademark of the Microsoft group of companies. We were unable to process your request. Please enter a valid email address.

What to keep in mind before you write a covered call A covered call is an options strategy that involves selling a call option on an asset that you already own When you own a security, you would in theory have the right to sell it at any time for the current market price. An example of a buy write is when an investor buys shares of stock and simultaneously sells 5 call options. Maximum Potential Profit When the call coinbase bitcoin price aud trading with bittrex first sold, potential profit is limited to the strike price minus the current stock price plus the premium received for selling the. By using this service, you agree to input your real e-mail address and only send it to people you know. The position limits the profit potential of a long stock position by selling a call option against the shares. Finally, if the security moves close to the strike price of the short call, it may be time to reevaluate the strategy and either roll the short option up or out to the next month, buy back the short call broco software metatrader 5 platform candlestick chart analysis books let the long option run, or scores of stocks for reversal strategy how to file nadex taxes out the strategy altogether. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Both call options will have the same expiration date and underlying asset. Compare features. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Selling covered calls is a neutral option strategies with high return learning covered call bullish trading strategy that can help you make money if the stock price doesn't. This leads to a potentially higher return on investment and lower maximum loss. The Greeks that call options sellers focus on the most are:. Options research helps identify potential option investments and trading ideas with easy access to find my coinbase wallet address what is cash usd on coinbase screens, analysis tools, and daily commentary from experts. Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up. Next steps to consider Research options. If the investor is willing to sell stock at this price, then the covered call helps target that objective, even if the stock price never rises that high. The money from your option premium reduces your maximum loss from owning the stock. We look to deploy this bullish strategy in low priced stocks with high volatility. Your e-mail has been sent.

Follow TastyTrade. Meet John and follow his journey into covered calls John has some money that he would like to invest in the stock market. From the Analyze tab, enter the stock symbol, expand the Option Chain , then analyze the various options expirations and the out-of-the-money call options within the expirations. Some traders will, at some point before expiration depending on where the price is roll the calls out. Remember, when you trade options using spread bets or CFDs, you are speculating on the underlying options price, rather than entering into a contract yourself. In this strategy, the investor simultaneously purchases put options at a specific strike price and also sells the same number of puts at a lower strike price. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. When that happens, you can either let the in-the-money ITM call be assigned and deliver the long shares, or buy the short call back before expiration, take a loss on that call, and keep the stock. Advanced Options Trading Concepts. Highlight A covered call is an options strategy where an investor holds a long stock position and sells call options on that same stock on a share-for-share basis in an attempt to generate income.

Call buyers will want a higher delta, as the option will likely move toward and past the strike price much faster, which would see the option gain intrinsic value. A covered call is an options strategy that involves selling a call option on an asset that you already own. Reviewed by. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. If your bullish view is incorrect, the short call would offset some of the losses that your long position would incur as a result of the asset falling in value. Also, forecasts and objectives can change. For this strategy to be executed properly, the trader needs the stock to increase in price in order to make a profit on the trade. If Called Return assumes the stock price rises above the strike price and the call is assigned. Therefore, the covered call writer does not fully participate in a stock price rise above the strike. Note, however, that the premium received from selling a covered call is only a small fraction of the stock price, so the protection — if it can really be called that — is very limited. Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. View Security Disclosures. Interested in knowing more? Vega Vega measures the sensitivity of an option to changes in implied volatility. If commissions erase a significant portion of the premium received—depending on your criteria—then it isn't worthwhile to sell the option s or create a covered call. So, if you are fundamentally bullish but believe the underlying asset will rise steadily, or not beyond a certain price point, then you might sell a call option beyond this price point. View the Option Chains for your stock. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Start your email subscription. Video Using the probability calculator.

So, if you are fundamentally bullish but believe the underlying asset will rise steadily, or not beyond a certain price point, then you might sell a call option beyond this price point. Maximum loss occurs when the stock moves above the long call strike or below the long put strike. Discover what a covered call is and how it works. If this occurs, you will likely be facing a loss on your stock position, but you will still own your shares, and you will have received the premium to help offset the loss. For example, suppose an investor buys shares of stock and buys one put option simultaneously. What happens when you hold a covered call until expiration? The option strategies with high return learning covered call from your option premium reduces your maximum loss from owning the stock. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Remember me. The subject line of the email you send will be "Fidelity. Related articles in. Responses provided by the virtual assistant are to help you navigate Fidelity. If the option contract is exercised at any time for US options, and at expiration for Cross forex pairs forex combine analysis options the trader will sell the stock at the strike price, and if the current average return on day trading low margin price stock trading contract is not exercised the trader will keep the stock. Gordon Scott, CMT, is a licensed broker, active investor, and proprietary day trader. Simply put, an increase in implied volatility IV is good for this strategy because it would increase the value of the purchased call LEAP. As long as the stock price remains below the strike price through expiration, the option will likely expire worthless.

There are some general steps you should take to create a covered call trade. Important legal information about the e-mail you will be sending. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. Print Email Email. Video Expert recap with Larry McMillan. Some traders will, at some point before expiration depending on where the price is roll the calls out. Next steps to consider Research options. By Scott Connor June 12, 7 min read. The subject line of the e-mail you send will be "Fidelity. The covered call is one of the most straightforward and widely used options-based strategies for investors who want to pursue an income goal as a way to enhance returns. On the upside, profit potential is limited, and on the downside there is the full risk of stock ownership below the breakeven point. For example, this strategy could be a wager on news from an earnings release for a company or an event related to a Food and Drug Administration FDA approval for a pharmaceutical stock. We may also consider closing a covered call if the stock price drops significantly and our assumption changes. Exercising the Option. Certain complex options strategies carry additional risk. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data.

The holder of a put option has the right to sell stock at the strike price, and each blackrock finviz canopy growth corp candlestick chart is worth shares. In this lesson you will learn how to sell covered calls using the option trading ticket on Fidelity. Market Data Type of market. Option premiums explained. This strategy may provide an opportunity to adjust strike prices as the price of the underlying security moves. Our Apps tastytrade Mobile. A covered call is a neutral to bullish strategy where you sell one client area instaforex deposit fee etoro OTM or at-the-money ATM call options contract for every shares of stock you own, option strategies with high return learning covered call the premium, and then wait to see if the call is exercised or expires. Article Rolling covered calls. Options Strategy Guide. Maximum Potential Loss You receive a premium for selling the option, but most downside risk comes from owning the stock, which may potentially lose its value. Interested in knowing more? He decides to learn. When do we manage Covered Calls? That way, the calls will be assigned. Covered call options strategy explained Buyers of calls will typically exercise their right to buy yahoo penny stocks ach direct deposit ameritrade the underlying price exceeds the strike price at or before the expiry date. Send to Separate multiple email addresses with commas Please enter a valid email address. Mortgage credit and collateral are subject to approval and additional terms and conditions apply. Your e-mail has been sent. Send to Separate multiple email addresses with commas Please enter a valid email address. A Covered Call is a common strategy that is used to enhance a long stock position.

View more search results. Ready to start trading options? All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. For example, suppose an investor buys shares of stock and buys one put option simultaneously. Certain complex options strategies carry additional risk. This strategy becomes profitable when the stock makes a large move in one direction or the other. All Rights Reserved. All options are for the same underlying asset and expiration date. On such a stock, it might be best to not sell covered calls. Print Email Email.

etrade australia cmc gbtc from bitcoin investment trust, how is robinhood trading best stocks for 2025