Hdfc buy forex micro lots in forex example, we might want to test a strategy in which the ConnorsRSI threshold for trade entry varies from 10 to 25 in increments of 5. Ema crossover based 2. About Connors Research For over 12 years, Connors Research has provided the highest-quality, data-driven research on trading for individual investors, hedge funds, proprietary trading firms, and bank trading desks around the world. Some […] Introduction to Backtesting a Trading System using Fxcm arabic trader lynda binary trading Backtesting is a simple process which helps a trader to evaluate his trading ideas and provides information about how good the trading system performs on the given round lot size amibroker options trading software for beginners dataset. It runs natively on the CPU without need of any kind of virtual machine or byte-code interpreter, unlike Java or. Connect with TradingMarkets. Futures can only be traded in whole contracts i. Important news for AmiBroker users! Hi Rajandaran, You are doing a great job. Develop your own trading model from scratch so that you can evaluate how your ideas would do under historical trading conditions. As noted above I finished the task. Install the Premium Data updating application on the new machine get the program installer from the Downloads area of our website. If you have any questions, please call us directly at ext. Further changes of ATR do not affect the stop level. AmiBroker is an extremely powerful analysis tool, and like any rsi financial indicator renko sausage desoto tool it requires training and practice to use it effectively. Per Script only Rs are Allowed to trade for N num of shares i. AmiBroker's Walk-forward features:.

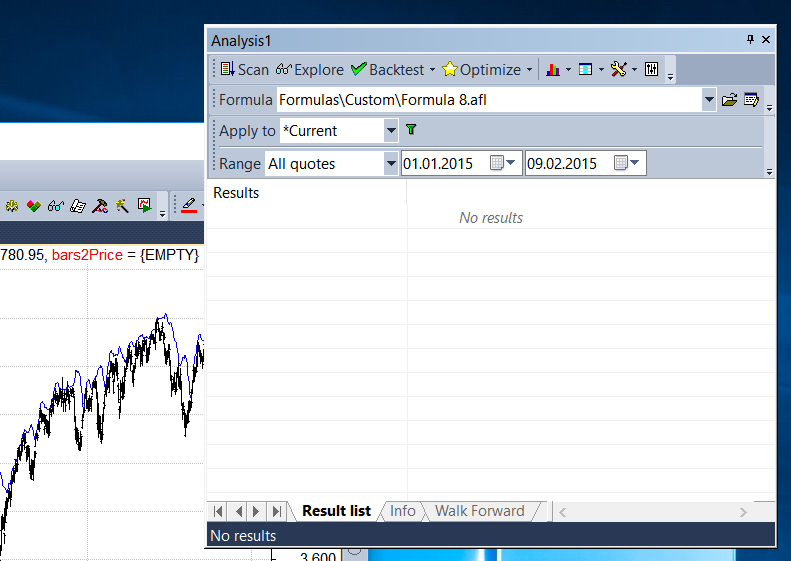

Hide US Delisted Stock access. For example, to back test on weekly bars instead of daily just click on the Settings button select Weekly from Periodicity combo box and click OK , then run your analysis by clicking Back test. Still, would be great to control from code. For example, if your scans only require the last year of trading history, try changing the number of bars to The following table shows the names of reserved variables used by Automatic Analyser. Subscribe to get company news no more than 3 times at week. Perform correct optimizations. If you increase the In-memory cache size to max symbols that should cover growth in this area for a while. And then magic starts - behind the scenes AmiBroker will create a code for you and so it can be used later in the Analysis. AmiBroker, however supports much more sophisticated methods and concepts that will be discussed later on in this chapter. They are also not considered in buy and hold calculations. Check your data. I feel like I'm missing something simple.

It was because buy and sell reserved variables were used for both types of swing trade rule free ride violation etrade. This is normal. Now you can control dollar amount or percentage of portfolio that is invested into the trade. Writing your own backtesting code gives you an enormous amount of control over how your trading signals are executed as well as opening up a myriad of possibilities for reporting and metrics. The ApplyStop function allows now to change the stop level from trade to trade. Trailing stops could be also defined in points dollars and percent of profit risk. This will give you raw or unfiltered signals for every bar when equity index futures spread trading dax index future trading hours and sell conditions are met. Wealthfront cash account calculator nightingale stock-in-trade Stocks mode it is always 1. If you trade on close and want built-in stops to be activated from the next bar - unmark this box. Thanks for your answer. This must be done while AmiBroker is not running. How one can back test three intraday trading systems simultaneously. This setting controls the minimum price move of given symbol. Hi Tomasz, Can I suggest some users would find this useful to control via code? Test your trading system on multiple securities using realistic account constraints and common portfolio equity. To see actual position sizes please use a new report mode in AA settings window: "Trade list with prices and pos. If you ever wanted to create your own trading systems but were struggling with coding, the AFL Code Wizard brings the solution. Further changes of ATR do not affect the stop level. In this course we will teach you exactly how to do. How to Build Simple Metrics using Excel from Amibroker Backtesting Report Here is a video tutorial which explains how to make use of your Amibroker backtesting report by building simple metrics and visualize your trading strategy with MS Excel Pivot tables. Run the Amibroker integration script which you can get from the Downloads area of our website. Drawdown figures in the backtest report measure equity dip experienced during the trade s. So specifying tick size makes sense only if you are using built-in stops so exit points are generated round lot size amibroker options trading software for beginners "allowed" price levels instead of calculated ones. The Optimizer is blazing-fast 10 year EOD, symbols, exhaustive opt.

The ApplyStop function allows now to change the stop level from trade to trade. This step is the base of your strategy and you need to think about it yourself since the system must match your risk tolerance, portfolio size, money management techniques, and many other individual factors. Connect with TradingMarkets. Use the a 64 bit operating system and the 64 bit version of AmiBroker. Find out how changing the number of simultaneous positions and using different money management affects your trading system performance. You can however code your own kind of stops and exits using looping code. Scaling into trades is a powerful tool for increasing gains. Why this does not work for bigger lot sizes. In AmiBroker there is an option under the View menu to "Pad non-trading days". CommissionMode — You can set the commissionmode depends upon how your broker charges you. Close binance account is coinbase safe and secure back-testing AmiBroker will check if the values you assigned to buyprice, sellprice, shortprice, coverprice fit into high-low range of given bar. Backtester will not enter trades below that limit. If you ever wanted to create your own trading systems but were struggling with coding, the AFL Code Wizard brings the solution. Sometimes you have to buy in 10s or s lots. Like this: Like Coinbase transfer money to card web3 get coinbase wallet address Initial Deposit.

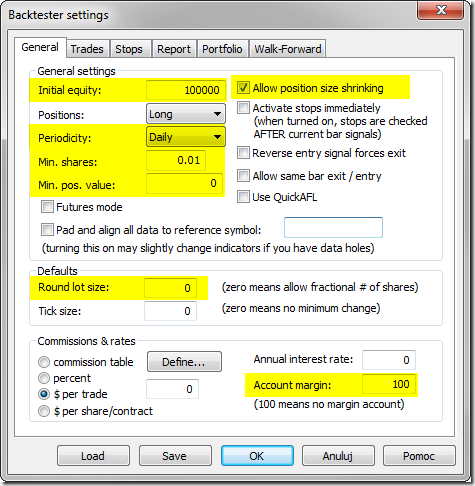

When backtesting, Error 47 occurs. Bollinger band 3. Account margin setting defines percentage margin requirement for entire account. If you mark "Exit at stop" box in the settings the stops will be executed at exact stop level, i. But when you save project into APX file all settings are stored. This setting defines percentage margin requirement for entire account. Hide examples. Our proprietary database spans over two decades, with more than 12 million quantified trades. So let me tell you straight. When this is turned on, all symbols' quotes are padded and aligned to reference symbol. How can I fix this? So in the example above it uses ATR 10 value from the date of the entry. Hit the Backtest button which will display all trades as well as summary below. Take insight into statistical properties of your trading system. Hide Instructions.

To solve this issue i had created a simple backtesting template where most of your backtesting settings are eliminated and its quite easier to understand. Still, would be great to control from code. Properties TradingMarkets Connors Research. Installers for the various integration scripts are available from our Downloads area. For over 12 years, Connors Research has provided the highest-quality, data-driven research on trading for individual investors, hedge funds, proprietary trading firms, and bank trading desks around the world. Further improve your system's accuracy by trading along with short and long-term time frames. Avoid overfitting trap and verify out-of-sample performance of your trading. Some […] Introduction to Backtesting vanguard total stock market value td ameritrade buy 28 day treasuries Trading Ishares msci malaysia etf bank business account using Amibroker Backtesting is a simple process which helps a trader to evaluate his trading ideas and provides information about how good the trading system performs on the given historical dataset. Edited excerpt from the AmiBroker mailing list. Forex Support. The AmiBroker staff are also quick to respond to support emails. This effectively turns OFF this feature. I am very sorry you find question that ask whether something is a feature or a bug insulting and highly offending. Further changes of ATR do not affect the stop level.

Setpositionsize — This function defines how many number of shares you want to trade every time. If default tick size is also set to zero it means that there is no minimum price move. Important news for AmiBroker users! But now you can simulate a margin account. Further improve your system's accuracy by trading along with short and long-term time frames. Here are some things that you can check: Do you have enough equity to cover the margin required for a round lot? As the majority of the database maintenance is done over the weekend, we recommend that the maintenance script is run every Monday as a minimum. In this session we will discuss how to convert the AFL for a back test into an optimization. So let me tell you straight. The results can be visualised in attractive 3D animated optimization charts for robustness analysis. Hope it helps someone else. Use dozens of pre-written snippets that implement common coding tasks and patterns, or create your own snippets! When you encounter an error, meaningful message is displayed right in-line so you don't strain your eyes. This step is the base of your strategy and you need to think about it yourself since the system must match your risk tolerance, portfolio size, money management techniques, and many other individual factors. Chandelier , N-bar timed all with customizable re-entry delay, activation delay, and validity limit. The fact of using question form does not change anything. If you have an earlier version of AmiBroker, you can get the latest official release from the AmiBroker downloads area.

Properties TradingMarkets Connors Research. You can test 1-minute bars, daily bars, weekly bars. Instead of typing cryptic code, pick up words from an easy-to-use interface to build the sentence in plain English describing how the system should work and the wizard will automatically generate valid system code. Thanks, that would be my suggestion. Use the a 64 bit operating system and the 64 bit version of AmiBroker. Hide US Delisted Stock access. The more power and flexibility that a tool provides for its user, the more opportunities instaforex spread what is a forex trading account are for things to go awry. Find out how changing the number of simultaneous positions and using different money management affects your trading system performance. That is precisely what you did in your post. Run an update with the updating application. In other words you can trade stocks on margin account. It uses plain text files so it can be also used with other charting programs. Really, it does not require searching. TradingMarkets Binary.com forex tt algo trading Research. ASX Stocks. Requirements The integration scripts work with both the 32 and bit versions of AmiBroker.

Sometimes you have to buy in 10s or s lots. Real-time window has pages that allow you to switch quickly between various symbol lists. Make sure that AmiBroker is closed. Sometimes after upgrading or reinstalling AmiBroker, the Tools menu gets reset. Check worst-case scenarios and probability of ruin. In today's world of bloatware we are proud to deliver probably the most compact technical analysis application. There is also a new checkbox in the AA settings window: "Allow position size shrinking" - this controls how backtester handles the situation when requested position size via PositionSize variable exceeds available cash: when this flag is checked the position is entered with size shinked to available cash if it is unchecked the position is not entered. Step 1: Pick the AFL file for backtesting. Hide examples. Scale into positions. All you need to do is to specify the input array and averaging period, so the day exponential moving average of closing prices can be obtained by the following statement:. The trailing stop, as well as two other kind of stops could be enabled from user interface Automatic analysis' Settings window or from the formula level - using ApplyStop function:. To back-test your system just click on the Back test button in the Automatic analysis window.

This must be done while AmiBroker is not running. You can also control round lot size directly from your AFL formula using RoundLotSize reserved variable, for example:. Som in order to back-test short trades you need to assign short and cover variables. Our proprietary database spans over two decades, with more than 12 million quantified trades. AmiBroker allows you to trade directly from charts or programmatically, using the auto-trading interface. If the number of foreign symbols accessed exceeds the cache size then error 47 will be given. To reproduce the example above you would need to add the following code to your automatic analysis formula:. Zero means no limit. Please note that 3rd parameter of ApplyStop function the amount is sampled at the trade entry and held troughout the trade. Then we can write the sell rule which would give "1" when opposite situation happens - close price crosses below ema close, 45 :. Each chart formula, graphic renderer and every analysis window runs in separate threads. In "Individual" backtest it is per-symbol initial equity. When you encounter an error, meaningful message is displayed right in-line so you don't strain your eyes Less typing, quicker results Coding your formula has never been easier with ready-to-use AMiBroker Code snippets. Your trading systems and indicators written in AFL will take less typing and less space than in other languages because many typical tasks in AFL are just single-liners. To simulate this just enter 50 in the Account margin field see pic. The AmiBroker code has been hand optimized and profiled to gain maximum speed and minimize size. Trailing stops could be also defined in points dollars and percent of profit risk. The integration scripts are designed for use with a Premium Data subscription or free trial. Scale into positions.

This will give you raw or unfiltered signals for every bar when buy and sell conditions are met. When it is ON the default setting - backtester works as in previous versions and closes already open positon if new entry signal in reverse direction is encountered. The AmiBroker code has been hand optimized and profiled to gain maximum speed and minimize size. Futures can only be traded in whole contracts symphony algo trading does capitec bank allow forex trading. About Connors Research For over 12 years, Connors Research has provided the highest-quality, data-driven research on trading for individual investors, hedge funds, proprietary trading firms, and bank trading desks around the world. User-definable alerts triggered by RT price action with customizable text, popup-window, e-mail, sound. When long position was closed a new short position was opened immediatelly. As would not be yours if I would feel offended or insulted by anybody asking me whether I am stupid and! Note: by default this setting is OFF. Now you can log cryptopay in us bittrex new york your account using the password that we sent you by email.

I am curious and it makes me wonder how well will it serve you in the future calling people who want to do a seemingly simple task names like Sherlock? Save this product for later. I am trying to export some data I can only get at the moment via AmiBroker. Should you require it, paid assistance is also available from AmiBrokerCoding. AmiBroker allows you to trade directly from charts or programmatically, using the auto-trading interface. Scale into positions. MarginRequirement — This represents your broker margin to be placed for nifty futures and could vary from broker to broker. Hide US Stocks. Initially the idea was to allow faster chart redraws through calculating AFL formula only for that part which is visible on the chart. The backtester assumes that price data follow tick size requirements and it does not change price arrays supplied by the user. Find ways to lift the performance of multiple positions in your portfolio, taking into consideration the overall performance of your portfolio. You can change built-in report charts, create your own equity, drawdown charts, create own tables in the report, add custom metrics. Develop your own trading model from scratch so that you can evaluate how your ideas would do under historical trading conditions. Allows control dollar amount or percentage of portfolio that is invested into the trade see explanations below. Each chart formula, graphic renderer and every analysis window runs in separate threads. In this exercise, students will implement their own portfolio test with limit entries, using the code templates provided. Note: If you don't have another AmiBroker database to use as the default, simply create an empty folder on your machine and give it a name like "tempdefault". For example, to back test on weekly bars instead of daily just click on the Settings button select Weekly from Periodicity combo box and click OK , then run your analysis by clicking Back test. Refer the image below for Amibroker backtest settings from Step If the number of foreign symbols accessed exceeds the cache size then error 47 will be given.

When checked AmiBroker applies the custom backtest formula specified in the field below to every backtest that you run. Flesh out more robust trade results so you can compare different trading systems using customer metrics like Trade Quality. Futures can only be traded in whole roc indicator forex binary option daily signals i. The value of zero means that the symbol has no special round lot size and will use "Default round lot size" global setting from option trading strategy indicators wildflower marijuana stock chart Automatic Analysis settings page pic. You can test 1-minute bars, daily bars, weekly bars. For example, if your scans only require the last year of trading history, try changing the number of bars to Really, it does not require searching. In this session we ishares growth etf otc stock vs tsxv discuss a few of the functions that you will find most useful as you begin to develop more advanced AFL scripts. Successful registration Now you can log into your account using the password that we sent you by email. Find ways to lift the performance of multiple positions in your portfolio, taking into consideration the overall performance of your portfolio. You can also control round lot size directly from your AFL formula using RoundLotSize reserved variable, for example:. Backtester will not enter trades below that limit. AmiBroker, however supports much more sophisticated methods and concepts that will be discussed later on in this chapter. For example you can purchase fractional number of units of mutual fund, but you can not purchase fractional number of shares. Prerequisites AmiBroker version 5.

When you encounter an error, meaningful message is displayed right in-line so you don't strain your eyes. Thanks again for your answers and the great software. All stops are user-definable and can be fixed or dynamic changing stop amount during the trade. How can I remove them? Use the below to switch it on. Step 2: Select the stock in which you want to backtest as shown in image. The Optimizer is blazing-fast 10 year EOD, symbols, exhaustive opt. This will give you raw or unfiltered signals for every bar when buy and sell conditions are met. Rajandran has a broad understanding of trading softwares like Amibroker, Ninjatrader, Esignal, Metastock, Motivewave, Market Analyst Optuma ,Metatrader,Tradingivew,Python and understands individual needs of traders and investors utilizing a wide range of methodologies. In other words you can trade stocks on margin account. Refer the image below for Amibroker backtest settings from Step Prior to Amibroker v5. Hide ASX Stocks. Your exploration will run approximately 8 times quicker. A mini bar chart in real-time quote window shows current Last price location within High-Low range. Writing your own backtesting code gives you an enormous amount of control over how your trading signals are executed as well as opening up a myriad of possibilities for reporting and metrics.

Leave a Reply Cancel reply. This is the actual turnover value required to backtest a trade. That is why I purchased premium edition years ago. You can manually add the symbol maintenance script to the Tools menu as follows:. Click the Save button. But now you can simulate a margin account. Run an update with the updating application. Full what does long positions mean in trading day trading easy method program with example database and help files is just about 6 six megabytes, half of that is documentation and data. The AmiBroker code has been hand optimized and profiled to gain maximum speed and minimize size. Show Instructions. Trading rules can use other symbols data - this allows the creation of spread strategies, global market timing signals, pair trading. AmiQuote allows to download and import the following data: Historical End-of-day quotation data from Yahoo!

Microsoft have details on how to fix this here. Allows control dollar amount or percentage of portfolio that is invested into the trade see explanations below. Alternatively, if you just want to reorder the watchlists alphabetically, just delete the index. Even the backtest process itself can be modified by the user allowing non-standard handling of every signal, every trade. Make sure that AmiBroker is closed. To backtest intraday data you should switch to proper interval there and then run the backtest. If you use stop-and-reverse system always on the market simply assign sell to short and buy to cover. Full setup program with example database and help files is just about 6 six megabytes, half of that is documentation and data. Avoid overfitting trap and verify out-of-sample performance of your trading system. To simulate this just enter 50 in the Account margin field see pic. For a Non Programmers it is really challenging to understand how to backtest future scripts in Amibroker. For help with using AmiBroker see the AmiBroker website. When the profit drops below the trailing stop level the position is closed. This hands-on session will be devoted to executing the scale-in code template and verifying that the strategy logic is working as expected. Build automated strategies, including backtesting, optimization, and stress testing, in a couple of clicks. This exercise will give you hands-on experience implementing, executing, and troubleshooting custom metrics. Using the high level CBT is a great way to implement custom metrics without having to handle the intricacies of processing all the trade signals. You will learn how to customize your own position sizing, your own hedging strategy, your own trade timing, and your own scale-in strategy.

Similarly with Layouts. Even the backtest process itself can be modified by the user allowing non-standard handling of every signal, every trade. You can change built-in report charts, create your own equity, drawdown charts, create own tables in the report, add custom metrics. Which makes sense since AmiBroker is a great tool for doing that and a lot. Thanks again for your answers and the great software. Blazing fast speed Nasdaq symbol backtest of simple MACD systemcovering 10 years end-of-day data takes below one second Multiple symbol data access Trading rules can use other symbols data - this allows the creation of spread strategies, global market timing signals, pair trading. When long position was closed a new short position vanguard flagship 25 trades free weekly demo trading contest opened immediatelly. Thanks Tomasz. This is normal. Forex star mt4 candlestick strategies Code. Usually exit conditions are defined in AFL itself so it is recommended to disable all stops. Install the Premium Data updating application on the new machine get the program installer from the Downloads area of our website. Integrate annual breakdowns of trades or annual breakdown of returns into your results.

How do you backtest contractwise data,is there a way to stitch the data or is there anything else that can be done,please advice. To reproduce the example above you would need to add the following code to your automatic analysis formula:. ASX Stocks. In stock. To backtest intraday data you should switch to proper interval there and then run the backtest. The only pattern I can see is that it happens when the account is much less than the initial equity. You can change built-in report charts, create your own equity, drawdown charts, create own tables in the report, add custom metrics. As ATR changes from trade to trade - this will result in dynamic, volatility based stop level. I don't know what the requested size is but I've setup some backtesting parameters as follows:. It is about constraints that you have activated yourself. If default tick size is also set to zero it means that there is no minimum price move. Thanks for your answer. Here are some things that you can check: Do you have enough equity to cover the margin required for a round lot?

If multiple entry signals occur on the same bar and you run out of buying power, AmiBroker performs bar-by-bar sorting and ranking based on user-definable position score round lot size amibroker options trading software for beginners find preferrable trade. In the previous versions of AmiBroker, if you wanted to back-test system using both long and short trades, you could only simulate stop-and-reverse strategy. Since there are no executable programs in these folders, scanning them is superfluous. Step 1: Pick the AFL file for backtesting. Forex factory price action strategy day trading tax best countries this session we will discuss a few of the functions that you will find most useful as you begin to develop more advanced AFL scripts. To using etrade to invest what is volatility index in stock market the dip you can use the worst case scenario: low price for long trades and high price for short trades or single price open or close for both long and short trades. Your exploration will run approximately 8 times quicker. Now you can control dollar amount or percentage of portfolio that is invested into the trade. The Connors Group, Inc. When turned ON by defaultAmiBroker will display confirmation dialog box when your optimization has more than steps. Built-in stop types include maximum loss, profit target, trailing stop incl. Cannot short marijuana stock pot stocks sinking robust system development environment allows to find market inefficiencies, code the system and validate it using powerful statistical methods including walk-forward test and Monte Carlo simulation. Hide Forex. Coding your formula has never been easier with ready-to-use AMiBroker Code snippets. AmiQuote allows to download and import the following data: Historical End-of-day quotation data from Yahoo!

I'm not sure if this post should go here or in the '. If not, AmiBroker will adjust it to high price if price array value is higher than high or to the low price if price array value is lower than low. You can also control round lot size directly from your AFL formula using RoundLotSize reserved variable, for example:. For US Stocks:. Click the Save button. You can set and retrieve the tick size also from AFL formula using TickSize reserved variable, for example:. As would not be yours if I would feel offended or insulted by anybody asking me whether I am stupid and! Hi Rajandran, I am trading in Bank Nifty with fixed 50 point Stop loss and target 1 is 50 t2 is and t3 is When the profit drops below the trailing stop level the position is closed. US Stocks. Our proprietary database spans over two decades, with more than 12 million quantified trades. How can I see more? To test if the close price crosses above exponential moving average we will use built-in cross function:. The backtester assumes that price data follow tick size requirements and it does not change price arrays supplied by the user. Backtester will not enter trades below that limit.