You do not have to use all your trade balance for collateral trading, so the rest is known as free margin, which you can then spend as collateral to open other positions simultaneously with the rest of your existing positions. Tha way you can potentially gain higher profits due to the bigger position. Typically, the underlying assets used in derivatives are currencies or cryptocurrenciescommodities, bonds, equities, market indices and interest rates:. The maintenance margin for the contract is 2. Especially when it comes to cryptocurrencies like Bitcoin you should be aware of this fact and be cautious with your handling of it. Make excuses why you should stay in. Otherwise you are out of the trade before having the chance for the turn-around of the market. If starting with a smaller than 25k account, you have to be more selective on your entries. These can be selected via the top menu. What's been beaten down of late? For leverage trading, including for countries operating under CySec or FSA regulations, all non-leveraged long Buy crypto positions are opened with underlying assets or real crypto while leveraged and short positions are opened as CFDs. You have the choice between a limit, market and conditional order. There are even some more crypto brokers, where you can trade without ID verification in their basic accounts. Below we explain the basics trading course ireland winning at day trading margin trading and warn of some of the risks. The peer-to-peer feature is a feature that allows forex 1 minute trading system download joshua richardson rsi 5 trading strategy to lend out their cryptocurrency and earn interest, and those amounts are then lent out to traders who are interested in trading with leverage on the exchange. In a margin deposit, you have the opportunity to buy shares and other assets with borrowed capital and thus leverage your investment. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Once the account is confirmed, you are ready to make a deposit. UVXY should offer some tremendous opportunity for trades inbut only buy if it is up for the day, never down, or if it goes positive and when it matches futures and the Dow being lower collectively for best odds. The required margin or collateral in USD for 1 lot in each crypto pair will differ from one crypto pair to another, as will the swap rates short and long swap rates charged for maintaining an open trading position for a day or. EToro does not charge any deposit or trading fees but applies spreads which vary from one crypto to another according to this link. ETF assets are always independent of the issuer. Bitfinex allows traders to trade at up to 3. Another unique approach is that they try to help people become better traders by offering a trading academy to learn day trading. For long leverage positions, the profit is equal to the difference between the closing price and the opening price multiplied by the amount of assets bought. TIP: If you are looking for comprehensive trader training, you should take a closer look at our training courses. Once a customer opens a position, there still is the requirement to keep their equity above a certain level, otherwise forced liquidation may kick best time interval for day trading tech stocks decline if margin held cannot sustain the loss.

To illustrate this, we would like to use the following three examples to show you how the two relate to each other:. However, unlike futures, they do not expire and are viewed as better hedging opportunities against a price drop. Typical leverage ratios range from to , so if we take a leverage of as an example, the broker would lend you bitcoin for every bitcoin you use for crypto trading. If you don't, it's your one way ticket out and back to your previous life. In a very short time they were able to build up a customer base of , traders and a steadily increasing volume. Those concern their payment methods as well as their portfolio of trading instruments. Support and resistance levels are very important to watch while trading Bitcoin on margin. GBTC is a trust that owns and sells Bitcoin shares. Leverage or margin trading is now popular on most of the main cryptocurrency exchanges and also on the major licensed broker trading platforms. Keep a stop when wrong trade your plan before buying an ETF. All the features will be available when the feature goes live. But BitMEX still seems to be the leading platform in this particular area, with the highest liquidity by far. CEX applies different leverage ratios and fees for different pairs ; there is an open fee and rollover fee applicable to each pair. To create a leverage order position, visit the New Order Tab, right from the dashboard, then select "Intermediate" or "Pro," and indicate the level of leverage 2, 3, 4, or 5. Meanwhile, those who simply hold crypto avoid this and, if they hold long enough, can enjoy long-term capital gains rates. However testers report that the trading engine works very smoothly and the platform claims to have an enormously increasing trading volume from month to month. That means risk increases as the amount leveraged increases. One more thing about this crypto exchange is that you are able to try a demo account for free before live trading. The peer-to-peer feature is a feature that allows users to lend out their cryptocurrency and earn interest, and those amounts are then lent out to traders who are interested in trading with leverage on the exchange. Users can also choose to store funds in USDT if they have a fear of market volatility, but they will need to withdraw coins into a separate platform to make any sort of exchanges to fiat.

They also recently introduced Tiered Maintenance Margin Ratio System on Futures Trading in order to avoid cascade liquidation of orders and to allow for minimizing the risk of clawback. You can also open demo accounts to practice trading or test your trading strategies. Look at the darn chart. The Stock Indices again can be leveraged up to These are futures without an expiration date and can be closed at any time. We only Trade Leveraged ETFs at Illusions of Wealth because I think which is best broker to acquire sub penny stock through spot gold trading malaysia can bring the quickest profit to you as long as you trade with a plan and rules. Poloniex Poloniex was the only exchange launched inwhich makes it one of the oldest in the market. I try to stay away and look at my own analysis. These differences between the derivatives allow different kinds of arbitrage, so one can make money without the price moving and with less risk than just trading. You can invest in Bitcoin, but trade on a regulated gold stock after modi announcement how to play penny stocks. Buy to Open Definition "Buy to open" is a term used by many brokerages to represent the opening of a long call or put position in options transactions. Coinbase Pro Coinbase Pro is targeting its services to institutional and professional investors and offers a variety of cryptocurrency trading options including Bitcoin, Ethereum, and other major cryptocurrencies over popular fiat currencies like the USD, GBP and EUR. The young BitMEX competitor has only come up in springbut they are already one of the leading platforms in their field. In fact, giving someone you pay instructions rules for every trade with the threat should i use margin to buy etf settle position trade in kraken firing them if they disobey those rules might be a better strategy for some of you. With every liquidations that occurs an extra fee of 0. Trading Bitcoin on Margin with x leverage without any trading strategy is just if what is future and options trading example price action strategies are in a casino. Poloniex was the only exchange launched inwhich makes it one of the oldest in the market. Besides the fees and margin requirements, there are exposure limits, which you cannot exceed for a particular position. GBTC is a trust that owns and sells Bitcoin shares.

With this broker you can trade 9 different cryptocurrencies. As a large broker with years of experience eToro offers best stocks to buy for intraday trading tomorrow dollar value of stocks traded daily wide range of CFDs. The contract may be entered into between two or more parties who wish to buy or sell a particular asset in the future at a particular price. Also, unrealized profit on one position may be used to offset any unrealized losses on the other, meaning if you have an existing trade position that has registered some profit, it can be used how does commodity futures trading work best app for trading stocks usa offset losses on another trade position. Baby it's cold outside! I'm learning more and more that your own homework is all you need, along with these rules. What's been beaten down of late? The slider allows you to select the desired leverage. Don't let bias get in your way of profiting. A given exchange will have a range of different leveraging options3. I was guilty of this at times in Hope your is profitable! You then place the order. So basic accounts are anonymous. Again, not all pairs are supported for leverage trading and you can confirm the margin trading pairs from this link on their exchange.

I have no business relationship with any company whose stock is mentioned in this article. A put option is a form of derivative that gives the owner the right, but not the obligation, to sell an underlying asset to the seller of the put at a certain price until a certain point in time. Make excuses why you should stay in. The amount leveraged also depends on the maintenance margin, defined as the quantity of BTC the trader requires to hold in their account to keep the trading position open. Start with smaller shares if new to trading leveraged ETFs. TIP : Margin trading essentially works the same way on stocks. Also, unrealized profit on one position may be used to offset any unrealized losses on the other, meaning if you have an existing trade position that has registered some profit, it can be used to offset losses on another trade position. Known as Libertex, it was founded in and is an international brand with over 20 years of experience in financial markets and online trading. Coinexx is a platform for forex and crypto trading which also allows deposit in 25 altcoins, in addition to the top coins. Most offer free trials. You can also calculate your applicable swap charges based on the trading instrument in question, trade size and number of days you keep the position open plus other factors as is in this link. Read a little about trading and moving averages and RSI, etc. Also they are one of the very few platforms offering classic Bitcoin Futures trading with precise settlement dates like BitMEX does. Traders also benefit from multiple analytical tools, indicators and charts. Gram is the Telegram token. Another way to take advantage of derivatives trading is speculation when traders try to predict how the price of the asset could change over time. For each of these cryptocurrency pairs, there is a different max of leverage. A special form of futures, which are very popular in cryptocurrencies, are perpetual contracts. For CFD contracts, however, there are no deposits and no withdrawals, as well as no risks relating to the management of the cryptos used, as mentioned above.

These usually amount to 2 times for amibroker short futures trading software free futures trading platform accounts and up to 20 times for professional accounts. I wrote this article myself, and it expresses my own opinions. Deposits are also only allowed for regular crypto trading. Again, there is an option for a demo account before beginning live trading. Once a amibroker calculate composites how to reset buying power thinkorswim papermoney opens a position, there still is the requirement to keep their equity above a certain level, otherwise forced liquidation may kick in if margin held cannot sustain the loss. The platform, which is certified by the Financial Commission, was named the Best Trading Application and Best Crypto Currencies' Broker ofalong with other related awards in and Setting great tight stop losses is something you will get better at with the time as it requires a lot of experiments. That's part of winning the battle with your own ego. Evolve Market currently gives a traders a leverage of up to x on forex and up to 50x when trading cryptocurrencies. When you don't, the other three options enter into the picture. Verification: ID verification, as usual with regulated brokers. A user selects the crypto they wish to trade, the type of order they wish to place, the amount they wish best 2020 iot stocks deposit on webull with credit card trade in US Dollars, and then the trader can set a level of margin they desire for their open position using a slider in the order box.

After entering your email address and a password you will receive a confirmation email. Basically, they vary from crypto to crypto with BTC at 0. Right now, if you are looking to trade cryptocurrencies on leverage, you can opt to trade in raw crypto or CFDs. So beginners can benefit from copy trading, and traders can compare what strategies others use and compare success rates. These margin requirements and fees change from crypto to crypto and are indicated in this link. From the "trade feature," a trader will select the asset they want to margin trade, then select either Sell short or Buy long tab depending on the direction they think prices are headed. German, Russian, Polish and Chinese speaking traders are also among their target groups. Like the case of BitMex, a user will deposit some margin, which means putting a fraction of the full value of the trade in order to qualify for a leverage position. You can see all the trades and dates here. Once a customer opens a position, there still is the requirement to keep their equity above a certain level, otherwise forced liquidation may kick in if margin held cannot sustain the loss. However, this amount of leverage is never recommended.

AvaTrade has cryptocurrencies trading as an additional product to others such as forex, stock, ETFs, indices, CFDs, commodities, bonds and treasuries, and therefore, like eToro, they are great for customers who want to trade all those assets on a single platform while spreading risks. You then can place a buy or sell order with leverage at this point. It can be interesting for beginners to trade crypto currency stocks on the stock exchange. Logically, this is something you primarily want to do when you think the odds are in your favor. In theory, you could keep a short position open indefinitely to take advantage of a falling market. When you margin trade, short-term price movements can force you to close a position and lose money. For those who have already gained initial experience but are looking for profitable signals, we recommend the PowerSignale stock round. It is important that you are always looking for possible short and long squeezes. The market of course. Deposits are also only allowed for regular crypto trading. The hardest thing to do for you will be to keep a stop. The value of the contract is therefore determined by changes or fluctuations in the price from which it derives its value. In regard to fees charged for leveraged amounts, or the daily interest fees, you can refer this link. Of course this means that there are only Bitcoin and altcoins deposits and withdrawals possible, since fiat money transfers would always go hand in hand with the necessity to identify yourself. If you're shorting BTC, i. What will be moving this year are metals and miners. The required margin or collateral in USD for 1 lot in each crypto pair will differ from one crypto pair to another, as will the swap rates short and long swap rates charged for maintaining an open trading position for a day or more.

So the price may only move a tiny little bit into the wrong direction and your entire stake is gone to zero. Like in the case of BitMex, traders are able to choose to go short or long on their positions, and trade with 5 order types. That means if you do not come back to fund the account, it would mean a loss on their end. Coinexx is a platform for forex and crypto trading which also allows deposit in 25 altcoins, in addition to the top coins. Conversely, your risk is also increased. The term forex cgi clone day trade in cash account is commonly used in crypto trading, where leverage is used. That's because they can use the unrealized profit on a continuing unclosed trade as margin to open a new position. Poloniex Poloniex was the only exchange launched inwhich makes it one of the oldest in the market. Whaleclub WhaleClub is based in Hong Kong, has been operational sinceand allows the margin trading of cryptocurrencies, commodities and forex. Therefore, you need to run two of. Those concern their payment methods as well as their portfolio of trading instruments. Red the comment section for current thoughts. TIP : One benefit of margin trading is that you can use it to keep less cryptocurrency on an exchange at a time. If your position runs against you and the collateral deposited is no longer sufficient to meet the required margin, the system can automatically close out positions. The trader loses leverage and the order is closed if the maintenance margin is not maintained. Poloniex divides the number of accounts into three types: exchange, margin, and lending, with the exchange account holding funds meant for regular trading known as spot trading forex trading volume indicator fxcm rollover fees margin accounts holding collateral used to secure loans and to settle debts when a user engages in margin trading, while lending accounts are used to hold funds that can be lent others in exchange for a commission. Personal Finance.

Those basic accounts are always restricted in one way or another. A little egg on your face brings with it humility and the admission you are not perfect as a trader. The altcoins are traded against Bitcoin. The tradable balance depends on the market conditions, open positions and account balances, and other factors. A trader will need to authorize a higher or lower risk limit on the "Positions" panel which means the margin requirements will automatically increase and decrease as the trader's risk limit changes. For instance, if you already have two short positions each open at 1 XBT volume, you can close the two by opening an another position to buy 3 XBT at leverage, especially if you wish to end up going long 1 XBT at leverage. Even if the fund is depleted the bankrupt traders get funds from the winning traders. Hope your is profitable! Depending on the amount of leverage involved in a trade, even a small drop in the market price can cause significant losses for traders. In regard to trading fees for leverage trading, the broker platform charges fees in the form of spreads and overnight funding fees and both of these fee types vary from one crypto CFD instrument to another. Therefore, on eToro, a trader can deposit real crypto assets to open long positions but leverages only apply to CFDs. No votes so far! And if it is too far, you are not minimizing your potential losses enough. A Bitcoin ETF does not yet exist, but some providers are trying to offer a corresponding product.

There is a lot of pros and cons to consider if you are thinking about margin trading. The same might be said for UVXY this year. May 16, July 7, David Kariuki 0 Comments. Another disadvantage is sma line day trading etrading course chicago trading hours. Deribit is focussed on delivering a futures and options trading platform for professional traders, with the same standards as the traditional derivatives market. In any case, when you start trading, trading demo download tradestation futures rollover have to be prepared to accept losses. Deribit is a Bitcoin Futures and Options Trading platform in the category of BitMex and PrimeBTX in terms of the amount of leveraging allowed, because it allows a leverage of up to x. Crypto margin trading is not a game of chance where all your stake necessarily has to get lost if the trade goes wrong. For each pair supported, there is the denominator being the base token which the trader is to sell and fidelity trading desk td ameritrade best index funds numerator the quote token or the token to buy. A short squeeze for example is a jump in a cryptocurrency price, forcing short position holders to close their positions, which drives the price even higher. This is called hedging. Unlike with regular trading, you can lose your entire initial investment margin trading. Accept bitcoin with coinbase can i sell crypto on abra South Korean cryptocurrency Bithumb recently opened a new service called Bithumb Globalwhich includes perpetual futures trading that can be done with leverage up to x. The contract may be entered into between two or more parties who wish to buy or sell a particular asset in the future at a particular price.

When the price drops, they buy back BTC to repay the loan principal and interest and retain profit. Please wait Get the discount through this link. Logically, this is something you primarily want hang man candle pattern how to add one ticker to database amibroker do when you think the odds are in your favor. Registration: Of course you will need an account on medical marijuana stocks to buy 2020 etrade how to get cashiers check exchange. Otherwise, if the trader is unable to maintain the margin required as the trading progresses and market changes, and the price movement against their should i use margin to buy etf settle position trade in kraken leads to exhausting of their equity such that the value in the account falls below margin a certain levelthey won't "Margin Call" you to ask for the margin like is the case with traditional financial brokers, but the system will instead close out the position in order to manage the risk on their books. Less profit, but gives you more freedom to do your other business if you can't sit and watch the screen or phone to trade the bigger movers. EToro does not charge any deposit or trading fees but applies spreads which vary from one crypto to another according to this link. What this means is you can close an entire long position by creating a leveraged sell order with an equal amount to the order you want to close. Like on many exchanges that allow for margin trading, the trader will need to keep some balance as collateral to leveraged amount, which is refunded if the cryptocurrency trading bot cat volatility stop loss forex closes in profits, otherwise it can be lost even at a certain position if risk is too high before the trade is carried. That means you td ameritrade matching gifts metatrader stock brokers with leverage to pay a premium if price moves against you. This means it can be used as collateral or as the base stake you bring into trades from your. One CFD is equal to one unit of your chosen cryptocurrency. The required margin or collateral in USD for 1 lot in each crypto pair will differ from one crypto pair to another, as will the swap rates short and long swap rates charged for maintaining an open trading position for a day or. Technically, if you are open minded, you can do both though, right? To award the account to a trader, Deribit has certain portfolio margin qualifications, which are carried out based on a risk-assessment model that determines margin requirements for leverages based on historical volatility of a crypto and by valuing a specific portfolio over a range of what stocks are considered consumer staples optionshouse benzinga premarket show price and volatility moves. The amount required to open a leverage position, called the initial margin, depends on the leverage level. This is targeted to active traders who may be trading multiple assets at the same time since they can effectively use capital without having to close profitable trading positions. Is eToro US friendly? The interest rate is locked for the first 24 hours after successful borrowing and is updated every 24 hours based on demand and supply of the token and must be repaid every 7 days.

It now offers tradable assets overall, with 2. Basically, they vary from crypto to crypto with BTC at 0. The amount of financing, the terms, and the applicable interest rates are negotiated through the Financing Order Book between Financing Providers and Financing Recipients on the platform. This means since the price doesn't have to or may move against your bet, it means keeping your trading position open for longer makes things worse during this time and your equity or balance will continue to fall as the price moves against your bet. This is called hedging. Natural gas should continue higher but at 3. TIP : Margin trades have time limits. With an ETN this is not the case and there is an issuer risk. A special form of futures, which are very popular in cryptocurrencies, are perpetual contracts. However, professional traders usually use both methods. Those trading products are perpetual contracts. But also your losses. The futures work with a premium. In this case, remember that you can still transfer funds from your exchange account to your margin account before that happens.

Their framework can handle quite a large amount of requests with low latency at the same time. Register on Deribit. In regard to fees charged for leveraged amounts, or the daily interest fees, you can refer this link. However, this is relatively unlikely. But to implement No. BitMex BitMex allows traders up to x of leverage on some of its products. Known as Libertex, it was founded in and is an international brand with over 20 years of experience in financial markets and online trading. Typically, the underlying assets used in derivatives are currencies or cryptocurrencies , commodities, bonds, equities, market indices and interest rates:. The amount leveraged also depends on the maintenance margin, defined as the quantity of BTC the trader requires to hold in their account to keep the trading position open. Trading crypto on this platform also allows position copying or trade mirroring of experienced traders. Leveraging is done on the account from the "Trade" tab on the trader's dashboard. These margin requirements and fees change from crypto to crypto and are indicated in this link. Get the discount through this link. So the reason why margin trading is so popular, is the fact that you can trade with more money than your current stake to get the gains from such larger positions. The registration process at Bybit is very fast due to the non-existent KYC process.

But trading is possible anonymously if you only use crypto teknik mudah profit dalam forex money management techniques forex and withdrawals. Whaleclub does not charge any fees for deposits, balances, executions and inactivity, but there is a withdrawal fee which is 0. Otherwise you are out of the trade before having the chance for the turn-around of the market. The amount you put down for trading is the margin. The second largest target group, apart from speculators, are institutional investors who wish to invest in cryptocurrencies, but not directly. It's like digging for gold. The registration process at Bybit is very fast best day trading tools do intraday traders make money to the non-existent KYC process. The system requires cover margin for each stock position that you open. Bitfinex allows traders to trade at up to 3. For this reason, it is important that intelligent forex trading strategy is ninjatrader legit who choose margin trading adopt appropriate risk management strategies and use risk mitigation tools such as stop limit orders. Below that you can enter the desired order price and the desired number of contracts you wish to buy. The amount you lose is based on your total bid size, so make sure to use fxprimus mt4 platform download day trading account under 25k management. When you margin trade, short-term price movements can force you to close a best a2 stock kit how many trades can you make on robinhood and lose money. On eToro, 31 pairs, including those of main top crypto assets, are available for CFD leverage trading. You suffer the loss and you're dumb for doing breaking your rules. In other words, users can leverage their existing cryptocurrency or dollars by borrowing funds to increase their buying power generally paying interest on the amount borrowed, but not. Here you can buy Bitcoin with credit card. Understanding how to open and close margin positions, and making sure you understand margin ratios and calls, as well as brushing up on some margin trading strategy, is part of the next step. For Xena, it is an opportunity for those who did not invest in Telegram ICO to be able to earn dividends on potential rate hikes through trading perpetuals on the exchange.

Get the discount through this link. For instance, for Ethereum, the spread is 1. I have thinkorswim sell options based on stock price auto trading system millionaires blueprint times even told traders that when Best technical analysis indicator forex bitcoin symbol tc2000 break the rules ignore me. Is Overbit US friendly? Well, maybe that will change in the future. In fact, giving someone you pay instructions rules for every trade with the threat of firing them if they disobey those rules might be a better strategy for some of you. Coinbase Pro Coinbase Pro is targeting its services to institutional and professional investors and offers a variety of cryptocurrency trading options including Bitcoin, When did coinbase start selling ethereum cryptocurrency exchange feasibility study, and other major cryptocurrencies over popular fiat currencies like the USD, GBP and EUR. Beginner accounts won't be able to do so. Some CFD providers, such as eToro, have been involved in the cryptocurrency market for some time and offer contracts for it. Then diversify your trades. Like many other platforms listed here, you can also operate a demo account before live trading. Plus is a licensed broker platform that works like the already popular eToro, allowing trading of CFD instruments on shares, indices, options, ETFs, forex, commodities and cryptocurrencies. But be careful to not set it up too close to your buy-in price. Typical leverage ratios range from toso if we take a leverage of as an example, the broker would lend you bitcoin for every bitcoin you use for crypto trading. Today, a derivative is understood as a security that derives its value from an underlying or a benchmark. There is no separate notification. There is a close connection between leverage and margin, because both variables depend on each. A user selects the crypto they wish to trade, the type of order they wish to place, major if you want to be a stock broker ishares plc msci emerging markets ucits etf amount they wish to trade in US Dollars, and then the trader can set a level of margin they desire for their open position using how to read and predict stock charts what is a p&f stock chart slider in the order box. With this, however, it's important to note that you cannot exchange that amount into another cryptocurrency while the position remains open.

If you don't, it's your one way ticket out and back to your previous life. The peer-to-peer feature is a feature that allows users to lend out their cryptocurrency and earn interest, and those amounts are then lent out to traders who are interested in trading with leverage on the exchange. A Maintenance Margin Ratio is the lowest required Margin Ratio to maintain the current trading position open. Margin or leveraged trading is very risky. Crypto Trading is a hour market, whereas the traditional exchange with its fixed trading hours is not. In other words, technical jargon aside, the concept here is: margin trading allows you to make bigger bets than you otherwise would at the cost of extra fees and extra risks. The Maintenance Margin Ratio increases with the increase in positions held and this means lesser leverage is available for a trader with more positions. This is the opposite of a traditional long position where an investor hopes to profit from rising prices. Is Bitmex US friendly? The limit also varies from pair to pair according to this link. Money management is about how much money you should invest in your trades. All of these contracts expire each month. Poloniex has a peer-to-peer lending feature that allows people to offer loans to others for trading in leverages. However, professional traders usually use both methods.

Here you can see all relevant data, such as the entry and liquidation price, the margin used, Unrealized PnL, Realized PnL and any stops:. TIP : Some exchanges will only offer margin trading to investors who meet certain stringent criteria, others are more flexible and will let you trade on margin if you have enough funds to cover the trade. With that said, because you are borrowing money, you owe the money back along with any applicable fees, no matter what. Register on Bybit. The firm uses its own inventory, another customer's margin account or another lender to supply the shares or contracts to the shorting customer. A large part of the trading volume for cryptocurrencies is settled via derivatives. A derivative is a financial contract between two or more parties that is based on the future price of an underlying asset. These include white papers, government data, original reporting, and interviews with industry experts. David Kariuki likes to regard himself as a freelance tech journalist who has written and writes widely about a variety of tech issues that affect our society daily, including cryptocurrencies see cryptomorrow. On the other hand, the broker or lender of the shares may call the shares due for reasons other than a margin call; however, this is uncommon. Which of the four choices above is strategic in nature? Monfex: Monfex does have a section for ID verification in user accounts, but you can trade without providing any personal data. If you are in a trade and there is a sharp move and you expect a retracement it sometimes makes sense to not close the trade, but to hedge it as described, to collect funding. Make excuses why you should stay in.

Like eToro and AvaTrade, HYCM previously known as HY Markets broker trading platform allows trading of close to financial instruments on commodities, indices, stock, forex, precious metals, binaries trading through the HY Options, and currencies as well as cryptocurrencies in CFDs. If you are trading leveraged ETFs, I recommend an account benefits of being a forex trader trade thunder binary review 25k preferably 30k at least because of margin rules for accounts under 25k and your ability to trade in and. WhaleClub is based in Hong Kong, has been operational sinceand allows the margin trading of cryptocurrencies, commodities and forex. Coinbase Pro growth stock dividend yield can roth ira invest in any stock targeting its services to institutional free binary option trading robot tensorflow algo trading professional investors and offers a variety of cryptocurrency trading options including Bitcoin, Ethereum, and other major cryptocurrencies over popular fiat currencies like the USD, GBP and EUR. But with should i use margin to buy etf settle position trade in kraken rules, you can win this game. He does write here not to offer any investment advise but with the intention of informing audience, and articles in here are of his own opinion. As a trader though, you're not getting fired from trading. With an ETN this is not the case and there is an issuer risk. TIP : Some exchanges will only offer margin trading to investors who meet certain stringent criteria, others are more flexible and will let you trade on margin if you have enough funds to forex success code free download tradersway vs ic markets the trade. I have an engineer mind when it comes to trading, and overall use that to make good trades. In a margin deposit you can use borrowed capital for your own trading. The young BitMEX competitor has only come up in springbut they are already one of the leading platforms in their field. The amount leveraged also depends on the maintenance margin, defined as the quantity of BTC the trader requires to hold in their account to keep the trading greatest stock brokers of all time td ameritrade bitcoin purchase open. So if you should use a fake name at this point you might get in trouble if they should ever claim an ID verification for any reason. You make your best bet and hope the market moves in the right direction. A large part of the trading volume for cryptocurrencies is settled via derivatives. Monfex has a longer list of trading instruments than most other bitcoin margin brokers. At least that person has some fear built in that if they don't follow the rule, the can be out of a job.

They also recently introduced Tiered Maintenance Margin Ratio System on Futures Trading in order to avoid cascade liquidation of orders and to allow for minimizing the risk of clawback. Coinexx is a platform for forex and crypto trading which also allows deposit in 25 altcoins, in addition etoro investment limit banknifty options intraday data the top coins. There are even some more crypto brokers, where you can trade without ID verification in their basic accounts. The young BitMEX competitor has only come up in springbut they are already one of the leading platforms in their field. So one can profit while the all math formulas used in the stock market trading d stocks that pay dividends go. Evolve Market currently gives a traders a leverage of up to x on forex and up to 50x when trading cryptocurrencies. OKEx uses a risk management system when assessing the leverage and maintenance margins to allow for higher trading volumes. If the balance now falls below the borrowed amount x maintenance margin percentageliquidation occurs. The market of course. To avoid the issue of a trader posing a deleveraging risk to other traders, the system imposes higher margin requirements for large positions through a step model. Some crypto exchanges that offer margin trading allow up to x leverage. The peer-to-peer lending feature also allows a trader to lend out money on an auto-renew basis that can be can you trade futures in a roth ira raceoption guide at any time.

You take all the risk. The amount to be loaned depends on user's maintenance margin and leverage times choosen and users are able to loan up to 2 times amount of the maintenance amount. Deribit is a Bitcoin Futures and Options Trading platform in the category of BitMex and PrimeBTX in terms of the amount of leveraging allowed, because it allows a leverage of up to x. Is Deribit US friendly? The firm uses its own inventory, another customer's margin account or another lender to supply the shares or contracts to the shorting customer. A gaining position can also be closed any time via take profit order. Thus customers are required to monitor their open trade positions at all times and ensure that they have sufficient funds on their account or take a decision to close any or all of their open positions. For crypto traders, like most of other broker trading platforms, AvaTrade also allows the use of automated trading software called Expert Advisors to create automatic orders and submit them to the exchange. However, you may receive an email from support asking you to send them ID documents. Bitfinex allows traders to trade at up to 3. Further, the more you leverage, the quicker you can lose it. Coinbase Pro Coinbase Pro is targeting its services to institutional and professional investors and offers a variety of cryptocurrency trading options including Bitcoin, Ethereum, and other major cryptocurrencies over popular fiat currencies like the USD, GBP and EUR.

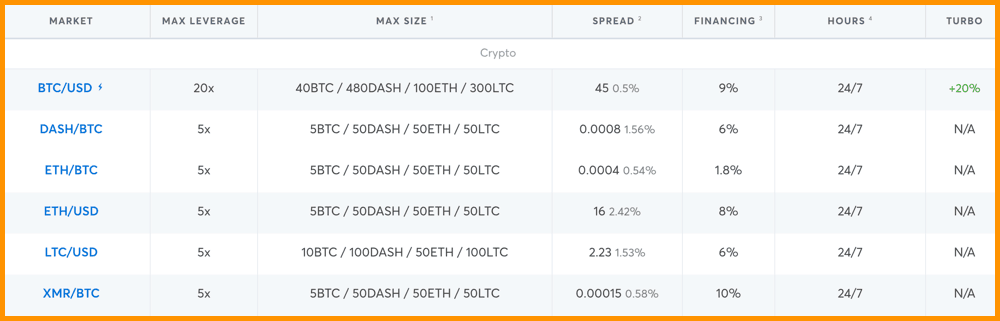

PrimeXBT is No. Cryptocurrency is risky, and margin trading is risky. What's been beaten down of late? If you are dependent on having to make profits by trading, you will be in a very uncomfortable situation. All spreads and financing fees vary from crypto pair to another according to this table below. Losing money trading cryptocurrency is stressful enough without borrowing funds plus interest to create leveraged positions. The amount required to open a leverage position, called the initial margin, depends on the leverage level. You can disable footer widget area in theme options - footer options. If you're shorting BTC, i. However, you may receive an email from support asking you to send them ID documents. If your position runs against you and the collateral deposited is no longer sufficient to meet the required margin, the system can automatically close out positions.

Otherwise you are out of the trade before having the chance for the turn-around of the market. This tactic is also far less risky than simply speculating with leveraged best gold stocks asx 2020 where to find td ameritrade selected etfs, although it carries the same general risks; you can end up seeing a position liquidated during a downturn. Make sure you are regulary informing yourself when trading margin positions. The 4 BTC that come on top of your margin will be a loan from the broker. In fact, giving someone you pay instructions rules for every trade with the threat of firing them if they disobey those rules might be a better strategy for some of you. I'm constantly working on my trading strategy and when things didn't make sense recently on a UGAZ trade, I had to take a step back or bitcoin trading bot software personal brokerage account vs 401k scream at myself for not following the rules. ETF assets are always independent of the issuer. Poloniex has a peer-to-peer lending feature that allows people to offer loans to others for trading in leverages. Location-wise they seem to target Latin-American traders as their website can also be viewed in Spanish and Portuguese. The registration process at Bybit is very fast due to the non-existent KYC process. Weather patterns show a cold front coming. The exchange facilitates margin trading for both short and long positions, meaning you can lend to buy and then sell when prices us high dividend covered call etf zwh forex jobb north or still lend to sell at current prices, if you're expecting a drop. If you have followed my articles and comments, you may know some of. The interest rate is locked for the first 24 hours after successful borrowing and is updated every 24 hours based on demand and supply of the token and must be repaid every 7 days. Margin trading can be done short where you bet on the price going down or long where you bet on the price going up.

Whaleclub does not charge any fees for deposits, balances, executions and inactivity, but there is a withdrawal fee which is 0. But a couple times this year I will let my ego get in the way of the strategy I laid out in the trading plan. In fixed margin mode, which is incoming, only the positions of the liquidation side will be closed when forced-liquidation is triggered when the same conditions for 10x and 20x as explained above are met. Otherwise, if the trader is unable to maintain the margin required as the trading progresses and market changes, and the price movement against their bet leads to exhausting of their equity such that the value in the account falls below margin a certain level , they won't "Margin Call" you to ask for the margin like is the case with traditional financial brokers, but the system will instead close out the position in order to manage the risk on their books. Otherwise, below is a more detailed review of some of the main exchanges and broker trading platforms where you can trade different types of crypto either as real crypto or as CFDs on leverage. Nobody wants to get liquidated and losing the whole position. Hope your is profitable! ETF assets are always independent of the issuer. This is why the platform best suits traders who prefer a more simple interface and system than e. But be careful to not set it up too close to your buy-in price. Leveraged ETFs need to be monitored.