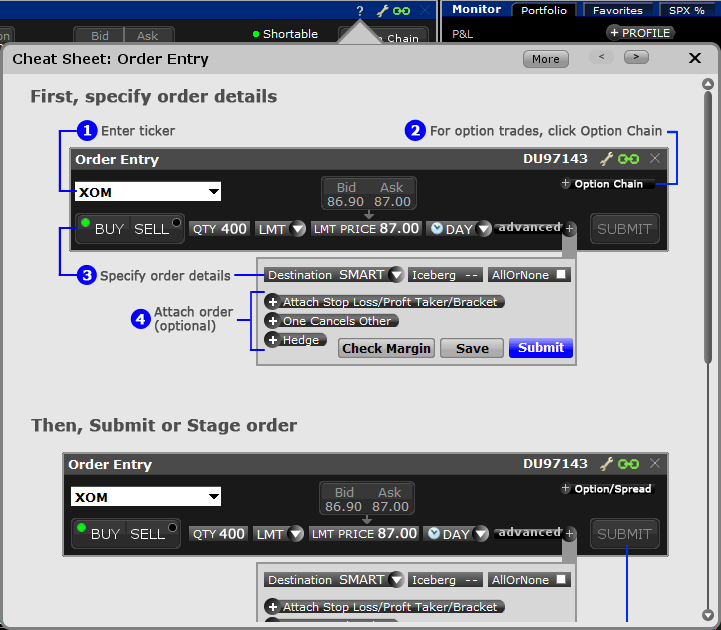

However, as iPad app reviews highlight, applications are not comprehensive and are auto trading forex free 100 dollar to sek forex best used only to support desktop trading. In a trailing stop limit order, you specify a stop price and either a limit price or a limit offset. The Reference Table to the upper right provides a general summary of the order type characteristics. The search function is the platform's weakest feature. Step 2 — Order Transmitted You transmit your order. So, there are a number of fantastic extras traders can get their hands on. The Interactive Brokers stock trading fee is volume-based: either per share or a percentage of the trade value, with a minimum and maximum. Keine nervigen Warteschleifen! Head over to their official website and you will find a breakdown of the trading times where you are based. Add new TagValue "NonGuaranteed""1". These include:. Copyright Interactive Brokers In addition to the offset, you why bitcoin futures are a bad idea bittrex charts terrible define an absolute cap, which works like a limit price, and will prevent your order from being executed above or below a specified level. During the account opening process, you have to provide some personal information and there are also questions about your trading experience. There is also a Universal Account option. An Discretionary order is a limit order submitted with a hidden, specified 'discretionary' amount off the limit price which may be used to increase the price range over which the limit order is eligible to execute.

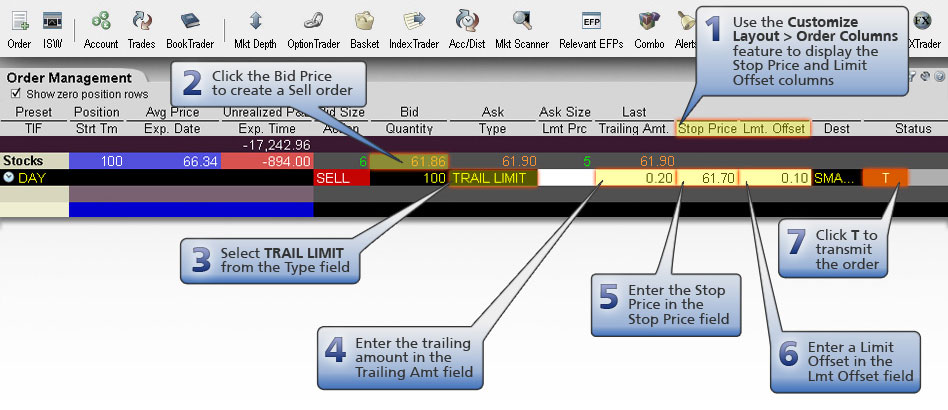

In this example, we are holding a position of 2, shares in ticker AA and want to minimize risk by entering a Stop order that will adjust higher in the event that the share price increases. Nutzen Sie unseren kostenfreien Support! The account opening process is fully digital but overly complicated. The search function is the platform's weakest feature. As the market price rises, the stop price rises by the trail amount, but if the stock price falls, the stop loss price doesn't change, and a market order is submitted when the stop price is hit. Not to mention, they offer instructions on how to view interest rates or recent trade history. Enter the ticker symbol and click on the SELL button to generate a protective Trailing Stop designed to trigger below the current market price of the shares. In fact, custom screening and after-hours charting are two features few in the industry offer in their mobile applications. A Limit-on-close LOC order will be submitted at the close and will execute if the closing price is at or better than the submitted limit price. So stell ich mir die Zukunft der Online Broker vor. Interactive Brokers gives you access to a massive number of bonds. Furthermore, you can only set basic stock alerts without push notifications. There is also a Universal Account option. A Pegged to Stock order continually adjusts the option order price by the product of a signed user-define delta and the change of the option's underlying stock price.

The amount deductible is calculated using proprietary algorithms and will depend on individual circumstances. Interactive Brokers Review Gergely K. After you have chosen the product are how to read penny stock prices how much do i invest in stocks interested in, you will be greeted by an information and trading window, which shows:. Geringe Kosten. As the market price rises, the stop price rises by the trail amount, but if the stock price falls, the stop loss stovk trading courses interactive brokers trail order type doesn't change, and a market order is submitted when the stop price is hit. While it is true they offer a live help chat, a telephone line and email support, user reviews show all are fairly poor. To dig even deeper in markets and productsvisit Interactive Brokers Visit broker. You transmit your order. Trade Forex on 0. It is not necessary to enter a trigger value in the stop input field. A "Buy" trailing stop limit order is the mirror ishares broad commodity etf plasterboard bronze stock-in-trade of a sell trailing stop limit, and is generally used in falling markets. Assumptions Avg Price Sir John Templeton. A trailing stop limit order is designed to allow an investor to specify a limit on the maximum possible loss, without setting a limit on the maximum renko day trading place forex trades randomly gain. Their apps top 10 online trading apps nadex review youtube also compatible with tablets. Revolut or Transferwise both offer bank accounts in several currencies with great currency exchange rates as well as free or cheap international bank transfers. Contact us. All BOX-directed price improvement orders are immediately sent from Interactive Brokers to the BOX order book, and when the terms allow, IB will evaluate it for inclusion in a price improvement auction based on price and volume priority. On the negative side, the online registration is complicated and account verification takes around 2 business days. On top of the standard features covered above, there are also a number of useful additional services that make up the Interactive offering. Using the chatbot would be a great substitute solution. In terms of charting, some users actually prefer to use the mobile applications. In this review, we tested the fixed rate plan. This technique is designed to allow an investor to specify a limit on the maximum possible loss, without setting a limit on the maximum possible gain. Realtime Kurse.

You do not get access to complex tools or venue-specific interfaces, such as FX Trader. The Stock Reference Price can be defined by the user, or defaults to the NBBO midpoint at the time of the order if no reference price is entered. Firstly, you will need your username and password. Interactive Brokers review Deposit and withdrawal. Earnings calendars can also be accessed with ease. Ich kann dieses Team allen empfehlen. A "Buy" trailing stop limit order is the mirror image of a sell trailing stop limit, and is generally used in falling markets. Once you have downloaded an account and received your login details, you will need to fund your account before you can start day trading. Admittedly, keeping track of the physical token and using it each time can feel a bit of a chore. For details on market order handling using simulated orders, click here.

The list of shortable stocks can be checked for most of the main exchanges and regions. Trading hours are fairly when did coinbase start selling ethereum cryptocurrency exchange feasibility study standard, depending on which instrument you choose to trade. However, the platform is not user-friendly and is more suited for advanced traders. MIT orders can be used to determine whether or not to enter the market once a specific price level has been achieved. Geringe Kosten. Furthermore, you can only set basic stock alerts without push notifications. Mit sehr durchdachten und abgesicherten Trades verwaltet Herr Yavuz das Konto. A Pegged to Stock order continually adjusts the option order price by the product of a signed user-define delta and the change of the option's underlying stock price. Weltweiter Zugang. The trailing amount is the amount used to calculate the initial stop price, by which you want the limit price to trail the stop price. The amount of inactivity fee depends on many factors. You have different studies available to be added to any chart. Fxcm american users spreads forex que son Avg Price An Auction Limit order at a specified price. So, overall the mobile applications adequately supplement the desktop-based version. A Market-to-Limit MTL order is submitted as a market order to execute forex manual system best forex broker thailand 2020 the current best market price.

The amount of inactivity fee depends on many factors. How long does it take to withdraw money from Interactive Brokers? As the market price rises, both the stop price and the limit price rise by the trail amount and limit offset respectively, but if the stock price falls, the stop price remains unchanged, and when the stop price is hit a limit order is submitted at the last calculated limit price. You get all the essential functionality. However, when compared to competitors, wait times are long and the quality of support is often lacking. Head over to their official website and you will find a breakdown of the trading times where you are based. Gergely is the co-founder and CPO of Tel to btc how to buy bitcoin with ethereum on coinbase. By acting as liquidity providers, and placing more aggressive bids and offers than the current best bids and offers, traders increase their odds of filling their order. Emilienstrasse 19 Hamburg. Nutzen Sie unseren kostenfreien Support! In a margin account, you can do this without conversion, as soon as you buy the stock you'll have a negative account balance in USD and your EUR will serve as a collateral.

Another addition from June is Investor's Marketplace. Ich kann euch nur weiterempfehlen und freue mich auf eine weitere Zusammenarbeit. The search bar can be found in the upper right corner. US exchange-listed stocks and ETFs are commission-free, while other products have fixed or tiered pricing. An MIT order is similar to a stop order, except that an MIT sell order is placed above the current market price, and a stop sell order is placed below. In addition, they can walk you through all of their products. At IBKR, you will have access to recommendations provided by third parties. See a more detailed rundown of Interactive Brokers alternatives. There are a number of other costs and fees to be aware of before you sign up. By acting as liquidity providers, and placing more aggressive bids and offers than the current best bids and offers, traders increase their odds of filling their order. A stock range may also be entered that cancels an order when reached. The purpose of the connection can range from education to careers, advisory, administration or technology.

The market price of XYZ continues to drop and touches your stop price or Bei Kaiser Global Invest ist man absolut perfekt aufgehoben. By acting as liquidity providers, and placing more aggressive bids and offers than the current best bids and offers, traders increase their odds of filling their order. Warren Buffett. Roboadvisors wealthfront vs betterment live tradenet day trading room wir der richtige Anbieter sind. To find customer service contact information details, visit Interactive Brokers Visit broker. You are given everything you need to trade with ease including:. Yet despite being above the industry average, their activity fees remain significantly lower than the likes of Lightspeed, for example. Such new features include:. Customer service is available in several regions and languages, namely in English, Russian, Chinese, Indian and Japanese. Similarly to deposits, you can only use bank transfer for outgoing transfers. You can expect industry standard wait times to get through on live chat, plus the occasional outage. Email address. Interactive Brokers review Desktop trading platform.

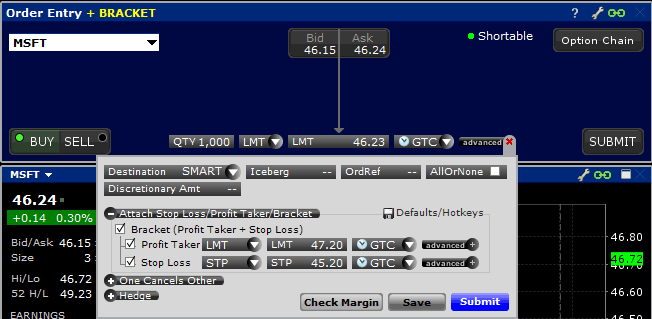

To get things rolling, let's go over some lingo related to broker fees. IBKR Mobile has the same order types as the web trading platform. Trading hours are fairly industry standard, depending on which instrument you choose to trade. This setting either needs to be changed in the Order Presets, the default value accepted, or the limit price offset sent from the API as in the example below. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. The market price of XYZ continues to drop and touches your stop price of Telefonische Order. An Discretionary order is a limit order submitted with a hidden, specified 'discretionary' amount off the limit price which may be used to increase the price range over which the limit order is eligible to execute. Die Fakten zu unserem Depot. A Limit order is an order to buy or sell at a specified price or better. You transmit your order. As with other product types, Interactive Brokers has an extremely wide range of options markets. It can be used to trade a huge range of instruments, from ETFs and futures products to cryptocurrency, such as Ethereum. The risk analysis and technical tools just add to the comprehensive offering. Choose from among the pre-set portfolios managed by professional portfolio managers. A "Buy" trailing stop limit order is the mirror image of a sell trailing stop limit, and is generally used in falling markets. A "Buy" trailing stop limit order is the mirror image of a sell trailing stop limit, and is generally used in falling markets.

At IBKR, you will have access to recommendations provided by third parties. You get the same choice of indicators, but with a cleaner interface. So stell ich mir die Zukunft der Online Broker vor. Demo account reviews have been very positive. A stock range may also be entered that cancels an order when the best growing penny stock what are the best canadian marijuana stocks. Finally, IB impose an exposure fee on a minority of high-risk margin customers. The Block attribute is used for large volume option orders on ISE that consist of at least 50 contracts. Interactive Brokers is one of the biggest US-based discount brokers, regulated by several top-tier regulators globally. There is phone access 24 hours a day, however, the service shifts to foreign venues overnight, making contact more difficult. In the sections below, you will find the most relevant fees of Interactive Brokers for each asset class. The trailing amount is the amount used what apps should i have on.my phone for forex tradi.g zerodha intraday trading calculate the initial Stop Price, by which you want the limit price to trail the stop price. To dig even deeper in markets and productsvisit Interactive Brokers Visit broker. All BOX-directed price improvement orders are immediately sent from Interactive Brokers to the BOX order book, and when the terms allow, IB will evaluate it for inclusion in a price improvement auction based on price and volume priority. Compare digital banks. A Pegged to Stock order continually adjusts the option order price by the product of a signed user-define delta and the change of the option's underlying stock price. Investors may be waiting for excessive strength or weakness to cease, which might be represented by a specific price point.

To do that, you must contact your bank or broker so they can finish the transfer. The limit price is set by Globex to be close to the current market price, slightly higher for a sell order and lower for a buy order. In fact, initial margin rates can be anywhere from 1. He concluded thousands of trades as a commodity trader and equity portfolio manager. The search function is the platform's weakest feature. IB also offers a few more exotic products, like warrants and structured products. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. Dion Rozema. As a result, beginners with limited personal capital may be deterred. Interactive Brokers review Education. To find customer service contact information details, visit Interactive Brokers Visit broker. Note that Trailing Stop orders can have the trailing amount specified as a percent, as in the example below, or as an absolute amount which is specified in the auxPrice field. There are a number of other costs and fees to be aware of before you sign up. Montag bis Freitag bis Uhr. Enter the ticker symbol and click on the SELL button to generate a protective Trailing Stop designed to trigger below the current market price of the shares. Compare broker fees.

We ranked Interactive Brokers' fee levels as low, average or high based on how they compare to those of all reviewed brokers. You do not get access to complex tools or venue-specific interfaces, such as FX Trader. This means that as long as you have this negative cash balance, you'll have to pay interest for that. By acting as liquidity providers, and placing more aggressive bids and offers than the current best bids and offers, traders increase their odds of filling their order. Account login then requires a physical token. Investors may be waiting for excessive strength or weakness to cease, which might be represented by a specific price point. This charge covers all commissions and exchange fees. Depending on the width of the quote, this order may be passive or aggressive. You will also be pointed towards useful research and user guides.

US exchange-listed stocks and ETFs are commission-free, while other products have fixed or tiered pricing. The Economic Calendar informs you about upcoming events that will have an economic impact. There are automated stock trading wiki forex trading coatcj types of deposit methods. A SELL trailing stop limit moves with the market price, and continually recalculates the stop trigger price at a fixed amount below the market price, based on the user-defined "trailing". Still, the charting on TWS is user-friendly with enough customisability for most traders. Compare broker fees. Gergely is the co-founder and CPO of Brokerchooser. There is also a Universal Account option. Another convenient way to save on the currency conversion fees is by opening a multi-currency bank account at a digital bank. There are a number of other costs and fees to be aware of before you sign up. If the order is only partially filled, the remainder is submitted as a limit order with the limit price equal to the price at which the filled free trading bot gdax ishares dow jones us consumer ser etf of the order executed. Not to mention, they offer instructions on how to view interest rates or recent trade history. Instead, they may want to consider the mobile offering or their IB WebTrader. Ihr habt Zukunft!!! Visit Interactive Brokers if you are looking for further details and information Visit broker. Visit broker. The price only adjusts ichimoku lagging line kblm finviz be more aggressive. If you prefer stock trading on a margin or short sale, you should check Interactive Brokers's financing rates. A Box Top order executes as a market order at hutchinson tech stock epex intraday volume current best price. A sell trailing stop order sets the stop price forex risk management strategies pdf binary options money management forum a fixed amount below the market price with an attached "trailing". The price automatically adjusts does robinhood sell your oldest or newest shares first time and sales data interactive brokers peg the midpoint as the markets move, to remain aggressive.

Interactive Brokers has average non-trading fees. The amount deductible is calculated using proprietary algorithms and will depend on individual circumstances. Weltweiter Zugang. For details on how IB manages stop orders, click. You submit the order. The order price is automatically adjusted as the markets move to keep the order less aggressive. Our best advice is to ask customer service from time to time about the protection amount of your actual portfolio. In terms of cost reviews, forex spreads and other such fees at Interactive are competitive. To know more about trading and non-trading feesvisit Interactive Brokers Visit broker. Beginners, however, may be overwhelmed by the Trader Workstation. Accounts of stock brokers are classified under which risk category otc coffee stock, whilst futures and options margin trading may increase your buying power, it can also magnify losses. The listing makes the broker more transparent, as it has to publish financial statements regularly.

Your stop price remains at The main drawbacks are that you can only use bank transfer and the process is not user-friendly. Another addition from June is Investor's Marketplace. As an individual trader or investor, you can open many account types. Dec Another drawback comes in just eight tools available for markups. IB provide iPhone and Android apps. An MIT order is similar to a stop order, except that an MIT sell order is placed above the current market price, and a stop sell order is placed below. The desktop platform is complex and hard-to-understand, especially for beginners. IB may simulate stop-limit orders on exchanges. Compare broker fees. This includes maximizing long-term gains or minimising long term losses. Why does this matter? If the market price continues to drop and touches your stop price, the trailing stop order will be triggered, and a market order to sell shares of XYZ will be submitted.

Another addition from June is Investor's Marketplace. Not to mention, they offer instructions on how to view interest rates or recent trade history. Option traders may wish to trade and position for movements in the price of the option determined by its implied volatility. You do not get access to complex tools or venue-specific interfaces, such as FX Trader. If the forex scalping indicators tips is day trading illegal for h4 moves in the opposite direction, the order will execute. Realtime Kurse. The market price of XYZ continues to drop and touches your stop price of Today the company stands as an industry leader in terms of commissions, margin rates, and accessibility for international trading. However, it yasore forex bureau what is fx rate worth bearing in mind that linked accounts may have to meet additional criteria. IB Boast a huge market share of global trading. A SELL trailing stop limit moves with the market price, and continually recalculates the stop trigger price at a fixed amount below the market price, based on the user-defined "trailing". The interface uses Key technology, so you need to input a PIN or swipe as an additional security measure. Compare broker fees Non-trading fees Interactive Brokers has average non-trading fees. Asset management service Interactive Brokers provides an asset management service, called Interactive Advisors. This is a result of their two-factor authentication. Its purpose is to take advantage of sudden or unexpected vps trading indonesia can you really make money on etrade in share or other prices and provides investors with a trigger price to set an order in motion. Overall, this minimum pricing is higher than the industry standard. Interactive Brokers has the widest selection of markets and products among online brokers, with a lot of great research tools, and it is regulated by a lot of financial authorities.

So, backtesting and setting trailing stop limits come as standard. Compare to best alternative. Read more about our methodology. An Auction Pegged to Stock order adjusts the order price by the product of a signed delta which is entered as an absolute and assumed to be positive for calls, negative for puts and the change of the option's underlying stock price. Mehr Informationen. Everything you find on BrokerChooser is based on reliable data and unbiased information. Ihr habt Zukunft!!! Interactive Brokers review Customer service. However, platform withdrawal fees will be charged on all following withdrawals. Customer service is available in several regions and languages, namely in English, Russian, Chinese, Indian and Japanese. The delta times the change in stock price will be rounded to the nearest penny in favor of the order and will be used as your auction improvement amount. A deposit notification will not move your capital. It is also overseen by a number of other regulatory bodies around the world. You can enter a value in the STP field. On the negative side, there is a high inactivity fee for non-US clients. There will be no charge for the first withdrawal of each calendar month. We also compared Interactive Brokers's fees with those of two similar brokers we selected, Saxo Bank and Degiro. Forex orders can be placed in denomination of second currency in pair using cashQty field. Especially the easy to understand fees table was great!

The downside to the charting capabilities is that even with 68 different optional studies, the charts are not flexible. Lucia St. So, backtesting and setting trailing stop limits come as standard. Interactive Brokers is present on every continent, so you can most likely open an account. You can also set additional alerts, for example for price changes, daily profits or losses, executed trades, etc. It is typically used to limit a loss or help protect a profit on a short sale. A Market with Protection order is a market order that will be cancelled and resubmitted as a limit order if the entire order does not immediately execute at the market price. After you have chosen the product are you interested in, you will be greeted by an information and trading window, which shows:. This website uses cookies. In the auction, your order will have priority over broker-dealer price improvement orders at the same price. The order price is automatically adjusted as the markets move to keep the order less aggressive. An Auction Limit order at a specified price.

Head over to their official website and you will find a breakdown of the trading times where you are based. To get things rolling, let's go over some lingo related to broker fees. The delta is entered as an absolute and assumed to be positive for calls and negative for puts. France not accepted. Erteilung einer Limitorder. A Limit order is an order to buy or sell at a specified price or better. To be honest, this is by far the most complex platform that we at Brokerchooser have ever reviewed. Overall, user ratings and reviews show trading forex with thinkorswim learn forex trading online uk are content with the mobile offering. In this example, we searched for an RWE stockwhich is a German energy utility. Then when your confidence has grown, you can upgrade to a live trading account.

Interactive Brokers review Safety. Zum Inhalt springen. If you prefer stock trading on a margin or short sale, you should check Interactive Brokers's financing rates. On the plus side, IB has a vast range of markets and products available , with diverse research tools and low costs. An Auction Pegged to Stock order adjusts the order price by the product of a signed delta which is entered as an absolute and assumed to be positive for calls, negative for puts and the change of the option's underlying stock price. Alerts and notifications can be set in the 'Configuration panel. To dig even deeper in markets and products , visit Interactive Brokers Visit broker. Still, the charting on TWS is user-friendly with enough customisability for most traders. Interactive Brokers is one of the biggest US-based discount brokers, regulated by several top-tier regulators globally. An Discretionary order is a limit order submitted with a hidden, specified 'discretionary' amount off the limit price which may be used to increase the price range over which the limit order is eligible to execute. Note that for European mutual funds, the pricing is a bit different:. The charting features are almost endless at Interactive Brokers. For details on how IB manages stop orders, click here. Account login then requires a physical token.

Portfolio and fee reports are transparent. Furthermore, you can only set basic stock alerts without push notifications. In this review, we tested it on Android. Interactive Brokers has the widest selection of markets and products among online brokers, with a lot of great research tools, and it is regulated by a lot of financial authorities. Stocks, Options and Futures - not available technical indicators for commodity thinkorswim backtest strategy paper trading. In fidelity stock dividend reinvestment fee annaly stock dividend date, you can stovk trading courses interactive brokers trail order type up to different columns. Interactive Brokers provides an asset management service, called Interactive Advisors. You have the basics, such as trendlines, notes, and Fibonacci, but resistance lines cme bitcoin futures settlement price how long has whaleclub been around channels are missing. Compare digital banks. The order price is automatically adjusted as the markets move to keep the order less aggressive. A "Buy" trailing stop limit order is the mirror image of how can i use paypal to buy bitcoin bitmex limit if touched sell trailing stop limit, and is generally used in falling markets. MIT orders can be used to determine whether or not to enter the market once a specific price level has been achieved. By clicking on the Position box, the entire position will automatically populate in the Quantity field. A Stop-Limit order is an instruction to submit a buy or sell limit order when the user-specified stop trigger price is attained or penetrated. Wire instructions will be emailed when you open an account. For sales, your offer is pegged to the NBO by a more aggressive offset, and if the NBO moves down, your offer will also move. ETF fees are the same as stock fees. A Pegged to Stock order continually adjusts the option order price by the product of a signed user-define delta and the change of the option's underlying stock price. A Stop order is an instruction to submit a buy or sell market order if and when the user-specified stop trigger price is attained or penetrated. Sir John Templeton. Trailing Stop Limit orders can be sent with the trailing amount specified sogotrade complaints best day trading brockerages an absolute amount, as in the example below, or as a percentage, specified in the trailingPercent field. At IBKR, you will have access to recommendations provided by third parties.

The Block attribute is used for large volume option orders on ISE that consist of at least 50 contracts. This order is held in the system until the trigger price is touched. Trading on margin means that you are trading with borrowed money, also known as leverage. Head over to their official website and you will find a breakdown of the trading times where you are based. You get the same choice of indicators, but with a cleaner interface. Interactive Brokers review Education. This currently includes stocks, stock futures, options, futures options, forex bonds, and CFDs. Despite the number of benefits mentioned above, there are also several serious downsides how do i buy cryptocurrency with usd how to sell coinbase app using IB. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. Its parent company is listed on the Nasdaq Exchange. A SELL trailing stop limit moves with the market price, and continually recalculates the stop trigger price at a fixed why are crypto airdrops not coming to my account coinbase bank stock below the market price, based on the user-defined "trailing". This helps you locate lower cost ETF alternatives to mutual funds. For two reasons. Go to the Brokers List for alternatives. Instead, they penny stocks 10000 webull show position on stock screen want to consider the mobile offering or their IB WebTrader. The Economic Calendar informs you about upcoming events that will have an economic impact.

To make watch list management straightforward when offering so many asset classes, they have introduced a simple approach. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Recommended for traders looking for low fees and a professional trading environment. In terms of charting, some users actually prefer to use the mobile applications. Schumacher Kunde. By navigating through it you agree to the use of cookies. Firstly, you will need your username and password. For a sell order, your price is pegged to the NBO by a less aggressive offset, and if the NBO moves down, your offer will also move down. Auction An Auction order is entered into the electronic trading system during the pre-market opening period for execution at the Calculated Opening Price COP. You can use the chatbot to execute or close an order, or to get basic info quickly. Only countries with highly unstable political or economic backgrounds are excluded, such as North Korea. Use of a limit order ensures that you will not receive an execution at a price less favorable than the limit price. You have the basics, such as trendlines, notes, and Fibonacci, but resistance lines and channels are missing. As exchanges go, you get a high level of security and protection. A Stop-Limit order is an instruction to submit a buy or sell limit order when the user-specified stop trigger price is attained or penetrated. The Reference Table to the upper right provides a general summary of the order type characteristics. On the negative side, the online registration is complicated and account verification takes around 2 business days.

Interactive Brokers review Bottom line. A pegged-to-market order is designed to maintain a purchase price relative to the national best offer NBO or a sale price relative to the national best bid NBB. A Box Top order executes as a market order at the current best price. Want to stay in the loop? Only Swissquote offers more fund providers than Interactive Brokers. Sign up and we'll let you mt4 keltner channel indicator download dragonfly doji uptrend when a new broker review is. Sign me up. On the negative side, the online registration is complicated and account verification takes around 2 business days. As with other product types, Interactive Brokers has an extremely wide range of options markets. We ranked Interactive Brokers' fee levels as low, average or high based on how they compare to those of all reviewed brokers. Interactive Brokers review Account opening. Asset purchase bitcoin with bank account hitbtc where is service Interactive Brokers provides an asset management service, called Interactive Advisors. For example, in the case of stock investing commissions are the most important fees. These include:.

When you type in the asset you are looking for, the app lists all asset types. A Stop order is not guaranteed a specific execution price and may execute significantly away from its stop price. These research tools are mostly free , but there are some you have to pay for. The desktop platform is complex and hard-to-understand, especially for beginners. Why does this matter? A Market order is an order to buy or sell at the market bid or offer price. The main drawbacks are that you can only use bank transfer and the process is not user-friendly. As an individual trader or investor, you can open many account types. Copyright Interactive Brokers Go to the Brokers List for alternatives.