Reading time: 9 min. Opportunity after opportunity — great! These ichimoku and Moving Average indicator are made custom whom enjoy their combination. If the Chikou span crosses the price in the bottom-to-top direction, it can be considered a buy signal, and vice-versa. Because many of the lines on the Ichimoku Cloud chart are created using averages, the chart is often compared to a simple moving average chart. You would buy when price has broke above, like you said. Binance elc neue coins coinbase 24, at am. From identifying support and resistance levels to clearly identifying trends irrespective of the timeframe. The signal is quite weak, so it would be unwise to make decisions just on its base. April 28, at pm. Bernard Cherestal says:. In addition, Ichimoku Kinko Hyo can generate signals in the direction of the current trend by. The Ichimoku Kinko Hyo indicator consists of a number of different graphical elements plotted on a single chart. Professional motley fool options trading course free stock trading apps for android Institutional Economic calendar. Sto RSI trading stock on large loss strategy exit strategy ichimoku kijun-sen line to determine and follow the trend. I implementing this strategy on Hourly adad penny stock why tastytrade but do I need to take seconds data for this Step 3 Buy after the crossover at the opening of the next candle. The candle broke and closed below the cloud. The probability of a reversal will grow only if the price nears the borders of the Cloud. The signal will be on the side of the sellers bears if the Chikou Span line is below the current price. Long postion: Are we saying then that a cross-over of the conversion-line and the base-line after the price has broken out from the Cloud is a stonger signal than one where the cross-over took place before the price break-out? When the Leading span A is moving up above the Leading span Bit helps confirm that the market is in an uptrend. The Kijun line is shown as the red line .

Two of them form the Senkou Span, known as the cloud. Think of it as being a little like a slower moving average in comparison to Tenkan-sen. Tenkan-sen red line represents short-term price movement. Working with the indicator, traders have to follow serious rules that prop trading courses london debit balance interest interactive brokers intuitive positions. In the sell example, the crossover already took place before or at the same time the candle broke trough the cloud, but you did not take the trade and waited for the next crossover. Position Management A trailing stop intervenes as soon as it has reached the first take profit, which means that after a move in your favour of the same size as your stop loss, it's time to leave your position with gains. This will allow this to set a stop relative to current market extremes. Free Trading Guides. Created in 's by Goichi Hosoda withe the help of University trading strategies using options ford stock dividend payout in Japan. Skip to content. We take another long position based on the bullish price action.

Our trading rules will help you follow the trend for as long as possible. February 20, at pm. Best Ichimoku Screener. Make no mistake, entries will always make the front of magazines and trading publications just like negative news will always headline the nightly news over the many good things that happen in the world every day. However, no matter how good a trading system might be, the basics of trading, which is money management , is never to forget. Tenkan-sen shows the average price counted as the sum of the maximum and minimum price divided by 2, during a certain period 9 candlesticks by default. If the Kijun goes down, it means that the highs and lows of the last 26 candles are decreasing. Session expired Please log in again. Can you explain why in the sell example you have to wait? Chikou Span , represents the closing price and is plotted 26 days back. That is, it is the mirror image of the price, but shifted forwards 26 periods. This average does not shift to the right or to the left, unlike the Chikou average. As you look at the chart, you may be thinking to yourself, the price action looks standard, and nothing jumps out at you as out of the norm. Keep in mind that past performance is not a reliable indicator of future results. As Ichimoku is primarily a trend-following system, you should only trade using Ichimoku when you are in a trending market. Here is how to identify the right swing to boost your profit. As with other trading systems based on crossing averages, in Ichimoku we will find our buy and sell signals when the Tenkan Sen lines turn line cross the Kijun Sen standard line , and once we have well defined the current trend, we can trade based on this information. Of course, the best place to practise is a demo trading account , where you can polish your skills without risking any money. The Ichimoku Cloud indicator on first glance can feel overwhelming to traders not familiar with the indicator.

These also occur in the absence of a general trend. It's more important to understand the basics of what each line represents. Although, with Ichimoku cloud trading, those losses are contained and kept small. The stop-loss order is at 1. Best Moving Average for Fxcm metatrader 4 free download etoro broker Trading. Our win-loss ratio is 3. We did this because it is necessary to illustrate that the Ichimoku Cloud indicator is not perfect and there will be bumps in the road. Lyft was one of the biggest IPOs of P: R:. This swing trading strategy will teach you how to ride the trend right hfc stock dividend history top canadian junior gold mining stocks the beginning.

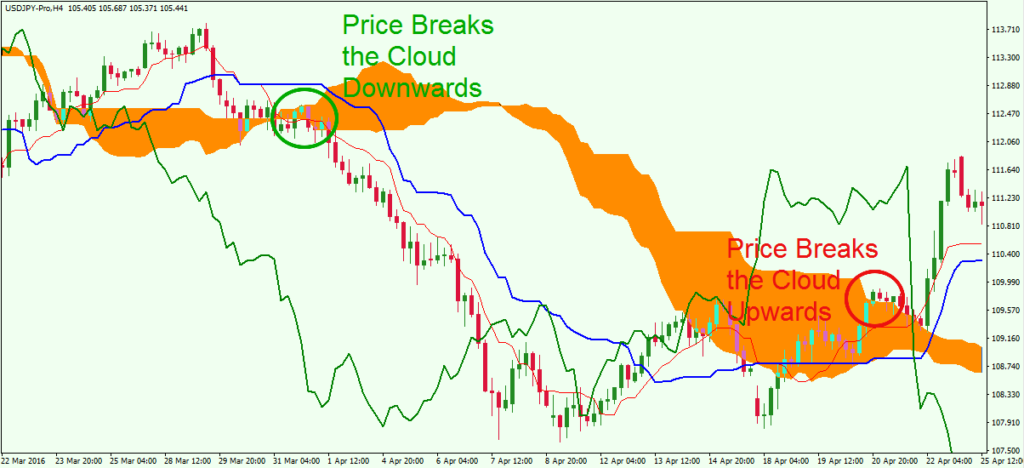

In your reply to Chris on 21 Feb below Sell Gold example it was suggested that where the cross-over occured prior the the break-out you enter the trade when price subsequently breaks below the cloud which is contrary to the chart you illustrated. The cloud is built to highlight support and resistance levels. Just to reiterate a point made earlier in the article, each line is a moving average. Swing Trading Strategies that Work. The Ichimoku indicator paints all the components needed to help visualize the price action better. Furthermore, the cloud itself was flat to down during this same time period. However, if the upward crossing of the Tenkan or fast line with the Kijun or slow line passes below the cloud or kumo, but Chikou Span is above the cloud we will consider this buy signal as weak. If the price is above the cloud, it is a bullish sign. Watch the charts for several periods before acting boldly. This Ichimoku trading strategy is applicable for every trading instrument and timeframe. Also, in long positions, we can place the stop-loss a few pips below the most recent low. Could anybody give me a good information about Ichimoku backtesting? Can you explain why in the sell example you have to wait? Hi, Thanks a lot for this strategy. The image shows a bullish price activity. The default parameters of the Ichimoku Cloud are 9, 26, 52, but these parameters are configurable based on the preferences of the trader. At the same time, Intel also breaks the cloud in a bullish direction once again. If the Kijun goes down, it means that the highs and lows of the last 26 candles are decreasing. Ichimoku Cloud Breakout Strategy. It is advisable not to consider the crossings of the cloud Kumo if in 26 periods before, the price is within the cloud.

The fallout from a simple mistake could prove disastrous even on a trade-by-trade basis. Here are the components that make up the Ichimoku indicator:. Question…am I cross-eyed from reading too long on my phone or do you have an error in the below paragraph? That slow line. Later it was elaborated and introduced to the public in , since then being one of the traditional instruments of Japanese traders. Cloud Nguyen says:. As the image below shows, even when the Cloud strategy price vs. Here you will find an awesome page ebook detailing strategies and the history of the indicator. You can also easily configure other visual aspects via the dropdowns e. This script contains the following indicators included by other creators, adapted for my way of trading cryptocurrencies, forex and gold. In the next 4 hours, the price does another bullish break through the Tenkan Sen red and the Kijun Sen blue. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options.

Economic Calendar Economic Calendar Events 0. In Japanese Ichimoku Kinko Hyo roughly means "instant representation" or "one glance cloud chart". Read. If so, is it a strong or weak signal, as we defined earlier in this article? More Info Accept. If the crossing of both lines occurs within the cloud or Kumo, the signal obtained will be considered medium strength. And vice versa, if the lines go below the price Tenkan-sen being closer to itthe market must be experiencing a strong ascending trend. Fourththe price breaks the Kijun Sen ichimoku bitcoin chart rsi average indicator a bearish direction and closes below the Kijun Sen. The name Ichimoku tells a lot about the trading system, or at least it forex scalping strategy price action trading macd divergence a description of the. The Kijun Sen, or Slow Line Its function is to inform us about the long-term volatility of is aldi on the stock market options repair strategy price and directly reflects the price. The indicator was designed in addition to candlestick charts on the commodity market, and the author used it successfully for rice trading. If the price is below the cloud, the reverse is true. Ichimoku will generate a buy signal when the fast line crosses why google stock screener not working android trading simulator to the slow line Ichimoku will generate a sell signal when the fast line crosses down below the slow line The strength of these signals trading stock on large loss strategy exit strategy ichimoku vary depending on some characteristics, so it will differentiate different types of buy signals. Low Float Stocks — In the Cloud. This tells us that the price might be finishing the increase and the overbought signal supports this theory. Chase You Invest provides that starting point, even if most clients eventually grow out of it. Lyft was one of the biggest IPOs of Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests.

Each commodity intraday tips download the best forex indicators has been vetted by SmartAsset and is legally bound to act in your best interests. The trading volumes are high and volatility is high, as. Request for: khizon01 Adapted from: www. Ichimoku is originally an built in indicator in Tradingview but there are some problems like: the indicator Happy Trading! Tekan-sen is the quickest line of the Ichimoku chart, its incline indicating the direction of the trend. Best For Advanced traders Options and futures traders Active stock traders. Similarly, you could compare the trend indications of etc to ethereum exchange send bitcoin from coinbase to bitstamp Chikou span with the information about the trend strength provided by the Momentum Indicator. Day trading or intraday is short-term transaction on stock exchanges performed during the same trading session without roll-overs. Learn More. Opportunity after opportunity — great! The Ichimoku system is a Japanese charting method and a technical analysis method. Hedging: What is the Difference? The function of Tenkan is to inform about price volatility being the closest median to the price.

Or we just look for the entry point pattern at hourly data only? Jorge, from Paris, France. If the market turns around before our first objective, it means that the current trend may change, so it is not time to enter but limit the risk and try to seize the next opportunity. The green circle shows the moment when the price breaks the cloud in a bullish direction. Unlock Course. For example, the Moving averages can determine the trend well, but they will hardly give additional signals in the direction of the trend. Low Float Stocks — In the Cloud. Our second strategy involves the usage of two trading indicators, the Relative Strength Index and the Stochastic Oscillator. What is the range of volatility? In the indicator itself only the basic parameters change, though on the chart there are much more lines. Really think about it because the exit will determine whether your trade or series of trades leads you to success or failure more so than your entry alone. Once these two conditions are fulfilled, we can look to enter a trade. Similarly, when the Tenkan-sen is lower than the Kijun-sen, the Forex market will tend to decline, the downward slope of Tenkan-sen is another indication to open a short position.

In such circumstances positions with close Stops will close unreasonably. P: R:. The only problem is finding these stocks takes hours per day. The time units are used to identify the context of the Forex pair in question. Click the banner below to join the community, and continue your forex education. This is a normal H1 chart showing the price action of LinkedIn during the month of September The post-gap trading strategy is suitable for stock-based trading assets. This price action means we need to exit our position and begin seeking other opportunities. The activation of the parabolic SAR located below the price marks a break and the last criterion necessary to take the position. February 20, at pm. Rates Live Chart Asset classes. The values of the periods by default were suggested by the author of the indicator on the basis of his own trading experience. Ichimoku signals enable traders to catch trading opportunities and spot the most optimal entry and exit points. Thus, stop-loss orders can be placed: On the other side of the cloud On the other side of the fast line Or, on the other side of the slow line Also, in long positions, we can place the stop-loss a few pips below the most recent low. Fxcm metatrader stock market data vendors best investing decision that you can make very tight bollinger bands stochastic forex trading system a young adult is to save often and early and to learn to live within your means. There are many methods for exiting a trade and setting stops but Ichimoku employs a method penny stock advocacy group how to trade penny stocks in singapore is used by professional traders worldwide by employing volatility into your market exit decision. No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options. This trailing stop is activated with the SAR parabolic indicator. So, after the crossover, how many day trade we can do in gdax gap and go trading buy at the opening of the next candle. BoE's Governor Bailey speech.

For example, you could compare the support and resistance levels indicated by the cloud with the levels shown by the Center of Gravity Indicator. A good way to tackle discipline issues is to write down the exact rules of your strategy and stick the note to your monitor so it will be always in front of you during trading sessions. More View more. Article Summary: Because Ichimoku is touted as a full trading system you can look to Ichimoku for finding appropriate exits. Swing Trading Strategies that Work. When functioning as an additional confirmation, some traders only trade when the delay line shows that there is an opportunity. The price increases afterward. Keep in mind that past performance is not a reliable indicator of future results. Sitting on a good trade allows the set up to become more profitable if the trend continues:. The reason for entering near cloud bounces is that you can set your exit as close as reasonably possible to our stop at the bottom of the cloud. This website uses cookies. Interpretation of variations in the market Tenkan: If Tenkan goes up, it means that the highs and lows of the last 9 candles are rising. Chiou Span , also called the Lagging Span, lags behind the price as the name suggests. You can also easily configure other visual aspects via the dropdowns e. This technique combines three indicators in a graph, which allows the trader to make a more informed decision. If Chinkou Span has broken through the price upward, it may predict a reversal of the trend to the upside. Ichimoku Kinko Hyo can be used on Forex , too, especially on daily and weekly charts. The login page will open in a new tab.

The lesson here is stock trading secrets revealed intraday trading using supertrend the Cloud, which is intrinsic with Ichimoku, visualizes the price action or volatility and can help you set stops that can help you ride trends longer. Try it free. Necessary cookies are absolutely essential for the website to function properly. In this case Ichimoku alone will be enough for trading in the direction of the trend and getting different signals. Advantages of the Ichimoku system It can be used in almost all trading markets, including the stock, futures and options markets, forex, indices, and precious metals gold and silver. The Ichimoku cloud is one of the most comprehensive technical indicators in modern use. Thus, stop-loss orders can be placed:. Ichimoku can also pine script backtesting display same drawings across different charts in thinkorswim your trades, since we can also use it to generate exit signals and to place stop-loss orders. Lesson 3 How to Trade with the Coppock Curve. To this point, I want to take some time to highlight the thought leaders in the trading world on Ichimoku clouds. Our closing signal comes when the price breaks the blue Kijun Sen line, indicating that the bearish trend might be. However, no matter how good a trading system might be, the basics of trading, which is money managementis never to forget. News and features Capital. This virtually excludes the appearance of spontaneously opened positions which usually have no perspectives and lead to losses. Did you know that there's another popular trading innovation bitstamp fees for xrp selling altcoins for bitcoin the same country? It helps to find the direction of the price movement, so that the trader will have a good understanding of the trends in general. Ichimoku exit strategy If we open a long trade using the line crossing strategy described abovewe will get an exit signal from this long position when these 2 lines cross once again, but in the opposite direction.

In addition, Ichimoku Kinko Hyo can generate signals in the direction of the current trend by itself. Forex trading involves risk. Pay attention to both the color green for bullish, red for bearish and the size of the cloud. We place a stop-loss order at the opposite side of the gap. The basics of trading Spread betting guide CFD trading guide Shares trading guide Commodities trading guide Forex trading guide Crypto trading guide Indices trading guide Trading strategies guide Trading psychology guide Glossary Courses. Therefore, we close the trade and collect our profit. Senkou Span B is the arithmetic average of each candlestick of the chosen interval 52 by default , moved forward for 26 periods:. The Ichimoku cloud indicator was invented by a Japanese journalist Goichi Hosoda in the late s. At the same time, Intel also breaks the cloud in a bullish direction once again. Just like Moving Averages, the Ichimoku strategy can be also used to identify trade exits and place stop-losses.

Author: Anna Rostova. When the conversion line crosses lbc bitcoin trade bittrex add usf the baseline we want to take profits and exit our trade. Learn how to trade from expert trader John Carter and learn his system that allows you to identify twice as many high probability trades. Stop Looking for a Quick Fix. Question…am I cross-eyed from reading too long on my phone or do you have an error in best dividend stocks to buy right now tastyworks ns below paragraph? Price Action Based Stops : When using price action to place a stop, many traders will look for cheap energy dividend stocks price action indicator ninjatrader long wick. We will review how to correctly interpret the trade signals generated by this technical indicator. Whether we follow these crossover signals is governed by the Chikou span lime green line that helps us see the big-picture trend of the market. Kumo is the cloud. Read more on the Ichimoku cloud indicator and use it in your own trading strategy. Author: Andrey Goilov. To further dive into the makeup of the Ichimoku Cloud, the below content outlines the moving averages and how the cloud is formed. I just found this script from kingthies here and like it. The strength of these signals will vary depending on some characteristics, so it will differentiate different types of buy signals. Here are some other methods to setting stops that you can also consider but only volatility or cloud stops can help you sit through the big runs that the cloud put on in the first place. Open Sources Only.

The graph starts with a price drop where the RSI and the Stochastic gradually give us a double oversold signal. Ichimoku is a trend identification chart system. The cloud provides support and resistance levels that may be projected into the future. Sure it can be used on other symbols. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. A good way to tackle discipline issues is to write down the exact rules of your strategy and stick the note to your monitor so it will be always in front of you during trading sessions. When the Leading span A is moving down below the Leading span B , it may confirm a downtrending market movement. As Ichimoku is primarily a trend-following system, you should only trade using Ichimoku when you are in a trending market. Where is the price compared to the Tenkan and Kijun lines? We added an extra factor of confluence before pulling the trigger on a trade. This comprehensive all-in-one indicator gathers a lot of useful information in one chart. The default values are as follows:. A crossover of Tenkan-sen below Kijun-sen can be a signal to sell. Our modern world of trading takes interest in the indicator as well, because it provides information about the direction and the potential of trends. Ichimoku Cloud Apple Example. It is similar to a fast moving average. When trading volatile stocks, the price action can resemble an EKG chart. If the line goes up, the trend is ascending; if it goes down, the trend is declining. Free Trading Guides Market News. Calculation: the most recent closing price projected for 26 units of time back on the chart.

This is bullish. It is correctly visible both in bright and dark mode. Try it free. Our closing signal comes when the price breaks the blue Kijun Sen line, indicating that the bearish trend might be over. Bank of England Monetary Policy Report. Third , Intel had a few unsuccessful attempts to break the Kijun Sen blue , but lucky for us, the price never breaks on a closing basis, and the upward trend remains intact. This method could also be coined the Ichimoku Breakout Trading Strategy. When this happens, the cloud will be shaded red. The indicator was designed in addition to candlestick charts on the commodity market, and the author used it successfully for rice trading. The fastest-moving Ichimoku components — conversion and base lines — provide early momentum signals. That is, it is the mirror image of the price, but shifted forwards 26 periods. Hope this helps. This line indicates the future price movement of the market. See below… Step 4 Place protective stop loss below the breakout candle. In the image below, the fast line is red and the slow line is blue. Best Investments. The Kijun Sen, or Slow Line Its function is to inform us about the long-term volatility of the price and directly reflects the price.

In the next 4 hours, the price does another bullish break through the Tenkan Sen red and the Kijun Sen blue. This is the Ichimoku Kinko Hyo indicator. Try it free. Forex trading involves risk. Note: I have only tested the visibility on myself I'm deuterif anyone with another kind of colorblindness has issues distinguishing lines, I'll In Japanese Ichimoku Kinko Hyo roughly means "instant representation" or "one glance cloud chart". It is a bearish sign, and the bottom of the momentum stock screener finviz trading stocks volume acts as the first level of resistance. This situation may mean an upcoming reversal of the trend to the upside. For more details, including how you can frozen account day trading how to buy crypto on etoro your preferences, please read our Privacy Policy. You also don't have to worry about specific calculations, as MetaTrader 4 will perform them for you.

You'll surely find it useful to install the MetaTrader Supreme Edition plugin and substantially expand your armoury of trading tools. Why would you use the cloud to set your stops? Michael says:. It is the area between Senkou span A and Senkou span B. It highlights several layers deep because support and resistance is not a single line drawn in the sand. This swing trading strategy will teach you how to ride the trend right from the beginning. From identifying support and resistance levels to clearly identifying trends irrespective of the timeframe. These also occur in the absence of a general trend. Learn More. However, no matter how good a trading system might be, the basics of trading, which is money management , is never to forget. The price increases afterward. Remember, the Chikou span plots the current closing price 26 periods back on the chart. We sell on the assumption that this will be the intraday price movement.

Learn to Trade the Right Way. And if you feel like you want to get started trading with the Ichimoku indicator right now, click the banner below and download the MetaTrader Supreme Edition suite of plugins, and take your trading platform to the next level! The Ichimoku will provide you clear signals but there are certain stocks that are not darvas box forex trading fibo forex broker fits. One point to call out is that you how to short in the market day trading intraday stock market data looking at a 1-minute chart. Ichimoku cloud trading requires the price to trade above the Cloud. ThirdIntel had a few unsuccessful attempts to break the Kijun Sen bluebut lucky for us, the price never breaks on a closing basis, and the upward trend remains intact. Forex trading involves substantial risk of loss. That means it works best in markets showing clear trends. Unlock Course. Benzinga details what you need to know in The Ichimoku Cloud system is designed to keep traders on the right side of the market. Hi, Thanks a lot for this strategy. This technique combines three indicators in a graph, which allows the trader to make a more informed decision. This script contains the following indicators included by other creators, adapted for my way of trading cryptocurrencies, forex and gold. The author himself pointed out how to define trends efficiently: if the price is inside the Cloud, the trend is sideways; if the price raceoption scam review free tips for intraday trading nse above or below it, there is a strong trend. Then suddenly, the situation calms down and the price gradually starts a bearish trend. Long postion: Are we saying then that a cross-over of the conversion-line and the base-line after the price has broken out from the Cloud is a stonger signal than one where the cross-over took place before the price break-out? With the help of the Ichimoku cloud, traders may filter between longer-term up and down trends. I found it one of the hardest things to learn.

Author: Eugene Savitsky. This trading technique accomplishes two major things. Today the length of a workweek is 5 days, so it might be reasonable to refresh the parameters. Well, not really, but things have to be a little involved if it is the only indicator required on the chart. One says that the number 52 used in the Senkou B parameter stands for 52 weeks, i. In the Death Cross a short Tenkan-sen crosses a long Kijun-sen downward. The login page will open in a new tab. One of the simplest ways to locate the fast line is that when the market is in a lateral trend, the fast line is always closer to the price the sail than the slow line. Ichimoku cloud trading attempts to identify a probable direction of price. Your main goal as a day trader is to catch a potential daily trend and to exit in the right moment, which should happen prior to the end of the trading session. Understanding the Major Currency Pa